Qualcomm stock falls after new autos, PC targets fail to wow investors

Qualcomm (QCOM) stock fell as much as 6% on Wednesday, a day after the company provided new financial targets for its non-smartphone business at its first Investor Day in three years.

Qualcomm, which gets the majority of its revenue from both designing and licensing handset chips, has been expanding into semiconductors that go into cars, personal computers and other devices.

The company now expects those businesses to generate a combined $22 billion in sales by 2029.

Eight billion dollars of that will come from Qualcomm’s automotive segment, where it already has partnerships with the likes of BMW to increase computing functionality in vehicles and push toward more autonomous driving.

Qualcomm forecast that $14 billion will come from its Internet of Things segment, which includes extended reality devices and industrial functions. It also includes PCs, expected to account for $4 billion. The company’s Snapdragon X Elite chips power Microsoft’s latest generation Surface laptops, which feature the GenAI Copilot assistant.

“Everybody that buys an X Elite is extremely happy with it,” Qualcomm CEO Cristiano Amon said in an interview following the Investor Day in New York.

“From all of our OEMs (original equipment manufacturers) and Microsoft, the current response is exceeding everybody’s expectation.” Amon called the $4 billion target for the PC business “high confidence.”

Some analysts, however, said the road there may not be smooth.

“While management is optimistic about AI PC opportunities, Windows-on-ARM skepticism and intense competition (from both x86 and ARM SoC suppliers) could limit QCOM’s opportunity,” Raymond James’ Srini Pajuri wrote in a note to clients. He has a hold-equivalent “market perform” rating on the stock.

Bank of America’s Tal Liani rates Qualcomm a “buy,’ and “came away incrementally positive on Qualcomm’s long-term positioning and the diversification outside of handsets.”

But Liani pointed out that not only is the company entering markets with emerging tech, but that it also needs to grab market share.

“These markets need to develop to support Qualcomm’s long-term targets, of which the pace and magnitude is uncertain,” he wrote.

Qualcomm’s biggest business remains smartphones, and its ramped-up diversification comes as Apple is working on migrating away from Qualcomm modems. As for the Android-based business, Amon said he’s projecting mid-single-digit growth, what he calls a “conservative assumption.”

That means the company expects to end the decade with its revenue about evenly split between handsets at 50% and autos and Internet of Things combined for the other 50%.

Target Margins And Inventory Issues Raise Analyst Caution After Weak Q3 Performance

Target Corporation TGT shares are trading lower on Wednesday after it reported weak third-quarter results and slashed FY24 outlook.

The company reported third-quarter adjusted earnings per share of $1.85, missing the street view of $2.30.

For FY24, the company now forecasts adjusted EPS between $8.30 and $8.90, down from the previous guidance of $9.00 to $9.70. The revised FY24 EPS outlook is also below the consensus estimate of $9.55.

Here are the analyst’s take on the earnings performance:

JP Morgan analyst Christopher Horvers reiterated the Neutral rating on Target Corporation.

The analyst notes that margins were a key factor in the stock’s reaction, as they are crucial to assessing the likelihood of meeting the 2025 operating margin estimate of 6.0%. While shrink (loss of inventory) helped, the analyst cautioned that higher fulfillment costs and excess inventory hurt margins, lowering the outlook.

For the fourth quarter, the analyst sees flat comparable sales, with a 40-basis-point headwind from the calendar shift, resulting in an operating margin of 4%-5% and earnings per share of $1.85-$2.45, below the Street’s expectation.

Also Read: Netflix Faces Class-Action Lawsuit Over Streaming Crashes During Jake Paul, Mike Tyson Fight

BofA Securities analyst Robert F. Ohmes reiterated the Buy rating on the company, with a price forecast of $195.

The analyst notes that Target’s fiscal third-quarter earnings release raises several questions. They highlight the CEO’s comments about the “unique challenges” faced by the retailer, expressing uncertainty about the specific cost pressures encountered in the third quarter and how much of this can normalize in 2025.

Ohmes is also cautious about the impact of digital growth on gross margin in the fourth quarter and 2025, following the pressures seen in the third quarter.

Additionally, the increase in general liability expenses raises questions, and the analyst is curious about whether shrink (inventory loss) provided a tailwind during the quarter and if it aligned with initial expectations. Finally, Ohmes is concerned about the shift in store-originated comps to a negative -1.9% in the third quarter, reversing the +0.7% growth seen in the second quarter.

Price Action: TGT shares are trading lower by 21.2% to $122.88 at last check Wednesday.

Image via Unsplash

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cover is bringing high-end customizable prefab homes to all of Southern California

In 2024, this homebuilder obtained a permit faster than 99.8% of other permits, and built a 2 bed 2 bath home in just 3 weeks. Now they’re expanding their operations to over 200 new cities.

LOS ANGELES, Nov. 20, 2024 /PRNewswire/ — After years of focused technology development and production, Cover is announcing its biggest service area expansion yet: Cover is now serving all of Southern California, from San Luis Obispo to San Diego—including Los Angeles, Orange, Riverside, San Bernardino, Ventura, and Santa Barbara counties.

Cover’s approach has been to do a few things and do them extraordinarily well. For seven years, they’ve been building in Los Angeles only, iterating and perfecting their product and building process. It’s working, and that’s clear. Just last month, they permitted their most recent Backyard Home in just 28 days. That’s faster than 99.8% of Los Angeles ADU projects. Earlier this year they also installed a two-bed, two-bath custom Backyard Home in just 3 weeks. All without a crane or heavy equipment.

Cover builds homes using their patented panelized building technology with impressive architect-grade quality, at record speeds. Recently, the company moved into an 80,000 square foot pilot factory in Gardena, Los Angeles County. This quadrupled the size of their previous operation, with a new production capacity of 100 homes a year.

“California faces a housing crisis with a shortfall of over 3 million homes. At California’s current home building rate, it’ll take decades to build enough homes to meet the demand. We have to do something differently.” said Alexis Rivas, Cofounder & CEO of Cover. “That’s why Cover developed technology to build homes on production lines, more like cars.”

“This expansion marks a huge step forward in our mission to make better homes for everyone,” said Mr. Rivas. “We’re excited to now bring our proven process and exceptional homes to homeowners across Southern California.”

Now, all Southern California residents working with Cover can expect full-service project management from designs and permits, through turnkey delivery.

State-Approved for Speed and Simplicity: Cover’s building system exceeds California’s stringent building codes, ensuring a safe home and streamlined permitting process in cities throughout Southern California. Their pre-engineered Lego-like panels can be arranged into custom layouts.

A Dedicated Team, All Under One Roof: Cover eliminates the inefficiencies of coordinating with architects, engineers, general contractors, and subcontractors. Instead, Cover is the one point of contact, with in-house architects, mechanical and structural engineers, construction professionals, and an installation team that work closely together to deliver a complete home.

Built Locally in Southern California: The panels are manufactured in Cover’s Gardena, Los Angeles factory and then transported to their final destination on a standard truck. No crane or heavy machinery needed.

Residents all over Southern California can now enter their address in Cover’s online tool and get started building with Cover.

About Cover:

Cover is a technology company founded in 2014 that designs, permits, manufactures, and installs custom architect-grade homes. Cover’s mission is to make thoughtfully designed and well-built homes for everyone. Using proprietary design software and a precision manufactured building system, Cover delivers exceptional design, functionality, and energy performance, in a fraction of the time of conventional construction. Cover builds out of its 80,000 square foot headquarters and factory located in Gardena, Los Angeles County California and currently serves Southern California.

For more information, please email Cover at hello@buildcover.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/cover-is-bringing-high-end-customizable-prefab-homes-to-all-of-southern-california-302311380.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/cover-is-bringing-high-end-customizable-prefab-homes-to-all-of-southern-california-302311380.html

SOURCE Cover Technologies, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

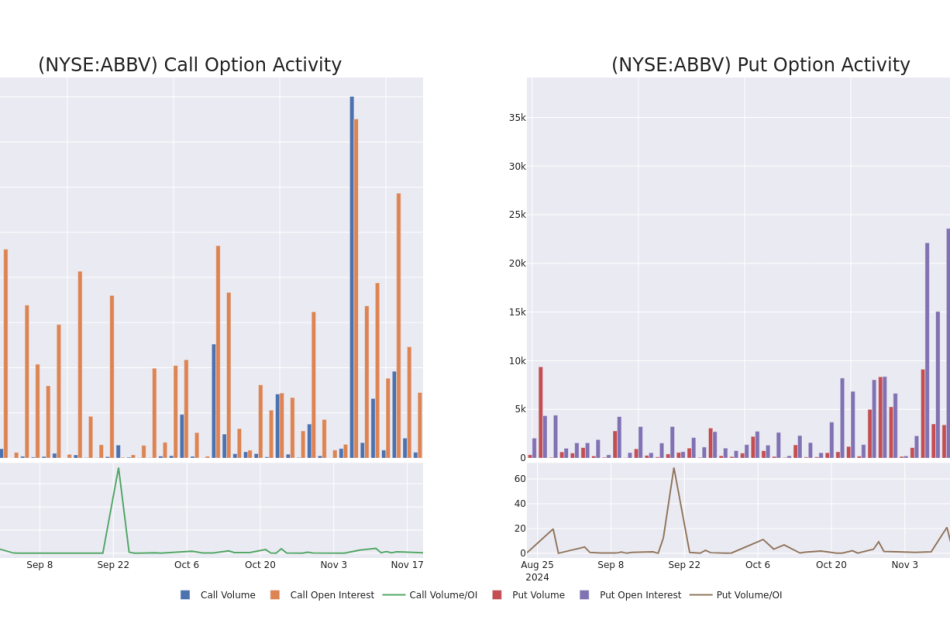

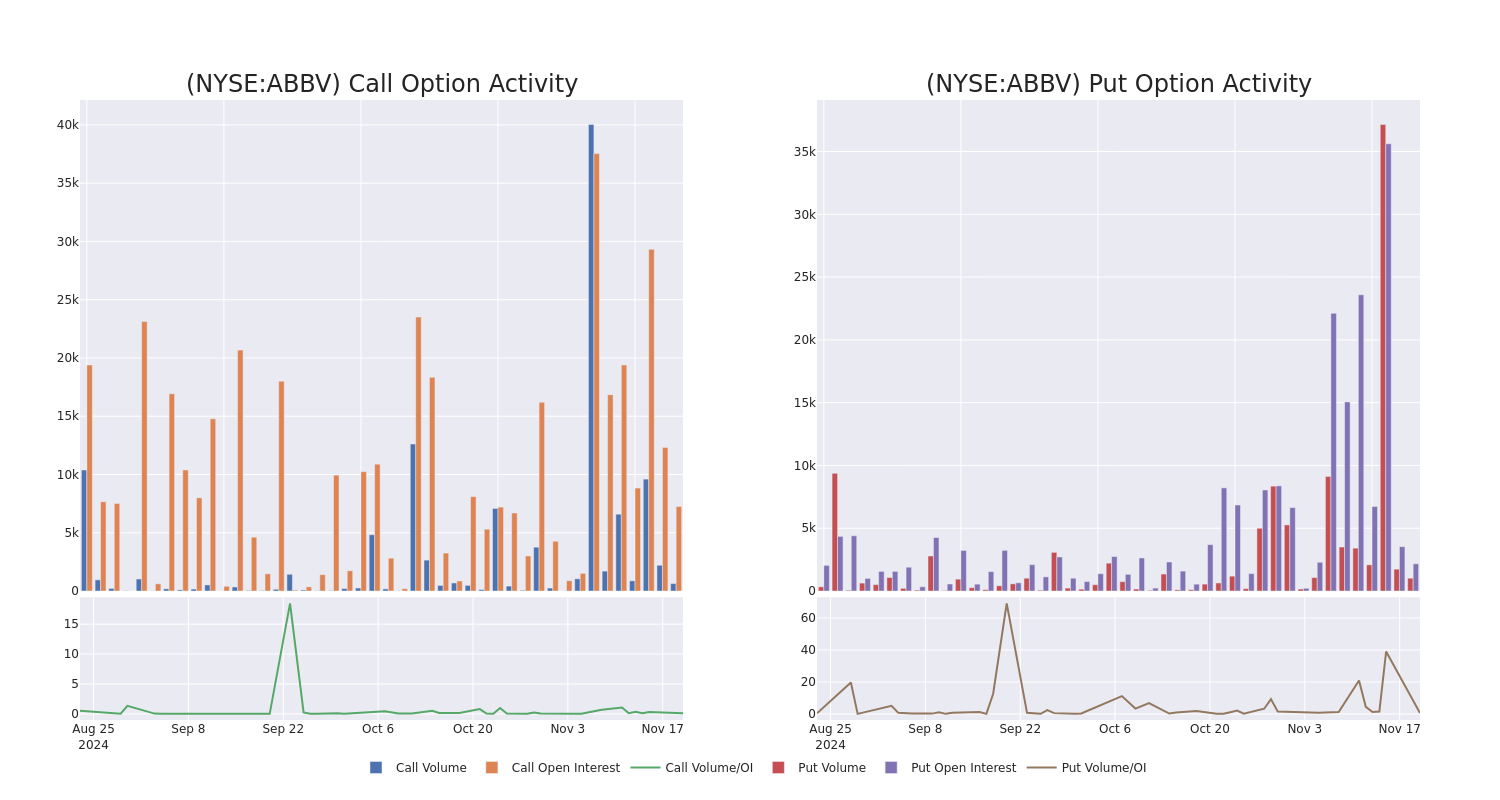

Unpacking the Latest Options Trading Trends in AbbVie

Whales with a lot of money to spend have taken a noticeably bullish stance on AbbVie.

Looking at options history for AbbVie ABBV we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $1,433,900 and 5, calls, for a total amount of $514,031.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $190.0 for AbbVie over the recent three months.

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for AbbVie’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AbbVie’s whale trades within a strike price range from $150.0 to $190.0 in the last 30 days.

AbbVie Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | PUT | TRADE | BULLISH | 12/20/24 | $2.06 | $1.31 | $1.38 | $160.00 | $1.2M | 1.8K | 1.0K |

| ABBV | CALL | SWEEP | BEARISH | 05/16/25 | $21.6 | $21.55 | $21.6 | $150.00 | $254.8K | 14 | 118 |

| ABBV | PUT | SWEEP | BULLISH | 12/20/24 | $1.4 | $1.36 | $1.4 | $160.00 | $145.9K | 1.8K | 1.0K |

| ABBV | CALL | SWEEP | NEUTRAL | 05/16/25 | $3.6 | $3.4 | $3.52 | $190.00 | $130.6K | 207 | 380 |

| ABBV | CALL | TRADE | BEARISH | 01/17/25 | $7.1 | $7.05 | $7.05 | $165.00 | $69.7K | 4.1K | 116 |

About AbbVie

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

Present Market Standing of AbbVie

- Trading volume stands at 1,463,877, with ABBV’s price up by 0.16%, positioned at $166.84.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 72 days.

What The Experts Say On AbbVie

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $215.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on AbbVie with a target price of $231.

* In a cautious move, an analyst from Wolfe Research downgraded its rating to Outperform, setting a price target of $205.

* Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on AbbVie with a target price of $200.

* An analyst from Citigroup has decided to maintain their Buy rating on AbbVie, which currently sits at a price target of $215.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on AbbVie with a target price of $224.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for AbbVie, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

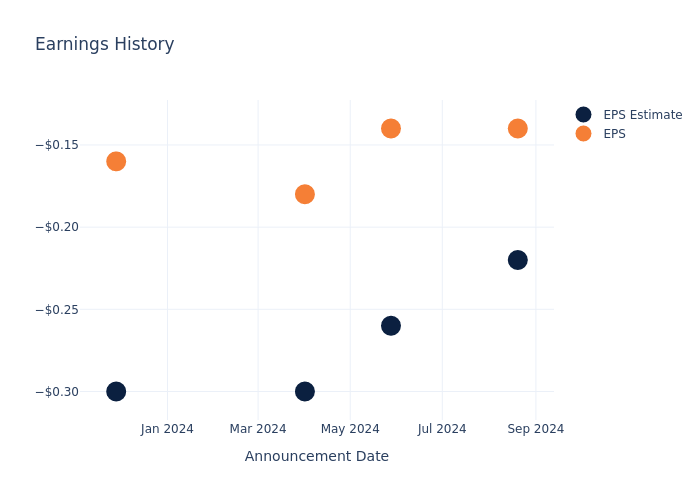

Preview: Nano X Imaging's Earnings

Nano X Imaging NNOX is set to give its latest quarterly earnings report on Thursday, 2024-11-21. Here’s what investors need to know before the announcement.

Analysts estimate that Nano X Imaging will report an earnings per share (EPS) of $-0.15.

The announcement from Nano X Imaging is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

Overview of Past Earnings

Last quarter the company beat EPS by $0.08, which was followed by a 7.29% increase in the share price the next day.

Here’s a look at Nano X Imaging’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.22 | -0.26 | -0.30 | -0.30 |

| EPS Actual | -0.14 | -0.14 | -0.18 | -0.16 |

| Price Change % | 7.000000000000001% | -1.0% | -4.0% | 4.0% |

Market Performance of Nano X Imaging’s Stock

Shares of Nano X Imaging were trading at $5.69 as of November 19. Over the last 52-week period, shares are down 12.08%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

To track all earnings releases for Nano X Imaging visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JULIE BRANDT HEUER Of Johnson Controls Intl Shows Optimism, Buys $999K In Stock

On November 19, JULIE BRANDT HEUER, VP at Johnson Controls Intl JCI executed a significant insider buy, as disclosed in the latest SEC filing.

What Happened: HEUER’s recent purchase of 11,954 shares of Johnson Controls Intl, disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, reflects confidence in the company’s potential. The total transaction value is $999,952.

As of Wednesday morning, Johnson Controls Intl shares are down by 0.0%, currently priced at $83.53.

Discovering Johnson Controls Intl: A Closer Look

Johnson Controls manufactures, installs, and services HVAC systems, building management systems and controls, industrial refrigeration units, and fire and security solutions. Commercial HVAC accounts for over 45% of sales, fire and security represents roughly 40% of sales, and residential HVAC, industrial refrigeration, and other solutions account for the remaining 15% of revenue. In fiscal 2023, Johnson Controls generated nearly $27 billion in revenue.

Johnson Controls Intl: Financial Performance Dissected

Decline in Revenue: Over the 3 months period, Johnson Controls Intl faced challenges, resulting in a decline of approximately -13.59% in revenue growth as of 30 September, 2024. This signifies a reduction in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 36.3%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): With an EPS below industry norms, Johnson Controls Intl exhibits below-average bottom-line performance with a current EPS of 0.95.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.59.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: Johnson Controls Intl’s current Price to Earnings (P/E) ratio of 40.16 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 2.46, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 24.14 reflects market recognition of Johnson Controls Intl’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Unlocking the Meaning of Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Johnson Controls Intl’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

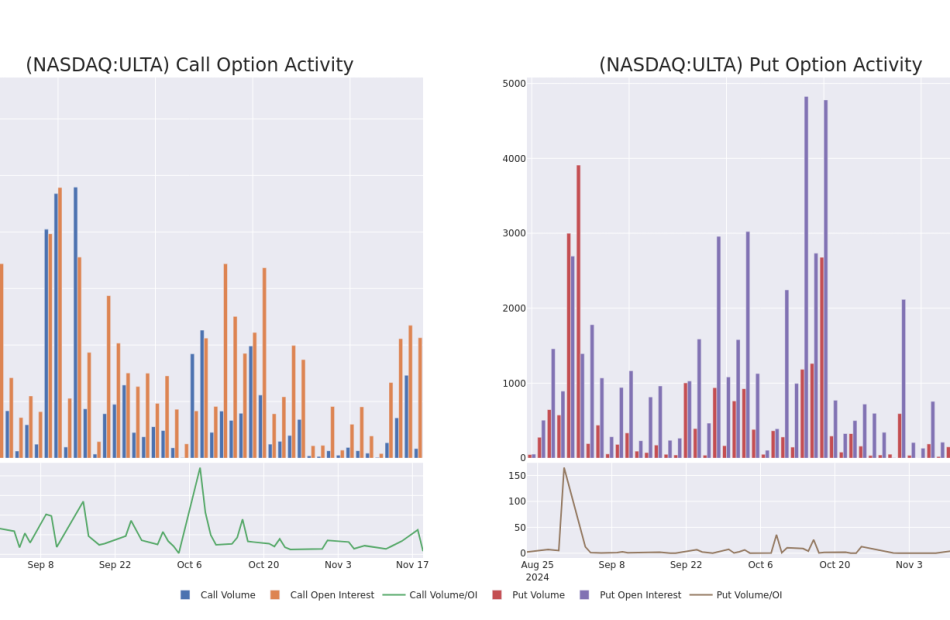

A Closer Look at Ulta Beauty's Options Market Dynamics

Investors with a lot of money to spend have taken a bearish stance on Ulta Beauty ULTA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ULTA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 24 uncommon options trades for Ulta Beauty.

This isn’t normal.

The overall sentiment of these big-money traders is split between 29% bullish and 54%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $391,914, and 18 are calls, for a total amount of $1,122,649.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $300.0 to $450.0 for Ulta Beauty over the last 3 months.

Insights into Volume & Open Interest

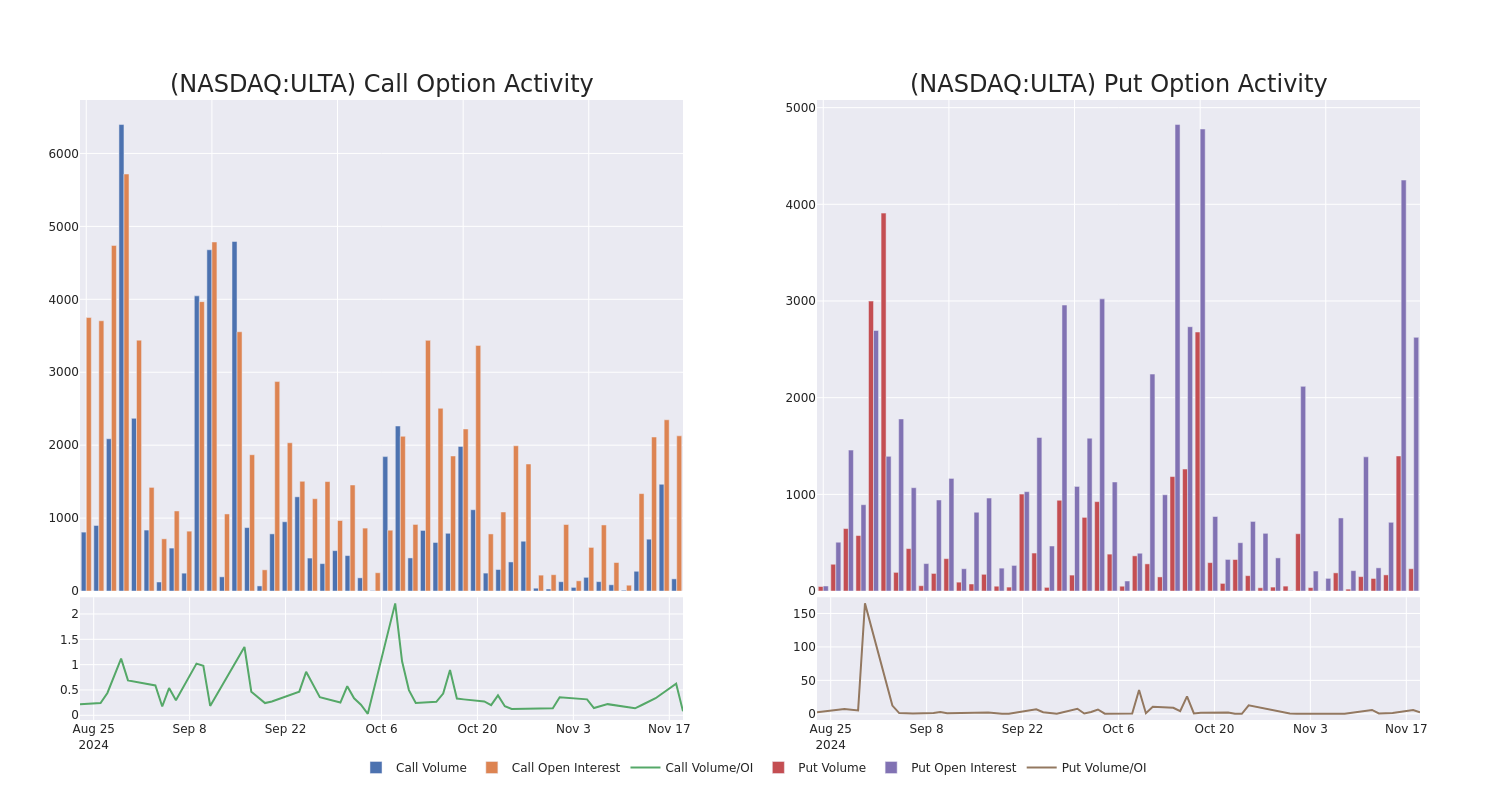

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Ulta Beauty’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Ulta Beauty’s substantial trades, within a strike price spectrum from $300.0 to $450.0 over the preceding 30 days.

Ulta Beauty Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ULTA | PUT | TRADE | BEARISH | 06/20/25 | $21.6 | $21.1 | $21.6 | $310.00 | $216.0K | 152 | 100 |

| ULTA | CALL | TRADE | NEUTRAL | 01/15/27 | $109.7 | $105.6 | $107.4 | $300.00 | $107.4K | 1.4K | 70 |

| ULTA | CALL | SWEEP | BULLISH | 01/15/27 | $108.5 | $105.2 | $107.6 | $300.00 | $107.1K | 1.4K | 50 |

| ULTA | CALL | TRADE | BULLISH | 01/15/27 | $107.6 | $105.6 | $107.6 | $300.00 | $86.0K | 1.4K | 60 |

| ULTA | CALL | TRADE | BULLISH | 01/15/27 | $110.4 | $103.4 | $107.6 | $300.00 | $86.0K | 1.4K | 30 |

About Ulta Beauty

With 1,385 stores at the end of fiscal 2023 and a partnership with Target, Ulta Beauty is the largest specialized beauty retailer in the US. The firm offers makeup (41% of 2023 sales), fragrances, skin care (19% of sales), and hair care products (19% of sales), and bath and body items. Ulta offers private-label products and more than 600 individual brands. It also offers salon services, including hair, makeup, skin, and brow services, in all stores. Most Ulta stores are approximately 10,000 square feet and are in suburban strip centers. Ulta was founded in 1990 and is based in Bolingbrook, Illinois.

Having examined the options trading patterns of Ulta Beauty, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Ulta Beauty

- With a trading volume of 392,950, the price of ULTA is up by 0.03%, reaching $342.27.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 15 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Ulta Beauty, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tony Thene Boosts Confidence With $97K Purchase Of Carpenter Tech Stock

On November 19, a substantial insider purchase was made by Tony Thene, President and CEO at Carpenter Tech CRS, as per the latest SEC filing.

What Happened: Thene’s recent move, as outlined in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, involves purchasing 5,500 shares of Carpenter Tech. The total transaction value is $97,460.

At Wednesday morning, Carpenter Tech shares are up by 0.8%, trading at $185.98.

Delving into Carpenter Tech’s Background

Carpenter Technology Corp supplies specialty metals to a variety of end markets, including aerospace and defense, industrial machinery and consumer durables, medical, and energy, among others. The company’s reportable segments include; Specialty Alloys Operations and Performance Engineered Products. It generates maximum revenue from the Specialty Alloys Operations segment. The SAO segment is comprised of the company’s alloy and stainless steel manufacturing operations. This includes operations performed at mills predominantly in Reading and Latrobe, Pennsylvania, and surrounding areas as well as South Carolina and Alabama. Geographically, the company derives its maximum revenue from the United States and the rest from Europe, Asia Pacific, Mexico, Canada, and other regions.

Financial Insights: Carpenter Tech

Positive Revenue Trend: Examining Carpenter Tech’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 10.08% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Materials sector.

Profitability Metrics:

-

Gross Margin: With a high gross margin of 24.57%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Carpenter Tech’s EPS is below the industry average. The company faced challenges with a current EPS of 1.69. This suggests a potential decline in earnings.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.42, caution is advised due to increased financial risk.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: Carpenter Tech’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 41.09.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 3.3 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Carpenter Tech’s EV/EBITDA ratio, surpassing industry averages at 21.14, positions it with an above-average valuation in the market.

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Navigating the World of Insider Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Carpenter Tech’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Tel-Aviv Stock Exchange Reports its Results for the Third Quarter of 2024

Quarterly revenue reached NIS 109 million, an increase of 14%;

EBITDA increased by 17% to NIS 45 million;

43% growth in net profit to NIS 26 million

- Revenue in the third quarter of the year reached a record NIS 109 million, compared to NIS 95 million in the corresponding quarter last year, an increase of 14%.

- Adjusted EBITDA in the third quarter of 2024 increased by 17%, totaling NIS 45 million, compared to NIS 38 million in the corresponding quarter last year.

- Net profit in the third quarter of the year totaled NIS 26 million, compared NIS 18 million in the corresponding quarter last year, an increase of 43%.

- Daily trading volumes were significantly higher this quarter, with a 7% increase in shares and 20% in bonds, compared to the average daily trading volumes in the corresponding quarter last year.

Ittai Ben Zeev, TASE CEO, said today:

“We conclude the third quarter with strong results that demonstrate the resilience of the Israeli economy. These results are the fruit of the ongoing implementation of TASE’s strategic plan, which focuses on aligning our operations with international standards, investing in technological advancement, and developing new financial products to enhance accessibility for investors.

Ben Zeev added: “Despite the ongoing war, TASE continues to demonstrate its strength as a crucial platform for raising equity and debt financing for both public companies and the Government of Israel., which is critical to the vitality and strength of the economy in these challenging times. Now, more than ever, it is important to generate growth catalysts that strengthen the local capital market, encourage international investment in the Israeli market and create incentives for local investments to facilitate continued growth and economic resilience.”

TEL AVIV, Israel, Nov. 20, 2024 /PRNewswire/ — The Tel-Aviv Stock Exchange Ltd. TASE today announced its financial results for the third quarter ended September 30, 2024.

Key trends and data in the capital market in the first nine months of 2024

The Israeli capital market continues to exhibit substantial resilience despite the ongoing war and the downgrading of Israel’s sovereign credit rating in recent months.

TASE’s leading indices maintain an upward trend: the TA-125 index increased by 12% from the beginning of the year through the end of September, similar to the increase in the Dow Jones Index and outperforming the 9% increase in the MSCI Europe Index, but less than the 21% increase in the S&P500 Index. Since October to date, TASE’s leading indices have continued to climb.

The market cap of the equity market at the end of September reached NIS 1,184 billion, a 12% increase over year-end 2023, with this resulting from the increase in TASE’s equity indices.

Trading volumes in the main trading channels increased significantly in the first nine months of 2024 compared to 2023. In the equity market, trading volumes were 5% higher than the average daily trading volume for all of 2023, and averaged NIS 2.1 billion a day. The average daily trading volume of bonds totaled NIS 4.4 billion, 12% greater than the average daily trading volume in 2023. The increase in the trading volumes was driven primarily by government shekel bonds, the average daily trading volume of which amounted to NIS 2.3 billion, compared to an average daily trading volume of NIS 1.9 billion in 2023, with this resulting from the surge in bond offerings by the Ministry of Finance.

In view of the ongoing war and the growing cumulative deficit, the Ministry of Finance continued to raise debt in the third quarter, and in the first nine months raised debt in a total amount of NIS 171 billion, compared to NIS 57.8 billion raised in the corresponding period last year. NIS 142.4 billion of said amount was raised on TASE.

The average daily trading volume of corporate bonds totaled NIS 1.1 billion, 6% higher than the average daily trading volume in 2023. T-bills also recorded substantial trading volumes, at a daily average of NIS 1.5 billion, 5% higher than the average daily trading volume in 2023.

Corporate bonds continue to serve as a significant channel for debt raising by public companies – during January-September 2024, the business sector raised debt totaling NIS 87.4 billion, 31% over the total of NIS 66.8 billion raised in the corresponding period last year.

Creations and redemptions of mutual funds reached an average daily volume of NIS 1.8 billion, 29% greater than the average daily volume in 2023. The market cap of the mutual funds at the end of the period reached NIS 405 billion, 23% greater than the market cap at the end of 2023, with this resulting from acquisitions of mutual funds and the appreciation of the mutual funds’ assets on TASE.

Renewed international interest in the local capital market, with foreign investors resuming equity purchases on TASE in July. At the end of the third quarter of 2024, their net purchases totaled NIS 3 billion, with this being in addition to ongoing investments by institutions investors, which have made net equity purchases of NIS 4.3 billion since the beginning of the year.

Enhancement of business operations and promotion of core activities

In the trading sphere, in early November TASE launched a Block Trade Facility for the pre-arranged and protected execution of large-scale transactions, which will be published instantaneously in a transparent and accessible manner, in alignment with global standards. In addition, the second development phase of the new OTC system was completed, improving its compatibility with the needs of foreign investors and with international standards. In August, TASE launched a market-making reform across all securities, with emphasis on shares included in the TA-90 index, which, for the first time, rewards market makers for liquidity, large quantities and tighter spreads.

