Unpacking the Latest Options Trading Trends in Hims & Hers Health

Deep-pocketed investors have adopted a bullish approach towards Hims & Hers Health HIMS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in HIMS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 28 extraordinary options activities for Hims & Hers Health. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 71% leaning bullish and 14% bearish. Among these notable options, 12 are puts, totaling $960,282, and 16 are calls, amounting to $827,190.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $15.0 and $42.0 for Hims & Hers Health, spanning the last three months.

Insights into Volume & Open Interest

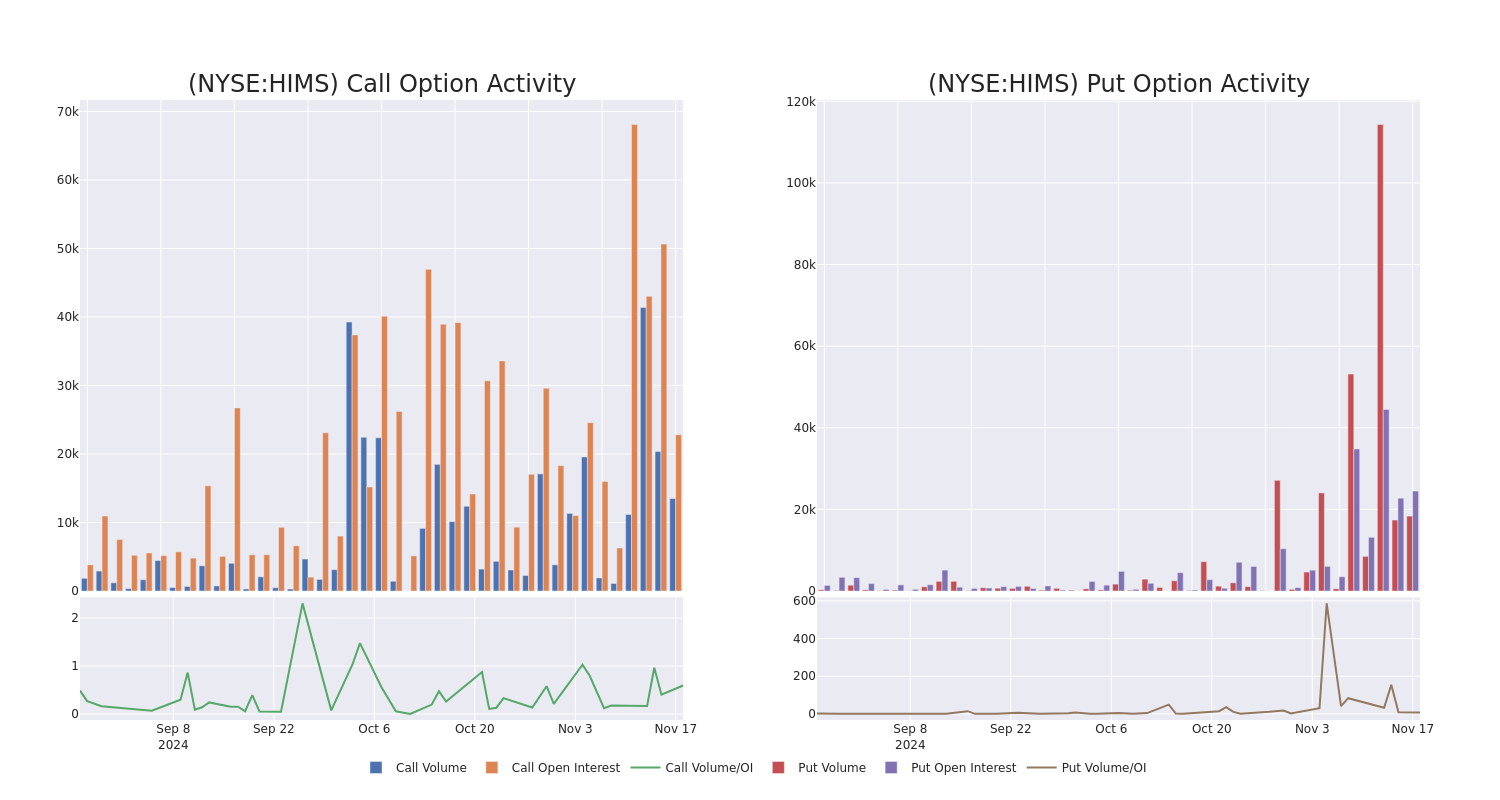

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Hims & Hers Health’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Hims & Hers Health’s whale activity within a strike price range from $15.0 to $42.0 in the last 30 days.

Hims & Hers Health Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HIMS | PUT | SWEEP | BULLISH | 12/20/24 | $5.4 | $5.3 | $5.3 | $25.00 | $208.8K | 3.5K | 1.7K |

| HIMS | PUT | SWEEP | NEUTRAL | 11/29/24 | $1.5 | $1.4 | $1.44 | $20.50 | $147.0K | 2.0K | 2.3K |

| HIMS | CALL | SWEEP | BULLISH | 01/17/25 | $1.35 | $1.25 | $1.34 | $28.00 | $132.7K | 2.7K | 1.2K |

| HIMS | PUT | SWEEP | BULLISH | 01/17/25 | $2.45 | $2.4 | $2.4 | $20.00 | $120.0K | 6.2K | 989 |

| HIMS | PUT | TRADE | NEUTRAL | 12/20/24 | $2.5 | $2.4 | $2.45 | $21.00 | $113.9K | 5.2K | 480 |

About Hims & Hers Health

Hims & Hers Health Inc is a multi-specialty telehealth platform that connects consumers to licensed healthcare professionals, enabling them to access high-quality medical care for numerous conditions related to mental health, sexual health, dermatology, primary care, and more.

In light of the recent options history for Hims & Hers Health, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Hims & Hers Health

- Currently trading with a volume of 10,964,198, the HIMS’s price is up by 12.73%, now at $21.78.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 98 days.

What Analysts Are Saying About Hims & Hers Health

In the last month, 5 experts released ratings on this stock with an average target price of $23.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from B of A Securities downgraded its rating to Underperform, setting a price target of $18.

* Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $21.

* An analyst from Canaccord Genuity persists with their Buy rating on Hims & Hers Health, maintaining a target price of $28.

* An analyst from Deutsche Bank has decided to maintain their Hold rating on Hims & Hers Health, which currently sits at a price target of $27.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Hims & Hers Health with a target price of $25.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Hims & Hers Health, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply