A Peek at Banco BBVA Argentina's Future Earnings

Banco BBVA Argentina BBAR is set to give its latest quarterly earnings report on Wednesday, 2024-11-20. Here’s what investors need to know before the announcement.

Analysts estimate that Banco BBVA Argentina will report an earnings per share (EPS) of $0.45.

The market awaits Banco BBVA Argentina’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

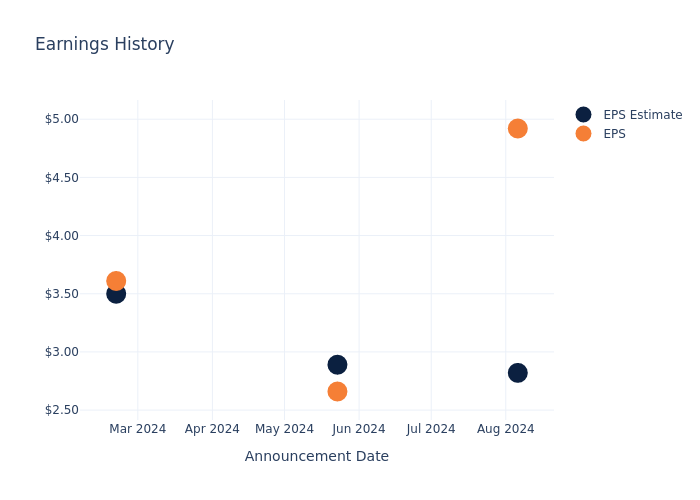

Here’s a look at Banco BBVA Argentina’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.25 | |||

| EPS Actual | 0.61 | 0.20 | 0.59 | 0.15 |

| Price Change % | -6.0% | -10.0% | 13.0% | -13.0% |

Banco BBVA Argentina Share Price Analysis

Shares of Banco BBVA Argentina were trading at $17.68 as of November 18. Over the last 52-week period, shares are up 295.42%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Banco BBVA Argentina visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Epilepsy Treatment Devices Market Size/Share Worth USD 787.3 Million by 2033 at a 4.1% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Nov. 19, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Epilepsy Treatment Devices Market Size, Trends and Insights By Product Type (Wearable Devices, Conventional Devices, Implantable Devices, Others), By Technology (Vagus Nerve Stimulator, Responsive Neurostimulation, Deep Brain Stimulation, Accelerometry, Others), By End Users (Adults, Pediatrics), By Application (Hospitals, Ambulatory Surgical Centers, Neurology Centers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

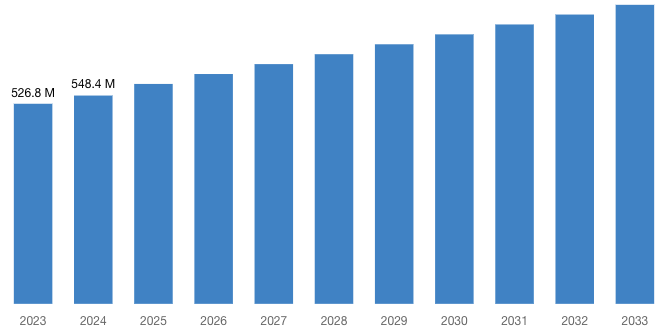

“According to the latest research study, the demand of global Epilepsy Treatment Devices Market size & share was valued at approximately USD 526.8 Million in 2023 and is expected to reach USD 548.4 Million in 2024 and is expected to reach a value of around USD 787.3 Million by 2033, at a compound annual growth rate (CAGR) of about 4.1% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Epilepsy Treatment Devices Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=54542

Epilepsy Treatment Devices Market: Growth Factors and Dynamics

- Technological Advancements: Continuous advancements in neurostimulation technologies such as Vagus Nerve Stimulation (VNS), Responsive Neurostimulation (RNS), and Deep Brain Stimulation (DBS) are pivotal. These innovations include enhanced electrode designs, improved stimulation algorithms, and integration with advanced imaging and monitoring systems, all contributing to better outcomes and broader adoption among healthcare providers and patients.

- Increasing Prevalence of Epilepsy: Epilepsy remains a significant global health concern, with rising prevalence rates attributed to aging populations, better diagnostic capabilities, and improved awareness. This demographic shift underscores the need for effective treatment modalities, driving the demand for epilepsy treatment devices.

- Government Initiatives and Support: Governments worldwide are prioritizing healthcare infrastructure development and enhancing access to advanced medical technologies. Supportive policies, funding initiatives, and regulatory frameworks aimed at facilitating the adoption of innovative epilepsy treatment devices are key drivers in market expansion.

- Advantages of Minimally Invasive Procedures: There is a notable trend towards minimally invasive surgical approaches in epilepsy treatment, such as laser ablation and stereotactic radiosurgery (SRS). These techniques offer advantages such as reduced post-operative recovery times, minimized risks of complications, and improved patient comfort, contributing to their increasing adoption and market growth.

- Growing Demand for Wearable and Non-Invasive Devices: Patient preferences are shifting towards wearable seizure detection devices and non-invasive neurostimulation technologies. These devices offer convenience, portability, and the ability to monitor and manage epilepsy symptoms in real-time without the need for invasive procedures, thereby driving their uptake in the market.

- Expansion of Healthcare Facilities: Investments in healthcare infrastructure, including the establishment of new hospitals, clinics, and ambulatory surgical centers (ASCs), are expanding access to epilepsy treatment devices globally. This infrastructure development is crucial in meeting the growing demand for advanced medical technologies and improving healthcare outcomes for epilepsy patients.

- Research and Development Investments: Significant investments in research and development (R&D) by medical device companies and academic institutions are driving innovation in epilepsy treatment devices. R&D efforts focus on developing next-generation technologies, improving device efficacy and safety profiles, exploring novel therapeutic approaches, and conducting clinical trials to validate new treatment modalities.

Request a Customized Copy of the Epilepsy Treatment Devices Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=54542

Epilepsy Treatment Devices Market: Partnership and Acquisitions

- In 2022, Spanish start-up mjn-NEURO introduced mjn-SERAS in the UK, a revolutionary device utilizing artificial intelligence to predict seizures with up to 3 minutes of advanced warning. This innovation marks a significant step forward in epilepsy management and patient care through proactive seizure detection.

- In 2021, Magstim acquired EGI, a subsidiary of Philips, to enhance its product portfolio with high-density EEG solutions. This acquisition supports Magstim in developing a comprehensive non-invasive system for advanced brain monitoring and neurostimulation therapies, benefiting epilepsy patients and healthcare providers alike.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 548.4 Million |

| Projected Market Size in 2033 | USD 787.3 Million |

| Market Size in 2023 | USD 526.8 Million |

| CAGR Growth Rate | 4.1% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Product Type, Technology, End Users, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Epilepsy Treatment Devices report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Epilepsy Treatment Devices report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Epilepsy Treatment Devices Market Report @ https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

Epilepsy Treatment Devices Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Epilepsy Treatment Devices Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Disruption in Supply Chains: The COVID-19 pandemic led to disruptions in global supply chains, affecting the manufacturing and distribution of epilepsy treatment devices. This disruption initially caused delays in device shipments and installation, impacting market growth.

- Reduced Elective Procedures: During the pandemic, many healthcare facilities postponed elective surgeries and procedures, including those for epilepsy treatment devices. This reduction in elective procedures temporarily decreased the demand for non-urgent epilepsy treatment devices.

- Resumed Elective Procedures: As healthcare systems stabilize and COVID-19 restrictions ease, there has been a gradual resumption of elective surgeries, including implantation procedures for epilepsy treatment devices. This recovery in elective procedures is driving the demand for these devices.

- Telemedicine and Remote Monitoring: The adoption of telemedicine and remote monitoring solutions increased during the pandemic, allowing healthcare providers to continue monitoring epilepsy patients remotely. This trend continues post-pandemic, supporting ongoing patient care and management with epilepsy treatment devices.

- Focus on Home Healthcare Solutions: There is a growing focus on home-based and wearable epilepsy treatment devices that enable remote monitoring and management of seizures. This trend has accelerated post-pandemic, catering to patient preferences for decentralized care and reducing hospital visits.

- Government Initiatives and Funding: Governments and healthcare authorities have allocated funding and resources to enhance healthcare infrastructure, including epilepsy treatment facilities. These initiatives support market recovery by improving access to advanced treatment options and expanding healthcare services.

- Rapid Technological Advancements: The COVID-19 pandemic has accelerated technological advancements in epilepsy treatment devices, including improved remote monitoring capabilities, enhanced connectivity features, and advancements in AI-driven algorithms for seizure detection. These innovations are driving market growth and adoption post-pandemic.

- Patient Education and Awareness: There has been an increased emphasis on patient education and awareness programs post-pandemic to educate epilepsy patients and caregivers about the benefits and availability of advanced treatment devices. These efforts aim to increase patient acceptance, adherence to treatment protocols, and overall market uptake of epilepsy treatment devices.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Epilepsy Treatment Devices Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Epilepsy Treatment Devices Market Report @ https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

Key questions answered in this report:

- What is the size of the Epilepsy Treatment Devices market and what is its expected growth rate?

- What are the primary driving factors that push the Epilepsy Treatment Devices market forward?

- What are the Epilepsy Treatment Devices Industry’s top companies?

- What are the different categories that the Epilepsy Treatment Devices Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Epilepsy Treatment Devices market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Epilepsy Treatment Devices Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

Epilepsy Treatment Devices Market – Regional Analysis

The Epilepsy Treatment Devices Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: North America leads in technological advancements and healthcare infrastructure, driving the adoption of advanced epilepsy treatment devices like Vagus Nerve Stimulation (VNS) and Responsive Neurostimulation (RNS). Trends include increasing investments in research and development, emphasis on personalized medicine, and integration of artificial intelligence for real-time seizure detection and management.

- Europe: Europe focuses on expanding access to epilepsy treatment devices through healthcare reforms and enhanced regulatory frameworks. Trends include a growing preference for minimally invasive surgical techniques, such as stereotactic radiosurgery (SRS), and the adoption of wearable seizure detection devices for remote monitoring. Additionally, there is an emphasis on sustainability in healthcare practices and digital health solutions.

- Asia-Pacific: The Asia-Pacific region is witnessing rapid market growth driven by increasing healthcare expenditures, rising prevalence of epilepsy, and improving healthcare infrastructure. Trends include the expansion of healthcare access in rural areas, the adoption of cost-effective treatment devices, and partnerships with global manufacturers for technology transfer and localization. There is also a trend towards integrating traditional medicine practices with modern epilepsy treatments.

- LAMEA (Latin America, Middle East, and Africa): The LAMEA region faces challenges such as healthcare disparities and limited access to advanced medical technologies. However, there is growing investment in healthcare infrastructure and initiatives to improve epilepsy diagnosis and treatment. Trends include government initiatives to enhance healthcare access, increasing partnerships with international medical device companies, and the adoption of telemedicine and mobile health solutions to overcome geographical barriers.

Request a Customized Copy of the Epilepsy Treatment Devices Market Report @ https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Epilepsy Treatment Devices Market Size, Trends and Insights By Product Type (Wearable Devices, Conventional Devices, Implantable Devices, Others), By Technology (Vagus Nerve Stimulator, Responsive Neurostimulation, Deep Brain Stimulation, Accelerometry, Others), By End Users (Adults, Pediatrics), By Application (Hospitals, Ambulatory Surgical Centers, Neurology Centers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

List of the prominent players in the Epilepsy Treatment Devices Market:

- Medtronic plc

- LivaNova PLC

- Abbott Laboratories

- Boston Scientific Corporation

- Cyberonics, Inc. (a subsidiary of LivaNova PLC)

- NeuroPace Inc.

- Nihon Kohden Corporation

- Biotronik SE & Co. KG

- Nevro Corp.

- ElectroCore Inc.

- Magstim Company Limited

- Soterix Medical Inc.

- NeuroSigma Inc.

- Brainsway Ltd.

- Saluda Medical Pty Limited

- Others

Click Here to Access a Free Sample Report of the Global Epilepsy Treatment Devices Market @ https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Bionic Devices Market: Bionic Devices Market Size, Trends and Insights By Fixation (Implantable, Wearable/ Externally Worn), By Product (Auditory Bionics/Cochlear Implants, Heart Transplant, Orthopedic Bionics, Neural Bionics), By Technology (Electronic, Mechanical), By End User (Hospitals & Clinics, Ambulatory Surgical Centers, Healthcare Facilities), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Milk Thistle Sprouts Market: Milk Thistle Sprouts Market Size, Trends and Insights By Type (Organic, Conventional), By Application (Pharmaceuticals, Nutraceuticals, Cosmetics, Others), By Distribution Channels (Retail Stores, Supermarket & Hypermarkets, Pharmacies, Online, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Medical Aesthetics Market: US Medical Aesthetics Market Size, Trends and Insights By Product Type (Aesthetic Laser Devices, Energy Devices, Body Contouring Devices, Facial Aesthetic Devices, Aesthetic Implants, Skin Aesthetic Devices), By Application (Anti-Aging and Wrinkles, Facial and Skin Rejuvenation, Breast Enhancement, Body Shaping and Cellulite, Tattoo Removal, Vascular Lesions, Sears, Pigment Lesions, Reconstructive, Psoriasis and Vitiligo, Others), By End User (Cosmetic Centers, Dermatology Clinics, Hospitals, Medical Spas, Beauty Centers, Others), By Distribution Channel (Direct Sale, Retail Sales, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Health Care Ecosystem Market: US Health Care Ecosystem Market Size, Trends and Insights By Healthcare Services (Hospitals, Clinics and Outpatient Centers, Diagnostic Laboratories, Pharmacies, Ambulatory Surgical Centers, Rehabilitation Centers, Others), By Healthcare IT Solutions (Electronic Health Records (EHR) Systems, Practice Management Software, Telemedicine and Remote Patient Monitoring, Healthcare Analytics, Revenue Cycle Management, Others), By Medical Devices and Equipment (Diagnostic Equipment, Therapeutic Equipment, Monitoring Devices, Surgical Instruments, Personal Protective Equipment (PPE), Others), By Healthcare Specializations (Primary Care, Specialty Care, Preventive Care, Emergency Care, Palliative Care, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Chiropractic Market: Europe Chiropractic Market Size, Trends and Insights By Type of Service (Chiropractic Adjustments, Spinal Manipulation Therapy, Therapeutic Massage, Rehabilitation Exercises, Lifestyle Counseling, Others), By Age Group (Pediatric Chiropractic Care, Adult Chiropractic Care, Geriatric Chiropractic Care), By Medical Condition (Back Pain, Neck Pain, Headaches/Migraines, Sports Injuries, Joint Pain, Posture Correction, Others), By Practice Setting (Private Chiropractic Clinics, Hospital-based Chiropractic Centers, Integrated Healthcare Facilities, Corporate Wellness Programs, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Biotechnology Market: Europe Biotechnology Market Size, Trends and Insights By Technology (Nanobiotechnology, Tissue Engineering and Regeneration, DNA Sequencing, Cell-based Assays, Fermentation, PCR Technology, Chromatography, Others), By Application (Health, Food & Agriculture, Natural Resources & Environment, Industrial Processing, Bioinformatics, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Medical Headwalls Market: Medical Headwalls Market Size, Trends and Insights By Type (Horizontal, Vertical), By Application (Intensive Care Unit (ICU)/Critical Care Unit (CCU), Post-anaesthesia Care Unit (PACU), Patient Rooms, Others), By End-use (Hospitals, Diagnostic Centers, Clinics, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Pharmacovigilance and Drug Safety Software Market: Pharmacovigilance and Drug Safety Software Market Size, Trends and Insights By Functionality (Adverse Event Reporting Software, Drug Safety Audits Software, Issue Tracking Software, Fully Integrated Software), By Delivery Mode (On-premises, Cloud-based), By End User (Pharmaceutical and Biotechnology Companies, Contract Research Organizations, Business Process Outsourcing Firms, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Epilepsy Treatment Devices Market is segmented as follows:

By Product Type

- Wearable Devices

- Conventional Devices

- Implantable Devices

- Others

By Technology

- Vagus Nerve Stimulator

- Responsive Neurostimulation

- Deep Brain Stimulation

- Accelerometry

- Others

By End Users

By Application

- Hospitals

- Ambulatory Surgical Centers

- Neurology Centers

- Others

Click Here to Get a Free Sample Report of the Global Epilepsy Treatment Devices Market @ https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Epilepsy Treatment Devices Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Epilepsy Treatment Devices Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Epilepsy Treatment Devices Market? What Was the Capacity, Production Value, Cost and PROFIT of the Epilepsy Treatment Devices Market?

- What Is the Current Market Status of the Epilepsy Treatment Devices Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Epilepsy Treatment Devices Market by Considering Applications and Types?

- What Are Projections of the Global Epilepsy Treatment Devices Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Epilepsy Treatment Devices Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Epilepsy Treatment Devices Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Epilepsy Treatment Devices Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Epilepsy Treatment Devices Industry?

Click Here to Access a Free Sample Report of the Global Epilepsy Treatment Devices Market @ https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

Reasons to Purchase Epilepsy Treatment Devices Market Report

- Epilepsy Treatment Devices Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Epilepsy Treatment Devices Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Epilepsy Treatment Devices Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Epilepsy Treatment Devices Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Epilepsy Treatment Devices market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Epilepsy Treatment Devices Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Epilepsy Treatment Devices market analysis.

- The competitive environment of current and potential participants in the Epilepsy Treatment Devices market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Epilepsy Treatment Devices market should find this report useful. The research will be useful to all market participants in the Epilepsy Treatment Devices industry.

- Managers in the Epilepsy Treatment Devices sector are interested in publishing up-to-date and projected data about the worldwide Epilepsy Treatment Devices market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Epilepsy Treatment Devices products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Epilepsy Treatment Devices Market Report @ https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Epilepsy Treatment Devices Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/epilepsy-treatment-devices-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why C3.ai Stock Popped a Lucky 13% Today

C3.ai (NYSE: AI) stock rushed out of the gate Tuesday morning, gaining 13.2% through 9:50 a.m. ET after announcing a “strategic alliance” with software powerhouse Microsoft.

Highlighting each company’s respective strengths, artificial intelligence (AI) applications specialist C3.ai and artificial intelligence server farm operator Microsoft say they will work together “to enhance existing capabilities and introduce new innovations that help our mutual customers maximize delivery of high-value enterprise AI solutions with Azure.”

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

More specifically, Microsoft intends to integrate C3.ai’s enterprise AI application software into the Microsoft Commercial Cloud Portal, align C3’s apps with new capabilities from Azure, and work together to both market and deliver C3’s products to customers.

Going forward, Microsoft will be “the preferred cloud provider for C3 AI offerings.” And vice-versa, too, C3.ai will be “a preferred AI application software provider on Microsoft Azure.”

But do note the details. As you’d expect in a relationship between a smaller company like C3, with a $3.8 billion market capitalization, and a titan like Microsoft, whose market cap exceeds $3 trillion, Microsoft is becoming “the” preferred provider for C3 apps, but C3 is only going to be “a” preferred provider for Microsoft.

Seems to me, that’s probably a distinction with a difference. It suggests C3.ai investors may be overreacting just a wee bit to today’s news.

Consider: In the same press that announces this new alliance, C3 also notes that it’s actually already in a strategic alliance with Microsoft — as has been the case for the last six years. Note, too, that today’s press release contains no actual numbers, no predictions of new revenue or profits for C3 that will arise from this new alliance. Last but not least, be aware that despite having an existing alliance with Microsoft, C3 lost $280 million last year, and is expected to keep losing money as far out as analysts are making estimates.

C3.ai remains a risky stock, and is no buy.

Before you buy stock in C3.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and C3.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Unpacking the Latest Options Trading Trends in Blackstone

Investors with a lot of money to spend have taken a bullish stance on Blackstone BX.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with BX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Blackstone.

This isn’t normal.

The overall sentiment of these big-money traders is split between 30% bullish and 30%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $170,649, and 7 are calls, for a total amount of $435,781.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $120.0 to $190.0 for Blackstone over the recent three months.

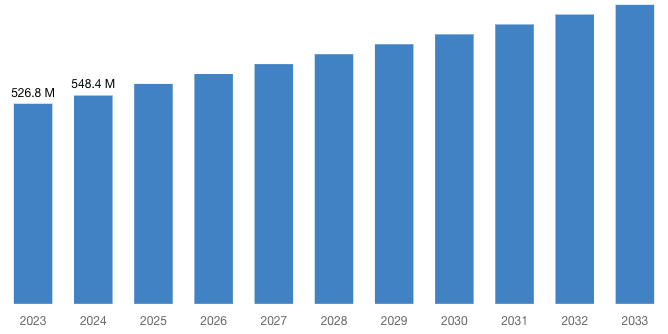

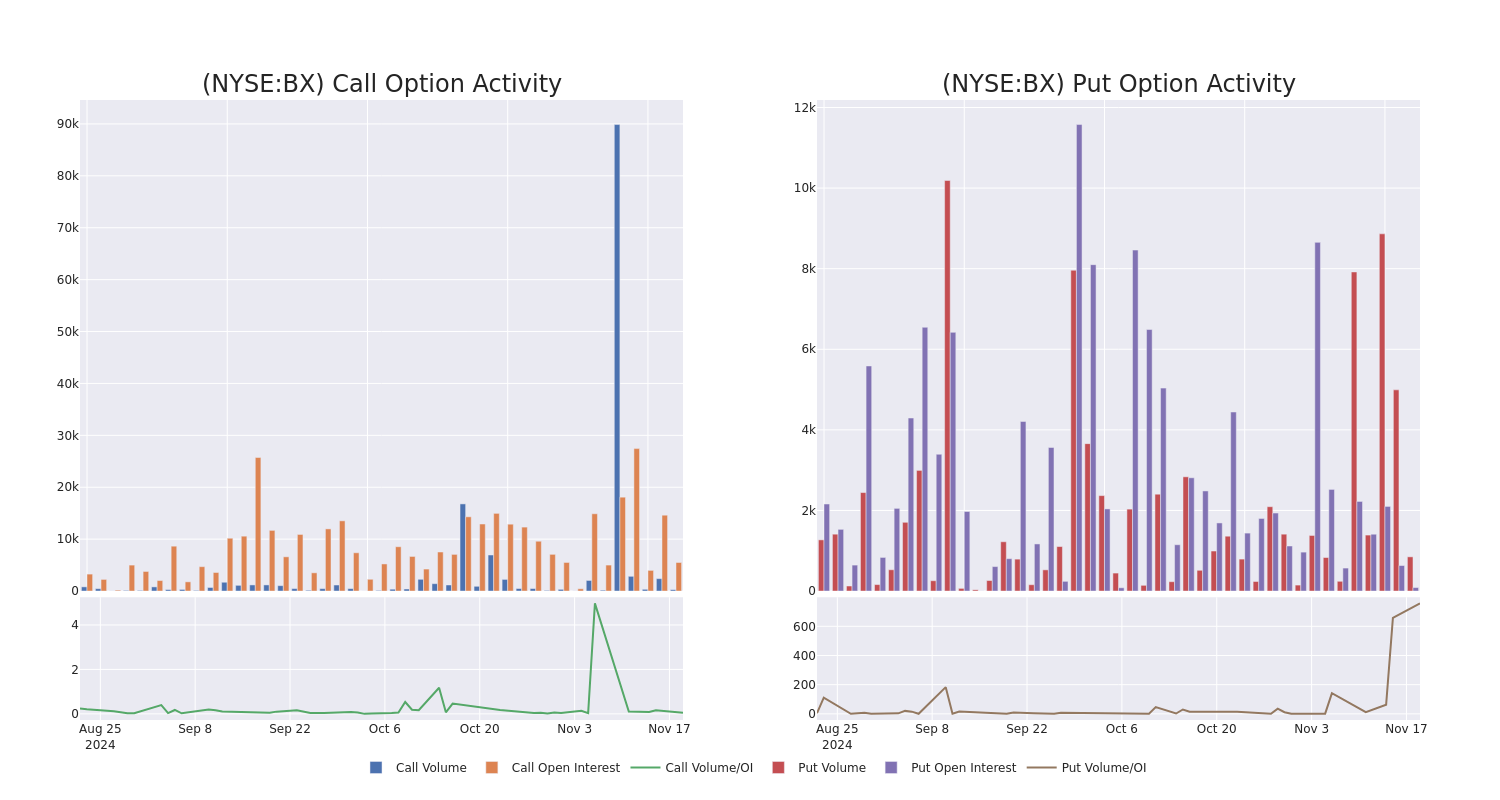

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Blackstone’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Blackstone’s whale activity within a strike price range from $120.0 to $190.0 in the last 30 days.

Blackstone Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BX | CALL | TRADE | BEARISH | 01/17/25 | $10.15 | $10.05 | $10.05 | $180.00 | $137.6K | 1.3K | 140 |

| BX | PUT | SWEEP | BULLISH | 12/20/24 | $0.94 | $0.74 | $0.94 | $167.50 | $71.1K | 1 | 756 |

| BX | CALL | TRADE | NEUTRAL | 01/16/26 | $46.5 | $43.8 | $45.04 | $150.00 | $67.5K | 270 | 15 |

| BX | CALL | TRADE | BULLISH | 12/19/25 | $41.3 | $40.6 | $41.06 | $155.00 | $61.5K | 84 | 40 |

| BX | CALL | TRADE | NEUTRAL | 01/15/27 | $36.7 | $35.05 | $36.0 | $180.00 | $54.0K | 48 | 15 |

About Blackstone

Blackstone is the world’s largest alternative-asset manager with $1.076 trillion in total asset under management, including $808.7 billion in fee-earning assets under management, at the end of June 2024. The company has four core business segments: private equity (25% of fee-earning AUM and 28% of base management fees), real estate (37% and 42%), credit and insurance (29% and 23%), and multi-asset investing (9% and 7%). While the firm primarily serves institutional investors (87% of AUM), it also caters to clients in the high-net-worth channel (13%). Blackstone operates through 25 offices in the Americas (8), Europe and the Middle East (9), and the Asia-Pacific region (8).

Having examined the options trading patterns of Blackstone, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Blackstone

- With a volume of 512,442, the price of BX is up 0.62% at $184.14.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 65 days.

What The Experts Say On Blackstone

In the last month, 1 experts released ratings on this stock with an average target price of $182.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Deutsche Bank has decided to maintain their Buy rating on Blackstone, which currently sits at a price target of $182.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Blackstone, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Savers Value Village Insider Trades Send A Signal

Richard Medway, General Counsel at Savers Value Village SVV, reported an insider sell on November 18, according to a new SEC filing.

What Happened: Medway’s recent move involves selling 19,500 shares of Savers Value Village. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value is $195,000.

Monitoring the market, Savers Value Village‘s shares down by 0.66% at $9.01 during Tuesday’s morning.

All You Need to Know About Savers Value Village

Savers Value Village Inc is a for-profit thrift operator in the United States and Canada. It purchases second hand textiles (i.e., clothing, bedding, and bath items), shoes, accessories, housewares, books and other goods from its non-profit partners (“NPPs”), either directly from them or via on-site donations (“OSDs”) at Community Donation Centers at its stores. The company then process, selects, price, merchandise and sell these items in its stores.

Savers Value Village: A Financial Overview

Revenue Growth: Over the 3 months period, Savers Value Village showcased positive performance, achieving a revenue growth rate of 0.53% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company excels with a remarkable gross margin of 56.74%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Savers Value Village’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.13.

Debt Management: With a high debt-to-equity ratio of 2.99, Savers Value Village faces challenges in effectively managing its debt levels, indicating potential financial strain.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 19.72 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.0 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 12.41, Savers Value Village presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Transaction Codes Worth Your Attention

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Savers Value Village’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Genetec expands access control market share and solidifies its global leadership position, according to the latest Omdia report

Montreal, Nov. 19, 2024 (GLOBE NEWSWIRE) — According to the 2024 Access Control report by Omdia, Genetec Inc. (“Genetec”), the global leader in enterprise physical security software, has consistently gained market share over the last six years, solidifying its position as a worldwide market leader and building upon its #2 global position for access control software.

In the Americas market, access control software has evolved beyond the physical security department to become an essential component of business operations. According to the Omdia report, this broader adoption has increased demand for unified security platforms that allow organizations to manage systems – such as access control, video surveillance, and intrusion detection – through a single interface. By anticipating market needs for access control innovation, Genetec continues to expand its market share, growing at a 28% CAGR over the past six years.

“While many legacy access control vendors rely on acquisitions to expand their market share, Genetec has achieved rapid organic growth through innovation and investment in new technologies,” said Christian Morin, Vice President of Product Engineering, Genetec Inc. “Over the last year, we introduced Security Center SaaS, HID Mercury Security MP controllers, Axis Powered by Genetec, and an I/O module in partnership with STid as part of our European high assurance access control system offering. This demonstrates our commitment to expanding our access control portfolio through innovation and partnerships, paving the way for future growth.”

In a highly fragmented EMEA market, Genetec remains among the top 10 access control software providers by focusing on open architecture systems that allow users to integrate components from different vendors. Omdia also reports that end users in the region prefer open systems that offer flexibility and customization. This further supports the company’s strategy to provide adaptable solutions tailored to the region, as evidenced by its partnership with STid.

In the Asia-Pacific region (excluding China), Genetec continues to rapidly expand its market share, reaching #6 position (up from #10 in 2021). As enterprise users and multinational corporations modernize their access control infrastructure, they seek feature-rich, cyber-secure systems with strong integration capabilities. An open-architecture solution, such as the Genetec access control solution, allows organizations to secure assets and people, enhance business operations, and easily upgrade technology at their own pace.

The Omdia report also indicates that the access control market is increasingly adopting hybrid cloud deployments. Genetec is at the forefront of this change. Security Center SaaS is a physical security solution that brings the power of Genetec access control and video management to the cloud. Security Center SaaS supports hybrid or full cloud deployments, allowing organizations to move components and sites to the cloud based on their needs and requirements at their own pace. Because Genetec solutions are based on an open platform architecture, users choose the access control devices that best suit their needs while also preserving their existing investments.

In addition to its success in access control, Genetec has retained its #1 global position in the VMS market while also ranking #1 in the combined Video Management Software (VMS) and Video Surveillance as a Service (VSaaS) market, according to Omdia’s recently released 2024 Video Surveillance & Analytics Database Report.

For more information about Genetec, visit www.genetec.com.

–ends–

About Genetec

Genetec Inc. is a global technology company that has been transforming the physical security industry for over 25 years. The company’s portfolio of solutions enables enterprises, governments, and communities around the world to secure people and assets while improving operational efficiency and respecting individual privacy.

Genetec delivers the world’s leading products for video management, access control, and ALPR, all built on an open architecture and designed with cybersecurity at their core. The company’s portfolio also includes intrusion detection, intercom, and digital evidence management solutions.

Headquartered in Montreal, Canada, Genetec serves its 42,500+ customers via an extensive network of accredited channel partners and consultants in over 159 countries.

For more information about Genetec, visit: https://www.genetec.com

© Genetec Inc., 2024. Genetec™, and the Genetec logo are trademarks of Genetec Inc. and may be registered or pending registration in several jurisdictions. Other trademarks used in this document may be trademarks of the manufacturers or vendors of the respective product.

Veronique Froment Genetec, Inc. 603-548-1429 veronique@highrezpr.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

In line with its projections, Hydro-Québec posts net income of $2.2 billion for the first nine months of 2024

MONTRÉAL, Nov. 19, 2024 /CNW/ – Hydro-Québec is posting net income of $2,189 million for the first nine months of 2024, down $861 million from the $3,050 million posted for the same period last year, due to a reduction in exports.

“Our results are in line with our expectations,” said Maxime Aucoin, Executive Vice President – Strategy and Finance. “Our strategy of prudent management of energy reserves is the right way forward in the context, given the rainfall that was below normal. The cycle of low runoff, which has no impact on Québec’s energy supply, continues to translate into a decrease in electricity sales on external markets. We will continue to monitor the situation as it evolves, while making sure to manage water resources closely.”

Financial highlights of the first nine months

- Action Plan 2035: strong growth in investments and financing activities

- Increase of more than 30% in investments in property, plant and equipment and intangible assets compared to the previous year

- Nearly $4.3 billion invested in nine months

- More than half of this amount allocated to generation, transmission and distribution asset sustainment to ensure service quality

- Financing activities raised $4.8 billion since the beginning of the year

- Increase of more than 30% in investments in property, plant and equipment and intangible assets compared to the previous year

- Low runoff in 2023 and 2024: Prudent management of energy reserves

- Decrease of $777 million in sales outside of Québec, due in particular to volume declining more than one third compared to the previous year

- Positive impact of the electricity price hedging strategy, but less significant than in 2023

- Average price obtained (including hedging effect): 9.6¢/kWh, compared to the average market price of 6.4¢/kWh

- Average price obtained (including hedging effect): 9.6¢/kWh, compared to the average market price of 6.4¢/kWh

- Higher revenue from sales in Québec

- Continued growth in electricity demand, due partly to an increase in the number of customer accounts, primarily in the residential and commercial segments

- Lower electricity consumption due to mild temperatures in the first quarter of 2024, which was the mildest in 10 years

- Increased revenue resulting from rate indexations that came into effect on April 1, 2023 and 2024

Action Plan 2035: highlights of the first nine months

- Improvement of service quality with a more than 50% decrease in the average number of minutes of service interruption for customers: 462 minutes in 2024 compared to 983 minutes in 2023 (as at October 31)

- Energy efficiency: expected increase of approximately 30% in energy saved in 2024 thanks to our initiatives

- New projects under the Wind Power Development Strategy:

- Partnerships with First Nations and local communities for the development of the Chamouchouane (3,000 MW potential) and Wocawson (1,000 MW potential) zones

For more information on Hydro-Québec’s results for the first three quarters of 2024, visit https://www.hydroquebec.com/about/financial-results/quarterly-bulletin.html.

SOURCE Hydro-Québec

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/19/c3896.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/19/c3896.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unpacking the Latest Options Trading Trends in Uber Technologies

Investors with a lot of money to spend have taken a bearish stance on Uber Technologies UBER.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with UBER, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Uber Technologies.

This isn’t normal.

The overall sentiment of these big-money traders is split between 30% bullish and 70%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $130,920, and 8 are calls, for a total amount of $365,061.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $100.0 for Uber Technologies during the past quarter.

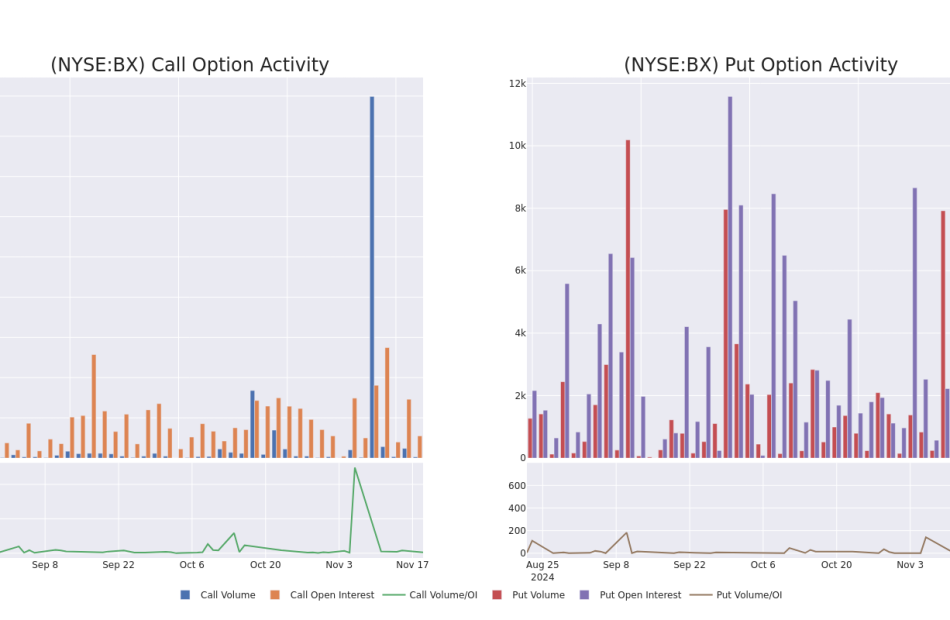

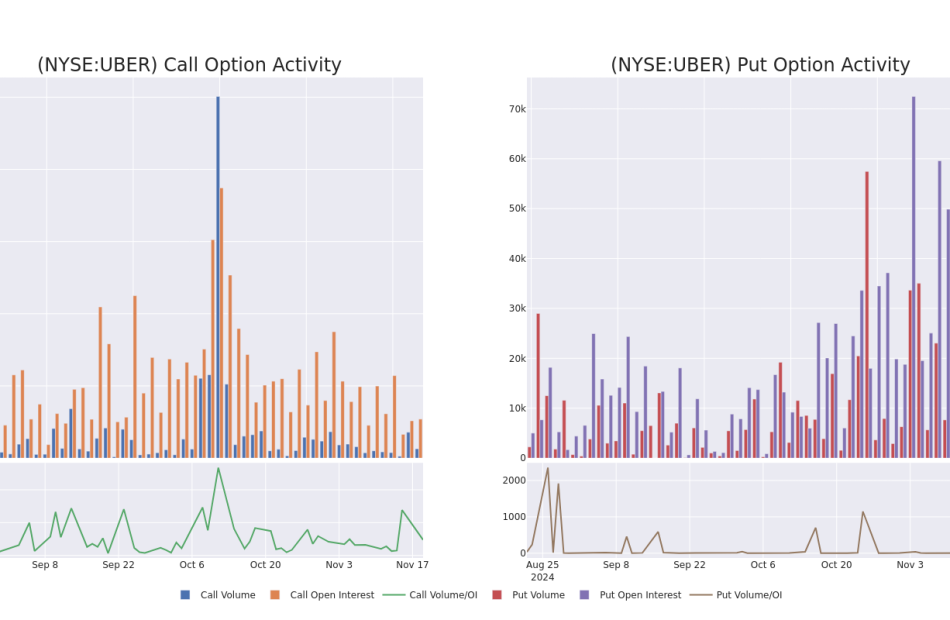

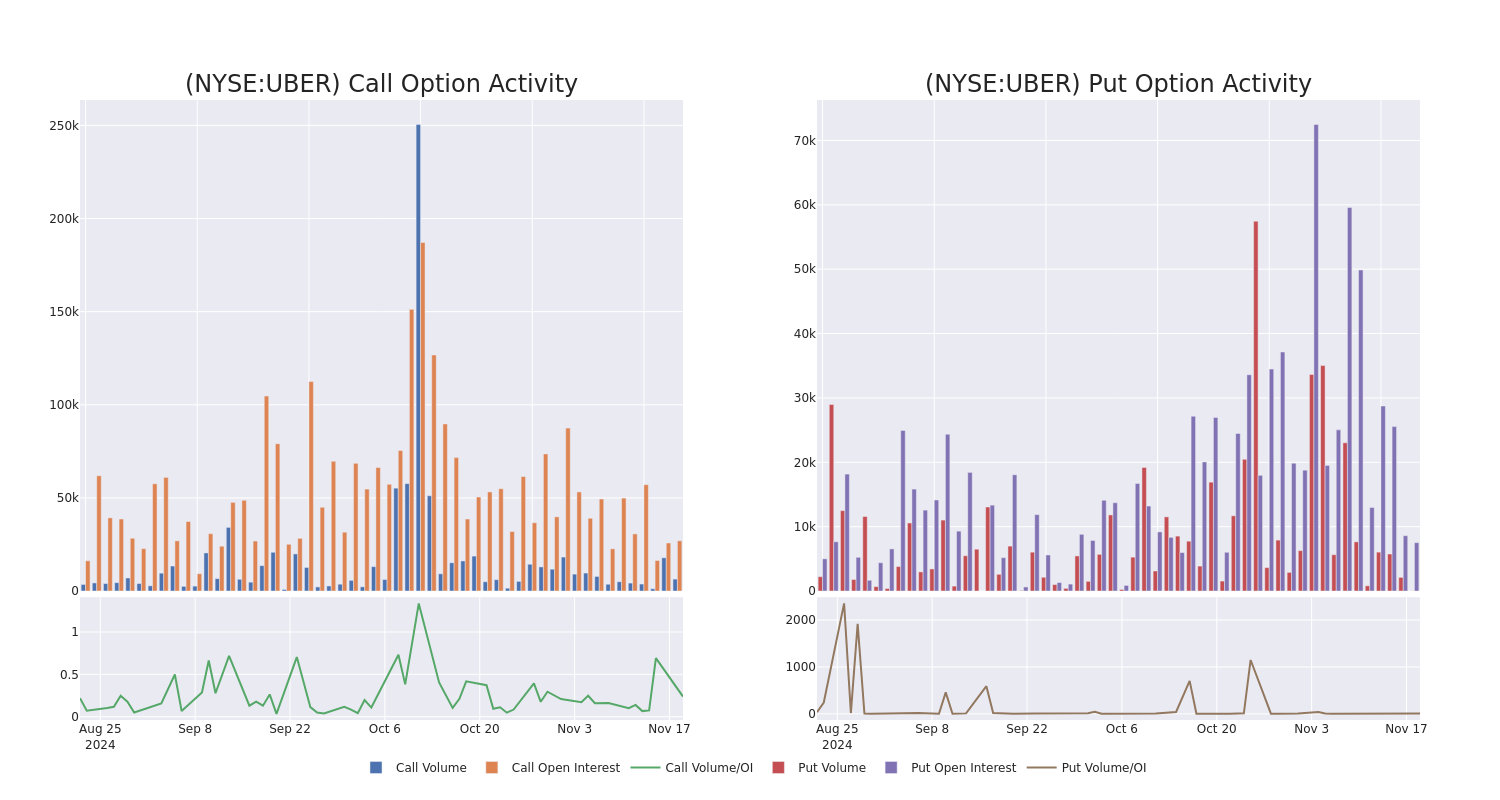

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Uber Technologies’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Uber Technologies’s significant trades, within a strike price range of $50.0 to $100.0, over the past month.

Uber Technologies 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UBER | PUT | SWEEP | BEARISH | 01/17/25 | $4.1 | $4.0 | $4.1 | $70.00 | $102.5K | 7.5K | 6 |

| UBER | CALL | TRADE | BULLISH | 01/17/25 | $0.7 | $0.6 | $0.7 | $80.00 | $70.0K | 14.5K | 1.0K |

| UBER | CALL | SWEEP | BEARISH | 12/27/24 | $1.1 | $1.0 | $1.01 | $74.00 | $68.5K | 2.6K | 986 |

| UBER | CALL | SWEEP | BEARISH | 06/20/25 | $21.35 | $21.0 | $21.0 | $50.00 | $63.0K | 1.4K | 31 |

| UBER | CALL | TRADE | BEARISH | 01/15/27 | $18.75 | $18.3 | $18.45 | $67.50 | $36.9K | 21 | 20 |

About Uber Technologies

Uber Technologies is a technology provider that matches riders with drivers, hungry people with restaurants and food delivery service providers, and shippers with carriers. The firm’s on-demand technology platform could eventually be used for additional products and services, such as autonomous vehicles, delivery via drones, and Uber Elevate, which, as the firm refers to it, provides “aerial ride-sharing.” Uber Technologies is headquartered in San Francisco and operates in over 63 countries with over 150 million users who order rides or food at least once a month.

After a thorough review of the options trading surrounding Uber Technologies, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Uber Technologies

- Currently trading with a volume of 7,389,919, the UBER’s price is down by -0.77%, now at $68.8.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 78 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Uber Technologies, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insights Ahead: Euroseas's Quarterly Earnings

Euroseas ESEA is preparing to release its quarterly earnings on Wednesday, 2024-11-20. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Euroseas to report an earnings per share (EPS) of $3.55.

The market awaits Euroseas’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Earnings Track Record

In the previous earnings release, the company beat EPS by $2.10, leading to a 0.63% increase in the share price the following trading session.

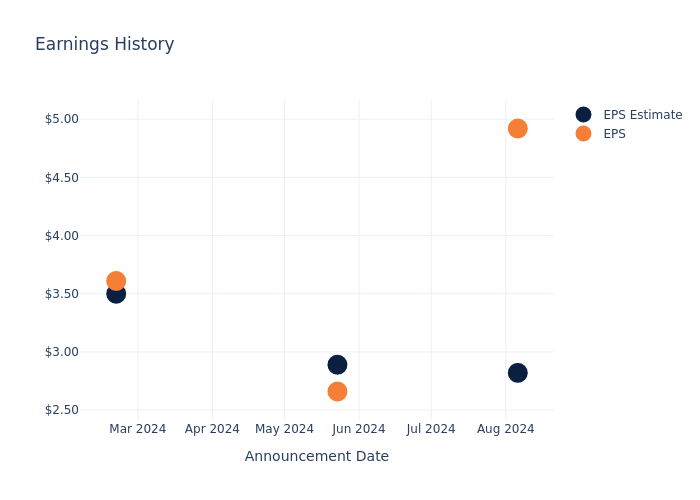

Here’s a look at Euroseas’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.82 | 2.89 | 3.50 | 3.01 |

| EPS Actual | 4.92 | 2.66 | 3.61 | 4.07 |

| Price Change % | 1.0% | 3.0% | -2.0% | -2.0% |

Market Performance of Euroseas’s Stock

Shares of Euroseas were trading at $42.37 as of November 18. Over the last 52-week period, shares are up 48.74%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on Euroseas

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Euroseas.

Analysts have provided Euroseas with 1 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $60.0, suggesting a potential 41.61% upside.

Comparing Ratings Among Industry Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Safe Bulkers, Genco Shipping & Trading and Global Ship Lease, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- For Safe Bulkers, analysts project an Buy trajectory, with an average 1-year price target of $6.0, indicating a potential 85.84% downside.

- The consensus outlook from analysts is an Buy trajectory for Genco Shipping & Trading, with an average 1-year price target of $21.33, indicating a potential 49.66% downside.

- Analysts currently favor an Buy trajectory for Global Ship Lease, with an average 1-year price target of $29.0, suggesting a potential 31.56% downside.

Overview of Peer Analysis

Within the peer analysis summary, vital metrics for Safe Bulkers, Genco Shipping & Trading and Global Ship Lease are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Euroseas | Buy | 23.12% | $39.44M | 13.53% |

| Safe Bulkers | Buy | 17.44% | $33.71M | 2.83% |

| Genco Shipping & Trading | Buy | 19.16% | $28.37M | 2.32% |

| Global Ship Lease | Buy | 8.16% | $96.39M | 6.62% |

Key Takeaway:

Euroseas ranks at the top for Revenue Growth among its peers. It is in the middle for Gross Profit. Euroseas is at the top for Return on Equity.

Unveiling the Story Behind Euroseas

Euroseas Ltd is a shipping company. Its fleet consists of containerships that transport container boxes providing scheduled service between ports. Its operations are managed by an affiliated ship management company, which is responsible for the day-to-day commercial and technical management and operations of the vessels. The company employs its vessels on spot and period charters and through pool arrangements.

Euroseas: A Financial Overview

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Euroseas’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 23.12% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Euroseas’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 69.39%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company’s ROE is a standout performer, exceeding industry averages. With an impressive ROE of 13.53%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Euroseas’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 8.04% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.64.

To track all earnings releases for Euroseas visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Altus Group Releases Inaugural U.S. Investment & Transactions Quarterly Report

NEW YORK, Nov. 19, 2024 (GLOBE NEWSWIRE) — Altus Group AIF, a leading provider of asset and fund intelligence for commercial real estate (CRE), today released its inaugural U.S. CRE Investment & Transactions Quarterly Report, covering national transaction activity for Q3 2024.

Altus Group’s transaction data analysis stands out from other industry reports by covering a broader range of transaction activity and slicing the data at a very granular level. This quarterly report offers a comprehensive overview of national commercial sale transactions across major property sectors, focusing on transaction volume, pricing, and pacing, with further insights by property subtype and at the metropolitan statistical area (MSA) level. While other reports tend to focus on large transactions, Altus takes a more holistic view of the market capturing single-asset transactions exceeding $100,000 in sale value.

Q3 2024 U.S. Investment & Transactions Quarterly Report

The U.S. commercial real estate market recorded $40.1 billion in dollar value transacted in Q3 2024, compared to $43.0 billion in Q2 2024 and $44.4 billion in Q3 2023. On an aggregated national basis, transaction activity in Q3 2024 remained down compared to the prior quarter and over last year across the following three key metrics:

| National transaction activity in Q3 2024 | ||

| Key metric | Sequential change over Q2 2024 | Year-over-year change over Q3 2023 |

| Count of properties transacted | -10.0% | -9.9% |

| Dollars transacted | -6.6% | -9.6% |

| Square feet transacted | -3.8% | -11.4% |

“While transactions continued to decline during the third quarter, the rate of decline has slowed which potentially reflects an improving financing environment and increased optimism,” said Cole Perry, Associate Director of Research at Altus Group. “Interestingly, 10 of the 15 property sub-sectors saw a positive quarter-over-quarter price growth per square foot, led by mixed-use, manufacturing, automotive and office properties. The granularity of our data provides valuable insights, helping CRE professionals stay on top of trends and identify the sectors that will lead the market recovery.”

Key Q3 2024 transaction activity highlights:

- During Q3 2024, transaction activity slowed but at a moderating pace. The year-over-year change in number of transactions in Q3 2024 was -11% for multifamily (vs. -33% in Q3 2023 over Q3 2022), -6% for industrial (vs. 31%), -15% for office (vs. -32%), and -9% for retail (vs. -36%).

- Year-to-date cumulative transaction volume remains low; the number of properties transacted is at its lowest since 2011, transaction dollar volume is at its lowest since 2013, and square footage transacted is at its lowest since 2010.

- The average count, dollar volume, and square footage of transactions on a given day during Q3 2024 sat at or below pandemic-era lows for all property types; however, the average square footage of an individual transaction increased quarter-over-quarter sequentially for all property sectors in Q3 2024.

- The average price per square foot of transacted properties rose by 1.2% quarter-over-quarter in Q3 2024, with increases across all sectors except hospitality, which fell by 2.6%.

- The multifamily sector posted $12.2 billion in dollar volume transacted in Q3, representing the largest contribution (30.4%) by a single sector. This was followed by industrial with $9.9 billion (24.7%), office with $8.0 billion (20.0%), and retail with $6.1 billion (15.3%).

To access the full Q3 2024 U.S. Investment & Transactions Quarterly Report, please click here.

Note: Property and transaction-level data are sourced from Altus Group’s Reonomy product, with data pulled on October 15, 2024 and transactions recorded through September 30, 2024 (the close of Q3 2024). Not all transactions for Q3 2024 were available as of October 15, 2024, so estimates were made to reflect national transaction activity. For information about the data contained in the report and methodology, please see the full report.

About Altus Group

Altus Group is a leading provider of asset and fund intelligence for commercial real estate. We deliver intelligence as a service to our global client base through a connected platform of industry-leading technology, advanced analytics, and advisory services. Trusted by the largest CRE leaders, our capabilities help commercial real estate investors, developers, proprietors, lenders, and advisors manage risks and improve performance returns throughout the asset and fund lifecycle. Altus Group is a global company headquartered in Toronto with approximately 2,900 employees across North America, EMEA and Asia Pacific. For more information about Altus AIF please visit www.altusgroup.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Elizabeth Lambe

Director, Global Communications, Altus Group

(416) 641-9787

elizabeth.lambe@altusgroup.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.