Spotlight on PDD Holdings: Analyzing the Surge in Options Activity

Financial giants have made a conspicuous bullish move on PDD Holdings. Our analysis of options history for PDD Holdings PDD revealed 87 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 39% showed bearish tendencies. Out of all the trades we spotted, 27 were puts, with a value of $1,964,219, and 60 were calls, valued at $8,300,647.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $230.0 for PDD Holdings over the last 3 months.

Analyzing Volume & Open Interest

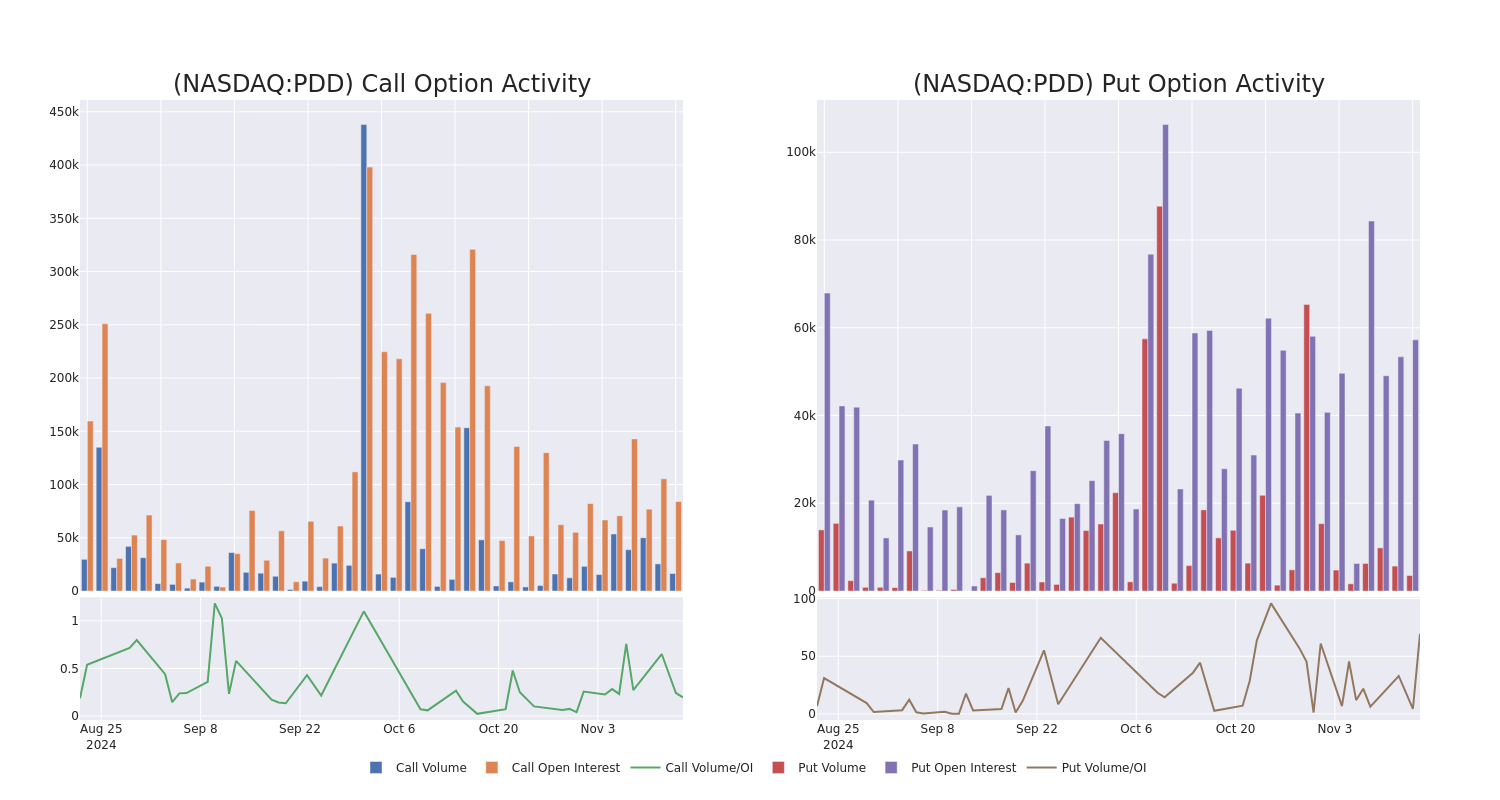

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PDD Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across PDD Holdings’s significant trades, within a strike price range of $100.0 to $230.0, over the past month.

PDD Holdings Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | BULLISH | 12/20/24 | $8.45 | $7.9 | $8.31 | $115.00 | $2.0M | 4.7K | 5.0K |

| PDD | CALL | TRADE | BEARISH | 12/20/24 | $8.15 | $8.0 | $8.0 | $115.00 | $2.0M | 4.7K | 2.5K |

| PDD | PUT | SWEEP | BULLISH | 12/13/24 | $28.05 | $27.75 | $27.8 | $144.00 | $247.4K | 0 | 139 |

| PDD | PUT | SWEEP | BULLISH | 12/20/24 | $38.7 | $38.45 | $38.45 | $155.00 | $192.2K | 1.0K | 50 |

| PDD | CALL | SWEEP | BULLISH | 12/20/24 | $6.3 | $6.2 | $6.3 | $120.00 | $184.5K | 4.2K | 654 |

About PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

Following our analysis of the options activities associated with PDD Holdings, we pivot to a closer look at the company’s own performance.

Present Market Standing of PDD Holdings

- Trading volume stands at 6,199,920, with PDD’s price up by 3.47%, positioned at $117.96.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 3 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PDD Holdings with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply