Trulieve Cannabis Execs Buy 26K Company Shares: What Does This Mean For Investors?

Trulieve Cannabis Corp. TCNNFTRUL executives recently purchased 26,000 shares, signaling potential confidence in the company’s future. Between November 8 and 13, COO Marie Zhang, CPO Kyle Landrum, and CLO Eric Powers increased their holdings, according to a report by Beacon Securities.

Zhang made the largest move, acquiring 21,300 shares at an average price of $7.19, adding $153,147 of an estimated total of around $186.000. What does this mean for investors? Is the stock undervalued?

Stock Decline

Trulieve’s stock has dropped sharply in recent weeks, trading at around $6.34 after peaking at $14 in mid-October. The decline follows two major setbacks: the failure of Florida’s cannabis legalization ballot and heightened political uncertainty tied to Donald Trump’s election victory.

These setbacks created an election gapt hat the stock has yet to close.

There’s a reason why those events had a significant impact on the company. Florida is the company’s largest market, and the ballot’s failure denied an opportunity to double the size of the state’s legal cannabis market. A Trump presidency also raises concerns about the future of federal cannabis reform, further complicating Trulieve’s growth outlook.

The ballot’s defeat was particularly damaging. If approved, it would have allowed Trulieve to expand its 156 Florida stores into the recreational market, dramatically boosting revenue potential.

Adding to these challenges, Trulieve’s third-quarter 2024 earnings showed mixed results. The company reported $284 million in revenue, a modest 3% increase from the previous year, with a strong gross margin of 61% and adjusted EBITDA of $96 million (up 24% year-over-year). However, a $60 million net loss, significantly higher than the $25.4 million loss in Q3 2023 highlighted the financial strain of $48 million in non-recurring expenses tied to the Florida ballot campaign.

Read Also: Can Trump’s Return Save The Cannabis Sector? Debt Mounts As Giants Face Post-Election Reckoning

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Is Trulieve Undervalued?

Insider stock purchases often indicate that management views the stock as undervalued. These moves could also be intended to restore investor confidence after a significant drop. However, determining undervaluation is complex and subjective, often requiring a mix of financial analyses and market sentiment.

From a technical perspective, Trulieve appears oversold, with an RSI of 31.94, suggesting the possibility of a rebound. Key resistance levels are $9.58 (SMA) and $14 (the October high), while support hovers at $6.00, with a critical floor near $3.71 (lower Bollinger Band). Recent high volumes during the selloff suggest heavy selling pressure, but the current lower volumes indicate stabilization.

Chart created using Benzinga Pro

At a glance, it seems the market has not bought yet on the promising future this cannabis company has to offer, with or without legal recreational cannabis in Florida. But, with small-cap cannabis stocks prone to volatility, this is a situation investors should monitor closely.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia stock rises on AI spending, chip deal ahead of earnings

Nvidia (NVDA) stock rose more than 4% on Tuesday following bullish notes from Wall Street analysts citing strong chip demand ahead of its earnings report set for Wednesday afternoon.

In a client note this week, Stifel (SF) analyst Ruben Roy raised his price target on Nvidia to $180 from $165, while Truist Securities’ (TFC) William Stein raised his price outlook to $167 from $148.

Roy cited “a diverse set of data points” including continued high spending on AI infrastructure by hyperscalers and demand for Nvidia’s latest Blackwell AI chips.

“We believe that NVDA is well positioned in markets that combine to yield an overall TAM [total addressable market, or revenue opportunity] of more than $100 billion exiting 2025 and a longer-term opportunity funnel that could approach $1 trillion,” Roy wrote.

Nvidia stock also rose on news that one of its customers, cloud provider Nebius Group (NBIS), is launching its first GPU cluster in the US, which will use up to 35,000 Nvidia chips. A GPU cluster is a network of graphics processing units, or AI chips, with massive compute power used to train and run artificial intelligence software.

For reference, Nebius’ order of 35,000 Nvidia chips is equivalent to about 4% of the volume of Hopper AI chips Wall Street analysts expect Nvidia to have shipped in the October period, Bloomberg consensus data shows.

Nvidia declined to comment on the deal.

Nvidia stock’s climb comes a day after shares fell on a report by the Information about overheating issues with its Blackwell AI servers. Nvidia in August was reportedly dealing with design flaws related to the individual Blackwell chips themselves, which prompted the company to push back the AI chips’ production ramp to the January quarter.

Nvidia has not confirmed overheating issues with its Blackwell servers, and the company told Yahoo Finance Monday: “The engineering iterations are normal and expected.”

Truist Securities’ William Stein said of the overheating issues reported this week, “Conversations with our industry contacts don’t precisely corroborate this latest data point, but they do reflect supply chain challenges around the production ramp.”

Despite reported Blackwell issues, Dell Technologies (DELL) said it has already shipped its latest AI hardware product, the PowerEdge system, with Nvidia’s latest GB200 NVL72 systems.

“[C]ommentary from NVDA, partners, and our industry contacts feel overwhelmingly positive,” Stein wrote in a note to investors. He pointed to emerging demand for Nvidia chips in the robotics and “traditional” computing sectors as well as that from AI software developers.

Trez Capital Reports Resilient Q3 2024 Performance with Key Investments in High-Growth Markets

Trez Capital Continues Strategic Focus on Residential Portfolio Amid Economic Shifts

VANCOUVER, BC, Nov. 19, 2024 /CNW/ – Trez Capital, a leader in North American commercial real estate investments, reports its Q3 2024 results, underscoring the Firm’s strong market position and stable portfolio growth. With assets under management (AUM) of $5.4 billion CAD, Trez Capital hits over $20 billion CAD in loans funded since inception.

Corporate Update: Leadership Strengthening Risk and Origination Focus

In Q3, Trez Capital reinforced its leadership structure in both Canadian and United States (U.S.) offices, officially appointing Christian Skogen, Chief Risk Officer, and Alec Barry, Executive Managing Director, U.S. Origination, to the Executive Leadership Team. Both executive leaders bring deep expertise to support Trez Capital’s focus on disciplined risk management and key submarket investment focus in the U.S. market.

Economic & Investment Strategy Update

As interest rates eased in Canada and the U.S., Trez Capital strategically focused on lot development and multi-family construction loans to repeat sponsors in regions with strong economic fundamentals, particularly in Texas and Arizona.

A significant equity investment made in the third quarter includes the Nobella project for Trez Opportunity Fund #8 (TOF VIII). The development comprises of 549 lots in the Phoenix metropolitan statistical area (MSA), specifically located in Surprise, Arizona. This project is strategically positioned to meet the strong housing demand in the area, which is supported by an annual population growth rate of nearly 2.0% and significant U.S. in-migration. The development features a diverse range of lots, including pre-sold options, with properties designed for both ‘for sale’ and ‘build-to-rent’ purposes. This approach caters to renters and buyers alike while aligning with Trez Capital’s residential development strategy, which focuses on delivering high-quality housing in economically and demographically strong markets

Phoenix’s strong job market and ongoing economic growth further reinforce long-term demand and stability for this lot development project. Nobella has already attracted substantial interest from local and national builders. The projects phased development approach is designed to take advantage of favourable market conditions while delivering a wide range of housing options to meet the evolving needs of Phoenix’s expanding population.

This investment highlights Trez Capital’s strategic agility in capitalizing on resilient markets, setting the stage for continued growth into 2025.

“Trez Capital has successfully navigated a highly stressed environment for real estate investors through robust risk management practices, diligent management of liquidity and strong, trusted relationships with our investors, borrowers and financing partners,” said John Maragliano, Chief Financial Officer & Chief Operating Officer. “We have selectively focused on the best deployment opportunities for our investors’ capital and are optimistic about the future as we turn the corner on this interest rate cycle.”

For further details, access the full Q3 2024 report here.

About Trez Capital

Founded in 1997, Trez Capital is a diversified real estate investment firm and preeminent provider of commercial real estate debt and equity financing solutions across North America. Trez Capital offers private and institutional investors strategies to invest in a variety of opportunistic, fully secured mortgage investment funds, syndications and joint-ventures; and provides property developers with quick approvals on flexible short- to mid-term financing.

With offices throughout North America, Trez Corporate Group has over $5.4* billion CAD in assets under management and has funded over 1,800 transactions totalling more than $20 billion CAD since its inception. For more information visit www.trezcapital.com. (*Trez Corporate Group AUM includes assets held by all Trez-related entities as well as $3.0 billion Manager AUM (Trez Capital Fund Management Limited Partnership)).

SOURCE Trez Capital

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/19/c8269.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/19/c8269.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leila Zhang Takes Money Off The Table, Sells $339K In Yum China Holdings Stock

Leila Zhang, Chief Technology Officer at Yum China Holdings YUMC, reported an insider sell on November 19, according to a new SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, Zhang sold 7,197 shares of Yum China Holdings. The total transaction value is $339,770.

During Tuesday’s morning session, Yum China Holdings shares down by 0.9%, currently priced at $47.23.

Get to Know Yum China Holdings Better

With almost 13,000 units and USD 10 billion in systemwide sales in 2022, Yum China is the largest restaurant chain in China. It generates revenue through its own restaurants and franchise fees. Key concepts include KFC (9,094 units) and Pizza Hut (2,903), but the company’s portfolio also includes other brands such as Little Sheep, East Dawning, Taco Bell, Huang Ji Huang, COFFii & Joy, and Lavazza (collectively representing about 950 units). Yum China is a trademark licensee of Yum Brands, paying 3% of total systemwide sales to the company it separated from in October 2016.

Unraveling the Financial Story of Yum China Holdings

Revenue Growth: Yum China Holdings displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 5.39%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company faces challenges with a low gross margin of 17.91%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Yum China Holdings’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 0.77.

Debt Management: Yum China Holdings’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.45.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 21.0 is lower than the industry average, implying a discounted valuation for Yum China Holdings’s stock.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.7 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Yum China Holdings’s EV/EBITDA ratio at 11.25 suggests potential undervaluation, falling below industry averages.

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

The Insider’s Guide to Important Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Yum China Holdings’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

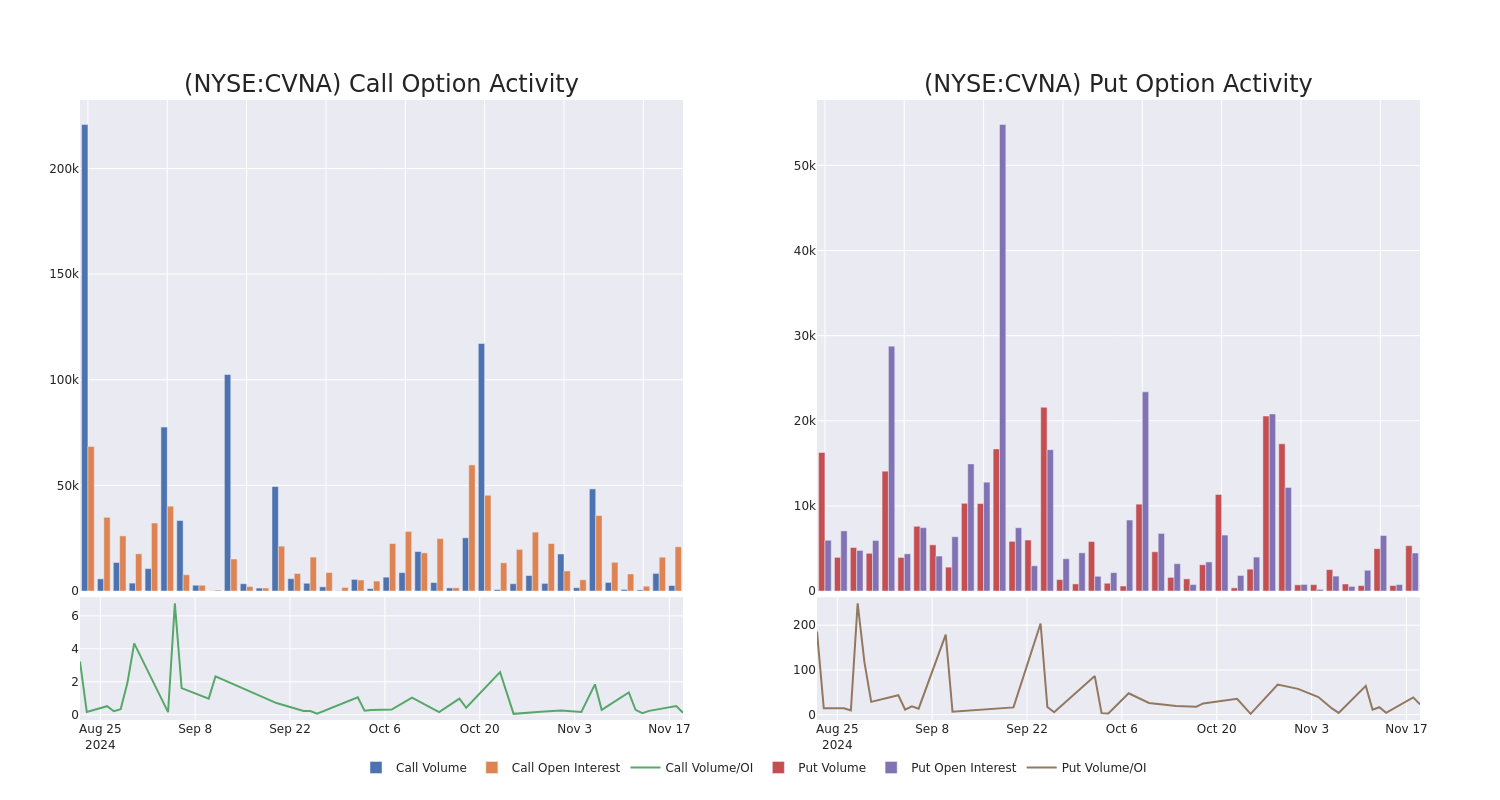

What the Options Market Tells Us About Carvana

Financial giants have made a conspicuous bearish move on Carvana. Our analysis of options history for Carvana CVNA revealed 34 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 16 were puts, with a value of $1,827,307, and 18 were calls, valued at $1,362,695.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $300.0 for Carvana over the recent three months.

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Carvana’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Carvana’s significant trades, within a strike price range of $15.0 to $300.0, over the past month.

Carvana Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | PUT | SWEEP | BEARISH | 02/21/25 | $32.35 | $31.95 | $32.35 | $260.00 | $342.8K | 207 | 429 |

| CVNA | PUT | TRADE | NEUTRAL | 02/21/25 | $32.55 | $32.15 | $32.36 | $260.00 | $323.6K | 207 | 681 |

| CVNA | PUT | TRADE | NEUTRAL | 02/21/25 | $32.6 | $32.05 | $32.33 | $260.00 | $323.3K | 207 | 794 |

| CVNA | PUT | SWEEP | BEARISH | 02/21/25 | $32.45 | $32.35 | $32.4 | $260.00 | $204.3K | 207 | 492 |

| CVNA | PUT | SWEEP | NEUTRAL | 02/21/25 | $32.45 | $32.35 | $32.44 | $260.00 | $178.2K | 207 | 548 |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

Following our analysis of the options activities associated with Carvana, we pivot to a closer look at the company’s own performance.

Where Is Carvana Standing Right Now?

- Currently trading with a volume of 1,025,270, the CVNA’s price is up by 2.36%, now at $250.47.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 93 days.

Professional Analyst Ratings for Carvana

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $267.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Carvana, targeting a price of $190.

* An analyst from Needham persists with their Buy rating on Carvana, maintaining a target price of $300.

* An analyst from JP Morgan persists with their Overweight rating on Carvana, maintaining a target price of $300.

* An analyst from JMP Securities persists with their Market Outperform rating on Carvana, maintaining a target price of $320.

* An analyst from Piper Sandler persists with their Neutral rating on Carvana, maintaining a target price of $225.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Carvana with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Data Center Operator GDS Holdings Surpasses Q3 Revenue Estimates, But Shares Drop Amid CapEx Revision

GDS Holdings Limited GDS shares are trading lower after its third-quarter results.

Net revenue increased 17.7% year over year to $422.6 million, beating the consensus of $415.42 million. The increase was mainly due to the ongoing ramp-up of the data centers and business growth.

Adjusted gross profit was $214.1 million, an increase of 20.4% Y/Y, and the margin was 50.7%, compared with 49.5% a year ago.

As of September-end, the total area committed and pre-committed increased by 20.2% Y/Y to 785,692 sqm, while the area in service grew by 16.8% Y/Y to 647,468 sqm.

The commitment rate for the area in service was 92.7%, up from 91.9% in the previous year.

The area under construction expanded to 234,741 sqm (from 189,585 sqm), with a pre-commitment rate rising to 79.2% from 76.1% in the prior year quarter.

Additionally, the area utilized grew by 20.9% Y/Y to 481,819 sqm, with a utilization rate of 74.4%, up from 71.9% a year earlier.

Adjusted EBITDA rose 15.0% Y/Y to $184.6 million, with margin declining to 43.7% from 44.7% a year ago.

As of September 30, the cash balance was $1.34 billion. Loss per ADS of 16 cents topped the consensus loss of 21 cents.

William Huang, Chairman and CEO, said, “In China, the accelerated move-in trend continued, as we executed our strategy of delivering the backlog while being selective on new orders. Internationally, our recent equity raise is a major step forward, and positions us well to capture the tremendous opportunities for growth in the international markets.”

Dan Newman, Chief Financial Officer, added, “The US$1 billion equity raise for GDSI will support our ambitious international expansion plans, further affirming the underlying value GDSI brings to our shareholders.”

2024 Outlook: GDS reaffirmed its guidance of total revenues of RMB 11.34 billion – RMB 11.76 billion in 2024 and Adjusted EBITDA of RMB 4.95 billion – RMB 5.15 billion.

The company revised the capital expenditure outlook to RMB 11.00 billion from RMB 6.50 billion earlier.

Investors can gain exposure to the stock via Pacer Data & Infrastructure Real Estate ETF SRVR and Global X Data Center & Digital Infrastructure ETF DTCR.

Price Action: GDS shares are down 10.33% at $21.08 at the last check Tuesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Move Higher, Walmart Hits Record High, Natural Gas Reaches 5-Month Peak: What's Driving Markets Tuesday?

Wall Street managed to recover from a red start caused by heightened geopolitical tensions stemming from the ongoing Russia-Ukraine conflict.

Ukraine launched its first U.S.-made missile strike on a Russian city, while Russian President Vladimir Putin adjusted the nation’s nuclear doctrine to broaden scenarios for a potential response. Yet, Russian Foreign Minister Sergei Lavrov sought to assuage fears of a nuclear escalation, stating that a nuclear war is not something Russia is considering.

Amid the geopolitical noise, investors remained focused on corporate earnings. Walmart Inc. WMT, often regarded as a bellwether of consumer health, surpassed expectations for the recent quarter. The retailer’s stock surged 4%, hitting fresh all-time highs and boosting market sentiment.

At midday, both the S&P 500 and Nasdaq 100 posted marginal gains, while blue-chip stocks showed a slight deceleration and small caps held steady.

In fixed income, longer-dated bond yields dipped, with the iShares 20+ Year Treasury Bond ETF TLT climbing 0.5%. The U.S. dollar gained 0.1%, attempting to rebound after two consecutive sessions of losses.

Geopolitical risks lifted demand for commodities, with gold and oil rebounding 0.8% and 0.5%, respectively. Natural gas prices – as closely tracked by the United States Natural Gas Fund LP UNG – extended the rally, adding 2.6% after a 5.3% jump on Monday and hitting the highest levels since June.

Meanwhile, Bitcoin BTC/USD continued to display extraordinary strength, with the cryptocurrency breaking to a new all-time high of $93,931, underscoring robust market interest despite broader macro uncertainties.

Tuesday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| Nasdaq 100 | 20,610.47 | 0.3% |

| S&P 500 | 5,907.68 | 0.2% |

| Russell 2000 | 2,309.75 | 0.1% |

| Dow Jones | 43,316.79 | -0.2% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY rose 0.2% to $589.41.

- The SPDR Dow Jones Industrial Average DIA fell 0.3% to $433.10.

- The tech-heavy Invesco QQQ Trust Series QQQ edged 0.4% higher to $502.08.

- The iShares Russell 2000 ETF IWM fell 0.3% to $229.50.

- The Technology Select Sector SPDR Fund XLK outperformed, rising 0.5%. The Energy Select Sector SPDR Fund XLE lagged, down 0.7%.

Tuesday’s Stock Movers

- Super Micro Computer Inc. SMCI surged 22% after appointing BDO US as its auditor and submitting a compliance plan to Nasdaq, signaling a proactive effort to address delisting concerns. The news bolstered investor confidence in the company’s governance and market stability.

- United Airlines Holdings Inc. UAL climbed 3.5%, reaching its highest level since December 2019, following a bullish call from TD Owen, which raised the stock’s price target from $100 to $110.

- Incyte Corp. INCY plummeted over 14% after announcing that data from its Phase 2 clinical study failed to support further development, disappointing investors hoping for progress in its pipeline.

- Valvoline Inc. VVV dropped 8% in reaction to a weaker-than-expected earnings report, as the market digested concerns over the company’s growth trajectory and profitability.

- Vertive Holdings Inc. VRT rallied 11.7% in reaction to price target raises from investment banks such as Deustsce Bank and Oppenheimer.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's How Much $100 In Bitcoin Could Be Worth In 2030 If Cathie Wood's Price Target Is Reached

Ark Invest CEO Cathie Wood has been a vocal bull for the cryptocurrency sector for years, specifically for leading cryptocurrency Bitcoin (CRYPTO: BTC), which she recently said could be helped by the incoming White House administration.

Wood has shared price targets for Bitcoin over the years, including a high of $3.8 million for BTC by the year 2030. Here’s a look at how much a small investment in Bitcoin today could increase over time if Wood’s various price targets are reached in the future.

Don’t Miss:

Following Wood Into Bitcoin: With Bitcoin hitting all-time highs after the 2024 presidential election, big questions remain about how high the leading cryptocurrency can go and how long it will take to reach various milestones like $100,000.

Earlier this year, Wood laid out her price targets for Bitcoin based on a bear case, base case and bull case for the year 2030. Wood also added a new bull case that includes the potential highest price Bitcoin could reach by 2030 if companies allocated 5% to Bitcoin.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

With Bitcoin trading at $89,384.76 at the time of writing, an investor could buy 0.00112 BTC today with $100. Here is a look at how much that $100 would be worth in the future under Wood’s various price targets.

-

Bear Case, $258,500: $100 today would be worth $289.52, up 189.5%

-

Base Case, $682,000: $100 today would be worth $763.84, up 663.8%

-

Bull Case, $1,480,000: $100 today would be worth $1,657.60, up 1,557.6%

-

Bullish Case, $3,800,000: $100 today would be worth $4,256.00, up 4,156.0%

As you can see, a small investment would turn into a sizable return if Wood’s base or bullish predictions come true. Even the bearish price target hitting would more than double the investment from today.

While there’s no guarantee that any of the price targets will hit, the exercise shows how a small investment in cryptocurrency could add up over time.

Trending: With over 7.8K investors including Meta, Google, And Amazon Execs — this AI Startup’s valuation has skyrocketed from $5 million to $85 million in just three years. Be an early investor with just $1,000 for only $0.50/share today before the offer closes in the next few days!

What’s Next: Wood recently reiterated her price targets in a CNBC interview while highlighting how Ark Invest was early to investing in Bitcoin.

Vertiv's Earnings Estimates Raised By Analyst Amid Improved Margin Outlook

BofA Securities analyst Andrew Obin reiterated the Buy rating on Vertiv Holdings VRT, with a price forecast of $150.

Obin writes that, management has revised its organic revenue growth forecast to a 12%-14% CAGR from 2024 to 2029, up from a previous range of 8%-11%.

This compares to BofA and consensus estimates of a 14% CAGR from 2024-2027.

The analyst attributes the revision to potential industry-wide constraints, such as electricity availability and skilled labor shortages.

Vertiv’s capital expenditure is projected to increase, with capex rising to approximately 3.0% of revenue in 2025, up from 2.6% in 2024, indicating a continued acceleration of capacity expansions.

Also Read: Grant Cardone Calls Himself A ‘Coward Investor,’ Puts His Money In ‘Real Assets’

As of 3Q24, Vertiv’s gross equipment assets grew by 25% year-over-year, the analyst writes.

Management also guided for an adjusted operating margin of 25+% by 2029 (or sooner), an improvement from the previous target of 20+% by 2028.

This enhanced margin outlook is despite an increase in R&D and capacity investment, which is now expected to reach $150-200 million per year, up from the previous $75-125 million range, Obin adds.

The analyst raised the 2025 adj. EPS estimate by $0.10 to $3.60 (+33% year over year), driven largely by faster revenue growth.

Obin raised the 2026 adj. EPS estimate by $0.15 to $4.40 (+22% year over year).

The analyst also raised the dividend forecast to reflect the 50% increase to $0.15/share annualized rate in conjunction with the Investor Day.

Price Action: VRT shares are trading higher by 10.9% to $136.49 at last check Tuesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Medtronic Q2 Earnings: Diabetes And Neuroscience Revenue Boost Growth, Raises Annual Outlook

Tuesday, Medtronic Plc MDT reported second-quarter 2025 sales of $8.40 billion, beating the consensus of $8.27 billion. The medical device maker reported adjusted EPS of $1.26, beating the consensus of $1.25.

Revenue increased 5.3% year over year, as reported, and 5% on an organic basis.

Also Read: Medtronic Recalls MiniMed Pump Due To Battery Life Concerns

Cardiovascular segment revenue reached $3.102 billion, up 6.1% year over year as reported, and increased 5.6% organically, with a high-single-digit increase in Structural Heart & Aortic and mid-single-digit increases in Cardiac Rhythm & Heart Failure and Coronary & Peripheral Vascular, all on an organic basis.

Neuroscience revenues of $2.45 billion increased 7.1% as reported and 6.7% organically, with a low-double-digit increase in Neuromodulation and mid-single-digit increases in Cranial & Spinal Technologies and Specialty Therapies, all on an organic basis.

Medical Surgical revenue of $2.13 billion increased by 1.2% as reported and increased by 0.7% organically, with a low-single-digit organic increase in Acute Care & Monitoring and flat organic result in Surgical & Endoscopy.

Surgical & Endoscopy year-over-year results were affected by a difficult comparison from the prior year supply recovery in Surgical and increased high-single digits sequentially.

Diabetes revenue of $686 million increased by 12.4%, as reported, and by 11% organic.

“Our momentum is building as we keep executing on our commitments, delivering yet another consecutive quarter of strong results that came in ahead of expectations,” said Geoff Martha, Medtronic chairman and chief executive officer.

Guidance: Medtronic raised its fiscal year 2025 organic revenue growth guidance to 4.75%-5%, up from the prior 4.5%-5%.

If recent foreign currency exchange rates hold, 2025 revenue growth on an adjusted basis would be 3.4%-3.9%.

Medtronic expects 2025 adjusted EPS guidance to be $5.44-$5.50 versus previous guidance of $5.42-$5.50 and consensus of $5.45.

Price Action: MDT stock is down 3.52% at $84.53 at the last check on Tuesday.

Read Next:

Photo by Tony Webster via Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.