This Artificial Intelligence (AI) Stock Soared Since Trump Won the Election, but Is It a Buy?

In the days following Donald Trump’s return to the White House, the stock market has set record highs. While Trump has promised to cut taxes and boost business, he’s also expressed his desire to regulate certain big tech players, and his tariff-based trade policy could affect the artificial intelligence (AI) companies that rely on foreign-made components.

We’ll have a better picture of his economic policy in the coming months. For now, investors appear to believe his administration will ultimately be a friend to the AI market. Palantir (NYSE: PLTR), in particular, saw its stock pop dramatically after Election Day, which was the day after Palantir issued its quarterly earnings.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

How much of this is from positive earnings and how much is from the election? I would pin the lion’s share on its earnings. Palantir’s stock was up 23% by market close on Nov. 5, well before we knew who won. That said, the firm certainly could benefit from a Trump presidency, and since the election, the stock is up another 16% as of this writing, so it seems both are at play.

So, with so much momentum behind it, is now the time to buy?

If you’re unfamiliar, the company gets its name from The Lord of The Rings. Palantirs are magical objects that allow their user to see everything happening in real time across huge swaths of land. That is, more or less, what the company does, providing AI-powered intelligence platforms that help companies and government agencies gather information and analyze it.

Though it has been using AI and machine learning for years, recent advancements supercharged its product capabilities, and its sales accelerated.

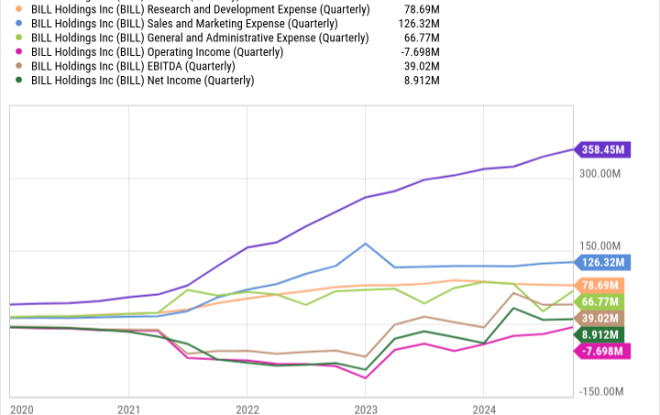

Palanir’s Q3 numbers were impressive, beating Wall Street’s revenue and earnings per share (EPS) estimates by 3.1% and 10.1%, respectively. It brought in $725 million in revenue for the quarter, up nearly 30% from a year ago, while its EPS rose nearly 43%. Those are impressive numbers. Perhaps more impressive is that the company has delivered that kind of revenue growth for three years now while its operating expenses have stayed relatively flat. Check out this chart showing the two lines diverge.

Palantir’s business appears to be incredibly scalable and, if the trend continues, extremely profitable.

Despite the company’s success dealing with the government, the revenue growth this quarter was especially driven by a swelling in its U.S. commercial segment client list. As CEO Alex Karp put it, there is a “U.S.-driven AI revolution that has taken full hold.” The company’s domestic client count rose 77% from a year ago, helping fuel the 54% growth in revenue for the segment. The company expects the trend to continue, setting a year-end target of 50% growth.

Leave a Reply