Earnings Scheduled For November 19, 2024

Companies Reporting Before The Bell

• Star Equity Hldgs STRR is likely to report quarterly loss at $0.32 per share on revenue of $13.15 million.

• EuroDry EDRY is projected to report quarterly loss at $0.23 per share on revenue of $19.14 million.

• S&W Seed SANW is expected to report quarterly loss at $1.40 per share on revenue of $17.00 million.

• GDS Holdings GDS is likely to report quarterly loss at $0.21 per share on revenue of $415.42 million.

• Valvoline VVV is expected to report quarterly earnings at $0.42 per share on revenue of $432.47 million.

• Energizer Hldgs ENR is likely to report quarterly earnings at $1.17 per share on revenue of $805.43 million.

• Jacobs Solutions J is likely to report quarterly earnings at $1.37 per share on revenue of $3.01 billion.

• Kingsoft Cloud Hldgs KC is likely to report quarterly loss at $0.14 per share on revenue of $247.64 million.

• Atour Lifestyle Holdings ATAT is expected to report quarterly earnings at $0.36 per share on revenue of $264.74 million.

• MYT Netherlands Parent MYTE is estimated to report quarterly loss at $0.06 per share on revenue of $203.93 million.

• Lowe’s Companies LOW is expected to report quarterly earnings at $2.82 per share on revenue of $19.94 billion.

• Vipshop Holdings VIPS is projected to report quarterly earnings at $0.33 per share on revenue of $2.91 billion.

• Weibo WB is expected to report quarterly earnings at $0.44 per share on revenue of $435.98 million.

• Walmart WMT is estimated to report quarterly earnings at $0.53 per share on revenue of $167.72 billion.

• Viking Holdings VIK is expected to report quarterly earnings at $0.85 per share on revenue of $1.66 billion.

• Danimer Scientific DNMR is likely to report quarterly loss at $0.20 per share on revenue of $8.57 million.

• Northern Technologies NTIC is likely to report quarterly earnings at $0.19 per share on revenue of $22.50 million.

• Eltek ELTK is likely to report quarterly earnings at $0.31 per share on revenue of $12.40 million.

• Futu Hldgs FUTU is expected to report quarterly earnings at $0.97 per share on revenue of $347.63 million.

• Allot ALLT is estimated to report quarterly loss at $0.03 per share on revenue of $22.80 million.

• Elbit Systems ESLT is likely to report quarterly earnings at $1.86 per share on revenue of $1.61 billion.

• XPeng XPEV is estimated to report quarterly loss at $0.27 per share on revenue of $1.38 billion.

• Amer Sports AS is projected to report quarterly earnings at $0.10 per share on revenue of $1.30 billion.

• Medtronic MDT is projected to report quarterly earnings at $1.25 per share on revenue of $8.27 billion.

• Oaktree Specialty Lending OCSL is estimated to report quarterly earnings at $0.56 per share on revenue of $96.90 million.

Companies Reporting After The Bell

• Workhorse Gr WKHS is projected to report quarterly loss at $0.82 per share on revenue of $4.68 million.

• XP XP is likely to report quarterly earnings at $0.40 per share on revenue of $772.20 million.

• AZEK Co AZEK is likely to report quarterly earnings at $0.27 per share on revenue of $339.99 million.

• Algorhythm Holdings RIME is estimated to report earnings for its third quarter.

• Sociedad Quimica Y Minera SQM is likely to report quarterly earnings at $0.66 per share on revenue of $1.09 billion.

• StoneX Group SNEX is estimated to report quarterly earnings at $2.05 per share on revenue of $462.98 million.

• Kore Group Holdings KORE is estimated to report quarterly loss at $0.63 per share on revenue of $67.90 million.

• ReNew Energy Glb RNW is expected to report quarterly earnings at $0.12 per share on revenue of $313.59 million.

• Qifu Technology QFIN is likely to report quarterly earnings at $1.42 per share on revenue of $588.49 million.

• Star Bulk Carriers SBLK is expected to report quarterly earnings at $0.99 per share on revenue of $305.05 million.

• Powell Industries POWL is likely to report quarterly earnings at $3.55 per share on revenue of $286.49 million.

• La-Z-Boy LZB is estimated to report quarterly earnings at $0.64 per share on revenue of $505.98 million.

• Auna AUNA is projected to report quarterly earnings at $0.21 per share on revenue of $297.67 million.

• Varex Imaging VREX is expected to report quarterly earnings at $0.09 per share on revenue of $200.54 million.

• Keysight Techs KEYS is likely to report quarterly earnings at $1.57 per share on revenue of $1.26 billion.

• ZTO Express (Cayman) ZTO is estimated to report quarterly earnings at $0.41 per share on revenue of $1.48 billion.

• Dolby Laboratories DLB is estimated to report quarterly earnings at $0.70 per share on revenue of $307.94 million.

• Golub Capital BDC GBDC is expected to report quarterly earnings at $0.44 per share on revenue of $234.39 million.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Shares To Climb Over $140+ Levels, Says Technical Analyst Ahead Of Q3 Results: '…Will Have To Beat Street Expectations For The Trend To Continue'

The world’s largest market capitalization company, Nvidia Corp NVDA, will report its September quarter earnings on Wednesday, Nov. 20. The street is keenly waiting for the company to report its financials as its shares have risen 191% year-to-date but declined by 2.5% over the last month.

On a year-to-date basis, Nvidia has outperformed the Nasdaq 100 Index, which grew by 24%, whereas, the technology company has underperformed the index in the last month, following Nasdaq 100’s growth of 0.87%.

What Happened: While many analysts expect good results from the chipmaker, technical analyst, and chief investment officer at NeoTrader, Dr C.K. Narayan says that “the trend is resolute in Nvidia charts.” He expects the stock to trade upwards of $140 per share if the third-quarter financials beat the street expectations.

Earnings Expectations

Nvidia, led by Jensen Huang has forecasted third-quarter revenue of approximately $32.5 billion, driven by strong demand for its Hopper and Blackwell GPUs.

These GPUs are expected to bolster Nvidia’s data center segment. The Blackwell units, priced between $30,000 and $40,000, are in high demand, with production ramping up in the fourth quarter of 2024.

Nvidia is fully supply-constrained on new products, which could limit the potential upside for the current quarter and the company’s outlook, said Joseph Moore, a Morgan Stanley analyst. Morgan Stanley maintains Nvidia as a top pick with an ‘overweight’ rating, raising the price target from $150 to $160.

Also read: Nvidia’s Blackwell Chip Revenue Could Hit $6 Billion Next Quarter: Analyst

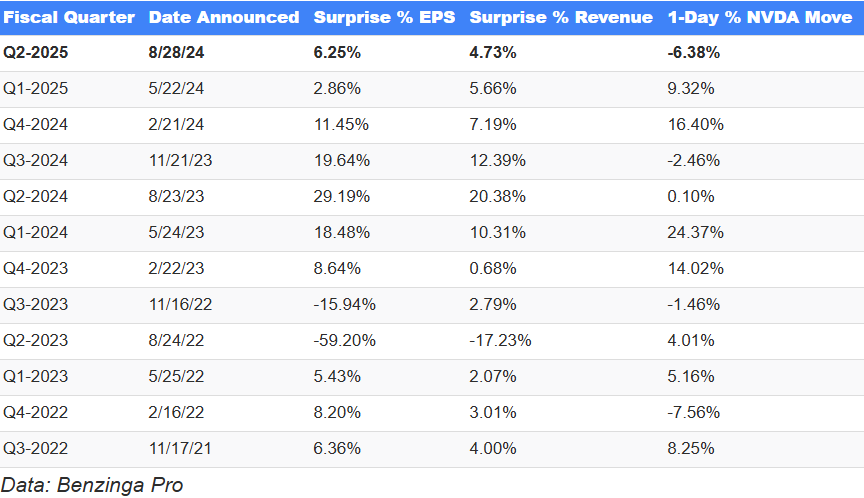

Historical Nvidia Earnings Data

According to a recent Benzinga report and Benzinga Pro data over the last 12 quarters, Nvidia has exceeded earnings-per-share (EPS) expectations 10 times and missed revenue expectations only once.

On average, Nvidia shares moved 5.3% in the single trading day following its earnings release.

The largest 1-day gain followed its first quarter 2024 earnings, when the stock surged 24.4%, while the worst reaction occurred after fourth quarter 2024 results, with a decline of 7.6%.

Here’s a snapshot of the company’s recent earnings performance:

Read next: Why Nvidia Earnings May Trigger Massive S&P 500 Volatility

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitfinex Bitcoin Laundering Case Lands 'Crocodile Of Wall Street' In Jail

Rapper Heather Morgan, known as the ‘Crocodile of Wall Street’, is set to serve 18 months in prison for conspiring with her hacker husband to launder billions of dollars of stolen Bitcoin BTC/USD.

What Happened: Morgan, 34, was sentenced on Monday in a federal court in Washington for her role in the sensational cyberattack on cryptocurrency exchange Bitfinex in 2016, according to a report by Bloomberg. Her spouse and hack mastermind, Ilya Lichtenstein, has already been awarded a five-year sentence.

See Also: Trump SEC Pick Speculation Sends This Altcoin Soaring Past Bitcoin And Ethereum In Daily Gains

Morgan became a well-known figure in Twitter’s (now X) high-finance community for posting obscure rap videos under the moniker “The Crocodile of Wall Street.”

Why It Matters: Morgan and Lichtenstein were charged by the Justice Department in February 2022 in what has been described by authorities as one of the most sophisticated money-laundering operations ever encountered in the cryptocurrency space.

The hack targeted Hong Kong-based exchange Bitfinex in 2016, compromising 36% of the company’s assets. About 119,754 BTCs were stolen in the attack, worth about $71 million at that time and over $11 billion today. By 2022, the couple had successfully laundered around 21% of the stolen funds, worth $14 million at 2016 prices and exceeding $1 billion in 2022.

Authorities recovered over 96% of the stolen Bitcoin, valued at over $6 billion, thanks in part to Lichtenstein’s cooperation following his arrest in 2022.

Last year, the couple pleaded guilty to charges. Morgan, who was not part of the original hack, was enlisted by Lichtenstein to launder the stolen digital currency.

Price Action: At the time of writing, Bitcoin was trading at $91,943.90, up 0.84% in the last 24 hours, according to data from Benzinga Pro.

Photo Courtesy: Shutterstock.com

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

California leaders call for bold solutions to solve State housing crisis at Summit

LOS ANGELES, Nov. 18, 2024 /PRNewswire/ — Top housing industry experts from across the state and nation gathered last month for the Center for California Real Estate’s flagship event of the year, the CCRE Housing Summit: Charting California’s Future. The forum brought together academics, state and local officials, and private sector experts to examine California’s political and socioeconomic landscape, homeownership trends, and strategies to expand housing supply.

Featuring keynotes from Senate President pro Tempore Emeritus Toni G. Atkins and Nobel laureate Dr. Douglas W. Diamond, the forum sparked critical conversations on the state’s housing crisis, drawing hundreds of attendees across California. The event built upon a year of CCRE dialogue on many converging issues around housing — yielding important emerging insights and setting the stage for crucial conversations in 2025.

Key among those shared during the Housing Summit include:

1. California’s affordability crisis demands urgency to expand options for the “missing middle.”

The state’s affordability crisis is described as “the biggest threat to California’s vitality,” according to Tomiquia Moss, California Business, Consumer Services, and Housing Secretary. Moss said that more than two-thirds of Californians today spend over 30 percent of their income on rent, stressing that “housing is foundational to all the other ways in which Californians live our lives,” influencing everything from health to educational outcomes. However, Moss noted that past efforts to address affordability have primarily centered on providing shelter for the elderly and unhoused, leaving little attention to the “missing middle” or first-time homebuyers.

Shane Phillips, Housing Initiative Manager, UCLA Lewis Center for Regional Policy Studies, agreed. “We do need more deed-restricted, affordable housing, but we also need a lot more market-rate housing and pitting these two things against each other has caused us a lot of problems,” Phillips said.

Los Angeles has struggled to deliver adequate supply, particularly for middle-income earners, according to Mary Leslie, President, Los Angeles Business Council & LABC Institute. “We built a lot of market-rate, high-end, and we built some low-income housing, but the middle was a failure—we hit just 3% of [the region’s] RHNA targets.”

Even with these shortages, a recent Los Angeles Times survey revealed a striking perception gap: “74 percent of respondents still believe that homeownership is within reach, despite the reality that, for most, it isn’t,” Leslie added. Policy solutions need to address the full spectrum of housing needs, yet “I do not think there is the political will to reach the scale we need,” said Leslie.

2. Despite persistent racial disparities, state financial support is helping increase homeownership for communities of color.

The panel discussed persistent racial disparities that continue to limit homeownership opportunities for communities of color in California, blocking pathways to generational wealth.

Tara Roche, Project Director, Pew Charitable Trusts’ Housing Policy Initiative, reported a 30-percentage point gap between black and white households when it comes to homeownership. Roche called for more modernization of the rules and regulations to bring more lenders back into this space as policy continues to change around the ways people can access financing. “Across the country, about three- quarters of black home applicants who apply for financing on a manufactured home are denied credit.”

Programs like California’s Dream for All, which provides targeted down payment assistance, are working to address these disparities, and have helped nearly 19,000 households in three years—60% of whom are people of color—qualify for homes with no defaults, said Tiena Johnson Hall, Executive Director, California Housing Finance Agency. “In spite of that imbalance, what we have seen is when we do wonderful things like down payment assistance, that tends to change the cycle.”

3. California’s high costs and complex regulatory landscape are hindering its housing production.

Panelists shared lessons from other states and sector-specific examples to show that easing California’s onerous development regulations can help expand housing options.

Dan Dunmoyer, President & CEO of the California Building Industry Association, emphasized that “the Metroplex of Houston builds more housing than the entire state of California,” where affordable units can cost from $700,000 to a record-breaking $1.2 million per unit, creating financial hurdles that would demand trillions [of dollars] to fully address the state’s housing needs.

Similarly, Jason M. Ward, Co-Director of the RAND Center on Housing and Homelessness, said that hard construction costs are about $140 per square foot in Texas versus $350 in California.

In the accessory dwelling unit (ADU) sector, regulatory reforms have yielded a rapid increase in construction. “When the government removed permit fees and delays, ADUs increased from 2,000 to 18,000 in one year,” said Dunmoyer.

Sujata Srivastava, Chief Policy Officer for the San Francisco Bay Area Planning and Urban Research Association, pointed out the need to shift towards more urban, high-density housing at attainable prices. Nearly all existing models are “suburban, low density”—a format that is ill-suited to California’s evolving housing needs,” Srivastava said.

Full panel sessions are available to watch here, and a full report will be released soon at ccre.us.

About the Center for California Real Estate

The Center for California Real Estate (CCRE), an institute of the California Association of Realtors (C.A.R.), advances knowledge and research by collaborating with varied partners, spurs innovative thinking about key issues facing California and the real estate industry, and extends C.A.R.’s influence via intellectual engagement with different audiences, diverse stakeholders and new external partners.

CCRE serves as a nexus for multi-disciplinary thinking aimed at solving some of the state’s most challenging issues. Bringing together key experts from a variety of fields — from academics and policymakers to industry leaders — CCRE produces new knowledge and serves as a key resource about housing issues for all C.A.R. members, external entities, the media and the public.

About the CALIFORNIA ASSOCIATION OF REALTORS®

Leading the way…® in California real estate for more than 118 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with 180,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/california-leaders-call-for-bold-solutions-to-solve-state-housing-crisis-at-summit-302308916.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/california-leaders-call-for-bold-solutions-to-solve-state-housing-crisis-at-summit-302308916.html

SOURCE CALIFORNIA ASSOCIATION OF REALTORS’ Center for California Real Estate

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

California leaders call for bold solutions to solve State housing crisis at Summit

LOS ANGELES, Nov. 18, 2024 /PRNewswire/ — Top housing industry experts from across the state and nation gathered last month for the Center for California Real Estate’s flagship event of the year, the CCRE Housing Summit: Charting California’s Future. The forum brought together academics, state and local officials, and private sector experts to examine California’s political and socioeconomic landscape, homeownership trends, and strategies to expand housing supply.

Featuring keynotes from Senate President pro Tempore Emeritus Toni G. Atkins and Nobel laureate Dr. Douglas W. Diamond, the forum sparked critical conversations on the state’s housing crisis, drawing hundreds of attendees across California. The event built upon a year of CCRE dialogue on many converging issues around housing — yielding important emerging insights and setting the stage for crucial conversations in 2025.

Key among those shared during the Housing Summit include:

1. California’s affordability crisis demands urgency to expand options for the “missing middle.”

The state’s affordability crisis is described as “the biggest threat to California’s vitality,” according to Tomiquia Moss, California Business, Consumer Services, and Housing Secretary. Moss said that more than two-thirds of Californians today spend over 30 percent of their income on rent, stressing that “housing is foundational to all the other ways in which Californians live our lives,” influencing everything from health to educational outcomes. However, Moss noted that past efforts to address affordability have primarily centered on providing shelter for the elderly and unhoused, leaving little attention to the “missing middle” or first-time homebuyers.

Shane Phillips, Housing Initiative Manager, UCLA Lewis Center for Regional Policy Studies, agreed. “We do need more deed-restricted, affordable housing, but we also need a lot more market-rate housing and pitting these two things against each other has caused us a lot of problems,” Phillips said.

Los Angeles has struggled to deliver adequate supply, particularly for middle-income earners, according to Mary Leslie, President, Los Angeles Business Council & LABC Institute. “We built a lot of market-rate, high-end, and we built some low-income housing, but the middle was a failure—we hit just 3% of [the region’s] RHNA targets.”

Even with these shortages, a recent Los Angeles Times survey revealed a striking perception gap: “74 percent of respondents still believe that homeownership is within reach, despite the reality that, for most, it isn’t,” Leslie added. Policy solutions need to address the full spectrum of housing needs, yet “I do not think there is the political will to reach the scale we need,” said Leslie.

2. Despite persistent racial disparities, state financial support is helping increase homeownership for communities of color.

The panel discussed persistent racial disparities that continue to limit homeownership opportunities for communities of color in California, blocking pathways to generational wealth.

Tara Roche, Project Director, Pew Charitable Trusts’ Housing Policy Initiative, reported a 30-percentage point gap between black and white households when it comes to homeownership. Roche called for more modernization of the rules and regulations to bring more lenders back into this space as policy continues to change around the ways people can access financing. “Across the country, about three- quarters of black home applicants who apply for financing on a manufactured home are denied credit.”

Programs like California’s Dream for All, which provides targeted down payment assistance, are working to address these disparities, and have helped nearly 19,000 households in three years—60% of whom are people of color—qualify for homes with no defaults, said Tiena Johnson Hall, Executive Director, California Housing Finance Agency. “In spite of that imbalance, what we have seen is when we do wonderful things like down payment assistance, that tends to change the cycle.”

3. California’s high costs and complex regulatory landscape are hindering its housing production.

Panelists shared lessons from other states and sector-specific examples to show that easing California’s onerous development regulations can help expand housing options.

Dan Dunmoyer, President & CEO of the California Building Industry Association, emphasized that “the Metroplex of Houston builds more housing than the entire state of California,” where affordable units can cost from $700,000 to a record-breaking $1.2 million per unit, creating financial hurdles that would demand trillions [of dollars] to fully address the state’s housing needs.

Similarly, Jason M. Ward, Co-Director of the RAND Center on Housing and Homelessness, said that hard construction costs are about $140 per square foot in Texas versus $350 in California.

In the accessory dwelling unit (ADU) sector, regulatory reforms have yielded a rapid increase in construction. “When the government removed permit fees and delays, ADUs increased from 2,000 to 18,000 in one year,” said Dunmoyer.

Sujata Srivastava, Chief Policy Officer for the San Francisco Bay Area Planning and Urban Research Association, pointed out the need to shift towards more urban, high-density housing at attainable prices. Nearly all existing models are “suburban, low density”—a format that is ill-suited to California’s evolving housing needs,” Srivastava said.

Full panel sessions are available to watch here, and a full report will be released soon at ccre.us.

About the Center for California Real Estate

The Center for California Real Estate (CCRE), an institute of the California Association of Realtors (C.A.R.), advances knowledge and research by collaborating with varied partners, spurs innovative thinking about key issues facing California and the real estate industry, and extends C.A.R.’s influence via intellectual engagement with different audiences, diverse stakeholders and new external partners.

CCRE serves as a nexus for multi-disciplinary thinking aimed at solving some of the state’s most challenging issues. Bringing together key experts from a variety of fields — from academics and policymakers to industry leaders — CCRE produces new knowledge and serves as a key resource about housing issues for all C.A.R. members, external entities, the media and the public.

About the CALIFORNIA ASSOCIATION OF REALTORS®

Leading the way…® in California real estate for more than 118 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with 180,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/california-leaders-call-for-bold-solutions-to-solve-state-housing-crisis-at-summit-302308916.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/california-leaders-call-for-bold-solutions-to-solve-state-housing-crisis-at-summit-302308916.html

SOURCE CALIFORNIA ASSOCIATION OF REALTORS’ Center for California Real Estate

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Futu Announces Third Quarter 2024 Unaudited Financial Results and Special Cash Dividend

HONG KONG, Nov. 19, 2024 (GLOBE NEWSWIRE) — Futu Holdings Limited (“Futu” or the “Company”) FUTU, a leading tech-driven online brokerage and wealth management platform, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Operational Highlights

- Total number of paying clients1 increased 33.1% year-over-year to 2,196,647 as of September 30, 2024.

- Total number of registered clients2 increased 22.8% year-over-year to 4,284,786 as of September 30, 2024.

- Total number of users3 increased 14.4% year-over-year to 24.1 million as of September 30, 2024.

- Total client assets increased 48.1% year-over-year to HK$693.4 billion as of September 30, 2024.

- Daily average client assets were HK$593.2 billion in the third quarter of 2024, an increase of 23.4% from the same period in 2023.

- Total trading volume in the third quarter of 2024 increased by 74.7% year-over-year to HK$1.90 trillion, in which trading volume for U.S. stocks was HK$1.53 trillion, and trading volume for Hong Kong stocks was HK$347.7 billion.

- Daily average revenue trades (DARTs)4 in the third quarter of 2024 increased 68.0% year-over-year to 698,811.

- Margin financing and securities lending balance increased 25.5% year-over-year to HK$40.6 billion as of September 30, 2024.

Third Quarter 2024 Financial Highlights

- Total revenues increased 29.6% year-over-year to HK$3,436.1 million (US$442.3 million).

- Total gross profit increased 27.0% year-over-year to HK$2,811.3 million (US$361.8 million).

- Net income increased 20.9% year-over-year to HK$1,319.2 million (US$169.8 million).

- Non-GAAP adjusted net income5 increased 20.8% year-over-year to HK$1,398.4 million (US$180.0 million).

Mr. Leaf Hua Li, Futu’s Chairman and Chief Executive Officer, said, “We acquired 154 thousand paying clients in the third quarter, up 138.0% year-over-year and flattish quarter-over-quarter. In the first nine months of the year, we acquired 487 thousand paying clients and we expect full year growth to comfortably exceed our guidance of 550 thousand, thanks to resilient growth in established markets and strong momentum in newer ones.”

“Hong Kong and Singapore altogether contributed over one-third of new paying clients. In these two markets, we continued to optimize the efficiency of our various client acquisition channels and launched effective marketing campaigns to capitalize on favorable market dynamics. Malaysia was again the top contributor of new paying clients, as we continued to invest in our brand and rolled out new products, such as U.S. options trading and money market funds. We brought in a steady number of paying clients in Japan, although the sluggish performance of Japan equities weighed on client acquisition.”

“Total client assets grew 48.1% year-over-year and 19.7% quarter-over-quarter to HK$693.4 billion. We witnessed another quarter of strong net asset inflow across markets, but the majority of asset growth this quarter was driven by the appreciation of clients’ stock holdings towards quarter end. In Singapore, total and average client assets rose by 18% and 10% quarter-over-quarter, respectively. We are also encouraged to see that average client assets in U.S., Canada, and Australia all recorded double-digit sequential growth for three consecutive quarters. Margin financing and securities lending balance moderated to HK$40.6 billion as some clients took profit amid the rally of China equities, but the daily average balance experienced single-digit quarter-over-quarter growth.”

“Total trading volume was HK$1.90 trillion, up 74.7% year-over-year and 17.4% quarter-over-quarter. U.S. stocks trading volume increased by 22.9% sequentially to HK$1.53 trillion as trading turnover of U.S. technology stocks and leveraged ETFs surged amid heightened volatility in August. Hong Kong stock trading volume was HK$347.7 billion, down 2.8% quarter-over-quarter. Trading activities were rather muted in July and August as Hong Kong equities stayed range-bound. However, clients were quick to react to the market rally in late September. In the week of September 23, trading volume of Hong Kong stocks surged by 267% week-over-week.”

“Wealth management asset balance was HK$97.3 billion, up 87.5% year-over-year and 21.9% quarter-over-quarter, primarily driven by inflow into money market funds and fixed income funds. As of quarter end, 27% of our paying clients held wealth management products, up from 25% in the second quarter. We launched ETF-based robo-advisory service in Hong Kong and Singapore to cater to allocation-driven clients.”

“We had 461 IPO distribution and IR clients, up 17.9% year-over-year.”

Mr. Arthur Yu Chen, Futu’s Chief Financial Officer, added, “In celebration of the fifth anniversary of our Nasdaq listing, we are pleased to announce that our board of directors approved a special cash dividend of US$0.25 per ordinary share, or US$2 per American Depositary Share (“ADS”), to holders of ordinary shares and holders of ADSs of record as of the close of business on December 6, 2024, payable in U.S. dollars. The aggregate amount of the special cash dividend to be paid will be approximately US$280 million, which will be funded by surplus cash on Futu’s balance sheet.”

Third Quarter 2024 Financial Results

Revenues

Total revenues were HK$3,436.1 million (US$442.3 million), an increase of 29.6% from HK$2,650.4 million in the third quarter of 2023.

Brokerage commission and handling charge income was HK$1,528.9 million (US$196.8 million), an increase of 51.5% from the third quarter of 2023. This was mainly due to the 74.7% year-over-year increase in total trading volume, partially offset by the decline in blended commission rate from 9.3 bps to 8.0 bps.

Interest income was HK$1,698.8 million (US$218.7 million), an increase of 12.9% from the third quarter of 2023. The increase was mainly driven by higher margin financing income as well as higher interest income from securities borrowing and lending business.

Other income was HK$208.5 million (US$26.8 million), an increase of 52.1% from the third quarter of 2023. The increase was primarily attributable to higher fund distribution service income and currency exchange income.

Costs

Total costs were HK$624.9 million (US$80.4 million), an increase of 42.9% from HK$437.4 million in the third quarter of 2023.

Brokerage commission and handling charge expenses were HK$81.5 million (US$10.5 million), an increase of 29.8% from the third quarter of 2023. Brokerage expenses didn’t move in tandem with brokerage income mainly due to cost savings from our U.S. self-clearing business.

Interest expenses were HK$413.6 million (US$53.2 million), an increase of 43.3% from the third quarter of 2023. The increase was primarily due to higher expenses associated with our securities borrowing and lending business.

Processing and servicing costs were HK$129.8 million (US$16.7 million), an increase of 51.3% from the third quarter of 2023. The increase was primarily driven by higher cloud service fees and data transmission fees.

Gross Profit

Total gross profit was HK$2,811.3 million (US$361.8 million), an increase of 27.0% from HK$2,213.0 million in the third quarter of 2023. Gross margin was 81.8%, as compared to 83.5% in the third quarter of 2023.

Operating Expenses

Total operating expenses were HK$1,079.9 million (US$139.0 million), an increase of 20.9% from HK$892.9 million in the third quarter of 2023.

Research and development expenses were HK$384.7 million (US$49.5 million), an increase of 7.0% from the third quarter of 2023. The increase was primarily due to an increase in research and development headcount to support new products and new markets.

Selling and marketing expenses were HK$314.3 million (US$40.5 million), an increase of 48.5% from HK$211.7 million in the third quarter of 2023. This was driven by a 138.0% year-over-year increase in new paying clients, partially offset by lower client acquisition costs.

General and administrative expenses were HK$380.9 million (US$49.0 million), an increase of 18.4% from the third quarter of 2023. The increase was primarily due to an increase in general and administrative personnel.

Income from Operations

Income from operations increased by 31.1% to HK$1,731.3 million (US$222.8 million) from HK$1,320.2 million in the third quarter of 2023. Operating margin increased to 50.4% from 49.8% in the third quarter of 2023.

Net Income

Net income increased by 20.9% to HK$1,319.2 million (US$169.8 million) from HK$1,091.2 million in the third quarter of 2023. Net income margin for the third quarter of 2024 declined to 38.4% from 41.2% in the year-ago quarter. The lower net income margin was due to the unrealized foreign exchange losses from the modest appreciation of Renminbi in the third quarter.

Non-GAAP adjusted net income increased by 20.8% to HK$1,398.4 million (US$180.0 million) from the third quarter of 2023. Non-GAAP adjusted net income is defined as net income excluding share-based compensation expenses. For further information, see “Use of Non-GAAP Financial Measures” at the bottom of this press release.

Net Income per ADS

Basic net income per ADS was HK$9.57 (US$1.23), compared with HK$7.97 in the third quarter of 2023. Diluted net income per ADS was HK$9.42 (US$1.21), compared with HK$7.86 in the third quarter of 2023. Each ADS represents eight Class A ordinary shares.

Special Cash Dividend

Dividend to be paid to the Company’s ADS holders through the depositary bank will be subject to the terms of the deposit agreement. The payment date is expected to be on or around January 10, 2025 for holders of ordinary shares and holders of ADSs.

Conference Call and Webcast

Futu’s management will hold an earnings conference call on Tuesday, November 19, 2024, at 7:30 AM U.S. Eastern Time (8:30 PM on the same day, Beijing/Hong Kong Time).

Please note that all participants will need to pre-register for the conference call, using the link

https://register.vevent.com/register/BId8704588e6684a3ca9bc030be815ec01.

It will automatically lead to the registration page of “Futu Holdings Ltd Third Quarter 2024 Earnings Conference Call”, where details for RSVP are needed.

Upon registering, all participants will be provided in confirmation emails with participant dial-in numbers and personal PINs to access the conference call. Please dial in 10 minutes prior to the call start time using the conference access information.

Additionally, a live and archived webcast of this conference call will be available at https://ir.futuholdings.com/.

About Futu Holdings Limited

Futu Holdings Limited FUTU is an advanced technology company transforming the investing experience by offering fully digitalized financial services. Through its proprietary digital platforms, Futubull and moomoo, the Company provides a full range of investment services, including trade execution and clearing, margin financing and securities lending, and wealth management. The Company has embedded social media tools to create a network centered around its users and provide connectivity to users, investors, companies, analysts, media and key opinion leaders. The Company also provides corporate services, including IPO distribution, investor relations and ESOP solution services.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses non-GAAP adjusted net income, a non-GAAP measure, as a supplemental measure to review and assess its operating performance. The presentation of the non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. The Company defines non-GAAP adjusted net income as net income excluding share-based compensation expenses. The Company presents the non-GAAP financial measure because it is used by the management to evaluate the operating performance and formulate business plans. Non-GAAP adjusted net income enables the management to assess the Company’s operating results without considering the impact of share-based compensation expenses, which are non-cash charges. The Company also believes that the use of the non-GAAP measure facilitates investors’ assessment of its operating performance.

Non-GAAP adjusted net income is not defined under U.S. GAAP and is not presented in accordance with U.S. GAAP. This non-GAAP financial measure has limitations as analytical tools. One of the key limitations of using non-GAAP adjusted net income is that it does not reflect all items of expense that affect the Company’s operations. Share-based compensation expenses have been and may continue to be incurred in the business and is not reflected in the presentation of non-GAAP adjusted net income. Further, the non-GAAP measure may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited.

The Company compensates for these limitations by reconciling the non-GAAP financial measure to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating the Company’s performance.

For more information on this non-GAAP financial measure, please see the table captioned “Unaudited Reconciliations of Non-GAAP and GAAP Results” set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain HK dollars (“HK$”) amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from HK$ to US$ were made at the rate of HK$7.7693 to US$1.00, the noon buying rate in effect on September 30, 2024 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the HK$ or US$ amounts referred could be converted into US$ or HK$, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the quotations from the management team of the Company, contain forward-looking statements. Futu may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Futu’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Futu’s goal and strategies; Futu’s expansion plans; Futu’s future business development, financial condition and results of operations; Futu’s expectations regarding demand for, and market acceptance of, its credit products; Futu’s expectations regarding keeping and strengthening its relationships with borrowers, institutional funding partners, merchandise suppliers and other parties it collaborates with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Futu’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Futu does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor inquiries, please contact:

Investor Relations

Futu Holdings Limited

ir@futuholdings.com

____________________

1 The number of paying clients refers to the number of clients with assets in their trading accounts with Futu.

2 The number of registered clients refers to the number of users with one or more trading accounts with Futu.

3 The number of users refers to the number of user accounts registered with Futu.

4 The number of Daily Average Revenue Trades (DARTs) refers to the number of average trades per day that generate commissions or fees.

5 Non-GAAP adjusted net income is defined as net income excluding share-based compensation expenses.

| FUTU HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except for share and per share data) |

||||||

| As of December 31, | As of September 30, | |||||

| 2023 | 2024 | 2024 | ||||

| HK$ | HK$ | US$ | ||||

| ASSETS | ||||||

| Cash and cash equivalents | 4,937,538 | 9,048,504 | 1,164,649 | |||

| Cash held on behalf of clients | 44,369,310 | 66,419,953 | 8,549,027 | |||

| Restricted cash | 1,232 | 1,238 | 159 | |||

| Term deposit | 5,540 | 5,440 | 700 | |||

| Short-term investments | 3,114,613 | 2,688,996 | 346,105 | |||

| Securities purchased under agreements to resell | 133,039 | 228,251 | 29,379 | |||

| Loans and advances-current (net of allowance of HK$45,949 thousand and HK$69,444 thousand as of December 31, 2023 and September 30, 2024, respectively) | 32,528,421 | 38,759,786 | 4,988,839 | |||

| Receivables: | ||||||

| Clients | 293,505 | 1,086,895 | 139,896 | |||

| Brokers | 5,189,155 | 14,717,638 | 1,894,333 | |||

| Clearing organizations | 4,244,793 | 5,251,095 | 675,877 | |||

| Fund management companies and fund distributors | 151,691 | 1,052,676 | 135,492 | |||

| Interest | 268,504 | 402,902 | 51,858 | |||

| Prepaid assets | 54,691 | 87,226 | 11,227 | |||

| Other current assets | 135,479 | 1,142,494 | 147,052 | |||

| Total current assets | 95,427,511 | 140,893,094 | 18,134,593 | |||

| Operating lease right-of-use assets | 224,092 | 293,142 | 37,731 | |||

| Long-term investments | 238,556 | 618,760 | 79,642 | |||

| Loans and advances-non-current | 18,934 | 18,824 | 2,423 | |||

| Other non-current assets | 1,226,754 | 1,638,204 | 210,857 | |||

| Total non-current assets | 1,708,336 | 2,568,930 | 330,653 | |||

| Total assets | 97,135,847 | 143,462,024 | 18,465,246 | |||

| LIABILITIES | ||||||||

| Amounts due to related parties | 69,018 | 130,723 | 16,826 | |||||

| Payables: | ||||||||

| Clients | 48,762,263 | 77,072,065 | 9,920,078 | |||||

| Brokers | 15,648,286 | 28,735,209 | 3,698,558 | |||||

| Clearing organizations | 24,096 | 1,006,077 | 129,494 | |||||

| Fund management companies and fund distributors | 175,575 | 1,078,427 | 138,806 | |||||

| Interest | 44,109 | 82,500 | 10,619 | |||||

| Borrowings | 5,651,565 | 3,668,962 | 472,238 | |||||

| Securities sold under agreements to repurchase | – | 403,104 | 51,884 | |||||

| Lease liabilities-current | 114,682 | 92,492 | 11,905 | |||||

| Accrued expenses and other current liabilities | 1,939,004 | 2,543,024 | 327,317 | |||||

| Total current liabilities | 72,428,598 | 114,812,583 | 14,777,725 | |||||

| Lease liabilities-non-current | 123,335 | 220,122 | 28,332 | |||||

| Other non-current liabilities | 12,183 | 11,102 | 1,430 | |||||

| Total non-current liabilities | 135,518 | 231,224 | 29,762 | |||||

| Total liabilities | 72,564,116 | 115,043,807 | 14,807,487 | |||||

| SHAREHOLDERS’ EQUITY | ||||||||

| Class A ordinary shares | 71 | 71 | 9 | |||||

| Class B ordinary shares | 27 | 27 | 3 | |||||

| Additional paid-in capital | 18,456,438 | 18,716,447 | 2,409,026 | |||||

| Treasury Stock | (5,199,257 | ) | (5,199,257 | ) | (669,205 | ) | ||

| Accumulated other comprehensive loss | (49,433 | ) | (26,520 | ) | (3,413 | ) | ||

| Retained earnings | 11,360,890 | 14,932,280 | 1,921,961 | |||||

| Total shareholders’ equity | 24,568,736 | 28,423,048 | 3,658,381 | |||||

| Non-controlling interest | 2,995 | (4,831 | ) | (622 | ) | |||

| Total equity | 24,571,731 | 28,418,217 | 3,657,759 | |||||

| Total liabilities and equity | 97,135,847 | 143,462,024 | 18,465,246 | |||||

| FUTU HOLDINGS LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands, except for share and per share data) |

|||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||

| September 30, 2023 |

September 30, 2024 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2024 |

||||||||||||

| HK$ | HK$ | US$ | HK$ | HK$ | US$ | ||||||||||||

| Revenues | |||||||||||||||||

| Brokerage commission and handling charge income | 1,008,854 | 1,528,910 | 196,789 | 3,040,780 | 3,987,317 | 513,214 | |||||||||||

| Interest income | 1,504,501 | 1,698,761 | 218,650 | 4,204,477 | 4,644,581 | 597,812 | |||||||||||

| Other income | 137,060 | 208,461 | 26,831 | 389,899 | 525,679 | 67,661 | |||||||||||

| Total revenues | 2,650,415 | 3,436,132 | 442,270 | 7,635,156 | 9,157,577 | 1,178,687 | |||||||||||

| Costs | |||||||||||||||||

| Brokerage commission and handling charge expenses | (62,814 | ) | (81,458 | ) | (10,485 | ) | (190,401 | ) | (228,997 | ) | (29,475 | ) | |||||

| Interest expenses | (288,749 | ) | (413,631 | ) | (53,239 | ) | (639,975 | ) | (1,104,098 | ) | (142,110 | ) | |||||

| Processing and servicing costs | (85,834 | ) | (129,791 | ) | (16,706 | ) | (272,365 | ) | (336,330 | ) | (43,290 | ) | |||||

| Total costs | (437,397 | ) | (624,880 | ) | (80,430 | ) | (1,102,741 | ) | (1,669,425 | ) | (214,875 | ) | |||||

| Total gross profit | 2,213,018 | 2,811,252 | 361,840 | 6,532,415 | 7,488,152 | 963,812 | |||||||||||

| Operating expenses | |||||||||||||||||

| Research and development expenses | (359,514 | ) | (384,728 | ) | (49,519 | ) | (1,077,761 | ) | (1,094,158 | ) | (140,831 | ) | |||||

| Selling and marketing expenses | (211,684 | ) | (314,316 | ) | (40,456 | ) | (527,887 | ) | (945,312 | ) | (121,673 | ) | |||||

| General and administrative expenses | (321,656 | ) | (380,901 | ) | (49,026 | ) | (943,067 | ) | (1,044,341 | ) | (134,419 | ) | |||||

| Total operating expenses | (892,854 | ) | (1,079,945 | ) | (139,001 | ) | (2,548,715 | ) | (3,083,811 | ) | (396,923 | ) | |||||

| Income from operations | 1,320,164 | 1,731,307 | 222,839 | 3,983,700 | 4,404,341 | 566,889 | |||||||||||

| Others, net | (16,770 | ) | (131,379 | ) | (16,910 | ) | 50,191 | (142,254 | ) | (18,310 | ) | ||||||

| Income before income tax expense and share of loss from equity method investments |

1,303,394 | 1,599,928 | 205,929 | 4,033,891 | 4,262,087 | 548,579 | |||||||||||

| Income tax expense | (211,499 | ) | (237,546 | ) | (30,575 | ) | (622,667 | ) | (639,913 | ) | (82,364 | ) | |||||

| Share of loss from equity method investments | (738 | ) | (43,216 | ) | (5,562 | ) | (8,661 | ) | (58,577 | ) | (7,540 | ) | |||||

| Net income | 1,091,157 | 1,319,166 | 169,792 | 3,402,563 | 3,563,597 | 458,675 | |||||||||||

| Attributable to: | |||||||||||||||||

| Ordinary shareholders of the Company | 1,091,465 | 1,321,062 | 170,036 | 3,403,249 | 3,571,390 | 459,678 | |||||||||||

| Non-controlling interest | (308 | ) | (1,896 | ) | (244 | ) | (686 | ) | (7,793 | ) | (1,003 | ) | |||||

| 1,091,157 | 1,319,166 | 169,792 | 3,402,563 | 3,563,597 | 458,675 | ||||||||||||

| Net income per share attributable to ordinary shareholders of the Company |

|||||||||||||||||

| Basic | 1.00 | 1.20 | 0.15 | 3.07 | 3.24 | 0.42 | |||||||||||

| Diluted | 0.98 | 1.18 | 0.15 | 3.04 | 3.19 | 0.41 | |||||||||||

| Net income per ADS | |||||||||||||||||

| Basic | 7.97 | 9.57 | 1.23 | 24.58 | 25.89 | 3.33 | |||||||||||

| Diluted | 7.86 | 9.42 | 1.21 | 24.29 | 25.53 | 3.29 | |||||||||||

| Weighted average number of ordinary shares used in computing net income per share |

|||||||||||||||||

| Basic | 1,095,876,818 | 1,104,332,890 | 1,104,332,890 | 1,107,509,193 | 1,103,586,659 | 1,103,586,659 | |||||||||||

| Diluted | 1,111,337,025 | 1,122,047,684 | 1,122,047,684 | 1,120,897,949 | 1,119,231,099 | 1,119,231,099 | |||||||||||

| Net income | 1,091,157 | 1,319,166 | 169,792 | 3,402,563 | 3,563,597 | 458,675 | |||||||||||

| Other comprehensive (loss)/income, net of tax | |||||||||||||||||

| Foreign currency translation adjustment | (24,735 | ) | 120,132 | 15,463 | (83,176 | ) | 22,880 | 2,945 | |||||||||

| Total comprehensive income | 1,066,422 | 1,439,298 | 185,255 | 3,319,387 | 3,586,477 | 461,620 | |||||||||||

| Attributable to: | |||||||||||||||||

| Ordinary shareholders of the Company | 1,066,757 | 1,441,210 | 185,501 | 3,320,101 | 3,594,303 | 462,627 | |||||||||||

| Non-controlling interest | (335 | ) | (1,912 | ) | (246 | ) | (714 | ) | (7,826 | ) | (1,007 | ) | |||||

| 1,066,422 | 1,439,298 | 185,255 | 3,319,387 | 3,586,477 | 461,620 | ||||||||||||

| FUTU HOLDINGS LIMITED UNAUDITED RECONCILIATIONS OF NON-GAAP AND GAAP RESULTS (In thousands) |

|||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||

| September 30, 2023 |

September 30, 2024 |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2024 |

||||||

| HK$ | HK$ | US$ | HK$ | HK$ | US$ | ||||||

| Net income | 1,091,157 | 1,319,166 | 169,792 | 3,402,563 | 3,563,597 | 458,675 | |||||

| Add: Share-based compensation expenses | 66,812 | 79,247 | 10,200 | 216,754 | 252,040 | 32,441 | |||||

| Adjusted net income | 1,157,969 | 1,398,413 | 179,992 | 3,619,317 | 3,815,637 | 491,116 | |||||

Non-GAAP to GAAP reconciling items have no income tax effect.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

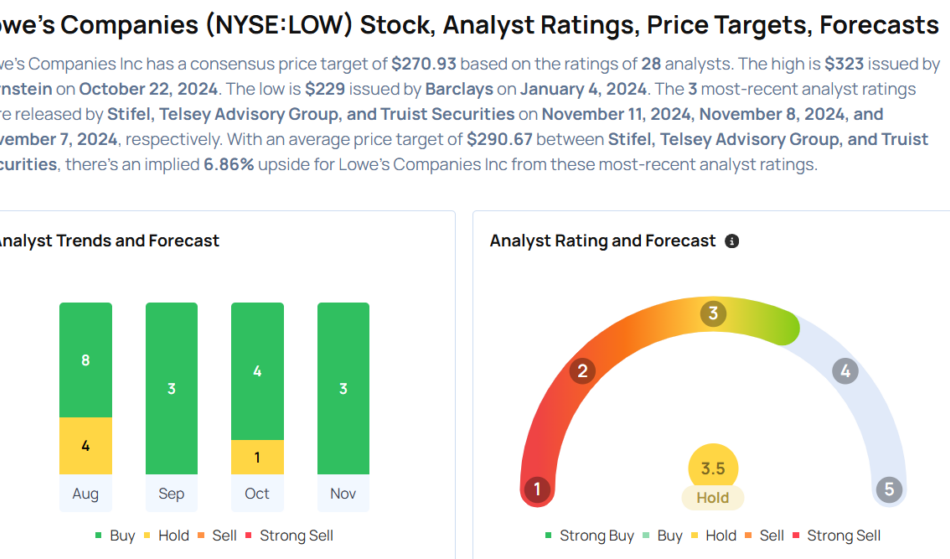

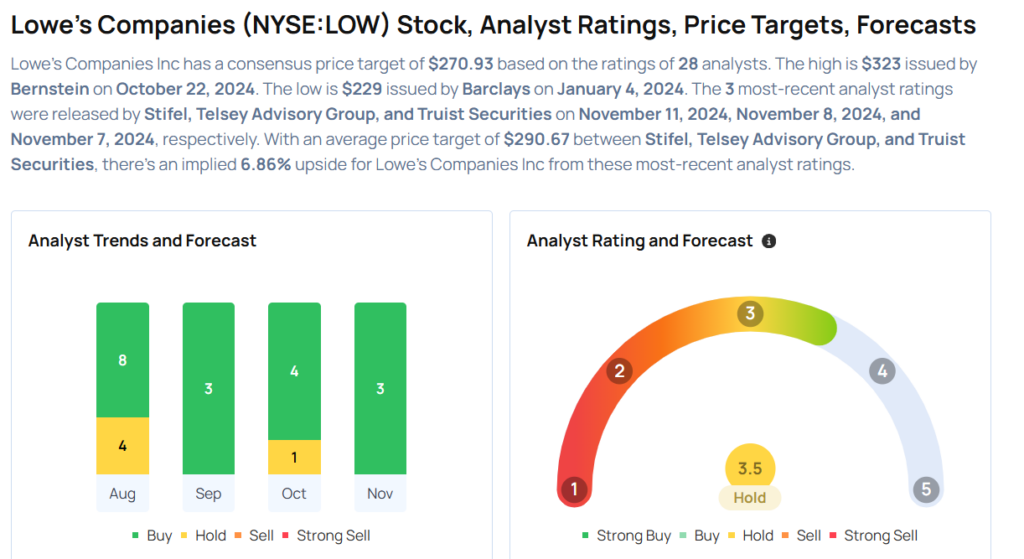

Lowe's Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Lowe’s Companies, Inc. LOW will release earnings results for its third quarter, before the opening bell on Tuesday, Nov. 19.

Analysts expect the Mooresville, North Carolina-based company to report quarterly earnings at $2.81 per share, down from $3.06 per share in the year-ago period. Lowe’s projects to report quarterly revenue of $19.91 billion, compared to $20.47 billion a year earlier, according to data from Benzinga Pro.

On Aug. 20, the company reported adjusted earnings per share of $4.10, beating the analyst consensus of $3.99. Quarterly revenues totaled $23.586 billion, missing the street view of $24.013 billion.

Lowe’s shares gained 0.9% to close at $271.77 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Telsey Advisory Group analyst Joseph Feldman upgraded the stock from Market Perform to Outperform and raised the price target from $275 to $305 on Nov. 8. This analyst has an accuracy rate of 69%.

- Truist Securities analyst Scot Ciccarelli maintained a Buy rating and increased the price target from $306 to $307 on Nov. 7. This analyst has an accuracy rate of 75%.

- Wells Fargo analyst Zachary Fadem maintained an Overweight rating and raised the price target from $280 to $295 on Nov. 6. This analyst has an accuracy rate of 87%.

- TD Cowen analyst Max Rakhlenko maintained a Hold rating and boosted the price target from $270 to $290 on Oct. 28. This analyst has an accuracy rate of 61%.

- Loop Capital analyst Laura Champine upgraded the stock from Hold to Buy and increased the price target from $250 to $300 on Oct. 9. This analyst has an accuracy rate of 64%.

Considering buying LOW stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

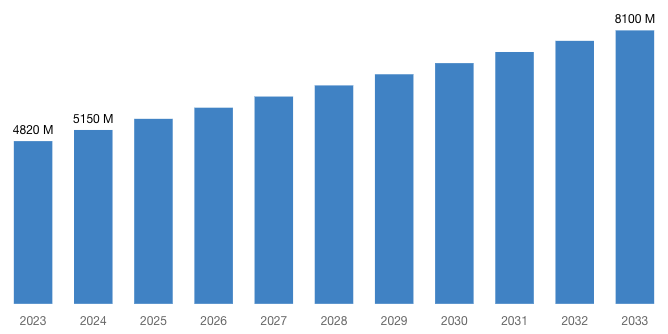

[Latest] Global Serological Testing Market Size/Share Worth USD 8,100 Million by 2033 at a 6.70% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

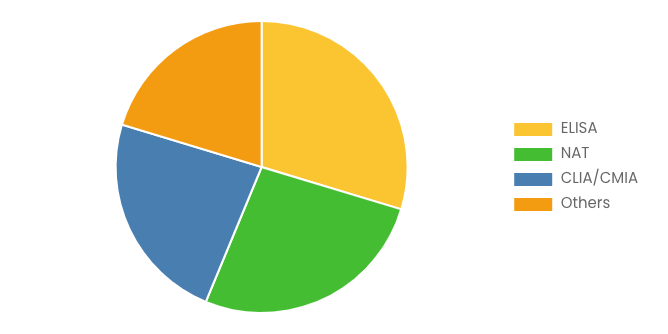

Austin, TX, USA, Nov. 19, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Serological Testing Market Size, Trends and Insights By Technology (ELISA, NAT, CLIA/CMIA, Others), By Product (Instruments, Consumables and Reagents), By Application (Hepatitis, Coronavirus (COVID-19), Human Immunodeficiency Virus (HIV), Rotavirus infections, Others), By End-User (Diagnostic Laboratories, Hospitals, Other End Users), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Serological Testing Market size & share was valued at approximately USD 4,820 Million in 2023 and is expected to reach USD 5,150 Million in 2024 and is expected to reach a value of around USD 8,100 Million by 2033, at a compound annual growth rate (CAGR) of about 6.70% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Serological Testing Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=54518

Serological Testing Market: Growth Factors and Dynamics

- Increasing Demand for Diagnostic Testing: There is an increasing demand for accurate and reliable diagnostic tests throughout the healthcare sector, fueled by the need for early detection and effective management of diseases.

- Rising Incidence of Infectious Diseases: The prevalence of infectious illnesses such as HIV, hepatitis, and COVID-19 has fueled the demand for serological testing to diagnose, screen, and monitor these medical conditions.

- Advancements in Technology: Technological developments in serological testing procedures have enhanced test accuracy, speed, and efficiency, making them more accessible and reliable to healthcare practitioners.

- Growing Awareness and Screening Programs: Public health initiatives and awareness campaigns have boosted the acceptance of serological testing as a component of routine health check-ups and disease prevention programs.

- Expanding Applications in Research and Development: Serological testing is critical in research and development efforts, such as vaccine development, epidemiological investigations, and understanding disease prevalence and transmission trends.

- Increased Healthcare Expenditure: Rising worldwide healthcare spending has prompted investments in diagnostic technology, such as serological testing platforms, consequently expanding the market.

- Point-of-Care Testing (POCT) Advancements: Advances in POCT technology have made serological tests more accessible in a variety of healthcare settings, including clinics, emergency departments, and remote locations, resulting in market expansion.

Request a Customized Copy of the Serological Testing Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=54518

Serological Testing Market: Partnership and Acquisitions

- In November 2023, Agilus Diagnostics, a Fortis Healthcare Limited subsidiary, launched a cutting-edge laboratory in Bongaigaon, Assam. Covering 2,000 square feet, the lab can process over 25,000 samples monthly and offers over 3,000 tests, including routine and specialized diagnostics. The facility includes divisions such as Hematology, Biochemistry, Clinical Pathology, Serology, and Microbiology, meeting the region’s growing demand for high-quality diagnostic services and preventive healthcare packages.

- In October 2022, LordsMed, part of Lord’s Mark Industries, inaugurated an IVD manufacturing facility in Vasai near Mumbai. The 20,000 sq ft facility features advanced technologies and infrastructure meeting global standards. It will produce various IVD and point-of-care diagnostic solutions, including analyzers, reagents for clinical biochemistry, haematology, serology, immunology, rapid testing kits (ICMR approved antigen kits), and lab consumables.

- In November 2023, Roche launched the Elecsys® Anti-HEV IgM and Anti-HEV IgG immunoassays for detecting hepatitis E virus (HEV) infections in CE mark-accepting countries. The Anti-HEV IgM assay detects acute or recent HEV infections, while the Anti-HEV IgG assay identifies recent or past infections. Both assays can be used with cobas® e 411, e 601/602, e 402, and e 801 analyzers.

- In February 2022, Thermo Fisher Scientific introduced two bead-based ELISA solutions for faster and simpler detection of SARS-CoV-2 antibodies. Unlike traditional methods with lengthy protocols, the Invitrogen Dynabeads SARS-CoV-2 Spike ELISA kits detect and quantify human antibodies from serum or plasma in just 45 minutes. The new plates-to-beads concept enhances binding kinetics by capturing antibodies in suspension, streamlining the serological research process.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 5,150 Million |

| Projected Market Size in 2033 | USD 8,100 Million |

| Market Size in 2023 | USD 4,820 Million |

| CAGR Growth Rate | 6.70% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Technology, Product, Application, End-User and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Serological Testing report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Serological Testing report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Serological Testing Market Report @ https://www.custommarketinsights.com/report/serological-testing-market/

Serological Testing Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Serological Testing Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Supply Chain Disruptions: Early in the pandemic, there were disruptions in the supply chain for serological testing kits, affecting availability and distribution globally.

- Quality Concerns: With the rush to meet demand, some serological tests initially had issues with accuracy and reliability. This raised concerns about false positives/negatives and quality control.

- Regulatory Challenges: Rapidly changing regulatory requirements and approvals posed challenges for manufacturers, delaying market entry for some products and increasing compliance costs.

- Market Saturation: As the initial surge in demand subsides and vaccination rates increase, the market for COVID-19 serological tests may experience saturation, impacting future growth prospects.

- Increased Demand: The pandemic led to a surge in demand for serological tests to detect antibodies against SARS-CoV-2, the virus causing COVID-19. This sudden demand boosted the market size and revenue for companies producing serological testing kits.

- Technological Advancements: The urgency of the pandemic accelerated research and development in serological testing technologies. This has led to innovations in assay sensitivity, specificity, and rapid test development, benefiting the overall market.

- Market Expansion: The pandemic highlighted the importance of serological testing not only for COVID-19 but also for other infectious diseases and immune-related conditions. This awareness has expanded the potential market beyond infectious diseases.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Serological Testing Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Serological Testing Market Report @ https://www.custommarketinsights.com/report/serological-testing-market/

Key questions answered in this report:

- What is the size of the Serological Testing market and what is its expected growth rate?

- What are the primary driving factors that push the Serological Testing market forward?

- What are the Serological Testing Industry’s top companies?

- What are the different categories that the Serological Testing Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Serological Testing market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Serological Testing Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/serological-testing-market/

Serological Testing Market – Regional Analysis

The Serological Testing Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: In North America, the serological testing market is witnessing several key trends. Firstly, there is an increasing demand for COVID-19 antibody testing, which is being driven by continuing surveillance initiatives and vaccine effectiveness examinations. Second, advances in assay technology, such as automated platforms and multiplex assays, improve testing efficiency and accuracy. Third, there is a shift towards point-of-care testing solutions that enable quick and decentralised testing capabilities. Furthermore, more awareness and adoption of personalised medicine approaches are influencing the industry, particularly targeted therapies and patient-specific treatment regimens. These trends influence the changing environment of serological testing in North America.

- Europe: The growth of the Serological Testing Market in Europe is supported by several key factors. These include rising disease rates, increased demand for early detection, advances in laboratory technology, and a strong healthcare infrastructure. Furthermore, the region’s emphasis on preventive healthcare measures and proactive screening programmes promotes market growth. Furthermore, the increasing use of serological testing in vaccine and pharmaceutical research and development drives market expansion in Europe.

- Asia-Pacific: The Serological Testing Market in Asia-Pacific is driven by several key trends. These include the increasing prevalence of infectious diseases necessitating reliable diagnostic tools, rising healthcare expenditure and infrastructure development, and growing awareness and adoption of advanced medical technologies. Additionally, expanding initiatives for early disease detection and management, alongside robust investments in healthcare R&D, further bolster market growth. Moreover, the COVID-19 pandemic has underscored the importance of serological testing, fostered innovation and enhanced market opportunities in the region.

- LAMEA (Latin America, Middle East, and Africa): In the LAMEA region, the growth of the Serological Testing Market is supported by a number of important factors. These include increased awareness of infectious diseases, expanding healthcare infrastructure, increasing healthcare costs, and a growing desire for precision diagnostic technologies. Furthermore, technological improvements, especially in immunodiagnostics and antibody testing, help to drive market growth. Furthermore, government measures to improve healthcare access and the incidence of chronic diseases drive the demand for serological testing in the LAMEA area.

Request a Customized Copy of the Serological Testing Market Report @ https://www.custommarketinsights.com/report/serological-testing-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Serological Testing Market Size, Trends and Insights By Technology (ELISA, NAT, CLIA/CMIA, Others), By Product (Instruments, Consumables and Reagents), By Application (Hepatitis, Coronavirus (COVID-19), Human Immunodeficiency Virus (HIV), Rotavirus infections, Others), By End-User (Diagnostic Laboratories, Hospitals, Other End Users), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/serological-testing-market/

List of the prominent players in the Serological Testing Market:

- Serological Research Institute (SERI)

- Chembio Diagnostics Inc

- Randox Laboratories Ltd

- Abbott Laboratories

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Ortho Clinical Diagnostics

- Quest Diagnostics Incorporated

- Abcam Plc

- Hoffmann-La Roche Ltd.

- ELITechGroup

- Teleflex Incorporated

- Grifols S.A.

- Global Scientific Company

- Beckman Coulter Inc.

- Biomedomics Inc.

- Others

Click Here to Access a Free Sample Report of the Global Serological Testing Market @ https://www.custommarketinsights.com/report/serological-testing-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Legal Marijuana Market: Legal Marijuana Market Size, Trends and Insights By Marijuana Type (Recreational Marijuana, Medical Marijuana), By Application (Chronic Pain, Mental Disorders, Cancer, Others (e.g., anxiety, epilepsy, PTSD)), By Product Type (Buds / Marijuana Flower, Cannabis Extracts, Oils, Tinctures, Edibles), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Silicone Implants Market: Silicone Implants Market Size, Trends and Insights By Type (Silicone Breast Implants, Silicone Facial Implants, Silicone Penile Implants, Silicone Gluteal Implants), By Application (Cosmetic Surgery, Reconstructive Surgery), By End-user (Hospitals, Specialty Clinics, Ambulatory Surgical Centers), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Facial Injectables Market: US Facial Injectables Market Size, Trends and Insights By Product (Collagen & PMMA Microspheres, Hyaluronic Acid (HA), Botulinum Toxin Type A, Calcium Hydroxylapatite (CaHA), Poly-L-lactic Acid (PLLA), Others), By Application (Facial Line Correction, Lip Augmentation, Face Lift, Acne Scar Treatment, Lipoatrophy Treatment, Others), By End-Use (MedSpas, Dermatology Clinics, Hospitals), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Weight Loss Market: Europe Weight Loss Market Size, Trends and Insights By Application (Dietary Supplements, Fitness Equipment, Meal Replacements, Weight Loss Programs), By Product Type (Conventional Weight Loss Products, Organic Weight Loss Products, Meal Plans & Services), By End User (Adults, Teenagers, Elderly), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Pacemaker Manufacturers Market: US Pacemaker Manufacturers Market Size, Trends and Insights By Product (Implantable pacemakers, External pacemakers), By Technology (Single Chamber, Dual Chamber, Biventricular Chamber), By Type (MRI Compatible Pacemakers, Conventional Pacemakers), By Application (Arrhythmias, Atrial Fibrillation, Heart Block, Long QT Syndrome, Congestive Heart Failure, Others), By End User (Hospitals, Cardiac Surgery Centers, Ambulatory Surgical Centers, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Intravascular Ultrasound Devices Market: Intravascular Ultrasound Devices Market Size, Trends and Insights By Product Type (IVUS Consoles, IVUS Catheters), By End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Diagnostic Laboratories, Research Institutes), By Application (Coronary Diagnosis, Coronary Intervention, Coronary Research, Non-coronary/Peripheral Applications), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Ascites Market: Ascites Market Size, Trends and Insights By Types (Transudative, Exudative, Others), By Diagnosis (Ultrasound, CT Scan, MRI, Blood Test, Laparoscopy, Angiography, Others), By Treatment (Medication, Paracentesis, Surgery, Others), By Route of Administration (Oral, Parenteral, Others), By End-Users (Hospitals, Homecare, Specialty Clinics, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Surgical Site Infection Control Market: Surgical Site Infection Control Market Size, Trends and Insights By Product (Surgical scrubs, Hair clippers, Surgical drapes, Surgical irrigation), By Surgery/Procedure (Cataract surgery, Cesarean section, Dental restoration, Gastric bypass, Others), By Type of Infection (Superficial incisional SSI, Deep incisional SSI, Organ or space SSI), By End-use (Hospitals, Ambulatory surgical centers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Serological Testing Market is segmented as follows:

By Technology

By Product

- Instruments

- Consumables and Reagents

By Application

- Hepatitis

- Coronavirus (COVID-19)

- Human Immunodeficiency Virus (HIV)

- Rotavirus infections

- Others

By End-User

- Diagnostic Laboratories

- Hospitals

- Other End Users

Click Here to Get a Free Sample Report of the Global Serological Testing Market @ https://www.custommarketinsights.com/report/serological-testing-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Serological Testing Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Serological Testing Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Serological Testing Market? What Was the Capacity, Production Value, Cost and PROFIT of the Serological Testing Market?

- What Is the Current Market Status of the Serological Testing Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Serological Testing Market by Considering Applications and Types?

- What Are Projections of the Global Serological Testing Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Serological Testing Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Serological Testing Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Serological Testing Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Serological Testing Industry?

Click Here to Access a Free Sample Report of the Global Serological Testing Market @ https://www.custommarketinsights.com/report/serological-testing-market/

Reasons to Purchase Serological Testing Market Report

- Serological Testing Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Serological Testing Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Serological Testing Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Serological Testing Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Serological Testing market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Serological Testing Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/serological-testing-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Serological Testing market analysis.

- The competitive environment of current and potential participants in the Serological Testing market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Serological Testing market should find this report useful. The research will be useful to all market participants in the Serological Testing industry.

- Managers in the Serological Testing sector are interested in publishing up-to-date and projected data about the worldwide Serological Testing market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Serological Testing products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.