Check Out What Whales Are Doing With Home Depot

Financial giants have made a conspicuous bullish move on Home Depot. Our analysis of options history for Home Depot HD revealed 9 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $69,300, and 7 were calls, valued at $255,371.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $365.0 and $420.0 for Home Depot, spanning the last three months.

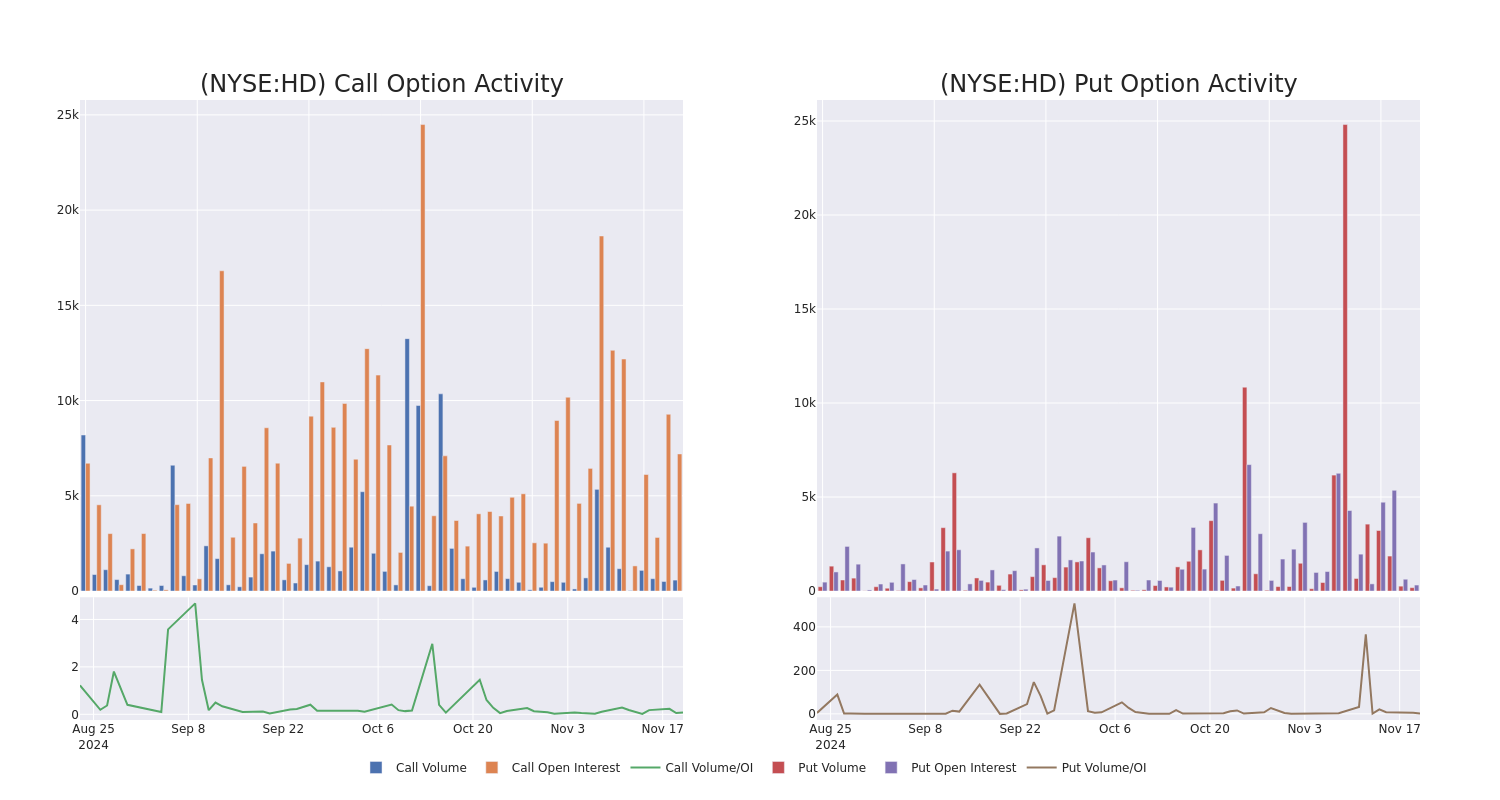

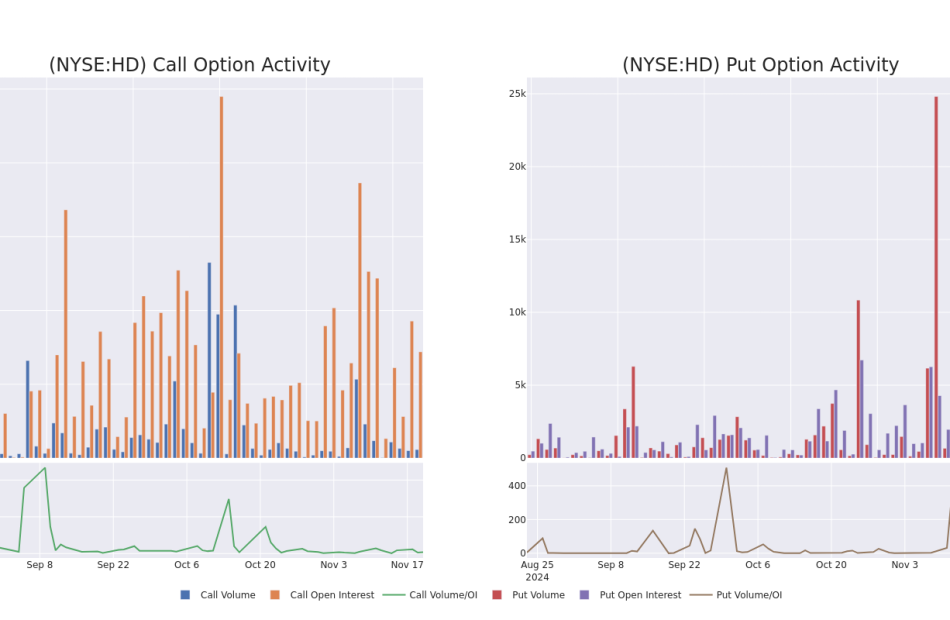

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Home Depot’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Home Depot’s substantial trades, within a strike price spectrum from $365.0 to $420.0 over the preceding 30 days.

Home Depot 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HD | CALL | TRADE | BULLISH | 01/17/25 | $41.2 | $39.9 | $41.2 | $365.00 | $53.5K | 30 | 13 |

| HD | PUT | TRADE | BEARISH | 12/27/24 | $4.35 | $2.55 | $4.35 | $385.00 | $43.4K | 122 | 100 |

| HD | CALL | TRADE | NEUTRAL | 02/21/25 | $10.7 | $10.25 | $10.49 | $420.00 | $41.9K | 482 | 46 |

| HD | CALL | TRADE | BULLISH | 06/20/25 | $26.2 | $26.2 | $26.2 | $410.00 | $39.3K | 1.7K | 2 |

| HD | CALL | SWEEP | BEARISH | 11/22/24 | $2.38 | $2.37 | $2.37 | $405.00 | $35.5K | 205 | 337 |

About Home Depot

Home Depot is the world’s largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the US, Canada, and Mexico. Its stores offer numerous building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals. The acquisition of Interline Brands in 2015 allowed Home Depot to enter the MRO business, which has been expanded through the tie-up with HD Supply (2020). The additions of the Company Store brought textiles to the lineup, and the recent tie-up with SRS will help grow professional demand in roofing, pool and landscaping projects.

Current Position of Home Depot

- With a trading volume of 901,415, the price of HD is down by -1.28%, reaching $401.61.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 90 days from now.

Professional Analyst Ratings for Home Depot

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $445.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Home Depot, targeting a price of $430.

* An analyst from Truist Securities persists with their Buy rating on Home Depot, maintaining a target price of $459.

* An analyst from Telsey Advisory Group persists with their Outperform rating on Home Depot, maintaining a target price of $455.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Home Depot, targeting a price of $465.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Home Depot, targeting a price of $420.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Home Depot with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply