Erik Ragatz Boosts Confidence With $2.01M Purchase Of Grocery Outlet Holding Stock

A significant insider buy by Erik Ragatz, Director at Grocery Outlet Holding GO, was executed on November 18, and reported in the recent SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Monday showed that Ragatz purchased 110,000 shares of Grocery Outlet Holding. The total transaction amounted to $2,007,500.

At Tuesday morning, Grocery Outlet Holding shares are up by 4.42%, trading at $18.65.

All You Need to Know About Grocery Outlet Holding

Grocery Outlet Holding Corp is a grocery store operator in the United States. Its flexible buying model allows them to offer quality, name-brand opportunistic products at prices generally 40% to 70% below those of conventional retailers. The stores are run by Entrepreneurial independent operators which create a neighborhood feel through personalized customer service and a localized product offering.

Grocery Outlet Holding: Financial Performance Dissected

Positive Revenue Trend: Examining Grocery Outlet Holding’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 10.39% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Consumer Staples sector, the company excelled with a growth rate higher than the average among peers.

Exploring Profitability:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 31.12%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Grocery Outlet Holding’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.25.

Debt Management: With a high debt-to-equity ratio of 1.29, Grocery Outlet Holding faces challenges in effectively managing its debt levels, indicating potential financial strain.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: Grocery Outlet Holding’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 35.02.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.42 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 16.53 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Understanding Crucial Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Grocery Outlet Holding’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Confidence On Display: CARL ICAHN Acquires $1.01M In CVR Partners Stock

It was revealed in a recent SEC filing that CARL ICAHN, 10% Owner at CVR Partners UAN made a noteworthy insider purchase on November 18,.

What Happened: In a Form 4 filing on Monday with the U.S. Securities and Exchange Commission, it was disclosed that ICAHN bought 13,971 shares of CVR Partners, amounting to a total of $1,010,026.

CVR Partners shares are trading down 0.31% at $71.47 at the time of this writing on Tuesday morning.

About CVR Partners

CVR Partners LP is a manufacturer and supplier of nitrogen fertilizer products. Its principal products include Urea Ammonium Nitrate (UAN) and ammonia. The company market ammonia products to industrial and agricultural customers and UAN products to agricultural customers. The primary geographic markets for its fertilizer products are Kansas, Missouri, Nebraska, Iowa, Illinois, Colorado, and Texas. The company’s product sales are heavily weighted toward UAN.

Key Indicators: CVR Partners’s Financial Health

Decline in Revenue: Over the 3 months period, CVR Partners faced challenges, resulting in a decline of approximately -4.13% in revenue growth as of 30 September, 2024. This signifies a reduction in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Materials sector.

Key Profitability Indicators:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 14.73%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): CVR Partners’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 0.36.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.92, caution is advised due to increased financial risk.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 14.42 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.44 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 7.18, CVR Partners presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Exploring Key Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of CVR Partners’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spotlight on Boeing: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Boeing.

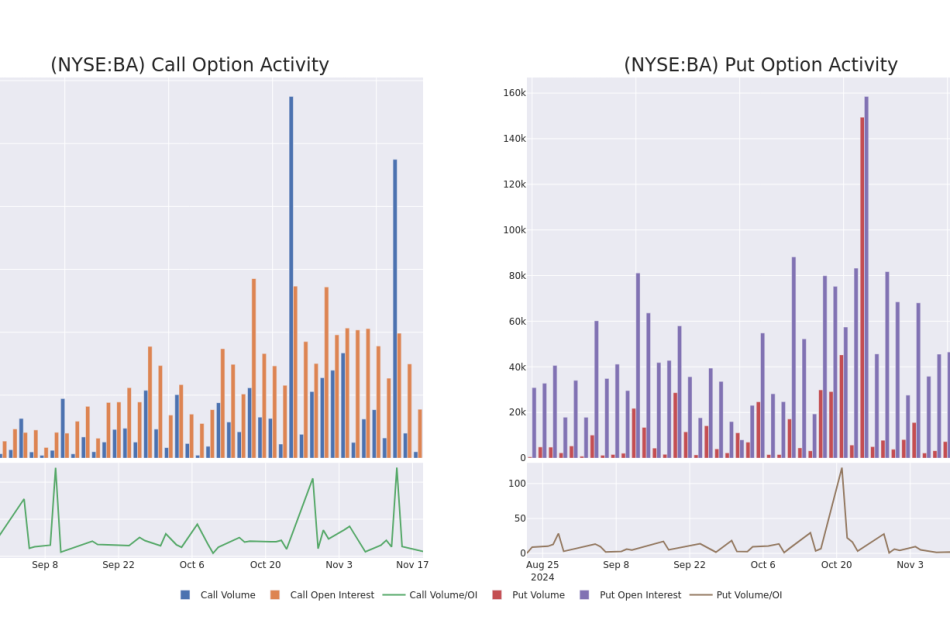

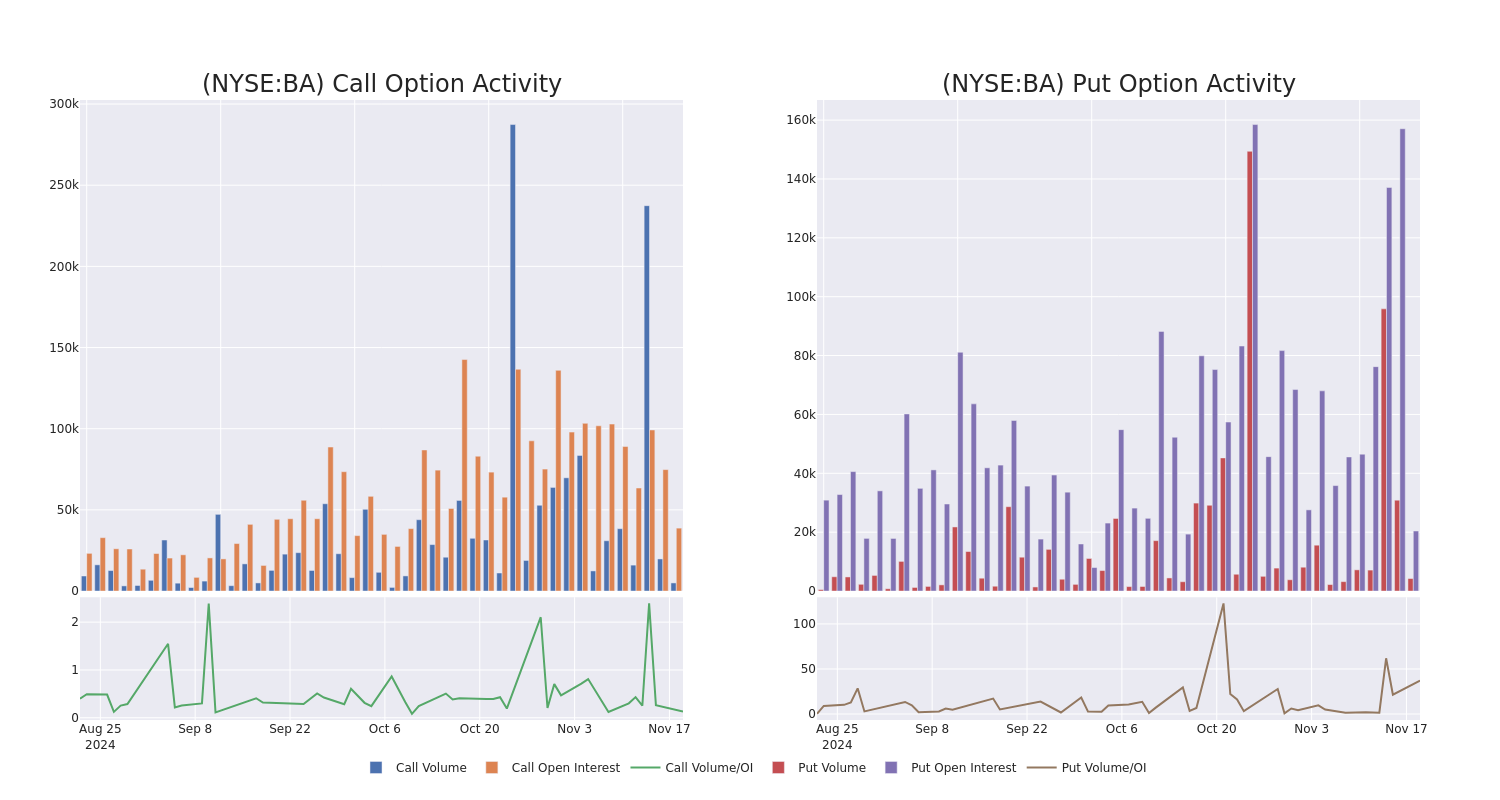

Looking at options history for Boeing BA we detected 46 trades.

If we consider the specifics of each trade, it is accurate to state that 54% of the investors opened trades with bullish expectations and 32% with bearish.

From the overall spotted trades, 20 are puts, for a total amount of $1,841,266 and 26, calls, for a total amount of $1,214,796.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $120.0 to $220.0 for Boeing over the last 3 months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Boeing’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Boeing’s whale activity within a strike price range from $120.0 to $220.0 in the last 30 days.

Boeing Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BA | PUT | SWEEP | BULLISH | 01/15/27 | $43.6 | $38.5 | $39.33 | $170.00 | $395.3K | 141 | 102 |

| BA | PUT | SWEEP | BEARISH | 01/15/27 | $39.35 | $38.15 | $39.35 | $170.00 | $161.3K | 141 | 253 |

| BA | PUT | SWEEP | BEARISH | 01/15/27 | $14.75 | $14.05 | $14.5 | $120.00 | $144.9K | 357 | 207 |

| BA | PUT | TRADE | BEARISH | 01/15/27 | $14.45 | $14.1 | $14.45 | $120.00 | $144.5K | 357 | 407 |

| BA | PUT | TRADE | NEUTRAL | 01/15/27 | $14.65 | $14.2 | $14.45 | $120.00 | $144.5K | 357 | 307 |

About Boeing

Boeing is a major aerospace and defense firm. It operates in three segments: commercial airplanes; defense, space, and security; and Global services. Boeing’s commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing’s defense, space, and security segment competes with Lockheed, Northrop, and several other firms to create military aircraft, satellites, and weaponry. Global services provides aftermarket support to airlines.

Having examined the options trading patterns of Boeing, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Boeing

- With a volume of 4,215,868, the price of BA is up 0.33% at $144.35.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 71 days.

Professional Analyst Ratings for Boeing

5 market experts have recently issued ratings for this stock, with a consensus target price of $204.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Benchmark downgraded its action to Buy with a price target of $250.

* An analyst from Susquehanna persists with their Positive rating on Boeing, maintaining a target price of $200.

* An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Boeing, which currently sits at a price target of $170.

* An analyst from RBC Capital has revised its rating downward to Outperform, adjusting the price target to $200.

* An analyst from Baird persists with their Outperform rating on Boeing, maintaining a target price of $200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Boeing, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PainReform Stock Is Soaring Tuesday: What's Going On?

PainReform Ltd. PRFX shares are ripping higher Tuesday following the company’s announcement of a 1-for-4 reverse stock split. Here’s what you need to know.

What To Know: The reverse stock split, announced in a filing with the U.S. Securities and Exchange Commission, will take effect after the market closes on Wednesday. The company’s shares will begin trading on a split-adjusted basis on Thursday.

Under the terms of the split, every four ordinary shares will be consolidated into one. Following the split, the company will have approximately 590,616 shares issued and outstanding.

No fractional shares will be issued and any fractional amounts will be rounded up to the nearest whole share. Moreover, adjustments will be made to the exercise price and the number of shares tied to outstanding options and warrants.

It’s worth noting that the company received a letter from the Nasdaq earlier this month noting that it was not in compliance with Nasdaq listing requirements. The company has until Dec. 19 to regain compliance.

PainReform shares are trending across various social platforms on Tuesday as the stock trades on abnormally high volume. PainReform’s average session volume is about 491,000, according to Benzinga Pro. Tuesday’s trading volume was around 164 million at the time of writing.

PRFX Price Action: PainReform shares were up 157.8% at $1.39 at the time of writing, according to Benzinga Pro.

Read Next:

Image Via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Dips Over 300 Points; Walmart Raises FY25 Forecast

U.S. stocks traded lower this morning, with the Dow Jones index falling by more than 300 points on Tuesday.

Following the market opening Tuesday, the Dow traded down 0.74% to 43,067.69 while the NASDAQ fell 0.29% to 18,738.99. The S&P 500 also fell, dropping, 0.48% to 5,865.32.

Check This Out: This Apollo Global Management Analyst Begins Coverage On A Bullish Note; Here Are Top 5 Initiations For Tuesday

Leading and Lagging Sectors

Consumer staples shares rose by 0.1% on Tuesday.

In trading on Tuesday, consumer discretionary shares fell by 1%.

