Qualcomm Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Qualcomm.

Looking at options history for Qualcomm QCOM we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $2,092,331 and 6, calls, for a total amount of $217,041.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $230.0 for Qualcomm over the last 3 months.

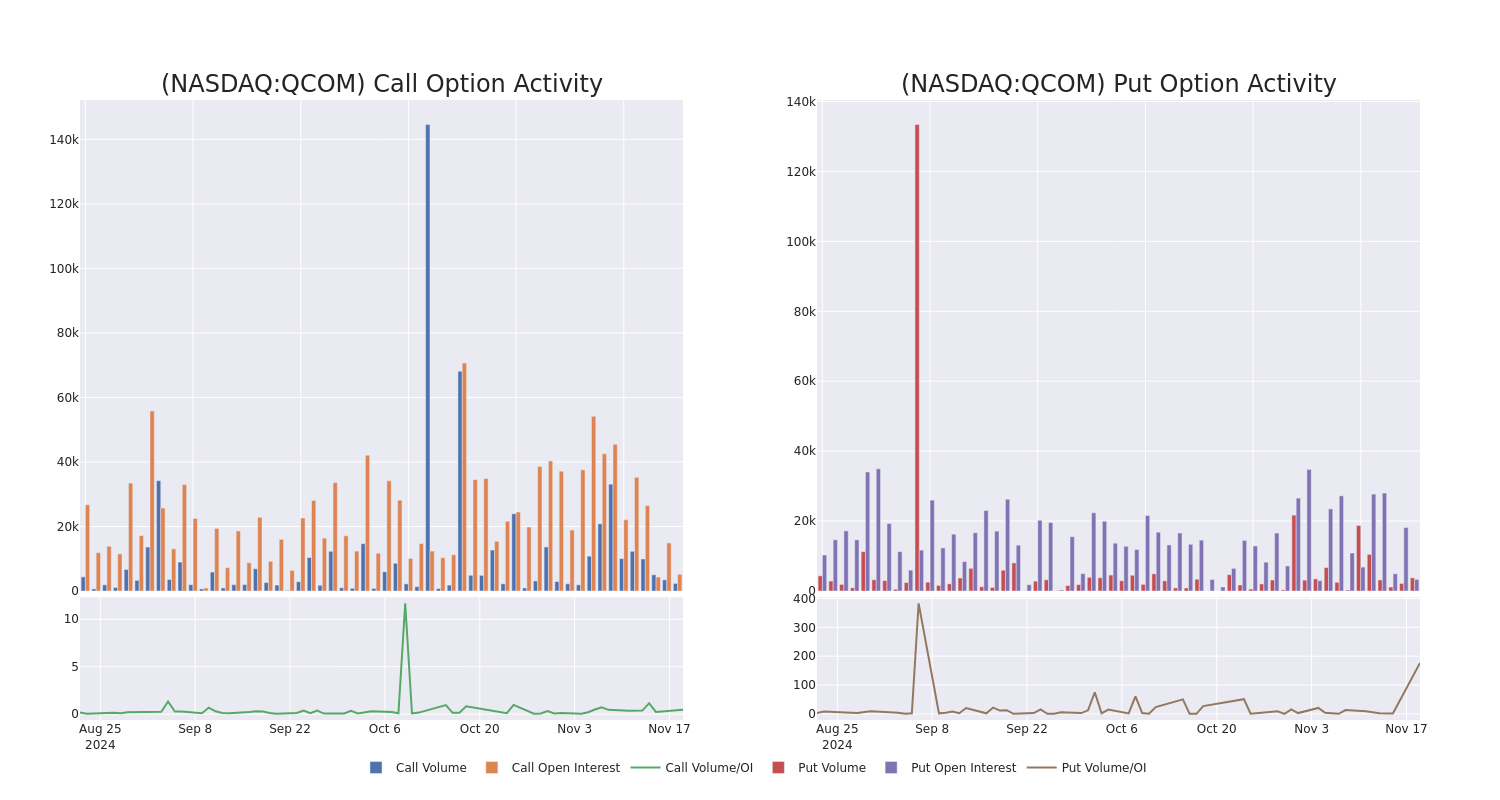

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Qualcomm’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Qualcomm’s substantial trades, within a strike price spectrum from $150.0 to $230.0 over the preceding 30 days.

Qualcomm Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | PUT | SWEEP | BEARISH | 04/17/25 | $14.6 | $14.5 | $14.54 | $165.00 | $758.5K | 119 | 1.0K |

| QCOM | PUT | SWEEP | BEARISH | 04/17/25 | $14.55 | $14.45 | $14.55 | $165.00 | $699.9K | 119 | 1.0K |

| QCOM | PUT | TRADE | BULLISH | 07/18/25 | $11.15 | $10.8 | $10.8 | $150.00 | $324.0K | 2 | 300 |

| QCOM | PUT | SWEEP | BULLISH | 04/17/25 | $17.35 | $17.3 | $17.3 | $170.00 | $197.2K | 1.8K | 114 |

| QCOM | CALL | SWEEP | BULLISH | 11/22/24 | $2.38 | $2.3 | $2.42 | $165.00 | $55.9K | 2.6K | 659 |

About Qualcomm

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company’s key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm’s IP is licensed by virtually all wireless device makers. The firm is also the world’s largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

Qualcomm’s Current Market Status

- With a trading volume of 2,592,300, the price of QCOM is down by -0.28%, reaching $164.04.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 71 days from now.

What The Experts Say On Qualcomm

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $196.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Loop Capital downgraded its rating to Hold, setting a price target of $180.

* An analyst from UBS has decided to maintain their Neutral rating on Qualcomm, which currently sits at a price target of $190.

* An analyst from Evercore ISI Group has decided to maintain their In-Line rating on Qualcomm, which currently sits at a price target of $199.

* Consistent in their evaluation, an analyst from Bernstein keeps a Outperform rating on Qualcomm with a target price of $215.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Qualcomm with a target price of $200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Qualcomm, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply