Soldier System Market Size is Projected to Reach USD 17.0 billion by 2031, with a 5.2% CAGR | Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Nov. 19, 2024 (GLOBE NEWSWIRE) — The global soldier system market (군인 시스템 시장) is estimated to flourish at a CAGR of 5.2% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for soldier system is estimated to reach US$ 17.0 billion by the end of 2031. A prominent force is the focus on psychological well-being within soldier-centric technologies.

As the understanding of the mental toll of combat deepens, innovations addressing stress, fatigue, and mental health in soldier systems are gaining traction. Solutions ranging from augmented reality for stress relief to cognitive performance-enhancing technologies contribute to a holistic approach in optimizing soldier effectiveness.

The utilization of artificial intelligence (AI) in soldier systems is quietly revolutionizing operational capabilities. AI-driven analytics provide real-time insights into situational awareness, aiding decision-making on the battlefield. From predictive maintenance for equipment to AI-assisted threat analysis, the integration of AI enhances the overall efficiency of soldier systems.

Download Sample PDF of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85472

The advent of smart textiles and adaptive materials in soldier gear represents a novel driver. These textiles offer enhanced functionality, adjusting to environmental conditions and providing dynamic support to soldiers. From self-healing fabrics to adaptive camouflage, smart textiles contribute to soldier comfort, survivability, and mission success.

Soldier System Market: Competitive Landscape

The soldier system market is marked by intense competition, featuring key players like Elbit Systems, Rheinmetall AG, and Thales Group. These industry leaders drive innovation, offering comprehensive soldier-centric solutions, from advanced communication systems to integrated wearable technologies.

Robust research and development initiatives, strategic partnerships, and a focus on meeting evolving military requirements define the competitive landscape. With a global outlook, the market witnesses continuous advancements, as companies vie for contracts and collaborations to deliver cutting-edge soldier systems that enhance military capabilities and ensure optimal performance in diverse operational scenarios.

Some prominent manufacturers are as follows:

- ASELSAN A.S

- Avon Protection plc

- Banc 3 Inc.

- Elbit Systems Ltd.

- Inmarsat Global Limited

- L3Harris Technologies Inc.

- Metravib Defence

- Rheinmetall AG

- Safran Vectronix AG

- Teldat Group

- Textron Systems

- Thales Group

Key Findings of the Market Report

- Body armor leads the soldier system market, prioritizing soldier safety with advanced protective gear for diverse operational environments.

- Defense is the leading end-user segment in the soldier system market, driving innovations and investments in advanced military technologies.

- North America leads the soldier system market, propelled by substantial defense investments, advanced technological capabilities, and ongoing soldier modernization programs.

Soldier System Market Growth Drivers & Trends

- Ongoing innovations in communication, sensors, and wearable technologies drive soldier system market growth, enhancing soldier capabilities and battlefield effectiveness.

- Demand for comprehensive, integrated soldier systems rises, focusing on seamless communication, real-time data sharing, and interoperability across military platforms.

- Rising global security concerns propel investments in soldier modernization programs, fostering market growth as nations prioritize advanced equipment and technologies to counter evolving threats.

- A trend towards lightweight yet durable materials in soldier equipment enhances mobility and comfort, driving market growth with a focus on soldier safety and effectiveness.

- Worldwide defense modernization efforts, particularly in North America, Europe, and Asia Pacific, contribute to the soldier system market’s expansion, fostering a globally competitive landscape.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85472

Global Soldier System Market: Regional Profile

- North America dominates the soldier system market, driven by the United States’ formidable defense investments. Advanced soldier modernization programs, led by companies like Lockheed Martin and General Dynamics, fuel the region’s market. Emphasis on next-gen technologies, integrated communication systems, and soldier-wearable solutions characterize the North American landscape.

- Europe stands as a key player, with countries like the UK, Germany, and France leading the region’s soldier system advancements. Companies such as BAE Systems and Rheinmetall AG contribute to a robust market, focusing on interoperability, situational awareness, and lightweight yet highly protective soldier equipment.

- The Asia Pacific region showcases substantial growth, driven by defense modernization initiatives in countries like China and India. Rising security concerns propel the demand for advanced soldier systems, and local companies, including Bharat Electronics Limited and Norinco Group, contribute significantly to the region’s dynamic market, focusing on enhancing soldier survivability and effectiveness.

Product Portfolio

- ASELSAN A.S. leads in defense technology with an extensive product portfolio. From communication systems to electronic warfare solutions, their innovative technologies ensure national security, offering cutting-edge solutions to military and defense organizations globally.

- Avon Protection plc specializes in respiratory protection and defense equipment. Their product portfolio includes advanced gas masks, filters, and respiratory systems, providing unmatched safety and protection for military, law enforcement, and first responders.

- Banc 3 Inc. excels in providing cutting-edge technology solutions. From cybersecurity to advanced analytics, their diverse product portfolio meets the evolving needs of government and private sector clients, ensuring efficient and secure operations.

Soldier System Market: Key Segments

By Type

- Body Armor

- Tactical Terminal Tablets

- Laser Target Acquisition Systems

- Respiratory Protective Equipment

- Night Vision Glasses

- Communication Devices

- Others (Navigation Devices, Training & Simulation)

By End User

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Buy this Premium Research Report – https://www.transparencymarketresearch.com/checkout.php?rep_id=85472<ype=S

More Trending Report by Transparency Market Research:

Microturbines Market (سوق التوربينات الدقيقة) – The global microturbines market is projected to grow at a CAGR of 8.6% from 2022 to 2031.

Water Analysis Instruments Market (水分析機器市場) – The global water analysis instruments market was valued at US$ 5.2 billion in 2021. It is projected to expand at a CAGR of 6.8% during the forecast period from 2023 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BlackRock's Spot Bitcoin ETF To Open For Options Trading: Here's Why It Could Be A Big Deal For Bitcoin

Options trading for spot Bitcoin BTC/USD exchange-traded funds are all set to launch on Wall Street on Tuesday, marking a new era of the leading cryptocurrency’s integration into traditional finance.

What happened: Nasdaq head of ETP listings Alison Hennessy told Bloomberg they plan to list options for iShares Bitcoin Trust ETF IBIT “as early as” Tuesday.

The approved options would be listed on the Nasdaq under the ticker symbol “IBIT,” paving the way for institutional investors and traders to hedge their exposure to Bitcoin more efficiently.

But why is it a big deal?

In a video posted on X Monday and reshared by Bloomberg’s senior ETF analyst Eric Balchunas, analyst and head of growth at Bitcoin custody firm Theya, Joe Consorti, said that the launch will open the “floodgates” for Bitcoin’s next evolution in financial markets.

Consorti stated the importance of options trading, especially for institutional investors. He explained that in sectors like equities and commodities, derivatives are 10 to 20 times the size of the underlying market cap.

On the other hand, Bitcoin’s derivatives market was much lower, with its total Open interest, or OI, being a fraction of its spot market capitalization.

See Also: Bitfinex Bitcoin Laundering Case Lands ‘Crocodile Of Wall Street’ In Jail

“So Bitcoins are vastly underdeveloped, and this limits the market majority because there is a huge institutional demand for these vehicles from a hedging perspective and an allocation perspective,” Consorti said.

With the debut of options trading, the analyst expected Bitcoin’s derivatives market to balloon into something “much, much larger.”

Why It Matters: Retail investors, who constitute nearly 44% of the listed equities options market, had trouble accessing Bitcoin ETF options due to the OTC (over-the-counter) nature of trading on platforms like Deribit.

However, all this changes with IBIT options, as investors previously excluded would be able to join the Bitcoin derivatives market, giving a boost to the investor base and demand.

“A robust derivatives ecosystem reduces volatility, improves price discovery, and allows institutional capital to engage with Bitcoin at scale,” Consorti emphasized.

The IBIT spot ETF was the biggest Bitcoin-related fund, according to SoSo Value, with assets worth more than $43 billion as of this writing.

Price Action: At the time of writing, Bitcoin was trading at $91,727.36, up 0.08% in the last 24 hours, according to data from Benzinga Pro.

What’s Next: The launch coincides with Benzinga’s Future of Digital Assets event on Nov. 19, where the focus will be on Bitcoin’s role in institutional portfolios, regulatory clarity, and the evolving crypto market landscape.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Magnificent High-Yield REIT Stock Down 39% to Buy and Hold Forever

It’s hard to find dependable dividend stocks with large yields. Often, a high dividend yield is a red flag, a warning from the market of potential risks within the company. However, certain types of companies are better suited to affording generous dividends.

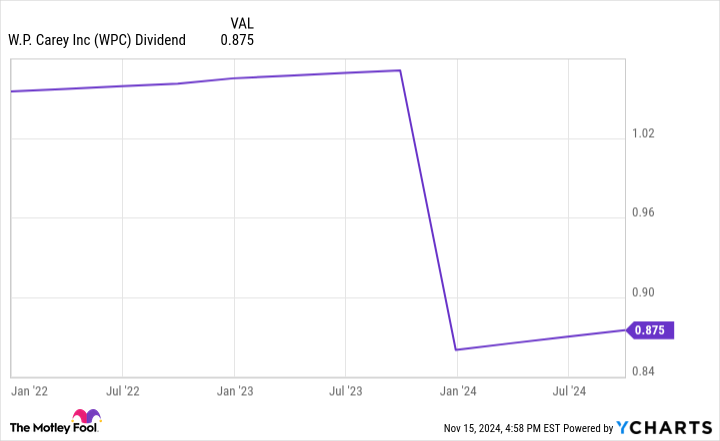

Real estate is a great place to look. Companies that acquire and lease property, called real estate investment trusts (REITs), must distribute at least 90% of their income to shareholders to avoid paying corporate income tax. W.P. Carey (NYSE: WPC) was a highly regarded REIT but encountered some challenges after the pandemic and cut its dividend.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Today, the stock is down nearly 40% from its high. Given the dividend cut and the stock’s decline, it’s easy to say, “I’ll pass.”

Yet, that could be a big mistake. I’ll explain what makes W.P. Carey a top-notch REIT worth buying today and holding potentially forever.

Most investors hold REITs for the dividend income, so cutting the dividend will (naturally) not go over well. Here’s what happened. W.P. Carey had significant exposure to office properties, which became troublesome after COVID-19 due partly to lockdowns and work-from-home policies. Approximately 16% of W.P. Carey’s rental income came from offices.

W.P. Carey decided to spin off its office properties (it wasn’t the only REIT to do so), which prompted a dividend cut last year:

Note that management has resumed dividend increases. However, it will take time for W.P. Carey to grow enough to pay as large a dividend as it once did. Analysts expect W.P. Carey to grow its funds from operations (FFO) at a low to mid-single-digit rate over the next few years.

The story of W.P. Carey’s dividend cut is somewhat ironic because it’s one of the most diversified REITs.

The company owns approximately 1,430 properties and leases to 346 tenants. W.P. Carey focuses on single-tenant commercial properties and uses net leases, meaning the tenant is responsible for the property’s overhead expenses, such as taxes, maintenance, and insurance. That de-risks W.P. Carey from unexpected costs. It also has a self-storage portfolio of 78 additional properties.

Its properties are divided roughly 2-to-1 between North America and Europe. Additionally, no tenant represents more than 2.7% of its rental income, and its top 10 combine for just 20%. Its properties include industrial buildings, warehouses, retail buildings, and others. The tenants come from dozens of end markets, ranging from retailers to cargo transporters.

Warren Buffett Just Bought 4 Stocks. Here's the Best of the Bunch.

One of the world’s greatest investors isn’t doing much investing these days. Warren Buffett was a net seller of stocks for the eighth consecutive quarter in Q3. He again slashed Berkshire Hathaway‘s position in Apple and sold shares of six other holdings.

However, Buffett and his two investment managers (Ted Weschler and Todd Combs) still put some of Berkshire’s massive cash stockpile to work. He recently bought four stocks. One of them stands out as the best of the bunch.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Berkshire initiated new positions in only two stocks in the last quarter. Its biggest addition was 1.28 million shares of pizza franchiser Domino’s Pizza (NYSE: DPZ). At the end of Q3, Berkshire’s stake in Domino’s was worth $549.4 million.

The conglomerate also dipped its toes in the water with swimming pool supplies distributor Pool Corporation (NASDAQ: POOL). Berkshire bought over 404,000 shares of Pool valued at nearly $152.3 million at the end of Q3.

Besides those two additions, Berkshire increased its positions in only two existing holdings. Its stake in satellite radio operator Sirius XM Holdings (NASDAQ: SIRI) increased by 6.99%. Some of this increase was due to the merger of Sirius XM and Liberty SiriusXM Holdings. Berkshire previously owned shares of the two tracking stocks reflecting Liberty Media’s interest in Sirius XM. However, Buffett or his investment managers also bought more shares of Sirius XM Holdings in October.

Finally, Berkshire boosted its position in Heico (NYSE: HEI) by 0.52% in Q3 after first buying shares in Q2. The conglomerate’s stake in the aerospace and electronics company was worth roughly $214 million at the end of the quarter.

If we only focused on performance this year, Heico would beat the other recent Buffett additions handily. The stock has skyrocketed over 50%. Domino’s comes in second with a year-to-date gain of less than 5%. Pool and Sirius XM are in negative territory with declines of around 10% and 53%, respectively.

The picture looks much different, though, when we look at valuations. Sirius XM Holdings has a bargain-basement forward price-to-earnings ratio of 7.3. Domino’s again grabs the second spot with a forward earnings multiple of 24.3. Pool is somewhat more expensive with its shares trading at 29.8 times forward earnings. Heico is the outlier with a sky-high forward earnings multiple of 63.7.

Energizer Holdings, Inc. Announces Fiscal 2024 Fourth Quarter and Full Year Results and Financial Outlook for Fiscal 2025

- Delivered fiscal 2024 Net Sales and Adjusted EBITDA in line with our outlook, and Adjusted EPS above our originally guided range.(1)

- Gross margin for the full year was 38.3% and on an adjusted basis 40.9%, up 190 basis points to prior year largely driven by the benefits of Project Momentum initiatives.(1)

- Operating cash flow was $429.6 million and Free cash flow was 11.7% of Net Sales for the fiscal year.(1)

- Reduced net leverage to 4.9 times in fiscal 2024 driven by $200 million of debt pay down and Adjusted EBITDA growth.(1)

- Delivered earnings per share of $0.52 and Adjusted Earnings per share of $3.32 for the fiscal year, an increase of 7% on an adjusted basis.(1)

- Company expects fiscal 2025 organic revenue growth of 1% to 2% and Adjusted EBITDA and Adjusted earnings per share in the ranges of $625 to $645 million and $3.45 to $3.65, respectively.(1)

ST. LOUIS, Nov. 19, 2024 /PRNewswire/ — Energizer Holdings, Inc. ENR today announced results for the fourth fiscal quarter and full fiscal year, which ended September 30, 2024.

“We finished fiscal 2024 with solid performances across both Battery and Auto Care, driving adjusted earnings growth above our initial expectations,” said Mark LaVigne, President and Chief Executive Officer.

“Our results are further proof that our strategies are working. We generated organic growth in the back half of the year, strengthened our gross margins and delivered strong free cash flow, which enabled significant investment behind our long term growth objectives.”

“We enter fiscal 2025 having significantly advanced the Company’s strategic foundation and financial position. I am confident we are well positioned to deliver our financial algorithm, anchored by consistent, ratable growth and continued improvement in our operating margins.”

(1) See Press Release attachments and supplemental schedules for additional information, including the GAAP to Non-GAAP reconciliations.

Top-Line Performance

Net sales were $805.7 million for the fourth fiscal quarter compared to $811.1 million in the prior year period and $2,887.0 million for the fiscal year compared to $2,959.7 million for the prior fiscal year.

|

Fourth |

% Chg |

Full Fiscal |

% Chg |

|||||

|

Net Sales – FY’23 |

$ 811.1 |

$ 2,959.7 |

||||||

|

Organic |

0.3 |

— % |

(66.2) |

(2.2) % |

||||

|

Change in Argentina operations |

(2.2) |

(0.3) % |

(7.8) |

(0.3) % |

||||

|

Impact of currency |

(3.5) |

(0.4) % |

1.3 |

— % |

||||

|

Net Sales – FY’24 |

$ 805.7 |

(0.7) % |

$ 2,887.0 |

(2.5) % |

For the fiscal quarter, organic net sales were consistent with prior year due to the following items: (1)

- Volume increases in the Battery & Lights segment driven by improved category trends and new distribution globally which resulted in 1.3% organic growth; and

- Volume increases in the Auto Care segment resulted in organic growth of 0.5% from distribution gains and early holiday sales, partially offset by timing of refrigerant sales that benefited the third quarter.

- These volume increases were offset by pricing declines of 1.8% driven by planned strategic pricing and promotional investments in the period.

For the fiscal year, organic net sales decreased 2.2% due to the following items: (1)

- The Battery & Lights segment experienced volume declines of approximately 0.7% primarily due to the timing of holiday orders compared to the prior year, which benefited the fourth quarter of 2023, partially offset by distribution gains and improved category trends; and

- Pricing declines of 2.2%, primarily within the Battery & Lights segment, driven by planned strategic pricing and promotional investments in the period.

- Offsetting these declines was increased Auto Care segment volumes of 0.7% largely driven by distribution gains in the period.

Gross Margin

Gross margin percentage on a reported basis for the fourth fiscal quarter was 38.1%, versus 37.9% in the prior year quarter. Excluding the current and prior year restructuring costs and the current year network transition costs and integration costs, Adjusted Gross margin was 42.2%, up 220 basis points from the prior year quarter and 70 basis points from the third fiscal quarter of 2024.(1)

Gross margin percentage on a reported basis for fiscal 2024 was 38.3%, versus 38.0% in the prior year. Excluding the current and prior year restructuring costs and the current year network transition costs and integration costs, Adjusted Gross margin was 40.9% for the fiscal year, up 190 basis points from prior year.(1)

|

Fourth Quarter |

Full Fiscal Year |

|||

|

Gross Margin – FY’23 Reported |

37.9 % |

38.0 % |

||

|

Prior year impact of restructuring costs |

2.1 % |

1.0 % |

||

|

Adjusted Gross Margin – FY’23 (1) |

40.0 % |

39.0 % |

||

|

Project Momentum initiatives |

2.2 % |

1.9 % |

||

|

Product cost impacts |

1.3 % |

1.8 % |

||

|

Pricing |

(1.1) % |

(1.5) % |

||

|

Currency impact and other |

(0.2) % |

(0.3) % |

||

|

Gross margin – FY’24 Adjusted |

42.2 % |

40.9 % |

||

|

Current year impact of restructuring, network transition and integration costs |

(4.1) % |

(2.6) % |

||

|

Gross margin – FY’24 Reported |

38.1 % |

38.3 % |

Adjusted Gross margin improvement in the fourth fiscal quarter was driven by both Project Momentum initiatives, which delivered savings of approximately $18 million, as well as lower input costs, including improved commodity and material pricing. These benefits were partially offset by the planned strategic pricing and promotional investments noted above.

Adjusted Gross margin improvement in fiscal 2024 was driven by both Project Momentum initiatives, which delivered savings of approximately $59 million, as well as lower input costs, including improved commodities pricing and lower ocean freight. These benefits were partially offset by the planned strategic pricing and promotional investments noted above.

Selling, General and Administrative Expense (SG&A)

SG&A for the fourth fiscal quarter was 15.3% of net sales, or $123.0 million, as compared to 14.2% of net sales, or $115.5 million, in the prior year when excluding restructuring and related costs, acquisition and integration costs and a litigation matter. The year-over-year increase was primarily driven by an increase in labor and benefit costs, higher travel expense, increased depreciation expense related to our digital transformation initiatives and increased legal fees. This increase was partially offset by savings from Project Momentum of approximately $7 million.(1)

SG&A for fiscal 2024 was $473.1 million, or 16.4% of net sales, as compared to $459.4 million, or 15.5% of net sales, in the prior year when excluding restructuring and related costs, acquisition and integration costs, and a litigation matter. The year-over-year increase was primarily driven by an increase in labor and benefit costs, higher travel expense, increased depreciation expense related to our digital transformation initiatives and increased legal, factoring and environmental fees. This increase was partially offset by Project Momentum savings of approximately $29 million in the period.(1)

Advertising and Promotion Expense (A&P)

A&P was 4.6% of net sales for the fourth fiscal quarter and 5.0% of net sales for fiscal 2024. A&P spending in the prior year was 4.1% for the fourth fiscal quarter of 2023 and 4.8% for fiscal 2023. For the quarter, this was an increase of 50 basis points, or $4.5 million and for fiscal 2024 this was an increase of 20 basis points or $1.4 million.

|

Earnings Per Share and Adjusted EBITDA |

Fourth Quarter |

Full Fiscal Year |

||||||

|

(In millions, except per share data) |

2024 |

2023 |

2024 |

2023 |

||||

|

Net earnings |

$ 47.6 |

$ 19.7 |

$ 38.1 |

$ 140.5 |

||||

|

Diluted net earnings per common share |

$ 0.65 |

$ 0.27 |

$ 0.52 |

$ 1.94 |

||||

|

Adjusted net earnings(1) |

$ 89.3 |

$ 86.8 |

$ 241.3 |

$ 224.0 |

||||

|

Adjusted diluted net earnings per common share(1) |

$ 1.22 |

$ 1.20 |

$ 3.32 |

$ 3.09 |

||||

|

Adjusted EBITDA(1) |

$ 187.3 |

$ 185.4 |

$ 612.4 |

$ 597.3 |

||||

|

Currency neutral Adjusted diluted net earnings per common share(1) |

$ 1.26 |

$ 3.35 |

||||||

|

Currency neutral Adjusted EBITDA(1) |

$ 191.0 |

$ 614.9 |

||||||

The increase in net earnings in the fourth fiscal quarter was driven by the prior year settlement charge on the US pension plan annuity buy out of $50.2 million of previously unamortized actuarial losses. The decrease in net earnings in the fiscal year was driven by the current year non-cash pre-tax impairment charge of $110.6 million compared to no impairments in fiscal 2023 as well as the Argentina devaluation recorded in the current fiscal year, partially offset by the prior year US pension plan annuity buy out.

For the fourth fiscal quarter, the increase in Adjusted earnings per share and Adjusted EBITDA reflects an increase in Gross margin due to Project Momentum savings, partially offset by higher SG&A and A&P spending as well as unfavorable currency in the current year. Adjusted earnings per share further benefited from lower interest expense as the Company’s overall debt balance has decreased, partially offset by increased tax expense.

For the full year, Adjusted net earnings per share and Adjusted EBITDA reflects the Gross margin improvement as well as decreased R&D spend. This was partially offset by higher A&P and SG&A spend and the unfavorable currency movement in the full year. Adjusted earnings per share further benefited from lower interest expense as the Company’s overall debt balance has decreased and lower amortization expense, partially offset by increased tax expense.

For the quarter, currency had an unfavorable pre-tax impact of $3.7 million, or $0.04 per share, and for fiscal 2024, currency had an unfavorable pre-tax impact of $2.5 million, or $0.03 per share.

Capital Allocation

- Operating cash flow for the quarter was $168.9 million and for fiscal 2024 was $429.6 million. Fiscal year 2024 free cash flow was $339.0 million, or 11.7% of Net Sales.

- The Company completed two acquisitions in fiscal 2024 including the acquisition of battery manufacturing equipment, raw materials and a leased facility in Belgium for $11.6 million in the first fiscal quarter and an Auto Care appearance and fragrance manufacturer and distributor based in Southern Brazil for $10.6 million during the third fiscal quarter.

- The Company paid down an additional $50 million of debt in the fourth quarter and $200 million in fiscal 2024. In fiscal 2024, Net debt decreased by $138.5 million and Net debt to Adjusted EBITDA was 4.9 times as of September 30, 2024, down from 5.2 times as of September 30, 2023.

- The Company paid dividends in the quarter of $21.6 million, or $0.30 per common share. Dividend payments for the year were $87.4 million, or $1.20 per common share.

- The Board has approved a new share repurchase program for up to 7.5 million shares. This replaced the prior authorization that was outstanding.

Financial Outlook and Assumptions for Fiscal 2025 (1)

In fiscal 2024, the Company was successful in achieving its priorities of restoring gross margin, generating healthy free cash flow, and reducing debt. As we move into fiscal 2025, the Company expects to continue to execute against those priorities while growing our Adjusted EBITDA and EPS.

For fiscal 2025, we expect organic revenue to be up 1% to 2%. The increase in revenues as well as implementing the last year of our Project Momentum initiatives are expected to drive an increase in Adjusted EBITDA. For fiscal 2025, Adjusted EBITDA is expected to be in the range of $625 million to $645 million, and Adjusted earnings per share is expected to be in the range of $3.45 to $3.65. For the first quarter, we expect organic revenue to be up 2% to 3% and Adjusted earnings per share to be in the range of $0.60 to $0.65.

Webcast Information

In conjunction with this announcement, the Company will hold an investor conference call beginning at 10:00 a.m. eastern time today. The call will focus on fourth quarter and fiscal 2024 financial results and the financial outlook for fiscal 2025. All interested parties may access a live webcast of this conference call at www.energizerholdings.com, under “Investors” and “Events and Presentations” tabs or by using the following link: https://app.webinar.net/BwdOWXlWNk9

For those unable to participate during the live webcast, a replay will be available on www.energizerholdings.com, under “Investors,” “Events and Presentations,” and “Past Events” tabs.

This document contains both historical and forward-looking statements. Forward-looking statements are not based on historical facts but instead reflect our expectations, estimates or projections concerning future results or events, including, without limitation, the future sales, gross margins, costs, earnings, cash flows, tax rates and performance of the Company. These statements generally can be identified by the use of forward-looking words or phrases such as “believe,” “expect,” “expectation,” “anticipate,” “may,” “could,” “will,” “intend,” “belief,” “estimate,” “plan,” “target,” “predict,” “likely,” “should,” “forecast,” “outlook,” or other similar words or phrases. These statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause our actual results to differ materially from those indicated by those statements. We cannot assure you that any of our expectations, estimates or projections will be achieved. The forward-looking statements included in this document are only made as of the date of this document and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Numerous factors could cause our actual results and events to differ materially from those expressed or implied by forward-looking statements, including, without limitation:

- Global economic and financial market conditions beyond our control might materially and negatively impact us.

- Competition in our product categories might hinder our ability to execute our business strategy, achieve profitability, or maintain relationships with existing customers.

- Changes in the retail environment and consumer preferences could adversely affect our business, financial condition and results of operations.

- We must successfully manage the demand, supply, and operational challenges brought on by any disease outbreak, including epidemics, pandemics, or similar widespread public health concerns.

- Loss or impairment of the reputation of our Company or our leading brands or failure of our marketing plans could have an adverse effect on our business.

- Loss of any of our principal customers could significantly decrease our sales and profitability.

- Our ability to meet our growth targets depends on successful product, marketing and operations innovation and successful responses to competitive innovation and changing consumer habits.

- We are subject to risks related to our international operations, including currency fluctuations, which could adversely affect our results of operations.

- If we fail to protect our intellectual property rights, competitors may manufacture and market similar products, which could adversely affect our market share and results of operations.

- Changes in production costs, including raw material prices and transportation costs, from inflation or otherwise, have adversely affected, and in the future could erode, our profit margins and negatively impact operating results.

- Our reliance on certain significant suppliers subjects us to numerous risks, including possible interruptions in supply, which could adversely affect our business.

- Our business is vulnerable to the availability of raw materials, our ability to forecast customer demand and our ability to manage production capacity.

- The manufacturing facilities, supply channels or other business operations of the Company and our suppliers may be subject to disruption from events beyond our control.

- The Company’s future results may be affected by its operational execution, including its ability to achieve cost savings as a result of any current or future restructuring events.

- If our goodwill and indefinite-lived intangible assets become impaired, we will be required to record impairment charges, which may be significant.

- A failure of a key information technology system could adversely impact our ability to conduct business.

- We rely significantly on information technology and any inadequacy, interruption, theft or loss of data, malicious attack, integration failure, failure to maintain the security, confidentiality or privacy of sensitive data residing on our systems or other security failure of that technology could harm our ability to effectively operate our business and damage the reputation of our brands.

- We have significant debt obligations that could adversely affect our business and our ability to meet our obligations.

- If we pursue strategic acquisitions, divestitures or joint ventures, we might experience operating difficulties, dilution, and other consequences that may harm our business, financial condition, and operating results, and we may not be able to successfully consummate favorable transactions or successfully integrate acquired businesses.

- Our business involves the potential for product liability claims, labeling claims, commercial claims and other legal claims against us, which could affect our results of operations and financial condition and result in product recalls or withdrawals.

- Our business is subject to increasing government regulations in both the U.S. and abroad that could impose material costs.

- Increased focus by governmental and non-governmental organizations, customers, consumers and shareholders on environmental, social and governance (ESG) issues, including those related to sustainability and climate change, may have an adverse effect on our business, financial condition and results of operations and damage our reputation.

- We are subject to environmental laws and regulations that may expose us to significant liabilities and have a material adverse effect on our results of operations and financial condition.

In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of any such forward-looking statements. The list of factors above is illustrative, but by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Additional risks and uncertainties include those detailed from time to time in our publicly filed documents, including those described under the heading “Risk Factors” in our Form 10-K filed with the Securities and Exchange Commission on November 14, 2023.

|

ENERGIZER HOLDINGS, INC. |

|||||||

|

Quarter Ended |

Twelve Months Ended |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Net sales |

$ 805.7 |

$ 811.1 |

$ 2,887.0 |

$ 2,959.7 |

|||

|

Cost of products sold (1) |

498.9 |

503.8 |

1,782.7 |

1,835.7 |

|||

|

Gross profit |

306.8 |

307.3 |

1,104.3 |

1,124.0 |

|||

|

Selling, general and administrative expense (1) |

146.1 |

134.6 |

526.3 |

489.4 |

|||

|

Advertising and promotion expense |

37.4 |

32.9 |

143.7 |

142.3 |

|||

|

Research and development expense |

8.5 |

8.5 |

31.6 |

32.9 |

|||

|

Amortization of intangible assets |

14.7 |

14.4 |

58.2 |

59.4 |

|||

|

Impairment of intangible assets (2) |

— |

— |

110.6 |

— |

|||

|

Interest expense |

37.8 |

41.6 |

155.7 |

168.7 |

|||

|

Loss/(gain) on extinguishment of debt (3) |

0.3 |

0.2 |

2.4 |

(1.5) |

|||

|

Other items, net (1) (4) |

2.5 |

52.5 |

22.0 |

57.1 |

|||

|

Earnings before income taxes |

59.5 |

22.6 |

53.8 |

175.7 |

|||

|

Income tax expense |

11.9 |

2.9 |

15.7 |

35.2 |

|||

|

Net earnings |

$ 47.6 |

$ 19.7 |

$ 38.1 |

$ 140.5 |

|||

|

Basic net earnings per common share |

$ 0.66 |

$ 0.28 |

$ 0.53 |

$ 1.97 |

|||

|

Diluted net earnings per common share |

$ 0.65 |

$ 0.27 |

$ 0.52 |

$ 1.94 |

|||

|

Weighted average shares of common stock – Basic |

71.8 |

71.5 |

71.8 |

71.5 |

|||

|

Weighted average shares of common stock – Diluted |

73.0 |

72.6 |

72.7 |

72.4 |

|||

|

(1) |

See the attached Supplemental Schedules – Non-GAAP Reconciliations, which break out the Project Momentum restructuring and related costs, Network transition costs, Acquisition and integration related costs, and Litigation matters recorded included within these lines. |

|

(2) |

The non-cash Impairment of intangible assets for the twelve months ended September 30, 2024 relates to the Company’s Rayovac trade name impairment of $85.2 million and Varta trade name impairment of $25.4 million. |

|

(3) |

The Loss on extinguishment of debt for the quarters ended September 30, 2024 and 2023, and for the twelve months ended September 30, 2024, related to the early repayment of term loan during the respective periods, as well as the term loan repricing during the current year. The Gain on the extinguishment of debt for the twelve months ended September 30, 2023 related to the repurchase of outstanding Senior Notes at a discount, partially offset by the repayment of term loan. |

|

(4) |

During December 2023, a new president was inaugurated in Argentina bringing significant economic reform to the country including devaluing the Argentine Peso by 50% in the month of December (the “December 2023 Argentina Economic Reform”). As a result of this reform and devaluation, the Company has recorded $22.0 million of currency exchange and related losses within Other items, net for the twelve months ended September 30, 2024. Other items, net for the quarter and twelve months ended September 30, 2023 included a $50.2 million settlement loss due to the execution of a partial retiree annuity buy out on the US pension plan in the fourth quarter of fiscal 2023. |

|

ENERGIZER HOLDINGS, INC. |

||||

|

SEPTEMBER 30, |

||||

|

2024 |

2023 |

|||

|

Assets |

||||

|

Current assets |

||||

|

Cash and cash equivalents |

$ 216.9 |

$ 223.3 |

||

|

Trade receivables |

441.3 |

511.6 |

||

|

Inventories |

657.3 |

649.7 |

||

|

Other current assets |

163.4 |

172.0 |

||

|

Total current assets |

$ 1,478.9 |

$ 1,556.6 |

||

|

Property, plant and equipment, net |

380.1 |

363.7 |

||

|

Operating lease assets |

94.7 |

98.4 |

||

|

Goodwill |

1,046.0 |

1,016.2 |

||

|

Other intangible assets, net |

1,070.9 |

1,237.7 |

||

|

Deferred tax asset |

145.8 |

88.4 |

||

|

Other assets |

126.0 |

148.6 |

||

|

Total assets |

$ 4,342.4 |

$ 4,509.6 |

||

|

Liabilities and Shareholders’ Equity |

||||

|

Current liabilities |

||||

|

Current maturities of long-term debt |

$ 12.0 |

$ 12.0 |

||

|

Current portion of finance leases |

0.6 |

0.3 |

||

|

Notes payable |

2.1 |

8.2 |

||

|

Accounts payable |

433.1 |

370.8 |

||

|

Current operating lease liabilities |

18.2 |

17.3 |

||

|

Other current liabilities |

353.8 |

325.6 |

||

|

Total current liabilities |

$ 819.8 |

$ 734.2 |

||

|

Long-term debt |

3,193.0 |

3,332.1 |

||

|

Operating lease liabilities |

82.4 |

84.7 |

||

|

Deferred tax liability |

8.3 |

12.4 |

||

|

Other liabilities |

103.1 |

135.5 |

||

|

Total liabilities |

$ 4,206.6 |

$ 4,298.9 |

||

|

Shareholders’ equity |

||||

|

Common stock |

0.8 |

0.8 |

||

|

Additional paid-in capital |

667.6 |

750.5 |

||

|

Retained losses |

(128.4) |

(164.8) |

||

|

Treasury stock |

(223.6) |

(238.1) |

||

|

Accumulated other comprehensive loss |

(180.6) |

(137.7) |

||

|

Total shareholders’ equity |

$ 135.8 |

$ 210.7 |

||

|

Total liabilities and shareholders’ equity |

$ 4,342.4 |

$ 4,509.6 |

||

|

ENERGIZER HOLDINGS, INC. |

|||

|

FOR THE YEARS ENDED |

|||

|

2024 |

2023 |

||

|

Cash Flow from Operating Activities |

|||

|

Net earnings |

$ 38.1 |

$ 140.5 |

|

|

Adjustments to reconcile net earnings to net cash flow from operations: |

|||

|

Non-cash integration and restructuring charges |

13.0 |

7.7 |

|

|

Impairment of intangible assets |

110.6 |

— |

|

|

Depreciation and amortization |

120.5 |

122.7 |

|

|

Deferred income taxes |

(43.3) |

(38.5) |

|

|

Share-based compensation expense |

23.1 |

21.8 |

|

|

Gain on sale of real estate |

(4.4) |

— |

|

|

Loss/(gain) on extinguishment on debt |

2.4 |

(1.5) |

|

|

Foreign currency exchange loss included in income |

32.1 |

17.3 |

|

|

Settlement loss on US pension annuity buy out |

— |

50.2 |

|

|

Non-cash items included in income, net |

17.8 |

14.6 |

|

|

Other, net |

(2.2) |

(2.7) |

|

|

Changes in assets and liabilities used in operations, net of acquisitions |

|||

|

Decrease/(increase) in accounts receivable, net |

71.8 |

(80.4) |

|

|

(Increase)/decrease in inventories |

(4.0) |

132.3 |

|

|

(Increase)/decrease in other current assets |

(0.1) |

10.0 |

|

|

Increase in accounts payable |

62.2 |

35.2 |

|

|

Decrease in other current liabilities |

(8.0) |

(34.0) |

|

|

Net cash from operating activities |

429.6 |

395.2 |

|

|

Cash Flow from Investing Activities |

|||

|

Capital expenditures |

(97.9) |

(56.8) |

|

|

Proceeds from sale of assets |

7.3 |

0.7 |

|

|

Acquisitions, net of cash acquired |

(22.4) |

— |

|

|

Purchase of available-for-sale securities |

(5.2) |

— |

|

|

Proceeds from sale of available-for-sale securities |

4.2 |

— |

|

|

Net cash used by investing activities |

(114.0) |

(56.1) |

|

|

Cash Flow from Financing Activities |

|||

|

Payments on debt with maturities greater than 90 days |

(200.8) |

(222.1) |

|

|

Net (decrease)/increase in debt with maturities 90 days or less |

(6.2) |

1.2 |

|

|

Debt issuance costs |

(0.9) |

— |

|

|

Dividends paid on common stock |

(87.4) |

(86.3) |

|

|

Taxes paid for withheld share-based payments |

(5.0) |

(2.2) |

|

|

Net cash used by financing activities |

(300.3) |

(309.4) |

|

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

(21.7) |

(11.7) |

|

|

Net (decrease)/increase in cash, cash equivalents and restricted cash |

(6.4) |

18.0 |

|

|

Cash, cash equivalents and restricted cash, beginning of period |

223.3 |

205.3 |

|

|

Cash, cash equivalents and restricted cash, end of period |

$ 216.9 |

$ 223.3 |

|

ENERGIZER HOLDINGS, INC.

Supplemental Schedules

Introduction to the Reconciliation of GAAP and Non-GAAP Measures

For the Quarter and Twelve Months ended September 30, 2024

The Company reports its financial results in accordance with accounting principles generally accepted in the U.S. (“GAAP”). However, management believes that certain non-GAAP financial measures provide users with additional meaningful comparisons to the corresponding historical or future period, and are used for management incentive compensation. These non-GAAP financial measures exclude items that are not reflective of the Company’s on-going operating performance, such as impairment of intangible assets, restructuring and related costs, network transition costs, acquisition and integration costs, a litigation matter, the loss/(gain) on extinguishment of debt, the December 2023 Argentina Economic Reform and the settlement loss on US pension annuity buyout. In addition, these measures help investors to analyze year over year comparability when excluding currency fluctuations as well as other Company initiatives that are not on-going. We believe these non-GAAP financial measures are an enhancement to assist investors in understanding our business and in performing analysis consistent with financial models developed by research analysts. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. In addition, these non-GAAP measures may not be the same as similar measures used by other companies due to possible differences in methods and in the items being adjusted.

We provide the following non-GAAP measures and calculations, as well as the corresponding reconciliation to the closest GAAP measure in the following supplemental schedules:

Segment Profit. This amount represents the operations of our two reportable segments including allocations for shared support functions. General corporate and other expenses, amortization expense, impairment of intangible assets, interest expense, loss/(gain) on extinguishment of debt, other items, net, restructuring and related costs, network transition costs, a litigation matter, and acquisition and integration costs have all been excluded from segment profit.

Adjusted Net Earnings and Adjusted Diluted Net Earnings Per Common Share (EPS). These measures exclude the impact of restructuring and related costs, network transition costs, impairment of intangible assets, costs related to acquisition and integration, a litigation matter, the loss/(gain) on extinguishment of debt, the December 2023 Argentina Economic Reform and the settlement loss on US pension annuity buyout.

Non-GAAP Tax Rate. This is the tax rate when excluding the pre-tax impact of restructuring and related costs, network transition costs, impairment of intangible assets, costs related to acquisition and integration, a litigation matter, the loss/(gain) on extinguishment of debt, the December 2023 Argentina Economic Reform and the settlement loss on US pension annuity buyout, as well as the related tax impact for these items, calculated utilizing the statutory rate for where the impact was incurred.

Organic. This is the non-GAAP financial measurement of the change in revenue or segment profit that excludes or otherwise adjusts for the change in Argentina operations and impact of currency from the changes in foreign currency exchange rates as defined below:

Change in Argentina Operations. The Company is presenting separately all changes in sales and segment profit from our Argentina affiliate due to the designation of the economy as highly inflationary as of July 1, 2018.

Impact of currency. The Company evaluates the operating performance of our Company on a currency neutral basis. The Impact of Currency is the change in foreign currency exchange rates year-over-year on reported results, which is calculated by comparing the value of current year foreign operations at the current period USD exchange rate versus the value of current year foreign operations at the prior period USD exchange rate. The impact of currency also includes gains/(losses) of currency hedging programs, and it excludes hyper-inflationary markets.

Adjusted Comparisons. Detail for adjusted gross profit, adjusted gross margin, adjusted SG&A and adjusted SG&A as percent of sales and adjusted Other items, net are also supplemental non-GAAP measure disclosures. These measures exclude the impact of restructuring and related costs, network transition costs, acquisition and integration costs, a litigation matter, the December 2023 Argentina Economic Reform and the settlement loss on US pension annuity buyout.

EBITDA and Adjusted EBITDA. EBITDA is defined as net earnings before income tax provision, interest, the loss/(gain) on extinguishment of debt, and depreciation and amortization. Adjusted EBITDA further excludes the impact of the costs related to restructuring, network transition costs, a litigation matter, the December 2023 Argentina Economic Reform, the settlement loss on US pension annuity buyout, impairment of intangible assets, acquisition and integration costs, and share based payments.

Free Cash Flow. Free Cash Flow is defined as net cash provided by operating activities reduced by capital expenditures, net of the proceeds from asset sales.

Net Debt. Net Debt is defined as total Company debt, less cash and cash equivalents.

Currency-neutral. Currency-neutral excludes the Impact of currency as defined above on key measures. Hyper inflationary markets are excluded from this calculation.

Energizer Holdings, Inc.

Supplemental Schedules – Segment Information and Supplemental Sales Data

For the Quarter and Twelve Months ended September 30, 2024

(In millions, except per share data – Unaudited)

Operations for Energizer are managed via two product segments: Batteries & Lights and Auto Care. Energizer’s operating model includes a combination of standalone and shared business functions between the product segments, varying by country and region of the world. Shared functions include the sales and marketing functions, as well as human resources, IT and finance shared service costs. Energizer applies a fully allocated cost basis, in which shared business functions are allocated between segments. Such allocations are estimates, and may not represent the costs of such services if performed on a standalone basis. Segment sales and profitability, as well as the reconciliation to earnings before income taxes for the quarters and twelve months ended September 30, 2024 and 2023 are presented below:

|

For the Quarter Ended |

For the Twelve Months Ended |

||||||

|

Net Sales |

2024 |

2023 |

2024 |

2023 |

|||

|

Batteries & Lights |

$ 651.6 |

$ 656.1 |

$ 2,259.5 |

$ 2,344.9 |

|||

|

Auto Care |

154.1 |

155.0 |

627.5 |

614.8 |

|||

|

Total net sales |

$ 805.7 |

$ 811.1 |

$ 2,887.0 |

$ 2,959.7 |

|||

|

Segment Profit |

|||||||

|

Batteries & Lights |

$ 179.5 |

$ 176.8 |

$ 554.8 |

$ 551.5 |

|||

|

Auto Care |

20.0 |

17.6 |

94.1 |

75.0 |

|||

|

Total segment profit |

$ 199.5 |

$ 194.4 |

$ 648.9 |

$ 626.5 |

|||

|

General corporate and other expenses (1) |

(28.7) |

(26.6) |

(115.3) |

(107.2) |

|||

|

Restructuring and related costs (2) |

(27.1) |

(36.5) |

(91.7) |

(59.7) |

|||

|

Network transition costs (3) |

(11.7) |

— |

(11.7) |

— |

|||

|

Acquisition and integration costs (2) |

(2.3) |

— |

(7.2) |

— |

|||

|

Amortization of intangible assets |

(14.7) |

(14.4) |

(58.2) |

(59.4) |

|||

|

Impairment of intangible assets |

— |

— |

(110.6) |

— |

|||

|

Litigation matter (4) |

(13.7) |

— |

(13.7) |

— |

|||

|

Interest expense |

(37.8) |

(41.6) |

(155.7) |

(168.7) |

|||

|

(Loss)/gain on extinguishment of debt |

(0.3) |

(0.2) |

(2.4) |

1.5 |

|||

|

December 2023 Argentina economic reform (5) |

— |

— |

(22.0) |

— |

|||

|

Settlement loss on US pension annuity buy out (6) |

— |

(50.2) |

— |

(50.2) |

|||

|

Other items, net – Adjusted (7) |

(3.7) |

(2.3) |

(6.6) |

(7.1) |

|||

|

Total earnings before income taxes |

$ 59.5 |

$ 22.6 |

$ 53.8 |

$ 175.7 |

|||

|

(1) |

Recorded in SG&A on the Consolidated (Condensed) Statement of Earnings. |

|

(2) |

See the Supplemental Schedules – Non-GAAP Reconciliations for the line items where these charges are recorded in the Consolidated (Condensed) Statement of Earnings. |

|

(3) |

This represents incremental network transition costs, primarily related to air freight and third-party packaging support, to maintain business continuity and service our customers as the Company decommissions certain facilities and relocates production and packaging lines as part of Project Momentum. These costs were recorded in Cost of products sold on the Consolidated (Condensed) Statement of Earnings. |

|

(4) |

Litigation matter relates to a September 2024 Swiss court judgment against Energizer. The Company disagrees with the judgment and filed an appeal in October 2024. |

|

(5) |

During December 2023, a new president was inaugurated in Argentina bringing significant economic reform to the country including devaluing the Argentine Peso by 50% in the month of December. As a result of this reform and devaluation, the Company recorded $22.0 million of currency exchange and related losses in Other items, net on the Consolidated (Condensed) Statement of Earnings for the twelve months ended September 30, 2024. |

|

(6) |

The Settlement loss is due to the execution of a partial retiree annuity buy out on the US pension plan in the fourth quarter of fiscal 2023. This charge is included in Other items, net in the Consolidated (Condensed) Statement of Earnings. |

|

(7) |

See the Supplemental Non-GAAP reconciliation for the Other items, net reconciliation between the reported and adjusted balances. |

Supplemental product information is presented below for depreciation and amortization:

|

Energizer Holdings, Inc. |

|||||||

|

For the Quarter Ended |

For the Twelve Months |

||||||

|

Depreciation and amortization |

2024 |

2023 |

2024 |

2023 |

|||

|

Batteries & Lights |

$ 13.1 |

$ 12.7 |

$ 50.3 |

$ 52.2 |

|||

|

Auto Care |

3.1 |

2.6 |

12.0 |

11.1 |

|||

|

Total segment depreciation and amortization |

16.2 |

15.3 |

62.3 |

63.3 |

|||

|

Amortization of intangible assets |

14.7 |

14.4 |

58.2 |

59.4 |

|||

|

Total depreciation and amortization |

$ 30.9 |

$ 29.7 |

$ 120.5 |

$ 122.7 |

|||

|

Energizer Holdings, Inc. |

||||||||

|

The following tables provide a reconciliation of Net earnings and Diluted net earnings per common share to Adjusted net earnings and Adjusted diluted net earnings per share, which are non-GAAP measures. |

||||||||

|

For the Quarter Ended |

For the Twelve Months |

|||||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

Net earnings |

47.6 |

19.7 |

38.1 |

140.5 |

||||

|

Pre-tax adjustments |

||||||||

|

Restructuring and related costs (1) |

$ 27.1 |

$ 36.5 |

$ 91.7 |

$ 59.7 |

||||

|

Network transition costs (1) |

11.7 |

— |

11.7 |

— |

||||

|

Acquisition and integration (1) |

2.3 |

— |

7.2 |

— |

||||

|

Impairment of intangible assets |

— |

— |

110.6 |

— |

||||

|

Litigation matter (1) |

13.7 |

— |

13.7 |

— |

||||

|

Loss/(gain) on extinguishment of debt |

0.3 |

0.2 |

2.4 |

(1.5) |

||||

|

December 2023 Argentina Economic Reform (1) |

— |

— |

22.0 |

— |

||||

|

Settlement loss on US pension annuity buy out (1) |

— |

50.2 |

— |

50.2 |

||||

|

Total adjustments, pre-tax |

$ 55.1 |

$ 86.9 |

$ 259.3 |

$ 108.4 |

||||

|

Total adjustments, after tax |

$ 41.7 |

$ 67.1 |

$ 203.2 |

$ 83.5 |

||||

|

Adjusted net earnings (2) |

$ 89.3 |

$ 86.8 |

$ 241.3 |

$ 224.0 |

||||

|

Diluted net earnings per common share |

$ 0.65 |

$ 0.27 |

$ 0.52 |

$ 1.94 |

||||

|

Adjustments |

||||||||

|

Restructuring and related costs |

$ 0.28 |

$ 0.40 |

$ 0.97 |

$ 0.64 |

||||

|

Network transition costs |

0.12 |

— |

0.12 |

— |

||||

|

Acquisition and integration |

0.02 |

— |

0.08 |

— |

||||

|

Impairment of intangible assets |

— |

— |

1.16 |

— |

||||

|

Litigation matter |

0.14 |

— |

0.14 |

— |

||||

|

Loss/(gain) on extinguishment of debt |

0.01 |

— |

0.03 |

(0.02) |

||||

|

December 2023 Argentina Economic Reform |

— |

— |

0.30 |

— |

||||

|

Settlement loss on pension plan terminations |

— |

0.53 |

— |

0.53 |

||||

|

Adjusted diluted net earnings per diluted common share |

$ 1.22 |

$ 1.20 |

$ 3.32 |

$ 3.09 |

||||

|

Weighted average shares of common stock – Diluted |

73.0 |

72.6 |

72.7 |

72.4 |

||||

|

(1) |

See Supplemental Schedules – Non-GAAP Reconciliation for where these costs are recorded on the unaudited Consolidated (Condensed) Statement of Earnings. |

|

(2) |

The Effective tax rate for the Adjusted – Non-GAAP Net Earnings and Diluted EPS for the quarters ended September 30, 2024 and 2023 was 22.1% and 20.7%, respectively, and for the twelve months ended September 30, 2024 and 2023 was 22.9% and 21.2%, respectively, as calculated utilizing the statutory rate for where the costs were incurred. |

|

Energizer Holdings, Inc. |

||||||||

|

For the Quarter Ended |

Prior Quarter Ended |

|||||||

|

September 30, 2024 |

% Change |

% Change |

||||||

|

As Reported |

Impact of Currency(1) |

Currency Neutral |

September 30, 2023 |

As Reported Basis |

Currency Neutral Basis |

|||

|

As Reported under GAAP |

||||||||

|

Diluted net earnings per common share |

$ 0.65 |

$ (0.04) |

$ 0.69 |

$ 0.27 |

140.7 % |

155.6 % |

||

|

Net earnings |

$ 47.6 |

$ (2.8) |

$ 50.4 |

$ 19.7 |

141.6 % |

155.8 % |

||

|

As Adjusted (non-GAAP)(2) |

||||||||

|

Adjusted diluted net earnings per common share |

$ 1.22 |

$ (0.04) |

$ 1.26 |

$ 1.20 |

1.7 % |

5.0 % |

||

|

Adjusted EBITDA |

$ 187.3 |

$ (3.7) |

$ 191.0 |

$ 185.4 |

1.0 % |

3.0 % |

||

|

For the Twelve Months Ended |

Prior Twelve Months Ended |

|||||||

|

September 30, 2024 |

% Change |

% Change |

||||||

|

As Reported |

Impact of Currency(1) |

Currency Neutral |

September 30, 2023 |

As Reported Basis |

Currency Neutral Basis |

|||

|

As Reported under GAAP |

||||||||

|

Diluted net earnings per common share |

$ 0.52 |

$ (0.03) |

$ 0.55 |

$ 1.94 |

(73.2) % |

(71.6) % |

||

|

Net earnings |

$ 38.1 |

$ (1.9) |

$ 40.0 |

$ 140.5 |

(72.9) % |

(71.5) % |

||

|

As Adjusted (non-GAAP)(2) |

||||||||

|

Adjusted diluted net earnings per common share |

$ 3.32 |

$ (0.03) |

$ 3.35 |

$ 3.09 |

7.4 % |

8.4 % |

||

|

Adjusted EBITDA |

$ 612.4 |

$ (2.5) |

$ 614.9 |

$ 597.3 |

2.5 % |

2.9 % |

||

|

(1) |

The Impact of Currency is the change in foreign currency exchange rates year-over-year on reported results, which is calculated by comparing the value of current year foreign operations at the current period USD exchange rate versus the value of current year foreign operations at the prior period USD exchange rate. The impact of currency also includes gains/(losses) of currency hedging programs, and it excludes hyper-inflationary markets. |

|

(2) |

See supplemental schedules – Non-GAAP Reconciliations for full reconciliations of the Company’s non-GAAP adjusted amounts. |

|

Energizer Holdings, Inc. |

|||||||||||||||||||

|

Net Sales |

|||||||||||||||||||

|

Batteries & Lights |

Q1’24 |

% Chg |

Q2’24 |

% Chg |

Q3’24 |

% Chg |

Q4’24 |

% Chg |

FY ’24 |

% Chg |

|||||||||

|

Net sales – prior year |

$ 671.6 |

$ 505.9 |

$ 511.3 |

$ 656.1 |

$ 2,344.9 |

||||||||||||||

|

Organic |

(60.8) |

(9.1) % |

(22.6) |

(4.5) % |

3.2 |

0.6 % |

0.1 |

— % |

(80.1) |

(3.4) % |

|||||||||

|

Change in Argentina operations |

(0.7) |

(0.1) % |

(3.4) |

(0.7) % |

(1.0) |

(0.2) % |

(2.1) |

(0.3) % |

(7.2) |

(0.3) % |

|||||||||

|

Impact of currency |

7.7 |

1.2 % |

1.1 |

0.3 % |

(4.4) |

(0.8) % |

(2.5) |

(0.4) % |

1.9 |

0.1 % |

|||||||||

|

Net sales – current year |

$ 617.8 |

(8.0) % |

$ 481.0 |

(4.9) % |

$ 509.1 |

(0.4) % |

$ 651.6 |

(0.7) % |

$ 2,259.5 |

(3.6) % |

|||||||||

|

Auto Care |

|||||||||||||||||||

|

Net sales – prior year |

$ 93.5 |

$ 178.2 |

$ 188.1 |

$ 155.0 |

$ 614.8 |

||||||||||||||

|

Organic |

4.5 |

4.8 % |

4.2 |

2.4 % |

5.0 |

2.7 % |

0.2 |

0.1 % |

13.9 |

2.3 % |

|||||||||

|

Change in Argentina operations |

(0.2) |

(0.2) % |

(0.2) |

(0.1) % |

(0.1) |

(0.1) % |

(0.1) |

(0.1) % |

(0.6) |

(0.1) % |

|||||||||

|

Impact of currency |

1.0 |

1.1 % |

0.1 |

— % |

(0.7) |

(0.4) % |

(1.0) |

(0.6) % |

(0.6) |

(0.1) % |

|||||||||

|

Net sales – current year |

$ 98.8 |

5.7 % |

$ 182.3 |

2.3 % |

$ 192.3 |

2.2 % |

$ 154.1 |

(0.6) % |

$ 627.5 |

2.1 % |

|||||||||

|

Total Net Sales |

|||||||||||||||||||

|

Net sales – prior year |

$ 765.1 |

$ 684.1 |

$ 699.4 |

$ 811.1 |

$ 2,959.7 |

||||||||||||||

|

Organic |

(56.3) |

(7.4) % |

(18.4) |

(2.7) % |

8.2 |

1.2 % |

0.3 |

— % |

(66.2) |

(2.2) % |

|||||||||

|

Change in Argentina operations |

(0.9) |

(0.1) % |

(3.6) |

(0.5) % |

(1.1) |

(0.2) % |

(2.2) |

(0.3) % |

(7.8) |

(0.3) % |

|||||||||

|

Impact of currency |

8.7 |

1.2 % |

1.2 |

0.2 % |

(5.1) |

(0.7) % |

(3.5) |

(0.4) % |

1.3 |

— % |

|||||||||

|

Net sales – current year |

$ 716.6 |

(6.3) % |

$ 663.3 |

(3.0) % |

$ 701.4 |

0.3 % |

$ 805.7 |

(0.7) % |

$ 2,887.0 |

(2.5) % |

|||||||||

|

Segment Profit |

|||||||||||||||||||

|

Batteries & Lights |

Q1’24 |

% Chg |

Q2’24 |

% Chg |

Q3’24 |

% Chg |

Q4’24 |

% Chg |

FY ’24 |

% Chg |

|||||||||

|

Segment Profit – prior year |

$ 138.3 |

$ 114.5 |

$ 121.9 |

$ 176.8 |

$ 551.5 |

||||||||||||||

|

Organic |

(6.8) |

(4.9) % |

2.1 |

1.8 % |

13.0 |

10.7 % |

5.7 |

3.2 % |

14.0 |

2.5 % |

|||||||||

|

Change in Argentina operations |

1.0 |

0.7 % |

(2.2) |

(1.9) % |

(1.5) |

(1.2) % |

(2.5) |

(1.4) % |

(5.2) |

(0.9) % |

|||||||||

|

Impact of currency |

(0.1) |

(0.1) % |

(0.9) |

(0.8) % |

(4.0) |

(3.3) % |

(0.5) |

(0.3) % |

(5.5) |

(1.0) % |

|||||||||

|

Segment Profit – current year |

$ 132.4 |

(4.3) % |

$ 113.5 |

(0.9) % |

$ 129.4 |

6.2 % |

$ 179.5 |

1.5 % |

$ 554.8 |

0.6 % |

|||||||||

|

Auto Care |

|||||||||||||||||||

|

Segment Profit – prior year |

$ 10.6 |

$ 29.4 |

$ 17.4 |

$ 17.6 |

$ 75.0 |

||||||||||||||

|

Organic |

(4.6) |

(43.4) % |

10.9 |

37.1 % |

9.9 |

56.9 % |

3.2 |

18.2 % |

19.4 |

25.9 % |

|||||||||

|

Change in Argentina operations |

— |

— % |

— |

— % |

(0.1) |

(0.6) % |

(0.1) |

(0.6) % |

(0.2) |

(0.3) % |

|||||||||

|

Impact of currency |

0.9 |

8.5 % |

0.1 |

0.3 % |

(0.4) |

(2.3) % |

(0.7) |

(4.0) % |

(0.1) |

(0.1) % |

|||||||||

|

Segment Profit – current year |

$ 6.9 |

(34.9) % |

$ 40.4 |

37.4 % |

$ 26.8 |

54.0 % |

$ 20.0 |

13.6 % |

$ 94.1 |

25.5 % |

|||||||||

|

Total Segment Profit |

|||||||||||||||||||

|

Segment Profit – prior year |

$ 148.9 |

$ 143.9 |

$ 139.3 |

$ 194.4 |

$ 626.5 |

||||||||||||||

|

Organic |

(11.4) |

(7.7) % |

13.0 |

9.0 % |

22.9 |

16.4 % |

8.9 |

4.6 % |

33.4 |

5.3 % |

|||||||||

|

Change in Argentina operations |

1.0 |

0.7 % |

(2.2) |

(1.5) % |

(1.6) |

(1.1) % |

(2.6) |

(1.3) % |

(5.4) |

(0.9) % |

|||||||||

|

Impact of currency |

0.8 |

0.6 % |

(0.8) |

(0.6) % |

(4.4) |

(3.2) % |

(1.2) |

(0.7) % |

(5.6) |

(0.8) % |

|||||||||

|

Segment Profit – current year |

$ 139.3 |

(6.4) % |

$ 153.9 |

6.9 % |

$ 156.2 |

12.1 % |

$ 199.5 |

2.6 % |

$ 648.9 |

3.6 % |

|||||||||

|

Energizer Holdings, Inc. |

||||||||||||

|

Gross Profit |

Q1’24 |

Q2’24 |

Q3’24 |

Q4’24 |

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

2024 |

2023 |

||

|

Net Sales |

$716.6 |

$663.3 |

$701.4 |

$805.7 |

$765.1 |

$684.1 |

$699.4 |

$811.1 |

$2,887.0 |

$2,959.7 |

||

|

Reported Cost of products sold |

449.6 |

410.0 |

424.2 |

498.9 |

466.8 |

430.8 |

434.3 |

503.8 |

1,782.7 |

1,835.7 |

||

|

Gross profit |

$267.0 |

$253.3 |

$277.2 |

$306.8 |

$298.3 |

$253.3 |

$265.1 |

$307.3 |

$1,104.3 |

$1,124.0 |

||

|

Gross margin |

37.3 % |

38.2 % |

39.5 % |

38.1 % |

39.0 % |

37.0 % |

37.9 % |

37.9 % |

38.3 % |

38.0 % |

||

|

Adjustments |

||||||||||||

|

Restructuring and related costs |

12.8 |

15.5 |

13.4 |

21.2 |

0.3 |

5.7 |

6.5 |

17.4 |

62.9 |

29.9 |

||

|

Network transition costs |

— |

— |

— |

11.7 |

— |

— |

— |

— |

11.7 |

— |

||

|

Acquisition and integration costs |

2.9 |

— |

0.2 |

— |

— |

— |

— |

— |

3.1 |

— |

||

|

Cost of products sold – adjusted |

433.9 |

394.5 |

410.6 |

466.0 |

466.5 |

425.1 |

427.8 |

486.4 |

1,705.0 |

1,805.8 |

||

|

Adjusted Gross profit |

$282.7 |

$268.8 |

$290.8 |

$339.7 |

$298.6 |

$259.0 |

$271.6 |

$324.7 |

$1,182.0 |

$1,153.9 |

||

|

Adjusted Gross margin |

39.5 % |

40.5 % |

41.5 % |

42.2 % |

39.0 % |

37.9 % |

38.8 % |

40.0 % |

40.9 % |

39.0 % |

||

|

SG&A |

Q1’24 |

Q2’24 |

Q3’24 |

Q4’24 |

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

2024 |

2023 |

||

|

Reported SG&A |

$128.1 |

$122.5 |

$129.6 |

$146.1 |

$120.4 |

$118.3 |

$116.1 |

$134.6 |

$526.3 |

$489.4 |

||

|

Reported SG&A % of Net Sales |

17.9 % |

18.5 % |

18.5 % |

18.1 % |

15.7 % |

17.3 % |

16.6 % |

16.6 % |

18.2 % |

16.5 % |

||

|

Adjustments |

||||||||||||

|

Restructuring and related costs |

9.6 |

7.9 |

9.8 |

7.1 |

6.3 |

1.8 |

2.8 |

19.1 |

34.4 |

30.0 |

||

|

Acquisition and integration costs |

0.7 |

0.7 |

1.4 |

2.3 |

— |

— |

— |

— |

5.1 |

— |

||

|

Litigation matter |

— |

— |

— |

13.7 |

— |

— |

— |

— |

13.7 |

— |

||

|

SG&A Adjusted – subtotal |

$117.8 |

$113.9 |

$118.4 |

$123.0 |

$114.1 |

$116.5 |

$113.3 |

$115.5 |

$473.1 |

$459.4 |

||

|

SG&A Adjusted % of Net Sales |

16.4 % |

17.2 % |

16.9 % |

15.3 % |

14.9 % |

17.0 % |

16.2 % |

14.2 % |

16.4 % |

15.5 % |

||

|

Other items, net |

Q1’24 |

Q2’24 |

Q3’24 |

Q4’24 |

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

2024 |

2023 |

||

|

Interest income |

$(5.6) |

$(2.4) |

$(1.4) |

$(1.3) |

$(0.2) |

$(1.1) |

$(0.4) |

$(7.2) |

$(10.7) |

$(8.9) |

||

|

Foreign currency exchange gain/(loss) |

2.7 |

5.9 |

(0.3) |

2.8 |

(1.0) |

4.5 |

5.1 |

8.7 |

11.1 |

17.3 |

||

|

Pension benefit other than service costs |

1.0 |

1.0 |

1.1 |

0.9 |

0.7 |

0.6 |

0.7 |

0.7 |

4.0 |

2.7 |

||

|

Other |

0.9 |

— |

— |

1.3 |

(0.9) |

(3.2) |

— |

0.1 |

2.2 |

(4.0) |

||

|

Other items, net – Adjusted |

$(1.0) |

$4.5 |

$(0.6) |

$3.7 |

$(1.4) |

$0.8 |

$5.4 |

$2.3 |

$6.6 |

$7.1 |

||

|

Settlement loss on US pension annuity buy out |

— |

— |

— |

— |

— |

— |

— |

50.2 |

— |

50.2 |

||

|

Acquisition and integration – TSA income |

(1.0) |

— |

— |

— |

— |

— |

— |

— |

(1.0) |

— |

||

|

December 2023 Argentina Economic Reform |

21.0 |

1.0 |

— |

— |

— |

— |

— |

— |

22.0 |

— |

||

|

Gain on sale of real estate (restructuring) |

— |

— |

(3.7) |

(0.7) |

— |

— |

— |

— |

(4.4) |

— |

||

|

Restructuring and related costs |

— |

— |

(0.7) |

(0.5) |

— |

— |

(0.2) |

— |

(1.2) |

(0.2) |

||

|

Total Other items, net |

$19.0 |

$5.5 |

$(5.0) |

$2.5 |

$(1.4) |

$0.8 |

$5.2 |

$52.5 |

$22.0 |

$57.1 |

||

|

Restructuring and related costs |

Q1’24 |

Q2’24 |

Q3’24 |

Q4’24 |

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

2024 |

2023 |

||

|

Cost of products sold |