Spotlight on HCA Healthcare: Analyzing the Surge in Options Activity

Benzinga’s options scanner just detected over 8 options trades for HCA Healthcare HCA summing a total amount of $532,222.

At the same time, our algo caught 6 for a total amount of 637,251.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $315.0 to $335.0 for HCA Healthcare over the last 3 months.

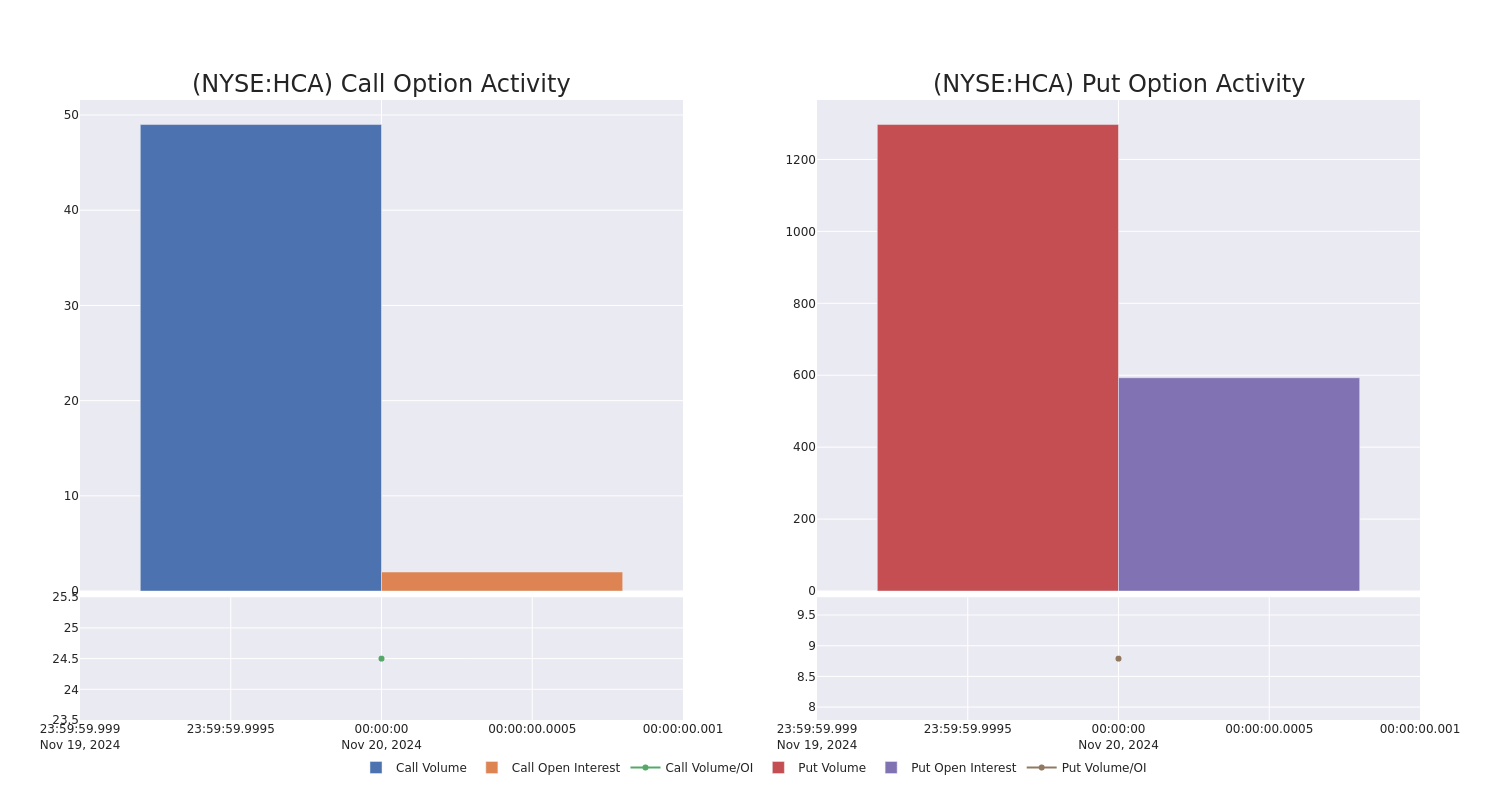

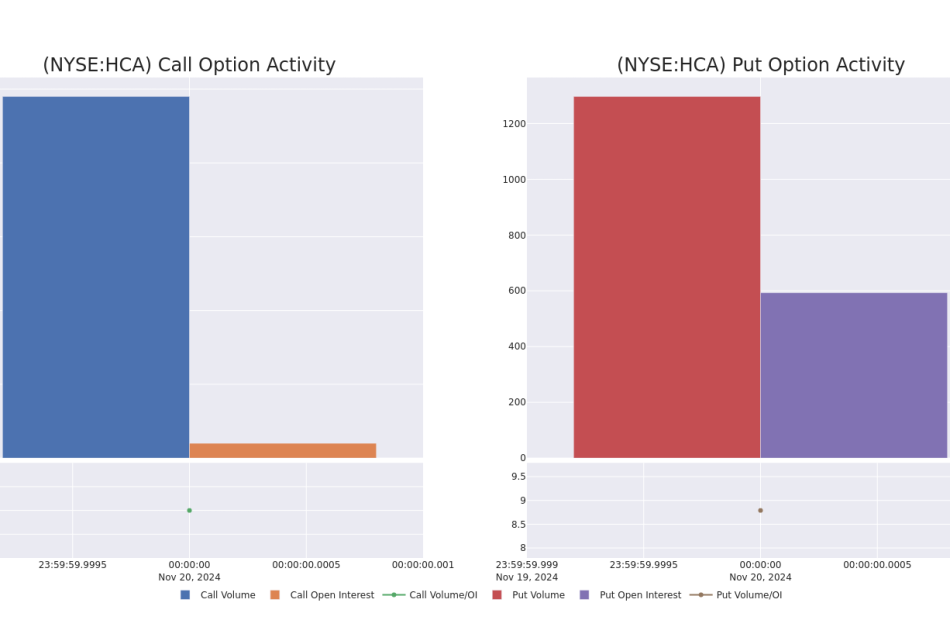

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for HCA Healthcare’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of HCA Healthcare’s whale trades within a strike price range from $315.0 to $335.0 in the last 30 days.

HCA Healthcare Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HCA | PUT | SWEEP | BEARISH | 12/20/24 | $8.6 | $8.4 | $8.6 | $325.00 | $215.7K | 86 | 262 |

| HCA | PUT | SWEEP | BULLISH | 12/20/24 | $9.6 | $9.5 | $9.5 | $330.00 | $139.7K | 97 | 150 |

| HCA | PUT | SWEEP | BULLISH | 12/20/24 | $9.7 | $9.7 | $9.7 | $330.00 | $95.9K | 97 | 259 |

| HCA | CALL | SWEEP | BULLISH | 02/21/25 | $18.4 | $18.3 | $18.4 | $335.00 | $80.9K | 2 | 36 |

| HCA | PUT | SWEEP | BULLISH | 01/17/25 | $7.8 | $7.2 | $7.2 | $315.00 | $72.7K | 410 | 222 |

About HCA Healthcare

HCA Healthcare is a Nashville-based healthcare provider organization operating the largest collection of acute-care hospitals in the United States. As of June 2024, the firm owned and operated 188 hospitals, 123 freestanding outpatient surgery centers, and a broad network of physician offices, urgent-care clinics, and freestanding emergency rooms across 20 states and a small foothold in England.

Following our analysis of the options activities associated with HCA Healthcare, we pivot to a closer look at the company’s own performance.

Where Is HCA Healthcare Standing Right Now?

- With a volume of 505,703, the price of HCA is down -1.79% at $329.1.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 69 days.

What The Experts Say On HCA Healthcare

In the last month, 5 experts released ratings on this stock with an average target price of $401.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on HCA Healthcare, which currently sits at a price target of $395.

* An analyst from Barclays has decided to maintain their Overweight rating on HCA Healthcare, which currently sits at a price target of $392.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for HCA Healthcare, targeting a price of $420.

* An analyst from Oppenheimer persists with their Outperform rating on HCA Healthcare, maintaining a target price of $400.

* An analyst from Wells Fargo persists with their Equal-Weight rating on HCA Healthcare, maintaining a target price of $400.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest HCA Healthcare options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply