Preview: Weibo's Earnings

Weibo WB is set to give its latest quarterly earnings report on Tuesday, 2024-11-19. Here’s what investors need to know before the announcement.

Analysts estimate that Weibo will report an earnings per share (EPS) of $0.44.

The market awaits Weibo’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Earnings Track Record

Last quarter the company beat EPS by $0.02, which was followed by a 0.0% drop in the share price the next day.

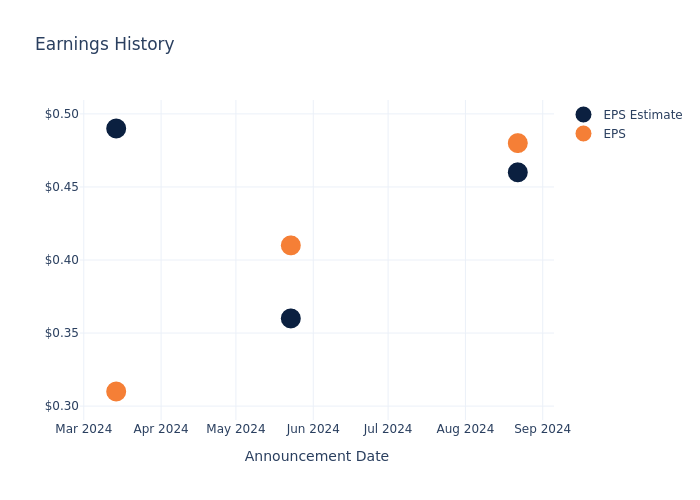

Here’s a look at Weibo’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.46 | 0.36 | 0.49 | 0.56 |

| EPS Actual | 0.48 | 0.41 | 0.31 | 0.57 |

| Price Change % | 0.0% | -0.0% | 4.0% | -1.0% |

Stock Performance

Shares of Weibo were trading at $8.35 as of November 15. Over the last 52-week period, shares are down 29.77%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts’ Take on Weibo

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Weibo.

Weibo has received a total of 2 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $9.75, the consensus suggests a potential 16.77% upside.

Analyzing Analyst Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of and Tripadvisor, three key industry players, offering insights into their relative performance expectations and market positioning.

Analysis Summary for Peers

The peer analysis summary presents essential metrics for and Tripadvisor, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Tripadvisor | Neutral | -0.19% | $485M | 4.33% |

Key Takeaway:

Weibo is positioned in the middle among its peers for consensus rating. It ranks at the bottom for revenue growth, with a negative percentage. In terms of gross profit, Weibo is ahead of its peers with a higher amount. However, its return on equity is lower compared to its peers.

Discovering Weibo: A Closer Look

Weibo Corp is a China-based company mainly engaged in the social media advertising business for people to create, discover and distribute content. The Company’s activities include Advertising and Marketing, which mainly provides a full range of advertising customization and marketing solutions. The Value-added Services mainly provide services such as membership services on social platforms, online games, live broadcasts, social e-commerce, and others. The Company’s main product is the social platform Weibo.

Weibo’s Financial Performance

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Challenges: Weibo’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -0.54%. This indicates a decrease in top-line earnings. When compared to others in the Communication Services sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 25.56%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Weibo’s ROE stands out, surpassing industry averages. With an impressive ROE of 3.43%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Weibo’s financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.56%, the company showcases efficient use of assets and strong financial health.

Debt Management: Weibo’s debt-to-equity ratio surpasses industry norms, standing at 0.8. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Weibo visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply