Lowe's Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Lowe’s Companies, Inc. LOW will release earnings results for its third quarter, before the opening bell on Tuesday, Nov. 19.

Analysts expect the Mooresville, North Carolina-based company to report quarterly earnings at $2.81 per share, down from $3.06 per share in the year-ago period. Lowe’s projects to report quarterly revenue of $19.91 billion, compared to $20.47 billion a year earlier, according to data from Benzinga Pro.

On Aug. 20, the company reported adjusted earnings per share of $4.10, beating the analyst consensus of $3.99. Quarterly revenues totaled $23.586 billion, missing the street view of $24.013 billion.

Lowe’s shares gained 0.9% to close at $271.77 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

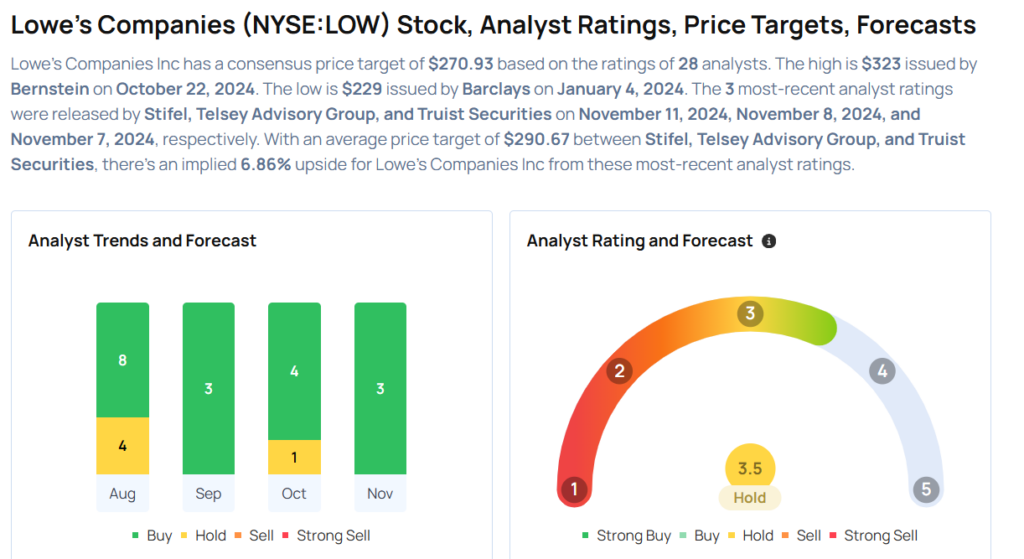

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Telsey Advisory Group analyst Joseph Feldman upgraded the stock from Market Perform to Outperform and raised the price target from $275 to $305 on Nov. 8. This analyst has an accuracy rate of 69%.

- Truist Securities analyst Scot Ciccarelli maintained a Buy rating and increased the price target from $306 to $307 on Nov. 7. This analyst has an accuracy rate of 75%.

- Wells Fargo analyst Zachary Fadem maintained an Overweight rating and raised the price target from $280 to $295 on Nov. 6. This analyst has an accuracy rate of 87%.

- TD Cowen analyst Max Rakhlenko maintained a Hold rating and boosted the price target from $270 to $290 on Oct. 28. This analyst has an accuracy rate of 61%.

- Loop Capital analyst Laura Champine upgraded the stock from Hold to Buy and increased the price target from $250 to $300 on Oct. 9. This analyst has an accuracy rate of 64%.

Considering buying LOW stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply