Insmed's Options: A Look at What the Big Money is Thinking

Financial giants have made a conspicuous bearish move on Insmed. Our analysis of options history for Insmed INSM revealed 13 unusual trades.

Delving into the details, we found 7% of traders were bullish, while 76% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $855,036, and 3 were calls, valued at $419,310.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $62.5 to $85.0 for Insmed over the recent three months.

Analyzing Volume & Open Interest

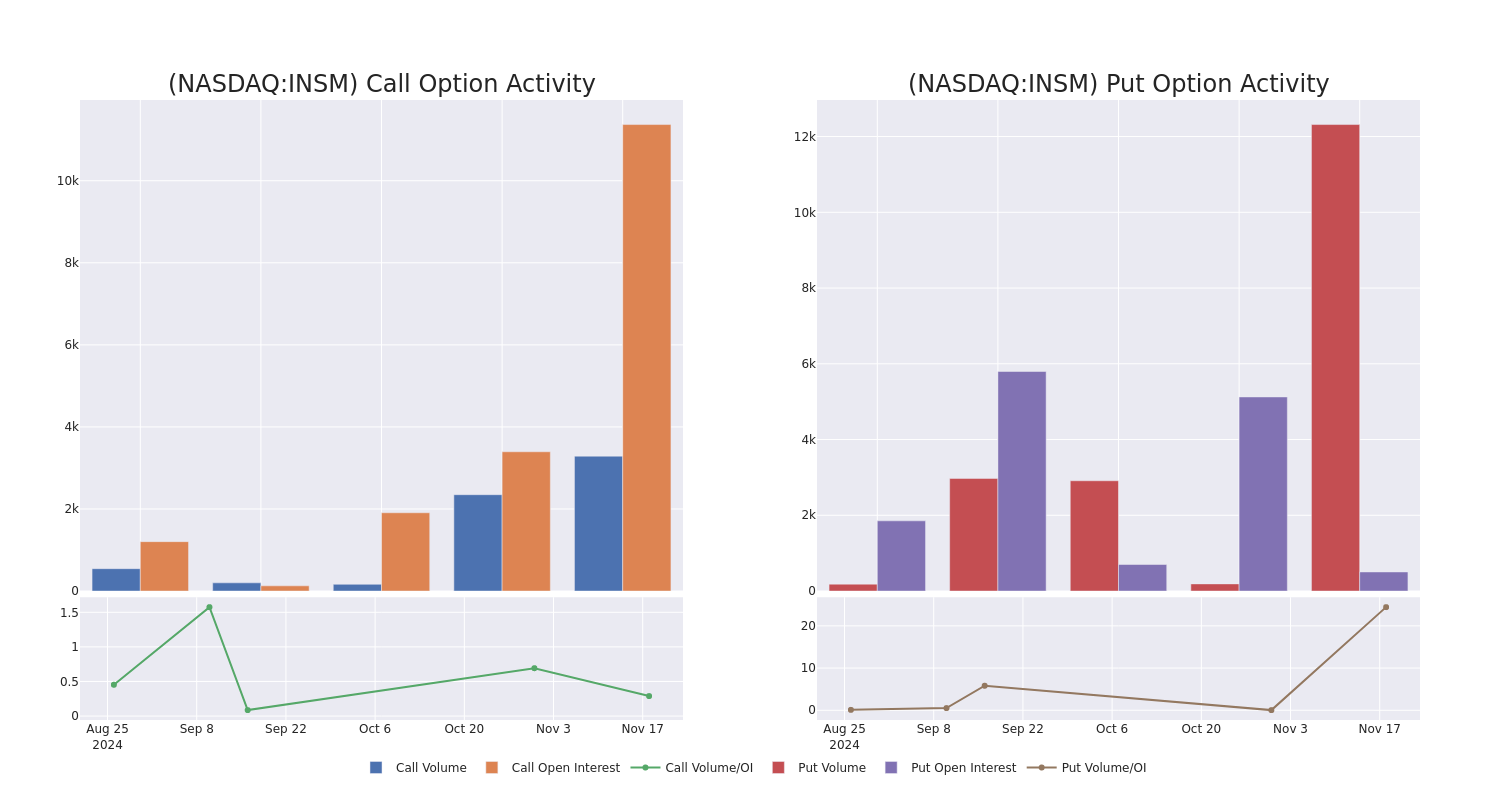

In today’s trading context, the average open interest for options of Insmed stands at 2968.25, with a total volume reaching 15,604.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Insmed, situated within the strike price corridor from $62.5 to $85.0, throughout the last 30 days.

Insmed Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INSM | CALL | TRADE | BULLISH | 01/17/25 | $1.2 | $0.75 | $1.2 | $85.00 | $360.0K | 7.1K | 3.0K |

| INSM | PUT | SWEEP | BEARISH | 01/17/25 | $4.1 | $3.8 | $4.06 | $62.50 | $150.3K | 504 | 2.3K |

| INSM | PUT | SWEEP | BEARISH | 01/17/25 | $4.5 | $3.4 | $3.9 | $62.50 | $142.3K | 504 | 365 |

| INSM | PUT | SWEEP | BEARISH | 01/17/25 | $4.0 | $3.7 | $4.0 | $62.50 | $138.4K | 504 | 1.5K |

| INSM | PUT | SWEEP | BEARISH | 01/17/25 | $4.0 | $3.7 | $4.0 | $62.50 | $123.2K | 504 | 746 |

About Insmed

Insmed Inc is a global biopharmaceutical company transforming the lives of patients with serious and rare diseases. The company’s first commercial product is ARIKAYCE (amikacin liposome inhalation suspension), approved in the US for the treatment of Mycobacterium Avium Complex (MAC) lung disease as part of a combination antibacterial drug regimen for adult patients with limited or no alternative treatment options. The company’s earlier-stage clinical pipeline includes Brensocatib, a novel oral reversible inhibitor of dipeptidyl peptidase 1 with therapeutic potential in non-cystic fibrosis bronchiectasis and other inflammatory diseases; and INS1009, an inhaled formulation of a treprostinil prodrug that may offer a differentiated product profile for pulmonary arterial hypertension.

After a thorough review of the options trading surrounding Insmed, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Insmed Standing Right Now?

- With a trading volume of 891,951, the price of INSM is down by -0.03%, reaching $66.27.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 94 days from now.

Professional Analyst Ratings for Insmed

2 market experts have recently issued ratings for this stock, with a consensus target price of $97.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Truist Securities downgraded its rating to Buy, setting a price target of $105.

* Reflecting concerns, an analyst from HC Wainwright & Co. lowers its rating to Buy with a new price target of $90.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Insmed options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply