Wearable Biometric Monitor Market to Surge to US$ 25.03 Billion with Growing at an 8.9% CAGR by 2034 | Fact.MR Report

Rockville, MD, Nov. 19, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global wearable biometric monitor market is estimated to reach a valuation of US$ 10,672.2 million in 2024 and is expected to grow at a CAGR of 8.9% during the forecast period of (2024 to 2034).

Wearable biometric monitors now tend to serve as a major driver in changing the health paradigm by monitoring important vital signs, such as heart rate (HR), blood pressure (BP), oxygen levels (O2) in the blood, and many others. Innovation has been pushing wearable devices’ envelope, with Garmin, Apple, and Fitbit on the forefront. Such devices with enhanced technologies have moved further from step counting to playing critical roles in chronic disease management, stress reduction, and real-time health monitoring. Increase in health awareness programs and initiatives across the globe, consumers are highly investing in technological advanced devices that enable them to monitor their real-time health metrics.

Medical device manufacturers are integrating digital solutions in product development, the incorporation of artificial intelligence (AI) and machine learning will further offer accuracy and functionality of wearable health tracking devices driving the sales of wearable monitoring devices. Growing healthcare applications, ranging from fitness tracking to chronic disease management are some of the key reason to invest in bringing wearables into healthcare systems to comprehend continuous and non-invasive monitoring. From Fitbit’s stress management score to advanced performance metrics offered by Garmin in health parameter tracking, manufacturers will continue to hold their market share by developing innovative health technologies.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10446

Since non-communicable diseases {cardiovascular diseases (CVD), hypertension (HTN), and diabetes (DM), and obesity} are on the rise, it definitely had a positive impact on the sales of wearable health monitoring devices which determined health metrics. According to the estimation of the World Health Organization, it was expected that about 41 million people lost their lives due to non-communicable diseases in 2023, overall 74 percent of the deaths in the world. 17 million people each year perish of NCD before 70 years of age, with 86% of these premature deaths in the low- and middle-income countries. About 77 percent of deaths due to an NCD occur in low- and middle-income countries. There is a rapid rise in chronic diseases seen in recent years, which has driven the growth for this market as patients demand wearables to better management of their health and clinical condition.

Key Takeaways from Market Study

Key Takeaways from Market Study

- The global wearable biometric monitor market is projected to grow at 9% CAGR and reach US$ 25,034.1 million by 2034

- The market created an opportunity of US$ 2,452.0 million growing at a CAGR of 5% between 2019 to 2024

- North America is a prominent region that is anticipated to hold a market share of 1% in 2024

- Predominating market players include Apple Inc., Fitbit Inc. (now part of Google LLC), and Garmin Ltd.

- Optical sensors under technology type are estimated to grow at a CAGR of 9% creating an absolute $ opportunity of US$ 8,480.7 million between 2024 and 2034

“Collaboration and partnership among manufacturers to drive the market in the upward direction” says a Fact.MR analyst.

Leading Players Driving Innovation in the Wearable Biometric Monitor Market:

Apple Inc.; Fitbit Inc. (now part of Google LLC); Garmin Ltd.; Samsung Electronics Co., Ltd.; Xiaomi Corporation; Huawei Technologies Co., Ltd.; Withings; Polar Electro Oy; Suunto Oy; BioTelemetry, Inc. (part of Philips); Oura Health Ltd.; Whoop, Inc.; Omron Healthcare, Inc.; ActiGraph LLC; Zephyr Technology Corporation; Valencell Inc.; Sensoria Inc.; ChronoTrack Systems Corp.; Wahoo Fitness; NeuroSky, Inc.; Hexoskin (Carre Technologies Inc.); Moov Inc.; Misfit Wearables (now part of Fossil Group); Jawbone (assets acquired by Jawbone Health); Atlas Wearables (acquired by Garmin); Other Prominent Players

Market Development:

The growth strategy for wearable biometric monitors is based on strategic partnerships in expanding product portfolios, geographic market entry, and consumer adoption. The manufacturers focused on emerging markets in Asia-Pacific and Latin America as the tide of health awareness rises with disposable incomes.

By 2028, the market can expect to see great strides being made in wearables for healthcare and fitness in general in Asia, particularly China. Supported by various governmental policy initiatives and consumer trends at large, China entered the category of leading wearable consumers in 2023.

Apple, Garmin, and Fitbit are investing intensively in research and development to launch new product lines for chronic disease management and elderly care. Most likely, this will double the market share of wearables for healthcare by 2030, considering the aspirations for wearable technology to turn into an indispensable tool in preventive healthcare. As this demand increases, the main reason for continuous improvement, advanced biometric capabilities, and strategic collaborations will be very important during the growth of the market in the next decade.

Wearable Biometric Monitor Industry News:

- In March 2023, Garmin launched Forerunner 965, which focused on integration of advanced metric system to track and analyze health performance of athletes.

- On September 2022, Apple launched its Apple 8 series of smartwatch that tracks ECG and blood oxygen levels for better health.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10446

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the global wearable biometric monitor market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of the by product type (smart watches, fitness bands, smart clothing, and head-mounted displays), by technology (optical sensors, electrocardiography (ECG), and accelerometers and gyroscopes), by application (sports and fitness, disease management, defense and military, and others), by end-user (home care settings, hospitals settings, sports & fitness centers, ambulatory surgical centers, and specialty clinics), across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Checkout More Related Studies Published by Fact.MR Research:

The global radioimmunotherapy market is analyzed to generate revenue worth US$ 1.37 billion in 2024 and is further projected to reach US$ 3.16 billion by 2034-end. Demand is forecasted to rise at an excellent CAGR of 8.7% between 2024 to 2034.

The global dental curing lights market was valued at US$ 405.3 million in 2023 and has been forecasted to expand at a CAGR of 5.8% to end up at US$ 765.8 million by 2034.

The global metastatic colorectal cancer (mCRC) market was valued at US$ 5,662.9 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 5.1% to end up at US$ 9,787.5 million by 2034.

The global peptide based hematological disorders therapeutics market was valued at US$ 530.2 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 8.1% to end up at US$ 1,253.9 Million by 2034.

The global olaparib API market is estimated at US$ 1.07 billion in 2024 and has been evaluated to increase at an excellent CAGR of 15.3% through 2034 to achieve a value of US$ 4.41 billion by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Universal Security Instruments Reports Second-Quarter Results

OWINGS MILLS, Md., Nov. 19, 2024 (GLOBE NEWSWIRE) — Universal Security Instruments, Inc. UUU today announced results for its fiscal second quarter and six months ended September 30, 2024.

For the three months ended September 30, 2024, sales increased 93.8% to $7,203,269 compared to sales of $3,717,455 for the same period last year. The Company reported net income of $576,978, or $0.25 per basic and diluted share, compared to a net loss of $186,425 or $0.08 per basic and diluted share for the same period last year.

For the six months ended September 30, 2024, sales increased 13.3% to $11,801,785 versus $10,416,266 for the same period last year. The Company reported net income of $134,772, or $0.06 per basic and diluted share, compared to a net loss of $21,295 or $0.01, per basic and diluted share for the corresponding 2023 period. Included in the results for the quarter ended September 30, 2024, were sales to a national retail chain which accounted for approximately $3,541,000 of the increased sales. The Company does not anticipate that this level of sales and net income will continue in succeeding quarters.

“As previously reported, on October 29, 2024, the Company entered into an Asset Purchase Agreement by and among the Company and its wholly owned subsidiary and Feit Electric Company, Inc., a California corporation. The Company expects to continue business as usual pending shareholder approval and the closing of the Asset Purchase Agreement which is expected to be in the first quarter of calendar 2025,” said Harvey Grossblatt, CEO.

UNIVERSAL SECURITY INSTRUMENTS, INC. is a U.S.-based manufacturer and distributor of safety and security devices. Founded in 1969, the Company has an over 55-year heritage of developing innovative and easy-to-install products, including smoke, fire and carbon monoxide alarms. For more information on Universal Security Instruments, visit our website at www.universalsecurity.com.

————————————————————

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: Certain matters discussed in this news release may constitute forward-looking statements within the meaning of the federal securities laws that inherently include certain risks and uncertainties. Actual results could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors, including, among other items, currency fluctuations, the impact of current and future laws and governmental regulations affecting us and other factors which may be identified from time to time in our Securities and Exchange Commission filings and other public announcements. We do not undertake and specifically disclaim any obligation to update any forward-looking statements to reflect occurrence of anticipated or unanticipated events or circumstances after the date of such statements. We will revise our outlook from time to time and frequently will not disclose such revisions publicly.

| UNIVERSAL SECURITY INSTRUMENTS, INC. CONDENSED CONSOLIDATED INCOME STATEMENTS (UNAUDITED) |

|||||||

| Three Months Ended September 30, |

|||||||

| 2024 | 2023 | ||||||

| Sales | $ | 7,203,269 | $ | 3,717,455 | |||

| Net income (loss) | 576,978 | (186,425 | ) | ||||

| Earnings (Loss) per share: | |||||||

| Basic and diluted | $ | 0.25 | $ | (0.08 | ) | ||

| Weighted average number of common shares outstanding: | |||||||

| Basic and diluted | 2,312,887 | 2,312,887 | |||||

| Six Months Ended September 30, |

|||||||

| 2024 | 2023 | ||||||

| Sales | $ | 11,801,785 | $ | 10,416,226 | |||

| Net income (loss) | 134,772 | (21,295 | ) | ||||

| Earnings (Loss) per share: | |||||||

| Basic and diluted | $ | 0.06 | $ | (0.01 | ) | ||

| Weighted average number of common shares outstanding: | |||||||

| Basic and diluted | 2,312,887 | 2,312,887 | |||||

| CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

|||||||

| ASSETS | |||||||

| Sept. 30, 2024 | Sept. 30, 2023 | ||||||

| Cash | $ | 234,199 | $ | 254,818 | |||

| Accounts receivable and amount due from factor | 6,460,368 | 3,130,458 | |||||

| Inventory | 5,980,798 | 4,968,433 | |||||

| Prepaid expense | 152,429 | 365,630 | |||||

| TOTAL CURRENT ASSETS | 12,827,794 | 8,719,339 | |||||

| PROPERTY, EQUIPMENT AND INTANGIBLE ASSETS–NET | 108,892 | 276,043 | |||||

| OTHER ASSETS | – | – | |||||

| TOTAL ASSETS | $ | 12,936,686 | $ | 8,995,382 | |||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||

| Line of credit – factor. | $ | 4,216,134 | $ | 912,147 | |||

| Short-term portion of operating lease liability | 93,065 | 154,969 | |||||

| Accounts payable | 3,064,147 | 1,990,116 | |||||

| Accrued liabilities | 465,541 | 507,563 | |||||

| TOTAL CURRENT LIABILITIES | 7,838,887 | 3,564,795 | |||||

| LONG TERM PORTION OF OPERATING LEASE LIABILITY | – | 93,065 | |||||

| TOTAL LONG-TERM LIABILITIES | – | 93,065 | |||||

| SHAREHOLDERS’ EQUITY: | |||||||

| Common stock, $.01 par value per share; authorized 20,000,000 shares; issued and outstanding 2,312,887 at September 30, 2024 and 2023 | 23,129 | 23,129 | |||||

| Additional paid-in capital | 12,885,841 | 12,885,841 | |||||

| Accumulated Deficit | (7,811,171 | ) | (7,571,448 | ) | |||

| TOTAL SHAREHOLDERS’ EQUITY | 5,097,799 | 5,337,522 | |||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 12,936,686 | $ | 8,995,382 | |||

Contact: Harvey Grossblatt, CEO

Universal Security Instruments, Inc.

(410) 363-3000, Ext. 224

or

Zachary Mizener

Lambert & Co.

(315) 529-2348

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

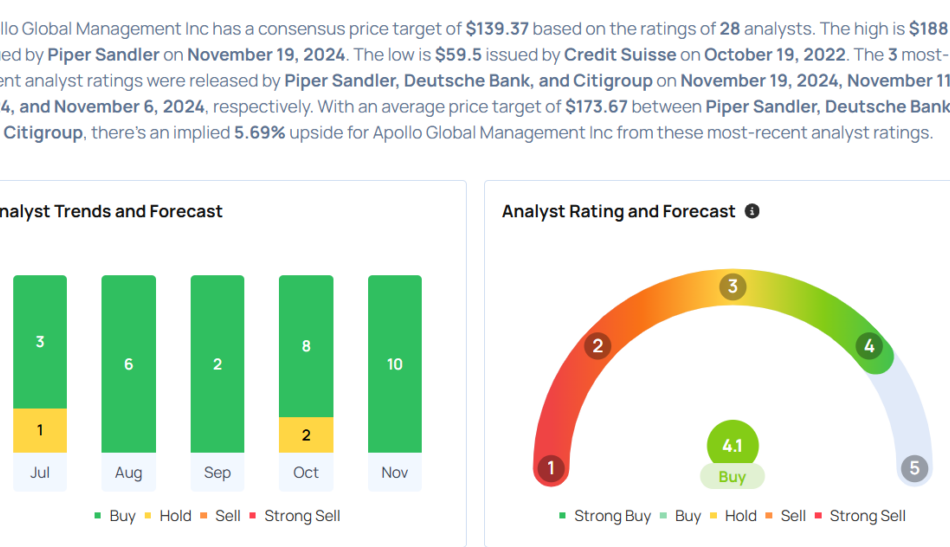

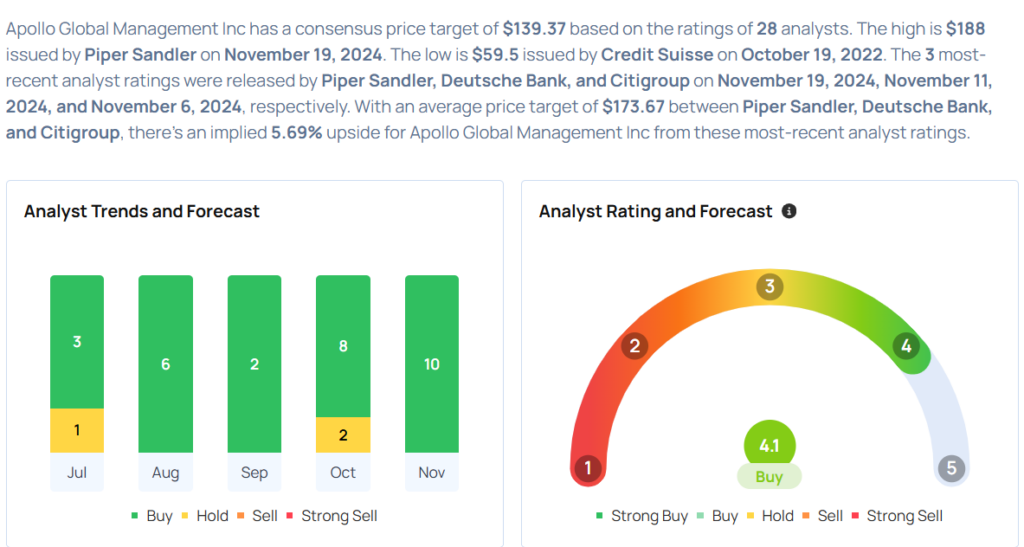

This Apollo Global Management Analyst Begins Coverage On A Bullish Note; Here Are Top 5 Initiations For Tuesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

Considering buying APO stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 No-Brainer Energy Stocks to Buy to Cash in on the Coming Power Surge

The U.S. power sector is at an inflection point. After barely growing over the last 20 years, electricity demand in the country is on track to surge over the next two decades. That should power explosive growth in renewable energy.

Few companies are in a better position to capitalize on the expected surge in U.S. power demand than NextEra Energy (NYSE: NEE) and Brookfield Renewable (NYSE: BEPC)(NYSE: BEP). That makes them no-brainer stocks to buy to cash in on the resurgence in the U.S. power sectors.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Electricity demand in the U.S. has meandered higher over the past two decades, growing 9% from 2000 to 2020 to 3.8 terawatt hours (TWh). According to a recent forecast from IHS, power demand in the country will increase by an astounding 2.1 TWh, or 55%, by 2040. Several catalysts will power that surge, including the electrification of the transportation sector, onshoring of manufacturing, and increased digitalization, including the rise of power-hungry AI data centers.

The country will need to build a tremendous amount of new electricity-generating capacity in the future, powered primarily by lower carbon sources due to climate change concerns. According to one estimate, the country will need to build 375 gigawatts to 400 gigawatts (GW) of new renewable energy capacity over the next seven years alone. That’s three times more capacity than was built over the last seven years.

NextEra Energy is one of the few companies with the scale and expertise to develop significant renewable energy capacity in the coming years. The company currently operates 38 GW of renewable energy and storage capacity across its electric utility, Florida Power & Light (FPL), and energy resources segments. That’s one of the biggest renewable energy-generation portfolios in the world.

The company’s energy resources segment currently has 24 GW of projects in its backlog that it expects to complete over the next few years. In addition, it recently signed contracts to build another 10.5 GW of projects for two large corporate customers through 2030. Meanwhile, FPL is working to double its solar panel installation from 15 million (4 GW) in 2022 to 30 million panels by next year.

NextEra Energy plans to more than double its renewables and storage capacity by 2027 to 81 GW. In the long term, the company has over 300 GW of renewables and storage projects in its development pipeline. It also plans to deploy hundreds of millions of solar panels by 2045 at FPL to produce 90 GW of power.

George Weston Limited Reports Third Quarter 2024 Results

TORONTO, Nov. 19, 2024 /CNW/ – George Weston Limited WN (“GWL” or the “Company”) today announced its consolidated unaudited results for the 16 weeks ended October 5, 2024(2).

GWL’s 2024 Third Quarter Report has been filed on SEDAR+ and is available at www.sedarplus.ca and in the Investor Centre section of the Company’s website at www.weston.ca.

“George Weston delivered another quarter of positive results, driven by the consistent financial performance of our underlying businesses,” said Galen G. Weston, Chairman and Chief Executive Officer, George Weston Limited. “Loblaw delivered exceptional value, quality, and service to Canadians, resulting in increased customer traffic, while Choice Properties experienced higher demand for its retail properties and strong leasing spreads in its industrial portfolio.”

Loblaw Companies Limited (“Loblaw”) reported consistent operational and financial performance in the third quarter as it continued to provide value to Canadians across its retail network, while maintaining its focus on retail excellence. Drug retail sales growth outperformed food retail in the quarter. Drug front store sales reflected continued strength in the beauty category but were pressured by Loblaw’s exit from certain low margin electronics categories and lower customer spend on convenience items. Pharmacy and healthcare services revenue increased due to ongoing strength in acute and chronic prescriptions. Food retail stores attracted increased customer visits in the quarter, despite Thanksgiving holiday sales shifting into the fourth quarter this year. Food sales growth reflected the ongoing strength of Loblaw’s Maxi and NoFrills hard discount stores, and its growing selection of multicultural foods across its banners, anchored by strong performance in the T&T banner. In the quarter, Loblaw continued to invest in its network of stores, including opening 25 new hard discount stores and piloting two new ultra-discount no name® stores.

Choice Properties Real Estate Investment Trust (“Choice Properties”) delivered strong operational and financial results in the third quarter, driven by increasing demand from retail tenants for its necessity-based neighbourhood centres and strong leasing spreads in its industrial portfolio. Choice Properties continues to leverage its size and financial strength, with $172 million of real estate transactions and over $125 million of financings completed in the third quarter, further improving the quality of its market leading portfolio and the strength of its balance sheet.

2024 THIRD QUARTER HIGHLIGHTS

- Revenue was $18,685 million, an increase of $278 million, or 1.5%.

- Adjusted EBITDA(1) was $2,158 million, an increase of $139 million, or 6.9%.

- Net earnings available to common shareholders of the Company were $15 million ($0.08 per common share), a decrease of $595 million, or 97.5%. The decrease was due to the unfavourable year-over-year net impact of adjusting items, primarily due to the unfavourable year-over-year impact of the fair value adjustment of the Trust Unit liability as a result of the increase of Choice Properties’ unit price in the quarter.

- Adjusted net earnings available to common shareholders of the Company(1) were $476 million, an increase of $10 million, or 2.1%.

- Contribution to adjusted net earnings available to common shareholders of the Company(1) from the publicly traded operating companies was $516 million, an increase of $19 million, or 3.8%.

- Adjusted diluted net earnings per common share(1) were $3.57, an increase of $0.21 per common share, or 6.3%.

- Repurchased for cancellation 1.3 million common shares at a cost of $284 million.

- GWL Corporate free cash flow(1) was $422 million.

CONSOLIDATED RESULTS OF OPERATIONS

The Company operates through its two reportable operating segments: Loblaw and Choice Properties, each of which are publicly traded entities. As such, the Company’s financial statements reflect and are impacted by the consolidation of Loblaw and Choice Properties. The consolidation of these entities into the Company’s financial statements reflect the impact of eliminations, intersegment adjustments and other consolidation adjustments, which can positively or negatively impact the Company’s consolidated results. Additionally, cash and short-term investments and other investments held by the Company, and all other company level activities that are not allocated to the reportable operating segments, such as net interest expense, corporate activities and administrative costs are included in GWL Corporate. To help our investors and stakeholders understand the Company’s financial statements and the effect of consolidation, the Company reports its results in a manner that differentiates between the Loblaw segment, the Choice Properties segment, the effect of consolidation of Loblaw and Choice Properties, and lastly, GWL Corporate.

The Company’s results reflect the year-over-year impact of the fair value adjustment of the Trust Unit liability as a result of the significant changes in Choice Properties’ unit price, recorded in net interest expense and other financing charges. The Company’s results are impacted by market price fluctuations of Choice Properties’ Trust Units on the basis that the Trust Units held by unitholders, other than the Company, are redeemable for cash at the option of the holder and are presented as a liability on the Company’s consolidated balance sheet. The Company’s financial results are negatively impacted when the Trust Unit price increases and positively impacted when the Trust Unit price declines.

|

($ millions except where otherwise indicated) For the periods ended as indicated |

16 Weeks Ended |

||||||||||

|

Oct. 5, 2024 |

Oct. 7, 2023 |

$ Change |

% Change |

||||||||

|

Revenue |

$ 18,685 |

$ 18,407 |

$ 278 |

1.5 % |

|||||||

|

Operating income |

$ 1,618 |

$ 1,231 |

$ 387 |

31.4 % |

|||||||

|

Adjusted EBITDA(1) from: |

|||||||||||

|

Loblaw |

$ 2,067 |

$ 1,924 |

$ 143 |

7.4 % |

|||||||

|

Choice Properties |

237 |

234 |

3 |

1.3 % |

|||||||

|

Effect of consolidation |

(139) |

(131) |

(8) |

(6.1) % |

|||||||

|

Publicly traded operating companies |

$ 2,165 |

$ 2,027 |

$ 138 |

6.8 % |

|||||||

|

GWL Corporate |

(7) |

(8) |

1 |

12.5 % |

|||||||

|

Adjusted EBITDA(1) |

$ 2,158 |

$ 2,019 |

$ 139 |

6.9 % |

|||||||

|

Adjusted EBITDA margin(1) |

11.5 % |

11.0 % |

|||||||||

|

Net earnings attributable to shareholders of the Company |

$ 29 |

$ 624 |

$ (595) |

(95.4) % |

|||||||

|

Loblaw(i) |

$ 409 |

$ 329 |

$ 80 |

24.3 % |

|||||||

|

Choice Properties |

(663) |

435 |

(1,098) |

(252.4) % |

|||||||

|

Effect of consolidation |

291 |

(141) |

432 |

306.4 % |

|||||||

|

Publicly traded operating companies |

$ 37 |

$ 623 |

$ (586) |

(94.1) % |

|||||||

|

GWL Corporate |

(22) |

(13) |

(9) |

(69.2) % |

|||||||

|

Net earnings available to common shareholders of the Company |

$ 15 |

$ 610 |

$ (595) |

(97.5) % |

|||||||

|

Diluted net earnings per common share ($) |

$ 0.08 |

$ 4.41 |

$ (4.33) |

(98.2) % |

|||||||

|

Loblaw(i) |

$ 405 |

$ 381 |

$ 24 |

6.3 % |

|||||||

|

Choice Properties |

102 |

102 |

— |

— % |

|||||||

|

Effect of consolidation |

9 |

14 |

(5) |

(35.7) % |

|||||||

|

Publicly traded operating companies |

$ 516 |

$ 497 |

$ 19 |

3.8 % |

|||||||

|

GWL Corporate |

(40) |

(31) |

(9) |

(29.0) % |

|||||||

|

Adjusted net earnings available to common shareholders of the Company(1) |

$ 476 |

$ 466 |

$ 10 |

2.1 % |

|||||||

|

Adjusted diluted net earnings per common share(1) ($) |

$ 3.57 |

$ 3.36 |

$ 0.21 |

6.3 % |

|||||||

|

(i) |

Contribution from Loblaw, net of non-controlling interests. |

Net earnings available to common shareholders of the Company in the third quarter of 2024 were $15 million ($0.08 per common share), a decrease of $595 million ($4.33 per common share) compared to the same period in 2023. The decrease was due to the unfavourable year-over-year net impact of adjusting items totaling $605 million ($4.54 per common share), partially offset by an improvement of $10 million ($0.21 per common share) in the consolidated underlying operating performance of the Company.

The unfavourable year-over-year net impact of adjusting items totaling $605 million ($4.54 per common share) was primarily due to:

- the unfavourable year-over-year impact of the fair value adjustment of the Trust Unit liability of $787 million ($5.90 per common share) as a result of the increase in Choice Properties’ unit price in the third quarter of 2024;

partially offset by,

- the favourable year-over-year impact of the fair value adjustment on Choice Properties’ investment in real estate securities of Allied Properties Real Estate Investment Trust (“Allied”) of $95 million ($0.70 per common share) as a result of the increase in Allied’s unit price;

- the favourable impact of the recovery related to a President’s Choice Bank (“PC Bank”) commodity tax matter at Loblaw of $66 million ($0.50 per common share). See “Loblaw Other Business Matter”, section of this News Release for further information; and

- the favourable year-over-year impact of the fair value adjustment on investment properties of $33 million ($0.25 per common share) driven by Choice Properties, net of the effect of consolidation.

Adjusted net earnings available to common shareholders of the Company(1) in the third quarter of 2024 were $476 million, an increase of $10 million, or 2.1%, compared to the same period in 2023. The increase was driven by the favourable year-over-year impact of $19 million from the contribution of the publicly traded operating companies, partially offset by the unfavourable year-over-year impact of $9 million at GWL Corporate due to an increase in income tax expense as a result of GWL’s participation in Loblaw’s Normal Course Issuer Bid (“NCIB”) program and the impact of other non-deductible items, and an increase in adjusted net interest expense and other financing charges(1).

Adjusted diluted net earnings per common share(1) were $3.57 in the third quarter of 2024, an increase of $0.21 per common share, or 6.3%, compared to the same period in 2023. The increase was due to the performance in adjusted net earnings available to common shareholders(1) as described above and the favourable impact of shares purchased for cancellation over the last 12 months ($0.13 per common share) pursuant to the Company’s NCIB program.

CONSOLIDATED OTHER BUSINESS MATTERS

GWL CORPORATE FINANCING ACTIVITIES The Company completed the following select GWL Corporate financing activities:

NCIB – Purchased and Cancelled Shares In the third quarter of 2024, the Company purchased and cancelled 1.3 million common shares (2023 – 2.4 million common shares) for aggregate consideration of $284 million (2023 – $364 million) under its NCIB. As at October 5, 2024, the Company had 130.8 million common shares issued and outstanding, net of shares held in trusts (October 7, 2023 – 135.5 million common shares).

In the third quarter of 2024, the Company entered into an automatic share purchase plan (“ASPP”) with a broker in order to facilitate the repurchase of the Company’s common shares under its NCIB. During the effective period of the ASPP, the Company’s broker may purchase common shares at times when the Company would not be active in the market.

Refer to note 11, “Share Capital” of the Company’s third quarter 2024 unaudited interim period condensed consolidated financial statements for more information.

Participation in Loblaw’s NCIB The Company participates in Loblaw’s NCIB in order to maintain its proportionate percentage ownership interest. In the third quarter of 2024, Loblaw repurchased 1.1 million common shares (2023 – 1.5 million common shares) from the Company for aggregate consideration of $193 million (2023 – $171 million).

Debenture Repayment and Issuance On June 17, 2024, the Company paid in full upon maturity, at par, plus accrued and unpaid interest thereon, the $200 million aggregated principal amount of the 4.12% senior unsecured notes outstanding.

On September 5, 2024, the Company completed an issuance of $250 million aggregate principal amount of senior unsecured notes bearing interest at 4.19% per annum and with a maturity date of September 5, 2029.

RESULTS BY OPERATING SEGMENT

The following table provides key performance metrics for the Company by segment.

|

16 Weeks Ended |

||||||||||||||

|

Oct. 5, 2024 |

Oct. 7, 2023 |

|||||||||||||

|

($ millions) For the periods ended as indicated |

Loblaw |

Choice Properties |

Effect of |

GWL |

Total |

Loblaw |

Choice Properties |

Effect of |

GWL |

Total |

||||

|

Revenue |

$ 18,538 |

$ 340 |

$ (193) |

$ — |

$ 18,685 |

$ 18,265 |

$ 325 |

$ (183) |

$ — |

$ 18,407 |

||||

|

Operating income |

$ 1,319 |

$ 376 |

$ (69) |

$ (8) |

$ 1,618 |

$ 1,063 |

$ 214 |

$ (37) |

$ (9) |

$ 1,231 |

||||

|

Adjusted operating income(1) |

1,319 |

236 |

(21) |

(8) |

1,526 |

1,198 |

233 |

(12) |

(9) |

1,410 |

||||

|

Adjusted EBITDA(1) |

$ 2,067 |

$ 237 |

$ (139) |

$ (7) |

$ 2,158 |

$ 1,924 |

$ 234 |

$ (131) |

$ (8) |

$ 2,019 |

||||

|

Net interest expense (income) and other financing charges |

$ 238 |

$ 1,039 |

$ (404) |

$ 2 |

$ 875 |

$ 234 |

$ (221) |

$ 73 |

$ (1) |

$ 85 |

||||

|

Adjusted net interest expense and other financing charges(1) |

248 |

134 |

(67) |

2 |

317 |

234 |

131 |

(60) |

(1) |

304 |

||||

|

Earnings (loss) before income taxes |

$ 1,081 |

$ (663) |

$ 335 |

$ (10) |

$ 743 |

$ 829 |

$ 435 |

$ (110) |

$ (8) |

$ 1,146 |

||||

|

Income taxes |

$ 263 |

$ — |

$ 44 |

$ (4) |

$ 303 |

$ 182 |

$ — |

$ 31 |

$ (11) |

$ 202 |

||||

|

Adjusted income taxes(1) |

263 |

— |

37 |

14 |

314 |

219 |

— |

34 |

7 |

260 |

||||

|

Net earnings attributable to non-controlling interests |

$ 409 |

$ — |

$ — |

$ 2 |

$ 411 |

$ 318 |

$ — |

$ — |

$ 2 |

$ 320 |

||||

|

Prescribed dividends on preferred shares in share capital |

— |

— |

— |

14 |

14 |

— |

— |

— |

14 |

14 |

||||

|

Net earnings (loss) available to common shareholders of the Company |

$ 409 |

$ (663) |

$ 291 |

$ (22) |

$ 15 |

$ 329 |

$ 435 |

$ (141) |

$ (13) |

$ 610 |

||||

|

Adjusted net earnings available to common shareholders of the Company(1) |

405 |

102 |

9 |

(40) |

476 |

381 |

102 |

14 |

(31) |

466 |

||||

Effect of consolidation includes the following items:

|

16 Weeks Ended |

||||||||||||||

|

Oct. 5, 2024 |

Oct. 7, 2023 |

|||||||||||||

|

($ millions) For the periods ended as indicated |

Revenue |

Operating Income |

Adjusted |

Net Interest Expense and Other Financing Charges |

Adjusted Net |

Revenue |

Operating Income |

Adjusted |

Net Interest Expense and Other Financing Charges |

Adjusted Net |

||||

|

Elimination of intercompany rental revenue |

$ (195) |

$ 56 |

$ 56 |

$ — |

$ 47 |

$ (185) |

$ 35 |

$ 35 |

$ — |

$ 29 |

||||

|

Elimination of internal lease arrangements |

2 |

18 |

(108) |

(44) |

45 |

2 |

(37) |

(163) |

(39) |

2 |

||||

|

Elimination of intersegment real estate transactions |

— |

(87) |

(87) |

— |

(77) |

— |

(1) |

(3) |

— |

(2) |

||||

|

Recognition of depreciation on Choice Properties’ |

— |

(8) |

— |

— |

(9) |

— |

(7) |

— |

— |

(9) |

||||

|

Fair value adjustment on investment properties |

— |

(48) |

— |

1 |

— |

— |

(27) |

— |

— |

— |

||||

|

Unit distributions on Exchangeable Units paid by |

— |

— |

— |

(75) |

75 |

— |

— |

— |

(74) |

74 |

||||

|

Unit distributions on Trust Units paid by Choice Properties, |

— |

— |

— |

52 |

(52) |

— |

— |

— |

53 |

(53) |

||||

|

Fair value adjustment on Choice Properties’ |

— |

— |

— |

(906) |

— |

— |

— |

— |

352 |

— |

||||

|

Fair value adjustment of the Trust Unit liability |

— |

— |

— |

568 |

— |

— |

— |

— |

(219) |

— |

||||

|

Tax expense on Choice Properties related earnings |

— |

— |

— |

— |

(20) |

— |

— |

— |

— |

(27) |

||||

|

Total |

$ (193) |

$ (69) |

$ (139) |

$ (404) |

$ 9 |

$ (183) |

$ (37) |

$ (131) |

$ 73 |

$ 14 |

||||

Loblaw Operating Results

Loblaw has two reportable operating segments, retail and financial services. Loblaw’s retail segment consists primarily of food retail and drug retail. Loblaw provides Canadians with grocery, pharmacy and healthcare services, health and beauty products, apparel, general merchandise and financial services.

|

($ millions except where otherwise indicated) For the periods ended as indicated |

16 Weeks Ended |

|||||||||

|

Oct. 5, 2024 |

Oct. 7, 2023 |

$ Change |

% Change |

|||||||

|

Revenue |

$ 18,538 |

$ 18,265 |

$ 273 |

1.5 % |

||||||

|

Operating income |

$ 1,319 |

$ 1,063 |

$ 256 |

24.1 % |

||||||

|

Adjusted EBITDA(1) |

$ 2,067 |

$ 1,924 |

$ 143 |

7.4 % |

||||||

|

Adjusted EBITDA margin(1) |

11.2 % |

10.5 % |

||||||||

|

Depreciation and amortization |

$ 903 |

$ 880 |

$ 23 |

2.6 % |

||||||

Revenue Loblaw revenue in the third quarter of 2024 was $18,538 million, an increase of $273 million, or 1.5%, compared to the same period in 2023, driven by an increase in retail sales and in financial services revenue.

Retail sales were $18,259 million, an increase of $277 million, or 1.5%, compared to the same period in 2023. The increase was primarily driven by the following factors:

- food retail sales were $12,966 million (2023 – $12,843 million) and food retail same-store sales growth was 0.5% (2023 – 4.5%). Food retail same-store sales growth was approximately 1.3% after excluding the unfavourable impact of the timing of Thanksgiving;

- the Consumer Price Index as measured by The Consumer Price Index for Food Purchased from Stores was 2.3% (2023 – 7.1%), which was lower than Loblaw’s internal food inflation; and

- food retail traffic increased and basket size decreased.

- drug retail sales were $5,293 million (2023 – $5,139 million) and drug retail same-store sales growth was 2.9% (2023 – 4.6%). The timing of Thanksgiving had a nominal impact on same-store sales growth for drug retail;

- pharmacy and healthcare services same-store sales growth was 6.3% (2023 – 7.4%). On a same-store basis, the number of prescriptions increased by 2.3% (2023 – 0.9%) and the average prescription value increased by 3.5% (2023 – 5.1%);

partially offset by,

-

- front store same-store sales decline of 0.5% (2023 – growth of 1.8%). The decline in front store same-store sales was primarily driven by lower sales of food and household items and the decision to exit certain low margin electronics categories, partially offset by the continued strength in beauty products.

Financial services revenue was $382 million, an increase of $3 million, or 0.8%, compared to the same period in 2023, primarily driven by higher interchange and credit card fee income, partially offset by lower sales attributable to The Mobile Shop.

Operating Income Loblaw operating income in the third quarter of 2024 was $1,319 million, an increase of $256 million, or 24.1%, compared to the same period in 2023. The increase included the recovery of $155 million related to a PC Bank commodity tax matter.

Adjusted EBITDA(1) Loblaw adjusted EBITDA(1) in the third quarter of 2024 was $2,067 million, an increase of $143 million, or 7.4%, compared to the same period in 2023, driven by an increase in retail of $130 million and an increase in financial services of $13 million.

Retail adjusted EBITDA(1) increased by $130 million compared to the same period in 2023, driven by an increase in retail gross profit of $140 million, partially offset by an increase in retail selling, general and administrative expenses (“SG&A”) of $10 million.

- Retail gross profit percentage of 30.9% increased by 30 basis points compared to the same period in 2023, primarily driven by improvements in shrink.

- Retail SG&A as a percentage of sales was 20.0%, a favourable decrease of 30 basis points compared to the same period in 2023, primarily due to the year-over-year impact of certain real estate activities and operating leverage, partially offset by incremental costs related to opening new stores.

Financial services adjusted EBITDA(1) increased by $13 million compared to the same period in 2023, primarily driven by lower customer acquisition expenses and operating costs, including the ongoing benefits associated with the renewal of a long-term agreement with Mastercard, and higher revenue as described above, partially offset by higher contractual charge-offs and higher loyalty program costs.

Depreciation and Amortization Loblaw depreciation and amortization in the third quarter of 2024 was $903 million, an increase of $23 million compared to the same period in 2023, primarily driven by an increase in depreciation of information technology (“IT”) assets and leased assets, and an increase in depreciation of fixed assets related to conversions of retail locations. Depreciation and amortization in the third quarter of 2024 included $155 million (2023 – $154 million) of amortization of intangible assets related to the acquisitions of Shoppers Drug Mart Corporation (“Shoppers Drug Mart”) and Lifemark Health Group (“Lifemark”).

Loblaw Other Business Matter

PC Bank Commodity Tax Matter In July 2022, the Tax Court of Canada (“Tax Court”) released a decision relating to PC Bank, a subsidiary of Loblaw. The Tax Court ruled that PC Bank is not entitled to claim notional input tax credits for certain payments it made to Loblaws Inc. in respect of redemptions of loyalty points. PC Bank subsequently filed a Notice of Appeal with the Federal Court of Appeal (“FCA”) and in March 2024, the matter was heard by the FCA. In August 2024, the FCA released its decision and reversed the decision of the Tax Court. As a result, PC Bank reversed charges of $155 million, including $111 million initially recorded in the second quarter of 2022. In addition, $10 million was recorded related to interest income on cash tax refunds.

Choice Properties Operating Results

Choice Properties owns, manages and develops a high-quality portfolio of commercial and residential properties across Canada.

|

($ millions except where otherwise indicated) For the periods ended as indicated |

16 Weeks Ended |

|||||||||

|

Oct. 5, 2024 |

Oct. 7, 2023 |

$ Change |

% Change |

|||||||

|

Revenue |

$ 340 |

$ 325 |

$ 15 |

4.6 % |

||||||

|

Net interest expense (income) and other financing charges |

$ 1,039 |

$ (221) |

$ 1,260 |

570.1 % |

||||||

|

Net (loss) income |

$ (663) |

$ 435 |

$ (1,098) |

(252.4) % |

||||||

|

Funds from Operations(1) |

$ 187 |

$ 181 |

$ 6 |

3.3 % |

||||||

Revenue Choice Properties revenue in the third quarter of 2024 was $340 million, an increase of $15 million, or 4.6%, compared to the same period in 2023 and included revenue of $196 million (2023 – $186 million) generated from tenants within Loblaw.

The increase in revenue in the third quarter of 2024 was primarily driven by:

- higher rental rates, primarily in the retail and industrial portfolios;

- higher recoveries; and

- acquisitions, net of dispositions, and completed developments;

partially offset by,

- lower lease surrender revenue.

Net Interest Expense (Income) and Other Financing Charges Choice Properties net interest expense and other financing charges in the third quarter of 2024 were $1,039 million, compared to net interest income and other financing charges of $221 million in the same period in 2023. The change of $1,260 million was primarily driven by the unfavourable year-over-year change in the fair value adjustment on the Class B LP units (“Exchangeable Units”) of $1,258 million, as a result of the increase in the unit price in the quarter.

Net (Loss) Income Choice Properties recorded a net loss of $663 million in the third quarter of 2024, compared to net income of $435 million in the same period in 2023. The unfavourable change of $1,098 million was primarily driven by:

- higher net interest expense and other financing charges as described above;

partially offset by,

- the favourable year-over-year change in the adjustment to fair value of investment in real estate securities of $103 million driven by the increase in Allied’s unit price; and

- the favourable year-over-year change in the adjustment to fair value of investment properties, including those held within equity accounted joint ventures, of $56 million.

Funds from Operations(1) Funds from Operations(1) in the third quarter of 2024 were $187 million, an increase of $6 million compared to the same period in 2023. The increase was primarily due to an increase in rental income, partially offset by higher general and administrative expenses including certain non-recurring items, an increase in interest expense net of an increase in interest income, and lower lease surrender revenue.

OUTLOOK(2)

The Company continues to expect adjusted net earnings(1) to increase due to the results from its operating segments, and to use excess cash to repurchase shares.

Loblaw Loblaw will continue to execute on retail excellence while advancing its growth initiatives with the goal of delivering consistent operational and financial results in 2024. Loblaw’s businesses remain well positioned to meet the everyday needs of Canadians.

For the full-year 2024, Loblaw continues to expect:

- its retail business to grow earnings faster than sales; and

- to return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.

Based on its year-to-date operating and financial performance and momentum exiting the third quarter, Loblaw is slightly increasing its guidance for full year adjusted net earnings per common share(1) growth from high single-digits into the low double-digits.

Additionally, based on the year-to-date investments in its store network and distribution centres, Loblaw now expects to invest a net amount of $1.9 billion in capital expenditures (previously $1.8 billion), which reflects gross capital investments of approximately $2.3 billion (previously $2.2 billion), net of approximately $400 million of proceeds from property disposals.

Choice Properties Choice Properties is focused on capital preservation, delivering stable and growing cash flows and net asset value appreciation, all with a long-term focus. Its high-quality portfolio is primarily leased to necessity-based tenants and logistics providers, who are less sensitive to economic volatility and therefore provide stability to its overall portfolio. Choice Properties continues to experience positive leasing momentum across its portfolio and has successfully completed the majority of its 2024 lease renewals. Choice Properties also continues to advance its development program, with a focus on commercial developments in the near term, which provides the best opportunity to add high-quality real estate to its portfolio at a reasonable cost and drive net asset value appreciation over time.

Choice Properties is confident that its business model, stable tenant base, strong balance sheet and disciplined approach to financial management will continue to position the business well for future success. In 2024, Choice Properties will continue to focus on its core business of essential retail and industrial, its growing residential platform and its robust development pipeline, and is targeting:

- stable occupancy across the portfolio, resulting in 2.5% – 3.0% year-over-year growth in Same-Asset NOI, cash basis(3);

- annual FFO(1) per unit diluted(3) in a range of $1.02 to $1.03, reflecting 2.0% – 3.0% year-over-year growth; and

- strong leverage metrics, targeting Adjusted Debt to EBITDAFV(3) below 7.5x.

FORWARD-LOOKING STATEMENTS

This News Release contains forward-looking statements about the Company’s objectives, plans, goals, aspirations, strategies, financial condition, results of operations, cash flows, performance, prospects, opportunities and legal and regulatory matters. Specific forward-looking statements in this News Release include, but are not limited to, statements with respect to the Company’s anticipated future results, events and plans, strategic initiatives and restructuring, regulatory changes including further healthcare reform, future liquidity, planned capital investments, and the status and impact of IT systems implementations. These specific forward-looking statements are contained throughout this News Release including, without limitation, in the “Outlook” section of this News Release. Forward-looking statements are typically identified by words such as “expect”, “anticipate”, “believe”, “foresee”, “could”, “estimate”, “goal”, “intend”, “plan”, “seek”, “strive”, “will”, “may”, “should” and similar expressions, as they relate to the Company and its management.

Forward-looking statements reflect the Company’s estimates, beliefs and assumptions, which are based on management’s perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances. The Company’s estimates, beliefs and assumptions are inherently subject to significant business, economic, competitive and other uncertainties and contingencies regarding future events and, as such, are subject to change. The Company can give no assurance that such estimates, beliefs and assumptions will prove to be correct.

Numerous risks and uncertainties could cause the Company’s actual results to differ materially from those expressed, implied or projected in the forward-looking statements, including those described in the “Enterprise Risks and Risk Management” sections of the Management’s Discussion and Analysis in the Company’s 2023 Annual Report and the Company’s Annual Information Form for the year ended December 31, 2023.

Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect the Company’s expectations only as of the date of this News Release. Except as required by law, the Company does not undertake to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

DECLARATION OF QUARTERLY DIVIDENDS

Subsequent to the end of the third quarter of 2024, the Company’s Board of Directors declared a quarterly dividend on GWL Common Shares, Preferred Shares, Series I, Preferred Shares, Series III, Preferred Shares, Series IV and Preferred Shares, Series V payable as follows:

|

Common Shares |

$0.820 per share payable January 1, 2025, to shareholders of record December 15, 2024; |

|

Preferred Shares, Series I |

$0.3625 per share payable December 15, 2024, to shareholders of record November 30, 2024; |

|

Preferred Shares, Series III |

$0.3250 per share payable January 1, 2025, to shareholders of record December 15, 2024; |

|

Preferred Shares, Series IV |

$0.3250 per share payable January 1, 2025, to shareholders of record December 15, 2024; |

|

Preferred Shares, Series V |

$0.296875 per share payable January 1, 2025, to shareholders of record December 15, 2024. |

2024 THIRD QUARTER REPORT

The Company’s 2023 Annual Report and 2024 Third Quarter Report are available in the Investor Centre section of the Company’s website at www.weston.ca and have been filed on SEDAR+ and are available at www.sedarplus.ca.

INVESTOR RELATIONS

Shareholders, security analysts and investment professionals should direct their requests to Roy MacDonald, Group Vice-President, Investor Relations, at the Company’s Executive Office or by e-mail at investor@weston.ca.

Additional financial information has been filed electronically with various securities regulators in Canada through SEDAR+. This News Release includes selected information on Loblaw, a public company with shares trading on the Toronto Stock Exchange (“TSX”), and selected information on Choice Properties, a public real estate investment trust with units trading on the TSX. For information regarding Loblaw or Choice Properties, readers should refer to the respective materials filed on SEDAR+ from time to time. These filings are also maintained on the respective companies’ corporate websites at www.loblaw.ca and www.choicereit.ca.

Ce rapport est disponible en français.

|

Endnotes |

|

|

(1) |

See the “Non-GAAP and Other Financial Measures” section in Appendix 1 of this News Release, which includes the reconciliation of such non-GAAP and other financial measures to the most directly comparable GAAP measures. |

|

(2) |

This News Release contains forward-looking information. See “Forward-Looking Statements” section of this News Release and the Company’s 2023 Annual Report for a discussion of material factors that could cause actual results to differ materially from the forecasts and projections herein and of the material factors and assumptions that were used when making these statements. This News Release should be read in conjunction with GWL’s filings with securities regulators made from time to time, all of which can be found at www.weston.ca and www.sedarplus.ca. |

|

(3) |

For more information on Choice Properties measures see the 2023 Annual Report filed by Choice Properties, which is available on www.sedarplus.ca or at www.choicereit.ca. |

APPENDIX 1: NON-GAAP AND OTHER FINANCIAL MEASURES

The Company uses non-GAAP and other financial measures and ratios as it believes these measures and ratios provide useful information to both management and investors with regard to accurately assessing the Company’s financial performance and financial condition.

Further, certain non-GAAP measures and other financial measures of Loblaw and Choice Properties are included in this document. For more information on these measures, refer to the materials filed by Loblaw and Choice Properties, which are available on www.sedarplus.ca or at www.loblaw.ca or www.choicereit.ca, respectively.

Management uses these and other non-GAAP and other financial measures to exclude the impact of certain expenses and income that must be recognized under GAAP when analyzing underlying consolidated and segment operating performance, as the excluded items are not necessarily reflective of the Company’s underlying operating performance and make comparisons of underlying financial performance between periods difficult. The Company adjusts for these items if it believes doing so would result in a more effective analysis of underlying operating performance. The exclusion of certain items does not imply that they are non-recurring.

These measures do not have a standardized meaning prescribed by GAAP and therefore they may not be comparable to similarly titled measures presented by other publicly traded companies, and should not be construed as an alternative to other financial measures determined in accordance with GAAP.

ADJUSTED EBITDA The Company believes adjusted EBITDA is useful in assessing and making decisions regarding the underlying operating performance of the Company’s ongoing operations and in assessing the Company’s ability to generate cash flows to fund its cash requirements, including its capital investment program.

The following table reconciles adjusted EBITDA to operating income, which is reconciled to GAAP net earnings attributable to shareholders of the Company reported for the periods ended as indicated.

|

16 Weeks Ended |

||||||||||||||

|

Oct. 5, 2024 |

Oct. 7, 2023 |

|||||||||||||

|

($ millions) |

Loblaw |

Choice |

Effect of |

GWL |

Consolidated |

Loblaw |

Choice |

Effect of |

GWL |

Consolidated |

||||

|

Net earnings attributable to shareholders of the Company |

$ 29 |

$ 624 |

||||||||||||

|

Add impact of the following: |

||||||||||||||

|

Non-controlling interests |

411 |

320 |

||||||||||||

|

Income taxes |

303 |

202 |

||||||||||||

|

Net interest expense and other financing charges |

875 |

85 |

||||||||||||

|

Operating income |

$ 1,319 |

$ 376 |

$ (69) |

$ (8) |

$ 1,618 |

$ 1,063 |

$ 214 |

$ (37) |

$ (9) |

$ 1,231 |

||||

|

Add (deduct) impact of the following: |

||||||||||||||

|

Amortization of intangible assets acquired with Shoppers Drug Mart and Lifemark |

$ 155 |

$ — |

$ — |

$ — |

$ 155 |

$ 154 |

$ — |

$ — |

$ — |

$ 154 |

||||

|

Recovery related to PC Bank commodity tax matter |

(155) |

— |

— |

— |

(155) |

— |

— |

— |

— |

— |

||||

|

Fair value adjustment of investment in real estate securities |

— |

(58) |

— |

— |

(58) |

— |

45 |

— |

— |

45 |

||||

|

Fair value adjustment on investment properties |

— |

(82) |

48 |

— |

(34) |

— |

(26) |

27 |

— |

1 |

||||

|

Gain on sale of non-operating properties |

— |

— |

— |

— |

— |

(13) |

— |

(2) |

— |

(15) |

||||

|

Fair value adjustment of derivatives |

— |

— |

— |

— |

— |

(6) |

— |

— |

— |

(6) |

||||

|

Adjusting items |

$ — |

$ (140) |

$ 48 |

$ — |

$ (92) |

$ 135 |

$ 19 |

$ 25 |

$ — |

$ 179 |

||||

|

Adjusted operating income |

$ 1,319 |

$ 236 |

$ (21) |

$ (8) |

$ 1,526 |

$ 1,198 |

$ 233 |

$ (12) |

$ (9) |

$ 1,410 |

||||

|

Depreciation and amortization excluding the impact of the above adjustment(i) |

748 |

1 |

(118) |

1 |

632 |

726 |

1 |

(119) |

1 |

609 |

||||

|

Adjusted EBITDA |

$ 2,067 |

$ 237 |

$ (139) |

$ (7) |

$ 2,158 |

$ 1,924 |

$ 234 |

$ (131) |

$ (8) |

$ 2,019 |

||||

|

(i) |

Depreciation and amortization for the calculation of adjusted EBITDA excludes amortization of intangible assets acquired with Shoppers Drug Mart and Lifemark, recorded by Loblaw. |

The following items impacted adjusted EBITDA in 2024 and 2023:

Amortization of intangible assets acquired with Shoppers Drug Mart and Lifemark The acquisition of Shoppers Drug Mart in 2014 included approximately $6 billion of definite life intangible assets, which are being amortized over their estimated useful lives. Annual amortization associated with the acquired intangible assets will be approximately $500 million until 2024 and will decrease thereafter.

The acquisition of Lifemark in 2022 included approximately $299 million of definite life intangible assets, which are being amortized over their estimated useful lives.

Recovery related to PC Bank commodity tax matter In July 2022, the Tax Court released a decision relating to PC Bank, a subsidiary of Loblaw. The Tax Court ruled that PC Bank is not entitled to claim notional input tax credits for certain payments it made to Loblaws Inc. in respect of redemptions of loyalty points. PC Bank subsequently filed a Notice of Appeal with the FCA and in March 2024, the matter was heard by the FCA. In August 2024, the FCA released its decision and reversed the decision of the Tax Court. As a result, PC Bank reversed charges of $155 million, including $111 million initially recorded in the second quarter of 2022.

Fair value adjustment of investment in real estate securities Choice Properties received Allied Class B Units as part of the consideration for the Choice Properties disposition of six office assets to Allied in 2022. Choice Properties recognized these units as investments in real estate securities. The investment in real estate securities is exposed to market price fluctuations of Allied trust units. An increase (decrease) in the market price of Allied trust units results in income (a charge) to operating income.

Fair value adjustment on investment properties The Company measures investment properties at fair value. Under the fair value model, investment properties are initially measured at cost and subsequently measured at fair value. Fair value is determined based on available market evidence. If market evidence is not readily available in less active markets, the Company uses alternative valuation methods such as discounted cash flow projections or recent transaction prices. Gains and losses on fair value are recognized in operating income in the period in which they are incurred. Gains and losses from disposal of investment properties are determined by comparing the fair value of disposal proceeds and the carrying amount and are recognized in operating income.

Gain on sale of non-operating properties In the third quarter of 2024, Loblaw did not record any gain or loss related to the sale of non-operating properties (2023 – gain of $13 million).

In the third quarter of 2023, Choice Properties disposed of a property and incurred a loss which was recognized in fair value adjustment on investment properties. On consolidation, the Company recorded the property as fixed assets, which was recognized at cost less accumulated depreciation. As a result, in the third quarter of 2023, on consolidation, an incremental gain of $2 million was recognized in operating income.

Fair value adjustment of derivatives Loblaw is exposed to commodity price and U.S. dollar exchange rate fluctuations. In accordance with Loblaw’s commodity risk management policy, Loblaw enters into exchange traded futures contracts and forward contracts to minimize cost volatility relating to fuel prices and the U.S. dollar exchange rate. These derivatives are not acquired for trading or speculative purposes. Pursuant to Loblaw’s derivative instruments accounting policy, changes in the fair value of these instruments, which include realized and unrealized gains and losses, are recorded in operating income. Despite the impact of accounting for these commodity and foreign currency derivatives on Loblaw’s reported results, the derivatives have the economic impact of largely mitigating the associated risks arising from price and exchange rate fluctuations in the underlying commodities and U.S. dollar commitments.

ADJUSTED NET INTEREST EXPENSE AND OTHER FINANCING CHARGES The Company believes adjusted net interest expense and other financing charges is useful in assessing the ongoing net financing costs of the Company.

The following table reconciles adjusted net interest expense and other financing charges to GAAP net interest expense and other financing charges reported for the periods ended as indicated.

|

($ millions) |

16 Weeks Ended |

|||||

|

Oct. 5, 2024 |

Oct. 7, 2023 |

|||||

|

Net interest expense and other financing charges |

$ 875 |

$ 85 |

||||

|

Add (deduct) impact of the following: |

||||||

|

Recovery related to PC Bank commodity tax matter |

10 |

— |

||||

|

Fair value adjustment of the Trust Unit liability |

(568) |

219 |

||||

|

Adjusted net interest expense and other financing charges |

$ 317 |

$ 304 |

||||

The following items impacted adjusted net interest expense and other financing charges in 2024 and 2023:

Recovery related to PC Bank commodity tax matter In the third quarter of 2024, $10 million was recorded related to interest income on cash tax refunds on the PC Bank commodity tax matter discussed above.

Fair value adjustment of the Trust Unit liability The Company is exposed to market price fluctuations as a result of the Choice Properties Trust Units held by unitholders other than the Company. These Trust Units are presented as a liability on the Company’s consolidated balance sheets as they are redeemable for cash at the option of the holder, subject to certain restrictions. This liability is recorded at fair value at each reporting date based on the market price of Trust Units at the end of each period. An increase (decrease) in the market price of Trust Units results in a charge (income) to net interest expense and other financing charges.

ADJUSTED INCOME TAXES AND ADJUSTED EFFECTIVE TAX RATE The Company believes the adjusted effective tax rate applicable to adjusted earnings before taxes is useful in assessing the underlying operating performance of its business.

The following table reconciles the effective tax rate applicable to adjusted earnings before taxes to the GAAP effective tax rate applicable to earnings before taxes as reported for the periods ended as indicated.

|

16 Weeks Ended |

||||||||

|

($ millions except where otherwise indicated) |

Oct. 5, 2024 |

Oct. 7, 2023 |

||||||

|

Adjusted operating income(i) |

$ 1,526 |

$ 1,410 |

||||||

|

Adjusted net interest expense and other financing charges(i) |

317 |

304 |

||||||

|

Adjusted earnings before taxes |

$ 1,209 |

$ 1,106 |

||||||

|

Income taxes |

$ 303 |

$ 202 |

||||||

|

(Deduct) add impact of the following: |

||||||||

|

Tax impact of items excluded from adjusted earnings before taxes(ii) |

(7) |

40 |

||||||

|

Outside basis difference in certain Loblaw shares |

18 |

18 |

||||||

|

Adjusted income taxes |

$ 314 |

$ 260 |

||||||

|

Effective tax rate applicable to earnings before taxes |

40.8 % |

17.6 % |

||||||

|

Adjusted effective tax rate applicable to adjusted earnings before taxes |

26.0 % |

23.5 % |

||||||

|

(i) |

See reconciliations of adjusted operating income and adjusted net interest expense and other financing charges above. |

|

(ii) |

See the adjusted EBITDA table and the adjusted net interest expense and other financing charges table above for a complete list of items excluded from adjusted earnings before taxes. |

In addition to certain items described in the “Adjusted EBITDA” and “Adjusted Net Interest Expense and Other Financing Charges” sections above, the following item impacted adjusted income taxes and the adjusted effective tax rate in 2024 and 2023:

Outside basis difference in certain Loblaw shares The Company recorded a deferred tax recovery of $18 million in the third quarter of 2024 (2023 – $18 million) on temporary differences in respect of GWL’s investment in certain Loblaw shares that are expected to reverse in the foreseeable future as a result of GWL’s participation in Loblaw’s NCIB.

ADJUSTED NET EARNINGS AVAILABLE TO COMMON SHAREHOLDERS AND ADJUSTED DILUTED NET EARNINGS PER COMMON SHARE The Company believes that adjusted net earnings available to common shareholders and adjusted diluted net earnings per common share are useful in assessing the Company’s underlying operating performance and in making decisions regarding the ongoing operations of its business.

The following table reconciles adjusted net earnings available to common shareholders of the Company and adjusted net earnings attributable to shareholders of the Company to net earnings attributable to shareholders of the Company and then to net earnings available to common shareholders of the Company reported for the periods ended as indicated.

|

($ millions except where otherwise indicated) |

16 Weeks Ended |

|||||

|

Oct. 5, 2024 |

Oct. 7, 2023 |

|||||

|

Net earnings attributable to shareholders of the Company |

$ 29 |

$ 624 |

||||

|

Less: Prescribed dividends on preferred shares in share capital |

(14) |

(14) |

||||

|

Net earnings available to common shareholders of the Company |

$ 15 |

$ 610 |

||||

|

Less: Reduction in net earnings due to dilution at Loblaw |

(4) |

(4) |

||||

|

Net earnings available to common shareholders for diluted earnings per share |

$ 11 |

$ 606 |

||||

|

Net earnings attributable to shareholders of the Company |

$ 29 |

$ 624 |

||||

|

Adjusting items (refer to the following table) |

461 |

(144) |

||||

|

Adjusted net earnings attributable to shareholders of the Company |

$ 490 |

$ 480 |

||||

|

Less: Prescribed dividends on preferred shares in share capital |

(14) |

(14) |

||||

|

Adjusted net earnings available to common shareholders of the Company |

$ 476 |

$ 466 |

||||

|

Less: Reduction in net earnings due to dilution at Loblaw |

(4) |

(4) |

||||

|

Adjusted net earnings available to common shareholders for diluted earnings per share |

$ 472 |

$ 462 |

||||

|

Diluted weighted average common shares outstanding (in millions) |

132.1 |

137.3 |

||||

The following table reconciles adjusted net earnings available to common shareholders of the Company and adjusted diluted net earnings per common share to GAAP net earnings available to common shareholders of the Company and diluted net earnings per common share as reported for the periods ended as indicated.

|

16 Weeks Ended |

||||||||||||||||||||

|

Oct. 5, 2024 |

Oct. 7, 2023 |

|||||||||||||||||||

|

Net Earnings Available |

Diluted |

Net Earnings Available |

Diluted |

|||||||||||||||||

|

($ millions except where otherwise indicated) |

Loblaw(i) |

Choice |

Effect of |

GWL |

Consol- |

Consol- |

Loblaw(i) |

Choice |

Effect of |

GWL |

Consol- |

Consol- |

||||||||

|

As reported |

$ 409 |

$ (663) |

$ 291 |

$ (22) |

$ 15 |

$ 0.08 |

$ 329 |

$ 435 |

$ (141) |

$ (13) |

$ 610 |

$ 4.41 |

||||||||

|

Add (deduct) impact of the following(ii): |

||||||||||||||||||||

|

Amortization of intangible assets acquired with Shoppers Drug Mart and Lifemark |

$ 62 |

$ — |

$ — |

$ — |

$ 62 |

$ 0.47 |

$ 60 |

$ — |

$ — |

$ — |

$ 60 |

$ 0.43 |

||||||||

|

Recovery related to PC Bank commodity tax matter |

(66) |

— |

— |

— |

(66) |

(0.50) |

— |

— |

— |

— |

— |

— |

||||||||

|

Fair value adjustment of investment in real estate securities |

— |

(58) |

5 |

— |

(53) |

(0.40) |

— |

45 |

(3) |

— |

42 |

0.30 |

||||||||

|

Fair value adjustment on investment properties |

— |

(83) |

51 |

— |

(32) |

(0.24) |

— |

(26) |

27 |

— |

1 |

0.01 |

||||||||

|

Gain on sale of non-operating properties |

— |

— |

— |

— |

— |

— |

(6) |

— |

(2) |

— |

(8) |

(0.05) |

||||||||

|

Fair value adjustment of derivatives |

— |

— |

— |

— |

— |

— |

(2) |

— |

— |

— |

(2) |

(0.01) |

||||||||

|

Fair value adjustment of the Trust Unit liability |

— |

— |

568 |

— |

568 |

4.30 |

— |

— |

(219) |

— |

(219) |

(1.60) |

||||||||

|

Outside basis difference in certain Loblaw shares |

— |

— |

— |

(18) |

(18) |

(0.14) |

— |

— |

— |

(18) |

(18) |

(0.13) |

||||||||

|

Fair value adjustment on Choice Properties’ Exchangeable Units |

— |

906 |

(906) |

— |

— |

— |

— |

(352) |

352 |

— |

— |

— |

||||||||

|

Adjusting items |

$ (4) |

$ 765 |

$ (282) |

$ (18) |

$ 461 |

$ 3.49 |

$ 52 |

$ (333) |

$ 155 |

$ (18) |

$ (144) |

$ (1.05) |

||||||||

|

Adjusted |

$ 405 |

$ 102 |

$ 9 |

$ (40) |

$ 476 |

$ 3.57 |

$ 381 |

$ 102 |

$ 14 |

$ (31) |

$ 466 |

$ 3.36 |

||||||||

|

(i) |

Contribution from Loblaw, net of non-controlling interests. |

|

(ii) |

Net of income taxes and non-controlling interests, as applicable. |

GWL CORPORATE FREE CASH FLOW GWL Corporate free cash flow is generated from dividends received from Loblaw, distributions received from Choice Properties, and proceeds from participation in Loblaw’s NCIB, less corporate expenses, interest and income taxes paid.

|

16 Weeks Ended |

||||||

|

($ millions) |

Oct. 5, 2024 |

Oct. 7, 2023 |

||||

|

Dividends from Loblaw |

$ 164 |

$ 148 |

||||

|

Distributions from Choice Properties |

113 |

84 |

||||

|

GWL Corporate cash flow from operating businesses |

$ 277 |

$ 232 |

||||

|

Proceeds from participation in Loblaw’s NCIB |

$ 190 |

$ 171 |

||||

|

GWL Corporate, financing, and other costs(i) |

(27) |

(64) |

||||

|

Income taxes paid |

(18) |

(20) |

||||

|

GWL Corporate free cash flow |

$ 422 |

$ 319 |

||||

|

(i) |

GWL Corporate, financing, and other costs includes all other company level activities that are not allocated to the reportable operating segments such as net interest expense, corporate activities, administrative costs and changes in non-cash working capital. Also included are preferred share dividends. |

CHOICE PROPERTIES’ FUNDS FROM OPERATIONS Choice Properties considers Funds from Operations to be a useful measure of operating performance as it adjusts for items included in net income that do not arise from operating activities or do not necessarily provide an accurate depiction of its performance.

Funds from Operations is calculated in accordance with the Real Property Association of Canada’s Funds from Operations & Adjusted Funds from Operations for International Financial Reporting Standards issued in January 2022.

The following table reconciles Choice Properties’ Funds from Operations to net income for the periods ended as indicated.

|

($ millions) |

16 Weeks Ended |

|||||

|

Oct. 5, 2024 |

Oct. 7, 2023 |

|||||

|

Net (loss) income |

$ (663) |

$ 435 |

||||

|

Add (deduct) impact of the following: |

||||||

|

Adjustment to fair value of unit-based compensation |

3 |

— |

||||

|

Fair value adjustment on Exchangeable Units |

906 |

(352) |

||||

|

Fair value adjustment on investment properties |

(82) |

(27) |

||||

|

Fair value adjustment on investment properties to proportionate share |

(1) |

1 |

||||

|

Fair value adjustment of investment in real estate securities |

(58) |

45 |

||||

|

Capitalized interest on equity accounted joint ventures |

4 |

3 |

||||

|

Unit distributions on Exchangeable Units |

75 |

74 |

||||

|

Internal expenses for leasing |

3 |

2 |

||||

|

Funds from Operations |

$ 187 |

$ 181 |

||||

SOURCE George Weston Limited