An Overview of Star Bulk Carriers's Earnings

Star Bulk Carriers SBLK is set to give its latest quarterly earnings report on Tuesday, 2024-11-19. Here’s what investors need to know before the announcement.

Analysts estimate that Star Bulk Carriers will report an earnings per share (EPS) of $0.99.

Anticipation surrounds Star Bulk Carriers’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

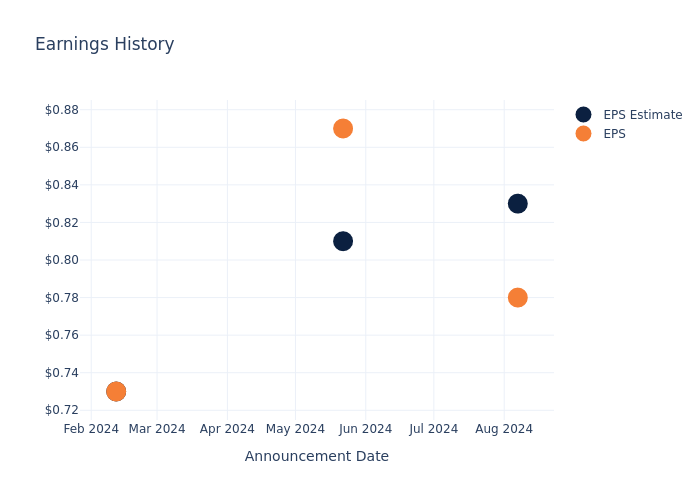

Historical Earnings Performance

The company’s EPS missed by $0.05 in the last quarter, leading to a 0.14% drop in the share price on the following day.

Here’s a look at Star Bulk Carriers’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.83 | 0.81 | 0.73 | 0.27 |

| EPS Actual | 0.78 | 0.87 | 0.73 | 0.34 |

| Price Change % | -0.0% | 2.0% | -5.0% | 2.0% |

Market Performance of Star Bulk Carriers’s Stock

Shares of Star Bulk Carriers were trading at $20.29 as of November 15. Over the last 52-week period, shares are up 3.88%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Insights on Star Bulk Carriers

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Star Bulk Carriers.

With 2 analyst ratings, Star Bulk Carriers has a consensus rating of Buy. The average one-year price target is $23.5, indicating a potential 15.82% upside.

Analyzing Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Golden Ocean Group, Costamare and Danaos, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Golden Ocean Group is maintaining an Neutral status according to analysts, with an average 1-year price target of $14.5, indicating a potential 28.54% downside.

- Costamare received a Neutral consensus from analysts, with an average 1-year price target of $13.0, implying a potential 35.93% downside.

- Danaos is maintaining an Buy status according to analysts, with an average 1-year price target of $105.0, indicating a potential 417.5% upside.

Summary of Peers Analysis

The peer analysis summary offers a detailed examination of key metrics for Golden Ocean Group, Costamare and Danaos, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Star Bulk Carriers | Buy | 47.84% | $131.76M | 5.10% |

| Golden Ocean Group | Neutral | 17.20% | $91.01M | 3.24% |

| Costamare | Neutral | 36.03% | $124.19M | 3.06% |

| Danaos | Buy | 7.09% | $150.59M | 3.69% |

Key Takeaway:

Star Bulk Carriers ranks highest in Revenue Growth among its peers. It also leads in Gross Profit margin. However, it has a lower Return on Equity compared to some peers. Overall, Star Bulk Carriers is positioned favorably within the group based on these metrics.

Unveiling the Story Behind Star Bulk Carriers

Star Bulk Carriers Corp provides seaborne transportation solutions in the dry bulk sector. The company owns and operates dry bulk carrier vessels, which are used to transport bulk, such as iron ore, coal, grains, bauxite, fertilizers, and steel products. It owns a fleet of vessels that consists of Newcastlemax, Capesize, Post Panamax, Kamsarmax, Panamax, Ultramax, and Supramax. It generates revenues through the voyages it carries out.

Star Bulk Carriers: Financial Performance Dissected

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Over the 3 months period, Star Bulk Carriers showcased positive performance, achieving a revenue growth rate of 47.84% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Star Bulk Carriers’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 30.06%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Star Bulk Carriers’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 5.1% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Star Bulk Carriers’s ROA excels beyond industry benchmarks, reaching 2.92%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.66.

To track all earnings releases for Star Bulk Carriers visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply