StakingBonus Highlights Booming Ethereum Activity as Spot ETF Inflows Hit Record $515 Million

New York,NY, Nov. 20, 2024 (GLOBE NEWSWIRE) — The crypto space is abuzz as the Ethereum Spot ETF had a record $515 million weekly net inflow, an all time high. This is a big thumbs up for Ethereum as an asset for institutions and retail investors alike and solidifies its place in the digital asset ecosystem.

StakingBonus, the premier staking platform for cryptocurrencies, invites crypto enthusiasts and investors to ride the Ethereum wave by checking out their Ethereum staking plans. With staking Ethereum more important than ever, StakingBonus has a secure, user friendly and profitable way to earn passive income.

Ethereum’s All Time High

The $515 million inflow into the Ethereum Spot ETF is a sign of the growing faith in Ethereum as a store of value and investment vehicle. This is a big tick for the blockchain and its ecosystem including DeFi, NFTs, and smart contract development.

As institutions and individuals are piling into Ethereum, staking ETH is now a way for long term holders to earn rewards while actively participating in the security and efficiency of the network.

Why Staking on StakingBonus?

StakingBonus makes staking easy for both newbies and experienced investors:

- High APYs: Get the highest rewards for Ethereum staking.

- Multiple Staking Options: From Ethereum to Bitcoin and USDT, StakingBonus has many staking choices.

- Low Fees: Staking with minimal commission, keep more of earnings.

- Secure: Protect assets with advanced security.

- User Friendly: New to staking or a seasoned investor, navigating is easy.

“We want our users to get the most out of their digital assets. With Ethereum at an all time high, there’s never been a better time to stake ETH on StakingBonus” said a Spokesperson at StakingBonus.com.

Multiple Staking Options for All Investors

While Ethereum is the hot topic, StakingBonus has options for all investors:

- Bitcoin (BTC): The number one crypto for steady rewards and stability.

- Litecoin (LTC): Low fees and steady returns.

- Ripple (XRP): For cross border staking, faster transactions and lower fees.

- Tether (USDT): A stablecoin for conservative investors looking for lower risk returns.

These multiple staking options allows users to build a portfolio that suits their financial goals.

Earning Passive Income in a Growing Market

As cryptocurrencies become more mainstream, staking is becoming a way to earn passive income. By staking their assets, investors get rewards and actively participate in the security of the blockchain and validation of transactions.

StakingBonus is a well known brand in the industry, providing users a simple and easy way to get their digital assets to work for them. Whether you’re a newbie looking to try staking or a seasoned investor looking for higher returns, StakingBonus has got covered.

About StakingBonus

StakingBonus.com is a professional staking platform designed to make staking seamless and rewarding. Supporting a wide array of cryptocurrencies, StakingBonus combines low fees, high APYs, and top-tier security to deliver an unparalleled user experience.

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Cryptocurrency mining and staking involves risk. There is potential for loss of funds. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

Edgar Siodina StakingBonus Amber (at) stakingbonus.org

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Intchains Group Limited Reports Third Quarter 2024 Unaudited Financial Results

SHANGHAI, China, Nov. 20, 2024 (GLOBE NEWSWIRE) — Intchains Group Limited ICG (“we,” or the “Company”), an innovative altcoins development company that primarily focuses on providing integrated solutions consisting of high-performance computing ASIC chip products for altcoins, and on acquiring and holding ETH-based cryptocurrencies as its long-term asset reserve to support its Web3 industry development initiatives including actively developing Web3-based applications, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Operating and Financial Highlights

- Sales volume of ASIC chips: Our sales volume of ASIC chips for Q3 2024 was 207,838 units, compared to 165,056 units for the same period in 2023, representing an increase of 25.9%. All ASIC chip sales in the third quarter of 2024 were for chips embedded in computing equipment used for blockchain applications.

- Revenue: Our revenue for Q3 2024 reached RMB60.3 million (US$8.6 million), reflecting a significant increase of 781.4% from RMB6.8 million for the same period of 2023. For the third quarter of 2024, revenue derived from mainland China and overseas countries and regions accounted for 37.8% and 62.2% of our total revenue, respectively.

- Net Income: We reported a net income of RMB3.2 million (US$0.5 million) for Q3 2024, compared to a net loss of RMB19.1 million for the same period in 2023.

- Non-GAAP Adjusted Net Income: Non-GAAP adjusted net income in the third quarter of 2024 was RMB6.4 million (US$0.9 million), as compared to a non-GAAP adjusted net loss of RMB17.6 million in the third quarter of 2023. Non-GAAP adjusted net income excludes share-based compensation expenses. For further information, please refer to “Use of Non-GAAP Financial Measures” in this press release.

- Cryptocurrency Assets: As of September 30, 2024, the fair value of our cryptocurrency assets was RMB149.5 million (US$21.3 million), primarily comprised of approximately 4,149 ETH, valued at RMB76.4 million (US$10.9 million), and approximately 9,847,687 Tether (USDT) and USD Coin (USDC) with a total fair value of RMB69.0 million (US$9.8 million).

Intchains Group Unveils: Innovation and a Promising Outlook

Mr. Qiang Ding, Chairman of the Board of Directors and Chief Executive Officer, commented, “We are pleased to see the development of the crypto industry in 2024, which has driven the Company’s third quarter revenue to US$8.6 million, representing a year-on-year increase of 781.4%. Our net income has turned positive compared to the same period last year. In Q3 2024, we continued to implement our strategy of accumulating ETH, reaching 4,149 ETH as of September 30, 2024 representing a 71.7% increase as of June 30, 2024. As part of our initial foray into blockchain application expansion, we launched Goldshell Pay in Q3 2024, offering a one-stop payment solution for merchants. In November 2024, we were excited to see that the total market capitalization of cryptocurrencies reached a historical high, with ETH prices surpassing the average cost of our holdings as of September 30, 2024. Based on our confidence in the future of the crypto industry, we plan to launch a hardware crypto wallet in Q4 2024, further advancing our application expansion on the foundation of Goldshell Pay. Actively exploring new projects, we expect to complete the production and commercialization of new ASICs by Q1 2025. Stay tuned as we continue to push boundaries with our initiatives.”

Third Quarter 2024 Financial Results

Revenue

Revenue was RMB60.3 million (US$8.6 million) for the third quarter of 2024, representing an increase of 781.4% from RMB6.8 million for the same period of 2023. The substantial growth was primarily driven by a significant increase in the average selling price of our latest ASIC chip products launched in 2024 compared to our earlier ASIC chip products.

Cost of Revenue

Cost of revenue was RMB19.5 million (US$2.8 million) for the third quarter of 2024, representing an increase of 29.6% from RMB15.1 million for the same period of 2023. The percentage increase in cost of revenue was substantially lower than the percentage increase in our revenue, which was primarily due to the higher gross margins for our latest ASIC chip products launched in 2024 compared to the older ASIC chip products.

Operating Expenses

Total operating expenses were RMB37.7 million (US$5.4 million) for the third quarter of 2024, representing an increase of 90.8% from RMB19.7 million for the same period of 2023. The increase was primarily due to an increase in research and development expenses, and general and administrative expenses, and loss on fair value of cryptocurrency, net.

- Research and development expenses increased by 21.1% to RMB13.8 million (US$2.0 million) for the third quarter of 2024 from RMB11.4 million for the same period of 2023. The increase was primarily due to the increased share-based incentive expenses and labor costs.

- Sales and marketing expenses remained steady at RMB2.2 million and RMB2.1 million (US$0.3 million), respectively, for the third quarter of 2023 and 2024.

- General and administrative expenses increased by 41.6% to RMB8.7 million (US$1.2 million) for the third quarter of 2024 from RMB6.2 million for the same period of 2023, mainly driven by increased share-based incentive expenses, travelling expenses, and entertainment fees.

- Loss on fair value of cryptocurrency, net, for the third quarter of 2024 was RMB13.1 million (US$1.9 million), compared to nil in the same period of 2023. The loss was primarily due to the volatility of the cryptocurrency market, with ETH falling approximately 24.2% from the end of the second quarter to the end of the third quarter of 2024.

Interest Income

Interest income decreased by 8.9% to RMB4.2 million (US$0.6 million) for the third quarter of 2024 from RMB4.6 million for the same period of 2023, mainly attributable to the decreased cash level due to our strategy of acquiring ETH-based cryptocurrencies using our cash flow.

Other Income, Net

Other income, net, increased by 90.9% to RMB2.6 million (US$0.4 million) for the third quarter of 2024 from RMB1.4 million for the same period of 2023. The increase was primarily due to an increase in grants received from the local government, which have no repayment obligations and change in fair value of short-term investments.

Net Income/(Loss)

As a result of the foregoing, we recorded a net income of RMB3.2 million (US$0.5 million) for the third quarter of 2024, compared to a net loss of RMB19.1 million for the same period of 2023.

Non-GAAP Adjusted Net Income/(Loss)

Non-GAAP adjusted net income in the third quarter of 2024 was RMB6.4 million (US$0.9 million), as compared to a non-GAAP adjusted net loss of RMB17.6 million for the same period of 2023.

Basic and Diluted Net Earnings/(Loss) Per Ordinary Share

Basic and diluted net earnings per ordinary share were RMB0.03 (US$nil) for the third quarter of 2024, compared to basic and diluted net loss per ordinary share of RMB0.16 for the same period of 2023.

Non-GAAP Basic and Diluted Net Earnings/(Loss) Per Ordinary Share

Non-GAAP adjusted diluted net income per ADS was RMB0.05 (US$nil) in the third quarter of 2024, compared to basic and diluted net loss per ordinary share of RMB0.15 in the same period of 2023. Each ADS represents two of the Company’s Class A ordinary shares.

Recent Development

Development of Goldshell Pay

As a part of our Web3 industry development initiatives, we have been actively developing applications based on blockchain technology. Goldshell Pay, our first such application, was launched in the third quarter of 2024. It provides professional, one-stop blockchain payment solutions for partners worldwide, equipping merchants with functions for risk monitoring, data operations, and business access. Once commercialized, we plan to collect service fees from merchants who process payments and receipts through Goldshell Pay. Currently in its trial stage, we do not expect Goldshell Pay to contribute materially to our profits during this phase. However, we believe it represents an important step toward becoming a company with a stable application development pipeline and the ability to navigate across the crypto cycle.

Conference Call Information

The Company’s management team will host an earnings conference call to discuss its financial results at 8:00 P.M. U.S. Eastern Time on November 20, 2024 (9:00 A.M. Beijing Time on November 21, 2024). Details for the conference call are as follows:

All participants must use the link provided above to complete the online registration process in advance of the conference call. Upon registering, each participant will receive a set of dial-in numbers and a personal access PIN, which will be used to join the conference call.

Additionally, a live and archived webcast of the conference call will also be available at the Company’s website at https://intchains.com/.

About Intchains Group Limited

Intchains Group Limited is an innovative altcoins development company that primarily focuses on providing integrated solutions consisting of high-performance computing ASIC chip products for altcoins, and on acquiring and holding ETH-based cryptocurrencies as its long-term asset reserve to support its Web3 industry development initiatives including actively developing Web3-based applications. For more information, please visit the Company’s website at: https://intchains.com.

Exchange Rate Information

The unaudited United States dollar (“US$”) amounts disclosed in the accompanying financial statements are presented solely for the convenience of the readers. Translations of amounts from RMB into US$ for the convenience of the reader were calculated at the noon buying rate of US$1.00=RMB7.0176 on the last trading day of the third quarter of 2024 (September 30, 2024). No representation is made that the RMB amounts could have been, or could be, converted into US$ at such rate.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Forward-looking statements include, but are not limited to, statements about: (i) our goals and strategies; (ii) our future business development, formed condition and results of operations; (iii) expected changes in our revenue, costs or expenditures; (iv) growth of and competition trends in our industry; (v) our expectations regarding demand for, and market acceptance of, our products; (vi) general economic and business conditions in the markets in which we operate; (vii) relevant government policies and regulations relating to our business and industry; (viii) fluctuations in the market price of ETH-based cryptocurrencies; gains or losses from the sale of ETH-based cryptocurrencies; changes in accounting treatment for the Company’s ETH-based cryptocurrencies holdings; a decrease in liquidity in the markets in which ETH-based cryptocurrencies are traded; security breaches, cyberattacks, unauthorized access, loss of private keys, fraud, or other events leading to the loss of the Company’s ETH-based cryptocurrencies; impacts to the price and rate of adoption of ETH-based cryptocurrencies associated with financial difficulties and bankruptcies of various participants in the industry; and (ix) assumptions underlying or related to any of the foregoing. Investors can identify these forward-looking statements by words or phrases such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the SEC.

Use of Non-GAAP Financial Measures

In evaluating Company’s business, the Company uses non-GAAP measures, such as adjusted income (loss) from operations and adjusted net income (loss), as supplemental measures to review and assess its operating performance. The Company defines adjusted income (loss) from operations as income (loss) from operations excluding share-based compensation expenses, and adjusted net income (loss) as net income (loss) excluding share-based compensation expenses. The Company believes that the non-GAAP financial measures provide useful information about the Company’s results of operations, enhance the overall understanding of the Company’s past performance and future prospects and allow for greater visibility with respect to key metrics used by the Company’s management in its financial and operational decision-making.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools and investors should not consider them in isolation, or as a substitute for net income, cash flows provided by operating activities or other consolidated statements of operations and cash flows data prepared in accordance with U.S. GAAP. One of the key limitations of using adjusted net income is that it does not reflect all of the items of income and expense that affect the Company’s operations. Share-based compensation expenses have been and may continue to be incurred in Company’s business and are not reflected in the presentation of adjusted net income. Further, the non-GAAP financial measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited. The Company mitigates these limitations by reconciling the non-GAAP financial measures to the most comparable U.S. GAAP performance measures, all of which should be considered when evaluating the Company’s performance.

For investor and media inquiries, please contact:

Intchains Group Limited

Investor relations

Email: ir@intchains.com

Redhill

Belinda Chan

Tel: +852-9379-3045

Email: belinda.chan@creativegp.com

| INTCHAINS GROUP LIMITED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (All amounts in thousands, except share and per share data, or as otherwise noted) |

|||||||

| As of December 31, | As of September 30, | ||||||

| 2023 | 2024 | ||||||

| RMB | RMB | US$ | |||||

| ASSETS | |||||||

| Current Assets: | |||||||

| Cash and cash equivalents | 694,750 | 514,027 | 73,248 | ||||

| Inventories, net | 41,767 | 87,436 | 12,460 | ||||

| Prepayments and other current assets, net | 47,403 | 78,202 | 11,143 | ||||

| Short-term investments | 13,596 | 49,348 | 7,032 | ||||

| Total current assets | 797,516 | 729,013 | 103,883 | ||||

| Non-current Assets: | |||||||

| Cryptocurrency | 645 | 149,529 | 21,308 | ||||

| Property, equipment, and software, net | 49,184 | 49,546 | 7,061 | ||||

| Intangible assets, net | 3,425 | 3,584 | 511 | ||||

| Right-of-use assets | 1,735 | 1,007 | 144 | ||||

| Deferred tax assets | 12,899 | 19,326 | 2,754 | ||||

| Prepayments on long-term assets | 113,425 | 112,856 | 16,080 | ||||

| Other non-current assets | 421 | 432 | 62 | ||||

| Total non-current assets | 181,734 | 336,280 | 47,920 | ||||

| Total assets | 979,250 | 1,065,293 | 151,803 | ||||

| LIABILITIES, AND SHAREHOLDERS’ EQUITY | |||||||

| Current Liabilities: | |||||||

| Accounts payable | 195 | 7,645 | 1,089 | ||||

| Contract liabilities | 9,828 | 45,131 | 6,431 | ||||

| Income tax payable | 1,634 | 3,381 | 482 | ||||

| Lease liabilities | 1,103 | 1,136 | 162 | ||||

| Provision for warranty | 40 | 22 | 3 | ||||

| Accrued liabilities and other current liabilities | 15,364 | 13,269 | 1,890 | ||||

| Total current liabilities | 28,164 | 70,584 | 10,057 | ||||

| Non-current Liabilities: | |||||||

| Deferred tax liabilities | — | 543 | 77 | ||||

| Lease liabilities | 761 | — | — | ||||

| Total non-current liabilities | 761 | 543 | 77 | ||||

| Total liabilities | 28,925 | 71,127 | 10,134 | ||||

| Shareholders’ Equity: | |||||||

| Ordinary shares (US$0.000001 par value; 50,000,000,000 shares authorized, 119,876,032 and 120,023,092 shares issued, 119,876,032 and 119,962,962 shares outstanding as of December 31, 2023 and September 30, 2024, respectively) | 1 | 1 | — | ||||

| Subscriptions receivable from shareholders | (1 | ) | (1 | ) | — | ||

| Additional paid-in capital | 186,262 | 193,243 | 27,537 | ||||

| Statutory reserve | 48,265 | 51,376 | 7,321 | ||||

| Accumulated other comprehensive income | 1,838 | (350 | ) | (50 | ) | ||

| Retained earnings | 713,960 | 749,897 | 106,861 | ||||

| Total equity | 950,325 | 994,166 | 141,669 | ||||

| Total liabilities and shareholders’ equity | 979,250 | 1,065,293 | 151,803 | ||||

| INTCHAINS GROUP LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME/(LOSS) (All amounts in thousands, except share and per share data, or as otherwise noted) |

||||||||

| For the Three Months ended September 30, | ||||||||

| 2023 | 2024 | |||||||

| RMB | RMB | US$ | ||||||

| Products revenue | 6,842 | 60,305 | 8,593 | |||||

| Cost of revenue | (15,054 | ) | (19,508 | ) | (2,780 | ) | ||

| Gross profit/(loss) | (8,212 | ) | 40,797 | 5,813 | ||||

| Operating expenses: | ||||||||

| Research and development expenses | (11,370 | ) | (13,769 | ) | (1,962 | ) | ||

| Sales and marketing expenses | (2,195 | ) | (2,056 | ) | (293 | ) | ||

| General and administrative expenses | (6,176 | ) | (8,744 | ) | (1,246 | ) | ||

| Loss on fair value of cryptocurrency, net | — | (13,089 | ) | (1,865 | ) | |||

| Total operating expenses | (19,741 | ) | (37,658 | ) | (5,366 | ) | ||

| Income/(loss) from operations | (27,953 | ) | 3,139 | 447 | ||||

| Interest income | 4,571 | 4,162 | 593 | |||||

| Foreign exchange gains, net | (603 | ) | (1,301 | ) | (185 | ) | ||

| Other income, net | 1,352 | 2,581 | 368 | |||||

| Income/(loss) before income tax expenses | (22,633 | ) | 8,581 | 1,223 | ||||

| Income tax (expense)/benefit | 3,537 | (5,425 | ) | (773 | ) | |||

| Net Income/(loss) | (19,096 | ) | 3,156 | 450 | ||||

| Foreign currency translation adjustment, net of nil tax | (399 | ) | (1,967 | ) | (280 | ) | ||

| Total comprehensive income/(loss) | (19,495 | ) | 1,189 | 170 | ||||

| Weighted average number of shares used in per share calculation | ||||||||

| — Basic | 119,876,032 | 119,961,032 | 119,961,032 | |||||

| — Diluted | 119,876,032 | 120,035,926 | 120,035,926 | |||||

| Net earnings/(loss) per share | ||||||||

| — Basic | (0.16 | ) | 0.03 | 0.00 | ||||

| — Diluted | (0.16 | ) | 0.03 | 0.00 | ||||

| INTCHAINS GROUP LIMITED RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS (All amounts in thousands, except per share data) |

|||||||

| For the Three Months ended September 30, | |||||||

| 2023 | 2024 | ||||||

| RMB | RMB |

US$ |

|||||

| Income/(loss) from operations | (27,953 | ) | 3,139 | 447 | |||

| Add: | |||||||

| Share-based compensation expense | 1,490 | 3,247 | 463 | ||||

| Non-GAAP adjusted income/(loss) from operations | (26,463 | ) | 6,386 | 910 | |||

| Net income/(loss) | (19,096 | ) | 3,156 | 450 | |||

| Add: | |||||||

| Share-based compensation expense | 1,490 | 3,247 | 463 | ||||

| Non-GAAP adjusted net income/(loss) | (17,606 | ) | 6,403 | 913 | |||

| Non-GAAP adjusted net earnings/(loss) per share | |||||||

| — Basic | (0.15 | ) | 0.05 | 0.00 | |||

| — Diluted | (0.15 | ) | 0.05 | 0.00 | |||

| INTCHAINS GROUP LIMITED UNAUDITED CRYPTOCURRENCY-ADDITIONAL INFORMATION |

||||||||||

| As of Quarter Ended | Cryptocurrency | Approximate Number of Cryptocurrency Held at End of Quarter | Original Cost Basis | Approximate Average Cost Price Per Unit of Cryptocurrency | Lowest Market Price Per Unit of Cryptocurrency During Quarter (a) | Market Value of Cryptocurrency Held at End of Quarter Using Lowest Market Price (b) | Highest Market Price Per Unit of Cryptocurrency During Quarter (c) | Market Value of Cryptocurrency Held at End of Quarter Using Highest Market Price (d) | Market Price Per Unit of Cryptocurrency at End of Quarter (e) | Market Value of Cryptocurrency Held at End of Quarter Using Ending Market Price (f) |

| Unit | USD | USD | USD | USD | USD | USD | USD | USD | ||

| September 30, 2024 | ETH | 3,522 | 10,115,116 | 2,872 | 2,116 | 7,452,552 | 3,563 | 12,548,886 | 2,596 | 9,143,112 |

| ETH-Coinbase Staked | 627 | 1,800,713 | 2,872 | 2,290 | 1,435,830 | 3,926 | 2,461,602 | 2,807 | 1,759,989 | |

| Bitcoin | 8.47 | 549,364 | 64,860 | 49,050 | 415,454 | 70,000 | 592,900 | 63,552 | 538,285 | |

| USDT&USDC | 9,847,687 | 9,849,266 | 1 | 1 | 9,814,682 | 1 | 9,857,395 | 1 | 9,845,929 | |

| Others | Multiple * | 105,405 | Multiple * | Multiple * | 36,415 | Multiple * | 72,441 | Multiple * | 53,661 | |

| Total | 22,419,864 | 19,154,933 | 25,533,224 | 21,340,976 | ||||||

| June 30, 2024 | ETH | 1,937 | 6,179,744 | 3,190 | 2,814 | 5,450,718 | 3,974 | 7,697,638 | 3,394 | 6,574,178 |

| ETH-Coinbase Staked | 480 | 1,301,108 | 2,711 | 2,954 | 1,417,920 | 4,243 | 2,036,640 | 3,645 | 1,749,600 | |

| Bitcoin | 3.95 | 265,883 | 67,312 | 56,500 | 223,175 | 72,777 | 287,469 | 61,613 | 243,371 | |

| USDT&USDC | 10,422,648 | 10,423,276 | 1 | 1 | 10,386,315 | 1 | 10,458,980 | 1 | 10,404,063 | |

| Others | Multiple * | 107,484 | Multiple * | Multiple * | 54,226 | Multiple * | 122,435 | Multiple * | 64,202 | |

| Total | 18,277,495 | 17,532,354 | 20,603,162 | 19,035,414 | ||||||

| March 31,2024 | ETH | 346 | 999,180 | 2,888 | 2,100 | 726,600 | 4,094 | 1,416,524 | 3,618 | 1,251,828 |

| ETH-Coinbase Staked | 479 | 1,297,687 | 2,709 | 2,236 | 1,071,044 | 4,341 | 2,079,339 | 3,842 | 1,840,318 | |

| Bitcoin | 0.67 | 44,995 | 67,157 | 38,501 | 25,796 | 73,836 | 49,470 | 70,407 | 47,173 | |

| USDT&USDC | 99,583 | 99,583 | 1 | 1 | 99,583 | 1 | 99,583 | 1 | 99,583 | |

| Others | Multiple * | 81,571 | Multiple * | Multiple * | 67,814 | Multiple * | 124,481 | Multiple * | 91,346 | |

| Total | 2,523,016 | 1,990,837 | 3,769,397 | 3,330,248 | ||||||

* The ‘Others’ category encompasses various cryptocurrencies that are not reported individually due to their lower significance. This category is labeled as ‘Multiple’ to indicate the presence of diverse prices associated with different type of cryptocurrency. Due to their immaterial nature, detailed price listings are not provided.

(a) The “Lowest Market Price Per Unit of Cryptocurrency During Quarter” represents the lowest market price for a single unit of cryptocurrency reported on the Coinbase exchange during the respective quarter, without regard to when we obtained any of the cryptocurrency.

(b) The “Market Value of Cryptocurrency Held at End of Quarter Using Lowest Market Price” represents a mathematical calculation consisting of the lowest market price for a single unit of cryptocurrency reported on the Coinbase exchange during the respective quarter multiplied by the number of cryptocurrency we held at the end of the applicable period.

(c) The “Highest Market Price Per Unit of Cryptocurrency During Quarter” represents the highest market price for a single unit of cryptocurrency reported on the Coinbase exchange during the respective quarter, without regard to when we obtained any of the cryptocurrency.

(d) The “Market Value of Cryptocurrency Held at End of Quarter Using Highest Market Price” represents a mathematical calculation consisting of the highest market price for a single unit of cryptocurrency reported on the Coinbase exchange during the respective quarter multiplied by the number of cryptocurrency we held at the end of the applicable period.

(e) The “Market Price Per Unit of Cryptocurrency at End of Quarter” represents the market price of a single unit of cryptocurrency on the Coinbase exchange at midnight UTC+8 time on the last day of the respective quarter, which aligns with the our revenue recognition cut-off.

(f) The “Market Value of Cryptocurrency Held at End of Quarter Using Ending Market Price” represents a mathematical calculation consisting of the market price of a single unit of cryptocurrency on the Coinbase exchange at midnight UTC+8 time on the last day of the respective quarter multiplied by the number of cryptocurrency we held at the end of the applicable period.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Genifi Announces Q3 2024 Results

TORONTO, Nov. 20, 2024 /CNW/ – Genifi Inc. (formerly Prodigy Ventures Inc.) GNFI (“genifi” or the “Company”) today announced its financial results for the three and nine months ended September 30, 2024.

Third Quarter 2024 Financial Results

- Revenue for the three months ended September 30, 2024 totalled $200,178 as compared to $521,679 for the three months ended September 30, 2023, a decrease of 62%.

- Gross profit for the three months ended September 30, 2024 of $57,882 as compared to $361,285 for the three months ended September 30, 2023, a decrease of 84%.

- Expenses for the three months ended September 30, 2024 of $467,889 as compared to $748,416 for the three months ended September 30, 2023, a decrease of 37%.

- Net loss from continuing operations for the three months ended September 30, 2024 of $310,360 as compared to a loss of $385,206 for the three months ended September 30, 2023.

- Income from discontinued operations net of tax for the three months ended September 30, 2024 of $76,584 as compared to $nil for the three months ended September 30, 2023.

- Net and comprehensive loss for the three months ended September 30, 2024 totalled $233,776 as compared to $385,206 for the three months ended September 30, 2023.

- The Company had working capital of $2,482,965 as of September 30, 2024 compared to $2,901,095 as of December 31, 2023.

Year-to-Date 2024 Financial Results

- Revenue for the nine months ended September 30, 2024 totalled $715,750 as compared to $1,512,257 for the nine months ended September 30, 2023, a decrease of 53%.

- Gross profit for the nine months ended September 30, 2024 of $310,032 as compared to $1,048,521 for the nine months ended September 30, 2023, a decrease of 70%.

- Expenses for the nine months ended September 30, 2024 of $1,074,278 as compared to $2,966,340 for the nine months ended September 30, 2023, a decrease of 64%.

- Net loss from continuing operations for the nine months ended September 30, 2024 of $576,030 as compared to $1,652,609 for the nine months ended September 30, 2023.

- Income from discontinued operations net of tax for the nine months ended September 30, 2024 of $159,482 as compared to $6,732,497 for the nine months ended September 30, 2023.

- Net and comprehensive loss for the nine months ended September 30, 2024 totalled $416,548 as compared to a net and comprehensive income of $5,079,888 for the nine months ended September 30, 2023.

|

Three months ended |

Nine months ended |

|||

|

2024 $ |

2023 $ |

2024 $ |

2023 $ |

|

|

Revenue |

200,178 |

521,679 |

715,750 |

1,512,257 |

|

Gross Profit |

57,882 |

361,285 |

310,032 |

1,048,521 |

|

Expenses |

467,889 |

748,416 |

1,074,278 |

2,966,340 |

|

Net (loss) from continuing operations |

(310,360) |

(385,206) |

(576,030) |

(1,652,609) |

|

Income from discontinued operations net of tax |

76,584 |

– |

159,482 |

6,732,497 |

|

Net and comprehensive income (loss) for the period |

(233,776) |

(385,206) |

(416,548) |

5,079,888 |

|

Net income (loss) per share – basic and diluted : |

||||

|

Continuing operations |

(0.00) |

(0.00) |

(0.00) |

(0.01) |

|

Discontinued operations |

0.00 |

0.00 |

0.00 |

0.05 |

The complete unaudited financial statements and associated Management’s Discussion and Analysis are available under the Company’s profile at www.sedarplus.ca and the Company’s website at www.genifi.com.

About genifi inc.:

Genifi (formerly Prodigy Ventures) delivers Fintech innovation, with its cutting-edge platforms: IDVerifact for digital identity verification, and tunl.chat for generative AI chat.

Forward-Looking and Cautionary Statements

Certain information set out in this news release constitutes forward-looking information. Forward looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Although genifi believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, and that information obtained from third party sources is reliable, they can give no assurance that those expectations will prove to have been correct. Readers are cautioned not to place undue reliance on forward-looking statements included in this document, as there can be no assurance that the plans, intentions or expectations upon which the forward-looking statements are based will occur. The forward-looking information is based on certain assumptions, which could change materially in the future. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, risk factors set forth in genifi’s Management’s Discussion and Analysis for the three and nine months ended September 30, 2024, a copy of which is filed on SEDAR+ at www.sedarplus.ca. Readers are cautioned that this list of risk factors should not be construed as exhaustive. These statements are made as at the date hereof and unless otherwise required by law, genifi does not intend, or assume any obligation, to update these forward-looking statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE genifi inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/20/c2268.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/20/c2268.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DraftKings Unusual Options Activity

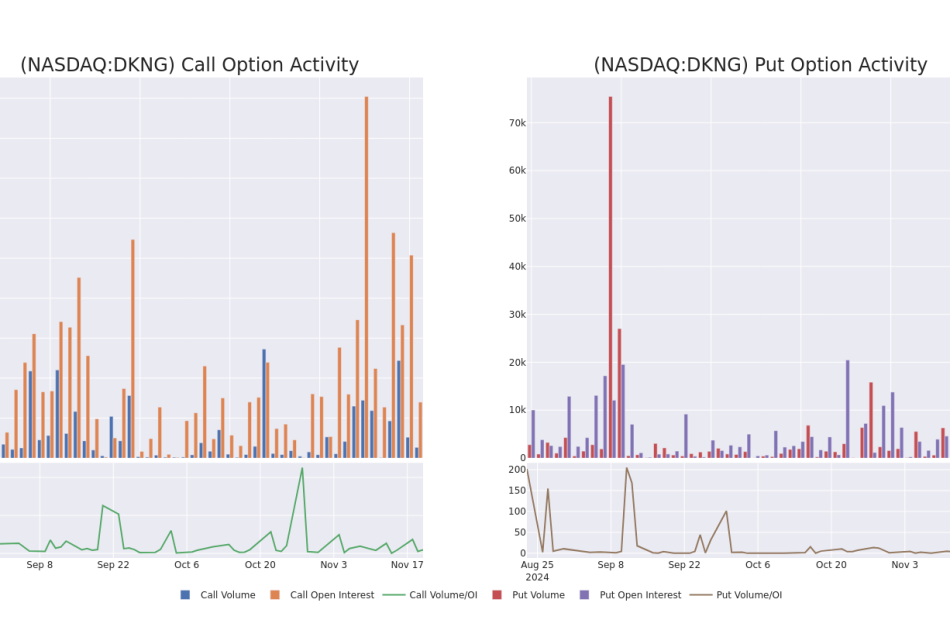

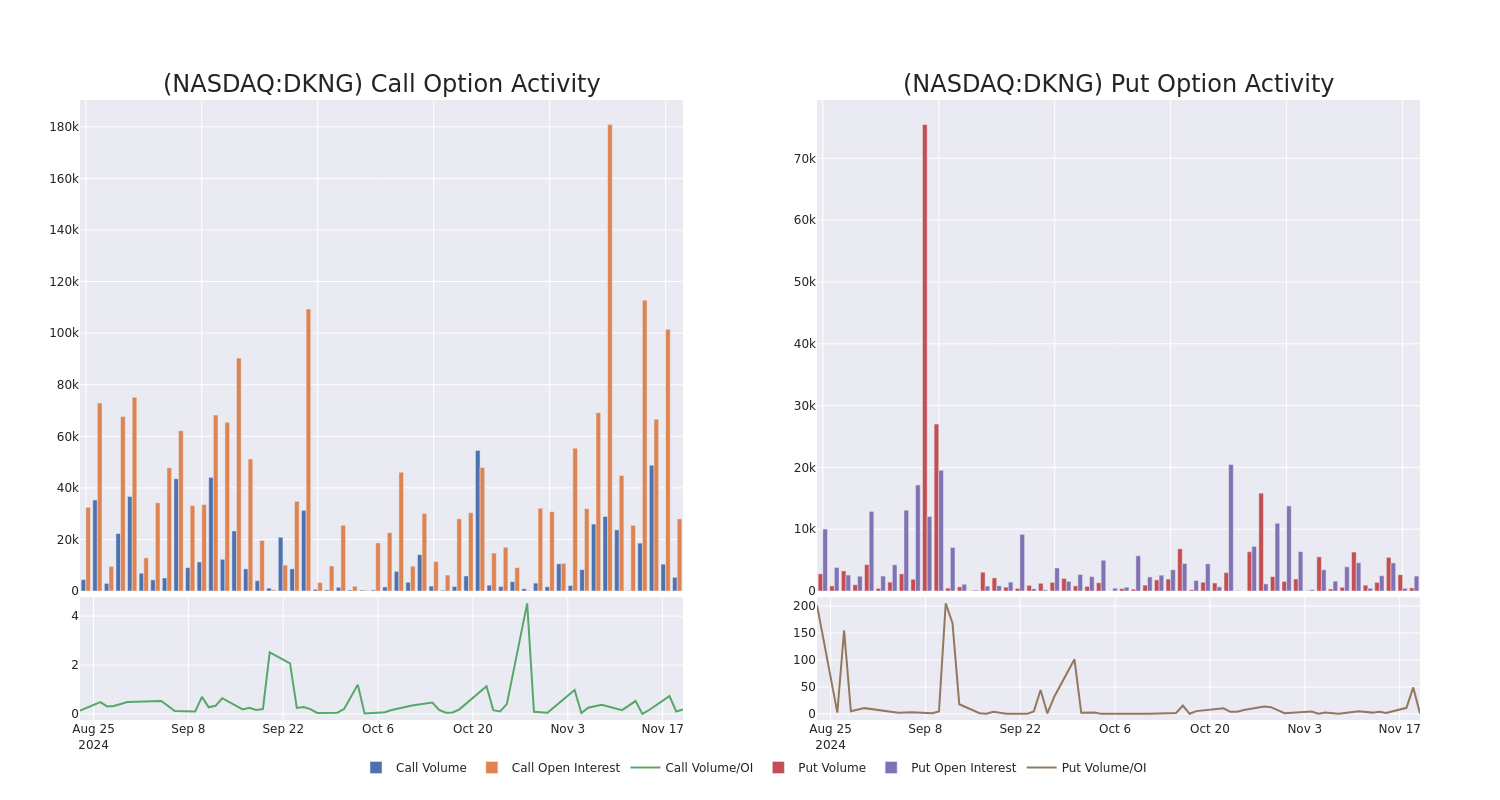

Whales with a lot of money to spend have taken a noticeably bearish stance on DraftKings.

Looking at options history for DraftKings DKNG we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 28% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $130,241 and 11, calls, for a total amount of $784,496.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $45.0 for DraftKings over the recent three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for DraftKings’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of DraftKings’s whale trades within a strike price range from $30.0 to $45.0 in the last 30 days.

DraftKings Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DKNG | CALL | SWEEP | BEARISH | 05/16/25 | $9.1 | $9.05 | $9.05 | $38.00 | $137.5K | 368 | 153 |

| DKNG | CALL | SWEEP | BEARISH | 01/15/27 | $16.4 | $15.9 | $16.2 | $37.00 | $98.8K | 44 | 72 |

| DKNG | CALL | SWEEP | BULLISH | 01/17/25 | $3.9 | $3.8 | $3.9 | $42.00 | $97.5K | 16.9K | 296 |

| DKNG | CALL | SWEEP | BEARISH | 01/17/25 | $3.6 | $3.55 | $3.55 | $42.00 | $79.8K | 16.9K | 1.3K |

| DKNG | CALL | SWEEP | BEARISH | 01/17/25 | $3.8 | $3.75 | $3.75 | $42.00 | $73.1K | 16.9K | 760 |

About DraftKings

DraftKings got its start in 2012 as an innovator in daily fantasy sports. Then, following a Supreme Court ruling in 2018 that allowed states to legalize online sports wagering, the company expanded into online sports and casino gambling, where it generally holds the number two or three revenue share position across states in which it competes. DraftKings is now live with online or retail sports betting in about 30 states and iGaming in seven states, with both products available to around 40% of Canada’s population. The company also operates a non-fungible token commissioned-based marketplace and develops and licenses online gaming products.

After a thorough review of the options trading surrounding DraftKings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

DraftKings’s Current Market Status

- With a trading volume of 4,258,596, the price of DKNG is up by 0.02%, reaching $43.22.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 85 days from now.

What Analysts Are Saying About DraftKings

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $54.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on DraftKings with a target price of $55.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for DraftKings, targeting a price of $48.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $60.

* In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $60.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on DraftKings with a target price of $50.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for DraftKings with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Breaking: $11 Million Jury Award Against Gunmaker Sig Sauer; Found Negligent, Reckless for Defective Design, Sale of P320 Pistol That Directly Caused Injuries to Gun Owner-Veteran

PHILADELPHIA, Nov. 20, 2024 (GLOBE NEWSWIRE) — A Philadelphia jury has just awarded $11 million in damages to U.S. Army veteran George Abrahams, who was shot by his own Sig Sauer P320 pistol while it was in its holster and without his hands touching the gun. The jury found that Sig Sauer defectively designed the P320, was negligent in selling the gun, and showed reckless indifference to the rights of others in the distribution of the pistol. The verdict and jury award – $10 million in punitive damages, and $1 million in compensatory damages – followed a three-week trial in the first Pennsylvania, P320 case against Sig Sauer to go to trial.

Mr. Abrahams is the latest victim of the Sig Sauer P320 to prevail at trial against the international gun manufacturer, according to his attorneys at Saltz Mongeluzzi Bendesky PC. The verdict follows the $2.35 million Federal jury award in June to the firm’s Georgia client (Lang v. Sig Sauer, 1:21-cv-04196, in the U.S. District Court for the Northern District of Georgia) who was also shot by his holstered P320 without ever touching the trigger.

Mr. Abrahams filed a negligence and products liability complaint against Sig Sauer, alleging that his and hundreds of other P320s have discharged and injured active-duty law enforcement personnel and civilian owners; the victims are well trained, safety-focused gun users concerned the manufacturer has to date adamantly resisted issuing a safety recall or redesign. Mr. Abrahams’ unintended and uncommanded shooting occurred suddenly on June 19, 2020 while Mr. Abrahams was simply walking down the stairs of his house; the bullet tore through his right leg, rendering him permanently injured.

“The jury saw the P320 for exactly what it is, defective and dangerous,” said firm Partner Robert W. Zimmerman, lead plaintiff’s counsel. “We successfully argued that Sig Sauer knew of the risks of the P320s design, predicted these risks would injure its customers, and saw these risks play out in the real world. Sig Sauer knowingly and negligently compromised safety in the name of profit.”

Every P320 sold to the military featured an external safety to guard against unintended, uncommanded firing. However, the vast majority of P320 models sold to the public and police do not even have an external safety as an option. Sig Sauer also designed a trigger safety that was used widely within the industry, but inexplicably scrapped the design before P320s with trigger safeties were put into production. Plaintiff’s counsel alleged that Sig Sauer is the only gun maker in the world to make this type of gun without a safety, and that Sig Sauer blatantly ignored its own policy that pre-cocked pistols come with a safety. “Mr. Abrahams demonstrated great courage in bringing this lawsuit, the same kind of courage he displayed serving our country with distinction as an enlisted field artillery specialist in the U.S. Army. He is hopeful this verdict, which came after several hours of jury deliberations over three days, sends a loud and clear message to Sig Sauer that there are consequences to its actions, and inactions. The only way for Sig Sauer to avoid injuring- or killing- innocent victims is to redesign this gun to include a safety like other gun manufacturers,” Zimmerman said.

“We have said it before, and juries are now speaking loud and clear with their verdicts; this gun is a danger to gun owners and anyone within the vicinity of this gun,” co-counsel Ryan Hurd affirmed. Plaintiff’s legal team also included SMB’s Larry Bendesky and Samuel A. Haaz.

SMB represents more than 100 other P320 victims injured by Sig Sauer’s first striker-fired pistol. The firm continues to uncover more instances of unintended discharges. The firm’s clients seek to hold Sig Sauer accountable for the defectively designed gun, and to call upon the company from taking steps that its competitors take to avoid injuring or killing other victims. The P320 has been the subject of controversy, litigation, and media scrutiny for years. Last year it was featured in a joint investigation by The Washington Post, joining other national investigative reports.

Additional related information on the Sig Sauer litigation – and the gun’s troubled history – can be found at www.SMB_SigSauerCases.

Contacts:

Robert W. Zimmerman / rzimmerman@smbb.com / 215-575-3898

Steph Rosenfeld / steph@idadvisors.com / 215-514-4101

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a3f20d6e-2800-4a24-9220-0067c4608d29

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PROREIT ANNOUNCES NOVEMBER 2024 DISTRIBUTION

MONTREAL, Nov. 20, 2024 /CNW/ – PRO Real Estate Investment Trust (“PROREIT” or the “REIT”) PRV announced today that a cash distribution of $0.0375 per trust unit of the REIT for the month of November 2024 ($0.45 on an annualized basis) will be payable on December 16, 2024 to unitholders of record as at November 29, 2024.

About PROREIT

PROREIT PRV is an unincorporated open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario. Founded in 2013, PROREIT owns a portfolio of high-quality commercial real estate properties in Canada, with a strong industrial focus in robust secondary markets.

For more information on PROREIT, please visit the website at: https://proreit.com.

SOURCE Pro Real Estate Investment Trust

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/20/c7169.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/20/c7169.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Target Plunges 21% While Williams-Sonoma Soars 27% On Same Day

Investors were treated to quite the pair trade on Wednesday when shares of big box retailer Target Corp TGT sunk while shares of home furnishing retailer Williams-Sonoma, Inc. WSM rocketed off earnings. The two stocks were the biggest movers of the day, according to Benzinga Pro.

Price Action: Target’s stock closed the day at $121.72, down 21.41%. According to market strategist Ryan Detrick, Wednesday was the Minneapolis, Minnesota-based company’s third-worst day in history in the market.

Meanwhile, Williams-Sonoma’s price action was certainly something to write home about. The San Fransisco, California-based company’s shares closed the Wednesday trading session at $175.04, up 27.54%. This was the company’s second-best day ever in the market.

Target Earnings: Target reported earnings-per-share of $1.85 in 2024’s third quarter, under Wall Street’s projection of $2.30. Revenue numbers also fell under expectations. Net income fell 12.1% year-over-year while cost of sales and administrative expenses increases outpaced revenue growth.

Management cited cost pressures and continued supply chain disruptions for its weak quarterly performance. The company has previously blamed store theft as a driver of financial underperformance.

Wells Fargo and Citigroup issued a downgrade for Target stock on Wednesday, according to Benzinga analyst ratings.

Williams-Sonoma Earnings: Williams-Sonoma’s report painted a rosier picture.

The company reported earnings-per-share of $1.96, beating estimates of $1.78. The home furnishing and cooking retailer also gained market share and raised guidance.

Laura Alber, president and CEO, highlighted the company’s margins as a catalyst for its earnings beat.

“Our operating results reflect the operational improvements that we have been focused on all year, and demonstrate the strength of our margin profile in a difficult environment,” Alber said in a press release.

The Retail Industry: Target sells Williams-Sonoma cookbooks on its online e-commerce platform.

The two earnings reports paint mixed signals for a retail industry at a crossroads. While some retailers have continued to struggle amid tough macroeconomic conditions and rapid change in the industry at large, others have flourished.

Also Read:

Photos: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

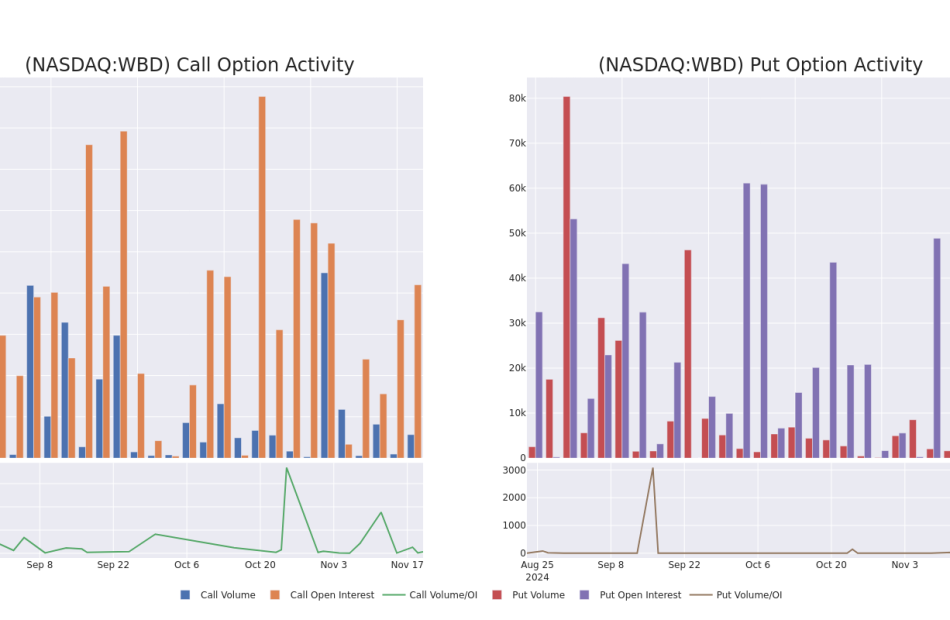

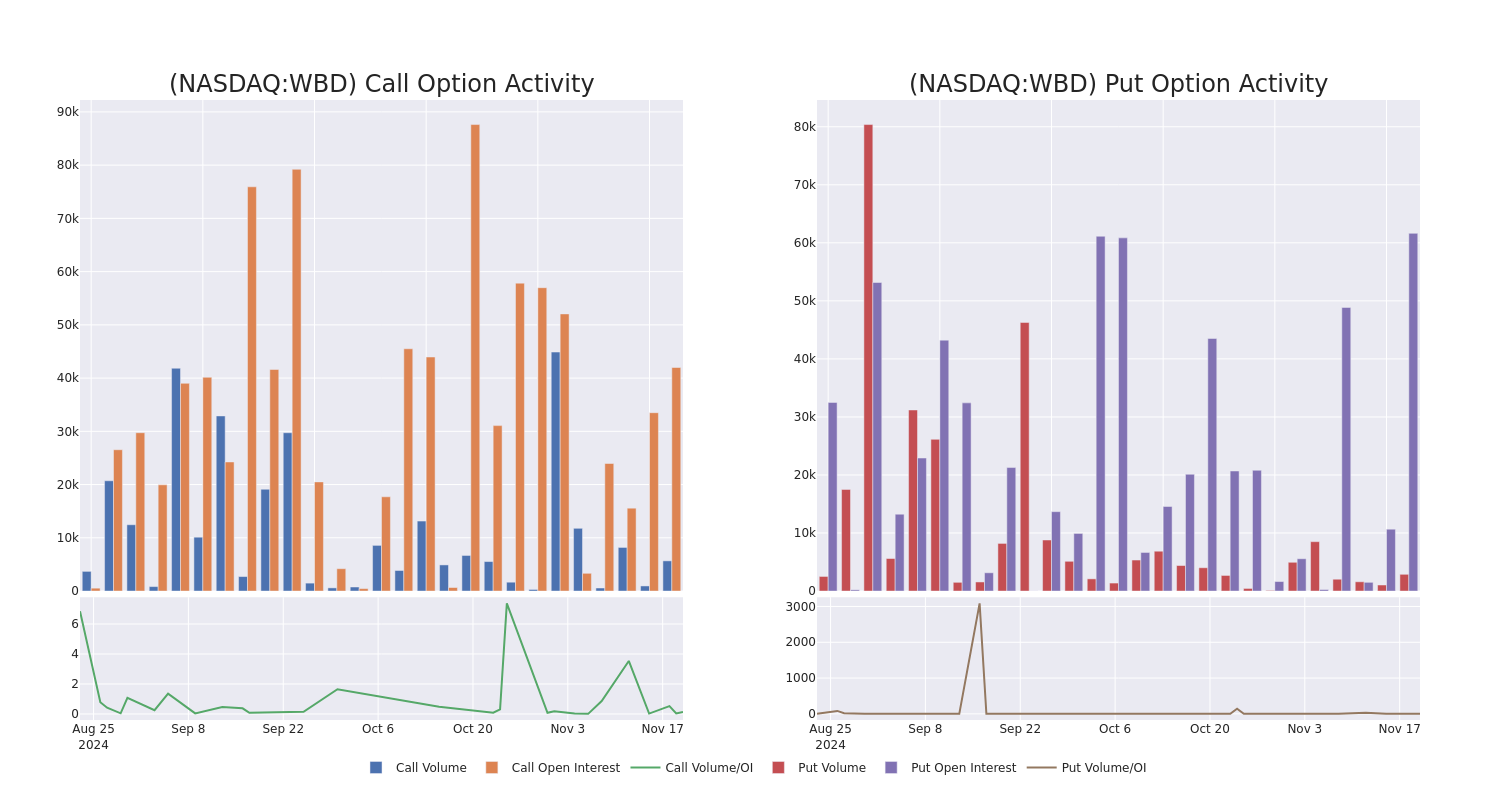

What the Options Market Tells Us About Warner Bros. Discovery

Whales with a lot of money to spend have taken a noticeably bullish stance on Warner Bros. Discovery.

Looking at options history for Warner Bros. Discovery WBD we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 66% of the investors opened trades with bullish expectations and 11% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $233,408 and 6, calls, for a total amount of $333,960.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $17.0 for Warner Bros. Discovery during the past quarter.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Warner Bros. Discovery’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Warner Bros. Discovery’s whale trades within a strike price range from $7.5 to $17.0 in the last 30 days.

Warner Bros. Discovery Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WBD | PUT | TRADE | BULLISH | 02/21/25 | $1.54 | $1.49 | $1.51 | $11.00 | $151.0K | 545 | 1.0K |

| WBD | CALL | SWEEP | BULLISH | 01/17/25 | $0.27 | $0.25 | $0.26 | $11.00 | $89.0K | 2.5K | 3.4K |

| WBD | CALL | TRADE | BULLISH | 12/20/24 | $2.1 | $2.08 | $2.1 | $8.00 | $79.8K | 13.1K | 398 |

| WBD | CALL | SWEEP | BULLISH | 11/29/24 | $0.73 | $0.59 | $0.6 | $9.50 | $60.0K | 2.4K | 1.3K |

| WBD | PUT | SWEEP | BEARISH | 06/20/25 | $0.4 | $0.39 | $0.4 | $7.50 | $51.4K | 60.7K | 1.7K |

About Warner Bros. Discovery

Warner Bros. Discovery was formed in 2022 through the combination of WarnerMedia and Discovery Communications. It operates in three global business segments: studios, networks, and direct-to-consumer. Warner Bros. Pictures is the crown jewel of the studios business, producing, distributing, and licensing movies and television shows. The networks business consists of basic cable networks, such as CNN, TNT, TBS, Discovery, HGTV, and the Food Network. Direct-to-consumer includes HBO and the firm’s streaming platforms, which have now been consolidated to Max and Discovery+. Much of the DTC content is created within the firm’s other two business segments. Each segment operates with a global reach, with Max available in over 60 countries.

In light of the recent options history for Warner Bros. Discovery, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Warner Bros. Discovery

- With a trading volume of 30,484,682, the price of WBD is up by 3.21%, reaching $9.8.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 93 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Warner Bros. Discovery with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Carlyle Credit Income Fund Announces Fourth Quarter and Full Year 2024 Financial Results and Declares Monthly Common and Preferred Dividends

NEW YORK, Nov. 20, 2024 (GLOBE NEWSWIRE) — Carlyle Credit Income Fund (“we,” “us,” “our,” “CCIF” or the “Fund”) CCIF today announced its financial results for its fourth quarter and full year ended September 30, 2024. The full detailed presentation of the Fund’s fourth quarter and full year ended September 30, 2024, financial results can be viewed on the Fund’s website carlylecreditincomefund.com/investor-dashboard.

Lauren Basmadjian, CCIF’s Chief Executive Officer said, “We’re pleased with our 4Q and FY results and continue to execute the strategy we laid out when we first became investment advisor to CCIF in July 2023. Since becoming investment advisor, we almost doubled the dividend rate from 7.8% to 15.2%, an increase of 7.4%. As we enter 2025, we will continue to work to find attractive CLO equity opportunities for our shareholders.”

Over the past quarter, the Fund has successfully:

- Maintained the monthly dividend of 10.5 cents through February 2025, equating to a 15.16% annualized dividend based on share price as of November 19, 2024, or 16.64% based on the Fund’s NAV as of October 31, 2024.

- Funded $39.6 million in new CLO investments with a weighted average GAAP yield of 16.5%. The aggregate portfolio weighted average GAAP yield was 18.6% as of September 30, 2024.

- Completed a private placement of 5-year, 7.125% convertible preferred shares due 2029 for net proceeds of $10.7 million.

- Completed a registered direct placement of common shares at a premium to NAV for net proceeds of $11.5 million.

- Sold 850,000 common shares in connection with the ATM offering program at a premium to NAV for net proceeds of $6.8 million.

Net investment income was $0.30 per common share and core net investment income was $0.45 per common share for the fourth quarter of 2024. Net asset value per common share was $7.64 as of September 30, 2024. The total fair value of investments was $173.5 million as of September 30, 2024.

Dividends

CCIF is maintaining a monthly dividend on shares of the Fund’s common stock of $0.1050 per share for December 2024, and January and February 2025.

| Security | Amount per Share | Record Dates | Payable Dates |

| Common Stock | $0.1050 | December 18, 2024 | December 31, 2024 |

| January 21, 2025 | January 31, 2025 | ||

| February 18, 2025 | February 28, 2025 |

CCIF is also pleased to announce the declaration of dividends on shares of the Fund’s 8.75% Series A Term Preferred Shares of $0.1823 per share for December 2024, and January and February 2025.

| Security | Amount per Share | Record Dates | Payable Dates |

| Series A Preferred Shares | $0.1823 | December 18, 2024 | December 31, 2024 |

| January 21, 2025 | January 31, 2025 | ||

| February 18, 2025 | February 28, 2025 |

Conference Call

The Fund will host a conference call at 10:00 a.m. EDT on Thursday, November 21, 2024, to discuss its fourth quarter financial results. Please register for the conference call here. The conference call information will also be available via a link on Carlyle Credit Income Fund’s website and the recording will be available on our website soon after the call’s completion.

About Carlyle Credit Income Fund

Carlyle Credit Income Fund CCIF is an externally managed closed-end fund focused on investing in primarily equity and junior debt tranches of collateralized loan obligations (“CLOs”). The CLOs are collateralized by a portfolio consisting primarily of U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. CCIF is externally managed by Carlyle Global Credit Investment Management L.L.C. (“CGCIM”), an SEC-registered investment adviser and wholly owned subsidiary of Carlyle. CCIF draws upon the significant scale and resources of Carlyle as one of the world’s largest CLO managers.

Web: www.carlylecreditincomefund.com

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may,” “plans,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions to identify forward-looking statements, although not all forward-looking statements include these words. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. There may be events in the future, however, that we are not able to predict accurately or control. You should not place undue reliance on these forward-looking statements, which speak only as of the date on which we make it. Factors or events that could cause our actual results to differ, possibly materially from our expectations, include, but are not limited to, the risks, uncertainties and other factors we identify in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in filings we make with the Securities and Exchange Commission, and it is not possible for us to predict or identify all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contacts:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Carlyle Credit Income Fund Announces Fourth Quarter and Full Year 2024 Financial Results and Declares Monthly Common and Preferred Dividends

NEW YORK, Nov. 20, 2024 (GLOBE NEWSWIRE) — Carlyle Credit Income Fund (“we,” “us,” “our,” “CCIF” or the “Fund”) CCIF today announced its financial results for its fourth quarter and full year ended September 30, 2024. The full detailed presentation of the Fund’s fourth quarter and full year ended September 30, 2024, financial results can be viewed on the Fund’s website carlylecreditincomefund.com/investor-dashboard.

Lauren Basmadjian, CCIF’s Chief Executive Officer said, “We’re pleased with our 4Q and FY results and continue to execute the strategy we laid out when we first became investment advisor to CCIF in July 2023. Since becoming investment advisor, we almost doubled the dividend rate from 7.8% to 15.2%, an increase of 7.4%. As we enter 2025, we will continue to work to find attractive CLO equity opportunities for our shareholders.”

Over the past quarter, the Fund has successfully:

- Maintained the monthly dividend of 10.5 cents through February 2025, equating to a 15.16% annualized dividend based on share price as of November 19, 2024, or 16.64% based on the Fund’s NAV as of October 31, 2024.

- Funded $39.6 million in new CLO investments with a weighted average GAAP yield of 16.5%. The aggregate portfolio weighted average GAAP yield was 18.6% as of September 30, 2024.

- Completed a private placement of 5-year, 7.125% convertible preferred shares due 2029 for net proceeds of $10.7 million.

- Completed a registered direct placement of common shares at a premium to NAV for net proceeds of $11.5 million.

- Sold 850,000 common shares in connection with the ATM offering program at a premium to NAV for net proceeds of $6.8 million.

Net investment income was $0.30 per common share and core net investment income was $0.45 per common share for the fourth quarter of 2024. Net asset value per common share was $7.64 as of September 30, 2024. The total fair value of investments was $173.5 million as of September 30, 2024.

Dividends

CCIF is maintaining a monthly dividend on shares of the Fund’s common stock of $0.1050 per share for December 2024, and January and February 2025.

| Security | Amount per Share | Record Dates | Payable Dates |

| Common Stock | $0.1050 | December 18, 2024 | December 31, 2024 |

| January 21, 2025 | January 31, 2025 | ||

| February 18, 2025 | February 28, 2025 |

CCIF is also pleased to announce the declaration of dividends on shares of the Fund’s 8.75% Series A Term Preferred Shares of $0.1823 per share for December 2024, and January and February 2025.

| Security | Amount per Share | Record Dates | Payable Dates |

| Series A Preferred Shares | $0.1823 | December 18, 2024 | December 31, 2024 |

| January 21, 2025 | January 31, 2025 | ||

| February 18, 2025 | February 28, 2025 |

Conference Call

The Fund will host a conference call at 10:00 a.m. EDT on Thursday, November 21, 2024, to discuss its fourth quarter financial results. Please register for the conference call here. The conference call information will also be available via a link on Carlyle Credit Income Fund’s website and the recording will be available on our website soon after the call’s completion.

About Carlyle Credit Income Fund

Carlyle Credit Income Fund CCIF is an externally managed closed-end fund focused on investing in primarily equity and junior debt tranches of collateralized loan obligations (“CLOs”). The CLOs are collateralized by a portfolio consisting primarily of U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. CCIF is externally managed by Carlyle Global Credit Investment Management L.L.C. (“CGCIM”), an SEC-registered investment adviser and wholly owned subsidiary of Carlyle. CCIF draws upon the significant scale and resources of Carlyle as one of the world’s largest CLO managers.

Web: www.carlylecreditincomefund.com

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may,” “plans,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions to identify forward-looking statements, although not all forward-looking statements include these words. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. There may be events in the future, however, that we are not able to predict accurately or control. You should not place undue reliance on these forward-looking statements, which speak only as of the date on which we make it. Factors or events that could cause our actual results to differ, possibly materially from our expectations, include, but are not limited to, the risks, uncertainties and other factors we identify in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in filings we make with the Securities and Exchange Commission, and it is not possible for us to predict or identify all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contacts:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.