DJT, Bakkt stocks pop on report Trump Media in talks to acquire crypto trading platform

Trump Media & Technology Group (DJT) stock closed over 16% higher on Monday following a report from the Financial Times that said the company, which operates the social network Truth Social, is in advanced talks to acquire crypto exchange Bakkt (BKKT).

Bakkt stock gained over 162% on Monday following the report. The company is majority-owned by NYSE parent company Intercontinental Exchange (ICE).

President-elect Donald Trump maintains a roughly 60% interest in DJT, which boasts a market cap of around $7.1 billion. Trump reiterated earlier this month that he has no intention of selling his stock in the company.

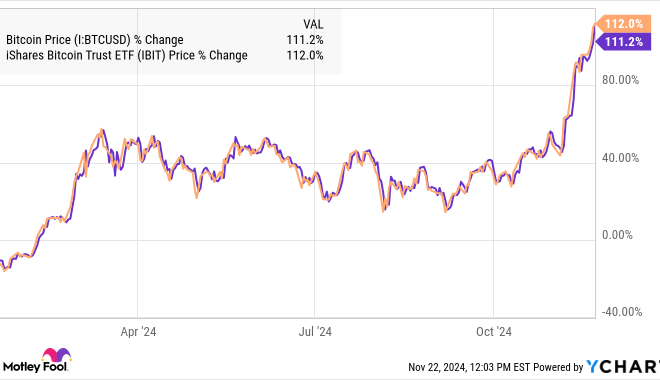

Trump’s election win has pushed bitcoin prices to all-time highs, with the administration viewed as generally more friendly to the alternative asset class.

In July, Trump attended a bitcoin conference in Nashville and has since pledged to usher in more supportive regulation. His promises also include appointing a crypto Presidential Advisory Council and firing current SEC Chair Gary Gensler.

On Monday, bitcoin (BTC-USD) rose over 2% to trade just below $92,000 a token.

Other crypto-adjacent names were also on the move higher.

Shares of MicroStrategy (MSTR), which owns nearly 280,000 bitcoins, closed almost 13% higher after it announced the purchase of an additional 51,780 bitcoins for $4.6 billion. The company now holds $16.5 billion worth of bitcoin.

Coinbase (COIN) stock also jumped over 6% on Monday, with the Wall Street Journal reporting its CEO, Brian Armstrong, was set to meet with Trump.

Bakkt, which has a market cap of around $190 million, has seen its stock fall sharply since going public in 2021. Intercontinental Exchange, its majority owner, is led by CEO Jeff Sprecher, who is married to former Georgia Sen. Kelly Loeffler, co-chair of Trump’s inaugural committee.

Trump founded Truth Social after he was kicked off major social media apps like Facebook (META) and Twitter, now X, following the Jan. 6, 2021, Capitol riots. Trump has since been reinstated on those platforms. He officially returned to posting on X in mid-August after about a year’s hiatus.

As Truth Social attempts to take on social media incumbents, the fundamentals of the company have long been in question.

On Nov. 5, just a few hours before the polls closed, DJT dropped third quarter results that revealed a net loss of $19.25 million for the quarter ending Sept. 30. DJT also reported revenue of $1.01 million. It held about $370 million in cash at the end of the quarter.

The stock is up 10% over the last month.

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Leave a Reply