Preview: Workhorse Gr's Earnings

Workhorse Gr WKHS is gearing up to announce its quarterly earnings on Tuesday, 2024-11-19. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Workhorse Gr will report an earnings per share (EPS) of $-1.20.

Anticipation surrounds Workhorse Gr’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

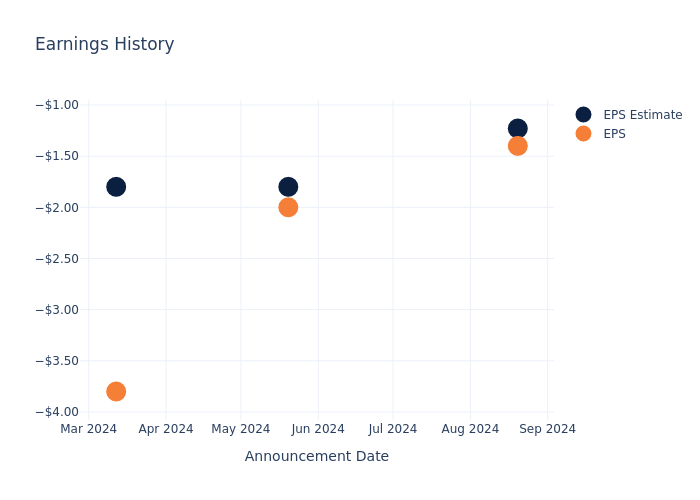

Historical Earnings Performance

In the previous earnings release, the company missed EPS by $0.17, leading to a 8.69% drop in the share price the following trading session.

Here’s a look at Workhorse Gr’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -1.23 | -1.8 | -1.8 | -2.4 |

| EPS Actual | -1.40 | -2 | -3.8 | -2.8 |

| Price Change % | -9.0% | -9.0% | -2.0% | 3.0% |

Workhorse Gr Share Price Analysis

Shares of Workhorse Gr were trading at $1.25 as of November 15. Over the last 52-week period, shares are down 82.4%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Insights Shared by Analysts on Workhorse Gr

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Workhorse Gr.

Workhorse Gr has received a total of 1 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $0.25, the consensus suggests a potential 80.0% downside.

Comparing Ratings Among Industry Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Winnebago Industries and Polestar Automotive, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- The consensus among analysts is an Buy trajectory for Winnebago Industries, with an average 1-year price target of $67.67, indicating a potential 5313.6% upside.

- Polestar Automotive received a Outperform consensus from analysts, with an average 1-year price target of $2.35, implying a potential 88.0% upside.

Overview of Peer Analysis

The peer analysis summary presents essential metrics for Winnebago Industries and Polestar Automotive, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Workhorse Gr | Neutral | -78.76% | $-6.46M | -41.76% |

| Winnebago Industries | Buy | -6.50% | $94.20M | -2.25% |

| Polestar Automotive | Outperform | -16.43% | $1.74M | -191.61% |

Key Takeaway:

Workhorse Gr ranks at the bottom for Revenue Growth and Gross Profit, indicating significant underperformance compared to its peers. Additionally, it has the lowest Return on Equity, reflecting poor profitability relative to others in the group. The consensus rating for Workhorse Gr is neutral, suggesting mixed market sentiment towards the company.

About Workhorse Gr

Workhorse Group Inc is a technology company with a vision to pioneer the transition to zero-emission commercial vehicles. Its focus is to provide sustainable and cost-effective solutions to the commercial transportation sector. It designs and manufactures all-electric delivery trucks and drone systems, including the technology that optimizes the way these vehicles operate. It’s focused on a core competency of bringing electric delivery vehicle platforms to serve the last-mile delivery market. Its products are marketed under the Workhorse brand.

Workhorse Gr’s Financial Performance

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Workhorse Gr’s revenue growth over a period of 3 months has faced challenges. As of 30 June, 2024, the company experienced a revenue decline of approximately -78.76%. This indicates a decrease in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Workhorse Gr’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -3124.26%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company’s ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -41.76%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -24.01%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Workhorse Gr’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.3.

To track all earnings releases for Workhorse Gr visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply