What's Going On With Broadcom (AVGO) Stock?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

As NVIDIA Corp prepares to release its highly anticipated earnings report Wednesday evening, investors are watching closely for the potential ripple effects on the broader market—and particularly on peer stocks like Broadcom Inc (NASDAQ:AVGO).

What To Know: Nvidia’s dominance in AI-driven technology and its pivotal role in the S&P 500’s performance make its results a market-moving event, with implications for key players in the semiconductor industry.

Broadcom, like Nvidia, has leveraged the surging demand for AI infrastructure. It supplies high-performance networking chips and custom silicon that power data centers—critical components for Nvidia’s AI-focused operations.

Don’t Miss:

A strong earnings beat from Nvidia could reinforce investor confidence in AI growth prospects, lifting sentiment around Broadcom as a beneficiary of the same demand drivers. Conversely, a disappointing Nvidia report could signal a slowdown in AI investments, weighing on Broadcom’s outlook.

Historically, Broadcom’s stock has moved in tandem with Nvidia’s during major market reactions. Nvidia’s implied one-day move of 12.5% adds volatility to the semiconductor sector, underscoring the high stakes.

By now you’re likely curious about how to participate in the market for Broadcom – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy ‘fractional shares,’ which allows you to own portions of stock without buying an entire share. For example, some stock, like Berkshire Hathaway, can cost thousands of dollars to own just one share. However, if you only want to invest a fraction of that, brokerages will allow you to do so.

If you’re looking to bet against a company, the process is more complex. You’ll need access to an options trading platform, or a broker who will allow you to ‘go short’ a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Smart Money Move: Michael J Roper Grabs $149K Worth Of Sadot Group Stock

A new SEC filing reveals that Michael J Roper, Chief Executive Officer at Sadot Group SDOT, made a notable insider purchase on November 20,.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Roper purchased 44,642 shares of Sadot Group. The total transaction amounted to $149,997.

The latest update on Wednesday morning shows Sadot Group shares up by 5.96%, trading at $3.2.

Delving into Sadot Group’s Background

Sadot Group Inc operates in the food supply chain sector, connecting producers and consumers across the globe, delivering agri-commodities from producing geographies such as the Americas, Africa, and the Black Sea to consumer markets in Southeast Asia, China, and the Middle East/North Africa (MENA) region. Its reportable segment includes Sadot food service and Sadot agri-foods. The key revenue is coming from the Sadot agri-foods segment which engaged in farming, commodity trading, and shipping of food and feed.

Financial Insights: Sadot Group

Revenue Growth: Sadot Group’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 10.74%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 1.22%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Sadot Group’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.25.

Debt Management: Sadot Group’s debt-to-equity ratio is below the industry average. With a ratio of 0.11, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 10.07 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.02 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 3.41, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Unlocking the Meaning of Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Sadot Group’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bullish Move: Kevin James Mohan Shows Confidence, Acquires $124K In Sadot Group Stock

A new SEC filing reveals that Kevin James Mohan, Chief Investment Officer at Sadot Group SDOT, made a notable insider purchase on November 20,.

What Happened: Mohan demonstrated confidence in Sadot Group by purchasing 37,202 shares, as reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the transaction is $124,998.

During Wednesday’s morning session, Sadot Group shares up by 5.96%, currently priced at $3.2.

Discovering Sadot Group: A Closer Look

Sadot Group Inc operates in the food supply chain sector, connecting producers and consumers across the globe, delivering agri-commodities from producing geographies such as the Americas, Africa, and the Black Sea to consumer markets in Southeast Asia, China, and the Middle East/North Africa (MENA) region. Its reportable segment includes Sadot food service and Sadot agri-foods. The key revenue is coming from the Sadot agri-foods segment which engaged in farming, commodity trading, and shipping of food and feed.

Sadot Group’s Financial Performance

Revenue Growth: Sadot Group’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 10.74%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 1.22%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Sadot Group exhibits below-average bottom-line performance with a current EPS of 0.25.

Debt Management: Sadot Group’s debt-to-equity ratio is below the industry average. With a ratio of 0.11, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 10.07, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.02 is lower than the industry average, implying a discounted valuation for Sadot Group’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 3.41, Sadot Group could be considered undervalued.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Sadot Group’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

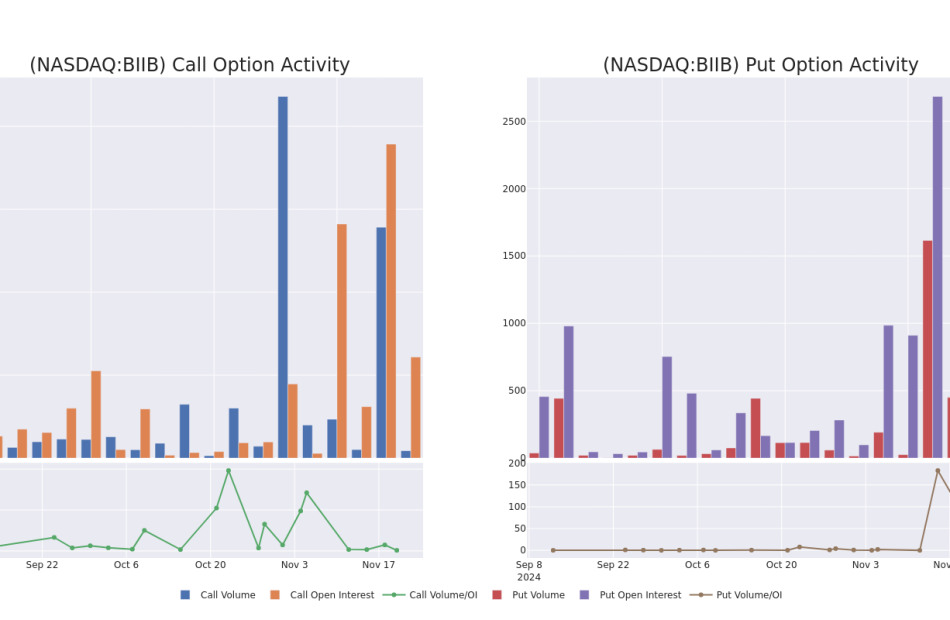

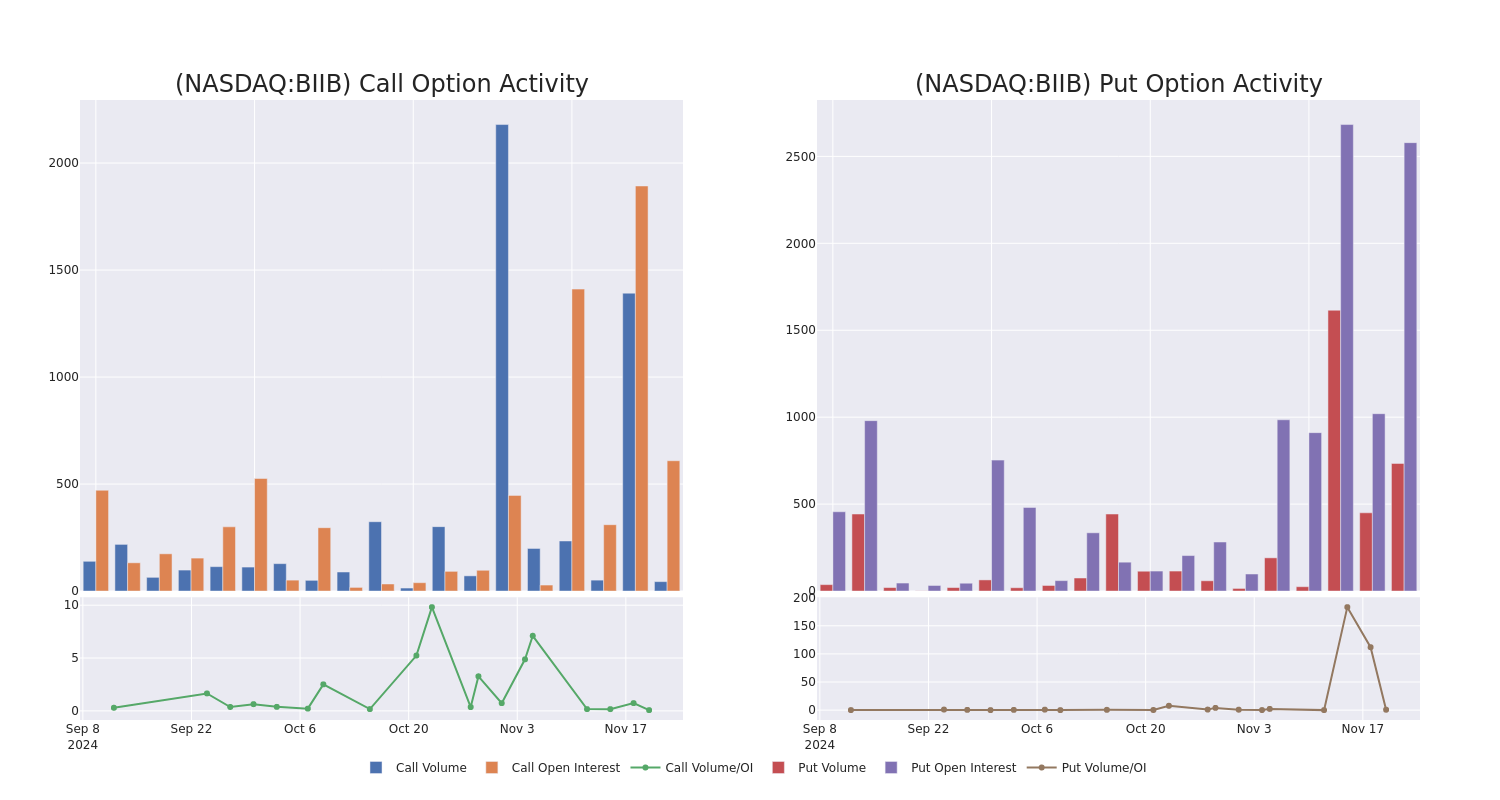

Biogen Unusual Options Activity For November 20

Investors with a lot of money to spend have taken a bearish stance on Biogen BIIB.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with BIIB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Biogen.

This isn’t normal.

The overall sentiment of these big-money traders is split between 22% bullish and 66%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $198,898, and 4 are calls, for a total amount of $138,060.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $130.0 to $200.0 for Biogen over the last 3 months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Biogen’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Biogen’s substantial trades, within a strike price spectrum from $130.0 to $200.0 over the preceding 30 days.

Biogen Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BIIB | PUT | TRADE | BEARISH | 11/22/24 | $2.35 | $1.35 | $2.0 | $155.00 | $60.0K | 1.5K | 663 |

| BIIB | CALL | TRADE | BEARISH | 04/17/25 | $22.6 | $18.3 | $19.32 | $150.00 | $48.3K | 0 | 25 |

| BIIB | PUT | TRADE | BULLISH | 12/20/24 | $29.6 | $21.7 | $24.0 | $180.00 | $48.0K | 111 | 20 |

| BIIB | CALL | SWEEP | BULLISH | 04/17/25 | $8.6 | $7.8 | $8.6 | $175.00 | $35.2K | 19 | 4 |

| BIIB | PUT | SWEEP | BEARISH | 11/22/24 | $2.1 | $1.55 | $2.09 | $155.00 | $33.5K | 1.5K | 0 |

About Biogen

Biogen and Idec merged in 2003, combining forces to market Biogen’s multiple sclerosis drug Avonex and Idec’s cancer drug Rituxan. Today, Rituxan and next-generation antibody Gazyva (oncology) and Ocrevus (multiple sclerosis) are marketed via a collaboration with Roche. Biogen markets several multiple sclerosis drugs including Plegridy, Tysabri, Tecfidera, and Vumerity. Biogen’s newer products include Spinraza (SMA, with partner Ionis), Leqembi (Alzheimers, with partner Eisai), Skyclarys (Friedreich’s Ataxia, Reata), Zurzuvae (postpartum depression, Sage), and Qalsody (ALS, Ionis). Biogen has several drug candidates in phase 3 trials in neurology, immunology, and rare diseases.

Following our analysis of the options activities associated with Biogen, we pivot to a closer look at the company’s own performance.

Where Is Biogen Standing Right Now?

- Trading volume stands at 839,529, with BIIB’s price down by -0.49%, positioned at $154.67.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 83 days.

Professional Analyst Ratings for Biogen

In the last month, 5 experts released ratings on this stock with an average target price of $261.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Needham downgraded its action to Buy with a price target of $270.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Biogen with a target price of $255.

* An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $270.

* An analyst from Baird has decided to maintain their Outperform rating on Biogen, which currently sits at a price target of $300.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Biogen, targeting a price of $210.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Biogen with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Brazilian Fintech Nubank Considers Domicile Move to UK

(Bloomberg) — Brazilian financial-technology company Nu Holdings Ltd. is considering plans to shift its legal base to the UK, in a move that would mark a major win in Britain’s push to encourage more tech companies to move to the country.

Most Read from Bloomberg

The digital challenger bank has been working with the British government on the plans, which were discussed as part of a broader set of agreements between Brazil and the UK on Tuesday on the sidelines of the Group of 20 leaders’ summit in Rio de Janeiro, according to people familiar with the talks.

The change in domicile was not included in a joint announcement by the two governments penned on Tuesday since it was still pending approval from the UK’s HM Revenue & Customs authority, according to two of the people, who asked not to be named discussing private information.

“Nubank continuously reviews its corporate legal structure to align with the footprint of its operations,” a spokesperson for the company said in a statement. “At this time, no decision has been made regarding the redomiciliation of Nu Holdings Ltd. or any other legal entities within our group. As a publicly traded company, we are committed to transparency and will follow standard communication protocols if and when any such decisions are made.”

Nubank — whose holding company is currently based in the Cayman Islands and is listed on the New York Stock Exchange — recently became the most valuable bank in all of Latin America. While its corporate headquarters would remain in Sao Paulo, Brazil, the change in legal domicile to the UK would be seen as a big achievement in efforts by British Prime Minister Keir Starmer’s government to attract more technology firms and investment to the country.

Last month, the UK Department for Science, Innovation and Technology said it was opening an office to speed up approvals of novel technologies. The new body, called the Regulatory Innovation Office, is designed to reduce the time entrepreneurs wait to get inventions to market and streamline the regulatory hurdles they must deal with.

The Labour government has been courting tech companies and investors as it faces a broad decline in sentiment among businesses, after Chancellor of the Exchequer Rachel Reeves unveiled £40 billion ($50.5 billion) of tax increases in its first budget. Measures included raising the national insurance payroll tax for businesses to 15% and reducing the threshold at which companies start paying the tax. The government also raised capital gains tax and scrapped the value-added-tax exemption on public-school fees.

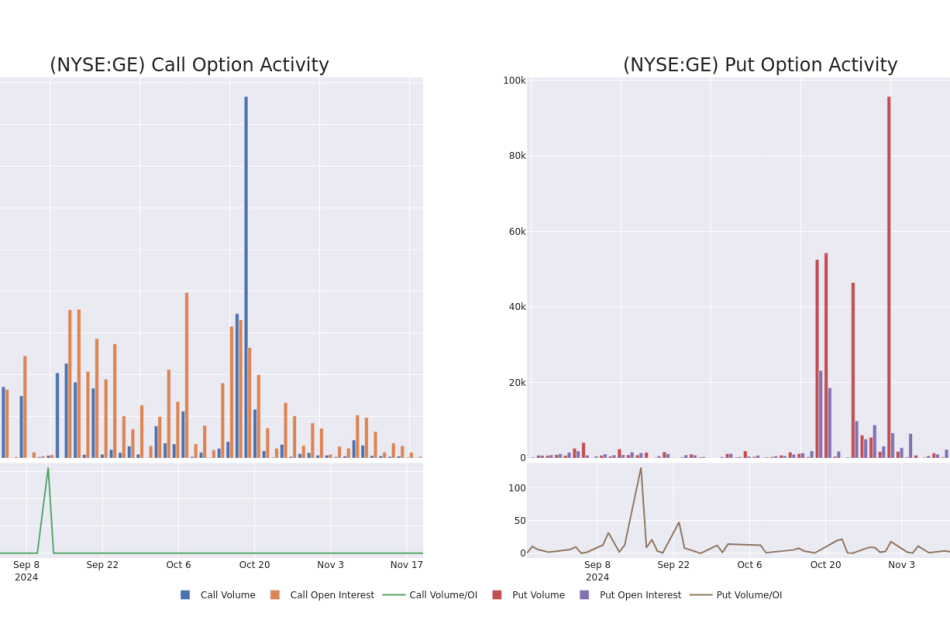

This Is What Whales Are Betting On GE Aero

Whales with a lot of money to spend have taken a noticeably bullish stance on GE Aero.

Looking at options history for GE Aero GE we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 75% of the investors opened trades with bullish expectations and 12% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $298,514 and 2, calls, for a total amount of $70,600.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $175.0 to $200.0 for GE Aero over the recent three months.

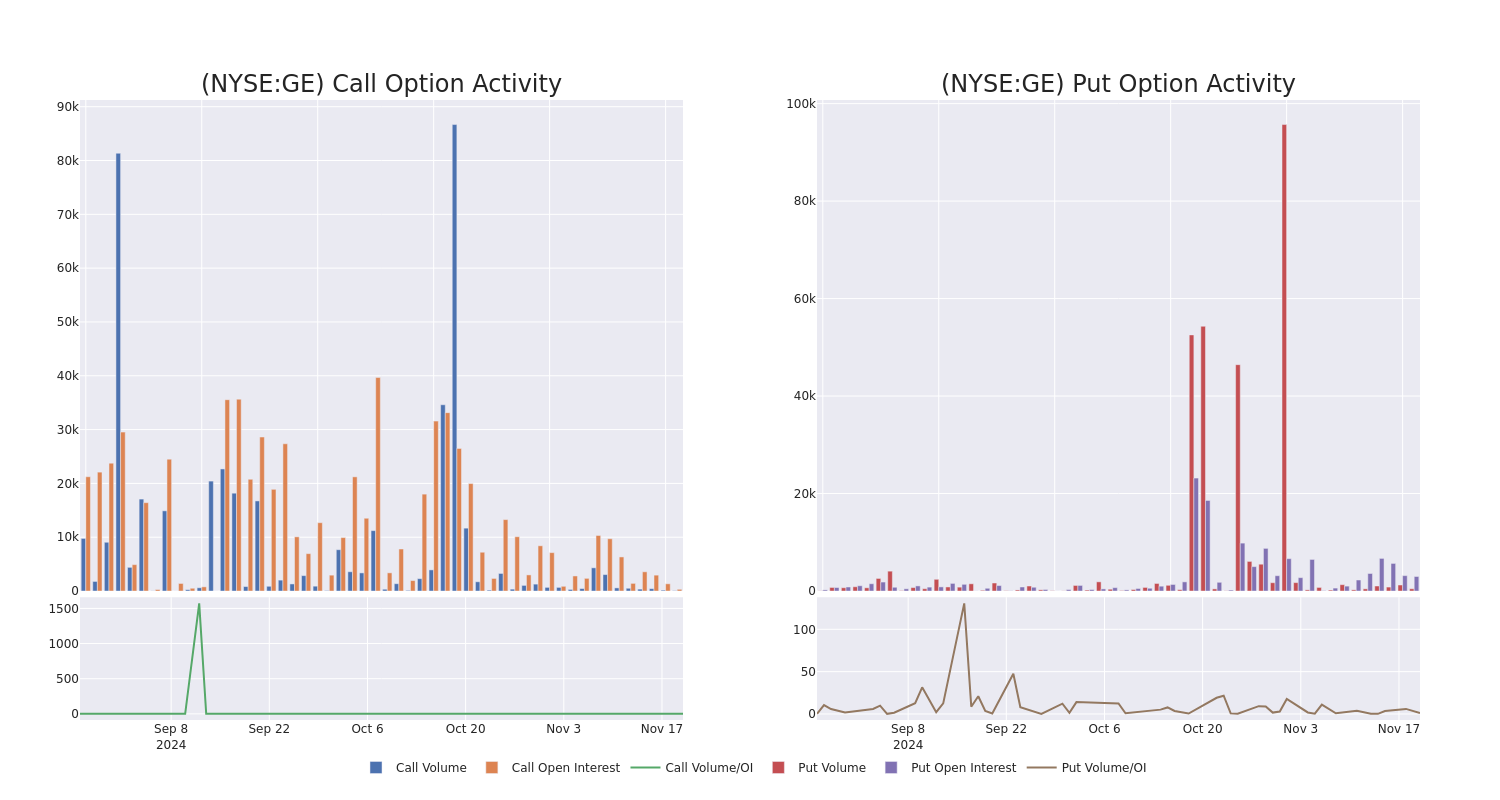

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for GE Aero’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across GE Aero’s significant trades, within a strike price range of $175.0 to $200.0, over the past month.

GE Aero Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GE | PUT | SWEEP | NEUTRAL | 02/21/25 | $11.55 | $11.5 | $11.55 | $180.00 | $51.9K | 172 | 48 |

| GE | PUT | SWEEP | BULLISH | 01/17/25 | $24.25 | $23.25 | $23.34 | $200.00 | $51.3K | 1.3K | 44 |

| GE | PUT | TRADE | BULLISH | 01/17/25 | $9.55 | $9.4 | $9.44 | $180.00 | $50.0K | 972 | 66 |

| GE | PUT | SWEEP | BULLISH | 01/17/25 | $9.45 | $9.25 | $9.26 | $180.00 | $49.0K | 972 | 197 |

| GE | PUT | SWEEP | BULLISH | 02/21/25 | $18.25 | $17.75 | $17.91 | $190.00 | $48.3K | 79 | 27 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

GE Aero’s Current Market Status

- With a trading volume of 1,683,143, the price of GE is down by -0.11%, reaching $177.37.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 62 days from now.

What Analysts Are Saying About GE Aero

4 market experts have recently issued ratings for this stock, with a consensus target price of $210.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on GE Aero, which currently sits at a price target of $210.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for GE Aero, targeting a price of $200.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on GE Aero with a target price of $230.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for GE Aero, targeting a price of $200.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for GE Aero with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FirstBank Reports Third Quarter Results, Emphasizing Community Commitment and Strategic Market Shift

LAKEWOOD, Colo., Nov. 20, 2024 (GLOBE NEWSWIRE) — FirstBank, one of the nation’s largest privately held banks with a focus on “banking for good,” announced its 2024 third-quarter summary of the company’s holdings and activities. At the end of September, the bank reported the following quarter-over-quarter results:

- Net income through the third quarter of 2024 increased to $157.7 million

- Total deposits decreased by 0.8% to $23.9 billion

- Net loan balance decreased by 1.2% to $16.1 billion

- Total assets increased by 0.4% to $27.4 billion

FirstBank climbed to Colorado’s second largest bank by deposits, according to a recent FDIC report, and was recognized as a “2024 Most Admired Company” by Arizona Business Magazine and BestCompaniesAZ for the eighth consecutive year.

“FirstBank continues to demonstrate a solid financial performance quarter-after-quarter and year-after-year by helping local businesses grow, strengthening communities and focusing on award-winning service,” said Kevin Classen. “This has enabled us to not only increase our market share in Colorado, but continue to be recognized as a top company despite a high interest rate environment and other industry challenges.”

As part of its commitment to the community, FirstBank donated $60,000 through its Go Green campaign to support planet-helping causes, including honey bee health, water conservation and reforestation. The bank also celebrated Hispanic Heritage Month by hosting ‘FirstBank Fiestas,’ a series of free bilingual events for community members and local businesses in Colorado and Arizona.

At the end of the quarter, FirstBank also announced the sale of its four California branch locations to California Bank & Trust (CB&T), a division of Zions Bancorporation. The decision was driven by FirstBank’s strategic focus on consolidating its operations and resources to concentrate on growth opportunities in Colorado and Arizona, where it sees greater potential for expansion. The transaction is expected to close early next year.

About FirstBank

FirstBank began providing banking services in 1963. Today, it’s known as an industry leader in digital banking. It has grown to be one of the top performing and largest privately held banks in the United States. FirstBank offers a variety of consumer deposit accounts, home equity loans, mortgages, rental property loans, and a full range of commercial banking services, including business financing, commercial real estate loans, treasury management, and more. Since 2000, FirstBank has been recognized as a top corporate philanthropist, contributing more than $90 million and thousands of volunteer hours to charitable organizations. The company is also unique in that a large portion of its stock is owned by management and employees, giving employees a financial stake in the bank’s success through its Employee Stock Ownership Program. For more information, visit www.efirstbank.com. Member FDIC.

Media Contact

Chandra Brin

303.235.1402

Chandra.Brin@efirstbank.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

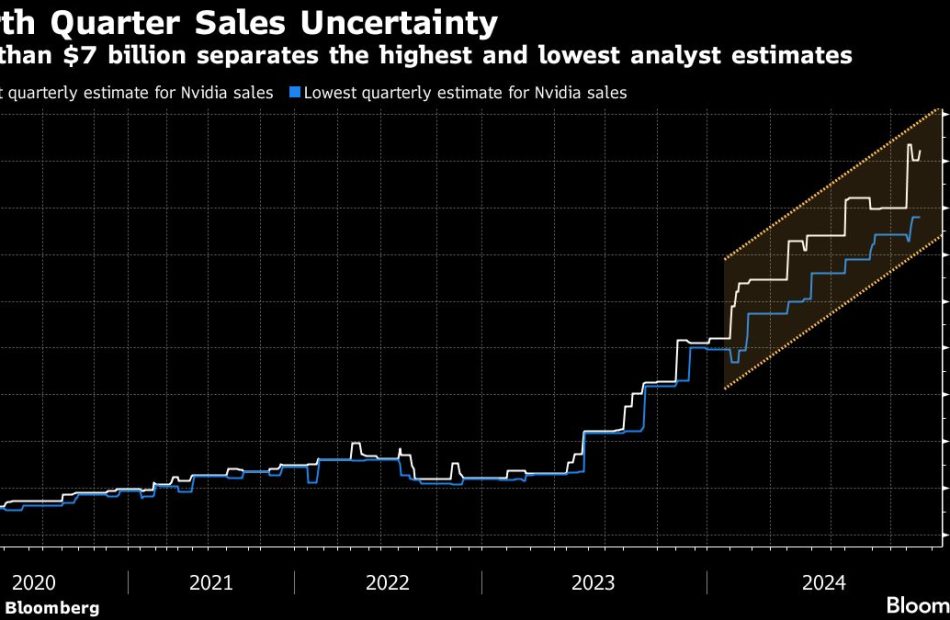

Nvidia Traders Brace for Potential $300 Billion Earnings Move

(Bloomberg) — With Nvidia Corp. due to report an unusually complex quarter as the world’s most valuable company, traders are preparing for a potentially mammoth stock swing.

Most Read from Bloomberg

The options-implied move for Nvidia shares the day after earnings is about 8% in either direction, according to data compiled by Bloomberg. That would equate to close to a $300 billion swing in market value — bigger than all but 25 companies in the S&P 500 Index. And according to strategists at Bank of America, the report carries more risk for the benchmark than the next Federal Reserve meeting or inflation data.

As the poster child of the artificial intelligence trade, Nvidia’s stock has rallied nearly 200% so far in 2024 and its reports have been the biggest event on the earnings calendar for more than a year. The shares fell 1.9% on Wednesday ahead of the chipmaker’s fiscal third quarter earnings, due after markets close, and there’s more uncertainty than normal about how the results and guidance will play out.

That’s because there are varying views on Wall Street about what to expect from the company’s newest product line, Blackwell. Nvidia has said that the new chips will contribute several billion dollars in revenue in the fiscal fourth quarter, while Chief Executive Officer Jensen Huang described demand for the chips as “insane.” But production delays have made modeling supply — a notoriously difficult task — even harder.

“There’s a big unknown around Blackwell capacity,” said Dan Eye, chief investment officer at Fort Pitt Capital Group. “The CEO has established a lot of credibility, but the bar is very high,” he said, adding that it will likely be challenging for Nvidia to give blowout guidance for next quarter.

The questions around Blackwell have led to a wide spread in analyst expectations for the fiscal fourth quarter that ends in January. Consensus is at $37.1 billion — with the gap between the highest and lowest projections at more than $7 billion, according to estimates compiled by Bloomberg. Nvidia typically provides revenue guidance for the upcoming quarter with its results.

Part of the reason for the gap in analyst forecasts is that some expect customers to delay purchases of Blackwell’s predecessor products, called Hopper, in anticipation of the newer chips.

Fed's Bowman Warns On Inflation, Says Neutral Interest Rates May Be Closer 'Than We Currently Think'

Federal Reserve Governor Michelle W. Bowman cautioned on Wednesday that inflation remains a significant concern and suggested that interest rates may already be closer to a “neutral” level than policymakers currently realize.

Speaking at the Forum Club of the Palm Beaches in West Palm Beach, Bowman indicated the need for caution in lowering rates further, citing risks of prematurely fueling demand and reigniting inflationary pressures.

Inflation Progress Stalling, Labor Market Still Strong

While inflation has cooled since early 2023, Bowman highlighted that progress has “stalled in recent months.”

“My view is that inflation remains a concern, and I continue to see price stability as essential for fostering a strong labor market and an economy that works for everyone in the longer term,” Bowman said.

She hinted that moving rates down too aggressively could risk stoking demand unnecessarily, potentially reversing inflation gains.

Bowman also indicated that unemployment has risen compared to a year ago but remains historically low and below estimates of full employment.

She attributed October’s mixed job report to special factors like hurricanes and the Boeing strike, stating that underlying payroll growth appears steady.

“Payroll employment continued to increase in October at a pace close to the average monthly gain seen in the second and third quarters,” Bowman said.

Proximity To ‘Neutral Rate’ Requires Cautious

According to Bowman, the neutral policy rate—the level at which monetary policy neither stimulates nor restricts economic activity—may now be higher than pre-pandemic estimates.

“We may be closer to a neutral policy stance than we currently think. I would prefer to proceed cautiously in bringing the policy rate down to better assess how far we are from the endpoint,” Bowman said.

At the Federal Reserve’s September meeting, policymakers lowered the federal funds rate by 50 basis points to a range of 4.75%-5.00%.

Bowman surprisingly dissented, advocating for a smaller 25-basis-point cut due to concerns that a larger move might be perceived as a “premature declaration of victory” on inflation.

Her dissent marked the first such vote by a Fed Board member in nearly 20 years.

At the November meeting, Bowman supported the 25-basis-point rate reduction, aligning with the Committee’s flexible, data-dependent approach.

“I am pleased that the November post meeting statement included a flexible, data-dependent approach, providing the Committee with optionality in deciding future policy adjustments,” she said.

Market Reactions

Bowman’s comments have further dampened expectations for a December rate cut.

Market-implied odds of a 25-basis-point cut fell sharply to 55%, down from 82% just a week ago, according to the CME FedWatch Tool. Traders have recalibrated their bets after a series of more cautious signals from Fed officials over the past week.

Last Thursday, Federal Reserve Chair Jerome Powell surprised markets by stating that the robust U.S. economy gives the Fed “no need to be in a hurry” to lower rates. This marked a notable shift from his more dovish tone during the November meeting press conference.

Risk assets continued to struggle on Wednesday. The SPDR S&P 500 ETF Trust SPY dropped 0.6% by midday, deepening earlier losses, while the 10-year Treasury yield ticked up 2 basis points to 4.42%.

Read Next:

Image created using Midjourney with a photo from Wikimedia.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

10% Owner Of Southwest Gas Hldgs Makes $106.67M Sale

CARL ICAHN, 10% Owner at Southwest Gas Hldgs SWX, executed a substantial insider sell on November 20, according to an SEC filing.

What Happened: ICAHN’s decision to sell 1,390,000 shares of Southwest Gas Hldgs was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $106,668,600.

During Wednesday’s morning session, Southwest Gas Hldgs shares down by 0.0%, currently priced at $79.11.

Unveiling the Story Behind Southwest Gas Hldgs

Southwest Gas Holdings Inc is a utility company engaged in the purchasing, distributing, and transporting of natural gas in the American Southwest. The company segments its activities into natural gas distribution and Utility Infrastructure Services units. The first of these encompasses the company’s core natural gas business as distributors in the states of Arizona and Nevada. The natural gas distribution division is responsible for roughly half of Southwest Gas’ total revenue through the sale of natural gas to mainly residential and small commercial customers. The Utility Infrastructure Services segment generates the other half of the company’s total revenue from the underground piping contractor services that its subsidiary, Centuri Construction Group, provides.

Southwest Gas Hldgs: A Financial Overview

Decline in Revenue: Over the 3 months period, Southwest Gas Hldgs faced challenges, resulting in a decline of approximately -7.72% in revenue growth as of 30 September, 2024. This signifies a reduction in the company’s top-line earnings. When compared to others in the Utilities sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 17.71%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Southwest Gas Hldgs’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 0.004021.

Debt Management: Southwest Gas Hldgs’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.47. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: Southwest Gas Hldgs’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 31.64.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.09 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 10.91, Southwest Gas Hldgs’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: Above industry benchmarks, the company’s market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Navigating the World of Insider Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Southwest Gas Hldgs’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.