Looking At United Parcel Service's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards United Parcel Service UPS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UPS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for United Parcel Service. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 62% leaning bullish and 37% bearish. Among these notable options, 4 are puts, totaling $114,507, and 4 are calls, amounting to $444,526.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $120.0 to $160.0 for United Parcel Service over the last 3 months.

Insights into Volume & Open Interest

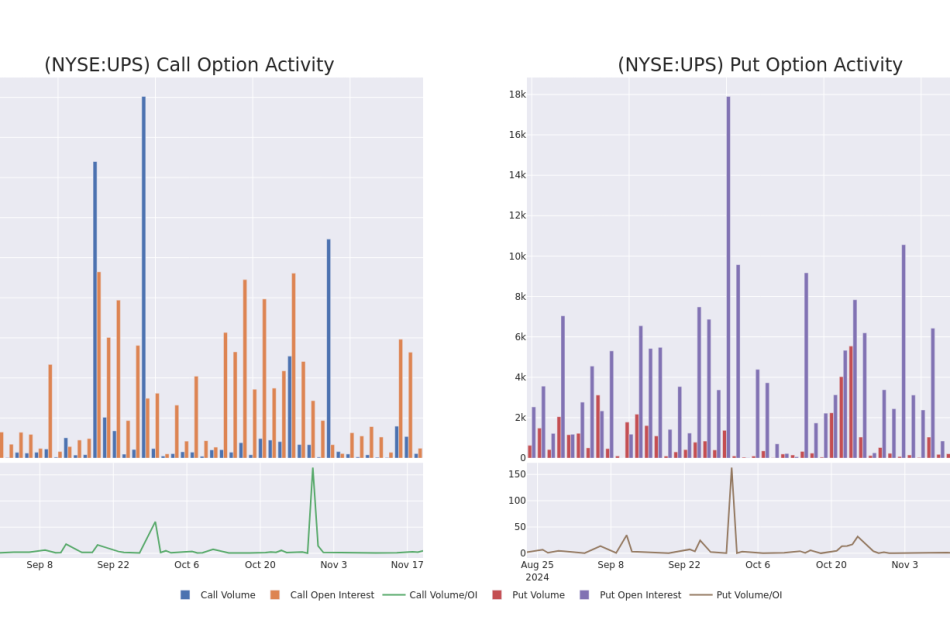

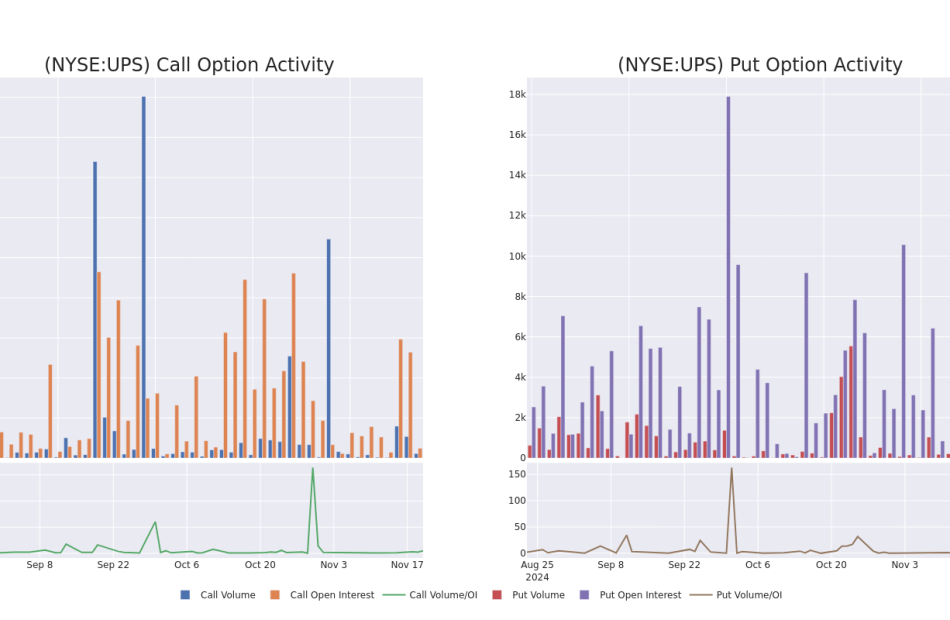

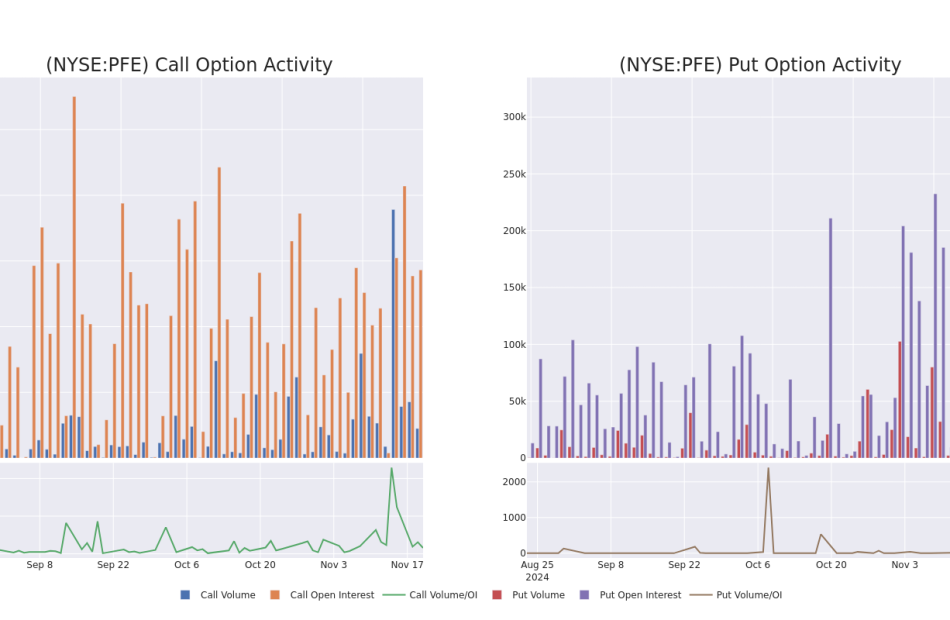

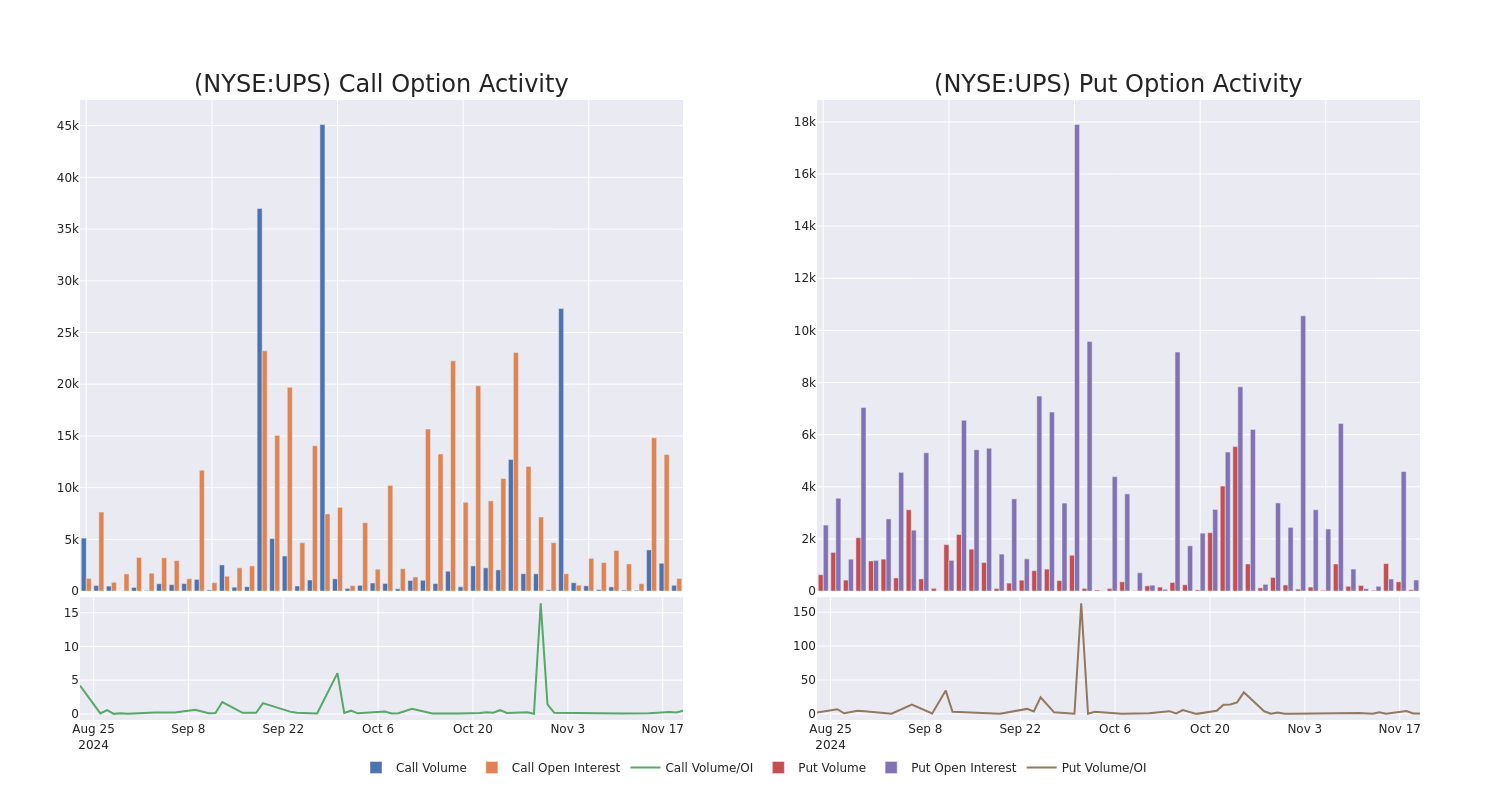

In today’s trading context, the average open interest for options of United Parcel Service stands at 234.86, with a total volume reaching 606.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in United Parcel Service, situated within the strike price corridor from $120.0 to $160.0, throughout the last 30 days.

United Parcel Service Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | TRADE | BULLISH | 01/17/25 | $13.15 | $12.95 | $13.1 | $120.00 | $327.5K | 547 | 250 |

| UPS | CALL | SWEEP | BEARISH | 11/29/24 | $6.35 | $6.0 | $6.0 | $126.00 | $60.0K | 10 | 100 |

| UPS | PUT | TRADE | BULLISH | 01/16/26 | $33.85 | $31.5 | $31.5 | $160.00 | $31.5K | 247 | 10 |

| UPS | CALL | SWEEP | BULLISH | 01/16/26 | $14.8 | $14.7 | $14.78 | $130.00 | $29.5K | 653 | 1 |

| UPS | PUT | TRADE | BULLISH | 01/16/26 | $28.6 | $28.2 | $28.2 | $155.00 | $28.2K | 99 | 20 |

About United Parcel Service

As the world’s largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS’ domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing “strategic alternatives” for its truck brokerage unit, Coyote, which it acquired in 2015.

Following our analysis of the options activities associated with United Parcel Service, we pivot to a closer look at the company’s own performance.

Where Is United Parcel Service Standing Right Now?

- With a volume of 1,493,806, the price of UPS is down -1.34% at $131.41.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 69 days.

Expert Opinions on United Parcel Service

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $153.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Evercore ISI Group persists with their In-Line rating on United Parcel Service, maintaining a target price of $141.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for United Parcel Service, targeting a price of $170.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on United Parcel Service with a target price of $146.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on United Parcel Service with a target price of $150.

* An analyst from Citigroup persists with their Buy rating on United Parcel Service, maintaining a target price of $158.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for United Parcel Service, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At United Parcel Service's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards United Parcel Service UPS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UPS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for United Parcel Service. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 62% leaning bullish and 37% bearish. Among these notable options, 4 are puts, totaling $114,507, and 4 are calls, amounting to $444,526.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $120.0 to $160.0 for United Parcel Service over the last 3 months.

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of United Parcel Service stands at 234.86, with a total volume reaching 606.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in United Parcel Service, situated within the strike price corridor from $120.0 to $160.0, throughout the last 30 days.

United Parcel Service Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | TRADE | BULLISH | 01/17/25 | $13.15 | $12.95 | $13.1 | $120.00 | $327.5K | 547 | 250 |

| UPS | CALL | SWEEP | BEARISH | 11/29/24 | $6.35 | $6.0 | $6.0 | $126.00 | $60.0K | 10 | 100 |

| UPS | PUT | TRADE | BULLISH | 01/16/26 | $33.85 | $31.5 | $31.5 | $160.00 | $31.5K | 247 | 10 |

| UPS | CALL | SWEEP | BULLISH | 01/16/26 | $14.8 | $14.7 | $14.78 | $130.00 | $29.5K | 653 | 1 |

| UPS | PUT | TRADE | BULLISH | 01/16/26 | $28.6 | $28.2 | $28.2 | $155.00 | $28.2K | 99 | 20 |

About United Parcel Service

As the world’s largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS’ domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing “strategic alternatives” for its truck brokerage unit, Coyote, which it acquired in 2015.

Following our analysis of the options activities associated with United Parcel Service, we pivot to a closer look at the company’s own performance.

Where Is United Parcel Service Standing Right Now?

- With a volume of 1,493,806, the price of UPS is down -1.34% at $131.41.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 69 days.

Expert Opinions on United Parcel Service

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $153.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Evercore ISI Group persists with their In-Line rating on United Parcel Service, maintaining a target price of $141.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for United Parcel Service, targeting a price of $170.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on United Parcel Service with a target price of $146.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on United Parcel Service with a target price of $150.

* An analyst from Citigroup persists with their Buy rating on United Parcel Service, maintaining a target price of $158.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for United Parcel Service, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Beats Q3 Revenue, EPS Estimates, Supply Constraints Ding Stock: Huang Says 'Age Of AI Is In Full Steam' (UPDATED)

Editor’s note: This story has been updated with additional information.

NVIDIA Corporation NVDA continued its streak of beating expectations with third-quarter revenue and earnings per share coming in ahead of Street estimates Wednesday

Nvidia’s Key Q3 Numbers: Nvidia reported third-quarter revenue of $35.1 billion, up 94% year-over-year, which beat a Street consensus estimate of $33.12 billion, according to data from Benzinga Pro.

The company reported earnings per share of 81 cents, which beat Street consensus estimate of 75 cents per share.

The company beat analyst estimates for revenue in nine straight quarters.

The company beat analyst estimates for earnings per share in eight straight quarters.

Analysts and Benzinga readers predicted Nvidia would meet or exceed third-quarter expectations ahead of the report.

“What’s your boldest prediction for Nvidia’s earnings report on Wednesday?” Benzinga asked readers.

The results were:

- Meets expectations: 45%

- Blowout beat: 42%

- Misses expectations: 13%

The majority of Benzinga readers expected the company to meet or beat the estimates from analysts. While more readers expected the company to meet estimates, 42% believed the company would beat estimates Wednesday.

Read Also: Nvidia Stock Historically Drops In December After Q3 Earnings

Nvidia’s Q3 Performance By Segment: The data center business posted a quarterly record for revenue in the third quarter.

Here is a look at the revenue performance by operating business segment.

| Segment | Revenue | Year-over-Year change | Quarter-over-Quarter change |

| Data Center | $30.8 billion | +112% | +17% |

| Gaming & AI PC | $3.3 billion | +15% | +14% |

| Professional Vizualization | $486 million | +17% | +7% |

| Auto | $449 million | +72% | +30% |

“The age of AI is in full steam, propelling a global shift to NVIDIA computing,” Nvidia CEO Jensen Huang said.

“Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference.

Huang said countries have “awakened to the importance” of AI.

“AI is transforming every industry, company and country. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging with breakthroughs in physical AI.”

Nvidia Q4 Outlook: Nvidia said it expects fourth-quarter revenue to be $37.5 billion plus or minus 2%.

The company said Blackwell production shipments are scheduled to begin in the fourth quarter of 2025 and will ramp into fiscal 2026. Nvidia said there is a continued demand for Hopper and the initial ramp of Blackwell. Both are seeing “certain supply constraints,” but the company said it was working as hard as it could to ramp up supply.

Demand for the Blackwell greatly exceeds supply and the Blackwell guidance remains on track, the company said.

Nvidia expects Blackwell margins to be in mid-70s% when ramped. “Demand for our infrastructure is really great,” Huang said. “Will deliver more Blackwells this quarter than previously estimated.”

Demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026, the company said.

Earnings Call Highlights: Nvidia executives told investors that Blackwell is “in full production” with customers racing to be the first to market with the company’s new product.

The company said the pipeline continues to build and enterprise AI and industrial AI are accelerating.

Nvidia’s gaming segment had a “great quarter” in the third quarter with strong back-to-school sales, the company added. The company said the channel inventory for gaming remains healthy and Nvidia is gearing up for the holiday shopping season.

What’s Next: With the chance of an earnings beat, Benzinga recently asked readers about their expectations for the stock if Nvidia blows out earnings estimates.

“If Nvidia shatters expectations, how high could its stock go by the end of 2024?” Benzinga asked.

The results were:

- $150 to $180: 55%

- $180 to $200: 26%

- Above $200: 18%

Benzinga readers predicted the stock will hit new all-time highs if third-quarter results come in ahead of analyst estimates.

If the stock goes higher, CEO Huang will continue to benefit as one of the key shareholders of the stock. Huang’s wealth soared to $128 billion in 2024, ranking 11th in the world according to Bloomberg.

Huang added $84.3 billion to his wealth and is around $17 billion away from cracking the top 10 richest people in the world milestone. If shares continue to trade higher to the end of the year, this milestone could be within reach.

NVDA Price Action: Nvidia stock is down 2.7% to $141.93 in after-hours trading Wednesday versus a 52-week trading range of $45.01 to $149.76. The stock closed Wednesday down 0.8% to $145.89. Nvidia stock was up over 200% year-to-date ahead of Wednesday’s earnings report

Read Next:

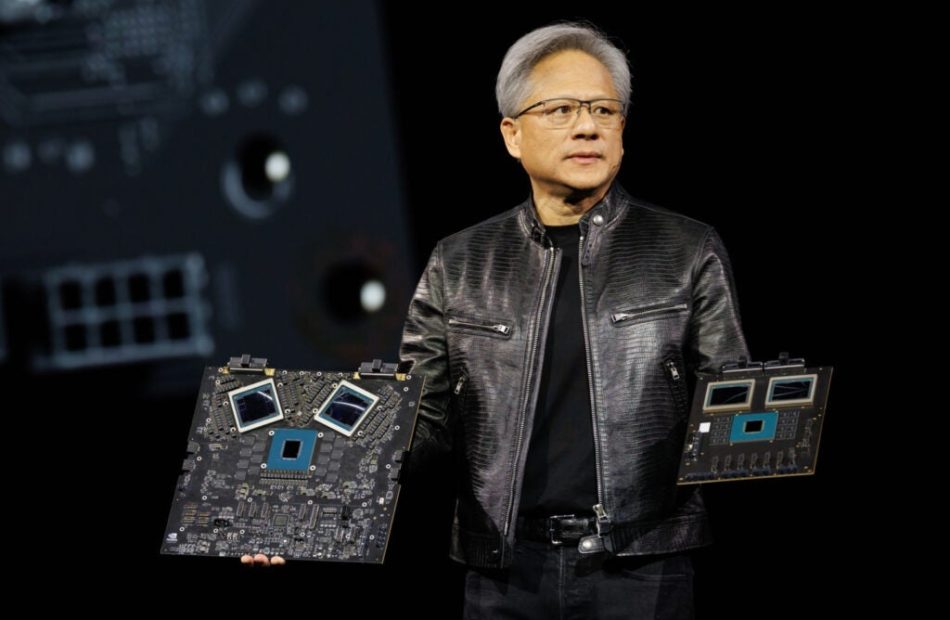

Nvidia CEO Jensen Huang. Photo courtesy of Nvidia.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About Zscaler

Whales with a lot of money to spend have taken a noticeably bearish stance on Zscaler.

Looking at options history for Zscaler ZS we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 26% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $485,321 and 6, calls, for a total amount of $239,539.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $185.0 to $240.0 for Zscaler over the last 3 months.

Insights into Volume & Open Interest

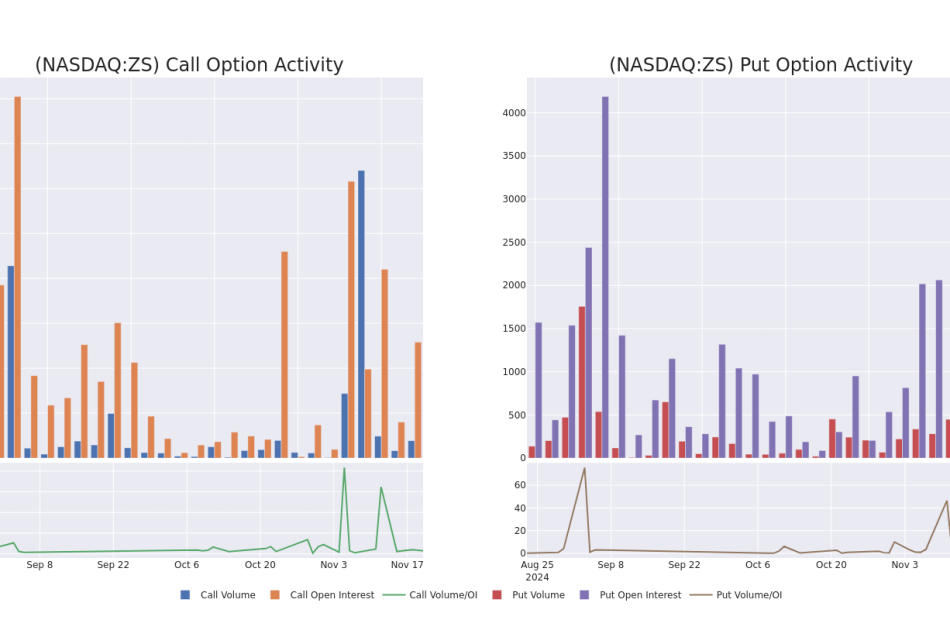

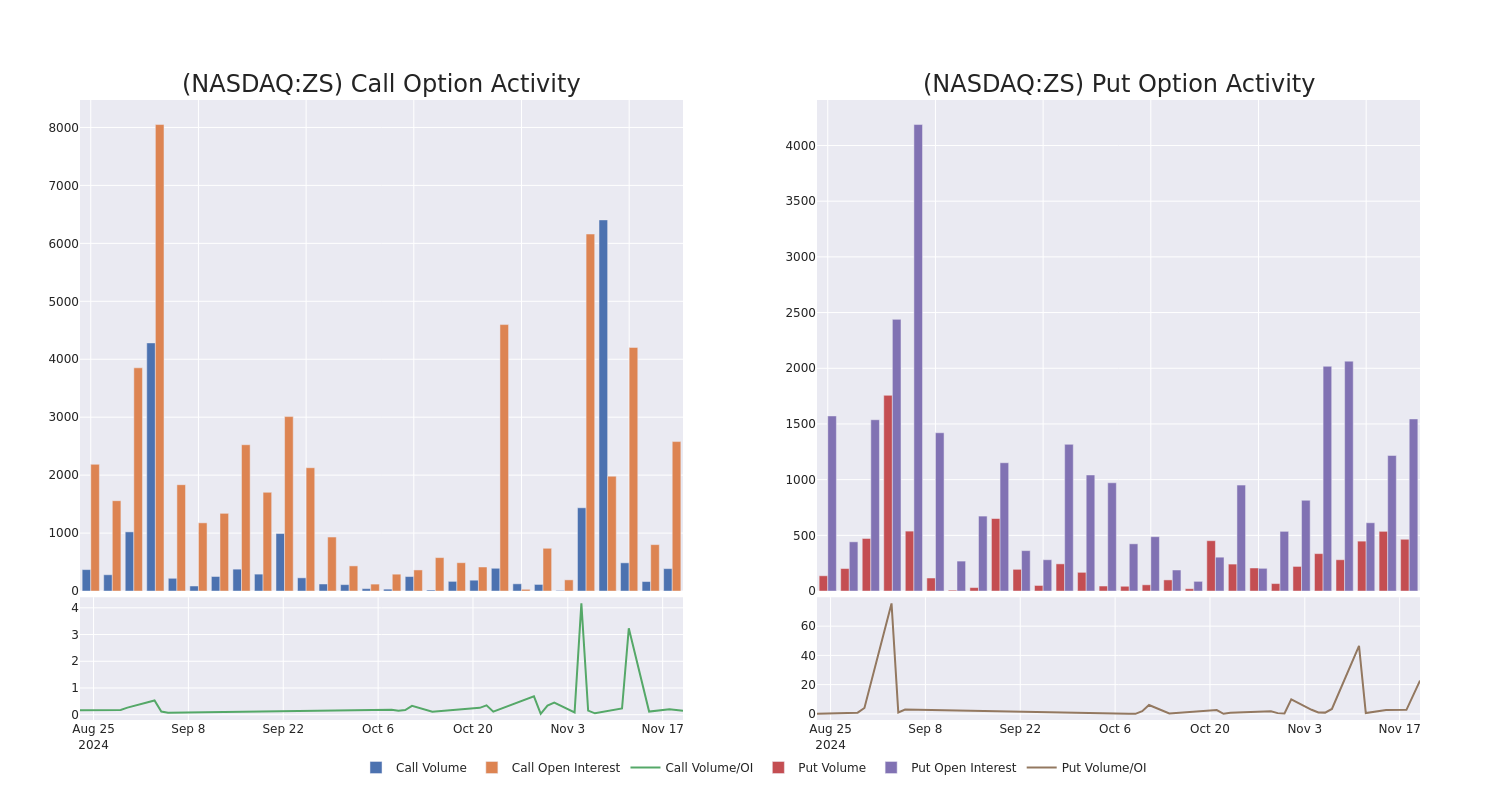

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Zscaler’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Zscaler’s whale trades within a strike price range from $185.0 to $240.0 in the last 30 days.

Zscaler 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZS | PUT | SWEEP | NEUTRAL | 12/18/26 | $32.85 | $29.9 | $32.85 | $185.00 | $98.6K | 30 | 0 |

| ZS | PUT | SWEEP | BULLISH | 12/20/24 | $21.1 | $20.3 | $20.35 | $215.00 | $85.8K | 5 | 81 |

| ZS | CALL | TRADE | BEARISH | 12/06/24 | $8.25 | $7.9 | $7.99 | $210.00 | $79.9K | 145 | 109 |

| ZS | PUT | SWEEP | BULLISH | 12/20/24 | $6.4 | $6.1 | $6.12 | $185.00 | $61.4K | 536 | 100 |

| ZS | PUT | TRADE | BEARISH | 01/17/25 | $19.3 | $18.7 | $19.3 | $210.00 | $50.1K | 763 | 4 |

About Zscaler

Zscaler is a software-as-a-service, or SaaS, firm focusing on providing cloud-native cybersecurity solutions to primarily enterprise customers. Zscaler’s offerings can be broadly partitioned into Zscaler Internet Access, which provides secure access to external applications, and Zscaler Private Access, which provides secure access to internal applications. The firm is headquartered in San Jose, California, and went public in 2018.

Having examined the options trading patterns of Zscaler, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Zscaler

- Trading volume stands at 626,595, with ZS’s price down by -0.18%, positioned at $203.99.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 12 days.

Expert Opinions on Zscaler

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $252.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from JMP Securities downgraded its rating to Market Outperform, setting a price target of $270.

* An analyst from Stifel has decided to maintain their Buy rating on Zscaler, which currently sits at a price target of $235.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Zscaler, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Copa Holdings Reports Financial Results for the Third Quarter of 2024

PANAMA CITY, Panama, Nov. 20, 2024 (GLOBE NEWSWIRE) — Copa Holdings, S.A. CPA, today announced financial results for the third quarter of 2024 (3Q24). The terms “Copa Holdings” and the “Company” refer to the consolidated entity. The following financial information, unless otherwise indicated, is presented in accordance with International Financial Reporting Standards (IFRS). See the accompanying reconciliation of non-IFRS financial information to IFRS financial information included in the financial tables section of this earnings release. Unless otherwise stated, all comparisons with prior periods refer to the third quarter of 2023 (3Q23).

OPERATING AND FINANCIAL HIGHLIGHTS

- Copa Holdings reported a net profit of US$146.0 million for 3Q24 or US$3.50 per share, a US$28.4 million decrease compared to 3Q23 on an adjusted basis. The Company reported an operating profit of US$173.7 million and an operating margin of 20.3%, a decrease of US$31.3 million and 3.3 percentage points respectively, compared to 3Q23.

- Consolidated capacity, measured in available seat miles (ASMs), increased by 9.5% in the quarter compared to 3Q23.

- Passenger traffic for the quarter, measured in terms of revenue passenger miles (RPMs), increased by 7.6% compared to 3Q23.

- The Company reported an 86.2% load factor in 3Q24, a 1.6 percentage-point decrease compared to 3Q23.

- Operating cost per available seat mile excluding fuel (Ex-fuel CASM) decreased by 1.6% in the quarter to 5.7 cents when compared to 3Q23.

- Revenue per available seat mile (RASM) decreased by 10.1% to 11.0 cents compared to 3Q23, driven by a decrease of 8.7% in passenger yields and 1.6 percentage points in load factor.

- The Company ended the quarter with approximately US$1.3 billion in cash, short-term and long-term investments, which represent 36% of the last twelve months’ revenues.

- The Company closed the quarter with total debt, including lease liabilities, of US$1.9 billion, while the Adjusted Net Debt to EBITDA ratio ended at 0.6 times.

- During the quarter, the Company took delivery of one Boeing 737 MAX 8 aircraft, ending the quarter with a consolidated fleet of 110 aircraft – 67 Boeing 737-800s, 32 Boeing 737 MAX 9s, 9 Boeing 737-700s, 1 Boeing 737 MAX 8, and 1 Boeing 737-800 freighter.

- Copa Airlines had an on-time performance for the quarter of 87.3% and a flight completion factor of 99.6%, once again positioning itself among the best in the industry.

Subsequent Events

- Copa Holdings will make its third dividend payment of the year of US$1.61 per share on December 13, 2024, to all Class A and Class B shareholders on record as of December 2, 2024.

| Consolidated Financial & Operating Highlights |

3Q24 | 3Q23 | Variance Vs 3Q23 |

2Q24 | Variance Vs 2Q24 |

|||||

| Revenue Passengers Carried (000s) | 3,449 | 3,272 | 5.4 | % | 3,303 | 4.4 | % | |||

| Revenue Passengers OnBoard (000s) | 5,187 | 4,873 | 6.4 | % | 4,970 | 4.4 | % | |||

| RPMs (millions) | 6,711 | 6,239 | 7.6 | % | 6,446 | 4.1 | % | |||

| ASMs (millions) | 7,785 | 7,109 | 9.5 | % | 7,424 | 4.9 | % | |||

| Load Factor | 86.2 | % | 87.8 | % | -1.6 | p.p | 86.8 | % | -0.6 | p.p |

| Yield (US$ Cents) | 12.2 | 13.4 | (8.7 | )% | 12.1 | 0.6 | % | |||

| PRASM (US$ Cents) | 10.5 | 11.7 | (10.3 | )% | 10.5 | (0.1 | )% | |||

| RASM (US$ Cents) | 11.0 | 12.2 | (10.1 | )% | 11.0 | (0.5 | )% | |||

| CASM (US$ Cents) | 8.7 | 9.3 | (6.2 | )% | 8.9 | (1.6 | )% | |||

| CASM Excl. Fuel (US$ Cents) | 5.7 | 5.8 | (1.6 | )% | 5.6 | 1.9 | % | |||

| Fuel Gallons Consumed (millions) | 91.3 | 83.9 | 8.8 | % | 87.6 | 4.3 | % | |||

| Avg. Price Per Fuel Gallon (US$) | 2.60 | 3.00 | (13.3 | )% | 2.79 | (6.9 | )% | |||

| Average Length of Haul (miles) | 1,946 | 1,907 | 2.0 | % | 1,952 | (0.3 | )% | |||

| Average Stage Length (miles) | 1,267 | 1,238 | 2.4 | % | 1,253 | 1.2 | % | |||

| Departures | 37,478 | 35,468 | 5.7 | % | 36,313 | 3.2 | % | |||

| Block Hours | 120,975 | 112,114 | 7.9 | % | 116,062 | 4.2 | % | |||

| Average Aircraft Utilization (hours) | 12.0 | 11.9 | 0.1 | % | 11.9 | 0.9 | % | |||

| Operating Revenues (US$ millions) | 854.7 | 867.7 | (1.5 | )% | 819.4 | 4.3 | % | |||

| Operating Profit (Loss) (US$ millions) | 173.7 | 205.0 | (15.3 | )% | 159.5 | 8.9 | % | |||

| Operating Margin | 20.3 | % | 23.6 | % | -3.3 | p.p | 19.5 | % | 0.9 | p.p |

| Net Profit (Loss) (US$ millions) | 146.0 | 187.4 | (22.1 | )% | 120.3 | 21.4 | % | |||

| Adjusted Net Profit (Loss) (US$ millions) (1) | 146.0 | 174.4 | (16.3 | )% | 120.3 | 21.4 | % | |||

| Basic EPS (US$) | 3.50 | 4.72 | (25.8 | )% | 2.88 | 21.4 | % | |||

| Adjusted Basic EPS (US$) (1) | 3.50 | 4.39 | (20.3 | )% | 2.88 | 21.4 | % | |||

| Shares for calculation of Basic EPS (000s) | 41,728 | 39,730 | 5.0 | % | 41,715 | — | % | |||

(1) Excludes Special Items. This earnings release includes a reconciliation of non-IFRS financial measures to the comparable IFRS measures.

FULL 3Q24 EARNINGS RELEASE AVAILABLE FOR DOWNLOAD AT:

https://copa.gcs-web.com/financial-information/quarterly-results

3Q24 EARNINGS RESULTS CONFERENCE CALL AND WEBCAST

About Copa Holdings

Copa Holdings is a leading Latin American provider of passenger and cargo services. The Company, through its operating subsidiaries, provides service to countries in North, Central, and South America and the Caribbean. For more information visit: www.copaair.com.

CONTACT: Copa Holdings S.A.

Investor Relations:

Ph: 011 507 304-2774

www.copaair.com (IR section)

This release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on current plans, estimates, and expectations, and are not guarantees of future performance. They are based on management’s expectations that involve several business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statement. The risks and uncertainties relating to the forward-looking statements in this release are among those disclosed in Copa Holdings’ filed disclosure documents and are, therefore, subject to change without prior notice.

CPA-G

Copa Holdings, S. A. and Subsidiaries

Consolidated statement of profit or loss

(In US$ thousands)

| Unaudited | Unaudited | % | Unaudited | % | |||||||||

| 3Q24 | 3Q23 | Change | 2Q24 | Change | |||||||||

| Operating Revenues | |||||||||||||

| Passenger revenue | 818,381 | 833,306 | (1.8 | %) | 781,497 | 4.7 | % | ||||||

| Cargo and mail revenue | 24,446 | 23,431 | 4.3 | % | 25,184 | (2.9 | %) | ||||||

| Other operating revenue | 11,881 | 10,973 | 8.3 | % | 12,722 | (6.6 | %) | ||||||

| Total Operating Revenue | 854,708 | 867,711 | (1.5 | %) | 819,403 | 4.3 | % | ||||||

| Operating Expenses | |||||||||||||

| Fuel | 238,714 | 252,077 | (5.3 | %) | 246,011 | (3.0 | %) | ||||||

| Wages, salaries, benefits and other employees’ expenses | 117,877 | 108,416 | 8.7 | % | 114,878 | 2.6 | % | ||||||

| Passenger servicing | 26,232 | 23,147 | 13.3 | % | 27,579 | (4.9 | %) | ||||||

| Airport facilities and handling charges | 65,029 | 58,243 | 11.7 | % | 62,768 | 3.6 | % | ||||||

| Sales and distribution | 49,716 | 54,058 | (8.0 | %) | 52,210 | (4.8 | %) | ||||||

| Maintenance, materials and repairs | 34,860 | 29,528 | 18.1 | % | 10,883 | 220.3 | % | ||||||

| Depreciation and amortization | 82,797 | 78,359 | 5.7 | % | 79,462 | 4.2 | % | ||||||

| Flight operations | 31,901 | 29,476 | 8.2 | % | 31,914 | — | % | ||||||

| Other operating and administrative expenses | 33,871 | 29,394 | 15.2 | % | 34,190 | (0.9 | %) | ||||||

| Total Operating Expense | 680,998 | 662,697 | 2.8 | % | 659,896 | 3.2 | % | ||||||

| Operating Profit/(Loss) | 173,710 | 205,014 | (15.3 | %) | 159,507 | 8.9 | % | ||||||

| Non-operating Income (Expense): | |||||||||||||

| Finance cost | (23,523 | ) | (82,926 | ) | (71.6 | %) | (20,632 | ) | 14.0 | % | |||

| Finance income | 15,565 | 15,108 | 3.0 | % | 13,537 | 15.0 | % | ||||||

| Gain (loss) on foreign currency fluctuations | (2,491 | ) | (1,566 | ) | 59.1 | % | (16,097 | ) | (84.5 | %) | |||

| Net change in fair value of derivatives | (762 | ) | 77,058 | (101.0 | %) | 2,533 | (130.1 | %) | |||||

| Other non-operating income (expense) | 6,787 | 1,867 | 263.6 | % | 1,766 | 284.4 | % | ||||||

| Total Non-Operating Income/(Expense) | (4,425 | ) | 9,540 | (146.4 | %) | (18,892 | ) | (76.6 | %) | ||||

| Profit before taxes | 169,285 | 214,555 | (21.1 | %) | 140,615 | 20.4 | % | ||||||

| Income tax expense | (23,259 | ) | (27,179 | ) | (14.4 | %) | (20,362 | ) | 14.2 | % | |||

| Net Profit/(Loss) | 146,026 | 187,375 | (22.1 | %) | 120,253 | 21.4 | % | ||||||

Copa Holdings, S. A. and Subsidiaries

Consolidated statement of financial position

(In US$ thousands)

| September 2024 | December 2023 | |||||

| ASSETS | (Unaudited) | (Audited) | ||||

| Cash and cash equivalents | 275,245 | 206,375 | ||||

| Short-term investments | 758,560 | 708,809 | ||||

| Total cash, cash equivalents and short-term investments | 1,033,805 | 915,184 | ||||

| Accounts receivable, net | 201,327 | 156,720 | ||||

| Accounts receivable from related parties | 2,782 | 2,527 | ||||

| Expendable parts and supplies, net | 123,571 | 116,604 | ||||

| Prepaid expenses | 40,422 | 44,635 | ||||

| Prepaid income tax | 5,802 | 66 | ||||

| Other current assets | 23,708 | 32,227 | ||||

| 397,612 | 352,780 | |||||

| TOTAL CURRENT ASSETS | 1,431,416 | 1,267,963 | ||||

| Long-term investments | 219,731 | 258,934 | ||||

| Long-term prepaid expenses | 8,849 | 9,633 | ||||

| Property and equipment, net | 3,363,353 | 3,238,632 | ||||

| Right of use assets | 337,684 | 281,146 | ||||

| Intangible, net | 94,097 | 87,986 | ||||

| Net defined benefit assets | 6,442 | 5,346 | ||||

| Deferred tax assets | 22,729 | 30,148 | ||||

| Other Non-Current Assets | 24,053 | 17,048 | ||||

| TOTAL NON-CURRENT ASSETS | 4,076,938 | 3,928,872 | ||||

| TOTAL ASSETS | 5,508,354 | 5,196,836 | ||||

| LIABILITIES | ||||||

| Loans and borrowings | 205,144 | 222,430 | ||||

| Current portion of lease liability | 59,779 | 68,304 | ||||

| Accounts payable | 175,443 | 182,303 | ||||

| Accounts payable to related parties | 1,312 | 1,228 | ||||

| Air traffic liability | 639,211 | 611,856 | ||||

| Frequent flyer deferred revenue | 136,520 | 124,815 | ||||

| Taxes Payable | 41,535 | 44,210 | ||||

| Accrued expenses payable | 50,085 | 64,940 | ||||

| Income tax payable | 7,331 | 26,741 | ||||

| Other Current Liabilities | 1,320 | 1,403 | ||||

| TOTAL CURRENT LIABILITIES | 1,317,680 | 1,348,229 | ||||

| Loans and borrowings long-term | 1,298,106 | 1,240,261 | ||||

| Lease Liability | 295,777 | 215,353 | ||||

| Deferred tax Liabilities | 57,297 | 36,369 | ||||

| Other long-term liabilities | 223,541 | 234,474 | ||||

| TOTAL NON-CURRENT LIABILITIES | 1,874,721 | 1,726,457 | ||||

| TOTAL LIABILITIES | 3,192,400 | 3,074,685 | ||||

| EQUITY | ||||||

| Class A – 34,195,954 issued and 30,654,831 outstanding | 23,244 | 23,201 | ||||

| Class B – 10,938,125 | 7,466 | 7,466 | ||||

| Additional Paid-In Capital | 212,877 | 209,102 | ||||

| Treasury Stock | (254,532 | ) | (204,130 | ) | ||

| Retained Earnings | 1,893,880 | 1,581,739 | ||||

| Net profit | 442,345 | 514,098 | ||||

| Other comprehensive loss | (9,326 | ) | (9,326 | ) | ||

| TOTAL EQUITY | 2,315,953 | 2,122,150 | ||||

| TOTAL EQUITY LIABILITIES | 5,508,354 | 5,196,836 | ||||

Copa Holdings, S. A. and Subsidiaries

Consolidated statement of cash flows

For the nine months ended

(In US$ thousands)

| 2024 | 2023 | 2022 | |||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | |||||||||

| Cash flow from operating activities | 659,392 | 764,586 | 543,471 | ||||||||

| Cash flow (used in) investing activities | (322,575 | ) | (274,166 | ) | (387,334 | ) | |||||

| Cash flow (used in) financing activities | (267,947 | ) | (375,966 | ) | (168,474 | ) | |||||

| Netincrease (decrease)in cash and cash equivalents | 68,870 | 114,454 | (12,337 | ) | |||||||

| Cash and cash equivalents on January 1 | 206,375 | 122,424 | 211,081 | ||||||||

| Cash and cash equivalents at September 30 | $ | 275,245 | $ | 236,878 | $ | 198,744 | |||||

| Short-term investments | 758,560 | 754,799 | 752,812 | ||||||||

| Long-term investments | 219,731 | 177,835 | 168,114 | ||||||||

| Total cash and cash equivalents and investments at September 30 | $ | 1,253,536 | $ | 1,169,512 | $ | 1,119,670 | |||||

Copa Holdings, S.A.

NON-IFRS FINANCIAL MEASURE RECONCILIATION

This press release includes the following non-IFRS financial measures: Adjusted Net Profit, Adjusted Basic EPS, and Operating CASM Excluding Fuel. This supplemental information is presented because we believe it is a useful indicator of our operating performance and is useful in comparing our performance with other companies in the airline industry. These measures should not be considered in isolation and should be considered together with comparable IFRS measures, in particular operating profit, and net profit. The following is a reconciliation of these non-IFRS financial measures to the comparable IFRS measures:

| Reconciliation of Adjusted Net Profit | 3Q24 | 3Q23 | 2Q24 | ||||||||

| Net Profit as Reported | $ | 146,026 | $ | 187,375 | $ | 120,253 | |||||

| Interest expense related to the settlement of the convertible notes | $ | — | $ | 64,894 | $ | — | |||||

| Net change in fair value of derivatives | $ | — | $ | (77,058 | ) | $ | — | ||||

| Net change in fair value of financial investments | $ | — | $ | (810 | ) | $ | — | ||||

| Adjusted Net Profit | $ | 146,026 | $ | 174,401 | $ | 120,253 | |||||

| Reconciliation of Adjusted Basic EPS | 3Q24 | 3Q23 | 2Q24 | ||||||||

| Adjusted Net Profit | $ | 146,026 | $ | 174,401 | $ | 120,253 | |||||

| Shares used for calculation of Basic EPS | 41,728 | 39,730 | 41,715 | ||||||||

| Adjusted Basic Earnings per share (Adjusted Basic EPS) | $ | 3.50 | $ | 4.39 | $ | 2.88 | |||||

| Reconciliation of Operating Costs per ASM | |||||||||||

| Excluding Fuel (CASM Excl. Fuel) | 3Q24 | 3Q23 | 2Q24 | ||||||||

| Operating Costs per ASM as Reported (in US$ Cents) | 8.7 | 9.3 | 8.9 | ||||||||

| Aircraft Fuel Cost per ASM (in US$ Cents) | 3.1 | 3.5 | 3.3 | ||||||||

| Operating Costs per ASM excluding fuel (in US$ Cents) | 5.7 | 5.8 | 5.6 | ||||||||

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pfizer Unusual Options Activity For November 20

Whales with a lot of money to spend have taken a noticeably bearish stance on Pfizer.

Looking at options history for Pfizer PFE we detected 40 trades.

If we consider the specifics of each trade, it is accurate to state that 35% of the investors opened trades with bullish expectations and 52% with bearish.

From the overall spotted trades, 18 are puts, for a total amount of $881,278 and 22, calls, for a total amount of $1,564,167.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $30.0 for Pfizer over the last 3 months.

Insights into Volume & Open Interest

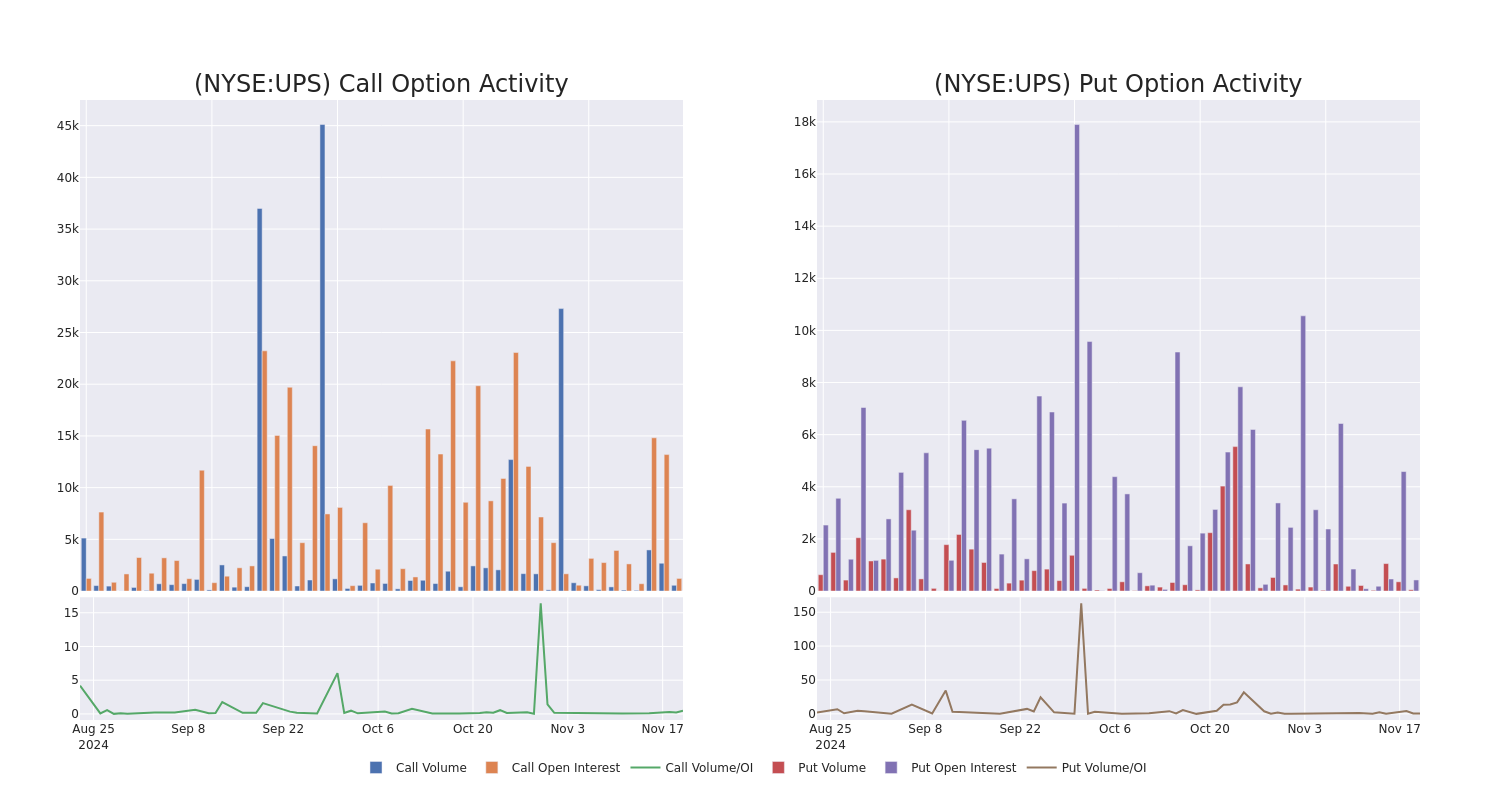

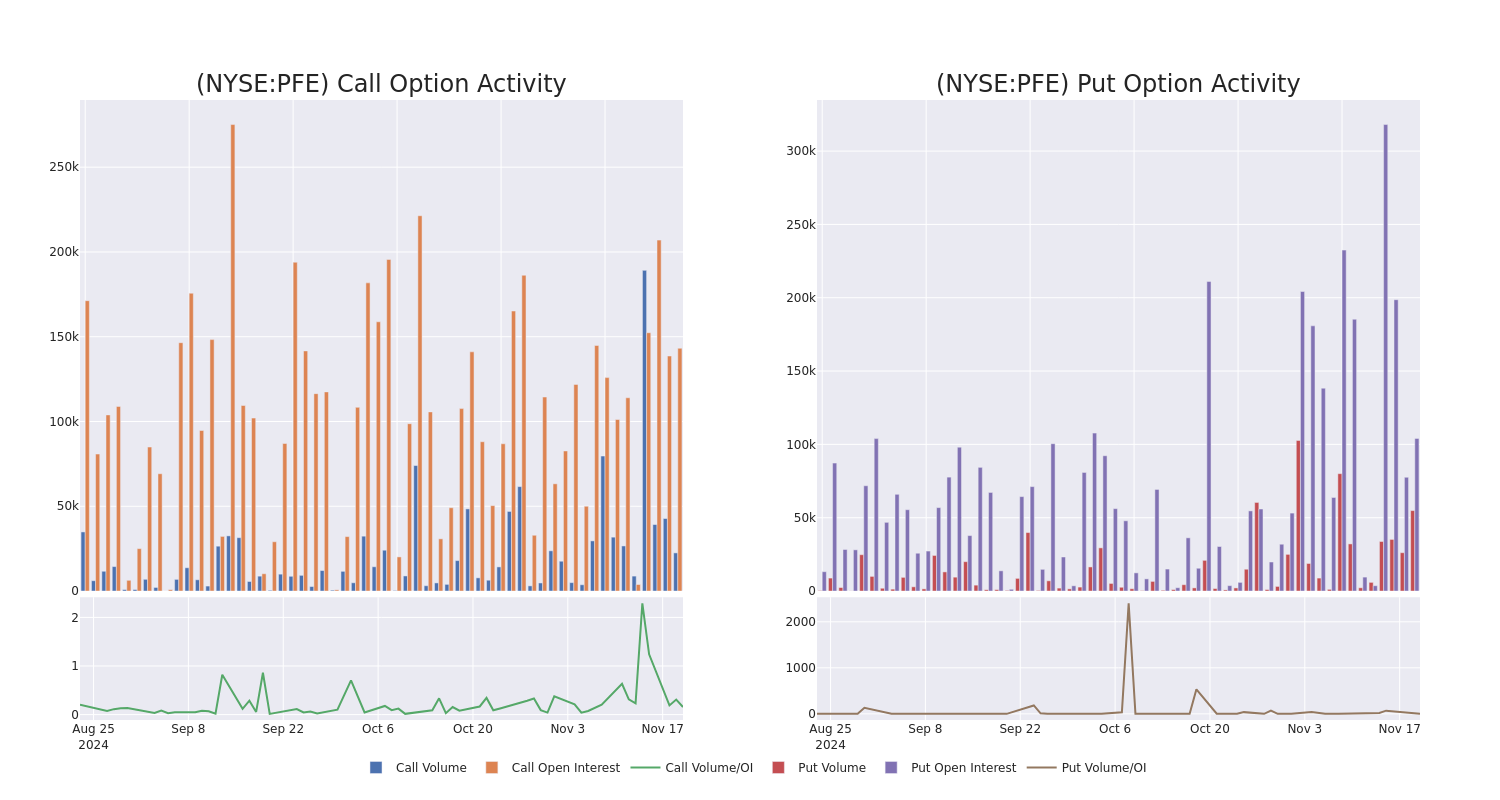

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Pfizer’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Pfizer’s significant trades, within a strike price range of $20.0 to $30.0, over the past month.

Pfizer Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PFE | CALL | SWEEP | BEARISH | 12/20/24 | $0.82 | $0.81 | $0.81 | $25.00 | $212.4K | 29.7K | 1.1K |

| PFE | CALL | SWEEP | BEARISH | 01/16/26 | $1.23 | $1.15 | $1.15 | $30.00 | $170.4K | 60.2K | 3.0K |

| PFE | PUT | SWEEP | BEARISH | 11/29/24 | $0.41 | $0.41 | $0.41 | $25.00 | $151.4K | 6.0K | 3.7K |

| PFE | CALL | TRADE | NEUTRAL | 06/20/25 | $0.77 | $0.65 | $0.7 | $29.00 | $140.0K | 1.7K | 2.0K |

| PFE | CALL | SWEEP | BULLISH | 05/16/25 | $4.55 | $4.45 | $4.55 | $21.00 | $130.1K | 92 | 287 |

About Pfizer

Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding covid-19-related product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

After a thorough review of the options trading surrounding Pfizer, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Pfizer

- Trading volume stands at 34,661,607, with PFE’s price down by -0.89%, positioned at $24.88.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 69 days.

What The Experts Say On Pfizer

In the last month, 3 experts released ratings on this stock with an average target price of $38.333333333333336.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

* In a cautious move, an analyst from Wolfe Research downgraded its rating to Underperform, setting a price target of $25.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $45.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Pfizer options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The U.S. Cannabis Strategy No One's Talking About: Inside Canopy's $300M Plan

Canopy Growth Corporation‘s CGC strategy for capturing the U.S. cannabis market was the focal point of a recent fireside chat hosted by Zuanic & Associates. CEO David Klein and CFO Judy Hong provided insights into Canopy USA’s (CUSA) growth strategy, financial projections and its significance for investors navigating the evolving cannabis industry.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Unique Structure For U.S. Expansion

CUSA’s innovative structure is designed to comply with NASDAQ and SEC regulations while preparing for potential federal cannabis reform. “The structure allows us to keep Canopy Growth compliant while positioning CUSA to grow independently in the U.S.,” Klein said.

This arrangement prevents Canopy Growth from directly financing CUSA but allows for co-investments alongside third-party investors when necessary. Additionally, Canopy Growth holds a beneficial interest in CUSA through exchangeable shares, which can be converted into voting shares once regulatory conditions permit.

Hong revealed CUSA’s long-term potential, noting it could generate up to $300 million in revenue annually with EBITDA margins of approximately 20%. She emphasized the importance of maintaining operational independence until a “federal permissibility event” allows for broader integration.

TerrAscend And Acreage: Growth Potential In Key States

Canopy Growth’s U.S. footprint includes significant stakes in key cannabis brands:

- 100% ownership of Wana and Acreage Holdings upon Acreage’s acquisition closure in 2025.

- 77% stake in Jetty.

- 21% beneficial interest in TerrAscend, subject to the full exercise of warrants and exchangeable shares.

TerrAscend TSNDF supports Wana’s operations in Maryland and New Jersey, generating mutual benefits for both companies. Meanwhile, Acreage is actively expanding in Ohio, where it operates five dispensaries and holds licenses for three more.

“Acreage’s transition to a wholly owned subsidiary will improve efficiency and enable cost savings,” Hong said, adding that these changes position Acreage to better compete in states like New Jersey, Illinois, and Ohio, where adult-use markets are booming.

Read Also: TerrAscend Expands Footprint Despite Q3 Losses, Can A Move To Ohio Turn The Tide?

Global Success And Local Challenges

Canopy Growth’s influence extends beyond the U.S., with strong performance in international markets. Germany, for instance, imported 20 tons of cannabis in Q3, up from 7 tons in Q1, driven by Canadian exporters like Canopy.

Domestically, CUSA is addressing challenges in mature markets such as Colorado, where price compression and competition have intensified. Wana has proactively adjusted its supply chain to lower costs, while Jetty’s focus on solventless extraction has solidified its reputation in California and Colorado.

Brand Synergies And Market Penetration

Collaboration between CUSA’s brands is a cornerstone of its strategy. Wana and Jetty have begun joint marketing efforts in New York and Colorado, leveraging a consumer packaged goods (CPG) approach to cannabis sales.

“Collaboration between Wana and Jetty is already yielding results,” Klein noted, with plans to further integrate operations once Acreage Holdings is acquired. Wana’s expansion into non-dispensary channels such as liquor stores has also helped broaden its consumer base, particularly with its hemp-derived product line.

Investor Perception And Market Positioning

Despite its strategic advancements, Canopy Growth faces challenges in convincing the market of CUSA’s value. “It’s a real business generating revenue daily, but the complexity of our structure sometimes overshadows its value,” Klein acknowledged.

Hong added that audited financial statements for CUSA expected in 2025 will provide much-needed transparency. “This should make it easier for investors to understand CUSA’s role within the broader Canopy Growth story,” she explained.

Investor Takeaways

CUSA offers investors exposure to the U.S. cannabis market without direct regulatory risk. Its portfolio, including brands like Wana and Jetty and its strategic collaborations with TerrAscend, position Canopy Growth to capitalize on evolving market opportunities.

Read Next: Canopy Growth: Q2 Net Revenue Drops 9% YoY, Projects Positive Earnings Ahead

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Options Exercise: Ashok Mishra At Innodata Realizes $6.32M

A large exercise of company stock options by Ashok Mishra, EVP and COO at Innodata INOD was disclosed in a new SEC filing on November 19, as part of an insider exercise.

What Happened: Disclosed in a Form 4 filing on Tuesday with the U.S. Securities and Exchange Commission, Mishra, EVP and COO at Innodata, executed a strategic derivative sale. This involved exercising stock options for 142,726 shares of INOD, resulting in a transaction value of $6,317,052.

The Wednesday morning market activity shows Innodata shares up by 1.45%, trading at $45.33. This implies a total value of $6,317,052 for Mishra’s 142,726 shares.

All You Need to Know About Innodata

Innodata Inc is a digital services and solutions company. It provides technology and services to information products and online retail destinations. The company has three operating segments: Digital data solutions, Synodex, and Agility. It serves publishers, media and information companies, digital retailers, banks, insurance companies, government agencies, and other industries. Geographically, it operates in the United States, United Kingdom, Netherlands, Canada, and Europe.

Breaking Down Innodata’s Financial Performance

Revenue Growth: Innodata’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 135.57%. This signifies a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Analyzing Profitability Metrics:

-

Gross Margin: Achieving a high gross margin of 40.85%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Innodata’s EPS is below the industry average. The company faced challenges with a current EPS of 0.6. This suggests a potential decline in earnings.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.1.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 73.25 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 10.46 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 62.16 positions the company as being more valued compared to industry benchmarks.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Innodata’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fly-E Group Announces Second Quarter and First Half of Fiscal Year 2025 Financial Results

NEW YORK, Nov. 20, 2024 /PRNewswire/ — Fly-E Group, Inc. FLYE (“Fly-E” or the “Company”), an electric vehicle company engaged in designing, installing and selling smart electric motorcycles, electric bikes, electric scooters, and related accessories, today announced its unaudited financial results for the second quarter and first half of fiscal year 2025 ended September 30, 2024.

Selected Second Quarter Financial Results

- Revenue: $6.8 million, compared with $8.8 million in Q2 2023.

- Gross profit: $2.9 million, compared with $3.8 million in Q2 2023.

- Total operating expense: $4.1 million, compared with $2.7 million in Q2 2023.

- Net loss: $1.1 million, or $0.05 per share, compared with net income of $0.7 million, or $0.03 per share, in Q2 2023.

Mr. Zhou (Andy) Ou, Chairman and Chief Executive Officer of Fly-E, remarked, “Despite recent market challenges, we remain committed to driving growth and expanding our market presence. In the second quarter of fiscal year 2025, we held a stable gross margin above 40%, even as operating expenses increased with our efforts to add e-bike rental business. For the first half of fiscal 2025, our gross margin improved to 40.9%, up from 39.0% last year, reflecting disciplined cost management and a commitment to profitability. While we saw a dip in revenue due to external factors, these stable margins underscore the effectiveness of our approach.

On the product and market side, we’re energized by the success of our recent initiatives. At October’s Electrify Expo in New York, our product lineup— featuring 11 models spanning e-bikes, e-motorcycles, and e-scooters, with three newly launched models in the e-motorcycles—drew strong interest and received highly positive feedback. Additionally, the launch of our e-bike Rental Service offers customers a flexible, affordable way to experience our products and positions us well to meet shifting consumer needs. As part of our growth strategy, we’re expanding into key markets like Miami, Los Angeles and Toronto and broaden our presence . On the technological front, we are leveraging innovation to enhance customer convenience, including ongoing development of our mobile apps designed to streamline user experiences and provide more features for our customers. Our involvement in New York City’s Trade-in Program for e-bikes and batteries is aligned with our commitment to setting high safety standards in the electric vehicle industry, helping provide UL-certified e-bikes for delivery workers. Moving forward, our dedication to innovation, safety, and superior customer experience is expected to continue to drive growth and enhance value for our shareholders.”

Second Quarter of Fiscal Year 2025 Financial Results

Net revenues were $6.8 million for the second quarter of fiscal year 2025, a decrease of 22.1%, from $8.8 million for the same period last year. The decrease in net revenues was primarily due to the decrease in sales volume by 5,850 units, from 20,906 units for the same period last year to 15,056 units for the second quarter of fiscal year 2025.

Retail sales revenue was $5.9 million for the second quarter of fiscal year 2025, a decrease of 12.5%, from $6.8 million for the same period last year. Wholesale revenue was $0.9 million for the second quarter of fiscal year 2025, a decrease of 54.8% from $2.0 million for the same period last year. The decrease in retail sales revenue is mainly due to recent lithium battery accidents involving E-Bikes and E-Scooters. With an increasing number of lithium-battery explosion incidents in New York, customers are less inclined to purchase E-Bikes. Consequently, the management believes that sales have declined as customers opt for oil-powered vehicles over electric vehicles. The decrease in wholesales revenue was driven primarily by the decrease in orders from the top two customers who closed their stores.

Cost of Revenues

Cost of revenues was $3.9 million for the second quarter of fiscal year 2025, a decrease of 21.6%, from $5.0 million for the same period last year. The decrease in cost of revenues was primarily attributable to a reduction in units sold, which declined by 5,850 units, to 15,056 units for the second quarter of fiscal year 2025 from 20,906 units for the same period last year.

Gross Profit

Gross profit was $2.9 million for the second quarter of fiscal year 2025, a decrease of 22.8%, from $3.8 million for the same period last year. Gross margin was 42.6% for the second quarter of fiscal year 2025, compared to 42.9% for the same period last year.

Total Operating Expenses

Total operating expenses were $4.1 million for the second quarter of fiscal year 2025, an increase of 54.5%, from $2.7 million for the same period last year. The increase in operating expenses was attributable to the increase in payroll expenses, rent expenses, advertising expenses, professional fees, and insurance expenses as the Company expanded its business.

- Selling expenses were $2.0 million for the second quarter of fiscal year 2025, compared to $1.6 million for the same period last year. Selling expenses primarily consist of payroll expenses, rent, utilities expenses, and advertising expenses of retail stores. Total payroll expenses were $0.9 million for the second quarter of fiscal year 2025, compared to $0.4 million for the same period last year. Rent expenses were $0.8 million for the second quarter of fiscal year 2025, compared to $0.6 million for the same period last year. Advertising expenses were $0.1 million for the second quarter of fiscal year 2025, compared to $14,339 for the same period last year. The increase in these expenses was primarily due to the increased number of new employees hired for repair and maintenance business operation in the second quarter of fiscal year 2025.

- General and administrative expenses were $2.1 million for the second quarter of fiscal year 2025, compared to $1.1 million for the same period last year. Professional fees increased to $0.9 million for the second quarter of fiscal year 2025, compared to $0.3 million for the same period last year, primarily attributable to the increase in audit fee, consulting fee, legal fee and IR expenses associated with ongoing reporting obligations. Payroll expenses increased to $0.4 million for the second quarter of fiscal year 2025 from $0.2 million for the same period last year primarily due to additional employees hired in operation departments. Insurance expenses increased to $0.3 million for the second quarter of fiscal year 2025, compared to $24,570 for the same quarter of prior year as a result of purchase of the directors and officers liability insurance after initial public offering in the second quarter of fiscal year 2025.

Net Income (Loss)

Net loss was $1.1 million for the second quarter of fiscal year 2025, compared to net income of $0.7 million for the same period last year.

Basic and Diluted Earnings (Losses) per Share

Basic and diluted losses per share were $0.05 for the second quarter of fiscal year 2025, compared to basic and diluted earnings per share of $0.03 for the same period last year.

EBITDA

EBITDA was negative $1.2 million for the second quarter of fiscal year 2025, compared to positive EBITDA of $1.3 million for the same period last year.

First Half of Fiscal Year 2025 Financial Results

Net Revenues

Net revenues were $14.7 million for the first half of fiscal year 2025, a decrease of 11.5%, from $16.6 million for the same period last year. The decrease in net revenues was driven primarily by a decrease in total units sold, which decreased by 4,067 units, to 31,936 units for the first half of fiscal year 2025 from 36,003 units for the same period last year. For the six months ended September 30, 2023 and for the six months ended September 30, 2024, the quantity of E-bikes and batteries sold decreased by 2,963 and 2,624, respectively.

Retail sales revenue was $12.8 million for the first half of fiscal year 2025, a decrease of 1.1%, from $12.9 million for the same period last year. Wholesale revenue was $1.9 million for the first half of fiscal year 2025, a decrease of 48.1% to $3.7 million for the same period last year. The decrease in retail sales revenue is mainly due to recent lithium-battery accidents involving E-Bikes and E-Scooters. With an increasing number of lithium-battery explosion incidents in New York, customers are less inclined to purchase E-Bikes. Consequently, sales have declined as customers opt for oil-powered vehicles over electric vehicles. The decrease in wholesales revenue was driven primarily by the closure of stores by the top two customers who closed their stores in December 2023 due to lack of profitability.

Cost of Revenues

Cost of revenues was $8.7 million for the for the first half of fiscal year 2025, a decrease of 14.1%, from $10.1 million for the same period last year. The decrease in cost of revenues was primarily attributable to more favorable pricing the Company obtained from its suppliers, particularly for batteries, as well as a reduction in battery sales volume. These factors collectively contributed to the overall decrease in cost of revenues. The unit cost for battery decreased 36%, to $75 in the first half of fiscal year 2025 from $117 in the same period last year.

Gross Profit

Gross profit was $6.0 million for the first half of fiscal year 2025, a decrease of 7.4%, from $6.5 million for the same period last year. Gross margin was 40.9% for the first half of fiscal year 2025, increased from 39.0% for the same period last year.

Total Operating Expenses

Total operating expenses were $7.3 million for the first half of fiscal year 2025, an increase of 57.2%, from $4.6 million for the same period last year. The increase in operating expenses was attributable to the increase in payroll expenses, rent expenses, meals and entertainment expenses, professional fees, and development expenses as the Company expanded business.

- Selling expenses were $3.7 million for the first half of fiscal year 2025, compared to $2.7 million for the same period last year. Selling expenses primarily consist of payroll expenses, rent, utilities expenses, and advertising expenses of retail stores. Total payroll expenses were $1.5 million for the first half of fiscal year 2025, compared to $0.8 million for the same period last year. Rent expenses were $1.5 million for the first half of fiscal year 2025, compared to $1.1 million for the same period last year. Utilities expenses were $119,252 for the first half of fiscal year 2025, compared to $68,863 for the same period last year. Advertising expenses were $0.2 million for the first half of fiscal year 2025, compared to $26,066 for the same period last year. The increase in these expenses was primarily due to the increase number of new employees hired for business operating in the first half of fiscal year 2025.

- General and administrative expenses were $3.6 million for the first half of fiscal year 2025, compared to $1.9 million for the same period last year. Professional fees increased to $1.3 million for the first half of fiscal year 2025, compared to $0.5 million for the same period last year, primarily attributable to the increase in audit fee, consulting fee, legal fee and IR expenses associated with the Company’s initial public offering and ongoing reporting obligations. Payroll expenses increased to $0.8 million for the first half of fiscal year 2025, from $0.4 million for the same period las year primarily due to additional employees hired in operation and accounting departments. Insurance expenses increased to $0.5 million for the first half of fiscal year 2025, compared to $0.1 million for the same period of prior year as a result of purchase of directors and officers liability insurance after initial public offering in the first half of fiscal year 2025. Software development fee increase to $0.3 million for the first half of fiscal year 2025, compared to $0.1 million for the same period last year as a result of maintenance for Fly E-Bike app during the first half of fiscal year 2025.

Net Income (Loss)

Net loss was $1.3 million for the first half of fiscal year 2025, compared to net income of $1.2 million for the same period last year.

Basic and Diluted Earnings (Losses) per Share

Basic and diluted losses per share were $0.06 for the first half of fiscal year 2025, compared to basic and diluted earnings per share of $0.05 for the same period last year.

EBITDA

EBITDA was negative $1.1 million for the first half of fiscal year 2025, compared to positive EBITDA of $2.1 million for the same period last year.

Financial Condition

As of September 30, 2024, the Company had cash of $1.3 million.

Net cash used in operating activities was $9.4 million for the first half of fiscal year 2025, compared to net cash provided by operating activities of $1.6 million for the same period last year.

Net cash used in investing activities was $2.8 million for the first half of fiscal year 2025, compared to $0.5 million for the same period last year.

Net cash provided by financing activities was $12.1 million for the first half of fiscal year 2025, compared to net cash used in financing activities of $0.3 million for the same period last year.

Business Update

At the Electrify Expo in New York, a leading event in the micromobility industry held from October 12 to 13, 2024, the Company showcased its full product lineup, featuring 11 models, including e-bikes, e-motorcycles, and e-scooters. Among the highlights were three newly launched e-motorcycle models: the DT, designed for off-road adventures; the EK, offering a balanced mix of stability and efficiency; and the DP, delivering a powerful and exhilarating riding experience.

Over the two-day event, Fly-E captivated more than 10,000 attendees, facilitating over 1,500 successful test rides and receiving overwhelmingly positive feedback. With four dedicated booths and meticulous preparation, the Company’s offerings attracted a diverse audience, ranging from couples and families to young professionals. Many attendees expressed interest in visiting the Company’s New York stores in Queens, Manhattan, Bronx, and Brooklyn for further exploration and in-store shopping.

As part of its growth strategy, Fly-E is committed to prioritizing eco-friendly innovation and enhancing user experience in its product development. Leveraging insights gained from the event, the Company plans to refine its offerings and expand its market presence.

About Fly-E Group, Inc.

Fly-E Group, Inc. is an electric vehicle company that is principally engaged in designing, installing and selling smart electric motorcycles, electric bikes, electric scooters and related accessories under the brand “Fly E-Bike.” The Company’s commitment is to encourage people to incorporate eco-friendly transportation into their active lifestyles, ultimately contributing towards building a more environmentally friendly future. For more information, please visit the Company’s website: https://investors.flyebike.com.

Non-GAAP Financial Measures

To supplement the Company’s financial information presented in accordance with the generally accepted accounting principles in the United States (the “U.S. GAAP”), management periodically uses certain “non-GAAP financial measures,” as such term is defined under the rules of the SEC, to clarify and enhance understanding of past performance and prospects for the future. Generally, a non-GAAP financial measure is a numerical measure of a company’s operating performance, financial position or cash flows that excludes or includes amounts that are included in or excluded from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. For example, non-GAAP measures may exclude the impact of certain items such as acquisitions, divestitures, gains, losses and impairments, or items outside of management’s control. Management believes that the following non-GAAP financial measure provides investors and analysts useful insight into its financial position and operating performance. Any non-GAAP measure provided should be viewed in addition to, and not as an alternative to, the most directly comparable measure determined in accordance with U.S. GAAP. Further, the calculation of these non-GAAP financial measures may differ from the calculation of similarly titled financial measures presented by other companies and therefore may not be comparable among companies.

The Company uses EBITDA (earnings before interest, taxes, depreciation, and amortization) to evaluate its operating performance. The Company believes EBITDA provides additional insight into its underlying, ongoing operating performance and facilitates year-to-year comparisons by excluding the earnings impact of interest, tax, depreciation and amortization and that presenting EBITDA is more representative of its operational performance and may be more useful for investors.

The Company reconciles its non-GAAP financial measure to its net income, which is its most directly comparable financial measure calculated and presented in accordance with U.S. GAAP. EBITDA includes adjustments for provision for income taxes, as applicable, interest income and expense, depreciation, and amortization. EBITDA does not represent and should not be considered an alternative to net income as determined by U.S. GAAP, and its calculations thereof may not be comparable to those reported by other companies. The Company believes EBITDA is an important measure of operating performance and provides useful information to investors because it highlights trends in its business that may not otherwise be apparent when relying solely on U.S. GAAP measures and because it eliminates items that have less bearing on its operating performance. EBITDA, as presented herein, is a supplemental measure of its performance that is not required by, or presented in accordance with, U.S. GAAP. The Company uses non-GAAP financial measures as supplements to its U.S. GAAP results in order to provide a more complete understanding of the factors and trends affecting its business. EBITDA is a measure of operating performance that is not defined by U.S. GAAP and should not be considered a substitute for net (loss) income as determined in accordance with U.S. GAAP.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct. The Company cautions investors that actual results may differ materially from the anticipated results, and that the forward-looking statements contained in this press release are subject to the risks set forth in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including the section under “Risk Factors” of its most recent Annual Report on Form 10-K for the fiscal year ended March 21, 2024, filed with the SEC on June 28, 2024. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law.

For investor and media inquiries, please contact:

Fly-E Group, Inc.

Investor Relations Department

Email: ir@flyebike.com

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: investors@ascent-ir.com

|

FLY-E GROUP, INC. |

||||||||

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||

|

(Expressed in U.S. dollars, except for the number of shares) |

||||||||

|

September 30, |

March 31, |

|||||||

|

ASSETS |

||||||||

|

Current Assets |

||||||||

|

Cash |

$ |

1,274,935 |

$ |

1,403,514 |

||||

|

Accounts receivable |

366,838 |

212,804 |

||||||

|

Accounts receivable – related parties |

91,885 |

326,914 |

||||||

|

Inventories, net |

8,596,108 |

5,364,060 |

||||||

|

Prepayments and other receivables |

2,453,340 |

588,660 |

||||||

|

Prepayments and other receivables – related parties |

387,808 |

240,256 |

||||||

|

Total Current Assets |

13,170,914 |

8,136,208 |

||||||

|

Property and equipment, net |

6,644,717 |

1,755,022 |

||||||

|

Security deposits |

837,179 |

781,581 |

||||||

|

Deferred IPO costs |

– |

502,198 |

||||||

|

Deferred tax assets, net |

497,939 |

35,199 |

||||||

|

Operating lease right-of-use assets |

15,438,347 |

16,000,742 |

||||||

|

Intangible assets, net |

527,538 |

36,384 |

||||||

|

Long-term prepayment for property |

– |

450,000 |

||||||

|

Long-term prepayment for software development– related parties |

1,055,980 |

1,279,000 |

||||||

|

Total Assets |

$ |

38,172,614 |

$ |

28,976,334 |

||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

|

Current Liabilities |

||||||||

|

Accounts payable |

$ |

365,129 |

$ |

1,180,796 |

||||

|

Short-term loan payables |

4,909,982 |

– |

||||||

|

Current portion of long-term loan payables |

90,809 |

1,213,242 |

||||||

|

Short term mortgage loan payables |

1,800,000 |

– |

||||||

|

Accrued expenses and other payables |

545,206 |

925,389 |

||||||

|

Other payables – related parties |

– |

92,229 |

||||||

|

Operating lease liabilities – current |

3,149,827 |

2,852,744 |

||||||

|

Taxes payable |

– |

1,530,416 |

||||||

|

Total Current Liabilities |

10,860,953 |

7,794,816 |

||||||

|

Long-term loan payables |

191,128 |

412,817 |

||||||

|

Operating lease liabilities – non-current |

13,288,194 |

13,986,879 |

||||||

|

Total Liabilities |

24,340,275 |

22,194,512 |

||||||

|

Commitment and Contingencies |

||||||||

|

Stockholders’ Equity |

||||||||

|

Preferred stock, $0.01 par value, 4,400,000 shares authorized and nil |

— |

— |

||||||

|

Common stock, $0.01 par value, 44,000,000 shares authorized and 24,587,500 |

245,875 |

220,000 |

||||||

|

Additional Paid-in Capital |

10,744,024 |

2,400,000 |

||||||

|

Shares Subscription Receivable |

(219,998) |

(219,998) |

||||||

|

Retained Earnings |

3,073,293 |

4,395,649 |

||||||

|

Accumulated other comprehensive loss |

(10,855) |

(13,829) |

||||||

|

Total FLY-E Group, Inc. Stockholders’ Equity |

13,832,339 |

6,781,822 |

||||||

|

Total Liabilities and Stockholders’ Equity |

$ |

38,172,614 |

$ |

28,976,334 |

||||

|

* |

Shares and per share data are presented on a retroactive basis to reflect the nominal share issuance on |

|

FLY-E GROUP, INC. |

||||||||||||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND |

||||||||||||||||

|

COMPREHENSIVE (LOSS) INCOME |

||||||||||||||||

|

(Expressed in U.S. dollars, except for the number of shares) |

||||||||||||||||

|

For the Three Months Ended |

For the Six Months Ended |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

Revenues |

$ |

6,824,406 |

$ |

8,763,839 |

$ |

14,697,832 |

$ |

16,606,185 |

||||||||

|

Cost of Revenues |

3,919,952 |

5,002,540 |

8,693,744 |

10,122,171 |

||||||||||||

|

Gross Profit |

2,904,454 |

3,761,299 |

6,004,088 |

6,484,014 |

||||||||||||

|

Operating Expenses |

||||||||||||||||

|

Selling Expenses |

2,041,435 |

1,618,439 |

3,653,930 |

2,701,545 |

||||||||||||

|

General and Administrative Expenses |

2,094,078 |

1,058,235 |

3,626,716 |

1,930,300 |

||||||||||||

|

Total Operating Expenses |

4,135,513 |

2,676,674 |

7,280,646 |

4,631,845 |

||||||||||||

|

(Loss) Income from Operations |

(1,231,059) |

1,084,625 |

(1,276,558) |

1,852,169 |

||||||||||||

|

Other Income (Expenses), net |

(53,929) |

40,779 |

(47,411) |

29,701 |

||||||||||||

|

Interest Expenses, net |

(23,795) |

(17,969) |

(91,877) |

(50,592) |

||||||||||||

|

(Loss) Income Before Income Taxes |

(1,308,783) |

1,107,435 |

(1,415,846) |

1,831,278 |

||||||||||||

|

Income Tax Benefit (Expense) |

165,935 |

(360,879) |

93,490 |

(644,279) |

||||||||||||

|

Net (Loss) Income |

$ |

(1,142,848) |

$ |

746,556 |

$ |

(1,322,356) |

$ |

1,186,999 |

||||||||

|

Other Comprehensive Income (Loss) |

||||||||||||||||

|

Foreign currency translation adjustment |

4,298 |

— |

2,974 |

— |

||||||||||||

|

Total Comprehensive (Loss) Income |

$ |

(1,138,550) |

$ |

746,556 |

$ |

(1,319,382) |

$ |

1,186,999 |

||||||||

|

(Losses) Earnings per Share* |

$ |

(0.05) |

$ |

0.03 |

$ |

(0.06) |

$ |

0.05 |

||||||||

|

Weighted Average Number of Common Stock |

||||||||||||||||

|

– Basic and Diluted* |

24,587,500 |

22,000,000 |

23,622,596 |

22,000,000 |

||||||||||||

|

* |

Shares and per share data are presented on a retroactive basis to reflect the nominal share issuance on |

|

FLY-E GROUP, INC. |

||||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||

|

(Expressed in U.S. dollars, except for the number of shares) |

||||||||

|

For the Six Months Ended |

||||||||

|

2024 |

2023 |

|||||||

|

Cash flows from operating activities |

||||||||

|

Net (loss) income |

$ |

(1,322,356) |

$ |

1,186,999 |

||||

|

Adjustments to reconcile net (loss) income to net cash (used in) provided |

||||||||

|

Depreciation expense |

180,910 |

190,559 |

||||||

|

Amortization expense |

8,846 |

— |

||||||

|

Deferred income taxes (benefits) expenses |

(462,740) |

189,600 |

||||||

|

Amortization of operating lease right-of-use assets |

1,676,991 |

1,221,280 |

||||||

|

Inventories reserve |

330,823 |

159,851 |

||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Accounts receivable |

(154,034) |

(463,949) |

||||||

|

Accounts receivable – related parties |

235,029 |

(203,069) |

||||||

|

Inventories |

(3,562,871) |

(1,672,986) |

||||||

|

Prepayments and other receivables |

(1,864,681) |

5,223 |

||||||

|

Prepayments for operation services to related parties |

(180,000) |

— |

||||||

|

Security deposits |

(55,598) |

(78,191) |

||||||

|

Accounts payable |

(815,667) |

1,813,644 |

||||||

|

Accrued expenses and other payables |

(380,183) |

33,873 |

||||||

|

Operating lease liabilities |

(1,516,198) |

(1,132,114) |

||||||

|

Taxes payable |

(1,530,416) |

343,148 |

||||||

|

Net cash (used in) provided by operating activities |

(9,412,145) |

1,593,868 |

||||||

|

Cash flows from investing activities |

||||||||

|

Purchases of equipment |

(1,575,936) |

(526,214) |

||||||

|

Purchase of Software from a related party |

(500,000) |

— |

||||||

|

Prepayment for purchasing software from a related party |

(801,980) |

— |

||||||

|

Repayment from a related party |