Solidion Technology Reports Third Quarter 2024 Results

DALLAS, Nov. 19, 2024 /PRNewswire/ — Solidion Technology, Inc. STI, an advanced silicon anode and battery technology materials provider (the “Company” or “Solidion”), today announced its operational and financial results for the third quarter of 2024.

Previously Announced Recent Business Highlights

Technological Advancements:

- Developed and secured a newly granted U.S. patent for technology enabling 5-minute charging of lithium batteries across all climates, overcoming a key barrier to electric vehicle (“EV”) adoption by ensuring fast, safe, and weather-independent charging. This innovation leverages a graphene-based heat spreader for optimal battery temperature control, positioning Solidion as a leader in advancing EV infrastructure and addressing consumer range anxiety.

- Expansion of the Company’s industry-leading intellectual property portfolio1 with 20 new U.S. patents granted this year. The portfolio offers patents for a diverse range of advanced anode materials, spanning from sustainable graphite to silicon oxide (SiOx), silicon (Si), and protected lithium metal anode, delivering specific capacities ranging from 300 to an extraordinary 3,500+ mAh/g (milliamp-hour per gram). The intellectual property also features non-silane gas based and graphene-enhanced versions for automakers and other energy storage applications.

- Achieved third-party validation for the Company’s innovative, cost-effective process that eliminates the need for toxic silane gas and CVD techniques. This milestone positions Solidion to become a key North American supplier in the rapidly growing energy storage battery market, offering materials that enhance energy density, and seamlessly integrate with existing battery manufacturing processes.

Business Development and Corporate Updates:

- Signing of the strategic Memorandum of Understanding with Bluestar Materials Company on November 8, 2024 to accelerate the commercialization of Solidion’s groundbreaking silicon-based anode technology. This collaboration strengthens Solidion’s position in the U.S. market, leveraging its extensive patent portfolio to drive advancements in battery efficiency, energy density, and domestic manufacturing opportunities.

- Bitcoin purchases are now part of the Company’s corporate treasury strategy, which includes allocating 60% of excess cash reserves, interest earnings, and a portion of future capital raises, reflecting confidence in Bitcoin as a store of value, inflation hedge and compelling investment. The Company will continue to explore opportunities to evolve its allocation to Bitcoin and enhance shareholder value.

- The inclusion into the Russell 3000® Index, enhancing Solidion’s visibility among institutional investors and positions the Company to attract broader market interest and capital.

CEO Statement:

“Solidion is well positioned for the rapidly changing political landscape as a low-cost U.S. manufacturer,” said Jaymes Winters, CEO of Solidion Technology. “We have achieved several milestones that several competitors have yet to achieve, despite spending exponentially more than Solidion”.

Third Quarter 2024 Financial Highlights

- $4.2 million loss from continuing operations, including increased spending on third-party validation testing for automakers.

- Net Loss of $6,636,679, with EPS of –$0.07, including a non-cash loss of $9,654,799 on issuance of PIPE common stock and warrants.

See below for additional information on Solidion’s operational results:

Summary of Statements of Operations

|

For the Three Months Ended |

|||||||||||

|

2024 |

2023 |

||||||||||

|

Net sales |

$ |

– |

$ |

1,315 |

|||||||

|

Cost of goods sold |

– |

– |

|||||||||

|

Operating expenses |

4,193,006 |

1,439,900 |

|||||||||

|

Total other income (expense) |

(2,443,673) |

1,091 |

|||||||||

|

Net Income (loss) |

$ |

(6,636,679) |

$ |

(1,437,494) |

|||||||

Operating Expenses

Operating expenses increased by $2,753,106 for the three months ended September 30, 2024. This increase was primarily driven by third party validation testing of our proprietary silicon anode, professional fees, stock-based compensation, insurance, and other administrative costs associated with the Company operating as a public entity as of February 2, 2024.

Other Income (expense)

Other expense increased by $2,444,764 for the three months ended September 30, 2024. This increase was largely driven by a gain of $7,232,835 due to a change in the fair value of derivative liabilities related to the Forward Purchase Agreement, and warrants related to the Private Placement financing. Additionally, there was a loss of $9,654,799 from the issuance of common stock and warrants related to the August Private Placement financing.

The unaudited condensed consolidated financial statements of Solidion and additional information can be found in the Company’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission on November 18, 2024 (the “Form 10Q”). This earnings release should be read together with the information contained in the Form 10-Q.

About Solidion

Headquartered in Dallas, Texas with pilot production facilities in Dayton, Ohio, Solidion’s STI core business includes manufacturing of battery materials and components, as well as development and production of next-generation batteries for energy storage systems and electric vehicles for ground, air, and sea transportation. Solidion holds a portfolio of over 550 patents, covering innovations such as high-capacity, non-silane gas and graphene-enabled silicon anodes, biomass-based graphite, advanced lithium-sulfur and lithium-metal technologies.

Solidion offers two lines of battery products: (i) advanced anode materials (ready for production expansion); and (ii) three classes of solid-state batteries, including Silicon-rich all-solid-state lithium-ion cells (Gen 1), anode less lithium metal cells (Gen 2), and lithium-sulfur cells (Gen 3), all featuring an advanced polymer- or polymer/inorganic composite-based solid electrolyte that is process-friendly. Solidion’s solid-state batteries can be manufactured at scale using current lithium-ion cell production facilities. Solidion batteries are designed to deliver extended EV range, improved battery safety, lower cost per KWh, and next-gen cathodes (potential to replace expensive nickel and cobalt with sulfur (S) and other more abundant elements).

For more information, please visit www.solidiontech.com or contact Investor Relations.

Forward-Looking Statements

This earnings release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of Solidion’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause Solidion’s actual results to differ materially from those described in the forward-looking statements can be found in Solidion’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024, which have been filed with the Securities and Exchange Commission and are available on Solidion’s website, and on the Securities and Exchange Commission’s website (www.sec.gov). Solidion does not undertake to update any forward-looking statements.

1 Source: Silicon Anode for Li-ion Batteries – Patent Landscape 2022 – FLYER (knowmade.com)

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/solidion-technology-reports-third-quarter-2024-results-302310622.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/solidion-technology-reports-third-quarter-2024-results-302310622.html

SOURCE Solidion Technology, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market Whales and Their Recent Bets on IONQ Options

Investors with a lot of money to spend have taken a bullish stance on IonQ IONQ.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with IONQ, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 62 uncommon options trades for IonQ.

This isn’t normal.

The overall sentiment of these big-money traders is split between 58% bullish and 32%, bearish.

Out of all of the special options we uncovered, 14 are puts, for a total amount of $1,331,990, and 48 are calls, for a total amount of $2,500,876.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $7.5 and $40.0 for IonQ, spanning the last three months.

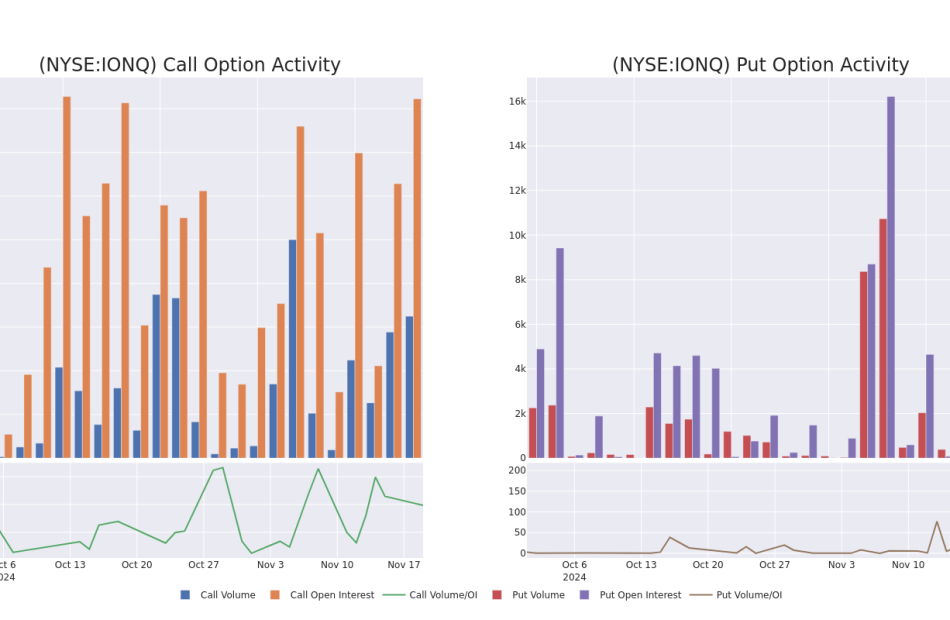

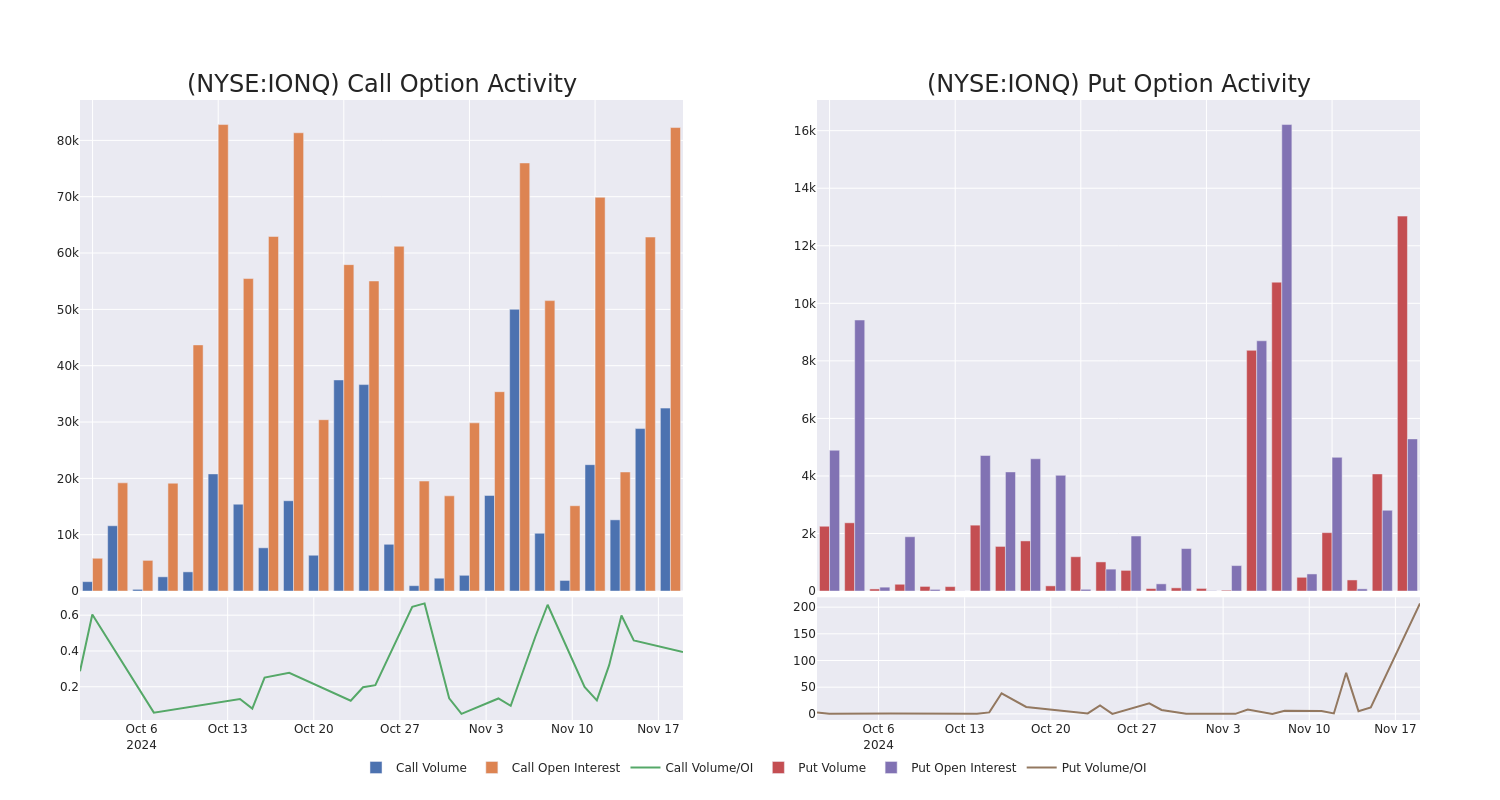

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of IonQ stands at 3648.38, with a total volume reaching 45,328.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in IonQ, situated within the strike price corridor from $7.5 to $40.0, throughout the last 30 days.

IonQ Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IONQ | PUT | SWEEP | BEARISH | 12/20/24 | $3.8 | $3.75 | $3.75 | $28.00 | $467.6K | 12 | 1.8K |

| IONQ | CALL | SWEEP | BEARISH | 11/22/24 | $3.1 | $2.95 | $2.94 | $25.00 | $146.5K | 3.9K | 1.4K |

| IONQ | CALL | SWEEP | BEARISH | 11/22/24 | $3.15 | $2.92 | $2.91 | $25.00 | $145.3K | 3.9K | 1.9K |

| IONQ | PUT | SWEEP | BULLISH | 01/17/25 | $11.0 | $10.95 | $10.95 | $35.00 | $141.2K | 1.2K | 151 |

| IONQ | CALL | TRADE | BEARISH | 01/17/25 | $13.25 | $13.05 | $13.1 | $15.00 | $131.0K | 7.6K | 151 |

About IonQ

IonQ Inc sells access to several quantum computers of various qubit capacities and is in the process of researching and developing technologies for quantum computers with increasing computational capabilities. The company currently makes access to its quantum computers available via cloud platforms and also to select customers via its own cloud service. This cloud-based approach enables the broad availability of quantum-computing-as-a-service (QCaaS). The company derives its revenue from its quantum-computing-as-a-service arrangements, consulting services related to co-developing algorithms on company’s quantum computing systems, and contracts associated with the design, development, and construction of specialized quantum computing systems together with related services.

Following our analysis of the options activities associated with IonQ, we pivot to a closer look at the company’s own performance.

Present Market Standing of IonQ

- Currently trading with a volume of 25,367,717, the IONQ’s price is up by 10.7%, now at $27.93.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 99 days.

Professional Analyst Ratings for IonQ

3 market experts have recently issued ratings for this stock, with a consensus target price of $20.666666666666668.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Needham continues to hold a Buy rating for IonQ, targeting a price of $18.

* Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for IonQ, targeting a price of $22.

* Consistent in their evaluation, an analyst from Craig-Hallum keeps a Buy rating on IonQ with a target price of $22.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest IonQ options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Moatable Reports Third Quarter 2024 Financial Results

PHOENIX, Nov. 19, 2024 /PRNewswire/ — Moatable, Inc. MTBLY (“Moatable” or the “Company”), a leading US-based SaaS company, today reported its third quarter 2024 financial results.

Third Quarter 2024 Financial Highlights

- Revenue increased 26% over Q3 2023 to $16.7 million in Q3 2024; Revenue for the nine months ended September 30, 2024 increased 20%, to $46.0 million, compared to the same period last year.

- Gross profit increased 21% over Q3 2023 to $12.6 million; Gross profit for the nine months ended September 30, 2024 increased 17% to $35.1 million, compared to the same period last year.

- Loss from operations improved 71% from a loss of $0.8 million in Q3 2023 to a loss of $0.2 million in Q3 2024; loss from operations for the nine months ended September 30, 2024 improved 74% to $1.9 million compared to $7.0 million in the same period last year.

- Adjusted EBITDA* increased 486% from a profit of $43 thousand in Q3 2023 to a profit of $252 thousand in Q3 2024; adjusted EBITDA for the nine months ended September 30, 2024 improved 134% to a profit of $1.4 million compared to a loss of $4.2 million in the same period last year.

- Total cash & cash equivalents and restricted cash were $38.4 million as of the end of Q3 2024 as compared to $39.0 million as of the end of 2023.

“We are very pleased with the continued steady revenue growth over the past seven quarters and are particularly encouraged by our profitability, on an Adjusted EBITDA basis, in the first nine months of 2024, including the third quarter. Our Adjusted EBITDA of $1.4 million profit in the first nine months of 2024 shows significant improvement over the $4.2 million loss in the same period of 2023, as we continue to rationalize our cost structure and maintain our path to profitability. The Adjusted EBITDA of $252 thousand in Q3 2024 continues the profitability trend through the first nine months of 2024,” said Scott Stone, the chief financial officer of Moatable.

* Adjusted EBITDA is a non-GAAP measure. We define adjusted EBITDA as loss from operations excluding share-based compensation expenses, depreciation and amortization expenses, impairment of intangibles, and certain other non-recurring expenses. See the table “Reconciliation of Non-GAAP Financial Measure to the Comparable GAAP Financial Measure” below for details.

About Moatable Inc.

Moatable, Inc. MTBLY operates two US-based SaaS businesses including Lofty and Trucker Path. Moatable’s American depositary shares, each of which currently represents forty-five Class A ordinary shares, trade on OTC Pink open market under the symbol “MTBLY”. For more news and information on Moatable, please visit Moatable.com.

Forward-Looking Statements

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Statements that are not historical facts, including statements about Moatable’s beliefs and expectations, including statements on making investments and operating businesses that generate long-term returns for investors, and expectations for future growth and innovation are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Moatable’s goals and strategies; Moatable’s future business development, financial condition and results of operations; Moatable’s expectations regarding demand for and market acceptance of its services; Moatable’s plans to enhance user experience, infrastructure and service offerings. Further information regarding these and other risks is included in our recent annual and quarterly reports on Form 10-K and Form 10-Q and other documents filed with the SEC. All information provided in this press release is as of the date of this press release, and Moatable does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Non-GAAP Financial Information

This press release includes certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Adjusted EBITDA. We define Adjusted EBITDA as loss from operations excluding equity-based compensation, depreciation and amortization, impairment of intangibles, and certain other non-recurring expenses. See “Reconciliation of Non-GAAP Financial Measure to the Comparable GAAP Financial Measure” below.

We believe that these non-GAAP financial measures are provided to enhance the reader’s understanding of our past financial performance and our prospects for the future. Our management team uses these non-GAAP financial measures in assessing the Company’s performance, as well as in planning and forecasting future periods. The non-GAAP financial information is presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly titled non-GAAP measures used by other companies.

|

MOATABLE, INC. |

||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) |

||||||||||||

|

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBR 30, 2023 and 2024 |

||||||||||||

|

(In thousands of US dollars) |

||||||||||||

|

For the three months ended September 30, |

For the nine months ended September 30, |

|||||||||||

|

2023 |

2024 |

2023 |

2024 |

|||||||||

|

Revenues: |

||||||||||||

|

SaaS revenue |

$ |

13,257 |

$ |

16,641 |

$ |

38,188 |

$ |

45,872 |

||||

|

Other services |

34 |

45 |

120 |

126 |

||||||||

|

Total revenues |

13,291 |

16,686 |

38,308 |

45,998 |

||||||||

|

Cost of revenues: |

||||||||||||

|

SaaS business |

2,776 |

4,017 |

8,037 |

10,761 |

||||||||

|

Other services |

37 |

36 |

120 |

108 |

||||||||

|

Total cost of revenues |

2,813 |

4,053 |

8,157 |

10,869 |

||||||||

|

Gross profit |

10,478 |

12,633 |

30,151 |

35,129 |

||||||||

|

Operating expenses |

||||||||||||

|

Selling and marketing |

4,382 |

4,628 |

13,917 |

12,991 |

||||||||

|

Research and development |

4,267 |

4,779 |

14,080 |

13,792 |

||||||||

|

General and administrative |

2,628 |

3,461 |

9,203 |

9,995 |

||||||||

|

Impairment of intangible assets |

— |

— |

— |

207 |

||||||||

|

Total operating expenses |

11,277 |

12,868 |

37,200 |

36,985 |

||||||||

|

Loss from operations |

$ |

(799) |

$ |

(235) |

$ |

(7,049) |

$ |

(1,856) |

||||

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURE TO THE COMPARABLE GAAP |

||||||||||||

|

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023 and 2024 |

||||||||||||

|

(In thousands of US dollars, except share data and per share data) |

||||||||||||

|

For the three months ended September 30, |

For the nine months ended September 30, |

|||||||||||

|

2023 |

2024 |

2023 |

2024 |

|||||||||

|

Loss from operations |

$ |

(799) |

$ |

(235) |

$ |

(7,049) |

$ |

(1,856) |

||||

|

Plus (minus) |

||||||||||||

|

Share-based compensation expense |

787 |

274 |

2,265 |

1,599 |

||||||||

|

Depreciation and amortization expenses |

55 |

213 |

573 |

638 |

||||||||

|

Impairment of intangibles |

— |

— |

— |

207 |

||||||||

|

Arbitration fees |

847 |

|||||||||||

|

Adjusted EBITDA |

43 |

252 |

(4,211) |

1,435 |

||||||||

![]() View original content:https://www.prnewswire.com/news-releases/moatable-reports-third-quarter-2024-financial-results-302310670.html

View original content:https://www.prnewswire.com/news-releases/moatable-reports-third-quarter-2024-financial-results-302310670.html

SOURCE Moatable, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Flex Set to Join S&P MidCap 400; Azenta and Concentra Group Holdings to Join S&P SmallCap 600

NEW YORK, Nov. 19, 2024 /PRNewswire/ — S&P Dow Jones Indices will make the following changes to the S&P MidCap 400 and S&P SmallCap 600:

- Flex Ltd FLEX will replace Azenta Inc. AZTA in the S&P MidCap 400, and Azenta will replace Envestnet Inc. ENV in the S&P SmallCap 600 effective prior to the opening of trading on Monday, November 25. Bain Capital is acquiring Envestnet in a deal expected to be completed soon, pending final closing conditions. Azenta’s market capitalization is no longer representative of the mid-cap market space.

- Concentra Group Holdings Inc. CON will replace Myers Industries Inc. MYE in the S&P SmallCap 600 effective prior to the opening of trading on Wednesday, November 27. S&P SmallCap 600 constituent Select Medical Holdings Corp. SEM is distributing the 80% of shares of Concentra Group Holdings it owns to shareholders in a transaction expected to be completed on November 26. Myers Industries’ market capitalization is no longer representative of the small-cap market space.

Following is a summary of the changes that will take place prior to the open of trading on the effective date:

|

Effective Date |

Index Name |

Action |

Company Name |

Ticker |

GICS Sector |

|

Nov 25, 2024 |

S&P MidCap 400 |

Addition |

Flex |

FLEX |

Information Technology |

|

Nov 25, 2024 |

S&P MidCap 400 |

Deletion |

Azenta |

AZTA |

Health Care |

|

Nov 25, 2024 |

S&P SmallCap 600 |

Addition |

Azenta |

AZTA |

Health Care |

|

Nov 25, 2024 |

S&P SmallCap 600 |

Deletion |

Envestnet |

ENV |

Information Technology |

|

Nov 27, 2024 |

S&P SmallCap 600 |

Addition |

Concentra Group Holdings |

CON |

Health Care |

|

Nov 27, 2024 |

S&P SmallCap 600 |

Deletion |

Myers Industries |

MYE |

Materials |

For more information about S&P Dow Jones Indices, please visit www.spdji.com

ABOUT S&P DOW JONES INDICES

S&P Dow Jones Indices is the largest global resource for essential index-based concepts, data and research, and home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P DJI has been innovating and developing indices across the spectrum of asset classes helping to define the way investors measure and trade the markets.

S&P Dow Jones Indices is a division of S&P Global SPGI, which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit www.spdji.com.

FOR MORE INFORMATION:

S&P Dow Jones Indices

index_services@spglobal.com

Media Inquiries

spdji.comms@spglobal.com

![]() View original content:https://www.prnewswire.com/news-releases/flex-set-to-join-sp-midcap-400-azenta-and-concentra-group-holdings-to-join-sp-smallcap-600-302310669.html

View original content:https://www.prnewswire.com/news-releases/flex-set-to-join-sp-midcap-400-azenta-and-concentra-group-holdings-to-join-sp-smallcap-600-302310669.html

SOURCE S&P Dow Jones Indices

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Engaging In Options Activity, Gary D Fields Exercises Options Valued At $3.49M In AAON

A substantial insider activity was disclosed on November 18, as Fields, CEO at AAON AAON, reported the exercise of a large sell of company stock options.

What Happened: Fields, CEO at AAON, made a strategic move by exercising stock options for 35,000 shares of AAON as detailed in a Form 4 filing on Monday with the U.S. Securities and Exchange Commission. The transaction value amounted to $3,488,100.

AAON shares are currently trading up by 0.01%, with a current price of $131.35 as of Tuesday morning. This brings the total value of Fields’s 35,000 shares to $3,488,100.

All You Need to Know About AAON

AAON Inc is a manufacturer of air-conditioning and heating equipment. The products include rooftop units, chillers, packaged outdoor mechanical rooms, air-handling units, makeup air units, energy-recovery units, condensing units, geothermal heat pumps, and self-contained units and coils. AAON’s products serve the commercial and industrial new construction and replacement markets, primarily in North America.

A Deep Dive into AAON’s Financials

Positive Revenue Trend: Examining AAON’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.9% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 34.88%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): With an EPS below industry norms, AAON exhibits below-average bottom-line performance with a current EPS of 0.65.

Debt Management: With a below-average debt-to-equity ratio of 0.09, AAON adopts a prudent financial strategy, indicating a balanced approach to debt management.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 57.61, AAON’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 9.07 is above industry norms, reflecting an elevated valuation for AAON’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 35.52, AAON demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Cracking Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of AAON’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yoshiharu Reports Third Quarter 2024 Financial Results

Third Quarter 2024 Revenues Increase 49% to $3.0 Million

9M 2024 Revenues Increase 36% to $9.2 Million

Strategic Partnerships in Sichuan and Liaoning Provinces in China Anchor International Expansion Plans, Entry into Growing Korean BBQ Segment Expands Presence and Cuisine

BUENA PARK, Calif., Nov. 19, 2024 (GLOBE NEWSWIRE) — Yoshiharu Global Co. YOSH (“Yoshiharu” or the “Company”), a restaurant operator specializing in authentic Japanese ramen & rolls, today reported results for the third quarter ended September 30, 2024.

Third Quarter 2024 and Recent Operational Highlights

- Grand opening of a new restaurant in San Clemente, CA, bringing the number of locations to 15 with 2 additional locations under construction.

- Entered into a non-binding Memorandum of Understanding (“MoU”) with Chengdu Octaday Entertainment Group through a Master License Agreement (“MLA”) for the Sichuan Province in China to introduce Yoshiharu Global’s Expanding Cuisine in Sichuan Province, China, with a rich and diverse culture and home to over 83 million people.

- Entered into a non-binding MoU with Xing Sheng Group through a MLA for the Liaoning Province in China to introduce a new flagship Yoshiharu restaurant in Shenyang, China, home to over 43 million people.

- Announced the planned entry into the lucrative and growing Korean BBQ (“KBBQ”) category, with synergies with existing ramen business expected to drive expanding market opportunity and footprint in high growth category.

- Closed a non-brokered $1.0 million private placement investment from an accredited investor and intends to use these proceeds for the expansion into the KBBQ segment.

- Nine months 2024 revenue increased 36.3% to $9.2 million.

- Restaurant-level contribution increased to $1.0 million for the nine-months ended September 30, 2024 from $543,000 in the same period last year.

Management Commentary

“The third quarter of 2024 was highlighted by strong revenue growth, the grand opening of our 15th location, and new partnerships and initiatives, all positioning us to grow the brand and move us steadily towards profitability,” said James Chae, Yoshiharu’s President, CEO and Chairman of the Board. “In the quarter, revenue growth was driven by our restaurant service across Southern California, Las Vegas and diversified mix of service channels, including takeout and delivery. We have successfully optimized operating expenses while maintaining a strong Average Unit Volume (“AUV”) comparable to previous periods, despite continued headwinds from input costs, consumer price sensitivity, and higher cost of capital.

“We continued to expand our presence and cuisine in both the US and international dining scenes in the third quarter. We celebrated the grand opening of our newest US location in San Clemente, CA, a classic beach town destination known for its beaches, world class surfing and vibrant dining scene. The new location benefits from excellent access and high visibility to I-5, drawing an estimated 8,300 visits a day and over 3 million visits a year, surrounded by an affluent population of more than 69,000 with an average household income of over $145,000 within a 3-mile radius.

“In China, two new strategic non-binding Memorandum of Understandings (“MoU”) through Master License Agreements (“MLA”) will enable us to open locations across China. With Chengdu Octaday Entertainment Group, we are aiming to introduce Yoshiharu Global’s expanding cuisine in Sichuan Province, China, home to over 83 million people. The partnership presents multiple opportunities to open locations within Chengdu Octaday’s 30 corporate owned and managed hotels, theme parks and other destination attractions. We also partnered with Xing Sheng Group to introduce a new flagship Yoshiharu restaurant in Shenyang, China, home to over 43 million people. Xing Sheng Group’s real estate arm specializes in developing tourist attraction centers in Shenyang and is currently constructing China’s largest water park. This partnership offers us a prime opportunity to develop a flagship location within the water park, catering to both local residents and visiting tourists.

“Recently we announced a new initiative to enter the lucrative and growing Korean BBQ (“KBBQ”) category, a highly complementary addition to our ramen business. Demand for KBBQ cuisine in the US has grown along with the popularity of Korean street food and the interest in new international flavors. The communal and interactive nature of KBBQ, with its extensive menus and relatively affordable prices, is a large part of this appeal. Armed with a $1.0 investment for this initiative, we believe we can capitalize on the resource and ingredient synergies between our existing offerings and KBBQ concept to enhance purchasing power, attract a wider audience, and explore cross-promotion opportunities to further solidify and expand the Yoshiharu brand. We also plan to explore further collaborative opportunities with Xing Sheng Group.

“Looking ahead, we are expanding our US geographic footprint with two more locations currently under construction and expected to open in Menifee, CA in December 2024 and Ontario, CA in January 2025. We continue to focus on the bottom-line as we remain keen on reaching profitability in the near future, supported by new initiatives such as adding kiosks across our stores and utilizing cooking robots to reduce labor costs. We are poised for additional growth with two new partnerships in China and expansion into the Korean BBQ segment. Taken together, we believe our multi-dimensional growth strategy will expand the Yoshiharu brand and build long-term shareholder value,” concluded Chae.

Third Quarter 2024 Financial Results

Revenues increased 48.9% to $3.0 million compared to $2.0 million in the prior year period. The increase was primarily driven by the three new Las Vegas restaurants acquired in April 2024.

Total restaurant operating expenses were $3.1 million compared to $2.2 million in the prior year period. The increase was primarily driven by increases in revenues from the three new Las Vegas restaurants acquired.

Operating loss increased to ($1.0) million compared to a loss of ($0.8) million in the prior year period as a result of higher general and administrative driven by the acquisition of Las Vegas entities.

Adjusted EBITDA, a non-GAAP measure defined below, was $(0.7) million compared to $(0.6) million in the prior year period.

Net loss was ($1.2) million compared to a net loss of ($0.9) million in the prior year period primarily due to an increase in expenses following the acquisition of Las Vegas.

Nine Months 2024 Financial Results

Revenues increased 36.3% to $9.2 million compared to $6.7 million in the prior year period. The increase was primarily driven by three new Las Vegas restaurants acquired in April 2024.

Restaurant-level contribution margin was 11.0% compared to 8.1% in the prior period with the increase in revenue from the LV acquisition and the management efforts to control the costs.

Total restaurant operating expenses were $8.7 million compared to $6.6 million in the prior year period. The increase was due to increases in in revenue. As a percentage of the revenue, the operating expenses were 96% compared to 98% in the prior period.

Operating loss improved to ($2.8) million compared to a loss of $(2.9) million in the prior year period.

Adjusted EBITDA, a non-GAAP measure defined below, was $(1.9) million compared to $(2.0) million in the prior year period.

Net loss was $3.2 million compared to a net loss of $3.0 million in the prior year period. The increase was primarily due to an increase in expenses following the acquisition of Las Vegas.

The Company’s cash balance totaled $1.7 million on September 30, 2024, compared to $1.4 million on December 31, 2023.

For more information regarding Yoshiharu’s financial results, including financial tables, please see our Form 10-Q for quarter ended September 30, 2024 filed with the U.S. Securities and Exchange Commission (the “SEC”). The Company’s SEC filings can be found on the SEC’s website at www.sec.gov or the Company’s investor relations site at ir.yoshiharuramen.com.

About Yoshiharu Global Co.

Yoshiharu is a fast-growing restaurant operator and was born out of the idea of introducing the modernized Japanese dining experience to customers all over the world. Specializing in Japanese ramen, Yoshiharu gained recognition as a leading ramen restaurant in Southern California within six months of its 2016 debut and has continued to expand its top-notch restaurant service across Southern California and Las Vegas, currently owning and operating 14 restaurants.

For more information, please visit www.yoshiharuramen.com.

Non-GAAP Financial Measures

EBITDA is defined as net income (loss) before interest, income taxes and depreciation and amortization. Adjusted EBITDA is defined as EBITDA plus stock-based compensation expense, non-cash lease expense and asset disposals, closure costs and restaurant impairments, as well as certain items, such as employee retention credit, litigation accrual, and certain executive transition costs, that we believe are not indicative of our core operating results. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by sales. EBITDA, and Adjusted EBITDA are non-GAAP measures which are intended as supplemental measures of our performance and are neither required by, nor presented in accordance with, GAAP. The Company believes that EBITDA, and Adjusted EBITDA provide useful information to management and investors regarding certain financial and business trends relating to its financial condition and operating results. However, these measures may not provide a complete understanding of the operating results of the Company as a whole and such measures should be reviewed in conjunction with its GAAP financial results.

The Company believes that the use of EBITDA, and Adjusted EBITDA provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing its financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. However, you should be aware when evaluating EBITDA, and Adjusted EBITDA that in the future the Company may incur expenses similar to those excluded when calculating these measures. In addition, the Company’s presentation of these measures should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items. The Company’s computation of Adjusted EBITDA may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate Adjusted EBITDA in the same fashion.

Because of these limitations, EBITDA, and Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. The Company compensates for these limitations by relying primarily on its GAAP results and using EBITDA, and Adjusted EBITDA on a supplemental basis. You should review the reconciliation of net loss to EBITDA, and Adjusted EBITDA in the Company’s SEC filings and not rely on any single financial measure to evaluate its business.

The full reconciliation of net loss to EBITDA and Adjusted EBITDA is set forth in our Form 10-Q for the quarter ended September 30, 2024 which can be found on the SEC ‘s website at www.sec.gov or the Company’s investor relations site at ir.yoshiharuramen.com.

Forward Looking Statements

This press release includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, statements regarding our position to execute on our growth strategy, and our ability to expand our leadership position. These forward-looking statements include, but are not limited to, the Company’s beliefs, plans, goals, objectives, expectations, assumptions, estimates, intentions, future performance, other statements that are not historical facts and statements identified by words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates” or words of similar meaning. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in, or suggested by, these forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including those risks and uncertainties described in the Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of our filings with the SEC including our Form 10-K for the year ended December 31, 2023, and subsequent reports we file with the SEC from time to time, which can be found on the SEC’s website at www.sec.gov. Such risks, uncertainties, and other factors include, but are not limited to: the risk that our plans to maintain and increase liquidity may not be successful to remediate our past operating losses; the risk that we may not be able to successfully implement our growth strategy if we are unable to identify appropriate sites for restaurant locations, expand in existing and new markets, obtain favorable lease terms, attract guests to our restaurants or hire and retain personnel; that our operating results and growth strategies will be closely tied to the success of our future franchise partners and we will have limited control with respect to their operations; the risk that we may face negative publicity or damage to our reputation, which could arise from concerns regarding food safety and foodborne illness or other matters; the risk that that minimum wage increases and mandated employee benefits could cause a significant increase in our labor costs; and the risk that our marketing programs may not be successful, and our new menu items, advertising campaigns and restaurant designs and remodels may not generate increased sales or profits. We urge you to consider those risks and uncertainties in evaluating our forward-looking statements. We caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Investor Relations Contact:

Larry W Holub

Director

MZ North America

YOSH@mzgroup.us

312-261-6412

| Yoshiharu Global Co. Unaudited Consolidated Balance Sheets |

||||||||

| As of | September 30, 2024 |

December 31, 2023 |

||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 1,712,064 | $ | 1,462,326 | ||||

| Accounts receivable | 36,397 | – | ||||||

| Inventories | 89,462 | 73,023 | ||||||

| Total current assets | 1,837,923 | 1,535,349 | ||||||

| Non-Current Assets: | ||||||||

| Property and equipment, net | 5,031,361 | 4,092,950 | ||||||

| Operating lease right-of-use asset | 6,846,051 | 5,459,708 | ||||||

| Intangible asset | 504,499 | – | ||||||

| Goodwill | 1,985,645 | – | ||||||

| Other assets | 1,106,597 | 1,931,357 | ||||||

| Total non-current assets | 15,474,153 | 11,484,015 | ||||||

| Total assets | $ | 17,312,076 | $ | 13,019,364 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 884,857 | $ | 647,811 | ||||

| Line of credit | 1,000,000 | 1,000,000 | ||||||

| Current portion of operating lease liabilities | 908,691 | 572,230 | ||||||

| Current portion of bank notes payables | 169,814 | 414,378 | ||||||

| Current portion of loan payable, EIDL | 2,669 | 10,536 | ||||||

| Loans payable to financial institutions | 119,939 | 534,239 | ||||||

| Due to related party | 1,770,796 | 24,176 | ||||||

| Other payables | 1,078,291 | 65,700 | ||||||

| Total current liabilities | 5,895,057 | 3,269,070 | ||||||

| Operating lease liabilities, less current portion | 6,770,605 | 5,689,535 | ||||||

| Bank notes payables, less current portion | 2,830,798 | 991,951 | ||||||

| Loan payable, EIDL, less current portion | 415,422 | 415,329 | ||||||

| Notes payable to related party | 600,000 | – | ||||||

| Convertible notes to related party | 1,200,000 | – | ||||||

| Total liabilities | 17,711,882 | 10,365,885 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders’ equity | ||||||||

| Class A Common Stock – $0.0001 par value; 49,000,000 authorized shares; 1,255,197 shares issued and outstanding at September 30, 2024 and 1,230,246 shares issued and outstanding at December 31, 2023 | 125 | 123 | ||||||

| Class B Common Stock – $0.0001 par value; 1,000,000 authorized shares; 100,000 shares issued and outstanding at September 30, 2024 and December 31, 2023 | 10 | 10 | ||||||

| Additional paid-in capital | 12,143,969 | 11,994,119 | ||||||

| Accumulated deficit | (12,543,910 | ) | (9,340,773 | ) | ||||

| Total stockholders’ equity (deficit) | (399,806 | ) | 2,653,479 | |||||

| Total liabilities and stockholders’ equity | $ | 17,312,076 | $ | 13,019,364 | ||||

| Yoshiharu Global Co. Unaudited Consolidated Statements of Operations |

||||||||||||||||

| Nine months Ended September 30, |

Three Months Ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue: | ||||||||||||||||

| Food and beverage | $ | 9,152,530 | $ | 6,714,429 | $ | 3,015,525 | $ | 2,025,386 | ||||||||

| Total revenue | 9,152,530 | 6,714,429 | 3,015,525 | 2,025,386 | ||||||||||||

| Restaurant operating expenses: | ||||||||||||||||

| Food, beverages and supplies | 2,362,515 | 1,787,046 | 853,943 | 557,705 | ||||||||||||

| Labor | 4,125,195 | 3,129,198 | 1,344,534 | 1,125,717 | ||||||||||||

| Rent and utilities | 1,262,963 | 840,389 | 493,667 | 285,013 | ||||||||||||

| Delivery and service fees | 398,986 | 415,139 | 118,070 | 130,189 | ||||||||||||

| Depreciation | 596,701 | 396,388 | 246,374 | 144,701 | ||||||||||||

| Total restaurant operating expenses | 8,746,360 | 6,568,160 | 3,056,588 | 2,243,325 | ||||||||||||

| Net operating restaurant operating income (loss) | 406,170 | 146,269 | (41,063 | ) | (217,939 | ) | ||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | 2,953,755 | 2,700,078 | 935,591 | 477,732 | ||||||||||||

| Related party compensation | 139,769 | 216,308 | 50,000 | 92,876 | ||||||||||||

| Advertising and marketing | 80,955 | 86,593 | 22,391 | 34,051 | ||||||||||||

| Total operating expenses | 3,174,479 | 3,002,979 | 1,007,982 | 604,659 | ||||||||||||

| Loss from operations | (2,768,309 | ) | (2,856,710 | ) | (1,049,045 | ) | (822,598 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Gain on disposal of fixed asset | – | 8,920 | – | – | ||||||||||||

| Other income | 12,207 | 14,774 | – | 7,784 | ||||||||||||

| Interest | (413,598 | ) | (186,877 | ) | (161,472 | ) | (48,049 | ) | ||||||||

| Total other income (expense), net | (401,391 | ) | (163,183 | ) | (161,472 | ) | (40,265 | ) | ||||||||

| Loss before income taxes | (3,169,700 | ) | (3,019,893 | ) | (1,210,517 | ) | (862,863 | ) | ||||||||

| Income tax provision | 33,437 | 29,068 | 11,599 | 22,080 | ||||||||||||

| Net loss | $ | (3,203,137 | ) | $ | (3,048,961 | ) | $ | (1,222,116 | ) | $ | (884,943 | ) | ||||

| Loss per share: | ||||||||||||||||

| Basic and diluted | $ | (2.39 | ) | (2.29 | ) | (0.91 | ) | (0.67 | ) | |||||||

| Weighted average number of common shares outstanding: | ||||||||||||||||

| Basic and diluted | 1,342,585 | 1,328,847 | 1,343,537 | 1,328,847 | ||||||||||||

| Yoshiharu Global Co. Unaudited Consolidated Statements of Cash Flows |

||||||||

| For the nine months ended September 30, |

||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (3,203,137 | ) | $ | (3,048,961 | ) | ||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 596,701 | 396,388 | ||||||

| Amortization | 26,552 | – | ||||||

| Gain on disposal of fixed asset | – | (8,920 | ) | |||||

| Changes in assets and liabilities: | ||||||||

| Accounts receivable | (36,397 | ) | – | |||||

| Inventories | (3,654 | ) | 390 | |||||

| Other assets | 825,960 | (564,775 | ) | |||||

| Accounts payable and accrued expenses | 199,483 | (3,118 | ) | |||||

| Due to related party | 1,746,620 | (142,106 | ||||||

| Other payables | 1,012,591 | 59,785 | ||||||

| Net cash provided by (used in) operating activities | 1,164,719 | (3,311,317 | ) | |||||

| Cash flows from investing activities: | ||||||||

| Purchases of property and equipment | (437,042 | ) | (1,339,132 | ) | ||||

| Acquisition of LV entities | (1,800,000 | ) | – | |||||

| Net cash used in investing activities | (2,237,042 | ) | (1,339,132 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Advance from line of credit | – | 500,000 | ||||||

| Proceeds from borrowings for acquisition of LV entities | 900,000 | 812,000 | ||||||

| Proceeds from borrowings | 1,138,164 | – | ||||||

| Repayments on bank notes payables | (451,655 | ) | (645,280 | ) | ||||

| Repayment of loan payable to financial institutions | (414,300 | ) | – | |||||

| Proceeds from sale of common shares | 149,852 | – | ||||||

| Net cash provided by financing activities | 1,322,061 | 666,720 | ||||||

| Net increase (decrease) in cash | 249,738 | (3,983,729 | ) | |||||

| Cash – beginning of period | 1,462,326 | 6,138,786 | ||||||

| Cash – end of period | $ | 1,712,064 | $ | 2,155,057 | ||||

| Supplemental disclosures of non-cash financing activities: | ||||||||

| Note payable to related party | $ | 600,000 | – | |||||

| Convertible notes to related party | $ | 1,200,000 | – | |||||

| Supplemental disclosures of cash flow information | ||||||||

| Cash paid during the periods for: | ||||||||

| Interest | $ | 401,861 | $ | 186,877 | ||||

| Income taxes | $ | 33,437 | $ | 29,068 | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Check Out What Whales Are Doing With CCJ

Deep-pocketed investors have adopted a bullish approach towards Cameco CCJ, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CCJ usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 22 extraordinary options activities for Cameco. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 77% leaning bullish and 18% bearish. Among these notable options, 2 are puts, totaling $529,500, and 20 are calls, amounting to $1,480,442.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $70.0 for Cameco during the past quarter.

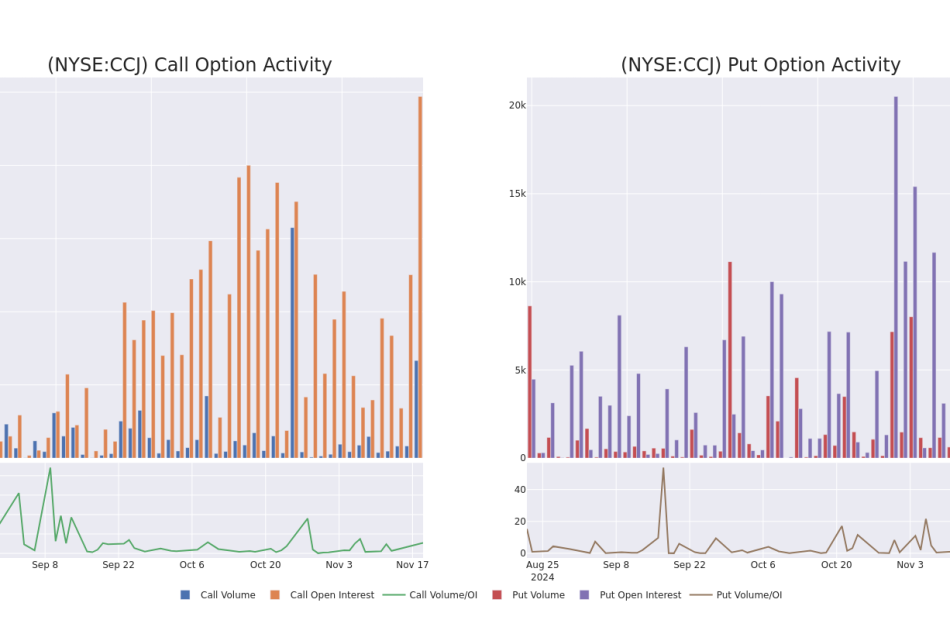

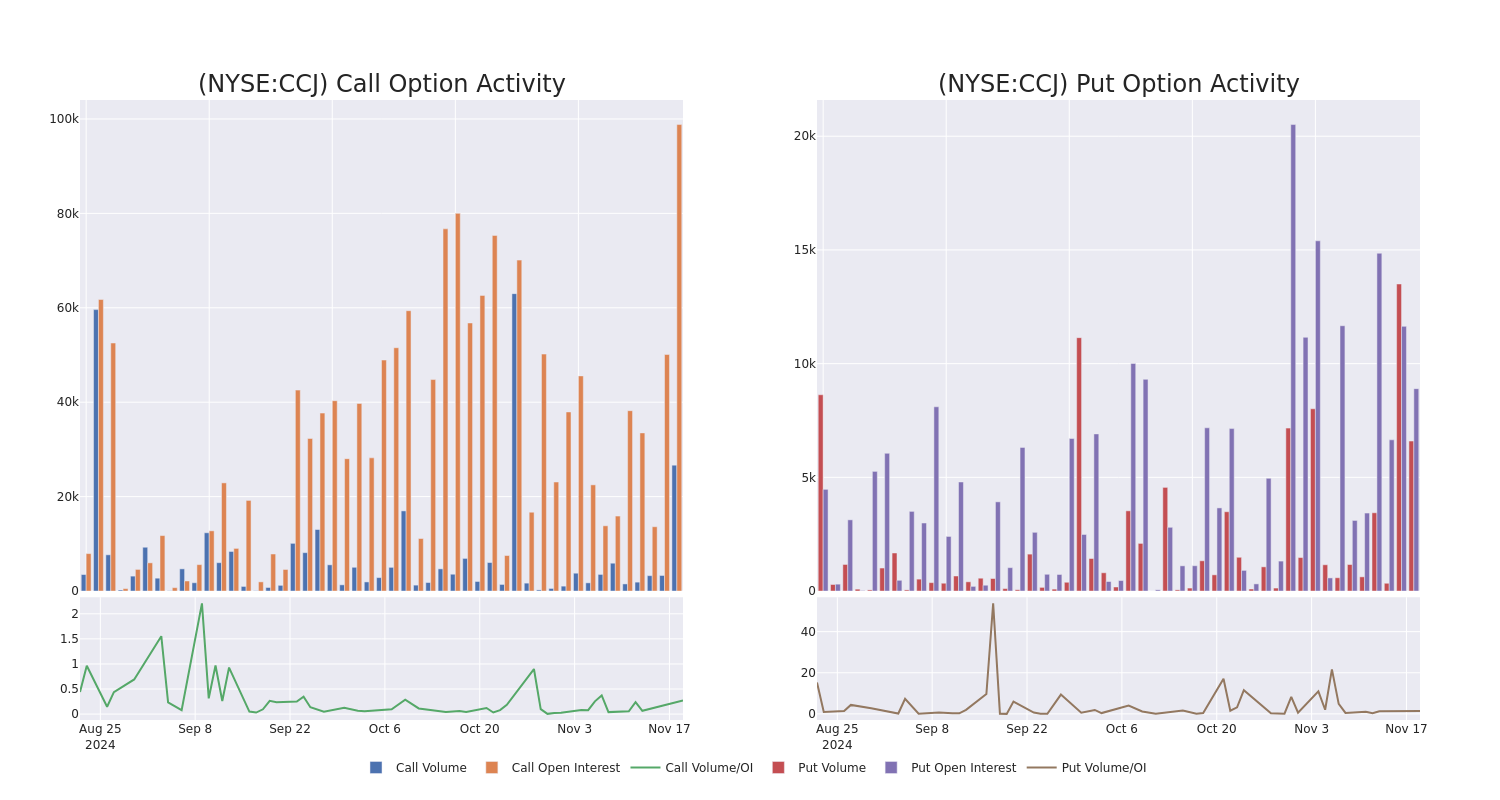

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Cameco stands at 8976.08, with a total volume reaching 33,251.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Cameco, situated within the strike price corridor from $20.0 to $70.0, throughout the last 30 days.

Cameco Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCJ | PUT | TRADE | BULLISH | 01/17/25 | $2.76 | $2.72 | $2.73 | $55.00 | $409.5K | 3.4K | 1.5K |

| CCJ | CALL | TRADE | BEARISH | 12/20/24 | $4.7 | $4.6 | $4.63 | $55.00 | $209.7K | 13.0K | 1.4K |

| CCJ | CALL | SWEEP | BEARISH | 12/20/24 | $0.38 | $0.34 | $0.34 | $70.00 | $195.3K | 4.8K | 5.7K |

| CCJ | PUT | TRADE | BEARISH | 11/22/24 | $0.3 | $0.15 | $0.24 | $53.00 | $120.0K | 5.4K | 5.0K |

| CCJ | CALL | SWEEP | BULLISH | 12/20/24 | $2.26 | $2.24 | $2.25 | $60.00 | $109.8K | 38.3K | 4.2K |

About Cameco

Cameco Corp is a provider of uranium needed to generate clean, reliable baseload electricity around the globe. one of those uranium producers. Cameco has three reportable segments, uranium, fuel services and Westinghouse. It derives maximum revenue from Uranium Segment. It has some projects namely; Millennium, Yeelirrie, Kintyre and Exploration. The company operates in Canada, Kazakhstan, Germany, Australia and United States.

Where Is Cameco Standing Right Now?

- Trading volume stands at 3,893,171, with CCJ’s price up by 2.33%, positioned at $57.2.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 79 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cameco options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mining Automation Market Share, Growth Drivers, Growth Analysis | Exactitude Consultancy

Luton, Bedfordshire, United Kingdom, Nov. 19, 2024 (GLOBE NEWSWIRE) — The integration of smart connected mines presents considerable opportunities, spurred by the rapid digital transformation sweeping through the global mining industry. Mining automation offers critical advantages, such as enhanced worker safety, increased operational uptime, and significant cost savings. Advanced technologies like remote operation platforms, fleet management software, and data analytics enable supervisors to track, monitor, and analyze vast datasets generated from equipment and workforce operations in real time.

Access PDF Sample Report (Including Graphs, Charts & Figures) @

https://exactitudeconsultancy.com/reports/33351/mining-automation-market/#request-a-sample

These innovations allow companies to optimize their operations, enhance productivity, and achieve cost efficiency. For example, automated mining systems can reduce downtime by approximately 20% while enhancing output quality. Predictive maintenance supported by advanced data analytics has the potential to cut maintenance costs by an estimated 10-20% annually, improving overall resource extraction and processing efficiency.

Moreover, the adoption of connected mining solutions aligns with global sustainability initiatives. Automation and data-driven processes optimize resource utilization and minimize energy consumption, thus reducing the environmental footprint. By incorporating these solutions, companies can better comply with stringent environmental standards and contribute to sustainability goals. The market for smart mining technologies is projected to grow at a compound annual growth rate (CAGR) of roughly 17-20% over the next five years, reflecting strong industry adoption.

As the mining sector increasingly embraces digital technologies, businesses stand to achieve enhanced operational efficiency, reduced safety hazards, and stronger environmental compliance. This digital shift positions forward-thinking companies to secure a competitive edge in an evolving and increasingly regulated industry.

Mining Automation Market Trends

Drivers: Expanding Demand for Fleet Management Systems

The connected mining fleet management market is witnessing significant growth, driven by increased demand for minerals and resources spurred by industrialization and population growth. The expansion of mining operations necessitates advanced fleet management solutions, which reduce costs, improve operational efficiency, and support better decision-making. Technologies like Internet of Things (IoT), machine learning (ML), and automation enable real-time data collection and analytics, enhancing equipment performance and productivity. These advancements result in higher output with minimal resource consumption while prioritizing worker safety. The fleet management system market is expected to grow robustly, with adoption rates projected to rise by 12–15% annually over the next five years as the mining sector continues to embrace digital transformation.

Restraints: Depletion of Natural Resources

The exhaustion of natural resources poses a significant barrier, leading to environmental degradation, habitat destruction, and climate impact through greenhouse gas emissions. Overexploitation has resulted in declining ore grades, forcing mining companies to process larger quantities of material for minimal yields, increasing energy consumption and operational costs. In recent years, the volume of extractable resources has fallen by an estimated 8–10% globally. These issues underscore the pressing need for sustainable mining practices and innovative solutions to balance resource extraction with ecological preservation.

Opportunities: Rising Digitalization in the Mining Sector

The increasing adoption of digital technologies is transforming the mining industry, presenting opportunities to enhance safety and productivity. Digitalization focuses on three main aspects:

- Autonomous Vehicles & Equipment: The deployment of autonomous haul trucks and tunnelling machines minimizes risks for operators in remote mines. Autonomous vehicles are estimated to improve productivity by 15–20% while reducing operational costs by up to 12%.

- Connected Operations: Integrating advanced monitoring and tracking systems enables centralized control of equipment and fosters a digital work environment.

- Actionable Insights via AI: Smart algorithms analyze large datasets generated from connected devices, offering supervisors actionable insights to optimize operations, increase uptime by approximately 10–15%, and improve decision-making. These technologies collectively contribute to a 25–30% increase in operational efficiency.

Report Link Click Here: https://exactitudeconsultancy.com/reports/33351/mining-automation-market/

Challenges: Shortage of Skilled Workforce for Automation

The mining automation sector faces a critical skill gap due to the workforce’s limited expertise in operating and maintaining automated systems. Automation reduces the dependency on manual labor, potentially displacing traditional roles while creating new opportunities requiring advanced technical skills. The sector requires substantial investment in training and upskilling programs, with global initiatives estimated to rise by 8–10% in expenditure to address this gap. Additionally, mining automation demands high initial capital outlay, ongoing maintenance costs, and rigorous operational risk management, presenting a multi-faceted challenge to adoption.

Software Segment Growth in Mining Automation

The software segment within mining automation is poised for substantial growth, with a projected compound annual growth rate (CAGR) of approximately 12–15% over the forecast period. This surge is driven by the increasing complexities of mining operations, including reduced tonnage per shift, escalating operational costs, and the growing inhospitality of mines. These challenges necessitate advanced digital solutions to optimize efficiency, improve safety, and reduce expenses.

Mining firms are adopting a diverse range of software solutions, leveraging technologies such as real-time data tracking, analytics, and automation to streamline operations and enhance decision-making. This segment encompasses several critical areas:

- Fleet Management Systems: Optimize vehicle usage, reduce fuel consumption, and improve operational efficiency.

- Workforce Management: Facilitate the allocation and monitoring of labor resources, boosting productivity by up to 20% in trial deployments.

- Data Management Tools: Enable effective collection, analysis, and utilization of vast data volumes from connected equipment and sensors.

- Environmental Monitoring: Solutions for air quality and temperature monitoring to maintain safety standards in mines.

- Remote Operating & Monitoring Systems: Enhance operational control and oversight from centralized locations.

- Proximity Detection & Collision Avoidance: Prevent accidents and ensure worker safety by leveraging AI and IoT-based sensors.

- Additional Applications: Include payload monitoring and asset tracking, contributing to resource optimization and inventory accuracy.

Asia-Pacific Mining Automation Market Overview

The mining automation market in Asia-Pacific is poised for significant growth, driven by the region’s abundant natural resources and increasing adoption of advanced technologies. Key countries studied in the region include Australia, China, India, and others. Estimates suggest that Asia-Pacific will surpass other regions, becoming the largest market globally for mining automation technologies and equipment by 2030.

This growth is attributed to:

- Adoption by Global Mining Giants: Companies such as Rio Tinto (UK), Fortescue Metals Group (FMG, Australia), and BHP Billiton (Australia) are leveraging automated equipment extensively in their operations.

- Technological Advancements in Australia: Western Australia serves as a global leader, with mining corporations integrating autonomous haul trucks, drilling rigs, and robotic systems into their operations to enhance productivity and safety.

- Rising Investments in Digitization: Across the region, mining corporations are investing heavily in technologies like IoT, AI-driven analytics, and fleet management systems, spurred by increasing economic globalization and the push for sustainable mining practices.

Focus on Australia’s Mining Sector

Australia remains at the forefront of mining automation due to:

- Rich Mineral Resources: The country holds extensive reserves of minerals such as iron ore, coal, and gold.

- Advanced Mining Ecosystem: The sector benefits from state-of-the-art exploration techniques, efficient processing technologies, and well-documented geological data.

- Skilled Workforce & Low Population Density: These factors have enabled scalable and safe mining operations.

- Sustainability Initiatives: Australian mining companies are aligning with global efforts to reduce carbon emissions by adopting energy-efficient machinery and low-impact exploration methods.

Strategic Implications in the Mining Automation Sector

The accelerating adoption of mining automation technologies across Asia-Pacific, particularly in Australia, signifies a transformative regional shift towards smart mining practices. This evolution is driven by increasing demand for critical minerals essential for batteries and renewable energy systems, aligning with the global push for sustainability and clean energy. Partnerships between leading mining firms and technology providers are pivotal, enabling cost reductions, enhanced operational efficiency, and increased productivity.

Governments and corporations are expected to ramp up investments in key areas to support this growth. Infrastructure development, advanced R&D initiatives, and tailored training programs will address emerging challenges, such as skill gaps and the integration of sophisticated technologies. Notably, Australia’s mining ecosystem, benefiting from rich mineral resources and a skilled workforce, is poised to lead this automation boom.

In addition, initiatives promoting sustainability—such as the deployment of zero-emission equipment and digital solutions—will further catalyze the sector’s transformation. The global market for mining automation technologies is anticipated to grow at a CAGR of approximately 17-20% over the next five years, underscoring the strategic importance of this shift for industry stakeholders aiming to remain competitive in a dynamic global market.

Key Players:

- CATERPILLAR

- KOMATSU LTD.

- LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH

- SANDVIK AB

- ROCKWELL AUTOMATION

- EPIROC AB

- RPMGLOBAL HOLDINGS LIMITED

- SIEMENS

- HITACHI CONSTRUCTION MACHINERY CO., LTD.

- SANY GROUP

- AB VOLVO

- TRIMBLE INC.

- AUTONOMOUS SOLUTIONS, INC.

- HEXAGON AB

Mining Automation Market Segmentations:

By Offering:

- Equipment

- Autonomous Hauling/Mining Trucks

- Autonomous Drilling Rigs

- Underground LHD Loaders

- Tunneling Equipment

- Smart Ventilation Systems

- Pumping Stations

- Software

- Workforce Management Systems

- Proximity Detection and Collision Avoidance Systems

- Air Quality and Temperature Monitoring Systems

- Fleet Management Systems

- Remote Operating and Monitoring Systems

- Data Management Solutions

- Communication Systems

- Wireless Mesh Networks

- Navigation Systems

- Radio-frequency Identification (RFID) Tags

By Workflow:

- Mine development

- Mining process

By Technique:

- Underground Mining

- Surface Mining

By Region:

- North America

- Europe

- Turkey

- Sweden

- Rest of Europe

- Asia Pacific

- Australia

- China

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa

- South Africa

- Rest of Middle East & Africa

Recent Developments in Mining Automation Industry:

- Sandvik’s Underground Equipment Order – November 2023: Sandvik secured a major order from Jimond Mining Management Company (JMMC), a subsidiary of JCHX Mining Management, for underground mining equipment. This equipment will be used at the Kamoa-Kakula copper mine in the Democratic Republic of the Congo.

- Epiroc’s Australian Contract for Minetruck MT65 S Haulers – October 2023: Epiroc AB received an order from Byrnecut, one of the largest underground mining contractors in Australia, for a fleet of Minetruck MT65 S haulers for the Kathleen Valley mine in Western Australia.

- Caterpillar’s New Dozer – May 2023: Caterpillar introduced a new dozer that offers enhanced fuel efficiency, improved productivity, and increased uptime. The updated model boasts up to a 6% efficiency improvement compared to its predecessor, featuring a stator clutch torque converter and load-sensing hydraulics.

- Epiroc’s Fleet Order in South Africa – August 2023: Epiroc won a significant contract to supply electric-powered mining equipment to a major gold mining operator in South Africa. This forms part of the industry’s shift toward reducing carbon emissions.

- Sandvik’s Equipment for Australia’s Evolution Mining – April 2023: Sandvik secured a significant order for underground mining equipment from Evolution Mining, one of Australia’s prominent mining firms. The order includes a variety of mining machines, enhancing operational efficiency and safety at their Australian sites.

Get a Sample PDF Brochure https://exactitudeconsultancy.com/reports/33351/mining-automation-market/#request-a-sample

Related Reports:

Integrated Marine Automation System Market

https://exactitudeconsultancy.com/reports/2212/integrated-marine-automation-system-market/

The global integrated marine automation system market is expected to grow at 10% CAGR from 2019 to 2028. It is expected to reach above USD 10.38 billion by 2028 from USD 4.40 billion in 2019.

Logistics Automation Market

https://exactitudeconsultancy.com/reports/2234/logistics-automation-market/

The global logistics automation market is expected to grow a 10% CAGR from 2019 to 2028. It is expected to reach above USD 103.75 billion by 2028 from USD 44 billion in 2019.

Electric Vehicle Polymers Market

https://exactitudeconsultancy.com/reports/2211/electric-vehicle-polymers-market/

The Electric Vehicle (Car) Polymers Market size is projected to grow from the estimated USD 49.2 billion in 2019 to USD 62.8 billion by 2028, at a compound annual growth rate (CAGR) of 4.2% during the forecast period.

Electric Ships Market

https://exactitudeconsultancy.com/reports/2197/electric-ships-market/

The global Electric Ships Market is expected to grow at more than 13% CAGR from 2019 to 2028. It is expected to reach above USD 15.11 billion by 2028 from a little above USD 3.96 billion in 2019.

Rail Signal Market

https://exactitudeconsultancy.com/reports/1411/rail-signal-market/

The Global Rail Signal Market is expected to grow at more than 8.7% CAGR from 2019 to 2028. It is expected to reach above USD 14.5 billion by 2028 from a little above USD 8.8 billion in 2019.

Automotive Sunroof Market

https://exactitudeconsultancy.com/reports/1043/automotive-sunroof-market/

The Global Automotive Sunroof Market size is expected to grow at more than 6% CAGR from 2019 to 2026. It is expected to reach above USD 19 billion by 2026 from USD 15 billion in 2019.

Aircraft & Marine Turbocharger Market

https://exactitudeconsultancy.com/reports/2050/aircraft-marine-turbocharger-market/

The Global Aircraft & Marine Turbocharger Market is Expected to Grow at more than 3% CAGR from 2019 To 2028. It is Expected to Reach Above USD 288 Million By 2028 From a Little Above USD 275 Million in 2019.

Headlamps Market

https://exactitudeconsultancy.com/reports/965/headlamps-market/

The Global Headlamps Market is expected to grow at more than 3.96% CAGR from 2018 to 2025. It is expected to reach above USD 229 million by 2025 from a little above USD 176 million in 2018.

Automotive Plastics Market

https://exactitudeconsultancy.com/reports/2103/automotive-plastics-market/

The global automotive plastics market is expected to grow at 7.9% CAGR from 2019 to 2028. It is expected to reach above USD 35.93 billion by 2028 from USD 18.12 billion in 2019.

Transportation Telematics Market

https://exactitudeconsultancy.com/reports/3118/transportation-telematics-market/

The global transportation telematics market is expected to grow at 20% CAGR from 2022 to 2029. It is expected to reach above USD 66.04 billion by 2029 from USD 12.79 billion in 2020.

Automotive E-E Architecture Market

https://exactitudeconsultancy.com/reports/987/automotive-e-e-architecture-market/

The Global Automotive E-E Architecture Market is expected to grow at more than 11.44% CAGR from 2019 to 2028. It is expected to reach above USD 184.9 billion by 2028 from a little above USD 84 billion in 2019.

Highway Drive-Assist Market

https://exactitudeconsultancy.com/reports/3227/highway-drive-assist-market/

The global Highway Drive-Assist Market is expected to grow at 24.6% CAGR from 2022 to 2029. It is expected to reach above USD 11.2 billion by 2029 from USD 2.3 Billion in 2020.

Irfan Tamboli (Head of Sales) Phone: + 1704 266 3234 Email: sales@exactitudeconsultancy.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aeries Technology Reports Results for Second Fiscal Quarter 2025

North America Revenue Up 13.3% Year-Over-Year

Business Re-Focused on Core North American Global Capability Center (GCC) Market

NEW YORK, Nov. 19, 2024 (GLOBE NEWSWIRE) — Aeries Technology AERT, a global professional services and consulting partner for businesses in transformation mode and their stakeholders, today announced financial results for the fiscal quarter ended September 30, 2024.

“We are taking significant steps, including continued alignment of our cost structure, to re-focus on our core business, which consists mostly of US-based, long tenure, high quality private equity backed portfolio companies. These clients have served as a consistent revenue base for Aeries and we believe the North American GCC market will continue to grow with us,” said Sudhir Panikassery, CEO of Aeries Technology. “Our North America revenue was up 13.3% year-over-year, demonstrating the growth potential behind this shift in focus. We’re seeing strong interest from new prospective core clients and have strong visibility into the pipeline that gives us confidence in our new guidance for fiscal 2025.”

Fiscal Quarter Ended September 30, 2024 (Second Fiscal Quarter 2025) Financial Highlights

Revenues: Revenues for the second fiscal quarter 2025 were $16.9 million, down 4% compared to $17.6 million for the second fiscal quarter of 2024.

North America Revenue: North America revenue for the second fiscal quarter 2025 was $15.7 million, up 13% compared to $13.9 million for the second fiscal quarter of 2024.

Income (Loss) from Operations: Income from operations for the second fiscal quarter 2025 was $(4.1) million, down compared to $1.5 million for the second fiscal quarter of 2024.

Net Income (Loss): Net loss for the second fiscal quarter 2025 was $(2.3) million compared to net income of $0.9 million for the second fiscal quarter of 2024.

Adjusted EBITDA: Adjusted EBITDA for the second fiscal quarter 2025 was negative $(2.3) million compared to $3.0 million for the second fiscal quarter of 2024.

Core Adjusted EBITDA: Core Adjusted EBITDA for the second fiscal quarter 2025 was $0.2 million, down 82% compared to $1.0 million for the second fiscal quarter of 2024.

Conference Call Details

The company will host a conference call to discuss their financial results on Wednesday, November 20, 2024 at 8:30 AM ET. The call will be accessible by telephone at 877-407-0792 (domestic) or 1-201-689-8263 (international). The call will also be available live via webcast on the company’s investor relations website at https://ir.aeriestechnology.com or directly here.

A telephone replay of the conference call will be available following its conclusion at 1-844-512-2921 (domestic) or 1-412-317-6671 (international) with access code 13750295 and will be available until 11:59 PM ET, November 27, 2024. An archive of the webcast will also be available on the company’s investor relations website at https://ir.aeriestechnology.com.

About Aeries Technology