Looking At United Parcel Service's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards United Parcel Service UPS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UPS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for United Parcel Service. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 62% leaning bullish and 37% bearish. Among these notable options, 4 are puts, totaling $114,507, and 4 are calls, amounting to $444,526.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $120.0 to $160.0 for United Parcel Service over the last 3 months.

Insights into Volume & Open Interest

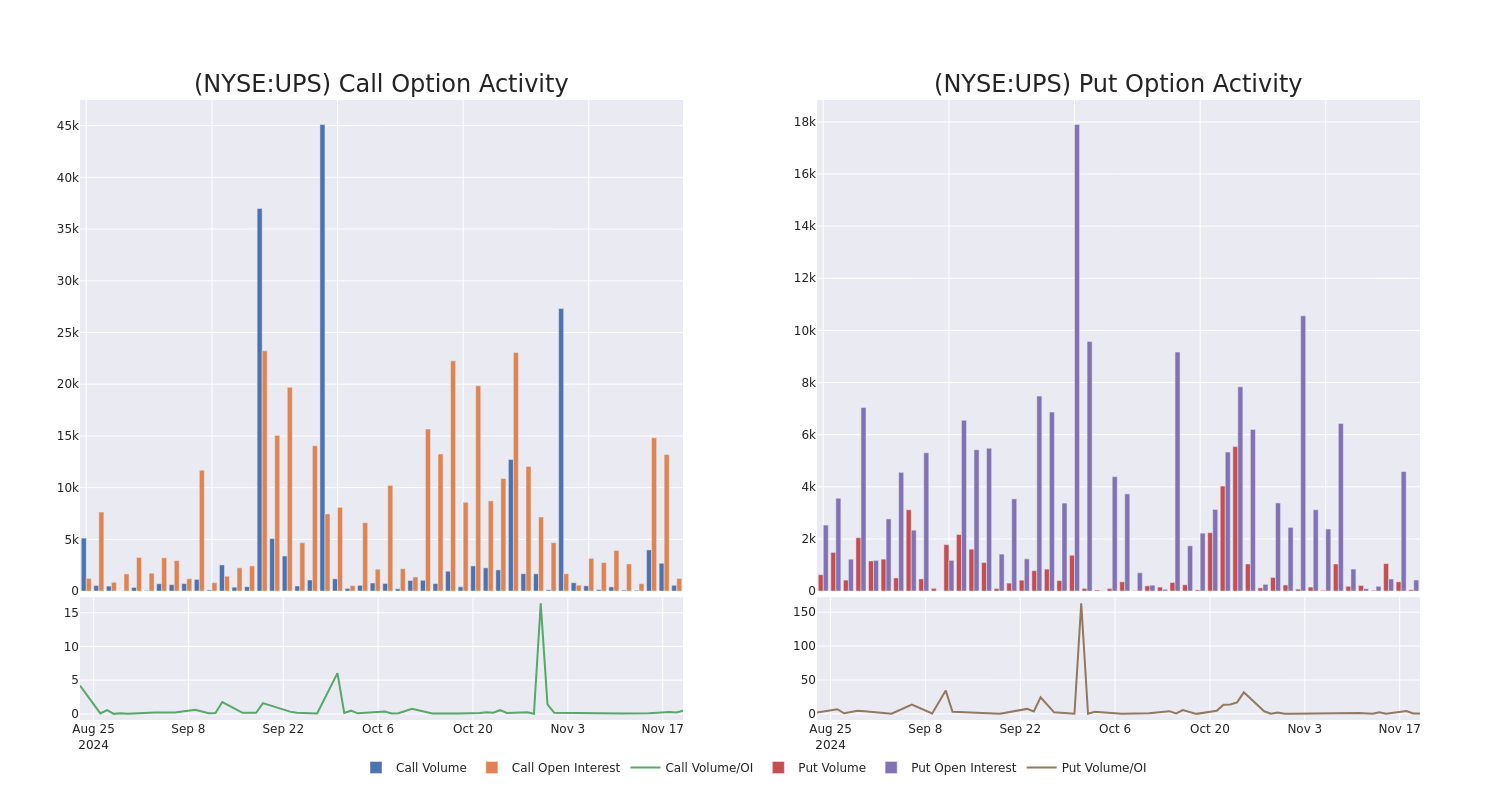

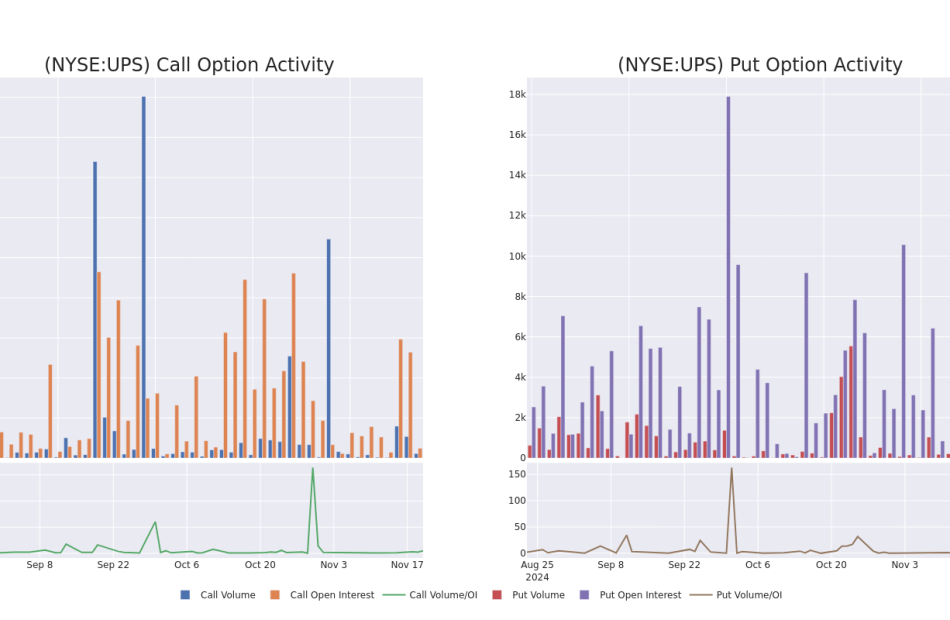

In today’s trading context, the average open interest for options of United Parcel Service stands at 234.86, with a total volume reaching 606.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in United Parcel Service, situated within the strike price corridor from $120.0 to $160.0, throughout the last 30 days.

United Parcel Service Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | TRADE | BULLISH | 01/17/25 | $13.15 | $12.95 | $13.1 | $120.00 | $327.5K | 547 | 250 |

| UPS | CALL | SWEEP | BEARISH | 11/29/24 | $6.35 | $6.0 | $6.0 | $126.00 | $60.0K | 10 | 100 |

| UPS | PUT | TRADE | BULLISH | 01/16/26 | $33.85 | $31.5 | $31.5 | $160.00 | $31.5K | 247 | 10 |

| UPS | CALL | SWEEP | BULLISH | 01/16/26 | $14.8 | $14.7 | $14.78 | $130.00 | $29.5K | 653 | 1 |

| UPS | PUT | TRADE | BULLISH | 01/16/26 | $28.6 | $28.2 | $28.2 | $155.00 | $28.2K | 99 | 20 |

About United Parcel Service

As the world’s largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS’ domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing “strategic alternatives” for its truck brokerage unit, Coyote, which it acquired in 2015.

Following our analysis of the options activities associated with United Parcel Service, we pivot to a closer look at the company’s own performance.

Where Is United Parcel Service Standing Right Now?

- With a volume of 1,493,806, the price of UPS is down -1.34% at $131.41.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 69 days.

Expert Opinions on United Parcel Service

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $153.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Evercore ISI Group persists with their In-Line rating on United Parcel Service, maintaining a target price of $141.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for United Parcel Service, targeting a price of $170.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on United Parcel Service with a target price of $146.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on United Parcel Service with a target price of $150.

* An analyst from Citigroup persists with their Buy rating on United Parcel Service, maintaining a target price of $158.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for United Parcel Service, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply