SoFi Stock vs. Palantir Stock: Wall Street Expects Earnings to Soar 48% for One and 115% for the Other in 2025

Many tech and artificial intelligence (AI) stocks trade at huge valuations, implying big earnings growth in the years to come, which is why investors are so bullish on these companies. They are buying earnings and growth in the future. The fintech SoFi Technologies (NASDAQ: SOFI) and the artificial intelligence company Palantir Technologies (NYSE: PLTR) both fit this description. Each has had a big year, with SoFi’s stock up over 41% this year and Palantir’s up over 296%.

With 2024 winding down, Wall Street is forecasting 48% earnings growth for one and a whopping 115% earnings growth for the other, according to data provided by Visible Alpha. Is Wall Street too optimistic about these stocks?

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Analysts expect Palantir’s diluted earnings per share to rise from $0.21 this year to $0.31 in 2025, implying a nearly 48% upside. Nine brokers provided estimates, with a low estimate of $0.25 and a high estimate of $0.42. Companies and governments use Palantir’s software to analyze vast amounts of data. The platform bridges the gap between complex AI and machine-learning language models and human analysis.

For example, the government uses Palantir in its counter-terrorism efforts to analyze and visualize data from unrelated sources to detect patterns and gain actionable insights. Palantir has raised awareness for its platform with its Artificial Intelligence Platform boot camps. The company allows customers to test out its platform and helps them use the tech to solve real problems with their business.

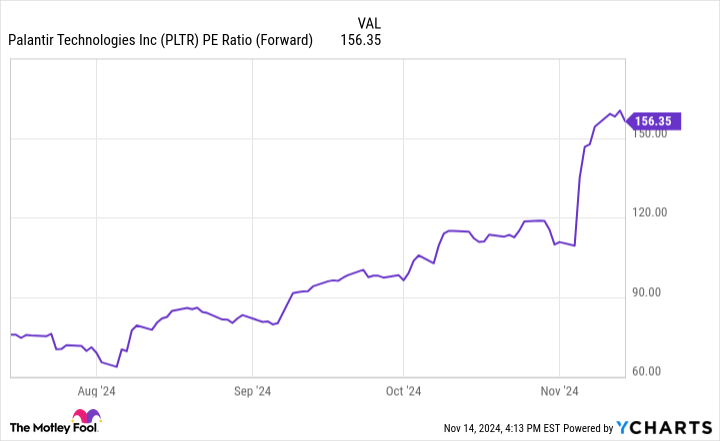

It’s easy to see how Palantir’s products could be useful for nearly every sector. What’s unclear is how differentiated Palantir is and whether that constitutes a true moat. You could probably say this about most AI businesses right now. Some believe Palantir is a leader, while others are less inclined to agree with its huge valuation.

After a stellar run for the stock, some analysts believe it will be more difficult to maintain the growth because the company will be up against difficult comparables. Palantir’s 48% earnings growth is nothing to sneeze at but it likely doesn’t justify this kind of valuation.

The fintech company SoFi aims to serve customers’ financial needs by providing bank accounts, personal budgeting tools, an investment platform, and loans including mortgages, student loans, and personal loans. SoFi also has a tech division that sells products and services that help power core banking activities for banks and other companies looking to add financial services.

Leave a Reply