Palantir's Stock Just Did Something It Hasn't Done Since 2021

Palantir (NYSE: PLTR) has been one of the hottest artificial intelligence (AI) stocks to own this year. It’s up around 280% as of the time of this writing and has far exceeded many investors’ expectations.

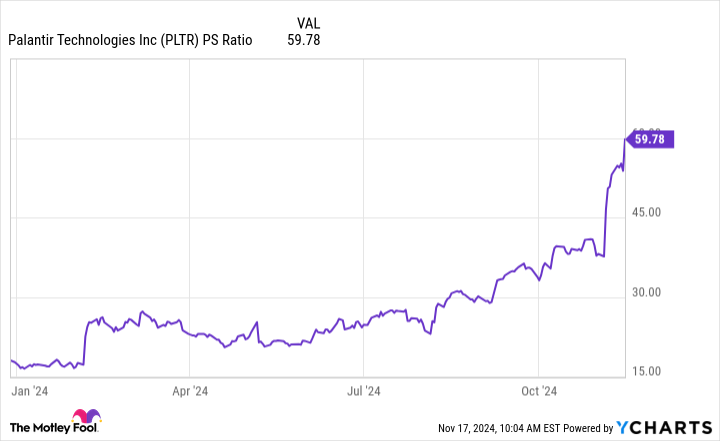

However, this run-up hasn’t entirely come from its business booming, as the price investors are willing to pay for its performance has surged alongside its stock price. This has caused the stock to do something it hasn’t done since 2021, and investors need to pay attention to it.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Palantir’s AI software has become a massive hit, as the company has years of expertise in this space that its competition doesn’t have. Palantir’s platform started off tailored for government use, allowing the software to take in massive amounts of information, process it quickly, and then give insights as to which actions to take next.

This general concept is also useful for commercial businesses, so Palantir eventually expanded to this side. As of the third quarter, the government business is still larger than the commercial side, but it’s starting to become a fairly even split, with government revenue making up 56% of the total.

The latest surge in AI demand has massively benefited Palantir, as more clients are looking for ways to integrate AI into their daily operations. This has a twofold effect for its customers. First, Palantir can automate some of the repetitive tasks that an employee may manually do. Second, the employees making decisions based on this information can be better informed because it gets to them in real-time.

All of this has caused Palantir’s product revenue to soar, rising 30% year over year to $726 million. The U.S., in particular, is seeing more demand than the international side. U.S. commercial revenue rose 54% year over year to $179 million, and U.S. government revenue rose 40% year over year to $320 million.

International sales are a big deal for Palantir, as they make up about a third of sales. While this part of the business isn’t necessarily “weak,” it just hasn’t seen the AI race that the U.S. has. Once the international client base starts to get the same AI fever as the U.S., Palantir’s growth could accelerate even more.

You may be tempted to place a significant bet on Palantir’s stock with just that information. However, what Palantir has recently done for the first time since 2021 isn’t good, and it could end in disaster for Palantir investors.

Leave a Reply