Nasdaq Gains 100 Points; Lowe's Earnings Beat Views

U.S. stocks traded mixed midway through trading, with the Nasdaq Composite gaining by around 100 points on Tuesday.

The Dow traded down 0.34% to 43,244.07 while the NASDAQ rose 0.53% to 18,892.31. The S&P 500 also rose, gaining, 0.14% to 5,902.02.

Check This Out: This Apollo Global Management Analyst Begins Coverage On A Bullish Note; Here Are Top 5 Initiations For Tuesday

Leading and Lagging Sectors

Information technology shares rose by 0.2% on Tuesday.

In trading on Tuesday, materials shares fell by 0.9%.

Top Headline

Lowe’s Companies, Inc. LOW posted better-than-expected earnings for its third quarter on Tuesday.

The company reported third-quarter adjusted earnings per share of $2.89 beating the street view of $2.82. Quarterly sales of $20.170 billion outpaced the analyst consensus estimate of $19.424 billion.

Lowe’s has revised its fiscal year 2024 outlook for its adjusted earnings per share (EPS) guidance from a range of $11.70 – $11.90 to a range of $11.80 – $11.90, compared with the consensus estimate of $11.85. Additionally, the company raised its sales forecast from a range of $82.70 billion – $83.20 billion to a new range of $83.00 billion – $83.50 billion, compared with the consensus estimate of $83.05 billion.

Equities Trading UP

- Super Micro Computer, Inc. SMCI shares shot up 28% to $27.54 after the company announced the appointment of BDO USA as its independent auditor and the filing of a compliance plan with Nasdaq.

- Shares of PainReform Ltd. PRFX got a boost, surging 195% to $1.5999. The company announced a 1-for-4 reverse stock split.

- Interactive Strength Inc. TRNR shares were also up, gaining 48% to $3.75. The company, which makes specialty fitness equipment under the CLMBR and FORME brands, disclosed that Armah Sports Group‘s B_FIT is installing CLMBRs in three of its nine locations in Saudi Arabia.

Equities Trading DOWN

- NWTN Inc. NWTN shares dropped 12% to $1.06. NWTN received Nasdaq staff delisting determination for non-compliance with Listing Rule 5250(c)(1).

- Shares of Incyte Corporation INCY were down 11% to $68.17 after the company announced that data from its Phase 2 study evaluating MRGPRX4 (INCB000547) in cholestatic pruritus does not support further development.

- Codere Online Luxembourg, S.A. CDRO was down, falling 9% to $6.93 after the company received a Nasdaq delisting notice due to its public reports rule.

Commodities

In commodity news, oil traded up 0.6% to $69.58 while gold traded up 0.6% at $2,630.60.

Silver traded up 0.1% to $31.255 on Tuesday, while copper fell 0.3% to $4.1080.

Euro zone

European shares were lower today. The eurozone’s STOXX 600 fell 0.91%, Germany’s DAX fell 1.28% and France’s CAC 40 fell 1.26%. Spain’s IBEX 35 Index fell 1.47%, while London’s FTSE 100 fell 0.36%.

Hourly labor costs in the Eurozone rose by 4.6% year-over-year in the third quarter compared to a revised 5% gain in the prior quarter. Annual inflation in the Eurozone rose to 2% in October from 1.7% in September.

Asia Pacific Markets

Asian markets closed higher on Tuesday, with Japan’s Nikkei 225 gaining 0.51%, Hong Kong’s Hang Seng Index gaining 0.44%, China’s Shanghai Composite Index gaining 0.67% and India’s BSE Sensex gaining 0.31%.

Malaysia’s trade surplus narrowed to MYR 12.0 billion in October from MYR 13.0 billion in the year-ago month.

Economics

- Housing starts in the U.S. declined by 3.1% to 1.311 million in October versus a revised 1.353 million in the previous month.

- U.S. building permits declined by 0.6% to an annual rate of 1.416 million in October.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 To Reach 6,500 By End Of 2025, Analysts Predict: Could It Spark M&A Revival?

Wall Street analysts are painting optimistic pictures for the U.S. stock market heading into 2025, with the S&P 500 index — as tracked by the SPDR S&P 500 ETF Trust SPY — expected to climb to 6,500 points by year’s end, according to both Goldman Sachs and Morgan Stanley.

That projection represents an 11% gain from current levels and places the return in the 46th percentile of 12-month S&P 500 returns since 1980.

Yet, while both firms share optimism about the market’s trajectory, their outlooks show notable differences in the rationale behind the call.

In a note shared to clients on Monday, Goldman Sachs equity analyst David J. Kostin said the bullish forecast hinges on continued economic expansion and a robust corporate earnings outlook.

The analyst expects “continued U.S. economic expansion, earnings growth of 11% in 2025 and 7% in 2026.”

Economic and fiscal policies are likely to have a significant impact on corporate performance. Kostin’s team assumes that the Trump administration will implement targeted tariffs on imported automobiles and select imports from China, alongside a 15% corporate tax rate for domestic manufacturers.

Michael Wilson, chief investment officer and strategist at Morgan Stanley, echoed Goldman Sachs’ optimism.

“We raise our base case 12-month price target to 6,500,” Wilson said in his latest research note, adding that a post-election rise in “corporate animal spirits” could catalyze balanced earnings growth across sectors.

In the base case, Morgan Stanley expects the S&P 500’s valuation multiple to hold steady despite its historically elevated level. “It’s rare to see significant multiple compression in periods of above-average earnings growth and accommodative monetary policy,” Wilson explained.

Wilson also laid out a wider range of scenarios for 2025, reflecting potential economic and policy volatility.

His bull case sees the S&P 500 reaching 7,400, while his bear case forecasts a steep drop to 4,600.

“Our prior bull case narrative has been playing out as macro data has improved alongside accommodative policy,” Wilson wrote.

Both analysts noted the recent U.S. presidential election could have profound market implications.

Kostin’s team anticipates regulatory rollbacks and a business-friendly tax environment, while Wilson highlighted the potential creation of a new Department of Government Efficiency (DOGE) as a key wildcard.

The proposed DOGE could shift fiscal policy by consolidating deficits and cutting federal spending. “In short, we are potentially going through another sea change in policy outcomes that could have both short- and longer-term implications for markets,” Wilson wrote.

The “Magnificent 7” tech giants — Microsoft Corp. MSFT, Apple Inc. AAPL, NVIDIA Corp. NVDA, Alphabet Inc. GOOG GOOGL, Amazon.com Inc. AMZN, Meta Platforms Inc. META and Tesla, Inc. TSLA — have dominated the market narrative for the past two years, delivering a jaw-dropping 148% return since the end of 2022. For context, the other 493 stocks in the S&P 500 gained just 35% in the same period.

“The seven companies in aggregate accounted for more than half of the S&P 500’s 57% rise over the past two years,” Kostin said. However, their dominance has begun to wane.

In 2023, the Magnificent 7 outperformed the rest of the index by 63 percentage points. In 2024, that gap has narrowed to just 22 points, with the Magnificent 7 rising 41% year-to-date versus an 18% gain for the remaining stocks.

For 2025, Kostin predicts that the Magnificent 7 will continue to outperform, but the margin will shrink even further.

“We expect in 2025 the Magnificent 7 stocks collectively will outperform the S&P 493, but by roughly seven percentage points, the slimmest margin in seven years,” he said.

Both Kostin and Wilson are urging investors to look beyond the Magnificent 7 and explore mid-cap and cyclical opportunities.

“We recommend investors benchmark the Magnificent 7 and seek opportunities in mid-cap equities,” Kostin said, pointing to the S&P 400 MidCap Index, which trades at a lower 16x forward P/E multiple and has historically outperformed large- and small-cap stocks.

Sector-wise Kostin is also particularly bullish on Materials, Software & Services, and Utilities.

Wilson also highlighted cyclicals, noting that lighter regulation and renewed optimism post-election could drive growth in this group. “In our view, the outcome of the U.S. election raises the likelihood of a lighter regulatory environment and a potential rebound in animal spirits, which should further benefit this group,” Wilson said.

Both analysts also highlighted the potential for a revival in merger and acquisition activity in 2025.

“CEO confidence is a key variable affecting executives’ inclination to engage in M&A activity,” Kosting said. Federal regulators’ antitrust policies over the past four years have created headwinds for dealmaking, but an expected reduction in regulatory uncertainty could reignite activity.

“We continue to expect a major, multiyear rebound in activity, aided by record-high stock market levels, an economic soft landing, lower interest rates, open capital markets, greater corporate confidence, and growing pressure on private asset managers to both deploy funds and harvest investments,” Wilson said.

Read Now:

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MICHAEL SIEVERT Takes Money Off The Table, Sells $9.57M In T-Mobile US Stock

A substantial insider sell was reported on November 18, by MICHAEL SIEVERT, President and CEO at T-Mobile US TMUS, based on the recent SEC filing.

What Happened: SIEVERT’s recent move involves selling 40,000 shares of T-Mobile US. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value is $9,568,800.

In the Tuesday’s morning session, T-Mobile US‘s shares are currently trading at $235.09, experiencing a down of 0.82%.

Discovering T-Mobile US: A Closer Look

Deutsche Telekom merged its T-Mobile USA unit with prepaid specialist MetroPCS in 2013, and that firm merged with Sprint in 2020, creating the second-largest wireless carrier in the US. T-Mobile now serves 77 million postpaid and 21 million prepaid phone customers, equal to around 30% of the US retail wireless market. The firm entered the fixed-wireless broadband market aggressively in 2021 and now serves more than 5 million residential and business customers. In addition, T-Mobile provides wholesale services to resellers.

A Deep Dive into T-Mobile US’s Financials

Positive Revenue Trend: Examining T-Mobile US’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.73% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Communication Services sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: Achieving a high gross margin of 65.14%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): T-Mobile US’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 2.62.

Debt Management: T-Mobile US’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.81.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 27.03, T-Mobile US’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 3.51 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 12.71, the company’s market valuation exceeds industry averages.

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Closer Look at Important Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of T-Mobile US’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Intuit and H&R Block Fall on Report of ‘DOGE’ Interest in Tax App

(Bloomberg) — Intuit Inc. and H&R Block Inc. shares fell on Tuesday, after the Washington Post reported that the leaders of President-elect Donald Trump’s “Department of Government Efficiency” discussed creating a new way for Americans to file their taxes.

Most Read from Bloomberg

H&R Block fell as much as 8.7%, dropping to its lowest since August, while Intuit fell as much as 6.8%, erasing much of an advance that had come in the wake of the election.

Intuit, the maker of TurboTax, and H&R Block dominate the US tax preparation industry, earning billions of dollars a year providing digital and in-person services. The discussions follow the roll out of a pilot program for taxpayers to file their returns for free online as part of the Biden administration’s Inflation Reduction Act.

The Washington Post report, which cited people familiar with the conversations, said that the “DOGE” panel discussed creating mobile app for Americans to file their taxes for free. A post from “DOGE” said that the tax code had gotten too complex and “must be simplified.”

Separately, Bloomberg Intelligence wrote that an IRS entry into the tax-prep industry “could, in theory, threaten revenue for H&R Block, Jackson Hewitt and Intuit,” with almost a third of Intuit’s sales at risk. However, analyst Andrew Silverman believes the “Direct File” tool “won’t successfully compete,” as the IRS “can’t devote the resources to it and is ill-equipped to create or maintain the software necessary to appeal to taxpayers.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Energizer, C3.ai, Insmed And Other Big Stocks Moving Higher On Tuesday

U.S. stocks were lower, with the Dow Jones index falling more than 350 points on Tuesday.

Shares of Energizer Holdings, Inc. ENR rose sharply during Tuesday’s session following better-than-expected quarterly earnings.

Energizer reported quarterly earnings of $1.22 per share which beat the analyst consensus estimate of $1.17 per share. The company reported quarterly sales of $805.70 million which missed the analyst consensus estimate of $806.4 million.

Energizer shares jumped 12.8% to $38.52 on Tuesday.

Here are some other big stocks recording gains in today’s session.

- Super Micro Computer, Inc. SMCI shares jumped 31.9% to $28.41 after the company announced the appointment of BDO USA as its independent auditor and the filing of a compliance plan with Nasdaq.

- Symbotic Inc. SYM gained 26.5% to $38.66 after the company on Monday reported better-than-expected quarterly financial results.

- BigBear.ai Holdings, Inc. BBAI shares rose 17% to $2.0600.

- Alumis Inc. ALMS shares jumped 16.2% to $10.04.

- Apellis Pharmaceuticals, Inc. APLS surged 15.4% to $30.20.

- C3.ai, Inc. AI shares rose 14.3% to $30.33 after the company announced a strategic alliance with Microsoft to accelerate the adoption of enterprise AI on Azure.

- Lemonade, Inc. LMND surged 12.7% to $38.93

- Applied Digital Corporation APLD rose 11.6% to $8.65.

- Oscar Health, Inc. OSCR gained 11.5% to $17.82.

- Intuitive Machines, Inc. LUNR gained 10% to $12.84.

- Insmed Incorporated INSM surged 7.7% to $71.73. Insmed, on Nov. 18, terminated sales agreement with Leerink Partners.

- Joby Aviation, Inc. JOBY shares rose 7.1% to $6.01. Needham analyst Chris Pierce initiated coverage on Joby Aviation with a Buy rating and announced a price target of $8.

- Oklo Inc. OKLO gained 5.5% to $21.83.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

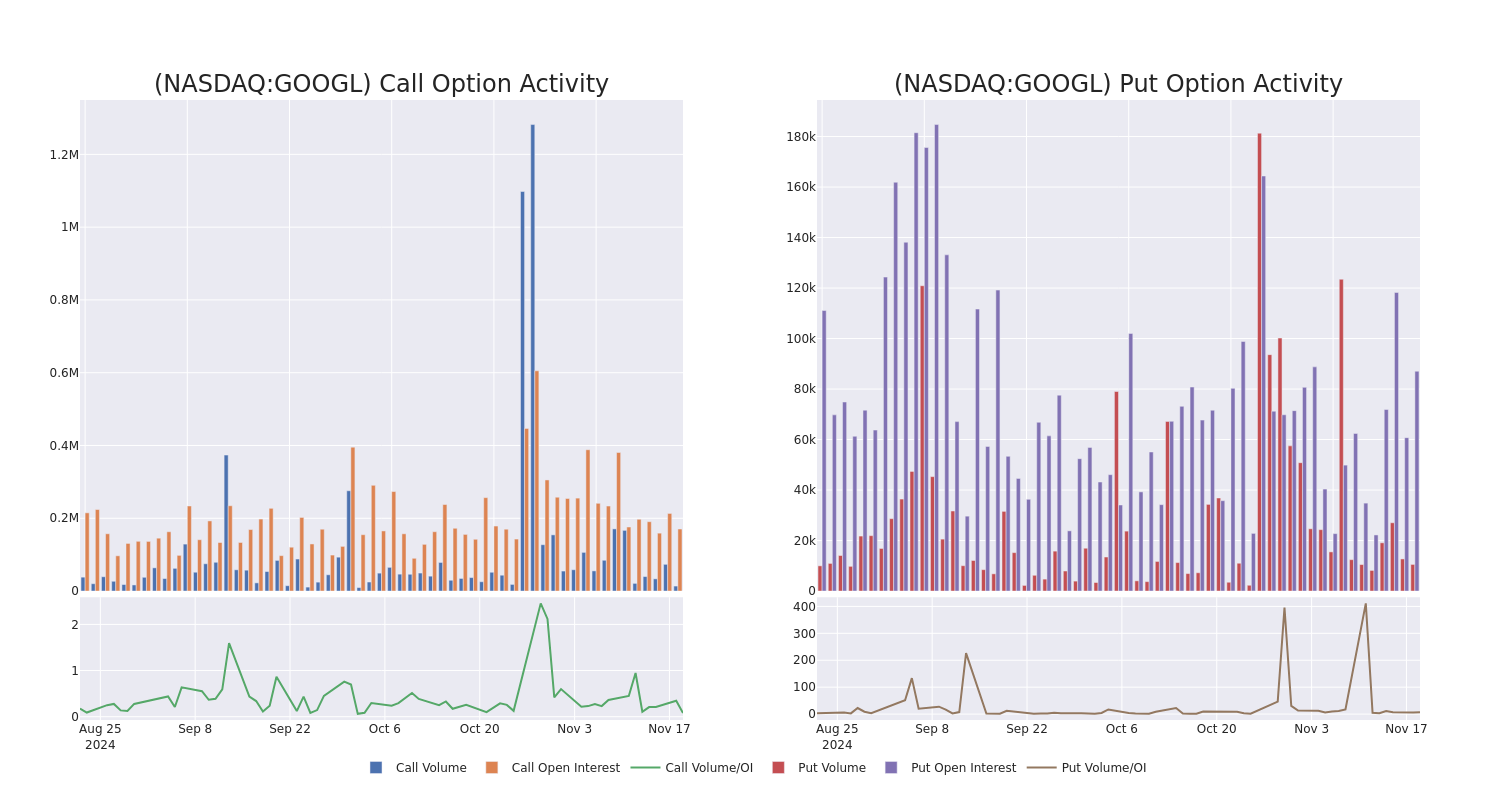

Alphabet Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Alphabet GOOGL, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GOOGL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 58 extraordinary options activities for Alphabet. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 51% leaning bullish and 37% bearish. Among these notable options, 26 are puts, totaling $2,325,158, and 32 are calls, amounting to $1,836,169.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $200.0 for Alphabet over the recent three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Alphabet’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Alphabet’s whale trades within a strike price range from $50.0 to $200.0 in the last 30 days.

Alphabet Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOOGL | PUT | SWEEP | BULLISH | 06/20/25 | $6.4 | $6.3 | $6.3 | $160.00 | $962.1K | 7.3K | 3.4K |

| GOOGL | CALL | SWEEP | BULLISH | 01/17/25 | $127.05 | $126.8 | $127.05 | $50.00 | $190.5K | 3.6K | 183 |

| GOOGL | CALL | SWEEP | BEARISH | 03/21/25 | $7.8 | $7.6 | $7.6 | $185.00 | $152.0K | 3.4K | 205 |

| GOOGL | PUT | SWEEP | BEARISH | 01/16/26 | $19.25 | $19.0 | $19.16 | $180.00 | $138.0K | 1.5K | 230 |

| GOOGL | CALL | SWEEP | BULLISH | 01/17/25 | $127.1 | $126.75 | $127.1 | $50.00 | $127.1K | 3.6K | 98 |

About Alphabet

Alphabet is a holding company that wholly owns internet giant Google. The California-based company derives slightly less than 90% of its revenue from Google services, the vast majority of which is advertising sales. Alongside online ads, Google services houses sales stemming from Google’s subscription services (YouTube TV, YouTube Music among others), platforms (sales and in-app purchases on Play Store), and devices (Chromebooks, Pixel smartphones, and smart home products such as Chromecast). Google’s cloud computing platform, or GCP, accounts for roughly 10% of Alphabet’s revenue with the firm’s investments in up-and-coming technologies such as self-driving cars (Waymo), health (Verily), and internet access (Google Fiber) making up the rest.

Having examined the options trading patterns of Alphabet, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Alphabet

- Currently trading with a volume of 10,588,450, the GOOGL’s price is up by 0.7%, now at $176.52.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 70 days.

Expert Opinions on Alphabet

In the last month, 5 experts released ratings on this stock with an average target price of $212.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Pivotal Research persists with their Buy rating on Alphabet, maintaining a target price of $225.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on Alphabet with a target price of $210.

* An analyst from Truist Securities persists with their Buy rating on Alphabet, maintaining a target price of $225.

* Consistent in their evaluation, an analyst from Bernstein keeps a Market Perform rating on Alphabet with a target price of $185.

* An analyst from BMO Capital downgraded its action to Outperform with a price target of $217.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Alphabet, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From Target Stock Ahead Of Q3 Earnings

Some investors may be eyeing potential gains from the Minneapolis-based company’s dividends. Target currently offers an annual dividend yield of 2.86%. That’s a quarterly dividend amount of $1.12 per share ($4.48 a year).

To figure out how to earn $500 monthly from Target, we start with the yearly target of $6,000 ($500 x 12 months). Next, we take this amount and divide it by Target’s $4.48 dividend: $6,000 / $4.48 = 1,339 shares.

So, an investor would need to own approximately $209,634 worth of Target, or 1,339 shares to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $4.48 = 268 shares, or $41,958 to generate a monthly dividend income of $100.

The dividend yield can change on a rolling basis; the dividend payment and the stock price both fluctuate over time.

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

Price Action: Target shares gained by 2.9% to close at $156.56 on Monday.

Analysts expect Target to report quarterly earnings at $2.30 per share. That’s up from $2.10 per share a year ago. The retailer projects to report quarterly revenue of $25.9 billion, compared to $25.4 billion a year earlier, according to data from Benzinga Pro.

On Nov. 13, Telsey Advisory Group analyst Joseph Feldman maintained Target with an Outperform rating and maintained a $195 price target.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Target Stock Today?

Target Corporation TGT shares are trading slightly higher following strong earnings from top peer Walmart Inc. WMT.

Today, Walmart announced third-quarter results and raised its fiscal-2025 guidance. The retailer reported adjusted EPS of 58 cents, beating the consensus of 53 cents. Sales were $169.59 billion, up 5.5% year over year or 6.2% (at constant currency), beating the consensus of $167.72 billion.

For FY25, Walmart raised its adjusted EPS outlook to $2.42 – $2.47 (from $2.35 – $2.43), vs. the consensus of $2.45. Walmart boosted FY25 net sales (at constant currency) growth guidance to 4.8% – 5.1% from 3.75% – 4.75% earlier.

Meanwhile, Target will report its third-quarter results on Wednesday, November 20, 2024, at 7:00 a.m. central time.

Last week, Target announced its store hours for Black Friday week and the holiday season.

On Friday, November 29, Target will open its doors early at 6 a.m. local time, offering exclusive items such as the “Taylor Swift | The Eras Tour Book” and “The Tortured Poets Department: The Anthology” on CD and vinyl.

These items will be available only at Target, along with top deals across the store. Special offers will be available in-store, online, and through the Target app, providing shoppers with great value for their holiday purchases.

According to Benzinga Pro, TGT stock has gained over 20.76% in the past year. Investors can gain exposure to the stock via SPDR Select Sector Fund – Consumer Staples XLP and VanEck Retail ETF RTH.

Price Action: TGT shares are trading higher by 0.57% to $157.46 at last check Tuesday.

Photo via Shutterstock

Read Next:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rohit Kapoor Takes Money Off The Table, Sells $4.53M In ExlService Holdings Stock

Disclosed on November 18, Rohit Kapoor, Chairman & CEO at ExlService Holdings EXLS, executed a substantial insider sell as per the latest SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Monday outlined that Kapoor executed a sale of 100,000 shares of ExlService Holdings with a total value of $4,531,000.

Monitoring the market, ExlService Holdings‘s shares down by 0.0% at $44.35 during Tuesday’s morning.

About ExlService Holdings

ExlService Holdings Inc. is a business process management company that provides digital operations and analytical services to clients driving enterprise-scale business transformation initiatives that leverage company’s deep expertise in analytics, AI, ML and cloud. The company offers business process outsourcing and automation services, and data-driven insights to customers across multiple industries. The company operates through four segments based on the products and services offered and markets served: Insurance, Healthcare, Emerging, Analytics. The vast majority of the company’s revenue is earned in the United States, and more than half of its revenue comes from Analytics segment.

Financial Milestones: ExlService Holdings’s Journey

Revenue Growth: Over the 3 months period, ExlService Holdings showcased positive performance, achieving a revenue growth rate of 14.87% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Exploring Profitability:

-

Gross Margin: With a low gross margin of 37.76%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): ExlService Holdings’s EPS reflects a decline, falling below the industry average with a current EPS of 0.33.

Debt Management: ExlService Holdings’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.47.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 38.9 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 4.14, ExlService Holdings’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): ExlService Holdings’s EV/EBITDA ratio stands at 21.48, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of ExlService Holdings’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Look Ahead: Canaan's Earnings Forecast

Canaan CAN is set to give its latest quarterly earnings report on Wednesday, 2024-11-20. Here’s what investors need to know before the announcement.

Analysts estimate that Canaan will report an earnings per share (EPS) of $-0.15.

Investors in Canaan are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Past Earnings Performance

In the previous earnings release, the company missed EPS by $0.13, leading to a 3.74% increase in the share price the following trading session.

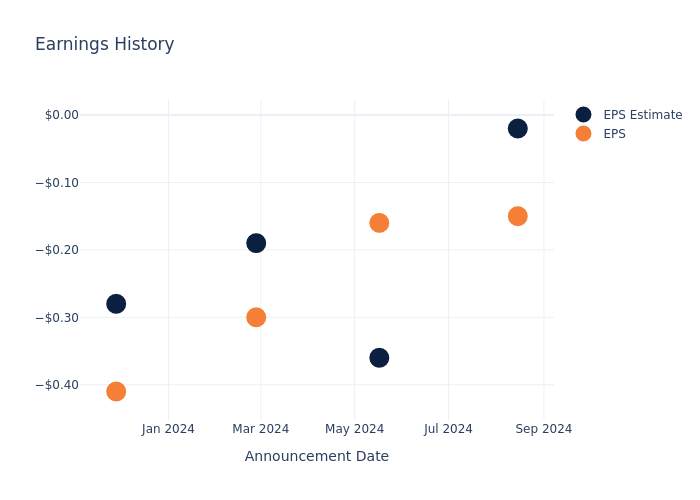

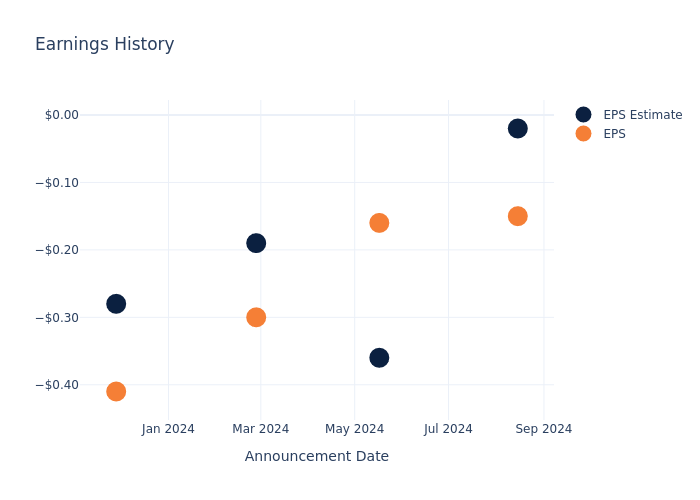

Here’s a look at Canaan’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.02 | -0.36 | -0.19 | -0.28 |

| EPS Actual | -0.15 | -0.16 | -0.30 | -0.41 |

| Price Change % | 4.0% | -10.0% | 6.0% | -7.000000000000001% |

Canaan Share Price Analysis

Shares of Canaan were trading at $1.53 as of November 18. Over the last 52-week period, shares are down 1.55%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

To track all earnings releases for Canaan visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.