Trump Victory-Led Rally In Stocks Shrugged Off Rise In Yields, But Analyst Says If Treasuries 'Don't Find A Ceiling…It Will Become A Problem': Here's What It Means For Investors

The victory of President-elect Donald Trump accompanied by stronger-than-expected economic data has been able to shrug off the worries from the rise in Treasury yields as the S&P 500 Index, which fell by 2.3% last week at 5,870.62 is still higher than its pre-election levels of 5,712.69 points on Monday, Nov. 4.

However, Fed Chair Jerome Powell‘s pirouette on interest rate reduction on Thursday last week may soon start weighing in on the equity markets as experts have highlighted the possible concerns about a “tighter monetary environment” if the economy remains strong.

After the 25 basis Nov. 7 rate cut, Powell said that “the economy is not sending any signals that we need to be in a hurry to lower rates.”

What Happened: Reducing interest rates increases liquidity in the system, thus giving a boost to investment in equities, but on the contrary, holding the interest rates at a higher level causes the liquidity to reduce, yields to rise, and consequently, the economy to shrink.

While the U.S. inflation and economy shows no sign of cooling off, Fed officials may decide not to cut the rates further in their Dec. 17-18 meeting, which will impact the equity markets.

The U.S. two-year Treasury yield rose to 4.31%, whereas the ten-year yield jumped to 4.45% on Friday. “If yields continue to trend up and they don’t find their ceiling, I think it will become a problem because it will basically translate into a tighter monetary environment,” said Irene Tunkel, chief U.S. equity strategist at BCA Research, to Reuters.

Also read: Powell’s Hawkish Remarks Shake Markets: Stocks Fall, Dollar Rockets, Bitcoin Dips

Why It Matters: “A tighter monetary environment” corresponds to higher central bank interest rates, lower bond prices, and higher yields. A tighter monetary policy, causes the yields to rise in the short term and makes borrowing more expensive, gradually reducing the liquidity in the system and hampering the growth while increasing the fear of recession.

The Federal Open Market Committee has the behemoth task of determining the rates and setting the targets while maintaining economic growth. Moreover, a tighter monetary environment is feared by equity investors as fixed-income and debt instruments become more lucrative than equities.

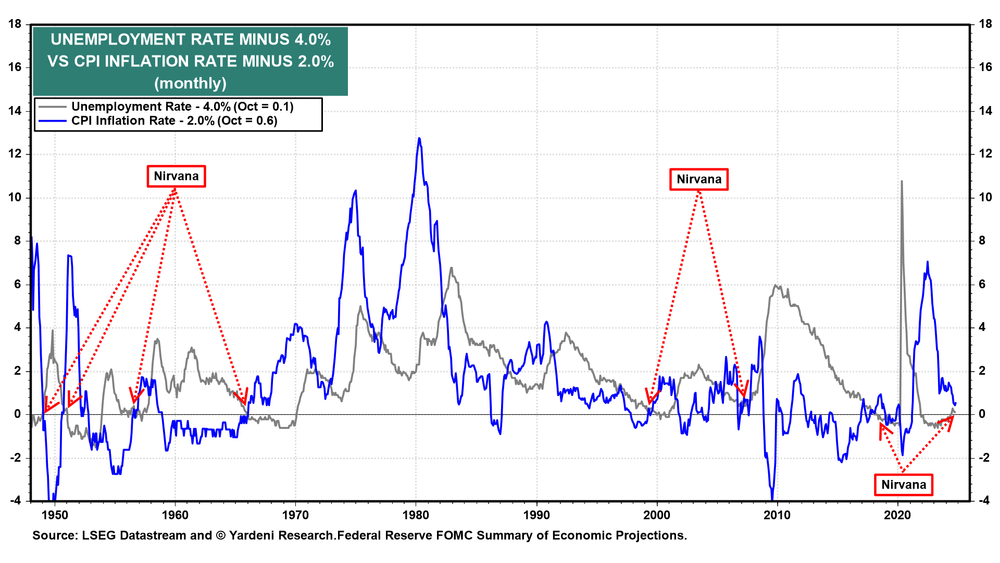

“Just last Thursday, at his presser, he (Powell) claimed that the FFR (Federal Fund Rate) was still too restrictive and had to be lowered to the neutral FFR. Meanwhile, our new ‘Nirvana Model’ shows that both the unemployment rate and inflation rates suggest that the current FFR is at the neutral rate.” said Yardeni Research in one of their quick takes.

Talking about the two-year and ten-year Treasuries, the note added that “we expect both yields to be range bound between 4.25% and 4.75% over the rest of this year and possibly into next year.”

Adding about equities the Yardeni Research note said that “this might be a signal that the stock market could experience a correction now that the Fed might pause rate cutting. Nevertheless, we expect a Santa Claus rally in the S&P 500 to 6,100 points by the end of this year.”

Similar to the S&P 500 Index, the Nasdaq Composite fell by 3.49% last week to 18,680.12 points but remains higher than its Nov. 4 level of 18,179.98 points. NYSE Composite, which was 1.46% lower last week at 19,645.77 points, is also higher than its pre-election level of 19,243.39 points. The SPDR S&P 500 ETF SPY which tracks the S&P 500 Index has had a similar momentum in 2024.

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply