Why Cryptocurrencies and Crypto Stocks Were Bouncing Higher on Tuesday

A combination of lingering good sentiment and company-specific news was lifting cryptocurrencies and associated stocks higher on Tuesday. For the former, we didn’t see many dramatic price leaps, yet it seems the latest rally still has some mileage to it.

The day really belonged to the crypto stocks, with Mara Holdings (NASDAQ: MARA) closing a sturdy 10% higher, and all-in Bitcoin (CRYPTO: BTC) investor MicroStrategy (NASDAQ: MSTR) booking a 12% increase.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

A clutch of cryptocurrencies was trading in positive territory late that afternoon, albeit not at such impressive rates. Among the gainers were Hedera (CRYPTO: HBAR) and Mantra (CRYPTO: OM).

It stands to reason that the crypto stocks took the spotlight Tuesday, as their news was more immediate and dramatic. Both Mara Holdings and MicroStrategy provided updates about their funding, and investors cheered the fact that they’ll have more capital to spend on buying more Bitcoin, still by far the world’s most popular digital coin.

Mara Holdings’ financing news was arguably more impressive. Last night, the company announced that it was upsizing its previously announced issue of convertible notes (debt securities that convert into equity under certain conditions) in a private offering. It will issue $850 million worth of convertible senior notes due in 2030, and paying quite a favorable (for the company) interest rate of 0%.

The initial buyers of the notes will have an option to purchase an additional $150 million worth of the securities. Originally, Mara Holdings was looking to raise $700 million. The company aims to use around $199 million to repurchase existing convertible notes and the rest to buy Bitcoin.

As for MicroStrategy, it hasn’t (yet) upsized its own financing effort, yet it stands to bring in far more capital. The company announced just after market close Monday that it’s floating $1.75 billion in convertible senior notes due in 2029, which, like Mara Holdings, have a 0% interest rate. It expects to grant initial purchasers an option to collectively buy an additional $250 million worth.

MicroStrategy will use its proceeds to — you guessed it — purchase Bitcoin.

That kind of liquidity flowing into only two companies, on its own, will help — at least — to support the price of Bitcoin, and perhaps extend the current crypto rally. And if Bitcoin is doing well, you can be sure that altcoins will generally follow along, as they do.

Cathie Wood Sounds Alarm On US Auto Loans As 90-Day Delinquency Rates Surpass 2009 Levels

ARK Invest CEO Cathie Wood popularly known for leading ARK Innovation ETF ARKK has raised alarm bells about the state of auto loans in America, noting that 90-day delinquency rates have now exceeded levels seen during the 2009 financial crisis.

What Happened: Wood’s comments came in response to recent data showing rising auto loan defaults, despite continued investor confidence in auto-backed securities. The Federal Reserve’s latest Supervision and Regulation Report confirms this trend, highlighting that auto loan delinquencies are approaching five-year highs in 2024.

Delinquency rates on auto loans refer to the percentage of auto loan borrowers who have failed to make their scheduled payments on time. A loan is typically considered delinquent when a payment is missed for a certain period, usually 30, 60, or 90 days.

Rising auto loan delinquency coincides with significant price cuts across the auto industry. Tesla Inc. TSLA reduced U.S. prices for its Model Y, Model X, and Model S by $2,000 in April following lower-than-expected first-quarter deliveries.

Ford Motor Co. F cut the Mustang Mach-E’s price by up to $8,100, and Nissan slashed up to $6,000 off its Ariya SUV. Stellantis NV STLA also introduced discounts on Jeep Wranglers and Grand Cherokees.

Despite these warning signs, investors are aggressively pursuing auto loan-backed bonds, with sales of securities tied to subprime auto loans reaching nearly $40 billion through October 2024 – a 17% increase from 2023’s total. Nicholas Tripodes, senior portfolio manager at Federated Hermes, reports seeing deals “almost 20 times oversubscribed,” according to The Wall Street Journal.

See Also: Dan Ives Expects ‘Drop The Mic Performance’ Tomorrow From Nvidia: Here’s Why

Why It Matters: The disconnect between rising delinquencies and investor enthusiasm reflects a broader market dynamic. Auto bonds from Global Lending Services with the lowest investment-grade rating yielded approximately 6% in October, triple the yield of comparable subprime auto loan-backed debt in 2021.

The stress is particularly evident among lower-income borrowers struggling with increased living costs and higher interest rates. The overall auto loan delinquency rate hit 3.8% in June, the highest since 2010, according to Federal Reserve data.

“The delinquency rate for consumer loans remained elevated in the first half of 2024,” the Federal Reserve noted, adding that while there was some improvement in credit card delinquencies during the second quarter, auto loan defaults continued to rise year-over-year.

Read Next:

Image via Benzinga YouTube and Unsplash

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wix Reports Third Quarter 2024 Results

Strong performance of key product initiatives drove third consecutive quarter of bookings growth acceleration – now expect to exit 2024 with y/y bookings growth of 18%

- Continued meaningful growth acceleration with total bookings of $449.8 million in the quarter, up 16% y/y, driven by Studio momentum, AI benefits, robust commerce activity and healthy business fundamentals

- Strengthening tailwinds from key AI innovations – notably, tests demonstrate a 13% conversion uplift in recent Self Creator cohort from AI-powered user onboarding tool

- Total revenue grew to $444.7 million, up 13% y/y, driven by accelerating growth across both Self Creators and Partners

- FCF margin expanded ~170 bps sequentially to 29% in the third quarter, driven by bookings strength and continued operating leverage

- Raising full year bookings, revenue and FCF guidance

- Expect to achieve 2H bookings growth of 17% y/y vs. 16% previously anticipated and exit the year at 18% y/y bookings growth at high end of guide

- Ample room for further growth acceleration and continued margin expansion in 2025

NEW YORK — Wix.com Ltd. WIX, the leading SaaS website builder platform,1 today reported financial results for the third quarter of 2024. In addition, the Company provided its outlook for the fourth quarter and an updated outlook for full year 2024. Please visit the Wix Investor Relations website at https://investors.wix.com to view the Q3’24 Shareholder Update and other materials.

“The continued momentum and accomplishments achieved this year are a testament to our intense focus on best-in-class innovation,” said Avishai Abrahami, Wix Co-founder and CEO. “Our key growth initiatives are firing on all cylinders and increasingly contributing to growth. First, Studio continues to outperform. Bookings growth attributable to Studio subscriptions accelerated meaningfully q/q as a result of new purchase strength and robust renewal activity. 75% of bookings from new Partners came from Studio accounts, an increase from the previous quarter, as more and larger agencies choose Studio for their projects. Additionally, our AI onboarding process, which includes AI Website Builder, has enabled users to build the websites of their dreams more efficiently than ever before – resulting in a 13% uplift in conversion rate according to tests in the most recent Self Creator cohort. We are also beginning to see early benefits from our growing suite of AI business assistants, including better conversion and improved Care efficiency. While these results are impressive, I am most excited for the new products still on the horizon. These upcoming AI-powered innovations are expected to transform the way merchants manage their businesses, reimagine how our users interact with their customers and continue to enhance the content creation experience. Notably, these will be the first AI capabilities to be monetized directly as we believe they will drive immense value for our users.”

“We delivered another quarter of accelerating top-line growth and FCF margin expansion, underpinned by focused execution of our key strategic initiatives,” added Lior Shemesh, CFO at Wix. “Bookings growth accelerated to 16% y/y in Q3, driven by Studio momentum, ramping benefits from our AI product suite, robust commerce activity and strong business fundamentals. Strong bookings coupled with a stable operating base resulted in FCF margin expanding sequentially to 29% of revenue. Propelled by the impressive performance year-to-date, we are increasing full year bookings, revenue and FCF outlook. We now expect 2H bookings growth to accelerate to 17% y/y compared to the 16% previously anticipated with y/y bookings growth of 18% exiting 2024, due primarily to growing contribution from our key product investments and strong cohort behavior. Even as we are well-positioned to achieve and surpass the Rule of 40 this year, we are not slowing down. We remain committed to making continued progress as I am confident there is still much opportunity for further growth acceleration and ample margin expansion in 2025 and beyond.”

Q3 2024 Financial Results

- Total revenue in the third quarter of 2024 was $444.7 million, up 13% y/y

- Creative Subscriptions revenue in the third quarter of 2024 was $318.8 million, up 10% y/y

- Creative Subscriptions ARR increased to $1.31 billion as of the end of the quarter, up 11% y/y

- Business Solutions revenue in the third quarter of 2024 was $125.8 million, up 22% y/y

- Transaction revenue2 was $54.3 million, up 23% y/y

- Partners revenue3 in the third quarter of 2024 was $155.2 million, up 30% y/y

- Total bookings in the third quarter of 2024 were $449.8 million, up 16% y/y

- Creative Subscriptions bookings in the third quarter of 2024 were $326.6 million, up 15% y/y

- Business Solutions bookings in the third quarter of 2024 were $123.1 million, up 17% y/y

- Total gross margin on a GAAP basis in the third quarter of 2024 was 68%

- Creative Subscriptions gross margin on a GAAP basis was 83%

- Business Solutions gross margin on a GAAP basis was 29%

- Total non-GAAP gross margin in the third quarter of 2024 was 69%

- Creative Subscriptions gross margin on a non-GAAP basis was 84%

- Business Solutions gross margin on a non-GAAP basis was 31%

- GAAP net income in the third quarter of 2024 was $26.8 million, or $0.49 per basic share and $0.46 per diluted share

- Non-GAAP net income in the third quarter of 2024 was $89.3 million, or $1.62 per basic share and $1.50 per diluted share

- Net cash provided by operating activities for the third quarter of 2024 was $129.8 million, while capital expenditures totaled $2.1 million, leading to free cash flow of $127.8 million

- Total employee count at the end of Q3’24 was 5,308

____________________

1 Based on number of active live sites as reported by competitors’ figures, independent third-party data and internal data as of H1 2024.

2 Transaction revenue is a portion of Business Solutions revenue, and we define transaction revenue as all revenue generated through transaction facilitation, primarily from Wix Payments, as well as Wix POS, shipping solutions and multi-channel commerce and gift card solutions.

3 Partners revenue is defined as revenue generated through agencies and freelancers that build sites or applications for other users (“Agencies”) as well as revenue generated through B2B partnerships, such as LegalZoom or Vistaprint (“Resellers”). We identify Agencies using multiple criteria, including but not limited to, the number of sites built, participation in the Wix Partner Program and/or the Wix Marketplace or Wix products used (incl. Wix Studio). Partners revenue includes revenue from both the Creative Subscriptions and Business Solutions businesses.

In Q1 2024, the definition was slightly revised to exclude revenue generated from agreements with enterprise users that, by their nature, are more suitable to be categorized under revenue generated by Self Creators. Such revision had an immaterial impact on prior period amounts.

Financial Outlook

We are increasing our full year bookings outlook to $1,822 – $1,832 million, or 14-15% y/y growth, compared to previous guidance of $1,802 – $1,822 million, or 13-14% y/y growth.

This high end of this updated outlook reflects the expectation that 2H bookings will accelerate to 17% y/y, compared to previous guidance of 16%, and y/y bookings growth to exit the year at 18%.

We are also updating our full year revenue outlook to $1,757 – $1,764 million, or 13% y/y, compared to $1,747 – $1,761 million previously.

We expect total revenue in Q4’24 of $457 – $464 million, or 13-15% y/y growth.

For the full year 2024, we now expect non-GAAP total gross margin of approximately 69%, slightly up from the 68-69% previously anticipated with non-GAAP Business Solutions gross margin still to exceed 30%. We also now expect non-GAAP operating expenses to be approximately 49% of revenue for the full year, down from approximately 50% previously.

As a result of our increased bookings expectation for the full year coupled with stable operating costs anticipated, we now expect to generate free cash flow, excluding headquarters costs, of $483 – $488 million, or 27-28% of revenue, in 2024, up from $460 – $470 million, or 26-27% of revenue.

The high end of our increased growth and profitability expectations would allow us to exceed the Rule of 40 this year, a full year ahead of our original plan presented to shareholders. Even with the earlier-than-expected achievement of this target, there is still room for further growth acceleration and ample margin expansion in our financial algorithm for 2025 and beyond.

The bookings acceleration in 2024, coupled with compounding tailwinds from Studio and AI as these new innovations continue to mature, are expected to translate into revenue growth acceleration in 2025. Additionally, we have the right employee base and overall cost structure currently in place to support a variety of growth scenarios and so, expect to maintain a stable operating cost trajectory even as growth accelerates next year. As a result, we continue to see room for meaningful FCF margin expansion going forward. The combination of these factors provide confidence in our ability to make progress over and above Rule of 40 as we continue to balance growth and profitability.

Conference Call and Webcast Information

Wix will host a conference call to discuss the results at 8:30 a.m. ET on Wednesday, November 20, 2024. To participate on the live call, analysts and investors should register and join at https://register.vevent.com/register/BId6c8de6013e944adbefcb241fb2d4027. A replay of the call will be available through November 20, 2025 via the registration link.

Wix will also offer a live and archived webcast of the conference call, accessible from the “Investor Relations” section of the Company’s website at https://investors.wix.com/.

About Wix.com Ltd.

Wix is the leading SaaS website builder platform1 to create, manage and grow a digital presence. Founded in 2006, Wix is a comprehensive platform providing users – self-creators, agencies, enterprises, and more – with industry-leading performance, security, AI capabilities and a reliable infrastructure. Offering a wide range of commerce and business solutions, advanced SEO and marketing tools, the platform enables users to take full ownership of their brand, their data and their relationships with their customers. With a focus on continuous innovation and delivery of new features and products, users can seamlessly build a powerful and high-end digital presence for themselves or their clients.

For more about Wix, please visit our Press Room

Media Relations Contact: PR@wix.com

Non-GAAP Financial Measures and Key Operating Metrics

To supplement its consolidated financial statements, which are prepared and presented in accordance with U.S. GAAP, Wix uses the following non-GAAP financial measures: bookings, cumulative cohort bookings, bookings on a constant currency basis, revenue on a constant currency basis, non-GAAP gross margin, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss), non-GAAP net income (loss) per share, free cash flow, free cash flow, as adjusted, free cash flow margins, non-GAAP R&D expenses, non-GAAP S&M expenses, non-GAAP G&A expenses, non-GAAP operating expenses, non-GAAP cost of revenue expense, non-GAAP financial expense, non-GAAP tax expense (collectively the “Non-GAAP financial measures”). Measures presented on a constant currency or foreign exchange neutral basis have been adjusted to exclude the effect of y/y changes in foreign currency exchange rate fluctuations. Bookings is a non-GAAP financial measure calculated by adding the change in deferred revenues and the change in unbilled contractual obligations for a particular period to revenues for the same period. Bookings include cash receipts for premium subscriptions purchased by users as well as cash we collect from business solutions, as well as payments due to us under the terms of contractual agreements for which we may have not yet received payment. Cash receipts for premium subscriptions are deferred and recognized as revenues over the terms of the subscriptions. Cash receipts for payments and the majority of the additional products and services (other than Google Workspace) are recognized as revenues upon receipt. Committed payments are recognized as revenue as we fulfill our obligation under the terms of the contractual agreement. Bookings and Creative Subscriptions Bookings are also presented on a further non-GAAP basis by excluding, in each case, bookings associated with long term B2B partnership agreements. Non-GAAP gross margin represents gross profit calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization, divided by revenue. Non-GAAP operating income (loss) represents operating income (loss) calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, amortization, acquisition-related expenses and sales tax expense accrual and other G&A expenses (income). Non-GAAP net income (loss) represents net loss calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, amortization, sales tax expense accrual and other G&A expenses (income), amortization of debt discount and debt issuance costs and acquisition-related expenses and non-operating foreign exchange expenses (income). Non-GAAP net income (loss) per share represents non-GAAP net income (loss) divided by the weighted average number of shares used in computing GAAP loss per share. Free cash flow represents net cash provided by (used in) operating activities less capital expenditures. Free cash flow, as adjusted, represents free cash flow further adjusted to exclude one-time cash restructuring charges and the capital expenditures and other expenses associated with the buildout of our new corporate headquarters. Free cash flow margins represent free cash flow divided by revenue. Non-GAAP cost of revenue represents cost of revenue calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP R&D expenses represent R&D expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP S&M expenses represent S&M expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP G&A expenses represent G&A expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP operating expenses represent operating expenses calculated in accordance with GAAP as adjusted for the impact of share-based compensation expense, acquisition-related expenses and amortization. Non-GAAP financial expense represents financial expense calculated in accordance with GAAP as adjusted for unrealized gains of equity investments, amortization of debt discount and debt issuance costs and non-operating foreign exchange expenses. Non-GAAP tax expense represents tax expense calculated in accordance with GAAP as adjusted for provisions for income tax effects related to non-GAAP adjustments.

The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The Company uses these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. The Company believes that these measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making.

For more information on the non-GAAP financial measures, please see the reconciliation tables provided below. The accompanying tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliations between these financial measures. The Company is unable to provide reconciliations of free cash flow, free cash flow, as adjusted, cumulative cohort bookings, non-GAAP gross margin, and non-GAAP tax expense to their most directly comparable GAAP financial measures on a forward-looking basis without unreasonable effort because items that impact those GAAP financial measures are out of the Company’s control and/or cannot be reasonably predicted. Such information may have a significant, and potentially unpredictable, impact on our future financial results.

Wix also uses Creative Subscriptions Annualized Recurring Revenue (ARR) as a key operating metric. Creative Subscriptions ARR is calculated as Creative Subscriptions Monthly Recurring Revenue (MRR) multiplied by 12. Creative Subscriptions MRR is calculated as the total of (i) the total monthly revenue of all Creative Subscriptions in effect on the last day of the period, other than domain registrations; (ii) the average revenue per month from domain registrations multiplied by all registered domains in effect on the last day of the period; and (iii) monthly revenue from other partnership agreements including enterprise partners.

Forward-Looking Statements

This document contains forward-looking statements, within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. Such forward-looking statements may include projections regarding our future performance, including, but not limited to revenue, bookings and free cash flow, and may be identified by words like “anticipate,” “assume,” “believe,” “aim,” “forecast,” “indication,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “outlook,” “future,” “will,” “seek” and similar terms or phrases. The forward-looking statements contained in this document, including the quarterly and annual guidance, are based on management’s current expectations, which are subject to uncertainty, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Important factors that could cause our actual results to differ materially from those indicated in the forward-looking statements include, among others, our expectation that we will be able to attract and retain registered users and partners, and generate new premium subscriptions, in particular as we continuously adjust our marketing strategy and as the macro-economic environment continues to be turbulent; our expectation that we will be able to increase the average revenue we derive per premium subscription, including through our partners; our expectation that new products and developments, as well as third-party products we will offer in the future within our platform, will receive customer acceptance and satisfaction, including the growth in market adoption of our online commerce solutions and our Wix Studio product; our expectations regarding our ability to develop relevant and required products using artificial intelligence (“AI”), the regulatory environment impacting AI and AI-related activities, including privacy and intellectual property, and potential competitive impacts from AI tools; our assumption that historical user behavior can be extrapolated to predict future user behavior, in particular during turbulent macro-economic environments; our prediction of the future revenues and/or bookings generated by our user cohorts and our ability to maintain and increase such revenue growth, as well as our ability to generate and maintain elevated levels of free cash flow and profitability; our expectation to maintain and enhance our brand and reputation; our expectation that we will effectively execute our initiatives to improve our user support function through our Customer Care team, and continue attracting registered users and partners, and increase user retention, user engagement and sales; our ability to successfully localize our products, including by making our product, support and communication channels available in additional languages and to expand our payment infrastructure to transact in additional local currencies and accept additional payment methods; our expectation regarding the impact of fluctuations in foreign currency exchange rates, interest rates, potential illiquidity of banking systems, and other recessionary trends on our business; our expectations relating to the repurchase of our ordinary shares and/or Convertible Notes pursuant to our repurchase program; our expectation that we will effectively manage our infrastructure; our expectation to comply with AI, privacy, and data protection laws and regulations as well as contractual privacy and data protection obligations; our expectations regarding the outcome of any regulatory investigation or litigation, including class actions; our expectations regarding future changes in our cost of revenues and our operating expenses on an absolute basis and as a percentage of our revenues, as well as our ability to achieve and maintain profitability; our expectations regarding changes in the global, national, regional or local economic, business, competitive, market, and regulatory landscape, including as a result of Israel-Hamas war and/or the Israel-Hezbollah hostilities and/or the Ukraine-Russia war and any escalations thereof and potential for wider regional instability and conflict; our planned level of capital expenditures and our belief that our existing cash and cash from operations will be sufficient to fund our operations for at least the next 12 months and for the foreseeable future; our expectations with respect to the integration and performance of acquisitions; our ability to attract and retain qualified employees and key personnel; and our expectations about entering into new markets and attracting new customer demographics, including our ability to successfully attract new partners large enterprise-level users and to grow our activities, including through the adoption of our Wix Studio product, with these customer types as anticipated and other factors discussed under the heading “Risk Factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2023 filed with the Securities and Exchange Commission on March 22, 2024. The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. Any forward-looking statement made by us in this press release speaks only as of the date hereof. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

| Wix.com Ltd. | |||||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS – GAAP | |||||||||||

| (In thousands, except loss per share data) | |||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| Revenues | |||||||||||

| Creative Subscriptions | $ | 318,825 | $ | 290,634 | $ | 935,243 | $ | 855,853 | |||

| Business Solutions | 125,848 | 103,207 | 364,952 | 302,041 | |||||||

| 444,673 | 393,841 | 1,300,195 | 1,157,894 | ||||||||

| Cost of Revenues | |||||||||||

| Creative Subscriptions | 52,909 | 53,187 | 160,751 | 162,721 | |||||||

| Business Solutions | 89,119 | 75,856 | 260,248 | 223,694 | |||||||

| 142,028 | 129,043 | 420,999 | 386,415 | ||||||||

| Gross Profit | 302,645 | 264,798 | 879,196 | 771,479 | |||||||

| Operating expenses: | |||||||||||

| Research and development | 124,593 | 125,117 | 368,095 | 355,550 | |||||||

| Selling and marketing | 109,096 | 100,765 | 318,828 | 295,935 | |||||||

| General and administrative | 43,110 | 40,865 | 128,152 | 116,632 | |||||||

| Impairment, restructuring and other costs | – | 3,843 | – | 29,511 | |||||||

| Total operating expenses | 276,799 | 270,590 | 815,075 | 797,628 | |||||||

| Operating income (loss) | 25,846 | (5,792) | 64,121 | (26,149) | |||||||

| Financial income, net | 4,198 | 14,583 | 35,465 | 56,013 | |||||||

| Other income | (191) | (474) | 58 | (299) | |||||||

| Income before taxes on income | 29,853 | 8,317 | 99,644 | 29,565 | |||||||

| Income tax expenses (benefit) | 3,075 | 1,342 | 9,346 | (618) | |||||||

| Net income | $ | 26,778 | $ | 6,975 | $ | 90,298 | $ | 30,183 | |||

| Basic net income per share | $ | 0.49 | $ | 0.12 | $ | 1.63 | $ | 0.53 | |||

| Basic weighted-average shares used to compute net income per share | 55,099,939 | 56,837,917 | 55,509,920 | 56,666,881 | |||||||

| Diluted net income per share | $ | 0.46 | $ | 0.12 | $ | 1.55 | $ | 0.52 | |||

| Diluted weighted-average shares used to compute net income per share | 58,166,801 | 58,497,072 | 58,294,313 | 58,289,105 | |||||||

| Wix.com Ltd. | |||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||||

| (In thousands) | |||||

| Period ended | |||||

| September 30, | December 31, | ||||

| 2024 | 2023 | ||||

| Assets | (unaudited) | (audited) | |||

| Current Assets: | |||||

| Cash and cash equivalents | $ | 439,434 | $ | 609,622 | |

| Short-term deposits | 176,214 | 212,709 | |||

| Restricted deposits | 2,279 | 2,125 | |||

| Marketable securities | 345,538 | 140,563 | |||

| Trade receivables | 50,224 | 57,394 | |||

| Prepaid expenses and other current assets | 55,864 | 47,792 | |||

| Total current assets | 1,069,553 | 1,070,205 | |||

| Long-Term Assets: | |||||

| Prepaid expenses and other long-term assets | 29,221 | 34,296 | |||

| Property and equipment, net | 132,627 | 136,928 | |||

| Marketable securities | 6,168 | 64,806 | |||

| Intangible assets, net | 23,601 | 28,010 | |||

| Goodwill | 49,329 | 49,329 | |||

| Operating lease right-of-use assets | 403,981 | 420,562 | |||

| Total long-term assets | 644,927 | 733,931 | |||

| Total assets | $ | 1,714,480 | $ | 1,804,136 | |

| Liabilities and Shareholders’ Deficiency | |||||

| Current Liabilities: | |||||

| Trade payables | $ 30,891 | $ 38,305 | |||

| Employees and payroll accruals | 75,600 | 56,581 | |||

| Deferred revenues | 656,671 | 592,608 | |||

| Current portion of convertible notes, net | 572,087 | – | |||

| Accrued expenses and other current liabilities | 74,021 | 76,556 | |||

| Operating lease liabilities | 31,287 | 24,981 | |||

| Total current liabilities | 1,440,557 | 789,031 | |||

| Long Term Liabilities: | |||||

| Long-term deferred revenues | 92,162 | 83,384 | |||

| Long-term deferred tax liability | 1,435 | 7,167 | |||

| Convertible notes, net | – | 569,714 | |||

| Other long-term liabilities | 11,264 | 7,699 | |||

| Long-term operating lease liabilities | 368,369 | 401,626 | |||

| Total long-term liabilities | 473,230 | 1,069,590 | |||

| Total liabilities | 1,913,787 | 1,858,621 | |||

| Shareholders’ Deficiency | |||||

| Ordinary shares | 105 | 110 | |||

| Additional paid-in capital | 1,772,023 | 1,539,952 | |||

| Treasury Stock | (1,025,167) | (558,875) | |||

| Accumulated other comprehensive loss | 3,298 | 4,192 | |||

| Accumulated deficit | (949,566) | (1,039,864) | |||

| Total shareholders’ deficiency | (199,307) | (54,485) | |||

| Total liabilities and shareholders’ deficiency | $ | 1,714,480 | $ | 1,804,136 | |

| Wix.com Ltd. | |||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||

| (In thousands) | |||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| OPERATING ACTIVITIES: | |||||||||||

| Net income | $ | 26,778 | $ | 6,975 | $ | 90,298 | $ | 30,183 | |||

| Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||||||

| Depreciation | 6,099 | 4,348 | 18,968 | 13,767 | |||||||

| Amortization | 1,461 | 1,489 | 4,409 | 4,466 | |||||||

| Share based compensation expenses | 60,892 | 58,249 | 178,920 | 166,430 | |||||||

| Amortization of debt discount and debt issuance costs | 792 | 787 | 2,373 | 3,405 | |||||||

| Changes in accrued interest and exchange rate on short term and long term deposits | (283) | (1,937) | 1,487 | (1,829) | |||||||

| Non-cash impairment, restructuring and other costs | – | 1,968 | – | 23,132 | |||||||

| Amortization of premium and discount and accrued interest on marketable securities, net | (10,077) | (563) | (5,543) | 4,109 | |||||||

| Remeasurement loss (gain) on Marketable equity | – | 2,400 | (3,367) | (20,312) | |||||||

| Changes in deferred income taxes, net | 30 | 3,713 | (5,189) | (6,749) | |||||||

| Changes in operating lease right-of-use assets | 9,585 | 8,905 | 19,895 | 20,057 | |||||||

| Changes in operating lease liabilities | (18,753) | (13,705) | (30,265) | (48,034) | |||||||

| Loss on foreign exchange, net | (716) | – | 1,435 | – | |||||||

| Decrease (increase) in trade receivables | 5,560 | (1,332) | 7,170 | (12,514) | |||||||

| Decrease (increase) in prepaid expenses and other current and long-term assets | 27,484 | (6,402) | (13,279) | (9,260) | |||||||

| Increase (decrease) in trade payables | 12,189 | (14,604) | (4,436) | (67,575) | |||||||

| Increase (decrease) in employees and payroll accruals | 7,758 | 6,749 | 19,019 | (21,225) | |||||||

| Increase in short term and long term deferred revenues | 6,096 | 387 | 72,841 | 73,405 | |||||||

| Increase (decrease) in accrued expenses and other current liabilities | (5,081) | 6,717 | 8,943 | 6,410 | |||||||

| Net cash provided by operating activities | 129,814 | 64,144 | 363,679 | 157,866 | |||||||

| INVESTING ACTIVITIES: | |||||||||||

| Proceeds from short-term deposits and restricted deposits | 178,661 | 70,040 | 179,646 | 493,741 | |||||||

| Investment in short-term deposits and restricted deposits | (114,619) | (134,732) | (144,792) | (198,192) | |||||||

| Investment in marketable securities | (75,664) | (4,125) | (267,209) | (4,125) | |||||||

| Proceeds from marketable securities | 19,021 | 42,901 | 110,176 | 217,270 | |||||||

| Purchase of property and equipment and lease prepayment | (1,665) | (18,690) | (16,251) | (53,439) | |||||||

| Capitalization of internal use of software | (388) | (686) | (1,122) | (2,620) | |||||||

| Investment in other assets | – | – | – | (111) | |||||||

| Proceeds from investment in other assets | – | – | 550 | – | |||||||

| Proceeds from sale of equity securities | – | – | 22,148 | 49,468 | |||||||

| Purchases of investments in privately held companies | (1,150) | (27) | (2,160) | (7,527) | |||||||

| Net cash provided by investing activities | 4,196 | (45,319) | (119,014) | 494,465 | |||||||

| FINANCING ACTIVITIES: | |||||||||||

| Proceeds from exercise of options and ESPP shares | 28,641 | 17,931 | 52,884 | 38,762 | |||||||

| Purchase of treasury stock | – | – | (466,302) | (68,319) | |||||||

| Repayment of convertible notes | – | – | – | (362,667) | |||||||

| Net cash provided by (used in) financing activities | 28,641 | 17,931 | (413,418) | (392,224) | |||||||

| Effect of exchange rates on cash, cash equivalent and restricted cash | 716 | – | (1,435) | – | |||||||

| INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 163,367 | 36,756 | (170,188) | 260,107 | |||||||

| CASH AND CASH EQUIVALENTS—Beginning of period | 276,067 | 468,037 | 609,622 | 244,686 | |||||||

| CASH AND CASH EQUIVALENTS—End of period | $ | 439,434 | $ | 504,793 | $ | 439,434 | $ | 504,793 | |||

| Wix.com Ltd. | |||||||||||

| KEY PERFORMANCE METRICS | |||||||||||

| (In thousands) | |||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| Creative Subscriptions | 318,825 | 290,634 | 935,243 | 855,853 | |||||||

| Business Solutions | 125,848 | 103,207 | 364,952 | 302,041 | |||||||

| Total Revenues | $ | 444,673 | $ | 393,841 | $ | 1,300,195 | $ | 1,157,894 | |||

| Creative Subscriptions | 326,638 | 283,917 | 990,242 | 891,275 | |||||||

| Business Solutions | 123,142 | 105,178 | 375,218 | 311,224 | |||||||

| Total Bookings | $ | 449,780 | $ | 389,095 | $ | 1,365,460 | $ | 1,202,499 | |||

| Free Cash Flow | $ | 127,761 | $ | 44,768 | $ | 346,306 | $ | 101,807 | |||

| Free Cash Flow excluding HQ build out and restructuring costs | $ | 127,761 | $ | 62,811 | $ | 356,631 | $ | 155,933 | |||

| Creative Subscriptions ARR | $ | 1,308,022 | $ | 1,181,629 | $ | 1,308,022 | $ | 1,181,629 | |||

| Wix.com Ltd. | |||||||||||

| RECONCILIATION OF REVENUES TO BOOKINGS | |||||||||||

| (In thousands) | |||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| Revenues | $ | 444,673 | $ | 393,841 | $ | 1,300,195 | $ | 1,157,894 | |||

| Change in deferred revenues | 6,096 | 387 | 72,841 | 73,405 | |||||||

| Change in unbilled contractual obligations | (989) | (5,133) | (7,576) | (28,800) | |||||||

| Bookings | $ | 449,780 | $ | 389,095 | $ | 1,365,460 | $ | 1,202,499 | |||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| Creative Subscriptions Revenues | $ | 318,825 | $ | 290,634 | $ | 935,243 | $ | 855,853 | |||

| Change in deferred revenues | 8,802 | (1,584) | 62,575 | 64,222 | |||||||

| Change in unbilled contractual obligations | (989) | (5,133) | (7,576) | (28,800) | |||||||

| Creative Subscriptions Bookings | $ | 326,638 | $ | 283,917 | $ | 990,242 | $ | 891,275 | |||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| Business Solutions Revenues | $ | 125,848 | $ | 103,207 | $ | 364,952 | $ | 302,041 | |||

| Change in deferred revenues | (2,706) | 1,971 | 10,266 | 9,183 | |||||||

| Business Solutions Bookings | $ | 123,142 | $ | 105,178 | $ | 375,218 | $ | 311,224 | |||

| Wix.com Ltd. | |||||

| RECONCILIATION OF COHORT BOOKINGS | |||||

| (In millions) | |||||

| Nine Months Ended | |||||

| September 30, | |||||

| 2024 | 2023 | ||||

| (unaudited) | |||||

| Q1 Cohort revenues | $ | 33 | $ | 30 | |

| Q1 Change in deferred revenues | 18 | 21 | |||

| Q1 Cohort Bookings | $ | 51 | $ | 51 | |

| Wix.com Ltd. | |||||

| RECONCILIATION OF REVENUES AND BOOKINGS EXCLUDING FX IMPACT | |||||

| (In thousands) | |||||

| Three Months Ended | |||||

| September 30, | |||||

| 2024 | 2023 | ||||

| (unaudited) | |||||

| Revenues | $ | 444,673 | $ | 393,841 | |

| FX impact on Q3/24 using Y/Y rates | 793 | – | |||

| Revenues excluding FX impact | $ | 445,466 | $ | 393,841 | |

| Y/Y growth | 13% | ||||

| Three Months Ended | |||||

| September 30, | |||||

| 2024 | 2023 | ||||

| (unaudited) | |||||

| Bookings | $ | 449,780 | $ | 389,095 | |

| FX impact on Q3/24 using Y/Y rates | (144) | – | |||

| Bookings excluding FX impact | $ | 449,636 | $ | 389,095 | |

| Y/Y growth | 16% | ||||

| Wix.com Ltd. | |||||||||||

| TOTAL ADJUSTMENTS GAAP TO NON-GAAP | |||||||||||

| (In thousands) | |||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (1) Share based compensation expenses: | (unaudited) | (unaudited) | |||||||||

| Cost of revenues | $ | 3,574 | $ | 3,621 | $ | 10,680 | $ | 11,338 | |||

| Research and development | 32,258 | 30,428 | 94,142 | 87,500 | |||||||

| Selling and marketing | 9,441 | 10,835 | 29,130 | 30,045 | |||||||

| General and administrative | 15,619 | 13,365 | 44,968 | 37,547 | |||||||

| Total share based compensation expenses | 60,892 | 58,249 | 178,920 | 166,430 | |||||||

| (2) Amortization | 1,461 | 1,489 | 4,409 | 4,466 | |||||||

| (3) Acquisition related expenses | – | 23 | 6 | 463 | |||||||

| (4) Amortization of debt discount and debt issuance costs | 792 | 787 | 2,373 | 3,405 | |||||||

| (5) Impairment, restructuring and other costs | – | 3,843 | – | 29,511 | |||||||

| (6) Sales tax accrual and other G&A expenses | 225 | 146 | 583 | 611 | |||||||

| (7) Unrealized loss (gain) on equity and other investments | – | 2,400 | (2,536) | (20,312) | |||||||

| (8) Non-operating foreign exchange income | (886) | (8,283) | (8,470) | (13,788) | |||||||

| (9) Provision for income tax effects related to non-GAAP adjustments | – | (552) | 583 | (6,705) | |||||||

| Total adjustments of GAAP to Non GAAP | $ | 62,484 | $ | 58,102 | $ | 175,868 | $ | 164,081 | |||

| Wix.com Ltd. | |||||||||||

| RECONCILIATION OF GAAP TO NON-GAAP GROSS PROFIT | |||||||||||

| (In thousands) | |||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| Gross Profit | $ | 302,645 | $ | 264,798 | $ | 879,196 | $ | 771,479 | |||

| Share based compensation expenses | 3,574 | 3,621 | 10,680 | 11,338 | |||||||

| Acquisition related expenses | – | 17 | – | 224 | |||||||

| Amortization | 667 | 668 | 2,002 | 2,002 | |||||||

| Non GAAP Gross Profit | 306,886 | 269,104 | 891,878 | 785,043 | |||||||

| Non GAAP Gross margin | 69% | 68% | 69% | 68% | |||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| Gross Profit – Creative Subscriptions | $ | 265,916 | $ | 237,447 | $ | 774,492 | $ | 693,132 | |||

| Share based compensation expenses | 2,562 | 2,673 | 7,751 | 8,386 | |||||||

| Non GAAP Gross Profit – Creative Subscriptions | 268,478 | 240,120 | 782,243 | 701,518 | |||||||

| Non GAAP Gross margin – Creative Subscriptions | 84% | 83% | 84% | 82% | |||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| Gross Profit – Business Solutions | $ | 36,729 | $ | 27,351 | $ | 104,704 | $ | 78,347 | |||

| Share based compensation expenses | 1,012 | 948 | 2,929 | 2,952 | |||||||

| Acquisition related expenses | – | 17 | – | 224 | |||||||

| Amortization | 667 | 668 | 2,002 | 2,002 | |||||||

| Non GAAP Gross Profit – Business Solutions | 38,408 | 28,984 | 109,635 | 83,525 | |||||||

| Non GAAP Gross margin – Business Solutions | 31% | 28% | 30% | 28% | |||||||

| Wix.com Ltd. | |||||||||||

| RECONCILIATION OF OPERATING INCOME (LOSS) TO NON-GAAP OPERATING INCOME | |||||||||||

| (In thousands) | |||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| Operating income (loss) | $ | 25,846 | $ | (5,792) | $ | 64,121 | $ | (26,149) | |||

| Adjustments: | |||||||||||

| Share based compensation expenses | 60,892 | 58,249 | 178,920 | 166,430 | |||||||

| Amortization | 1,461 | 1,489 | 4,409 | 4,466 | |||||||

| Impairment, restructuring and other charges | – | 3,843 | – | 29,511 | |||||||

| Sales tax accrual and other G&A expenses | 225 | 146 | 583 | 611 | |||||||

| Acquisition related expenses | – | 23 | 6 | 463 | |||||||

| Total adjustments | $ | 62,578 | $ | 63,750 | $ | 183,918 | $ | 201,481 | |||

| Non GAAP operating income | $ | 88,424 | $ | 57,958 | $ | 248,039 | $ | 175,332 | |||

| Non GAAP operating margin | 20% | 15% | 19% | 15% | |||||||

| Wix.com Ltd. | |||||||||||

| RECONCILIATION OF NET INCOME TO NON-GAAP NET INCOME AND NON-GAAP NET INCOME PER SHARE | |||||||||||

| (In thousands, except per share data) | |||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| September 30, | September 30, | ||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | ||||||||||

| Net income | $ | 26,778 | $ | 6,975 | $ | 90,298 | $ | 30,183 | |||

| Share based compensation expenses and other Non GAAP adjustments | 62,484 | 58,102 | 175,868 | 164,081 | |||||||

| Non-GAAP net income | $ | 89,262 | $ | 65,077 | $ | 266,166 | $ | 194,264 | |||

| Basic Non GAAP net income per share | $ | 1.62 | $ | 1.14 | $ | 4.79 | $ | 3.43 | |||

| Weighted average shares used in computing basic Non GAAP net income per share | 55,099,939 | 56,837,917 | 55,509,920 | 56,666,881 | |||||||

| Diluted Non GAAP net income per share | $ | 1.50 | $ | 1.10 | $ | 4.46 | $ | 3.22 | |||

| Weighted average shares used in computing diluted Non GAAP net income per share | 59,593,549 | 59,923,820 | 59,721,061 | 61,411,030 | |||||||

| Wix.com Ltd. | ||||||||||||

| RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW | ||||||||||||

| (In thousands) | ||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||

| September 30, | September 30, | |||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||

| (unaudited) | (unaudited) | |||||||||||

| Net cash provided by operating activities | $ | 129,814 | $ | 64,144 | $ | 363,679 | $ | 157,866 | ||||

| Capital expenditures, net | (2,053) | (19,376) | (17,373) | (56,059) | ||||||||

| Free Cash Flow | $ | 127,761 | $ | 44,768 | $ | 346,306 | $ | 101,807 | ||||

| Restructuring and other costs | – | – | – | 4,504 | ||||||||

| Capex related to HQ build out | – | 18,043 | 10,325 | 49,622 | ||||||||

| Free Cash Flow excluding HQ build out and restructuring costs | $ | 127,761 | $ | 62,811 | $ | 356,631 | $ | 155,933 | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cynthia Lummis Says Strategic Bitcoin Reserve Could Take Shape Soon After Trump 'Raises His Hand And Is Sworn In'

Sen. Cynthia Lummis (R-Wyo.) expressed optimism that certain aspects of the proposed strategic Bitcoin BTC/USD reserve could begin to take shape following President-elect Donald Trump’s inauguration ceremony.

What happened: During an interaction on X spaces hosted by asset manager VanEck on Tuesday, the Republican said she was hopeful of things moving in 2025 but stopped short of giving a specific timeline.

Lummis said that certain actions on the proposed bill could be taken even before it gets congressional approval.

“If we win with the schedule that is proposed in the BITCOIN Act, we could just start by using our existing asset forfeiture Bitcoin to fund the first year of it,” she stated. “And then start converting our gold certificates to Bitcoin.”

“Some of what we’re proposing could begin to take form right after President Trump raises his hand and is sworn in,” the senior senator remarked.

Why It Matters: Lummis proposed the legislation, called the BITCOIN Act, to create a strategic reserve in Bitcoin to support America’s balance sheet and address its mounting debt, which topped $35 trillion this year.

The bill outlines a $1 million purchase program to acquire 5% of Bitcoin’s total supply over five years, with a minimum holding period of 20 years.

The funding for these Bitcoin acquisitions would come from several sources detailed in the bill, including the revaluation of the Federal Reserve banks’ gold certificates to their fair market value.

President-elect Trump had previously advocated for the U.S. to become a “Bitcoin superpower” and suggested the creation of a national Bitcoin reserve during a conference.

Bettors on the popular prediction market platform Polymarket priced in a 35% possibility of Trump creating a Bitcoin reserve.

Price Action: At the time of writing, Bitcoin was exchanging hands at $92,425.03, up 0.92% in the last 24 hours, according to data from Benzinga Pro.

Photo Courtesy: Wikimedia Commons

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Max Stock Limited Reports Third Quarter 2024 Financial Results

Third Quarter Revenue Increased 18.6% to ILS 373.1 million; Comparable Store Sales Increased 9.2%; GAAP Net Income (Attributable to Shareholders) Increased 35.3%

First Nine Month Revenue Increased 18.4% to ILS 1.0 billion; Comparable Store Sales Increased 9.0%; GAAP Net Income (Attributable to Shareholders) Increased 37.0%

CAESAREA, Israel, Nov. 20, 2024 /PRNewswire/ — Max Stock Limited MAXO (the “Company”) today reported financial results for the third quarter and nine months ended September 30, 2024.

Third Quarter 2024 Summary

- Revenue increased 18.6% to ILS 373.1 million.

- Comparable store sales increased 9.2%.

- Gross margin was 41.3%.

- GAAP Net income (attributable to shareholders) increased 35.3% to ILS 31.3 million.

- Adjusted Net income1 (attributable to shareholders) increased 34.8% to ILS 31.3 million.

- Adjusted EPS1 (attributable to shareholders) increased 34.7% to ILS 0.22.

- Adjusted EBITDA2 increased 25.0% to ILS 56.5 million.

First Nine Months 2024 Summary

- Revenue increased 18.4% to ILS 1.0 billion.

- Comparable store sales increased 9.0%.

- Gross margin was 41.7%.

- GAAP net income (attributable to shareholders) increased 37.0% to ILS 83.0 million.

- Adjusted Net income1 (attributable to shareholders) increased 38.4% to ILS 83.2 million.

- Adjusted EPS1 (attributable to shareholders) increased 37.5% to ILS 0.59.

- Adjusted EBITDA2 increased 28.7% to ILS 144.3.

Note: Totals may be slightly impacted by minor rounding differences.

1 As used throughout this release, adjusted Net Income (attributable to shareholders) defined as Net Income + Share-based payment, multiplied by the portion attributable to shareholders. Adjusted EPS (attributable to shareholders) is then divided by the number of basic shares.

2 As used throughout this release, adjusted EBITDA Pre IFRS 16 defined as Net Income + Income Tax Expenses + Net Interest Expenses + D&A + Other Expenses – the impact of IFRS 16 + Share-based payment.

“We were pleased to carry our first half momentum into the third quarter, delivering high-teens revenue growth fueled by a high single-digit increase in comparable store sales and successful new store openings over the past 12-months,” said Ori Max, Chief Executive Officer. “This topline performance generated meaningful expense leverage, driving a 25% increase in adjusted EBITDA and a 35% increase in adjusted Net Income. The work we’ve done to simultaneously accelerate sales growth and enhance profitability is underscored by adjusted earnings per share of ILS 0.59 for the first nine months 2024, which eclipsed the ILS 0.58 we reported for the full year 2023. Looking ahead, we remain well-positioned to capitalize on the ongoing consumer shift toward our value-oriented offerings which is adding to our optimism about the growth opportunities that lie ahead for Max Stock.”

Third Quarter Results (2024 compared with 2023)

Revenue increased 18.6% to ILS 373.1 million in the third quarter 2024 as compared with revenue of ILS 314.5 million in the third quarter 2023. The increase over the same period last year was largely attributable to the opening of new branches which added approximately 6,000 net square meters of selling space compared to the year-ago period, combined with a 9.2% increase in comparable store sales largely driven by an increase in store traffic and higher conversion driven by demand for seasonal items, partially offset by a shift in timing of the Jewish New Year holiday into the fourth quarter of 2024, compared to being included in the third quarter of 2023.

Comparable store sales for July – October 2024, which neutralizes the timing of the holidays, was 10.9%. However, October 2023 was impacted by the onset of the Iron Swords war, with negative comparable store sales of ~16%, due to temporary closure of our stores and reduced time schedule throughout the month of October 2023.

Gross profit increased 16.9% to ILS 154.1 million in the third quarter 2024 from ILS 131.8 million in the third quarter 2023. Gross margin was ~41.3% as compared to ~41.9% in the last year period. The 60-basis point decline in gross margin over Q3 2023 was primarily attributable to temporarily higher costs associated with the Company’s distribution facility consolidation.

Selling, general and administrative expenses increased to ILS 99.3 million in the third quarter 2024 from ILS 87.7 million in the third quarter 2023, primarily driven by branch expansion which added incremental expenses related to marketing, salary and the addition of right of use assets. As a percentage of sales, selling, general and administrative expenses decreased approximately 120 basis points to 26.6% in the third quarter 2024, compared with 27.8% in the third quarter 2023, largely due to operating leverage.

GAAP net income (attributable to shareholders) increased 35.3% to ILS 31.3 million.

Adjusted net income attributable to shareholders increased 34.8% to ILS 31.3 million in the third quarter of 2024, as compared with adjusted net income attributable to shareholders of ILS 23.2 million in the third quarter of 2023.

Adjusted EPS attributable to shareholders increased 34.7% to ILS 0.22 per share, in the third quarter of 2024, as compared with adjusted EPS attributable to shareholders of ILS 0.17 per share, in the third quarter of 2023.

Adjusted EBITDA increased 25.0% to ILS 56.5 million in the third quarter of 2024 from ILS 45.2 million in the third quarter of 2023.

First Nine Months 2024 Results

Revenue for the first nine months of 2024 increased 18.4% to ILS 1.0 billion, compared with revenue of ILS 846.9 million in the first nine months of 2023. The increase in revenue was driven by a 9.0% gain in comparable store sales and the sales contribution from new branches. The increase in same stores sales was fueled by an increase in store traffic and higher conversion driven by demand for seasonal items, partially offset by a shift in timing of the Jewish New Year holiday into the fourth quarter of 2024, compared to being included in the third quarter of 2023.

Gross profit increased 19.1% to ILS 418.7 million in the first nine months of 2024 from ILS 351.7 million a year ago. Gross margin was ~41.7% as compared to ~41.5% in the prior year period.

Selling, general and administrative expenses increased to ILS 277.0 million in the first nine months of 2024 from ILS 239.7 million in the first nine months of 2023. The increase in operating expenses was related to branch expansion which added incremental expenses related to marketing, salary and the addition of right of use assets. As a percentage of sales, selling, general and administrative expenses improved 80 basis-points to 27.6% in the first nine months of 2024 compared with 28.4% in the first nine months of 2023.

GAAP net income (attributable to shareholders) increased 37.0% to ILS 83.0 million.

Adjusted net income (attributable to shareholders) increased 38.4% to ILS 83.2 million.

Adjusted EPS1(attributable to shareholders) increased 37.5% to ILS 0.59 in the first nine months of 2024 as compared with adjusted EPS1(attributable to shareholders) of ILS 0.43 per share, in the first nine months of 2023.

Adjusted EBITDA2 increased 28.7% to ILS 144.3 million in the first nine months of 2024 from ILS 112.1 million in 2023.

Balance Sheet and Cash Flow Highlights

The Company’s cash and cash equivalents balance at September 30, 2024 was ILS 87.2 million compared with ILS 128.9 million at December 31, 2023 and ILS 119.9 million at September 30, 2023. The Company ended the third quarter of 2024 with total debt of ILS 14.6 million compared with total debt of ILS 33.0 million at December 31, 2023 and ILS 31.1 million at September 30, 2023.

Inventories at September 30, 2024 were ILS 221.4 million compared with ILS 144.6 million at December 31, 2023 and ILS 148.6 million at September 30, 2023. The increase in inventories is primarily attributable to the building up of inventories for the opening of new branches.

Conference Call Information

The Company will host a conference call on November 20, 2024 at 8:00 a.m. Eastern Standard Time to discuss third quarter 2024 results (link). The conference call will also be accessible at https://ir.maxstock.co.il/en/event-en/.There will be a slide presentation that accompanies the call. The slides will be accessible at https://ir.maxstock.co.il/en/presentation-en/. An archived webcast of the conference call will be available at https://ir.maxstock.co.il/en/presentation-en/.

About Max Stock

Max Stock is Israel’s leading extreme value retailer, currently present in 64 locations throughout Israel and 2 locations in Portugal. We offer a broad assortment of quality products for customers’ everyday needs at affordable prices, helping customers “Dream Big, Pay Small”. For more information, please visit https://ir.maxstock.co.il

Forward-Looking Statements

It should be emphasized that this report includes forward-looking information as defined under the Securities Law, 5728-1968. Forward-looking information is uncertain information regarding the future, including forecasts, projections, estimates or other information which refer to a future event or matter, the eventuation of which is uncertain and/or not within the Company’s control. The forward-looking information included in this report is based on the current information held by the Company or its current assessments, as of the publication date of this report.

Company Contacts:

Talia Sessler,

Chief Corporate Development and IR Officer

talia@maxstock.co.il

![]() View original content:https://www.prnewswire.com/news-releases/max-stock-limited-reports-third-quarter-2024-financial-results-302310967.html

View original content:https://www.prnewswire.com/news-releases/max-stock-limited-reports-third-quarter-2024-financial-results-302310967.html

SOURCE Max Stock Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

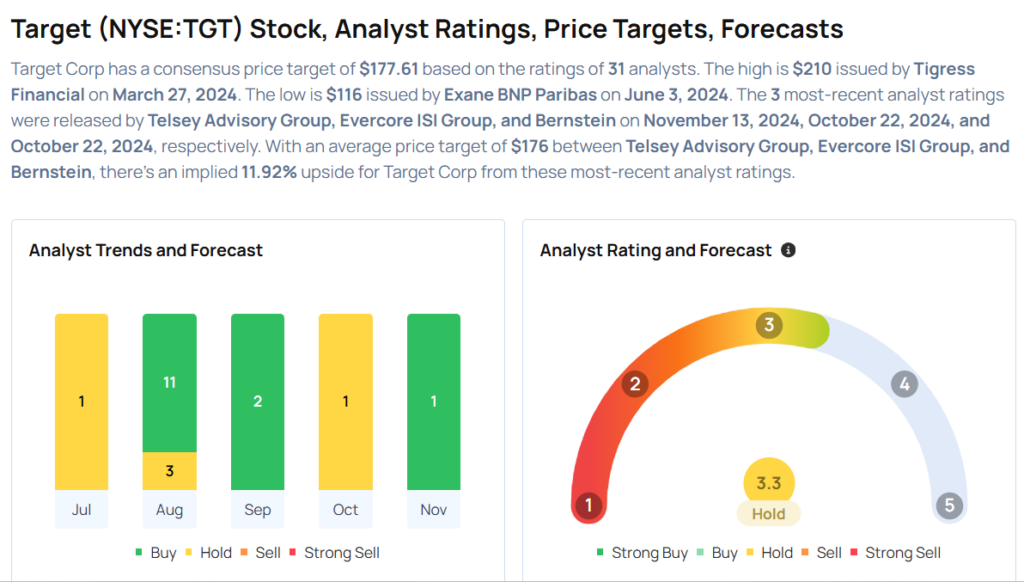

Target Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Target Corporation TGT will release earnings results for the third quarter, before the opening bell on Wednesday, Nov. 20.

Analysts expect Target to report quarterly earnings at $2.30 per share. That’s up from $2.10 per share a year ago. The retailer projects to report quarterly revenue of $25.9 billion, compared to $25.4 billion a year earlier, according to data from Benzinga Pro.

On Oct. 22, Target announced plans to slash prices on over 2,000 items for holiday savings, expanding discounts on gifts and essentials.

Target shares fell 0.4% to close at $156.00 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Telsey Advisory Group analyst Joseph Feldman maintained an Outperform rating with a price target of $195 on Nov. 13. This analyst has an accuracy rate of 71%.

- Evercore ISI Group analyst Greg Melich maintained an In-Line rating and cut the price target from $170 to $165 on Oct. 22. This analyst has an accuracy rate of 78%.

- Bernstein analyst Dean Rosenblum initiated coverage on the stock with a Market Perform rating and a price target of $168 on Oct. 22. This analyst has an accuracy rate of 61%.

- JP Morgan analyst Christopher Horvers maintained a Neutral rating and boosted the price target from $153 to $167 on Aug. 29. This analyst has an accuracy rate of 72%.

- Wells Fargo analyst Edward Kelly maintained an Overweight rating and increased the price target from $160 to $180 on Aug. 22. This analyst has an accuracy rate of 63%.

Considering buying TGT stock? Here’s what analysts think:

Read This Next: Wall Street’s Most Accurate Analysts Weigh In On 3 Defensive Stocks With Over 5% Dividend Yields

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

OKX Showcases Commitment to Australian Crypto Community as Gold Sponsor of Australia Crypto Convention, Hosts Ordinals World Tour

SYDNEY, Nov. 20, 2024 (GLOBE NEWSWIRE) — OKX, a leading cryptocurrency exchange and global onchain company, today announced it will serve as Gold Sponsor of Australia Crypto Convention 2024 and host the Australia edition of its Ordinals World Tour. These events, scheduled for 23-24 November, underscore OKX’s continued commitment to strengthening Australia’s digital asset ecosystem.

Since launching its crypto exchange services in Australia in May 2024, OKX has emerged as a key player in the local market, tripling its customer base. OKX has also established itself as a leading exchange in Australia for AUD-crypto trading pairs, while expanding its local team by more than 150% within a span of six months.

Against the backdrop of Bitcoin recently reaching its all-time high, Australia Crypto Convention 2024 will welcome over 10,000 attendees at the International Convention Centre (ICC) in Sydney, where OKX will showcase its extensive suite of crypto trading and onchain products.

The Australia edition of OKX’s Ordinals World Tour, co-hosted in partnership with Ordzaar, takes place on 23 November in Sydney, bringing together pioneers, builders, artists, creators and members of the Australian Ordinals community. This event follows the recent launch of ‘Creators Collective,’ an invite-only community of forward-thinkers in the onchain economy – with an initial focus on Bitcoin innovations like Ordinals.

The success of OKX’s Australian operations was recently recognised at the WeMoney Cryptocurrency Awards in July 2024, where the company secured five prestigious awards, including “Cryptocurrency Exchange of the Year” and “Best for Professional Investors – Cryptocurrency.” In August, OKX further enhanced its local offering with the introduction of dedicated AUD trading order books.

OKX Australia General Manager Jamie Kennedy said: “We plan to increase our investment in Australia throughout 2025 as we develop new products and features which provide a secure and user-friendly trading experience for local customers. The Australian crypto community is in need of an exchange that is accessible, seeks feedback from customers and actively embraces the technological trends that drive the industry forward. We look forward to meeting attendees this weekend and introducing more features tailored specifically for Australian customers very soon.”

Australia Crypto Convention attendees can meet the OKX team at booth 67 to learn more about OKX’s latest products and onchain innovations, including its self-custody wallet and Ordinals Marketplace.

Learn more at okx.com

For further information, please contact:

Media@okx.com

OKX is a technology company with a mission to organize the world’s blockchains and make them more accessible and useful.

We want to create a future that makes our world more efficient, transparent and connected.

OKX began as a crypto exchange giving millions of people access to trading and over time became among the largest platforms in the world. In recent years, we have developed one of the most connected onchain wallets used by millions to access decentralized applications (dApps).

OKX is trusted by hundreds of large institutions seeking access to crypto markets on a reliable platform that seamlessly connects with global banking and payments.

Our most well-known products include: OKX Exchange, OKX Wallet, OKX Explorer, OKX OS, OKX Ventures and OKX Institutional. To learn more about OKX, download our app or visit: okx.com

Disclaimer

Information about: digital currency exchange services is prepared by OKX Australia Pty Ltd (ABN 22 636 269 040); derivatives and margin by OKX Australia Financial Pty Ltd (ABN 14 145 724 509, AFSL 379035) and is only intended for wholesale clients (within the meaning of the Corporations Act 2001 (Cth)); and other products and services by the relevant OKX entities which offer them (see Terms of Service – Australia). Information is general in nature and should not be taken as investment advice, personal recommendation or an offer of (or solicitation to) buy any crypto or related products. You should do your own research and obtain professional advice, including to ensure you understand the risks associated with these products, before you make a decision about them. Past performance is not indicative of future performance – never risk more than you are prepared to lose. Read OKX’s Terms of Service – Australia for more information.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Government of Canada unlocks 12 more federal properties for housing

OTTAWA, ON, Nov. 19, 2024 /CNW/ – Everyone deserves a place to call home. However, for many across the country, home ownership and renting are out of reach due to the housing crisis Canada is facing. We need to build more homes, faster, to get Canadians into homes that meet their needs, at prices they can afford. That’s why in Budget 2024 and Solving the Housing Crisis: Canada’s Housing Plan, the federal government announced the most ambitious housing plan in Canadian history: a plan to build 4 million more homes.

As part of this plan, the Government of Canada is identifying properties within its portfolio that have the potential for housing and is actively adding them to the Canada Public Land Bank. Wherever possible, the government will turn these properties into housing through a long-term lease, to support affordable housing and ensure public land stays public.

Today, the Honourable Jean-Yves Duclos, Minister of Public Services and Procurement, joined by the Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance, announced that 12 new properties have been added to the Canada Public Land Bank. These additional properties will create close to 3,900 units of housing for middle-class Canadians.

The 12 new properties included in the Canada Public Land Bank are:

- Calgary, Alberta – Currie – Phase 14, Block 27A, at the corner of Calais Drive and Breskens Street Southwest

- Calgary, Alberta – Currie – Phase 14, Block 31B, at the corner of Bessborough Drive and Breskens Street Southwest

- Calgary, Alberta – Currie – Phase 12C, at the corner of Bessborough Drive and Quesnay Wood Drive

- Edmundston, New Brunswick – 22 Emerson Street

- Grand Falls, New Brunswick – 373-377 Broadway Boulevard

- Dartmouth, Nova Scotia – 15 Iroquois Drive

- Bracebridge, Ontario – 98 Manitoba Street

- London, Ontario – 451 Talbot Street

- Ottawa, Ontario – 529 Richmond Road

- Laval, Quebec – Montée Saint-François – Laval Penitentiary

- Laval, Quebec – Vacant land next to 1575 Chomedey Boulevard

- Whitehorse, Yukon – 419-421 Range Road

A total of 83 federal properties have now been identified as being suitable to support housing. With today’s additions, the Canada Public Land Bank now has properties in 9 provinces and 2 territories. This list will continue to grow in the coming months, with further details on listed properties available soon.

To solve Canada’s housing crisis, the federal government is using every tool at its disposal. The Government of Canada is accelerating its real property disposal process to meet the urgency of getting affordable homes built across Canada.

Quotes

“Safe, accessible and affordable housing options are out of reach for far too many Canadians. Since the launch of the Canada Public Land Bank in August 2024, 83 properties have been identified for potential housing development, paving the way to build affordable housing across the country at a pace and scale not seen in generations.”

The Honourable Jean-Yves Duclos

Minister of Public Services and Procurement and Quebec Lieutenant

“We are delivering on the most ambitious housing plan in Canadian history, to build 4 million homes and make the housing market fairer for first-time buyers and renters alike. Building more student housing will relieve rental demand for students and confronting the financialization of housing will ensure homes are for Canadians, not a speculative asset class for investors. We are taking action on all fronts to build more homes and make housing more affordable for Canadians.”

The Honourable Chrystia Freeland

Deputy Prime Minister and Minister of Finance

“We need to build more homes in Canada, and one of the largest costs in building is land. By building on public lands, we can make it easier to build, and by leasing those same properties, we can make sure the homes built stay affordable for the long term.”

The Honourable Sean Fraser

Minister of Housing, Infrastructure and Communities

Quick facts

- In Budget 2024 and Solving the Housing Crisis: Canada’s Housing Plan, the federal government announced an ambitious whole-of-government approach to addressing the housing crisis by building more homes, making it easier to rent or own a home, and helping Canadians who cannot afford a home.

- A key component of Canada’s Housing Plan is the new Public Lands for Homes Plan. This plan aims to partner with all levels of government, homebuilders and housing providers to build homes, faster, on surplus and underused public lands across the country.

- The Public Lands for Homes Plan supports the government’s goal of unlocking 250,000 new homes by 2031.

- Budget 2024 also provided $500 million, on a cash basis, to launch the new Public Lands Acquisition Fund. This fund will buy land from other orders of government to allow the federal government to acquire more land for housing to help build middle-class homes. Work on the fund is already underway, and more details will be released in the coming weeks.

- In August 2024, a new tool for builders called the Canada Public Land Bank was launched with an initial 56 properties under the Public Lands for Homes Plan.

- As of November 5, 2024, there are 83 properties listed in the Canada Public Land Bank, representing a total of 430 hectares of land, which is the size of approximately 2,700 hockey rinks or almost 525 Canadian Football League football fields.

- So far, Canada Lands Company, in partnership with Canada Mortgage and Housing Corporation, issued a call for proposals for 5 properties located in Edmonton, Calgary, Toronto, Ottawa and Montréal, as well as 2 additional separate opportunities in Ottawa. The initial calls for proposals have closed, and evaluations have begun.

- Building on this momentum, Canada Lands Company has additional opportunities available.

- In addition, a call for proposals was launched for 1 National Capital Commission property located in Gatineau.

- The Government of Canada is processing the feedback received from provinces, territories and municipalities, as well as developers, housing advocates and Indigenous groups. This information will be used to develop and bring more properties to market.

- To provide feedback on the Canada Public Land Bank and its properties, the Government of Canada launched a call for housing solutions for communities, which can be accessed via a secure online platform.

Associated links

Budget 2024

Solving the Housing Crisis: Canada’s Housing Plan

Public lands for homes

Portfolio optimization: Disposal list

Follow us on X (Twitter)

Follow us on Facebook

SOURCE Public Services and Procurement Canada

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/19/c6879.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/19/c6879.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microstrategy's Michael Saylor To Advocate For Bitcoin At Microsoft Board Meeting, Offers To Educate Rumble CEO As Well

In a big development, MicroStrategy MSTR Chairman Michael Saylor will present a case for Bitcoin BTC/USD investment to the board of directors at Microsoft Corporation MSFT.

What Happened: During an X space hosted by asset manager VanEck, Saylor said he was contacted by the activist who put up the shareholder proposal to present to the board.

“I agreed to provide a three-minute presentation. That’s all you’re allowed. I’m going to actually post that online and I’m going to present it to the board.”

Saylor said he even proposed meeting with CEO Satya Nadella to discuss the strategy, but the offer was not accepted.

“I think it’s not a bad idea to put it on the agenda of every company. It ought to be put on the agenda of Berkshire Hathaway, Apple, and Google because they all have huge hordes of cash and they’re all burning shareholder value,” Saylor argued.

The MicroStrategy chief said that Microsoft stock would be “much less risky” if half of its enterprise value—which was currently just around 1.5%— is based on tangible assets like Bitcoin.

Meanwhile, Saylor also offered to discuss the implications of adding Bitcoin to the Treasury with Rumble Inc. RUM CEO Chris Pavloski.

https://x.com/saylor/status/1858945523258159169

Why It Matters: Microsoft was set to vote on an assessment of investing in Bitcoin during next month’s shareholders meeting. The shareholders requested the board conduct the assessment, citing Bitcoin’s healthy gains over the last five years.

The proposal explicitly mentioned MicroStrategy, a pioneer in corporate Bitcoin adoption whose shares have outperformed Microsoft in 2024.

Price Action: At the time of writing, Bitcoin was trading at $92,054.06, up 0.86% in the last 24 hours, according to data from Benzinga Pro. Shares of MicroStrategy surged nearly 12% during Tuesday’s regular session, while Microsoft closed 0.49% higher.

Photo: DCStockPhotography/Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.