In September, an agreement was signed for the launch of 6 new exclusive indices with Analyst Mutual Funds, and to date TASE has exclusivity agreements in place with 4 leading manufacturers for the launch of more than 20 new indices in the coming months.

In the derivatives market, in September, TASE launched the futures market on the leading flagship indices, TA-35, TA-90 and TA-Banks5. Within this framework, a first market maker was appointed to ensure liquidity and trade volume, which enable investors to benefit from more competitive prices. In addition, the reduction of the multipliers in the derivatives market for options on the TA-35, TA-Banks5 and TA-125 indices and for foreign currency options, increased the average daily trading volumes by 7% compared to 2023. The average daily trading volume of weekly options increased to 52 thousand units, the highest volume recorded since their launch and 9% greater than the average daily trading volume in 2023. At the same time, the average daily trading volume of the monthly options totaled 65 thousand units, 6% greater than the average daily trading volume in 2023.

In October, TASE launched TASE+, an innovative AI-based tool for monitoring and analyzing capital market investments in Israel and abroad. This free and user-friendly platform, available in English and Hebrew, allows the public to gain capital market experience by managing a virtual data-based investment portfolio. The move is aligned with TASE’s strategy of enhancing its direct engagement with the public, removing trading barriers and improving the public’s access to information. To date, more than 30,000 investment portfolios have been created, and new portfolios are being created daily.

Highlights of the results for the third quarter of 2024:

Revenue in the third quarter of 2024 totaled NIS 109 million, compared to NIS 95.5 million in the corresponding quarter last year, an increase of 14%. The increase in revenue is due mainly to an increase in revenue from data distribution and connectivity services, as a result of the increased volume of activity and the impact of the updated index-usage fees, this in addition to the increase in trading and clearing commissions as a result of the increase in the trading volumes and in the volume of creations/redemptions of mutual fund units.

Costs in the third quarter of 2024 totaled NIS 79 million, compared to NIS 72.1 million in the corresponding quarter last year. The higher costs are due mainly to the increase in payroll expenses, computer and communication expenses, and marketing expenses.

Net financing income in the third quarter of 2024 totaled NIS 4 million, compared to net financing income of NIS 2 million in the corresponding quarter last year, an increase of 103%. Financing income in the quarter increased due to interest income on the deposits and gains on financial assets. The increase in the income in the quarter was partly offset by the increase in financing expenses as a result of a bank loan obtained at the end of 2023.

The profit in the third quarter of 2024 totaled NIS 26 million, compared to NIS 18.2 million in the corresponding quarter last year, an increase of 43%. The increase in profit was due mainly to the increase in revenue, less the increase in costs and in tax expenses.

The adjusted EBITDA in the third quarter of 2024 totaled NIS 45.1 million, compared to NIS 38.4 million in the corresponding quarter last year, an increase of 17%. Most of the increase is due to the NIS 6.5 million increase in profit before financing.

The adjusted profit in the third quarter of 2024 totaled NIS 27.2 million, compared to NIS 20.1 million in the corresponding quarter last year, an increase of 35%. Most of the increase is due to an increase in revenue from services, less the increase in costs and in tax expenses.

Equity as of September 30, 2024 totaled NIS 686.7 million, compared to NIS 401.7 million as of December 31, 2023, an increase of 71%. Most of the increase is due to an increase in a capital reserve as a result of receipts from the sale of shares within the framework of the TASE ownership restructuring, in an amount of NIS 242.5 million.

Seasonality

The revenue of the Company from trading and clearing is affected, inter alia, by the number of trading and clearing days. In the third quarter of 2024, there were 65 trading days, compared to 61 days in the corresponding quarter last year, a 6.6% increase. In the first nine months of 2024 there were 185 trading days, compared to 183 days in the corresponding period last year, a 1.1% increase. Presented below is information on the quarterly breakdown of trading days:

|

Year |

First quarter |

Second quarter |

Third quarter |

Fourth quarter |

Total |

|

2023 |

64 |

58 |

61 |

66 |

249 |

|

2024 |

63 |

57 |

65 |

60 |

245 |

This notification does not supersede that stated in the periodic financial statements of the Company, which contain the full and accurate information.

Click here for the link to the full financial statements for the third quarter of 2024

Contact:

Orna Goren

Head of Communication and Public Relations Unit

Tel: +972 76 8160405

tase.ir@tase.co.il

![]() View original content:https://www.prnewswire.com/news-releases/the-tel-aviv-stock-exchange-reports-its-results-for-the-third-quarter-of-2024-302311893.html

View original content:https://www.prnewswire.com/news-releases/the-tel-aviv-stock-exchange-reports-its-results-for-the-third-quarter-of-2024-302311893.html

SOURCE The Tel Aviv Stock Exchange Ltd.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.