Top Headline

Walmart Inc WMT announced upbeat third-quarter results and raised its fiscal-2025 guidance.

The retailer reported adjusted EPS of 58 cents, beating the consensus of 53 cents. Sales were $169.59 billion, up 5.5% year over year or 6.2% (at constant currency), beating the consensus of $167.72 billion.

For FY25, the big box retailer raised its adjusted EPS outlook to $2.42 – $2.47 (from $2.35 – $2.43), vs. the consensus of $2.45. Walmart boosted FY25 net sales (at constant currency) growth guidance to 4.8% – 5.1% from 3.75% – 4.75% earlier.

Equities Trading UP

- noco-noco Inc. NCNC shares shot up 160% to $0.2520.

- Shares of PainReform Ltd. PRFX got a boost, surging 104% to $1.0898. The company announced a 1-for-4 reverse stock split.

- Interactive Strength Inc. TRNR shares were also up, gaining 36% to $3.4499. The company, which makes specialty fitness equipment under the CLMBR and FORME brands, disclosed that Armah Sports Group‘s B_FIT is installing CLMBRs in three of its nine locations in Saudi Arabia.

Equities Trading DOWN

- QMMM Holdings Limited QMMM shares dropped 40% to $1.04.

- Shares of Wellchange Holdings Company Limited WCT were down 25% to $2.62.

- Apollomics, Inc. APLM was down, falling 22% to $0.1506.

Commodities

In commodity news, oil traded down 0.5% to $68.85 while gold traded up 1% at $2,641.50.

Silver traded up 0.8% to $31.485 on Tuesday, while copper fell 0.4% to $4.1040.

Euro zone

European shares were lower today. The eurozone’s STOXX 600 fell 0.8%, Germany’s DAX fell 1.1% and France’s CAC 40 fell 1.2%. Spain’s IBEX 35 Index fell 1.5%, while London’s FTSE 100 fell 0.4%.

Hourly labor costs in the Eurozone rose by 4.6% year-over-year in the third quarter compared to a revised 5% gain in the prior quarter. Annual inflation in the Eurozone rose to 2% in October from 1.7% in September.

Asia Pacific Markets

Asian markets closed higher on Tuesday, with Japan’s Nikkei 225 gaining 0.51%, Hong Kong’s Hang Seng Index gaining 0.44%, China’s Shanghai Composite Index gaining 0.67% and India’s BSE Sensex gaining 0.31%.

Malaysia’s trade surplus narrowed to MYR 12.0 billion in October from MYR 13.0 billion in the year-ago month.

Economics

- Housing starts in the U.S. declined by 3.1% to 1.311 million in October versus a revised 1.353 million in the previous month.

- U.S. building permits declined by 0.6% to an annual rate of 1.416 million in October.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GE Vernova to acquire Woodward’s gas turbine parts business in US

GE Vernova, a division of General Electric, has agreed to purchase the heavy-duty gas turbine combustion parts business of Woodward, located in Greenville, South Carolina, US.

The move is a strategic effort by GE Vernova to bolster US manufacturing and strengthen its domestic supply chain.

GE Vernova will acquire all assets associated with Woodward’s Greenville site, which is primarily engaged in supplying parts and services to GE Vernova’s gas turbine manufacturing operations.

GE Vernova has had a presence in the Greenville region for more than five decades, with operations that include gas turbine manufacturing and testing, and global engineering support.

GE Vernova Gas Power business president and CEO Eric Gray stated: “We are excited to acquire and integrate this critical capability for our domestic supply chain as we continue to see increasing demand for our heavy-duty gas turbines and upgrades globally.

“Welcoming these experts to our Greenville, SC team will further enable us to address this growing demand from our customers and meet the electrification needs of our country while serving as an indicator of our commitment to the industry and the community.”

Although the financial details of the deal remain undisclosed, the acquisition is anticipated to be finalised in early 2025.

GE Vernova is committed to collaborating with Woodward to ensure a seamless transition for the Greenville employees.

Woodward chairman and CEO Chip Blankenship stated: “We are pleased to sign this agreement with GE Vernova.

“This targeted transaction is good for our customers and members and will allow us to focus resources on products that will drive the most value as part of Woodward.

“I am grateful for our Greenville members’ longtime dedication to Woodward and to serving the customer. They will have opportunities to continue their great work as GE Vernova takes on ownership of the operations.”

In November 2024, GE Vernova and ASHOMCo completed FEED studies to reduce carbon emissions at three Saudi cogeneration plants.

“GE Vernova to acquire Woodward’s gas turbine parts business in US” was originally created and published by Power Technology, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

Check Out What Whales Are Doing With ELF

Investors with a lot of money to spend have taken a bullish stance on e.l.f. Beauty ELF.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ELF, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

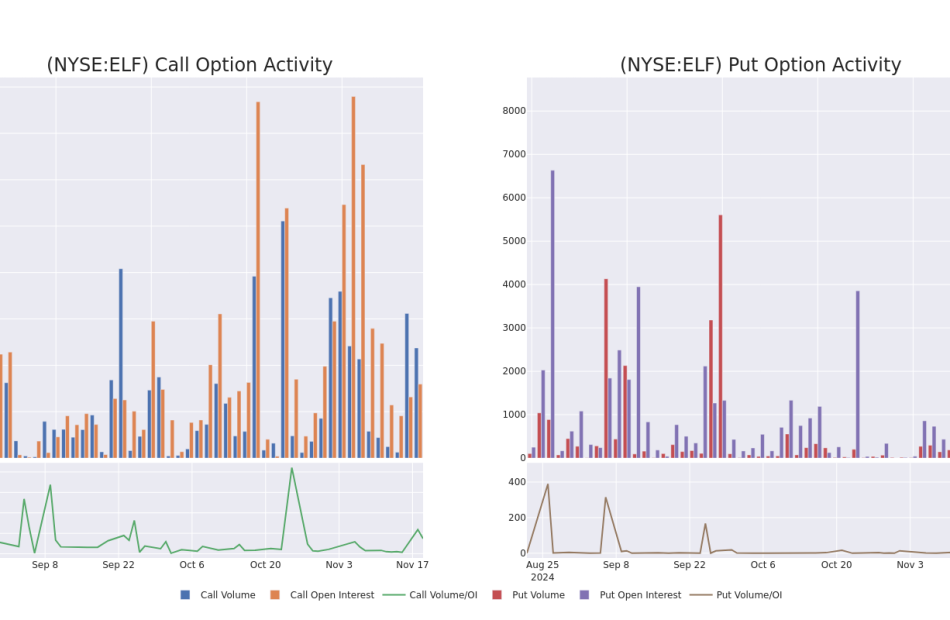

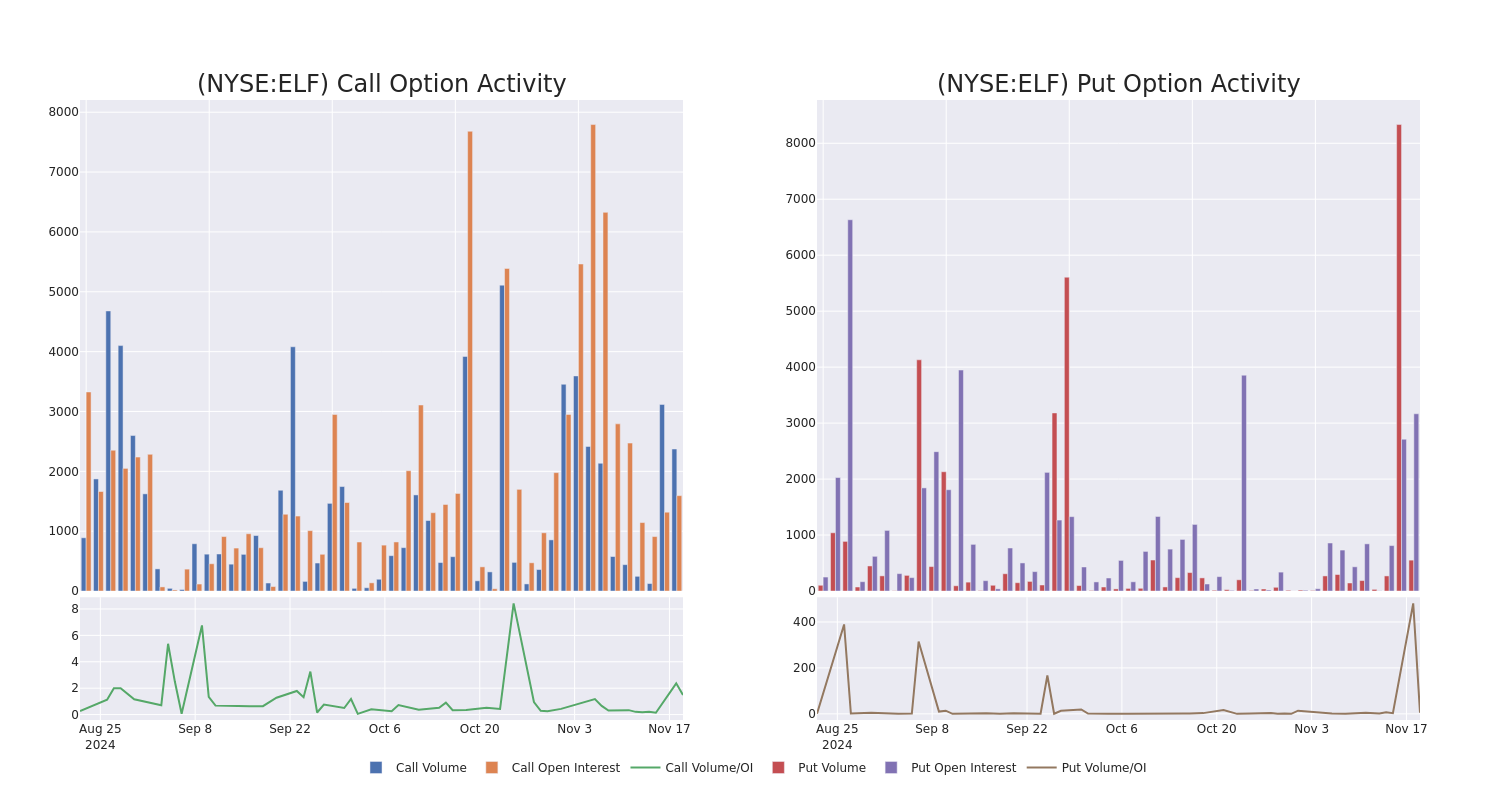

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for e.l.f. Beauty.

This isn’t normal.

The overall sentiment of these big-money traders is split between 50% bullish and 40%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $173,793, and 5 are calls, for a total amount of $435,620.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $110.0 and $270.0 for e.l.f. Beauty, spanning the last three months.

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for e.l.f. Beauty’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of e.l.f. Beauty’s whale trades within a strike price range from $110.0 to $270.0 in the last 30 days.

e.l.f. Beauty Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ELF | CALL | SWEEP | BULLISH | 11/22/24 | $1.8 | $1.75 | $1.75 | $125.00 | $180.3K | 762 | 1.6K |

| ELF | CALL | SWEEP | BULLISH | 11/22/24 | $2.15 | $2.1 | $2.1 | $125.00 | $113.1K | 762 | 542 |

| ELF | CALL | SWEEP | BEARISH | 06/20/25 | $23.7 | $21.7 | $22.86 | $125.00 | $55.3K | 131 | 11 |

| ELF | CALL | SWEEP | BEARISH | 01/16/26 | $5.9 | $5.0 | $5.0 | $270.00 | $50.0K | 156 | 100 |

| ELF | PUT | TRADE | BEARISH | 12/20/24 | $11.8 | $11.7 | $11.8 | $125.00 | $47.2K | 635 | 44 |

About e.l.f. Beauty

e.l.f. Beauty Inc is a multi-brand beauty company that offers inclusive, accessible, clean, vegan and cruelty-free cosmetics and skin care products. The Company’s mission is to make the best of beauty accessible to every eye, lip, face, and skin concern. The company offers cosmetic accessories for women which include eyeliner, mascara, false eyelashes, lipstick, the foundation for the face, moisturizer, cleanser, and other tools through its stores and e-commerce channels. The products that the company sells are marketed under the e.l.f. Cosmetics, W3LL PEOPLE and Keys Soulcare brands. It carries out sales within the US and internationally, out of which maximum revenue is generated from the US.

Following our analysis of the options activities associated with e.l.f. Beauty, we pivot to a closer look at the company’s own performance.

Where Is e.l.f. Beauty Standing Right Now?

- With a volume of 965,299, the price of ELF is down -1.93% at $120.3.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 77 days.

Professional Analyst Ratings for e.l.f. Beauty

5 market experts have recently issued ratings for this stock, with a consensus target price of $162.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from DA Davidson continues to hold a Buy rating for e.l.f. Beauty, targeting a price of $170.

* An analyst from Piper Sandler downgraded its action to Overweight with a price target of $165.

* An analyst from B. Riley Securities has decided to maintain their Buy rating on e.l.f. Beauty, which currently sits at a price target of $150.

* An analyst from JP Morgan persists with their Overweight rating on e.l.f. Beauty, maintaining a target price of $154.

* An analyst from Baird persists with their Outperform rating on e.l.f. Beauty, maintaining a target price of $175.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for e.l.f. Beauty with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why QuantumScape Stock Jumped Higher Today

QuantumScape (NYSE: QS) is working to revolutionize electric-vehicle (EV) battery technology. If its solid-state solution can be proven successful and able to be produced at scale, it could lead to a surge of interest in consumer EV demand.

One Wall Street firm is acknowledging the company’s progress and has raised its view of the stock. That led QuantumScape shares to surge today by as much as nearly 6%. As of 11:45 a.m. ET, the stock was still trading higher by 3.9%.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

According to reports, financial services firm HSBC has upgraded QuantumScape from the equivalent of a sell to a hold recommendation. It also raised its price target on the stock by nearly 13% to $5.30. QuantumScape shares closed Monday’s trading at $4.73 per share.

The company has made meaningful progress with its battery technology this year. It also announced an agreement with PowerCo earlier this year, the battery division of global automaker Volkswagen.

That agreement will help to industrialize QuantumScape’s technology, giving PowerCo a non-exclusive license to manufacture batteries using the technology to build as many as 1 million EVs per year. It was also a large reason for HSBC’s upgrade. The agreement could lead to other deals at production levels beyond QuantumScape’s internal capabilities.

Investors still need to view QuantumScape as a high-risk investment. If successful, the batteries are intended to provide charging capability in under 15 minutes while allowing for higher range and lower overheating risks.

However, the company just recently shipped its first prototypes for automotive testing. The collaboration with PowerCo will lower QuantumScape’s capital needs and thus extend its cash runway into 2028. But it will likely take that much time for its technology to be fully evaluated and validated by potential customers.

An investment here could pay off down the road. However, it will likely take several years before the business itself can be sustainable.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Super Micro Computer Just Announced Big News and the Stock Is Soaring. Is the Worst Finally Over?

The mad dash to adopt artificial intelligence (AI) has catapulted a number of companies into the spotlight, and Super Micro Computer (NASDAQ: SMCI), commonly called Supermicro, has arguably been one of the biggest beneficiaries. The company is the leading provider of servers specially designed to withstand the rigors of AI, giving Supermicro a pivotal role in the AI revolution.

However, the spotlight can be a cruel mistress, which Supermicro recently experienced firsthand. The company became a victim of its own success, causing a number of self-inflicted injuries that sent the stock plunging as much as 84% from its all-time high, reached earlier this year.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Supermicro announced that it had developed a plan to avoid delisting and had hired a new auditor. The news sent the stock soaring, up more than 30% Tuesday morning (as of this writing).

Let’s take a look at the events leading up to today, the company’s big announcement, and what it means for investors.

Supermicro was flying high earlier this year, riding the wave of AI adoption that caused a surge in demand for its AI-centric servers, sending the stock up more than 1,000% since the AI revolution kicked off in early 2023. But the celebration was short-lived, and the stock came crashing down. For those who haven’t been following along, here’s a quick recap of the issues that have plagued the beleaguered company:

-

Hindenburg issued a short report that alleged, among other things, that Supermicro’s financials contained accounting irregularities, the company had failed to disclose related-party transactions, and had violated U.S. export bans.

-

The very next day, Supermicro added fuel to the fire by announcing it would be late filing its annual 10-K report with the Securities and Exchange Commission (SEC), saying it needed additional time to review its internal controls — or the processes it uses to ensure compliance with accounting rules and regulations.

-

Just weeks later, reports emerged that the U.S. Department of Justice (DOJ) was conducting a probe of the company, according to The Wall Street Journal. The investigation appeared to be the result of a whistleblower report that alleged accounting violations.

-

Supermicro revealed that it had received a letter of non-compliance from the Nasdaq exchange, which could ultimately lead to delisting.

-

Supermicro disclosed that its auditor, Ernst & Young — one of the world’s most respected accounting firms — had resigned in the midst of the company’s audit. The auditors cited issues related to internal controls over Supermicro’s financial reporting.

-

In another regulatory filing, Supermicro admitted it wouldn’t be able to file its most recent quarterly report on time, which again raised the specter of delisting.