A Look Ahead: Ross Stores's Earnings Forecast

Ross Stores ROST is set to give its latest quarterly earnings report on Thursday, 2024-11-21. Here’s what investors need to know before the announcement.

Analysts estimate that Ross Stores will report an earnings per share (EPS) of $1.40.

The announcement from Ross Stores is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

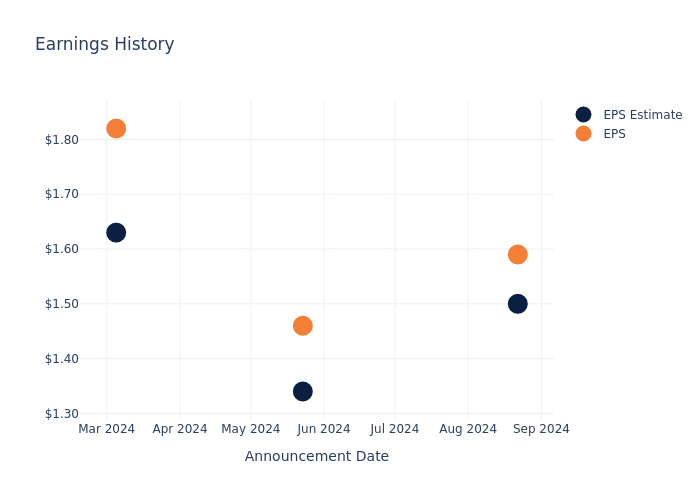

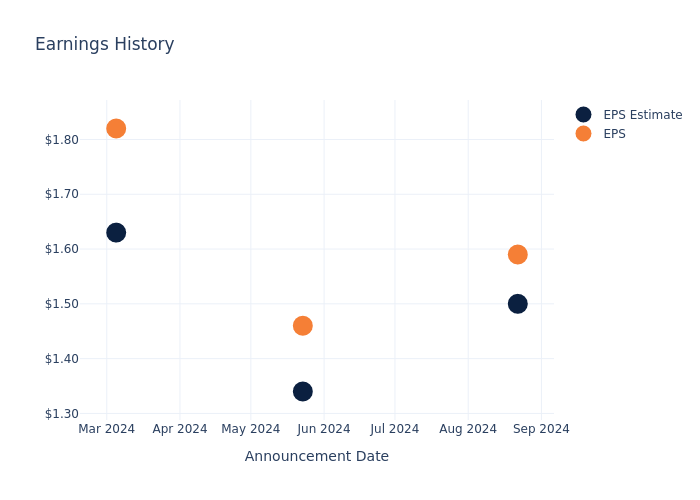

Past Earnings Performance

The company’s EPS beat by $0.09 in the last quarter, leading to a 1.76% increase in the share price on the following day.

Here’s a look at Ross Stores’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.50 | 1.34 | 1.63 | 1.21 |

| EPS Actual | 1.59 | 1.46 | 1.82 | 1.33 |

| Price Change % | 2.0% | 8.0% | -1.0% | 7.000000000000001% |

Performance of Ross Stores Shares

Shares of Ross Stores were trading at $139.26 as of November 19. Over the last 52-week period, shares are up 5.61%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Insights on Ross Stores

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Ross Stores.

Ross Stores has received a total of 14 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $174.93, the consensus suggests a potential 25.61% upside.

Peer Ratings Comparison

The following analysis focuses on the analyst ratings and average 1-year price targets of Burlington Stores, Gap and Abercrombie & Fitch, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Burlington Stores received a Outperform consensus from analysts, with an average 1-year price target of $309.85, implying a potential 122.5% upside.

- Gap received a Neutral consensus from analysts, with an average 1-year price target of $27.17, implying a potential 80.49% downside.

- As per analysts’ assessments, Abercrombie & Fitch is favoring an Neutral trajectory, with an average 1-year price target of $185.62, suggesting a potential 33.29% upside.

Comprehensive Peer Analysis Summary

In the peer analysis summary, key metrics for Burlington Stores, Gap and Abercrombie & Fitch are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ross Stores | Neutral | 7.15% | $1.50B | 10.46% |

| Burlington Stores | Outperform | 13.37% | $1.06B | 7.02% |

| Gap | Neutral | 4.85% | $1.58B | 7.35% |

| Abercrombie & Fitch | Neutral | 21.24% | $736.26M | 11.65% |

Key Takeaway:

Ross Stores ranks in the middle for Consensus rating among its peers. It ranks at the bottom for Revenue Growth. It is at the top for Gross Profit. It is in the middle for Return on Equity.

About Ross Stores

Ross Stores operates as an off-price apparel and accessories retailer with the majority of its sales derived from its Ross Dress for Less banner. The firm opportunistically procures excess brand-name merchandise made available via manufacturing overruns and retail liquidation sales at a 20%-60% discount to full prices. As such, its stores are often filled with a vast array of stock-keeping units, each with minimal product depth that creates a treasure hunt shopping experience. The firm’s more than 1,750 Ross Dress for Less stores are primarily located in densely populated suburban communities and typically serve middle-income consumers. Ross also operates about 350 DD’s Discounts chains targeting lower-income shoppers.

Key Indicators: Ross Stores’s Financial Health

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Ross Stores displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 7.15%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Ross Stores’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 9.97% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Ross Stores’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 10.46% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Ross Stores’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 3.61% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Ross Stores’s debt-to-equity ratio is below the industry average. With a ratio of 1.14, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Ross Stores visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply