Tevogen Bio Reports Third Quarter 2024 Financial Results; Highlights Significantly Improved Financial Position, Unreported Asset Value on Balance Sheets, Efficient Business Model

- Improved operating performance by reducing net loss by $52.5 million; reported net loss of $4.3 million and $56.8 million for the nine months ended September 30, for 2024 and 2023, respectively.

- Significantly improved financial position by eliminating nearly all of its liabilities; reported $10.5 million as of September 30, 2024, and $99.9 million as of December 31, 2023.

- $10 billion+, representing Tevogen’s IP and product assets based on internal discounted cash flow models, is not reflected on the company balance sheet. Similarly, Tevogen’s AI assets, a critical component of its innovation platform, remain unreported on company balance sheet.

- Sufficient available capital to fund operations for the next 33 months, supported by a loan agreement.

- Approximately 78% of equity retained by Tevogen officers.

WARREN, N.J., Nov. 19, 2024 (GLOBE NEWSWIRE) — Tevogen Bio (“Tevogen” or “Tevogen Bio Holdings Inc.”) TVGN, a clinical-stage specialty immunotherapy biotech developing off-the-shelf, genetically unmodified T cell therapeutics to treat infectious disease and cancers, has announced financial results for the fiscal quarter ending September 30, 2024, and filed its quarterly report on Form 10-Q with the Securities and Exchange Commission.

Tevogen’s internally developed intellectual property and product assets, valued internally at $10 billion+ using discounted cash flow models, are not reflected on the balance sheet. Due to US GAAP accounting rules, the company was unable to report the fair market value of its assets, including proprietary immunotherapy technologies and cutting-edge artificial intelligence platforms. The company believes that the inclusion of Tevogen’s IP assets on its balance sheet would significantly enhance its enterprise value.

Tevogen reiterated its confidence in its financial stability, confirming sufficient available capital to fund operations for at least the next 33 months, supported by a loan agreement, which Tevogen entered into in June. Additionally, Tevogen eliminated almost all of its liabilities which were $99.9 million as reported at December 31, 2023 and now are $10.5 million as reported at September 30, 2024.

Kirti Desai, CPA, Tevogen’s CFO, commented, “The company is in a unique position as it relates to reporting intangible assets on our balance sheet. Tevogen has multiple granted patents, which were developed internally, and as per US GAAP rules, these internally developed intangible assets are not reported on the balance sheet as they do not have an acquisition price. This is significantly different than IP obtained through acquisition which can be capitalized as a noncurrent asset on the balance sheet and subsequently amortized like an intangible asset.”

Dr. Ryan Saadi, Founder and CEO of Tevogen Bio added, “The lack of an established market price to assign fair value of our highly appraised internally developed assets on our balance sheet, marks a distinct difference from similar cell therapy companies, such as Gilead and Bristol-Myers Squibb, which are able to capitalize similar assets acquired through multibillion-dollar acquisitions.”

Commenting on the company’s performance and unique ownership structure, Dr. Saadi concluded, “Tevogen’s leadership stands apart in the biotech sector, with approximately 78% of equity retained by our officers, an extraordinary figure compared to the industry average of just 4%. In addition to our officers, our key employees have also been granted substantial restricted stock units in the company, reflecting our belief that our employees should also be owners of our success.”

About Tevogen Bio

Tevogen is a clinical-stage specialty immunotherapy company harnessing one of nature’s most powerful immunological weapons, CD8+ cytotoxic T lymphocytes, to develop off-the-shelf, genetically unmodified precision T cell therapies for the treatment of infectious diseases, cancers, and neurological disorders, aiming to address the significant unmet needs of large patient populations. Tevogen Leadership believes that sustainability and commercial success in the current era of healthcare rely on ensuring patient accessibility through advanced science and innovative business models. Tevogen has reported positive safety data from its proof-of-concept clinical trial, and its key intellectual property assets are wholly owned by the company, not subject to any third-party licensing agreements. These assets include three granted patents, nine pending US and twelve ex-US pending patents, two of which are related to artificial intelligence.

Tevogen is driven by a team of highly experienced industry leaders and distinguished scientists with drug development and global product launch experience. Tevogen’s leadership believes that accessible personalized therapeutics are the next frontier of medicine, and that disruptive business models are required to sustain medical innovation.

Forward Looking Statements

This press release contains certain forward-looking statements, including without limitation statements relating to: expectations regarding the healthcare and biopharmaceutical industries; Tevogen’s development of, the potential benefits of, and patient access to its product candidates for the treatment of infectious diseases, cancer and neurological disorders, including TVGN 489 for the treatment of COVID-19 and Long COVID; Tevogen’s ability to develop additional product candidates, including through use of Tevogen’s ExacTcell platform; the anticipated benefits of ExacTcell; expectations regarding Tevogen’s future clinical trials; and Tevogen’s ability to generate revenue in the future. Forward-looking statements can sometimes be identified by words such as “may,” “could,” “would,” “expect,” “anticipate,” “possible,” “potential,” “goal,” “opportunity,” “project,” “believe,” “future,” and similar words and expressions or their opposites. These statements are based on management’s expectations, assumptions, estimates, projections and beliefs as of the date of this press release and are subject to a number of factors that involve known and unknown risks, delays, uncertainties and other factors not under the company’s control that may cause actual results, performance or achievements of the company to be materially different from the results, performance or other expectations expressed or implied by these forward-looking statements.

Factors that could cause actual results, performance, or achievements to differ from those expressed or implied by forward-looking statements include, but are not limited to: that Tevogen will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; the effect of the recent business combination with Semper Paratus Acquisition Corporation (the “Business Combination”) on Tevogen’s business relationships, operating results, and business generally; the outcome of any legal proceedings that may be instituted against Tevogen; changes in the markets in which Tevogen competes, including with respect to its competitive landscape, technology evolution, or regulatory changes; changes in domestic and global general economic conditions; the risk that Tevogen may not be able to execute its growth strategies or may experience difficulties in managing its growth and expanding operations; the risk that Tevogen may not be able to develop and maintain effective internal controls; costs related to the Business Combination and the failure to realize anticipated benefits of the Business Combination; the failure to achieve Tevogen’s commercialization and development plans and identify and realize additional opportunities, which may be affected by, among other things, competition, the ability of Tevogen to grow and manage growth economically and hire and retain key employees; the risk that Tevogen may fail to keep pace with rapid technological developments to provide new and innovative products and services or make substantial investments in unsuccessful new products and services; the ability to develop, license or acquire new therapeutics; that Tevogen will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; the risk of regulatory lawsuits or proceedings relating to Tevogen’s business; uncertainties inherent in the execution, cost, and completion of preclinical studies and clinical trials; risks related to regulatory review, approval and commercial development; risks associated with intellectual property protection; Tevogen’s limited operating history; and those factors discussed or incorporated by reference in Tevogen’s Annual Report on Form 10-K and subsequent filings with the SEC.

You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Tevogen undertakes no obligation to update any forward-looking statements, except as required by applicable law.

Contacts

Tevogen Bio Communications

T: 1 877 TEVOGEN, Ext 701

Communications@Tevogen.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Dogecoin Gain, Ethereum Drops As BlackRock's ETF Options Volume Breaches $1B On Debut: Analyst Flags 'Opportunity' To Buy ETH Before It Outperforms BTC

Leading cryptocurrencies rose Tuesday with the successful debut of spot Bitcoin BTC/USD exchange-traded funds (ETFs) options.

| Cryptocurrency | Gains +/- | Price (Recorded at 7:45 p.m. ET) |

| Bitcoin BTC/USD | +1.46% | $92,264.28 |

| Ethereum ETH/USD |

-1.96% | $3,112.15 |

| Dogecoin DOGE/USD | +4.77% | $0.3875 |

What Happened: Bitcoin recorded a new all-time high after breaching $94,000. The rally came after Nasdaq listed options for BlackRock’s iShares Bitcoin Trust ETF IBIT for the first time, giving a fillip to institutional adoption of the world’s largest cryptocurrency.

Robert Mitchnick, BlackRock’s head of digital assets, told a panel at the Benzinga Future of Digital Assets conference that the options trading volume breached the 1 billion mark on its first day.

Ethereum wiggled in the $3,100 zone throughout the day. Over the last week, the asset lost nearly 5% of its value, while Bitcoin gained 4.59%.

Total cryptocurrency liquidations reached $293 million in the last 24 hours, with $183 million in bullish bets getting evaporated. .

Bitcoin’s Open Interest (OI) increased by 2.54% in the last 24 hours, indicating opening of new derivatives.

Most of the new positions bet against Bitcoin’s price rise, as Long/Shorts Ratio fell sharply below 1 in the last 24 hours.

The euphoria ebbed considerably, as the reading on the Cryptocurrency Fear and Greed Index dropped from 90 to 83.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 7:45 p.m. ET) |

| Cronos (CRO) | +10.25% | $0.1855 |

| Kaia (KAIA) | +8.04% | $0.1481 |

| Goatseus Maximus (GOAT) | +7.70% | $1.13 |

The global cryptocurrency market capitalization stood at $3.08 trillion, growing by 0.43% in the last 24 hours.

Tech-related stocks moved up Tuesday, bolstered by Nvidia Corp.’s NVDA rally.

The Nasdaq Composite lifted 195.66 points, or 1.04%, to end at 18,987.47. The S&P 500 added 0.40% to close at 5,916.98. Meanwhile, the Dow Jones Industrial Average recorded a second straight day of decline, closing 0.28% lower at 43,268.94.

Shares of Nvidia jumped 4.89% ahead of the company’s highly-anticipated third-quarter earnings report on Wednesday.

Oil prices rose slightly after Ukraine used American-made long-range ATACMS missiles to hit Russia. The U.S. West Texas Intermediate (WTI) traded at $69.53 a barrel, up 0.22%.

See More: Best Cryptocurrency Scanners

Analyst Notes: Popular on-chain analytics firm Santiment noted lower enthusiasm on social media despite Bitcoin smashing past $94,000.

“The lack of euphoria is an encouraging sign, as FOMO typically leads to corrections,” it added.

Santiment stated that as long as retail investors were quiet, whales can pump the market with minimal pushback.

Widely-followed cryptocurrency analyst Ali Martinez raised the possibility of Ethereum outperforming Bitcoin in the days ahead.

“That hasn’t happened yet in the current cycle, but it is certainly on the horizon. As ETH lags behind, there is an opportunity here to buy before it outperforms,” the analyst added.

In terms of price action, Martinez predicted that the second-largest cryptocurrency will reach the middle and upper boundaries of the ascending parallel channel, at $4,000 and $6,000, respectively.

Photo by Avi Rozen on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comcast Stock Climbs on Anticipation of $7B Spinoff of NBCUniversal Cable Networks

Bloomberg / Contributor / Getty Images

-

Comcast shares gained in extended trading Tuesday following a report the company is expected to announce plans Wednesday to spin off its NBCUniversal cable TV networks.

-

The spinoff could mean the separation of assets that generated about $7 billion in revenue in the 12 months ended Sept. 30, the Wall Street Journal reported.

-

The move could help streamline the entertainment and media conglomerate’s operations.

Comcast (CMCSA) shares gained in extended trading Tuesday following a report the entertainment and media conglomerate is expected to announce plans Wednesday to spin off its NBCUniversal cable TV networks.

The move could mean the separation of assets including channels like MSNBC and USA that together generated about $7 billion in revenue in the 12 months ended Sept. 30, the Wall Street Journal reported, citing people familiar with the matter.

The spinoff, which is expected to take about a year to complete, could help streamline the entertainment giant’s operations, and better position NBCUniversal’s remaining assets for growth.

Comcast had acquired a 51% stake in NBCUniversal in 2011, before buying the rest of NBCUniversal for $16.7 billion in 2013.

Mark Lazarus, current chair of NBCUniversal Media Group, is expected to be named CEO of the new company.

Shares of Comcast climbed close to 3% in extended trading Tuesday following the news. They were down about 3.5% from the start of the year through Tuesday’s close.

CORRECTION—Nov. 19, 2024: This article has been corrected to reflect the spinoff could reportedly mean the separation of assets that together generated about $7 billion in revenue in the 12 months ended Sept. 30.

Comcast to proceed with plans to spin off its cable channels, sources say

By Dawn Chmielewski

(Reuters) – Comcast is moving forward with plans to spin off its NBCUniversal cable television networks including MSNBC and CNBC, sources say, shedding a once core part of the business that has been a casualty of the streaming video revolution.

The company last month told investors it was evaluating hiving off its cable networks into a separate company owned by Comcast’s shareholders.

“We think there could be an opportunity to play some offense,” said Comcast President Michael Cavanagh said during the company’s third quarter investor call.

The new venture would be well-capitalized, said one source, who added on Tuesday that it would be positioned to acquire other cable networks if the industry consolidates.

Comcast would retain NBCUniversal’s NBC broadcast television network, its film and television studios and its theme parks, as well as its Peacock streaming service. Comcast also would retain its Xfinity broadband service.

The spinoff would be comprised of the cable news outlets and other cable networks, such as USA, E!, Syfy and the Golf Channel, according to the Wall Street Journal, which first reported the decision.

These still-profitable networks generated about $7 billion in revenue over the last 12 months, the Journal reported.

The cable networks were an attractive lure when Comcast completed its takeover of NBC Universal in 2011, but the rise in popularity of streaming services has eroded cable TV subscriptions and viewership.

In August, Warner Bros Discovery wrote down the value of its television assets by $9 billion. Paramount Global followed suit, taking a $5.98 billion charge for its television networks that same month. Walt Disney evaluated shedding its cable networks earlier this year, but ultimately rejected the idea.

(Reporting by Dawn Chmielewski in Los Angeles, editing by Peter Henderson, Michael Perry)

As Tesla Rides Trump Rally, Cathie Wood Sells $15.4M Worth Of Stock

On Tuesday, Cathie Wood-led Ark Invest made a notable move by offloading a significant number of shares in Tesla Inc TSLA. This decision comes amidst a surge in Tesla’s stock, fueled by reports of the incoming administration’s plans to ease restrictions on self-driving vehicles.

The TSLA Trade

Ark Invest’s decision to sell Tesla shares coincides with a period of significant growth for the electric vehicle giant. The company’s stock has been on an upward trajectory, largely due to reports suggesting that President-elect Donald Trump’s administration intends to prioritize a federal framework for autonomous vehicles. Such a move could potentially simplify the operation of self-driving cars, providing a significant boost to companies like Tesla.

According to data provided, Ark Invest sold 44,520 shares of Tesla on Tuesday. Given the closing price of $346 per share, the total value of the trade amounts to approximately $15.4 million. The trade was made through the ARK Innovation ETF ARKK.

Meanwhile, CNBC host Jim Cramer supports owning Tesla stock but dismisses reports of Trump easing self-driving regulations as a “bad reason” to buy. He highlights Tesla’s strength as a tech company with high valuation potential beyond regulatory changes.

Other Key Trades:

- Ark purchased Intellia Therapeutics Inc. (NTLA) and Tempus AI Inc. (TEM) stock on Tuesday.

- The firm sold stock of Rocket Lab USA Inc. (RKLB) and of Markforged Holding Corp. (MKFG).

- Ark also sold Senti Biosciences Inc (SNTI) and Nurix Therapeutics Inc (NRIX) stock.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Emmaus Life Sciences Reports Improved Quarterly Financial Results

TORRANCE, Calif., Nov. 19, 2024 /PRNewswire/ — Emmaus Life Sciences, Inc. (OTCQB: EMMA), a commercial-stage biopharmaceutical company and leader in the treatment of sickle cell disease, today reported on its financial condition and results of operations as of and for the three and nine months ended September 30, 2024.

Highlights

“We are pleased to report that we were able to resume inventory production and fulfill back orders in August which led to increases of $0.5 million, or 9%, and $0.8 million, or over 3000%, in net revenues and income from operations, respectively, as compared to the same period a year earlier and net income of $1.8 million, an increase of 2,626% as compared to Q3 2023,” commented Willis Lee, Chairman and Chief Executive Officer of Emmaus. “We expect net revenues and income from operations to stabilize in Q4. Due to the inventory shortages we suffered earlier this year, net revenues for the nine months ended September 30 decreased 41% as compared to 2023 and we realized a loss from operations as compared to income from operations in the prior year. We expect results of operations for the full year to be materially lower than in 2023 for the same reason. Our Endari U.S. sales in Q3 may have been adversely affected by the launch in July of a competing generic L-Glutamine Oral Powder, and we are continuing to assess the possible effect on future Endari sales and net revenues and steps to bolster Endari sales,” he added.

Financial and Operating Results

Net Revenues. Net revenues for the three months ended September 30 were $5.5 million, compared to $5.0 million in the same period in 2023. The increase was due to an increase in sales in the Middle East North Africa region, partially offset by a decrease in U.S. sales which management attributes to competition from a generic product.

Operating Expenses. Total operating expenses for the three months were $4.3 million compared to $4.8 million in the comparable period in 2023. The decrease was due primarily to a decrease in clinical research organization expenses. Total operating expenses for the nine months were $13.8 million compared to $19.2 million in the comparable period in 2023. The decrease was due primarily to a $2.3 million decrease in payroll expenses including share-based compensation.

Income (Loss) From Operations. We realized income from operations for the three months of $0.8 million compared to income from operations of $0.02 million in the same period in 2023. The increase was due to the $0.5 million increase in net revenues and $0.5 million decrease in operating expenses. We recorded a $1.3 million loss from operations for the nine months ended September 30, 2024 compared to $2.2 million of income from operations for the same period last year. The decrease resulted from the $9.2 million decrease in net revenues, partially offset by the $5.4 million decrease in operating expenses.

Other Income (Expense). The company realized other income of $1.0 million for the three months compared to $0.08 million in the same period in 2023. The increase was due primarily to decreases of $0.7 million in foreign exchange loss, $0.6 million in interest expense and $0.6 million in loss on debt extinguishment, partially offset by a decrease of $0.4 million in change in fair value of conversion feature derivative liabilities. Other expense for the nine months ended September 30, 2024 decreased to $3.3 million from $7.1 million in the same period in 2023 due primarily to an increase of $1.0 million in gain on restructured debt and decreases of $3.2 million in foreign exchange loss and $1.0 million in interest expenses, partially offset by an increase of $2.2 million in change in fair value of conversion feature derivative liabilities from a $2.1 million decrease in 2023 to a $0.1 million increase in 2024.

Net Income (Loss). For the three months, the company realized net income of $1.8 million, or $0.03 per share based on approximately 63.9 million weighted average basic common shares, compared to net income of $0.07 million, or $0.00 per share based on approximately 53.6 million weighted average basic common shares in the comparable period in 2023. The increase in net income was primarily attributable to the increases in income from operations and other income. For the nine months ended September 30, 2024, the company reported a net loss of $4.7 million, or $0.07 per share, based on approximately 63.0 million weighted average basic common shares. This compares to a net loss of $4.9 million, or $0.09 per share, based on approximately 52.4 million weighted average basic common shares for the nine months ended September 30, 2023. The decrease was primarily due to the decreases of $5.4 million in operating expenses and $3.7 million in other expenses, partially offset by the decrease in net revenues of $9.2 million.

Liquidity and Capital Resources. At September 30, 2024, the company had cash and cash equivalents of $1.3 million, compared to $2.5 million at December 31, 2023.

About Emmaus Life Sciences

Emmaus Life Sciences, Inc. is a commercial-stage biopharmaceutical company and leader in the treatment of sickle cell disease. Endari® (L-glutamine oral powder), indicated to reduce the acute complications of sickle cell disease in adults and children 5 years and older, is approved for marketing in the United States, Israel, Kuwait, Qatar, the United Arab Emirates, Bahrain and Oman and is available on a named patient or early access basis in France, the Netherlands, and the Kingdom of Saudi Arabia, where Emmaus’ application for marketing authorization is awaiting final action by the Saudi Food & Drug Authority. For more information, please visit www.emmausmedical.com.

About Endari® (prescription grade L-glutamine oral powder)

Endari®, Emmaus’ prescription grade L-glutamine oral powder, was approved by the U.S. Food and Drug Administration (FDA) in July 2017 for treating sickle cell disease in adult and pediatric patients five years of age and older.

Indication

Endari® is indicated to reduce the acute complications of sickle cell disease in adult and pediatric patients five years of age and older.

Important Safety Information

The most common adverse reactions (incidence >10 percent) in clinical studies were constipation, nausea, headache, abdominal pain, cough, pain in extremities, back pain, and chest pain.

Adverse reactions leading to treatment discontinuation included one case each of hypersplenism, abdominal pain, dyspepsia, burning sensation, and hot flash.

The safety and efficacy of Endari® in pediatric patients with sickle cell disease younger than five years of age has not been established.

For more information, please see full Prescribing Information of Endari® at: www.ENDARIrx.com/PI.

About Sickle Cell Disease

There are approximately 100,000 people living with sickle cell disease (SCD) in the United States and millions more globally. The sickle gene is found in every ethnic group, not just among those of African descent; and in the United States an estimated 1-in-365 African Americans and 1-in-16,300 Hispanic Americans are born with SCD.1 The genetic mutation responsible for SCD causes an individual’s red blood cells to distort into a “C” or a sickle shape, reducing their ability to transport oxygen throughout the body. These sickled red blood cells break down rapidly, become very sticky, and develop a propensity to clump together, which causes them to become stuck and cause damage within blood vessels. The result is reduced blood flow to distal organs, which leads to physical symptoms of incapacitating pain, tissue and organ damage, and early death.2

1Source: Data & Statistics on Sickle Cell Disease – National Center on Birth Defects and Developmental Disabilities, Centers for Disease Control and Prevention, December 2020.

2Source: Committee on Addressing Sickle Cell Disease – A Strategic Plan and Blueprint for Action — National Academy of Sciences Press, 2020.

Forward-looking Statements

This press release contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended, including statements regarding the expected net revenues for the full year 2024 and the possible effect on Endari sales and net revenues of the introduction of competing generic drugs. These forward-looking statements are subject to numerous assumptions, risks and uncertainties which change over time, including the company’s need to restructure or refinance its existing indebtedness and raise additional funds from related-party loans, third-party loans or other financing to meet its current liabilities and fund its business and operations and doubt about the company’s ability to continue as a going concern and other factors disclosed in the company’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Reports on Form 10-Q for the quarter ended September 30, 2024, and actual results may differ materially. Such forward-looking statements speak only as of the date they are made, and Emmaus assumes no duty to update them, except as may be required by law.

Company Contact:

Emmaus Life Sciences, Inc.

Investor Relations

(310) 214-0065

IR@emmauslifesciences.com

(Financial Tables Follow)

|

Emmaus Life Sciences, Inc. |

|||||||

|

Three Months Ended September 30 |

Nine Months Ended September 30 |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Revenues, Net |

$5,478 |

$5,018 |

$13,361 |

$22,530 |

|||

|

Cost of Goods Sold |

394 |

214 |

892 |

1,151 |

|||

|

Gross Profit |

5,084 |

4,804 |

12,469 |

21,379 |

|||

|

Operating Expenses |

4,263 |

4,780 |

13,806 |

19,194 |

|||

|

Income (Loss) from Operations |

821 |

24 |

(1,337) |

2,185 |

|||

|

Total Other Income (Expense) |

1,005 |

81 |

(3,345) |

(7,074) |

|||

|

Net Income (Loss) |

1,827 |

67 |

(4,705) |

(4,942) |

|||

|

Comprehensive Income (Loss) |

3,205 |

(1,322) |

(6,561) |

(3,826) |

|||

|

Net Income (Loss) Per Share |

$0.03 |

$0.00 |

($0.07) |

($0.09) |

|||

|

Weighted Average Common Shares Outstanding |

63,865,571 |

53,637,554 |

63,025,296 |

52,414,903 |

|||

|

Emmaus Life Sciences, Inc. Condensed Consolidated Balance Sheets (In thousands) |

|||

|

As of |

|||

|

September 30, |

December 31, |

||

|

Assets |

|||

|

Current Assets: |

|||

|

Cash and cash equivalents |

$1,255 |

$2,547 |

|

|

Accounts receivable, net |

4,938 |

4,010 |

|

|

Due from factoring of accounts receivable |

54 |

1,514 |

|

|

Inventories, net |

1,610 |

1,711 |

|

|

Prepaid expenses and other current assets |

1,347 |

1,727 |

|

|

Total Current Assets |

9,204 |

11,509 |

|

|

Property and equipment, net |

49 |

59 |

|

|

Right of use assets |

1,719 |

2,337 |

|

|

Investment in convertible bond |

16,059 |

20,978 |

|

|

Other Assets |

312 |

296 |

|

|

Total Assets |

$27,343 |

$35,179 |

|

|

Liabilities and Stockholders’ Deficit |

|||

|

Current Liabilities: |

|||

|

Accounts payable and accrued expenses |

$18,707 |

$16,951 |

|

|

Conversion feature derivative, notes payable |

523 |

451 |

|

|

Notes payable, current portion |

7,915 |

8,215 |

|

|

Convertible notes payable, net of discount |

16,205 |

16,383 |

|

|

Other current liabilities |

20,781 |

19,507 |

|

|

Total Current Liabilities |

64,131 |

61,507 |

|

|

Other long-term liabilities |

16,993 |

21,428 |

|

|

Total Liabilities |

81,124 |

82,935 |

|

|

Stockholders’ Deficit |

(53,781) |

(47,756) |

|

|

Total Liabilities & Stockholders’ Deficit |

$27,343 |

$35,179 |

|

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/emmaus-life-sciences-reports-improved-quarterly-financial-results-302310615.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/emmaus-life-sciences-reports-improved-quarterly-financial-results-302310615.html

SOURCE Emmaus Life Sciences, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Riceland, Hill's Pet Nutrition Announce Sustainably Grown Rice Collaboration

New Program Enables and Incentivizes Rice Growers to Incorporate Sustainable Farming Practices for Environmental Benefits

STUTTGART, Ark., Nov. 19, 2024 /PRNewswire/ — Riceland Foods, Inc. and Hill’s Pet Nutrition announce a new collaboration to incentivize Riceland farmer-members to grow rice using climate-smart practices as part of the 2024 Riceland Carbon Ready™ program.

The Riceland-Hill’s Pet Nutrition Sustainable Rice Program will focus on helping Riceland farmer-members overcome barriers to adopting environmentally-friendly practices. Hill’s Pet Nutrition will receive Scope 3 Greenhouse Gas (GHG) emission reductions that result from the updated farming practices by participating Riceland farmer-members.

Riceland Vice President of Government Affairs & Sustainability Adam Shea said this collaboration will continue the growth and momentum the Riceland’s Carbon Ready™ Program has received since the program launched in 2022.

“While farmers are constantly adapting their production practices to do more with less, the razor-thin margins they are faced with amplify the risk of changing too much, too soon. That’s where programs like the Riceland-Hill’s Pet Nutrition Sustainable Rice program come into play,” Shea said. “The ability to quantify the environmental impact generated through these practices and use them to help our customers achieve their climate goals creates a win-win for everyone involved.”

Riceland’s partnership with Arva Intelligence makes it possible to quantify Scope 3 GHG emission reductions. As a valued partner of the Riceland Carbon Ready™ program, Arva Intelligence will quantify the carbon reductions associated with the various sustainable farm practices in the Riceland-Hill’s Pet Nutrition Sustainable Rice Program to provide the proof points to help Hill’s achieve its goals to reduce their Scope 3 GHG emissions by 42% by 2030.

“Hill’s Pet Nutrition continues to enhance operations to produce high-quality pet nutrition with less environmental impact,” Bas Tabak, senior director of direct procurement for Hill’s Pet Nutrition, said. “We are actively collaborating with our suppliers, like Riceland Foods, to identify ways to lower the carbon footprint across various ingredients, including rice, while also finding ways to support farmers as they transition to environmentally-friendly farming practices.”

The Riceland-Arva Intelligence partnership was established in 2022, and it has been key to the Riceland Carbon Ready™ Program success.

“It is an honor to serve Riceland members and their clients with an impactful sustainability solution that rewards farmers for their environmentally beneficial stewardship and helps companies like Hill’s Pet Nutrition to meet their corporate emission reduction goals,” Arva Co-Founder and CEO Jay McEntire said. “We are proud that Riceland Carbon Ready™ program and partnership has become one of the leading sustainability programs that provides a win-win solution across the supply chain.”

The Riceland Carbon Ready Program™ is the gateway program for the cooperative’s farmer members to become eligible for incentives for sustainable practices on farm. For more information regarding the Riceland- Hill’s Pet Nutrition Sustainable Rice Program partnership and the Riceland Carbon Ready Program™, please contact Ashten Adamson at abadamson@riceland.com.

About Riceland Foods, Inc

Riceland Foods is the world’s largest miller and marketer of rice serving 5,500 farmer members in Arkansas and Missouri. As a farmer-owned cooperative, Riceland stores, transports, processes and markets more than 2.5 million metric tons of grain each year, and its products are sold across the United States and around 25 countries. It’s also one of the Mid-South’s major soybean processors. Riceland products include white, brown and parboiled rice, rice bran oil, soybean meal and oil and feed ingredients. Learn more at: Riceland.com.

About Hill’s Pet Nutrition

Founded more than 75 years ago, Hill’s Pet Nutrition has been committed to providing pets with the best nutrition through extensive research and a scientific understanding of their specific needs. Their team of 220+ veterinarians, PhD nutritionists, and food scientists constantly strive to develop innovative solutions for pet health. Hill’s offers a full line of products, including their Prescription Diet therapeutic nutrition and Science Diet wellness products, which are available at veterinary clinics and pet specialty retailers worldwide. For more information about their products and nutritional philosophy, please visit HillsPet.com.

![]() View original content:https://www.prnewswire.com/news-releases/riceland-hills-pet-nutrition-announce-sustainably-grown-rice-collaboration-302310744.html

View original content:https://www.prnewswire.com/news-releases/riceland-hills-pet-nutrition-announce-sustainably-grown-rice-collaboration-302310744.html

SOURCE Riceland Foods, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gray Capital Report: "Extend-and-Pretend" Has Created a New Wave of Loan Maturities

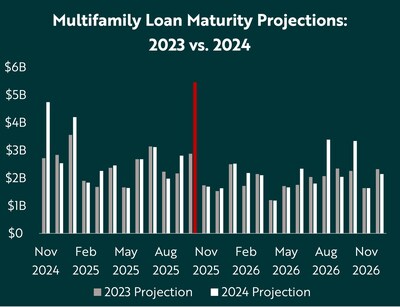

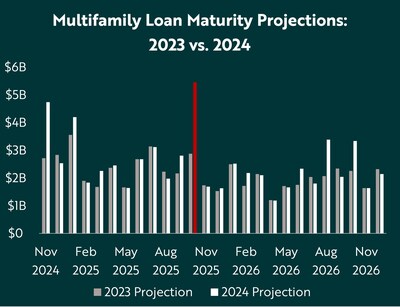

INDIANAPOLIS, Nov. 19, 2024 /PRNewswire/ — Gray Capital, a private equity real estate company, has published a new report on an emerging wave of loan maturities in the multifamily market. Drawing from recent work by the Federal Reserve Bank of New York, Gray Capital’s report highlights the impact of extend-and-pretend practices among borrowers and lenders, in which lenders extended or modified the terms of loans approaching maturity with the goal of avoiding realized losses.

Extend and pretend is coming to an end, and a new wave of multifamily loan maturities is already building.

“Extend and pretend is coming to an end, and as lenders are increasingly incentivized to cease these practices, opportunities to invest in distressed properties will be elevated, but at the individual asset level rather than sector-wide,” says Spencer Gray, President and CEO of Gray Capital.

Gray Capital’s new report follows its previous research on loan maturities in 2023 and helps to explain how the lending market handled last year’s wall of loan maturities and how the blunted effects of 2023’s loan maturity wave have been pushed forward, due in no small part to the loan extensions, accommodations, and workouts commonly referred to as “extend and pretend.”

Based on data from CoStar and the New York Federal Reserve, Gray Capital projects a new wave of loan maturities in late 2025, early 2026.

“Multifamily-specific data from CoStar shows an October 2025 spike in loan maturities that’s 25% larger than the October 2023 surge, which suggests that some of these 2023 loans were extended, contributing to that spike in October 2025,” says Matt Bastnagel, Communications and Marketing Director at Gray Capital.

For multifamily borrowers, improved asset performance and a more active sales market preclude much of the losses they could have faced in 2023, and borrowers will also benefit from lower interest rates expected in 2025 and 2026. Despite these projections, interest rates and property prices will not improve as rapidly as needed for many borrowers, especially those who purchased assets at the market’s peak in 2021-2022.

For additional data on the conditions shaping the market for borrowers, lenders, and investors, download the complete report, and Gray Capital will continue to follow the issue of loan maturities in its future research on the multifamily market. To learn more about Gray Capital, visit www.graycapitalllc.com or follow Gray Capital on LinkedIn, Instagram, and YouTube.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/gray-capital-report-extend-and-pretend-has-created-a-new-wave-of-loan-maturities-302310575.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/gray-capital-report-extend-and-pretend-has-created-a-new-wave-of-loan-maturities-302310575.html

SOURCE Gray Capital

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ZTO Reports Third Quarter 2024 Unaudited Financial Results

Robust Profitability amidst Consumption Mix-shift

Adjusted Net Income Grew 2.0% to RMB2.4 Billion

Parcel Volume Increased 15.9% to 8.7 Billion

SHANGHAI, Nov. 19, 2024 /PRNewswire/ — ZTO Express (Cayman) Inc. ZTO, a leading and fast-growing express delivery company in China (“ZTO” or the “Company”), today announced its unaudited financial results for the third quarter ended September 30, 2024[1]. The Company grew parcel volume by 15.9% year over year while maintaining high quality of service and customer satisfaction. Adjusted net income increased 2.0%[2] to reach RMB2,387.3 million. Cash generated from operating activities was RMB3,112.0 million.

Third Quarter 2024 Financial Highlights

- Revenues were RMB10,675.0 million (US$1,521.2 million), an increase of 17.6% from RMB9,075.9 million in the same period of 2023.

- Gross profit was RMB3,334.8 million (US$475.2 million), an increase of 23.2% from RMB2,706.4 million in the same period of 2023.

- Net income was RMB2,379.0 million (US$339.0 million), an increase of 1.3% from RMB2,349.6 million in the same period of 2023.

- Adjusted EBITDA[3] was RMB3,739.5 million (US$532.9 million), an increase of 8.7% from RMB3,438.6 million in the same period of 2023.

- Adjusted net income was RMB2,387.3 million (US$340.2 million), an increase of 2.0% from RMB2,340.7 million in the same period of 2023.

- Basic and diluted net earnings per American depositary share (“ADS”[4]) were RMB2.98 (US$0.42) and RMB2.90 (US$0.41), an increase of 2.4% and 2.1% from RMB2.91 and RMB2.84 in the same period of 2023, respectively.

- Adjusted basic and diluted earnings per American depositary share attributable to ordinary shareholders[5] were RMB2.99 (US$0.43) and RMB2.91 (US$0.41), an increase of 3.5% and 2.8% from RMB2.89 and RMB2.83 in the same period of 2023, respectively.

- Net cash provided by operating activities was RMB3,112.0 million (US$443.5 million), compared with RMB2,938.1 million in the same period of 2023.

Operational Highlights for Third Quarter 2024

- Parcel volume was 8,723 million, an increase of 15.9% from 7,523 million in the same period of 2023.

- Number of pickup/delivery outlets was over 31,000 as of September 30, 2024.

- Number of direct network partners was over 6,000 as of September 30, 2024.

- Number of self-owned line-haul vehicles was over 10,000 as of September 30, 2024.

- Out of the over 10,000 self-owned trucks, over 9,700 were high capacity 15 to 17-meter-long models as of September 30, 2024, compared to over 9,300 as of September 30, 2023.

- Number of line-haul routes between sorting hubs was over 3,900 as of September 30, 2024, compared to over 3,800 as of September 30, 2023.

- Number of sorting hubs was 95 as of September 30, 2024, among which 91 are operated by the Company and 4 by the Company’s network partners.

|

(1) An investor relations presentation accompanies this earnings release and can be found at http://zto.investorroom.com. |

|

(2) Adjusted net income is a non-GAAP financial measure, which is defined as net income before share-based compensation expense and non-recurring items such as impairment of investments in equity investees, gain/(loss) on disposal of equity investment and subsidiary and corresponding tax impact which management aims to better represent the underlying business operations. |

|

(3) Adjusted EBITDA is a non-GAAP financial measure, which is defined as net income before depreciation, amortization, interest expenses and income tax expenses, and further adjusted to exclude the shared-based compensation expense and non-recurring items such as impairment of investments in equity investees, gain/(loss) on disposal of equity investment and subsidiary which management aims to better represent the underlying business operations. |

|

(4) One ADS represents one Class A ordinary share. |

|

(5) Adjusted basic and diluted earnings per American depositary share attributable to ordinary shareholders is a non-GAAP financial measure. It is defined as adjusted net income attributable to ordinary shareholders divided by weighted average number of basic and diluted American depositary shares, respectively. |

Mr. Meisong Lai, Founder, Chairman and Chief Executive Officer of ZTO, commented, “During the third quarter, ZTO maintained high quality of services and customer satisfaction, and achieved 8.72 billion of parcel volume and 2.39 billion of adjusted net income. Our retail volume increased by over 40% year over year for the quarter as we systematically improved cooperations with various ecommerce platforms for reverse logistics, remote area delivery and premium services. Our strategy to improve volume mix has generated very positive contributions to both revenue and operating margin.”

Mr. Lai added, “For nearly a decade since ZTO took the number one position in the industry, volume leadership has always been one of our key priorities. The recent stimulus policies by the central government sent a very strong signal for its commitment to support China’s economic recovery and long-term growth. In the meantime, the downgrade of consumer spending may still be present for a while before an economic turnaround takes place. Volume leadership is the cornerstone of our business. We are setting plans in motion to maintain high quality of services and customer satisfaction, to regain market share and widen our leadership in parcel volume while achieving a reasonable level of earnings.”

Ms. Huiping Yan, Chief Financial Officer of ZTO, commented, “ZTO’s core express ASP increased 1.8% for this quarter thanks to continued improvements in key accounts’ mix offsetting negative impact from lower per parcel weight and volume incentive increases. Combined unit sorting and transportation costs decreased 8.4%, or 6 cents benefiting from sustained productivity gain initiatives. SG&A as a percentage of revenue remained stable at approximately 5%. Cash flow from operating activities was 3.1 billion, and capital spending was 1.8 billion.”

Ms. Yan added, “The express delivery industry experienced high growth contrary to the soft macroeconomic conditions. We have guided down our annual volume targets based on the visibility we have for the year. The increasing proportion of low-value ecommerce packages presented new challenges to the execution of our overall strategy to achieve continuous and simultaneous growth or improvements in quality of services, volume market share and profit. We are making modifications to rebalance our resource allocation as well as key network pricing approaches to regain volume growth momentum and expand our existing market share lead. Our quality of earnings will remain intact, and we are confident in maintaining our leadership in profitability in the industry.”

Third Quarter 2024 Unaudited Financial Results

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||

|

2023 |

2024 |

2023 |

2024 |

||||||||||||||||

|

RMB |

% |

RMB |

US$ |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||

|

(in thousands, except percentages) |

|||||||||||||||||||

|

Express delivery services |

8,341,620 |

91.9 |

9,812,807 |

1,398,314 |

91.9 |

25,728,807 |

92.6 |

28,928,902 |

4,122,336 |

92.2 |

|||||||||

|

Freight forwarding services |

238,565 |

2.6 |

240,491 |

34,270 |

2.3 |

670,162 |

2.4 |

676,480 |

96,398 |

2.2 |

|||||||||

|

Sale of accessories |

460,870 |

5.1 |

588,233 |

83,823 |

5.5 |

1,297,486 |

4.7 |

1,653,717 |

235,653 |

5.3 |

|||||||||

|

Others |

34,863 |

0.4 |

33,517 |

4,775 |

0.3 |

103,026 |

0.3 |

101,919 |

14,522 |

0.3 |

|||||||||

|

Total revenues |

9,075,918 |

100.0 |

10,675,048 |

1,521,182 |

100.0 |

27,799,481 |

100.0 |

31,361,018 |

4,468,909 |

100.0 |

|||||||||

Total Revenues were RMB10,675.0 million (US$1,521.2 million), an increase of 17.6% from RMB9,075.9 million in the same period of 2023. Revenue from the core express delivery business increased by 18.1% compared to the same period of 2023 driven by a 15.9% growth in parcel volume and a 1.8% increase in unit price. KA revenue including delivery fees from direct sales organizations, established to serve core express KA customers, increased by 122.1% as the proportion of higher-valued parcels such as returned parcels from e-commerce platforms continued to increase. Revenue from freight forwarding services increased by 0.8% compared to the same period of 2023. Revenue from sales of accessories, largely consisted of sales of thermal paper used for digital waybills’ printing, increased by 27.6%. Other revenues were derived mainly from financing services.

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||

|

2023 |

2024 |

2023 |

2024 |

||||||||||||||||

|

RMB |

% of |

RMB |

US$ |

% of |

RMB |

% of |

RMB |

US$ |

% of |

||||||||||

|

revenues |

revenues |

revenues |

revenues |

||||||||||||||||

|

(in thousands, except percentages) |

|||||||||||||||||||

|

Line-haul transportation cost |

3,245,767 |

35.8 |

3,398,007 |

484,212 |

31.8 |

9,627,419 |

34.6 |

10,052,623 |

1,432,487 |

32.1 |

|||||||||

|

Sorting hub operating cost |

2,048,438 |

22.6 |

2,224,206 |

316,947 |

20.8 |

5,996,475 |

21.6 |

6,620,077 |

943,353 |

21.1 |

|||||||||

|

Freight forwarding cost |

221,742 |

2.4 |

226,111 |

32,221 |

2.1 |

626,986 |

2.3 |

631,217 |

89,948 |

2.0 |

|||||||||

|

Cost of accessories sold |

117,036 |

1.3 |

161,648 |

23,035 |

1.5 |

351,164 |

1.3 |

454,788 |

64,807 |

1.5 |

|||||||||

|

Other costs |

736,491 |

8.1 |

1,330,265 |

189,560 |

12.6 |

2,663,160 |

9.5 |

3,644,940 |

519,400 |

11.5 |

|||||||||

|

Total cost of revenues |

6,369,474 |

70.2 |

7,340,237 |

1,045,975 |

68.8 |

19,265,204 |

69.3 |

21,403,645 |

3,049,995 |

68.2 |

|||||||||

Total cost of revenues was RMB7,340.2 million (US$1,046.0 million), an increase of 15.2% from RMB6,369.5 million in the same period last year.

Line-haul transportation cost was RMB3,398.0 million (US$484.2 million), an increase of 4.7% from RMB3,245.8 million in the same period last year. The unit transportation cost decreased 9.7% or 4 cents mainly attributable to better economies of scale and improved load rate through more effective route planning.

Sorting hub operating cost was RMB2,224.2 million (US$316.9 million), an increase of 8.6% from RMB2,048.4 million in the same period last year. The increase primarily consisted of (i) RMB108.0 million (US$15.4 million) increase in labor-associated costs, a net result of wage increases partially offset by automation-driven efficiency improvements and (ii) RMB74.9 million (US$10.7 million) increase in depreciation and amortization costs associated with expansion of automation equipment and facility upgrades to further improve the transit efficiency. With standardization in operating procedures, effective performance evaluation system, sorting hub operating cost per unit decreased 6.4% or 2 cents. As of September 30, 2024, there were 535 sets of automated sorting equipment in service, compared to 482 sets as of September 30, 2023.

Cost of accessories sold was RMB161.6 million (US$23.0 million), increased 38.1% compared with RMB117.0 million in the same period last year.

Other costs were RMB1,330.3 million (US$189.6 million), increased 80.6% from RMB736.5 million in the same period last year, included costs for serving higher-valued enterprise customers which increased by RMB546.8 million (US$77.9 million).

Gross Profit was RMB3,334.8 million (US$475.2 million), increased by 23.2% from RMB2,706.4 million in the same period last year. Gross margin rate improved to 31.2% from 29.8% in the same period last year.

Total Operating Expenses were RMB493.0 million (US$70.3 million), compared to RMB282.8 million in the same period last year.

Selling, general and administrative expenses were RMB544.6 million (US$77.6 million), increased by 25.6% from RMB433.7 million in the same period last year, mainly due to (i) RMB74.1 million (US$10.6 million) change in credit loss provision for financing services, and (ii) disposal losses of RMB41.1 million (US$5.9 million) on fixed assets.

Other operating income, net was RMB51.6 million (US$7.3 million), compared to RMB150.9 million in the same period last year. Other operating income mainly consisted of (i) RMB43.4 million (US$6.2 million) of rental income, and (ii) RMB8.2 million (US$1.2 million) of government subsidies and tax rebates.

Income from operations was RMB2,841.8 million (US$405.0 million), an increase of 17.3% from RMB2,423.6 million for the same period last year. Operating margin rate decreased to 26.6% from 26.7% in the same period last year.

Interest income was RMB238.5 million (US$34.0 million), compared with RMB246.4 million in the same period last year.

Interest expenses was RMB66.4 million (US$9.5 million), compared with RMB83.8 million in the same period last year.

Loss from fair value changes of financial instruments was RMB62.7 million (US$8.9 million), compared with a gain of RMB8.6 million in the same period last year. The large swing in USD and RMB exchange rate near quarter end caused a RMB94.9 million (US$13.5 million) unrealized foreign exchange loss related to cash management products.

Income tax expenses were RMB555.0 million (US$79.1 million) compared to RMB271.4 million in the same period last year. In the third quarter of 2023, Shanghai Zhongtongji Network Technology Co., Ltd.(上海中通吉網絡技術有限公司), a wholly-owned subsidiary of the Company, received an income tax refund of RMB207.1 million for being a “Key Software Enterprise” for the tax year 2022.

Net income was RMB2,379.0 million (US$339.0 million), which increased by 1.3% from RMB2,349.6 million in the same period last year.

Basic and diluted earnings per ADS attributable to ordinary shareholders were RMB2.98 (US$0.42) and RMB2.90 (US$0.41), compared to basic and diluted earnings per ADS of RMB2.91 and RMB2.84 in the same period last year, respectively.

Adjusted basic and diluted earnings per ADS attributable to ordinary shareholders were RMB2.99 (US$0.43) and RMB2.91 (US$0.41), compared with RMB2.89 and RMB2.83 in the same period last year, respectively.

Adjusted net income was RMB2,387.3 million (US$340.2 million), compared with RMB2,340.7 million during the same period last year.

EBITDA[1] was RMB3,731.3 million (US$531.7 million), compared with RMB3,449.5 million in the same period last year.

Adjusted EBITDA was RMB3,729.5 million (US$532.8million), compared to RMB3,438.6 million in the same period last year.

Net cash provided by operating activities was RMB3,112.0 million (US$443.5 million), compared with RMB2,938.1 million in the same period last year.

|

(1) EBITDA is a non-GAAP financial measure, which is defined as net income before depreciation, amortization, interest expenses and income tax expenses which management aims to better represent the underlying business operations. |

Business Outlook

Based on current market and operating conditions, the Company revises its previously stated annual guidance. Parcel volume for 2024 is expected to be in the range of 33.7 billion to 33.9 billion, representing a 11.6% to 12.3% increase year over year. Such estimates represent management’s current and preliminary view, which are subject to change.

Exchange Rate

This announcement contains translation of certain Renminbi amounts into U.S. dollars at specified rates solely for the convenience of readers. Unless otherwise noted, all translations from Renminbi to U.S. dollars were made at the exchange rate of RMB7.0176 to US$1.00, the noon buying rate on September 30, 2024 as set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve Systems.

Use of Non-GAAP Financial Measures

The Company uses EBITDA, adjusted EBITDA, adjusted net income, adjusted net income attributable to ordinary shareholders, and adjusted basic and diluted earnings per American depositary share attributable to ordinary shareholders, each a non-GAAP financial measure, in evaluating ZTO’s operating results and for financial and operational decision-making purposes.

Reconciliations of the Company’s non-GAAP financial measures to its U.S. GAAP financial measures are shown in tables at the end of this earnings release, which provide more details about the non-GAAP financial measures.

The Company believes that such Non-GAAP measures help identify underlying trends in ZTO’s business that could otherwise be distorted by the effect of the related expenses and gains that the Company includes in income from operations and net income. The Company believes that EBITDA, adjusted EBITDA, adjusted net income, adjusted net income attributable to ordinary shareholders and adjusted basic and diluted earnings per American depositary share attributable to ordinary shareholders provide useful information about its operating results, enhance the overall understanding of its past performance and future prospects and allow for greater visibility with respect to key metrics used by ZTO’s management in its financial and operational decision-making.

EBITDA, adjusted EBITDA, adjusted net income, adjusted net income attributable to ordinary shareholders and adjusted basic and diluted earnings per American depositary share attributable to ordinary shareholders should not be considered in isolation or construed as an alternative to net income or any other measure of performance or as an indicator of the Company’s operating performance. Investors are encouraged to compare the historical non-GAAP financial measures to the most directly comparable GAAP measures. EBITDA, adjusted EBITDA, adjusted net income, adjusted net income attributable to ordinary shareholders and adjusted basic and diluted earnings per American depositary share attributable to ordinary shareholders presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to ZTO’s data. ZTO encourages investors and others to review the Company’s financial information in its entirety and not rely on a single financial measure.

Conference Call Information

ZTO’s management team will host an earnings conference call at 7:30 PM U.S. Eastern Time on Tuesday, November 19, 2024 (8:30 AM Beijing Time on November 20, 2024).

Dial-in details for the earnings conference call are as follows:

|

United States: |

1-888-317-6003 |

|

Hong Kong: |

800-963-976 |

|

Mainland China: |

4001-206-115 |

|

Singapore: |

800-120-5863 |

|

International: |

1-412-317-6061 |

|

Passcode: |

0501133 |

Please dial in 15 minutes before the call is scheduled to begin and provide the passcode to join the call.

A replay of the conference call may be accessed by phone at the following numbers until November 26, 2024:

|

United States: |

1-877-344-7529 |

|

International: |

1-412-317-0088 |

|

Passcode: |

1609584 |

Additionally, a live and archived webcast of the conference call will be available at http://zto.investorroom.com.

About ZTO Express (Cayman) Inc.

ZTO Express (Cayman) Inc. ZTO (“ZTO” or the “Company”) is a leading and fast-growing express delivery company in China. ZTO provides express delivery service as well as other value-added logistics services through its extensive and reliable nationwide network coverage in China.

ZTO operates a highly scalable network partner model, which the Company believes is best suited to support the significant growth of e-commerce in China. The Company leverages its network partners to provide pickup and last-mile delivery services, while controlling the mission-critical line-haul transportation and sorting network within the express delivery service value chain.

For more information, please visit http://zto.investorroom.com.

Safe Harbor Statement

This announcement contains statements that may constitute “forward-looking” statements pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “likely to,” and other similar expressions. Among other things, the business outlook and quotations from management in this announcement contain forward-looking statements. ZTO may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”) and The Stock Exchange of Hong Kong Limited (the “HKEX”), in its interim and annual reports to shareholders, in announcements, circulars or other publications made on the website of the HKEX, in press releases and other written materials, and in oral statements made by its officers, directors, or employees to third parties. Statements that are not historical facts, including but not limited to statements about ZTO’s beliefs, plans, and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: risks relating to the development of the e-commerce and express delivery industries in China; its significant reliance on certain third-party e-commerce platforms; risks associated with its network partners and their employees and personnel; intense competition which could adversely affect the Company’s results of operations and market share; any service disruption of the Company’s sorting hubs or the outlets operated by its network partners or its technology system; ZTO’s ability to build its brand and withstand negative publicity, or other favorable government policies. Further information regarding these and other risks is included in ZTO’s filings with the SEC and the HKEX. All information provided in this announcement is as of the date of this announcement, and ZTO does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

|

UNAUDITED CONSOLIDATED FINANCIAL DATA |

|||||||||||

|

Summary of Unaudited Consolidated Comprehensive Income Data: |

|||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

|

2023 |

2024 |

2023 |

2024 |

||||||||

|

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

||||||

|

(in thousands, except for share and per share data) |

|||||||||||

|

Revenues |

9,075,918 |

10,675,048 |

1,521,182 |

27,799,481 |

31,361,018 |

4,468,909 |

|||||

|

Cost of revenues |

(6,369,474) |

(7,340,237) |

(1,045,975) |

(19,265,204) |

(21,403,645) |

(3,049,995) |

|||||

|

Gross profit |

2,706,444 |

3,334,811 |

475,207 |

8,534,277 |

9,957,373 |

1,418,914 |

|||||

|

Operating (expenses)/income: |

|||||||||||

|

Selling, general and administrative |

(433,682) |

(544,573) |

(77,601) |

(1,724,896) |

(2,034,192) |

(289,870) |

|||||

|

Other operating income, net |

150,850 |

51,552 |

7,346 |

443,448 |

400,507 |

57,072 |

|||||

|

Total operating expenses |

(282,832) |

(493,021) |

(70,255) |

(1,281,448) |

(1,633,685) |

(232,798) |

|||||

|

Income from operations |

2,423,612 |

2,841,790 |

404,952 |

7,252,829 |

8,323,688 |

1,186,116 |

|||||

|

Other income/(expenses): |

|||||||||||

|

Interest income |

246,362 |

238,510 |

33,987 |

505,382 |

771,608 |

109,953 |

|||||

|

Interest expense |

(83,801) |

(66,364) |

(9,457) |

(227,729) |

(266,135) |

(37,924) |

|||||

|

Gain/(loss) from fair value changes of |

|||||||||||

|

financial instruments |

8,551 |

(62,699) |

(8,935) |

215,764 |

34,883 |

4,971 |

|||||

|

Gain/(loss) on disposal of equity investees, |

|||||||||||

|

subsidiary and others |

10,838 |

(1,440) |

(205) |

10,074 |

10,694 |

1,524 |

|||||

|

Impairment of investments in equity investees |

– |

– |

– |

– |

(672,816) |

(95,876) |

|||||

|

Foreign currency exchange gain before tax |

4,650 |

(38,174) |

(5,440) |

75,571 |

(17,612) |

(2,510) |

|||||

|

Income before income tax, and share of |

|||||||||||

|

loss in equity method investments |

2,610,212 |

2,911,623 |

414,902 |

7,831,891 |

8,184,310 |

1,166,254 |

|||||

|

Income tax expense |

(271,387) |

(554,959) |

(79,081) |

(1,301,979) |

(1,786,275) |

(254,542) |

|||||

|

Share of gain in equity method investments |

10,785 |

22,378 |

3,189 |

14,732 |

42,751 |

6,092 |

|||||

|

Net income |

2,349,610 |

2,379,042 |

339,010 |

6,544,644 |

6,440,786 |

917,804 |

|||||

|

Net (income)/loss attributable to non- |

|||||||||||

|

controlling interests |

(4,452) |

17,255 |

2,459 |

12,054 |

(6,641) |

(946) |

|||||

|

Net income attributable to ZTO Express |

|||||||||||

|

(Cayman) Inc. |

2,345,158 |

2,396,297 |

341,469 |

6,556,698 |

6,434,145 |

916,858 |

|||||

|

Net income attributable to ordinary |

|||||||||||

|

shareholders |

2,345,158 |

2,396,297 |

341,469 |

6,556,698 |

6,434,145 |

916,858 |

|||||

|

Net earnings per share attributed to |

|||||||||||

|

ordinary shareholders |

|||||||||||

|

Basic |

2.91 |

2.98 |

0.42 |

8.11 |

7.99 |

1.14 |

|||||

|

Diluted |

2.84 |

2.90 |

0.41 |

7.94 |

7.80 |

1.11 |

|||||

|

Weighted average shares used in |

|||||||||||

|

calculating net earnings per ordinary |

|||||||||||

|

share/ADS |

|||||||||||

|

Basic |

807,081,026 |

804,565,579 |

804,565,579 |

808,298,164 |

805,388,468 |

805,388,468 |

|||||

|

Diluted |

838,290,093 |

838,131,679 |

838,131,679 |

839,507,232 |

838,954,568 |

838,954,568 |

|||||

|

Net income |

2,349,610 |

2,379,042 |

339,010 |

6,544,644 |

6,440,786 |

917,804 |

|||||

|

Other comprehensive income/(loss), |

|||||||||||

|

net of tax of nil: |

|||||||||||

|

Foreign currency translation adjustment |

(32,832) |

137,698 |

19,622 |

(174,729) |

20,138 |

2,870 |

|||||

|

Comprehensive income |

2,316,778 |

2,516,740 |

358,632 |

6,369,915 |

6,460,924 |

920,674 |

|||||

|

Comprehensive (income)/loss attributable to |

|||||||||||

|

non-controlling interests |

(4,452) |

17,255 |

2,459 |

12,054 |

(6,641) |

(946) |

|||||

|

Comprehensive income attributable to ZTO |

|||||||||||

|

Express (Cayman) Inc. |

2,312,326 |

2,533,995 |

361,091 |

6,381,969 |

6,454,283 |

919,728 |

|||||

|

Unaudited Consolidated Balance Sheets Data: |

|||||

|

As of |

|||||

|

December 31, |

September 30, |

||||

|

2023 |

2024 |

||||

|

RMB |

RMB |

US$ |

|||

|

(in thousands, except for share data) |

|||||

|

ASSETS |

|||||

|

Current assets: |

|||||

|

Cash and cash equivalents |

12,333,884 |

11,703,151 |

1,667,686 |

||

|

Restricted cash |

686,568 |

32,350 |

4,610 |

||

|

Accounts receivable, net |

572,558 |

782,772 |

111,544 |

||

|

Financing receivables |

1,135,445 |

1,272,992 |

181,400 |

||

|

Short-term investment |

7,454,633 |

11,213,470 |

1,597,907 |

||

|

Inventories |

28,074 |

27,651 |

3,940 |

||

|

Advances to suppliers |

821,942 |

862,789 |

122,946 |

||

|

Prepayments and other current assets |

3,772,377 |

4,162,249 |

593,116 |

||

|

Amounts due from related parties |

148,067 |

99,206 |

14,137 |

||

|

Total current assets |

26,953,548 |

30,156,630 |

4,297,286 |

||

|

Investments in equity investees |

3,455,119 |

2,092,880 |

298,233 |

||

|

Property and equipment, net |

32,181,025 |

33,591,675 |

4,786,775 |

||

|

Land use rights, net |

5,637,101 |

6,097,476 |

868,883 |

||

|

Intangible assets, net |

23,240 |

18,592 |

2,649 |

||

|

Operating lease right-of-use assets |

672,193 |

573,209 |

81,682 |

||

|

Goodwill |

4,241,541 |

4,241,541 |

604,415 |

||

|

Deferred tax assets |

879,772 |

711,368 |

101,369 |

||

|

Long-term investment |

12,170,881 |

13,511,938 |

1,925,436 |

||

|

Long-term financing receivables |

964,780 |

850,440 |

121,187 |

||

|

Other non-current assets |

701,758 |

953,451 |

135,866 |

||

|

Amounts due from related parties-non current |

584,263 |

520,833 |

74,218 |

||

|

TOTAL ASSETS |

88,465,221 |

93,320,033 |

13,297,999 |

||

|

LIABILITIES AND EQUITY |

|||||

|

Current liabilities |

|||||

|

Short-term bank borrowing |

7,765,990 |

10,770,422 |

1,534,773 |

||

|

Accounts payable |

2,557,010 |

2,112,632 |

301,048 |

||

|

Advances from customers |

1,745,727 |

1,662,922 |

236,964 |

||

|

Income tax payable |

333,257 |

316,260 |

45,067 |

||

|

Amounts due to related parties |

234,683 |

154,447 |

22,009 |

||

|

Operating lease liabilities |

186,253 |

166,392 |

23,711 |

||

|

Dividends payable |

1,548 |

1,993,865 |

284,123 |

||

|

Convertible bond |

– |

6,979,057 |

994,508 |

||

|

Other current liabilities |

7,236,716 |

7,126,793 |

1,015,558 |

||

|

Total current liabilities |

20,061,184 |

31,282,790 |

4,457,761 |

||

|

Non-current operating lease liabilities |

455,879 |

374,057 |

53,303 |

||

|

Deferred tax liabilities |

638,200 |

541,115 |

77,108 |

||

|

Convertible bond |

7,029,550 |

– |

– |

||

|

TOTAL LIABILITIES |

28,184,813 |

32,197,962 |

4,588,172 |

||

|

Shareholders’ equity |

|||||

|

Ordinary shares (US$0.0001 par value; 10,000,000,000 shares authorized; |

|||||

|

December 31, 2023; 810,339,182 shares issued and 804,140,620 shares |

|||||

|

outstanding as of September 30, 2024) |

525 |

523 |

75 |

||

|

Additional paid-in capital |

24,201,745 |

24,383,137 |

3,474,569 |

||

|

Treasury shares, at cost |

(510,986) |

(337,541) |

(48,099) |

||

|

Retained earnings |

36,301,185 |

36,715,863 |

5,231,969 |

||

|

Accumulated other comprehensive loss |

(190,724) |

(170,586) |

(24,308) |

||

|

ZTO Express (Cayman) Inc. shareholders’ equity |

59,801,745 |

60,591,396 |

8,634,206 |

||

|

Noncontrolling interests |

478,663 |

530,675 |

75,621 |

||

|

Total Equity |

60,280,408 |

61,122,071 |

8,709,827 |

||

|

TOTAL LIABILITIES AND EQUITY |

88,465,221 |

93,320,033 |

13,297,999 |

||

|

Summary of Unaudited Consolidated Cash Flow Data: |

|||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

|

2023 |

2024 |

2023 |

2024 |

||||||||

|

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

||||||

|

(in thousands) |

|||||||||||

|

Net cash provided by operating activities |

2,938,104 |

3,111,972 |

443,452 |

9,437,682 |

8,623,087 |

1,228,780 |

|||||

|

Net cash used in investing activities |

(4,025,760) |

(1,910,131) |

(272,191) |

(13,433,920) |

(8,955,072) |

(1,276,088) |

|||||

|

Net cash provided by/(used in) financing activities |

2,529,988 |

10,183 |

1,451 |

1,396,265 |

(963,309) |

(137,270) |

|||||

|

Effect of exchange rate changes on cash, cash |

|||||||||||

|

equivalents and restricted cash |

9,459 |

(43,349) |

(6,176) |

105,393 |

(8,272) |

(1,178) |

|||||

|

Net increase/(decrease) in cash, cash equivalents |

|||||||||||

|

and restricted cash |

1,451,791 |

1,168,675 |

166,536 |

(2,494,580) |

(1,303,566) |

(185,756) |

|||||

|

Cash, cash equivalents and restricted cash at |

|||||||||||

|

beginning of period |

8,656,716 |

10,579,069 |

1,507,505 |

12,603,087 |

13,051,310 |

1,859,797 |

|||||

|

Cash, cash equivalents and restricted cash at end of |

|||||||||||

|

period |

10,108,507 |

11,747,744 |

1,674,041 |

10,108,507 |

11,747,744 |

1,674,041 |

|||||

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown in the condensed consolidated statements of cash flows:

|

As of |

|||||

|

September 30, |

September 30, |

||||

|

2023 |

2024 |

||||

|

RMB |

RMB |

US$ |

|||

|

(in thousands) |

|||||

|

Cash and cash equivalents |

9,284,625 |

11,703,151 |

1,667,686 |

||

|

Restricted cash, current |

793,037 |

32,350 |

4,610 |

||

|

Restricted cash, non-current |

30,845 |

12,243 |

1,745 |

||

|

Total cash, cash equivalents and restricted cash |

10,108,507 |

11,747,744 |

1,674,041 |

||

|

Reconciliations of GAAP and Non-GAAP Results |

|||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

|

2023 |

2024 |

2023 |

2024 |

||||||||

|

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

||||||

|

(in thousands, except for share and per share data) |

|||||||||||

|

Net income |

2,349,610 |

2,379,042 |

339,010 |

6,544,644 |

6,440,786 |

917,804 |

|||||

|

Add: |

|||||||||||

|