Market Whales and Their Recent Bets on IONQ Options

Investors with a lot of money to spend have taken a bullish stance on IonQ IONQ.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with IONQ, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 62 uncommon options trades for IonQ.

This isn’t normal.

The overall sentiment of these big-money traders is split between 58% bullish and 32%, bearish.

Out of all of the special options we uncovered, 14 are puts, for a total amount of $1,331,990, and 48 are calls, for a total amount of $2,500,876.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $7.5 and $40.0 for IonQ, spanning the last three months.

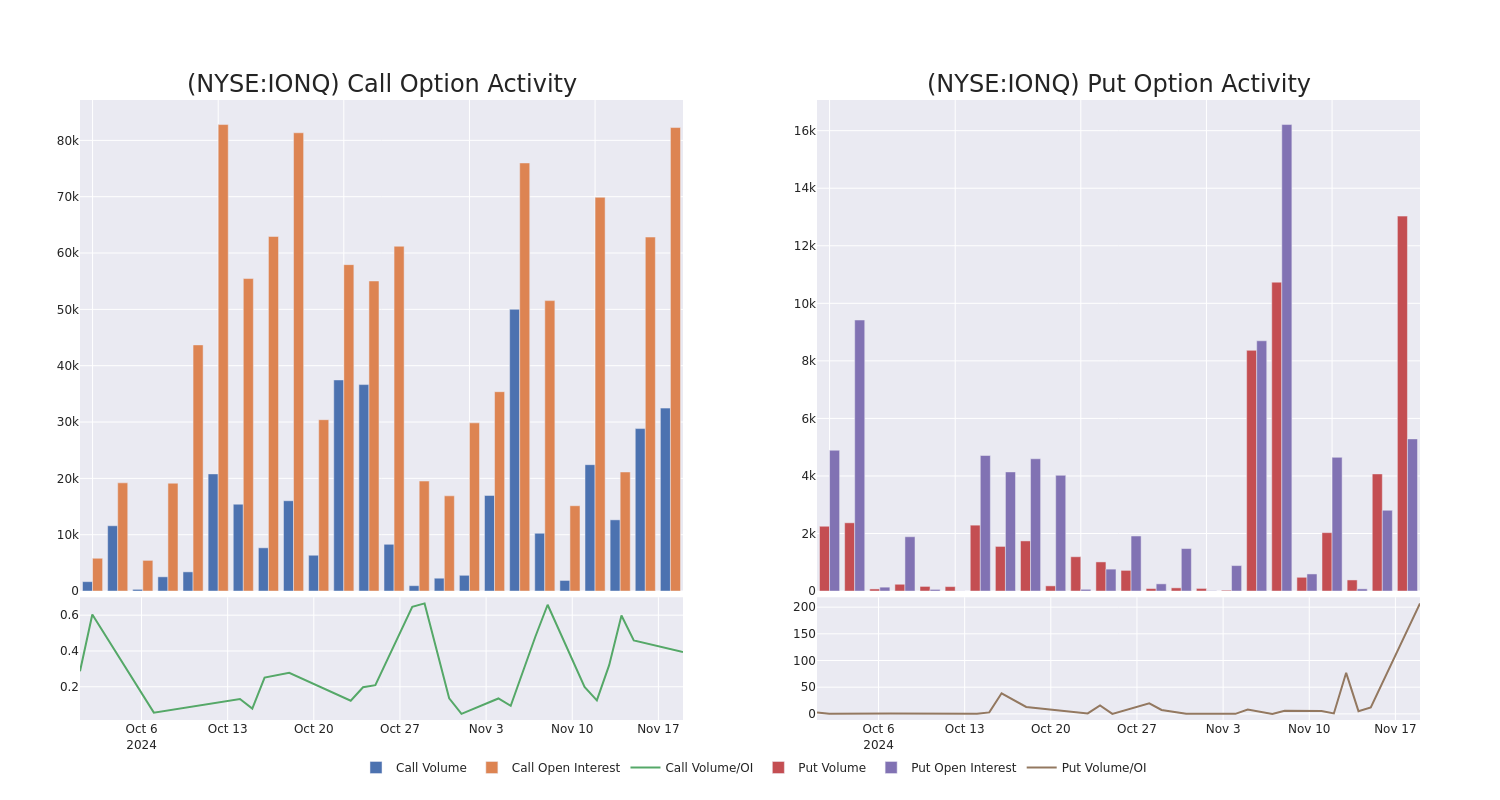

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of IonQ stands at 3648.38, with a total volume reaching 45,328.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in IonQ, situated within the strike price corridor from $7.5 to $40.0, throughout the last 30 days.

IonQ Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IONQ | PUT | SWEEP | BEARISH | 12/20/24 | $3.8 | $3.75 | $3.75 | $28.00 | $467.6K | 12 | 1.8K |

| IONQ | CALL | SWEEP | BEARISH | 11/22/24 | $3.1 | $2.95 | $2.94 | $25.00 | $146.5K | 3.9K | 1.4K |

| IONQ | CALL | SWEEP | BEARISH | 11/22/24 | $3.15 | $2.92 | $2.91 | $25.00 | $145.3K | 3.9K | 1.9K |

| IONQ | PUT | SWEEP | BULLISH | 01/17/25 | $11.0 | $10.95 | $10.95 | $35.00 | $141.2K | 1.2K | 151 |

| IONQ | CALL | TRADE | BEARISH | 01/17/25 | $13.25 | $13.05 | $13.1 | $15.00 | $131.0K | 7.6K | 151 |

About IonQ

IonQ Inc sells access to several quantum computers of various qubit capacities and is in the process of researching and developing technologies for quantum computers with increasing computational capabilities. The company currently makes access to its quantum computers available via cloud platforms and also to select customers via its own cloud service. This cloud-based approach enables the broad availability of quantum-computing-as-a-service (QCaaS). The company derives its revenue from its quantum-computing-as-a-service arrangements, consulting services related to co-developing algorithms on company’s quantum computing systems, and contracts associated with the design, development, and construction of specialized quantum computing systems together with related services.

Following our analysis of the options activities associated with IonQ, we pivot to a closer look at the company’s own performance.

Present Market Standing of IonQ

- Currently trading with a volume of 25,367,717, the IONQ’s price is up by 10.7%, now at $27.93.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 99 days.

Professional Analyst Ratings for IonQ

3 market experts have recently issued ratings for this stock, with a consensus target price of $20.666666666666668.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Needham continues to hold a Buy rating for IonQ, targeting a price of $18.

* Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for IonQ, targeting a price of $22.

* Consistent in their evaluation, an analyst from Craig-Hallum keeps a Buy rating on IonQ with a target price of $22.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest IonQ options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply