3 Unstoppable Multibaggers Up Between 965% and 3,450% Since 2014 to Buy After a Recent Pullback

One of my favorite opportunities when investing is finding long-term multibaggers that have recently experienced short-term pullbacks in their share prices.

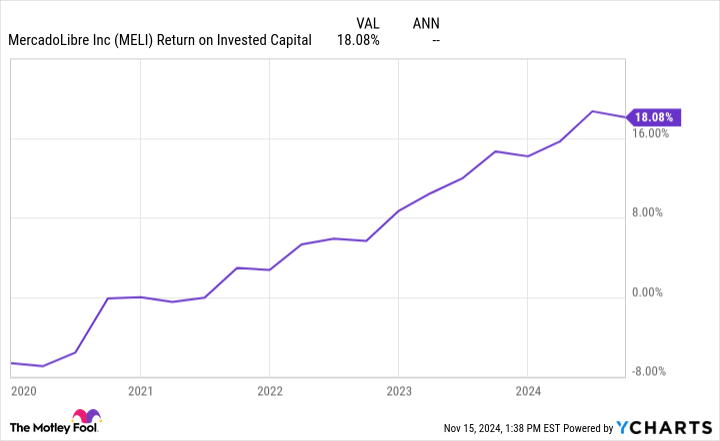

Three high-growth businesses currently meeting these requirements are Celsius (NASDAQ: CELH), MercadoLibre (NASDAQ: MELI), and Wingstop (NASDAQ: WING). After delivering share price increases ranging from 965% to 3,450% over the last decade, these multibaggers have pulled back between 11% and 73% from their 52-week highs.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Here’s why I believe these short-term drops in price could prove to be an opportunity for investors thinking a decade ahead.

In the third quarter of 2023, better-for-you energy drink maker Celsius more than doubled its sales compared to the previous year’s quarter. Fast-forward to Q3 2024, and Celsius saw sales drop 31%. This dramatic slowdown (and eventual shrinking) has caused the market to send the company’s shares down 73% from its recent highs.

So why am I highlighting a stock with declining sales as one of my favorite growth stock opportunities right now?

First, most of this slowdown results from how the company recognizes revenue upfront when it sells drinks through its largest distributor, Pepsi. The two companies signed a distribution deal in 2022, and Pepsi loaded up on Celsius drinks, prompting incredible growth from Celsius. Now, Pepsi is rightsizing its inventory with smaller orders from Celsius as the two businesses continue to learn how to work together.

However, despite this alarming-looking slowdown in sales via Pepsi’s distribution channels, Celsius’ underlying demand (what it actually sells to customers at retail locations) remains robust. During Q3, Celsius grew retail dollar and unit volume sales by 7%. The ready-to-drink energy market as a whole has only eked out 1% growth so far in 2024.

This relative retail sales strength helped Celsius maintain its No. 3 market share at 11.6% of its niche, compared to 11.5% a year ago. These results stand in stark contrast to what might otherwise look like an awful Q3 at first glance.

Second, sales to Amazon and Costco were up 21% and 15%, respectively, while international revenue jumped 37%. Thanks to this global growth potential and strong retail demand for Celsius drinks, it seems far too early to give up the promising growth stock which has risen 3,450% over the last 10 years.

Celsius currently trades at a price-to-sales (P/S) ratio of 4.4 — which compares nicely to its peer Monster‘s ratio of 7.4 — making it a reasonable time to buy into the company’s growth prospects.

Leave a Reply