Looking At Oklo's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Oklo OKLO.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with OKLO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 18 uncommon options trades for Oklo.

This isn’t normal.

The overall sentiment of these big-money traders is split between 27% bullish and 55%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $179,530, and 15 are calls, for a total amount of $757,027.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $18.0 to $26.0 for Oklo over the last 3 months.

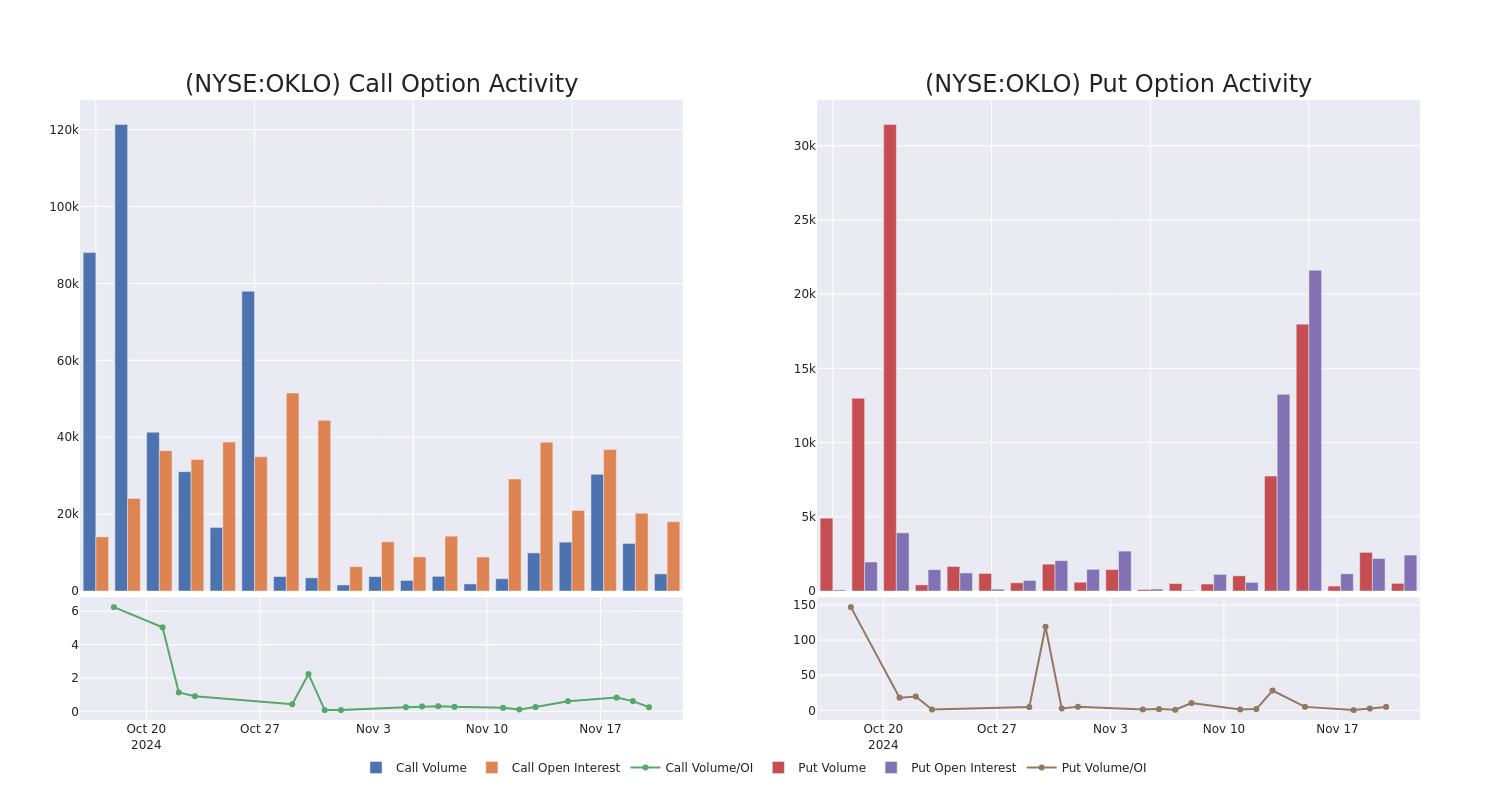

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Oklo’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Oklo’s whale activity within a strike price range from $18.0 to $26.0 in the last 30 days.

Oklo Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OKLO | CALL | SWEEP | BEARISH | 03/21/25 | $5.0 | $4.7 | $4.7 | $21.00 | $141.0K | 1.4K | 552 |

| OKLO | CALL | SWEEP | BEARISH | 01/17/25 | $2.4 | $2.2 | $2.35 | $25.00 | $117.5K | 3.0K | 534 |

| OKLO | PUT | SWEEP | BULLISH | 11/22/24 | $0.6 | $0.5 | $0.55 | $18.50 | $75.5K | 2.3K | 10 |

| OKLO | CALL | SWEEP | BULLISH | 12/20/24 | $3.6 | $3.6 | $3.6 | $20.00 | $68.7K | 3.7K | 702 |

| OKLO | PUT | SWEEP | BEARISH | 12/13/24 | $2.3 | $2.3 | $2.3 | $19.00 | $64.1K | 105 | 4 |

About Oklo

Oklo Inc is developing advanced fission power plants to provide clean, reliable, and affordable energy at scale. It is pursuing two complementary tracks to address this demand: providing reliable, commercial-scale energy to customers; and selling used nuclear fuel recycling services to the U.S. market. The Company plans to commercialize its liquid metal fast reactor technology with the Aurora powerhouse product line. The first commercial Aurora powerhouse is designed to produce up to 15 megawatts of electricity (MWe) on both recycled nuclear fuel and fresh fuel.

After a thorough review of the options trading surrounding Oklo, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Oklo

- Currently trading with a volume of 6,318,619, the OKLO’s price is down by -4.27%, now at $20.87.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 85 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Oklo options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply