Eli Lilly Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Eli Lilly LLY, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LLY usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 41 extraordinary options activities for Eli Lilly. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 46% leaning bullish and 26% bearish. Among these notable options, 27 are puts, totaling $1,787,322, and 14 are calls, amounting to $807,770.

Expected Price Movements

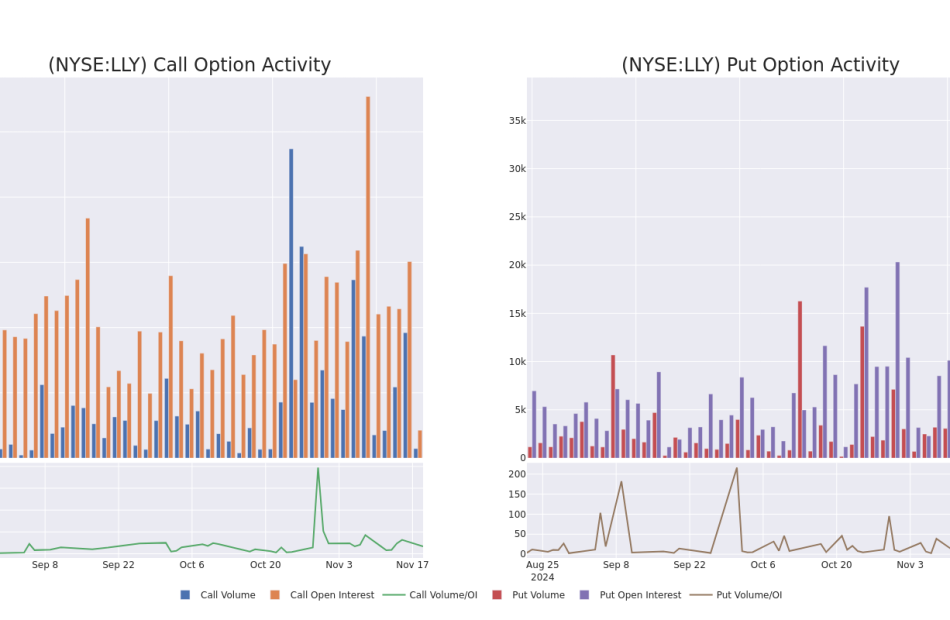

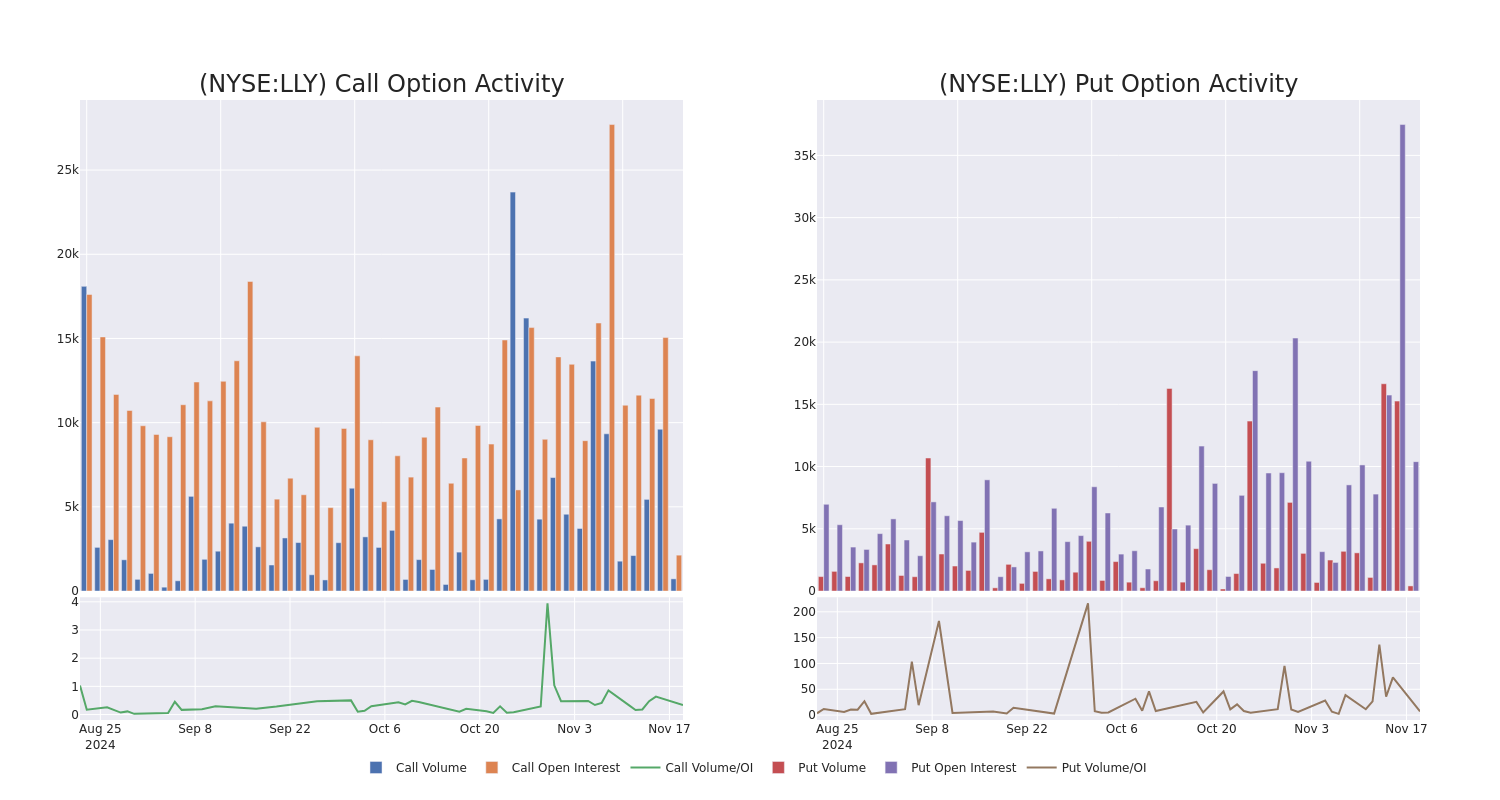

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $520.0 to $950.0 for Eli Lilly over the last 3 months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Eli Lilly options trades today is 358.06 with a total volume of 1,100.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Eli Lilly’s big money trades within a strike price range of $520.0 to $950.0 over the last 30 days.

Eli Lilly Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | PUT | TRADE | NEUTRAL | 01/16/26 | $57.7 | $52.75 | $55.5 | $650.00 | $416.2K | 153 | 77 |

| LLY | CALL | TRADE | BULLISH | 07/18/25 | $44.15 | $41.2 | $43.0 | $850.00 | $129.0K | 0 | 20 |

| LLY | PUT | SWEEP | BULLISH | 04/17/25 | $59.5 | $57.1 | $57.1 | $720.00 | $119.9K | 211 | 23 |

| LLY | PUT | TRADE | NEUTRAL | 02/21/25 | $233.5 | $226.4 | $229.83 | $950.00 | $114.9K | 66 | 0 |

| LLY | PUT | SWEEP | BEARISH | 03/21/25 | $71.85 | $70.2 | $70.2 | $750.00 | $112.3K | 200 | 19 |

About Eli Lilly

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly’s key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

Eli Lilly’s Current Market Status

- With a trading volume of 1,880,416, the price of LLY is down by -0.65%, reaching $722.49.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 77 days from now.

What The Experts Say On Eli Lilly

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $1068.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Eli Lilly, targeting a price of $975.

* An analyst from B of A Securities has decided to maintain their Buy rating on Eli Lilly, which currently sits at a price target of $1100.

* An analyst from Wolfe Research has revised its rating downward to Outperform, adjusting the price target to $1000.

* An analyst from Citigroup has decided to maintain their Buy rating on Eli Lilly, which currently sits at a price target of $1250.

* An analyst from Deutsche Bank has decided to maintain their Buy rating on Eli Lilly, which currently sits at a price target of $1015.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Eli Lilly with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Synthetic Graphite Market Size to be Worth USD 38.3 billion by 2031, with Notable CAGR of 6.4%| Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Nov. 19, 2024 (GLOBE NEWSWIRE) — The global synthetic graphite market (سوق الجرافيت الاصطناعي) was projected to attain US$ 22.0 billion in 2022. It is anticipated to garner a 6.4% CAGR from 2023 to 2031 and by 2031, the market is likely to attain US$ 38.3 billion by 2031.

Lithium-ion batteries, solar infrastructure, metal manufacturing, and other specialized companies depend heavily on synthetic graphite. The substance is primarily used as an addition to increase carbon in the iron and steel industry. In addition, it helps the synthetic graphite sector by producing ferroalloys, melting iron and steel in metal furnaces, and storing energy.

Click to Request Sample PDF Report and Drive Impactful Decisions: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=38636

Global synthetic graphite Market: Key Players

Prominent manufacturers are making significant investments in the advancement of high-performance synthetic graphite applications and synthetic graphite manufacturing methods. In order to create a superior product range and keep a strong position in the industry, close partnerships within the market as well as mergers and acquisitions are considered essential tactics. The following companies are well-known participants in the global synthetic graphite market:

- GrafTech International

- Showa Denko K.K

- SGL Carbon SE

- Graphite India Limited

- HEG Limited

- Tokai Carbon Co. Ltd.

- Nippon Carbon Co. Ltd.

- SEC Carbon, Ltd.

- Kaifeng Carbon Co. Ltd.

- Nantong Yangzi Carbon Co. Ltd.

Key Findings of the Market Report

- Synthetic graphite is used to create temperature-resistant conducting materials known as graphite electrodes.

- They are employed in various smelting procedures and the refining of steel.

- High-quality iron and steel manufacturing requires graphite electrodes due to a number of its features, including strong electrical and thermal conductivity, chemical stability, strong shock resistance, and high metal removal rate.

Market Trends for Synthetic Graphite

- Electric vehicle (EV) adoption is being encouraged by governments throughout the globe in an effort to lower greenhouse gas emissions and combat climate change.

- The popularity of EVs is increasing because of advancements in battery technology, government incentives, and a growth in environmental consciousness. Hence, growth in use of EVs is boosting the synthetic graphite market size.

- One essential ingredient used in the creation of lithium-ion batteries is synthetic graphite. In Li-ion batteries, it serves as the negative electrode, or anode. It is used to shorten charging times and boost energy density in electric cars.

- China is a significant EV manufacturer. It promotes the development of a supply chain for the production of Li-ion batteries, which begins with the processing of minerals and other components like graphite or synthetic carbon.

Global Market for Synthetic Graphite: Regional Outlook

- In 2022, Asia Pacific accounted for the most significant proportion. Since China has a strong chemical, iron, and steel industry, it is a key basis for the artificial graphite market as well as the high-performance graphite sector. The demand for lithium-ion batteries is increasing due to the growing use of electric cars in India and China, which is driving the market dynamics in the Asia Pacific region.

- By 2025, it is anticipated that Chinese battery makers would generate 4,800 gigawatt-hours (GWh) of energy. The U.S. Geological Survey estimates that in 2022, China will produce around 65% of the world’s graphite.

- Over the course of the projected period, the industry in North America is anticipated to rise steadily. Northwestern University study indicates that 63% of domestically manufactured graphite in the United States was synthetic.

Download Your Executive Sample – Informed Decisions Start Here: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=38636

Key developments by the players in this market are:

- A start-up company from New Zealand called CarbonScape created a method in December 2023 to turn woodchips into synthetic graphite. The business boasts that it can create one metric ton of synthetic graphite from seven tons of dry wood chips.

- The Imerys Graphite & Carbon Company announced the initiation of the “EMILI Project,” a lithium extraction initiative, in October 2022. The initiative may help produce about 700,000 electric car batteries yearly and significantly reduce the need to import lithium.

Global Synthetic Graphite Market Segmentation

Product

- Electrodes

- Isostatic

- Specialty Graphite

- Carbon Fibers

- Others

End-use Industry

- Electronics

- Nuclear

- Chemical

- Mechanical Engineering

- Metallurgy

- Energy Storage & Transmission

- Others

Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy this Premium Research Report @

https://www.transparencymarketresearch.com/checkout.php?rep_id=38636<ype=S

More Trending Report by Transparency Market Research:

- Nanocrystalline Cellulose Market – The nanocrystalline cellulose (السليلوز البلوري النانوي) global market was valued at US$ 55.0 million in 2022. The market is projected to increase at a CAGR of 31.0% between 2023 and 2031, reaching US$ 628.2 million by 2031.

- Carbon Nanotubes Market – The global carbon nanotubes market (سوق أنابيب الكربون النانوية) is estimated to flourish at a CAGR of 14.4% from 2022 to 2031. Transparency Market Research projects that the overall sales revenue for carbon nanotubes is estimated to reach US$ 19.9 billion by the end of 2031.

- Nanosilver Market – The global nanosilver market (سوق الفضة النانوية) is exhibiting a CAGR of 12.9% during the period from 2022 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lemon Bioflavonoids Market Projected to Grow Significantly, Reaching US$ 663.5 Million by 2034 | Fact.MR Report

Rockville, MD, Nov. 19, 2024 (GLOBE NEWSWIRE) — According to a newly published report by Fact.MR, a market research and competitive intelligence provider, the global lemon bioflavonoids market is evaluated to reach US$ 304.5 million in 2024. The market is projected to advance at a CAGR of 8.1% between 2024 and 2034.

Natural substances, which are included in citrus fruits called lemon bioflavonoids. They are in high demand worldwide because of several uses and health advantages. These potent antioxidants are making their way into a staggering number of products and sectors, including drinks, food, cosmetics, and medicine. Lemon bioflavonoids are highly valued in the health and wellness industry for their ability to strengthen the immune system and reduce inflammation, which is contributing to their popularity in dietary supplements. They are used in the food industry as natural flavor enhancers and preservatives to meet the rising demand from consumers for clean-label goods.

These substances have anti-aging properties, thus skincare firms are using them in their compositions to guard against environmental harm. Researchers are now investigating their potential for treating a range of illnesses, including some malignancies and cardiovascular disorders. The potential for lemon bioflavonoids is bright, as seen by the growing worldwide market for these chemicals produced from citrus fruits and the emergence of novel uses and advantages.

Click to Request a Sample of this Report for Additional Market Insights https://www.factmr.com/connectus/sample?flag=S&rep_id=10401

Key Takeaways from the Market Study

- The global lemon bioflavonoids market is forecasted to attain a valuation of US$ 663.5 million by the end of 2034.The market in Japan is projected to advance at a CAGR of 8.6% between 2024 and 2034, occupying a market share of 29.4% in the East Asia region by 2034.

- The North American market is evaluated to reach a worth of US$ 161.2 million by 2034-end.The market in Canada is evaluated to capture a share of 34.5% in the North American region by 2034.

- Based on the nature, the organic segment is approximated to progress at a CAGR of 8.2% between 2024 and 2034.The East Asia region is approximated to expand at a CAGR of 8.4% through 2034.

“Enhanced nutrient absorption and skin health protection are enticing customers to consume lemon bioflavonoids steadily,” says a Fact.MR analyst.

Key Companies Profiled in Lemon Bioflavonoids Market:

BOC Sciences; BORDAS S.A.; Healthcare; BioGin Biochemicals Co. Ltd.; BioCrick Co., Ltd.; Di’ao Pharma; Ingredients By Nature; Morre-Tec Industries, Inc.; Nans Products; SV Agrofood; Zukan.

High levels of vitamins and bioflavonoids are driving growth

Because of their high vitamin and bioflavonoid content, citrus fruits are becoming more and more popular. Because they contain significant bioflavonoids like hesperidin and eriocitrin in high concentrations, lemons are among the citrus fruits that have caught the attention of researchers. Important polyphenolic compounds found in lemons boost immunity and aid in the fight against a number of viral diseases.

Oranges, lemons, and other citrus fruits are rich in vitamins and minerals that the body need for optimal operation. Lemons include essential bioflavonoid compounds and components that improve capillary permeability, decrease cholesterol, and balance blood sugar levels. They also protect the cells against the harmful effects of oxygen-free radicals, which are produced during inflammation and viral infection. The market for lemon bioflavonoids is growing as a result of suppliers profiting from the increased demand for citrus fruit components.

Get a Custom Analysis for Targeted Research Solutions https://www.factmr.com/connectus/sample?flag=S&rep_id=10401

Suppliers are taking advantage of the increasing demand for natural ingredients and health consciousness to raise the profile of lemon bioflavonoids on a worldwide scale through a variety of strategies. Health-conscious customers respond well to educational marketing initiatives that highlight the chemicals’ health advantages, from immune support to anti-aging effects. Partnerships with producers of food and drink have resulted in cutting-edge product introductions that have expanded the market for lemon bioflavonoids. Additionally, several suppliers are collaborating with cosmetic businesses to market these substances as high-end components for skincare products.

Research and development expenditures have revealed new uses, increasing market potential. To maintain consistency and quality in their products, several suppliers have vertically integrated, taking control of the whole supply chain. Adoption has increased because of strategic pricing and quantity reductions that have made lemon bioflavonoids more affordable for smaller enterprises. Several market players are also using social media and e-Commerce sites to directly access international marketplaces.

Lemon Bioflavonoids Industry News:

- In March 2021, Ingredients by Nature (IBN) undertook renovations at its Brewster and Montclair sites. The improvements allowed IBN to improve several processes for better production and customisation of ingredients and for future preventative improvements to the workplace environment for workers.

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the lemon bioflavonoids market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on type (hesperidin, eriocitrin, naringin), nature (organic, conventional), and end use (dietary supplements, pharmaceuticals, cosmetics & personal care, food & beverages), across seven major regions of the world (North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, and MEA).

Discover Additional Market Insights from Fact.MR Research:

The global citrus fiber market is estimated to generate a turnover of US$ 378.2 million in 2024 and is further forecasted to expand at 5.7% CAGR to reach a valuation of US$ 656.2 million by the end of 2034, according to an updated research report by Fact.MR.

The global lemon oil market stands at a valuation of US$ 979.4 million and is projected to evolve at 4.8% CAGR over the next ten years. Sales of lemon oil are anticipated to reach a market value of US$ 1.56 billion by the end of 2033.

Worldwide citrus peel extract product sales are currently valued at around US$ 7.59 billion. Detailed industry analysis has revealed that the global citrus peel extract market is expected to expand at a CAGR of 4.5% and reach a value of US$ 11.84 billion by 2032.

The global citrus essential oil market is projected to expand at a CAGR of 4.1% and hit a valuation of US$ 6 billion by 2032, up from its current size of US$ 4 billion in 2022.

The global citrus concentrate market is projected to be worth US$ 8,978.2 million in 2024. Projections indicate the market will expand at a CAGR of 5.3% through 2034. The market is anticipated to cross US$ 15,107.3 million in 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: MSCI Inc

Summary

MSCI is a leading provider of investment-decision support tools worldwide. Its line of products and services includes indices, analytical tools, and ESG and climate research products. The stock is a comp

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

LogicMark Offers Safety Technology for Free To American Veterans Nationwide

Falls are the leading cause of injury and death among aging adults in America, including our nation’s 8.1 million veterans over 65. Due to chronic conditions and physical disabilities, they are actually more susceptible to falls than their non-veteran counterparts. With more than one in five veterans living alone in America, many are in unsafe situations.

Staying strong and healthy is the best way to prevent falls, but there are many other ways to decrease the risk. Making simple updates in the home, such as removing throw rugs, improving lighting, installing grab bars, using bed rails, widening hallways and doorways and adding ramps outside, can enhance safety and prevent common accidents. But even so, a fall may still occur. Unfortunately, constant physical monitoring and surveillance aren’t possible for a lot of people, and how quickly help comes could mean the difference between a non-fatal or fatal injury.

That’s where LogicMark Inc. LGMK, a leading provider of personal emergency response systems (PERS), health communication devices and IoT technologies, is making a significant impact for those in these situations. Instead of relying on in-person monitoring, the company uses advanced technology to offer a comprehensive suite of products aimed at protecting users from falls both at home and on the go.

Confidence And Independence In A Compact Device

LogicMark’s Freedom Alert Mini is a compact 4G LTE device that allows users to call for help with just the push of a button, ensuring help is always within reach wherever there is cellular service. The Freedom Alert Mini is equipped with LogicMark’s patented fall detection technology which uses accelerometer sensors that measure the user’s speed and orientation to detect a fall. When a fall has been detected, the device sends an alert to a 24/7 monitoring center, a loved one or 911. This can be life-saving if a user falls and is unable to dial an emergency contact due to an injury, loss of consciousness, or disorientation.

In addition to its fall detection capabilities, the device features GPS location services that can pinpoint the exact location of a fall and alert authorities and caregivers. It also includes geofencing capabilities, allowing caregivers to establish a virtual boundary for their loved ones. If the device user moves beyond this designated area, caregivers receive an immediate alert.

Guardian Alert 911 Plus is an additional on-the-go device in LogicMark’s product line. It is designed to enhance safety both inside and outside the home and features 4G LTE technology that enables users to connect directly to 911 with a single button press. Additionally, the device includes a two-way communication feature, allowing users to speak directly with 911 operators during emergencies. This functionality provides users with the confidence to live independently, knowing help is just a call away.

Veterans Can Feel Safe At Home

70% of falls occur indoors. For veterans who spend considerable time at home, LogicMark’s Freedom Alert and Guardian Alert 911 offer reliable solutions to enhance safety and peace of mind. Both wearable medical devices use the customer’s landline to connect to emergency services. The Freedom Alert allows users to quickly connect with friends, family or 911 in an emergency. With the push of a button, the device can call up to four pre-programmed contacts or dial 911 directly. Emergency responders can pinpoint the location of a LogicMark device within a 600-foot radius of the base unit. The Guardian 911 connects directly to emergency services with a single button press. Ensuring users can easily call for help or notify a caregiver even during stressful or confusing moments. Both devices feature long-lasting batteries that last at least one month.

These devices give aging adults freedom and confidence, knowing help is a push of a button away. For caregivers and loved ones, the devices offer an added layer of monitoring and peace of mind when they cannot be present. Meanwhile, first responders receive crucial information that enables them to reach the scene quickly and efficiently.

Globally, the fall detection systems market is forecasted to grow at a CAGR of 7.6% from now through 2030. Driving that growth is the demand for solutions to ensure the aging adult population’s safety and independence with devices that can aid in home health care. LogicMark’s products check off both boxes.

Aging adults over 65 make up half the nation’s veterans, and just like their non-veteran counterparts, they are at risk of falls. As the population ages, demand for devices that detect falls is projected to grow. LogicMark aims to capitalize on this growth, positioning its devices – from the Freedom Alert Mini to the Guardian Alert 911 Plus – as potential leaders in the market. Take a glance at LogicMark’s stock chart here.

Featured photo by sydney Rae on Unsplash.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Walmart raises guidance after another strong earnings report ahead of the holiday season

The good times keep rolling on at Walmart (WMT), as inflation-weary shoppers continue to search for value.

On Tuesday, the world’s biggest retailer posted fiscal third quarter results that easily beat Wall Street expectations. Sales of $169.59 billion topped analyst estimates for $167.5 billion. Adjusted earnings per share eclipsed estimates by 5 cents at $0.58.

“We had a strong quarter, continuing our momentum,” CEO Doug McMillon said in a statement. “In the US, in-store volumes grew, pickup from store grew faster, and delivery from store grew even faster than that.”

Shares of Walmart rose over 4% in premarket trading on Tuesday. The stock is up 60% year to date, out-performing the Dow Jones Industrial Average’s (^DJI) 15% advance.

Here’s what Walmart posted for its third quarter of fiscal year 2025 results, compared to Bloomberg consensus estimates:

Revenue: $169.59 billon versus $167.5 billion

Adjusted earnings per share: $0.58 versus $0.53

Overall same-store sales growth: 5.5% versus 3.81%

Walmart US same-store sales growth: 5.3% versus 3.68%

-

Traffic: 3.1% versus 2.82%

-

Ticket growth: 2.1% versus 1.20%

-

E-commerce growth: 22% versus 2.22%

Sam’s Club US same-store sales growth: 7.0% versus 4.22%

Walmart US saw same-store sales jump 5.3%, driven by more foot traffic, up 3.1% and a higher average ticket, up 2.1%. That’s compared to a 4.9% increase it posted this time last year.

In the US, e-commerce sales jumped 22%, while advertising unit Walmart Connect grew 26%. Membership income also saw a double-digit increase.

The retailer notched gains across all product categories and income cohorts, primarily driven by upper-income households.

Sales in the groceries category grew by mid-single digits as “food units reached highest level in four years” led by pantry products. Personal care and household cleaning products also saw sales growth. Its private-brand penetration rose 80 basis points as it doubled down with new lines like BetterGoods early this year.

Groceries make up about 60% of US sales for Walmart.

Walmart signaled it sees the momentum continuing for the holiday shopping season.

The retail giant raised its guidance for fiscal year 2025 for the third time.

Net sales are now expected to grow between the range of 4.8% to 5.1%. Previously, Walmart guided to 3.75% to 4.75% sales growth. Coming into the year, Walmart had expected 3.0% to 4.0% sales growth.

Adjusted operating income is expected to grow between 8.5% to 9.25%, compared to previous guidance of 6.5% to 8.0%.

Lowe's Q3: Earnings: Revenue And EPS Beat But Comp Sales Fall Amid Softness In Bigger-Ticket DIY Discretionary Demand

Lowe’s Companies, Inc. LOW shares are trading lower in the premarket session on Tuesday.

The company reported third-quarter adjusted earnings per share of $2.89 beating the street view of $2.82.

Quarterly sales of $20.170 billion outpaced the analyst consensus estimate of $19.424 billion.

Comparable sales for the quarter decreased 1.1%, driven by continued softness in DIY bigger-ticket discretionary demand, partly offset by storm-related sales and positive comparable sales in Pro and online.

Gross margin in the quarter under review remained relatively flat year over year to 33.69%. Quarterly operating income totaled $2.536 billion compared with $2.696 billion a year ago.

Also Read: Boeing To Lay Off Over 2,500 Workers In The US Amid Global Workforce Reduction

During the third quarter, the company recognized a $54 million pre-tax gain associated with the 2022 sale of the Canadian retail business. This positively impacted third-quarter diluted EPS by 10 cents.

“Next month at our Analyst and Investor Conference, I look forward to discussing our new growth and productivity initiatives, which underscore our confidence that we are well-positioned to capitalize on the expected recovery in home improvement,” said Marvin R. Ellison, Lowe’s chairman, president and CEO.

As of Nov. 1, Lowe’s operated 1,747 stores representing 195.0 million square feet of retail selling space.

Guidance: Lowe’s has revised its fiscal year 2024 outlook for its adjusted earnings per share (EPS) guidance from a range of $11.70 – $11.90 to a range of $11.80 – $11.90, compared with the consensus estimate of $11.85.

Additionally, the company raised its sales forecast from a range of $82.70 billion – $83.20 billion to a new range of $83.00 billion – $83.50 billion, compared with the consensus estimate of $83.05 billion.

For FY24, Comparable sales is expected to be -3.0 to -3.5%, as compared to prior year (previous view -3.5% to -4.0%).

Adjusted operating income as a percentage of sales (adjusted operating margin) of 12.3% to 12.4% (previously 12.4% to 12.5%).

Price Action: LOW shares are trading lower by 1.02% to $269.00 premarket at last check Tuesday.

Photo via Wikimedia Commons

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why BlackRock's Rick Rieder Believes Markets Will Rise Despite Valuation Worries

Despite ongoing market fluctuations, Rick Rieder, the global CIO of fixed income at BlackRock, has expressed confidence in the continued rise of stock markets, even in the face of high valuations. His insights were shared during a Yahoo Finance conference, where he highlighted the absence of sellers as a crucial factor supporting this trend.

What Happened: Rieder emphasized that despite the allure of money-market funds due to high interest rates, the momentum in stock buying remains robust. He noted that consistent inflows into equities from 401(k)s and other sources continue without significant selling pressure, Business Insider reported on Tuesday.

Corporate buybacks are also playing a pivotal role. Rieder pointed out that major companies have repurchased a trillion dollars worth of their own shares, reducing the equity supply and boosting per-share values. This activity, he argued, more than compensates for any valuation concerns.

See Also: Major Investor In Trump Media Offloads Most Of Its Stake In DJT Stock

While acknowledging stretched valuations, Rieder suggested that market multiples could normalize if earnings rise significantly.

“I think markets tend to react to the shark closest to the boat,” Rieder said, adding that these are not immediate threats.

“I don’t know if it’s the latter part of 2025 or the beginning of 2026 unless they address the size of the spending dynamics, the amount of debt we’re issuing, and, then obviously, inflation relative to that.”

Why It Matters: The stock market has experienced a series of ups and downs recently. On Monday, U.S. stocks rebounded after a challenging week, with all 11 sectors of the S&P 500 trading positively. This recovery was driven by a decrease in pressures from the dollar and Treasury yields. Notably, consumer discretionary stocks outperformed, with Tesla Inc. TSLA surging by 7% due to reports of the incoming Donald Trump administration prioritizing a federal framework for autonomous vehicles.

However, geopolitical tensions have recently weighed on investor sentiment. Today, before the bell, futures of major indices pointed to a cautious stance on Wall Street, influenced by economic data and comments from Federal Reserve Chair Jerome Powell about the future of rate cuts, as well as geopolitical developments, including Russian President Vladimir Putin‘s expanded nuclear doctrine.

Price Action: In premarket trading on Tuesday, the SPDR S&P 500 ETF Trust SPY, which tracks the S&P 500 Index, fell 0.35% to $586.11 and the Invesco QQQ ETF QQQ, which tracks the Nasdaq 100 Index, declined 0.29% to $498.58, according to Benzinga Pro data.

Read Next:

Image via Unsplash

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New Interface Report Reveals Top Security Risks for U.S. Retail Chains

St. Louis, MO, Nov. 19, 2024 (GLOBE NEWSWIRE) — Interface Systems, a leading managed service provider of security, actionable insights, and purpose-built networks for multi-location businesses, has released its 2024 State of Remote Video Monitoring in Retail Chains report. The detailed study analyzed over 2 million monitoring requests across 4,156 retail locations in the United States from September 2023 to August 2024.

Offering valuable insights to strengthen store security and protect employees, the report provides an overview of the critical challenges faced by retailers. It highlights the peak times for security incidents, the importance of interactive monitoring, and the effectiveness of advanced technologies such as video verification and voice-down commands.

“This report underscores the critical role that data-driven security strategies play in safeguarding retail environments. By leveraging interactive monitoring solutions, retail chains can effectively mitigate risks, reduce false alarms, and ensure a safer experience for both employees and customers,” said Brent Duncan, CEO of Interface Systems

Key findings include:

Theft, Disturbances, and Loitering Dominate Security Incidents

The report identifies theft, disturbances, and loitering as the most common security threats in retail locations. Loitering incidents, in particular, led to the highest rate of police dispatches at 65.8%.

Critical Times for Store Security

The data reveals that peak security risks occur during store closing times, particularly between 5:00 p.m. and 8:00 p.m. when dispatch rates are the highest. Early morning and late-night hours see minimal incidents, indicating a reduced need for escalation during these times.

Effectiveness of Video Verification and Voice-Down Commands

Stores utilizing video verification saw a 97% reduction in false alarms, significantly minimizing unnecessary dispatches and associated penalties. Voice-down interventions proved to be a highly effective deterrent, resolving over 99.86% of incidents without requiring police involvement, reinforcing the value of real-time audio deterrence.

Impact of Interactive Monitoring Solutions

The deployment of interactive monitoring solutions has proven to be effective in enhancing security and employee confidence. By providing real-time access to remote security professionals, stores can efficiently manage incidents, especially during high-risk periods like store closings.

Tyson Johns, SVP of Security Monitoring Operations at Interface Systems, emphasized, “Our data reveals actionable patterns that retail chains can leverage to deploy more effective loss prevention strategies. The significant reduction in police dispatches through our interactive monitoring solutions demonstrates the power of technology in maintaining a secure environment.”

For more information and to access the full report, visit: https://interfacesystems.com/state-of-remote-video-monitoring-retail/

About Interface Systems

Interface Systems is a leading managed service provider of business security, actionable insights, and purpose-built networks for multi-location businesses. We enhance security, streamline connectivity, optimize operations, and reduce IT costs, maximizing ROI for the nation’s top brands. Learn more and follow us on our blog, Making IT Happen, and on LinkedIn.

Veronique Froment Interface Security Systems 6035379248 veronique@highrezpr.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lowe's beats all quarterly estimates but negative sales outlook draws focus

Lowe’s (LOW) posted results that beat the Street’s estimates, but investors are honing in on its ongoing negative sales growth.

The home improvement retailer posted revenue of $20.17 billion, compared to estimates of $19.93 billion. Adjusted earnings per share came in at $2.89, versus the $2.82 expected.

“Our results this quarter were modestly better-than-expected, even excluding storm-related activity, driven by high-single-digit positive comps in Pro, strong online sales and smaller-ticket outdoor DIY projects,” Lowe’s CEO Marvin Ellison said in the release.

Same-store sales is down 1.1%, less than the 2.7% decline anticipated. The company alluded to ongoing softness in the “DIY bigger-ticker discretionary demand,” which was offset by hurricane-related recovery efforts following Hurricanes Helene and Milton and positive same-store sales in its Pro business and online.

But its shares were moving lower in premarket trading on Tuesday, down nearly 2%, as the company is expected to end the year with total net sales in the range of $83.0 to $83.5 billion, slightly higher than the previously expected range of $82.7 billion to $83.2 billion.

Same-store sales growth are expected to end the year down 3.0% to 3.5% year-over-year, compared to the previously expected decline of 3.5% to 4.0%.

The company is expected to host an Analyst and Investor Conference in December, where it plans to discuss “new growth and productivity initiatives” and explain on how it’s “well-positioned to to capitalize on the expected recovery in home improvement.”

“Lowe’s is lapping difficult comparisons from the past four years fueled by higher home values and heightened home-related spending as a result of the pandemic,” Telsey Advisory Group’s Joe Feldman wrote in a note to clients prior to results.

Positive catalysts in the near future include Fed rate cuts, hurricane-related recovery efforts, and normalizing “post-pandemic demand trends,” per Feldman.

“Lower interest rates [are] expected to spur increased consumer spending in the coming months — historically, there has been about a six to nine month lag from the first rate cut, particularly in home improvement,” he wrote.

TD Cowen analyst Max Rakhlenko said the company is “well positioned for the next Home Improvement Cycle” and he expects to see growth within the Pro business, specifically the small to medium-size Pro market. DIY customers make up roughly 75% of Lowe’s business as of the latest quarter.