What the Options Market Tells Us About United Airlines Holdings

Investors with a lot of money to spend have taken a bearish stance on United Airlines Holdings UAL.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with UAL, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 36 options trades for United Airlines Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 22% bullish and 27%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $183,549, and 35, calls, for a total amount of $1,842,350.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $33.0 to $95.0 for United Airlines Holdings over the recent three months.

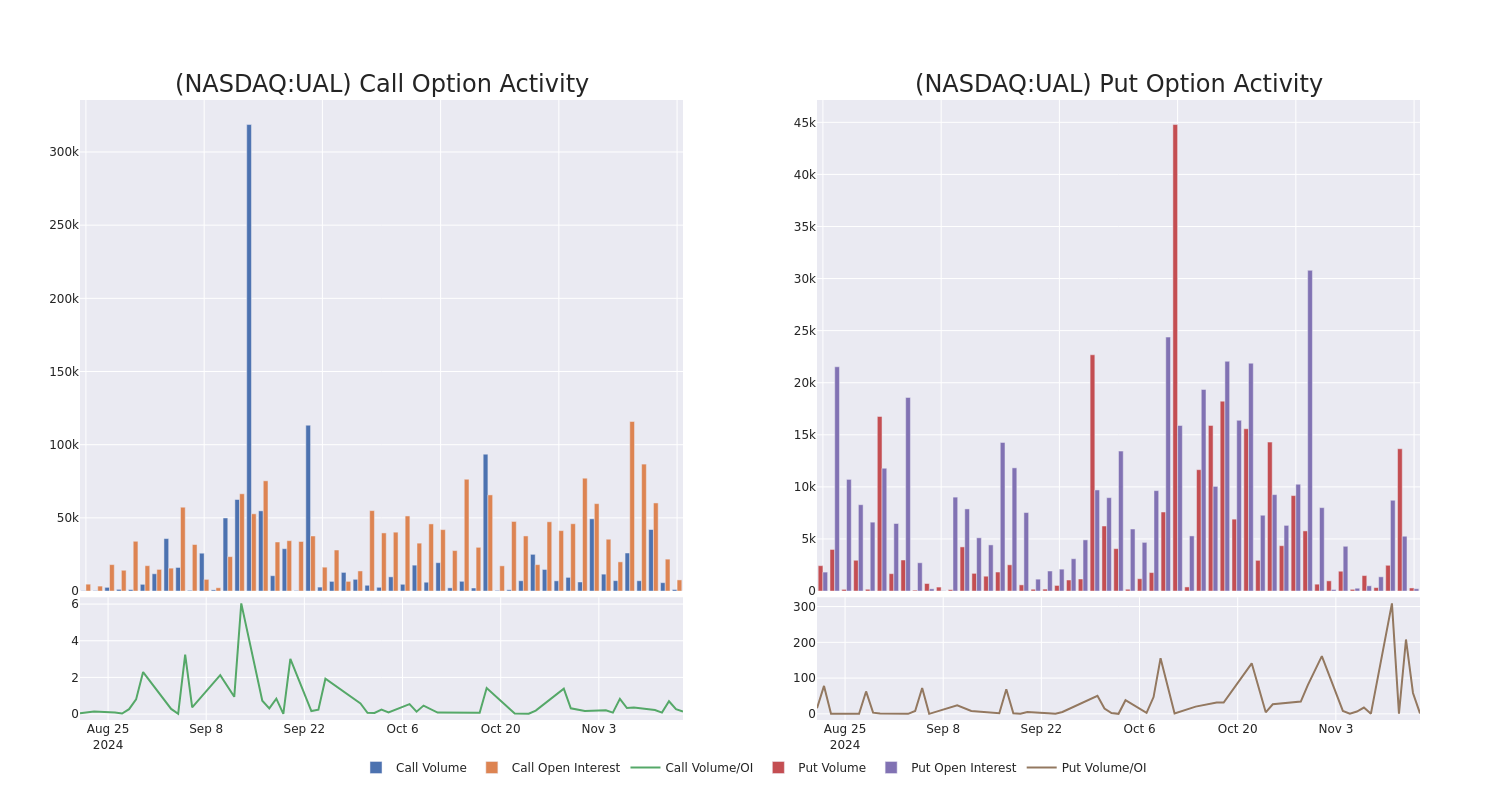

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for United Airlines Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across United Airlines Holdings’s significant trades, within a strike price range of $33.0 to $95.0, over the past month.

United Airlines Holdings 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UAL | PUT | SWEEP | NEUTRAL | 12/20/24 | $6.3 | $6.2 | $6.2 | $95.00 | $183.5K | 222 | 296 |

| UAL | CALL | TRADE | BULLISH | 01/17/25 | $9.55 | $8.9 | $9.4 | $87.50 | $84.6K | 5.3K | 100 |

| UAL | CALL | TRADE | NEUTRAL | 12/18/26 | $64.65 | $61.55 | $63.15 | $33.00 | $63.1K | 56 | 22 |

| UAL | CALL | TRADE | NEUTRAL | 12/18/26 | $65.0 | $61.5 | $63.1 | $33.00 | $63.1K | 56 | 42 |

| UAL | CALL | TRADE | BEARISH | 12/18/26 | $64.85 | $63.05 | $63.05 | $33.00 | $63.0K | 56 | 62 |

About United Airlines Holdings

United Airlines is a major us network carrier with hubs in San Francisco, Chicago, Houston, Denver, Los Angeles, New York/Newark, and Washington, D.C. United operates a hub-and-spoke system that is more focused on international and long-haul travel than its large us peers.

After a thorough review of the options trading surrounding United Airlines Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of United Airlines Holdings

- Trading volume stands at 913,136, with UAL’s price up by 0.46%, positioned at $91.58.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 67 days.

What The Experts Say On United Airlines Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $106.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Jefferies persists with their Buy rating on United Airlines Holdings, maintaining a target price of $95.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for United Airlines Holdings, targeting a price of $84.

* An analyst from Goldman Sachs has revised its rating downward to Buy, adjusting the price target to $119.

* An analyst from Bernstein has decided to maintain their Outperform rating on United Airlines Holdings, which currently sits at a price target of $85.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on United Airlines Holdings with a target price of $150.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest United Airlines Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply