Dow's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bearish approach towards Dow DOW, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DOW usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 13 extraordinary options activities for Dow. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 38% bearish. Among these notable options, 5 are puts, totaling $1,267,514, and 8 are calls, amounting to $278,560.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $47.5 for Dow over the recent three months.

Volume & Open Interest Development

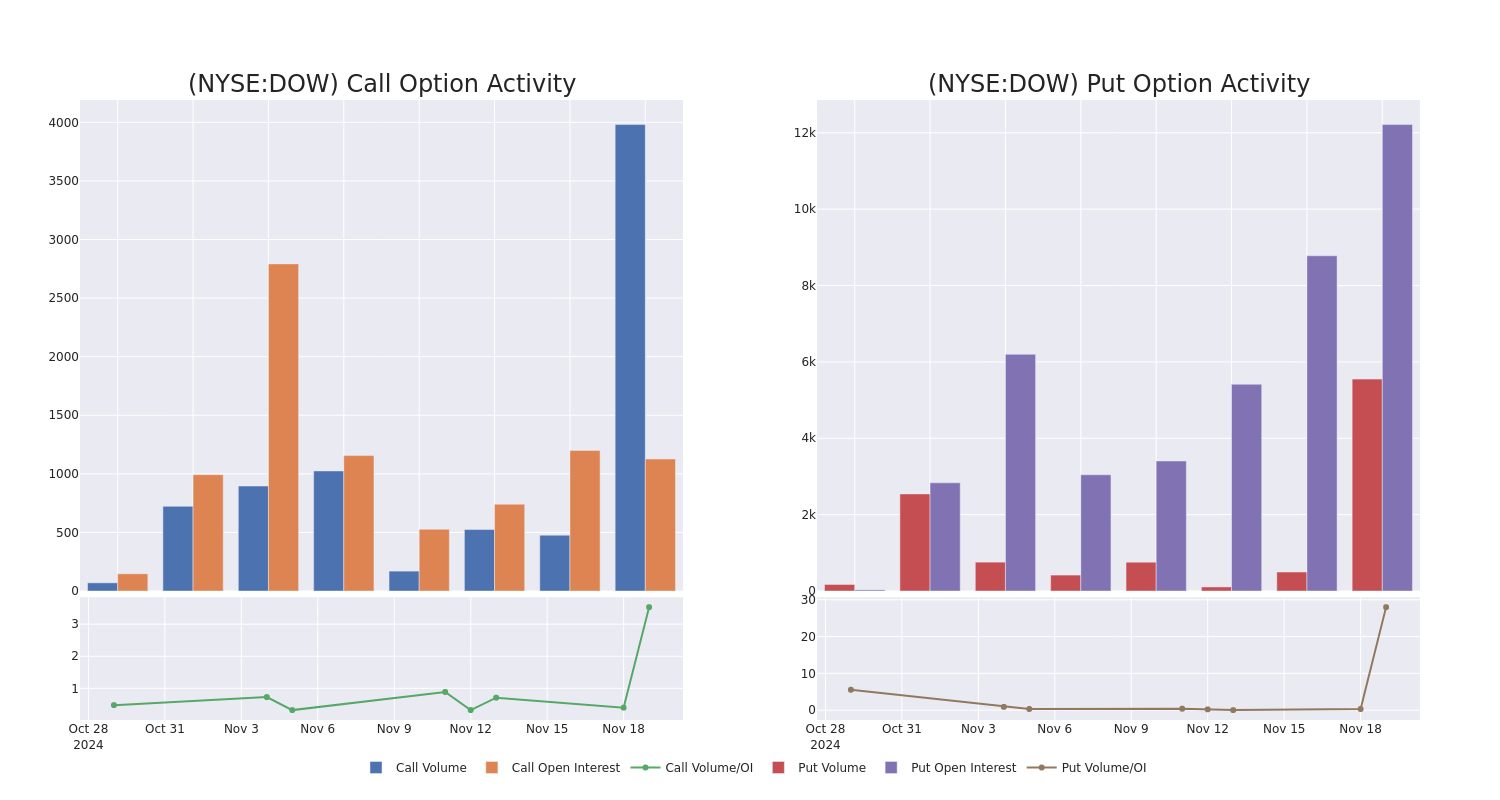

In terms of liquidity and interest, the mean open interest for Dow options trades today is 1667.75 with a total volume of 9,530.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dow’s big money trades within a strike price range of $25.0 to $47.5 over the last 30 days.

Dow Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DOW | PUT | TRADE | BULLISH | 06/20/25 | $3.2 | $3.1 | $3.14 | $42.50 | $628.0K | 1.5K | 2.0K |

| DOW | PUT | SWEEP | BEARISH | 02/21/25 | $1.88 | $1.88 | $1.89 | $42.50 | $283.8K | 37 | 975 |

| DOW | PUT | SWEEP | BEARISH | 03/21/25 | $2.28 | $2.01 | $2.28 | $42.50 | $208.7K | 6.9K | 915 |

| DOW | PUT | TRADE | BULLISH | 03/21/25 | $2.29 | $2.25 | $2.25 | $42.50 | $92.0K | 6.9K | 1.4K |

| DOW | CALL | TRADE | BULLISH | 01/15/27 | $6.9 | $6.6 | $6.8 | $40.00 | $68.0K | 77 | 100 |

About Dow

Dow Chemical is a diversified global chemicals producer, formed in 2019 as a result of the DowDuPont merger and subsequent separations. The firm is a leading producer of several chemicals, including polyethylene, ethylene oxide, and silicone rubber. Its products have numerous applications in both consumer and industrial end markets.

In light of the recent options history for Dow, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Dow

- Trading volume stands at 1,898,002, with DOW’s price down by -1.29%, positioned at $43.65.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 72 days.

Professional Analyst Ratings for Dow

3 market experts have recently issued ratings for this stock, with a consensus target price of $58.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Piper Sandler has decided to maintain their Overweight rating on Dow, which currently sits at a price target of $60.

* Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on Dow with a target price of $54.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Dow, which currently sits at a price target of $60.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Dow with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply