Looking At Vistra's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Vistra VST.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with VST, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 66 uncommon options trades for Vistra.

This isn’t normal.

The overall sentiment of these big-money traders is split between 39% bullish and 45%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $377,116, and 57 are calls, for a total amount of $3,201,254.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $210.0 for Vistra during the past quarter.

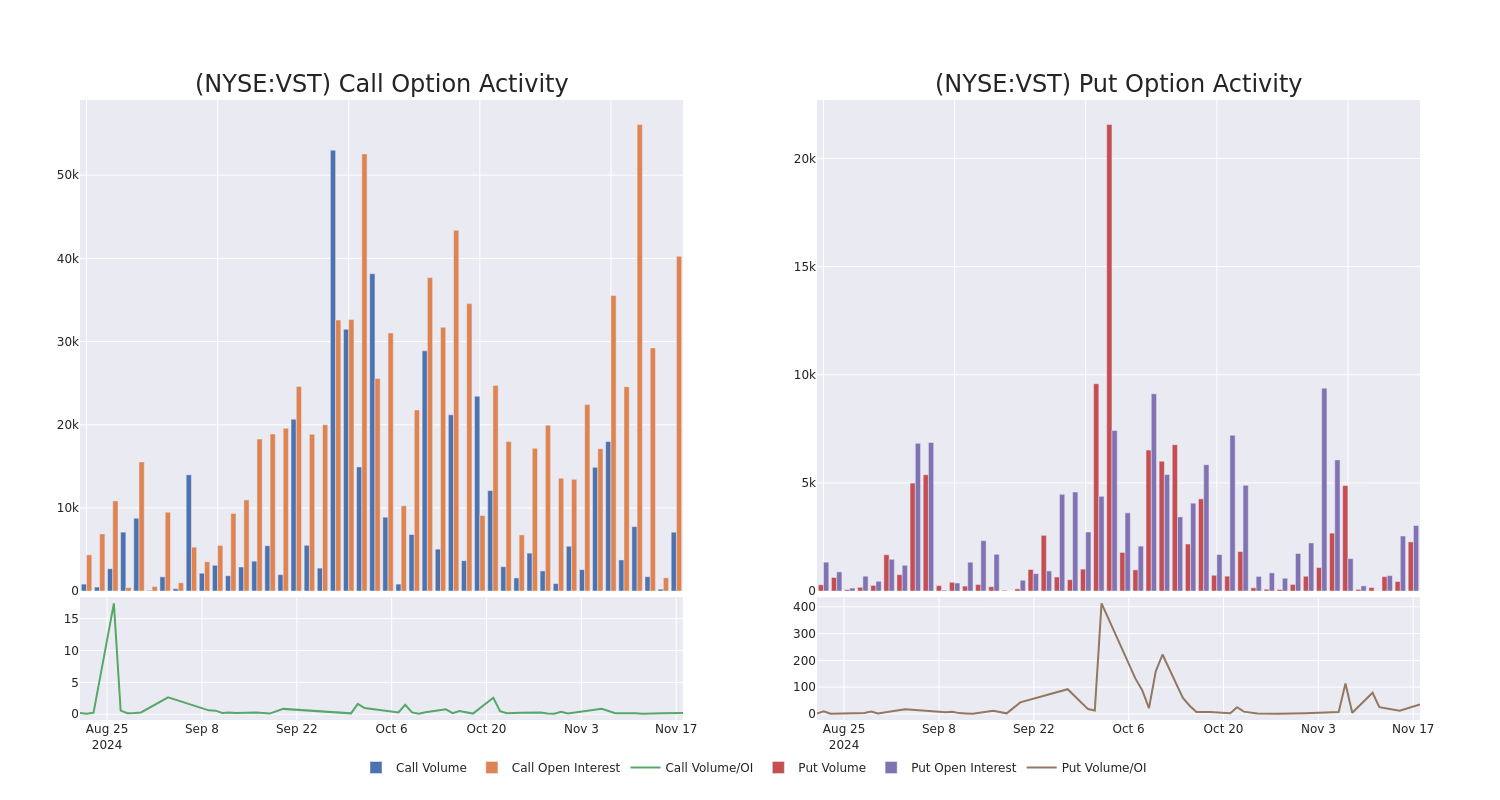

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Vistra’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vistra’s whale activity within a strike price range from $65.0 to $210.0 in the last 30 days.

Vistra Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | SWEEP | NEUTRAL | 12/20/24 | $11.9 | $11.4 | $11.62 | $150.00 | $348.4K | 4.3K | 247 |

| VST | CALL | TRADE | BULLISH | 04/17/25 | $41.7 | $41.1 | $41.5 | $120.00 | $166.0K | 4.3K | 100 |

| VST | CALL | SWEEP | BULLISH | 12/20/24 | $7.5 | $7.2 | $7.38 | $160.00 | $147.4K | 788 | 388 |

| VST | PUT | SWEEP | BEARISH | 01/17/25 | $5.4 | $5.2 | $5.4 | $130.00 | $108.5K | 2.3K | 1.9K |

| VST | CALL | TRADE | BEARISH | 12/20/24 | $11.7 | $11.6 | $11.6 | $145.00 | $91.6K | 1.4K | 337 |

About Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Following our analysis of the options activities associated with Vistra, we pivot to a closer look at the company’s own performance.

Vistra’s Current Market Status

- With a volume of 4,078,647, the price of VST is up 3.6% at $147.26.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 100 days.

What The Experts Say On Vistra

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $148.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from BMO Capital has decided to maintain their Outperform rating on Vistra, which currently sits at a price target of $147.

* An analyst from UBS has decided to maintain their Buy rating on Vistra, which currently sits at a price target of $150.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Vistra, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply