Decoding DoorDash's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on DoorDash DASH.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DASH, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 12 options trades for DoorDash.

This isn’t normal.

The overall sentiment of these big-money traders is split between 41% bullish and 58%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $32,065, and 11, calls, for a total amount of $996,583.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $190.0 for DoorDash during the past quarter.

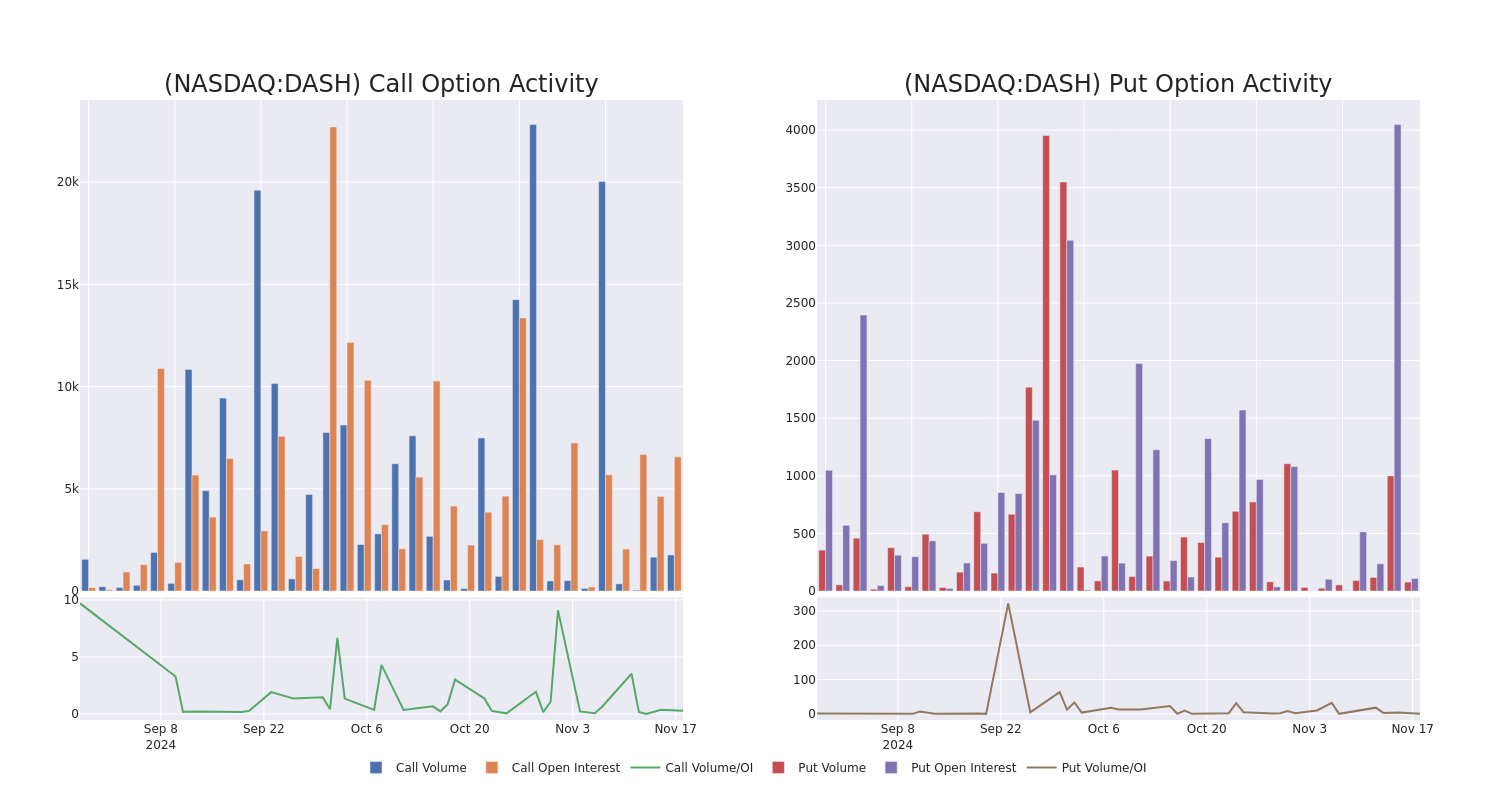

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for DoorDash’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across DoorDash’s significant trades, within a strike price range of $130.0 to $190.0, over the past month.

DoorDash Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DASH | CALL | SWEEP | BULLISH | 01/17/25 | $25.9 | $25.55 | $25.75 | $150.00 | $374.7K | 2.5K | 145 |

| DASH | CALL | SWEEP | BEARISH | 12/20/24 | $1.68 | $1.01 | $1.22 | $190.00 | $118.0K | 68 | 1.0K |

| DASH | CALL | TRADE | BEARISH | 01/17/25 | $40.2 | $39.7 | $39.85 | $135.00 | $79.7K | 1.6K | 71 |

| DASH | CALL | TRADE | BEARISH | 01/17/25 | $40.55 | $39.85 | $39.85 | $135.00 | $79.7K | 1.6K | 27 |

| DASH | CALL | TRADE | BEARISH | 01/17/25 | $40.25 | $40.0 | $40.0 | $135.00 | $76.0K | 1.6K | 143 |

About DoorDash

Founded in 2013 and headquartered in San Francisco, DoorDash is an online food order demand aggregator. Consumers can use its app to order food on-demand for pickup or delivery from merchants mainly in the US. Through the acquisition of Wolt in 2022, the firm also provides this service in Europe. DoorDash provides a marketplace for the merchants to create a presence online, market their offerings, and meet demand by making the offerings available for pickup or delivery. The firm provides similar service to businesses in addition to restaurants, such as grocery, retail, pet supplies, and flowers.

After a thorough review of the options trading surrounding DoorDash, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is DoorDash Standing Right Now?

- Currently trading with a volume of 598,876, the DASH’s price is up by 2.57%, now at $173.78.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 87 days.

Professional Analyst Ratings for DoorDash

In the last month, 5 experts released ratings on this stock with an average target price of $179.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities persists with their Buy rating on DoorDash, maintaining a target price of $172.

* An analyst from Jefferies persists with their Buy rating on DoorDash, maintaining a target price of $180.

* Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for DoorDash, targeting a price of $190.

* An analyst from RBC Capital persists with their Outperform rating on DoorDash, maintaining a target price of $175.

* An analyst from BMO Capital persists with their Outperform rating on DoorDash, maintaining a target price of $180.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for DoorDash with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply