Prediction: Nvidia Will Be the World's First $4 Trillion Company

As measured by market capitalization, there has never been a company worth $4 trillion, but Nvidia (NASDAQ: NVDA) is starting to close in. At the time of this writing, Nvidia was worth around $3.6 trillion. At that size, it only has to rise in value another 11% before it crosses this threshold. This is significant because second-place Apple (NASDAQ: AAPL), which needs to rise 16% in value to beat Nvidia to the mark, was the first company to cross the $1 trillion, $2 trillion, and $3 trillion market cap thresholds.

For those who care about such financial measurements, the central question is: Can Nvidia hit the next valuation milestone before Apple does?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Nvidia and Apple took two different paths to get to this point. Apple has steadily grown its revenue and earnings through its various consumer products (most notably the iPhone), although that growth has significantly slowed in recent years.

Nvidia’s primary product is the graphics processing unit (GPU), originally developed to process gaming graphics quickly. The GPU’s unique ability to process multiple calculations in parallel makes it a top pick for anything that requires intense calculations. This makes GPUs strong choices for other difficult tasks, like drug research and engineering simulations.

However, the largest use for Nvidia GPUs has arrived recently: artificial intelligence (AI) model training. Creating a powerful AI model requires a ton of computing resources, and the AI hyperscalers are all buying Nvidia GPUs by the truckload to build out the capacity they need.

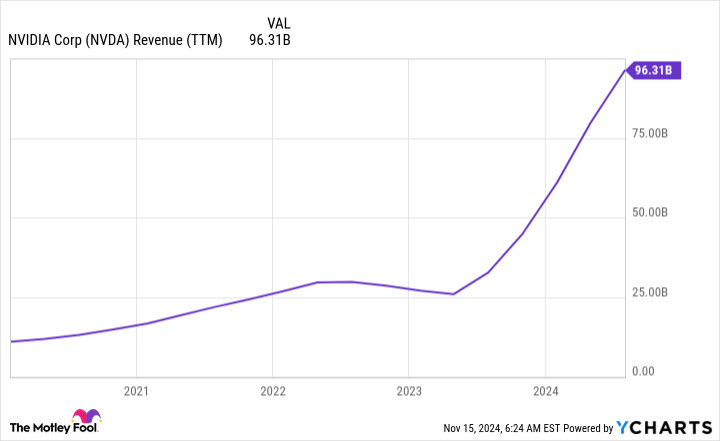

This demand has caused Nvidia’s revenue to surge, sometimes tripling year over year over the past few quarters.

Alongside its revenue surge, Nvidia’s profit margins have skyrocketed because it didn’t need to hire many more people or build out a lot of production to handle the surging demand. The combined effect of rising revenue and increasing profit margins caused Nvidia’s profits to grow faster than revenue.

The chart above may look unimpressive until you look at the scale and see that Nvidia’s profits were rising more than 10x year over year during 2023.

Nvidia’s growth is starting to slow, but it’s still impressive.

In the third quarter of fiscal year 2025 (ending in October), Nvidia expects its revenue to come in around $32.5 billion, indicating 80% revenue growth. That’s still really fast, but it is starting to come down a fair amount from previous levels. That’s because Nvidia is starting to face more difficult year-over-year comparisons as it laps another period of strong growth from a year ago.

Leave a Reply