This Is What Whales Are Betting On GE Aero

Whales with a lot of money to spend have taken a noticeably bullish stance on GE Aero.

Looking at options history for GE Aero GE we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 75% of the investors opened trades with bullish expectations and 12% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $298,514 and 2, calls, for a total amount of $70,600.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $175.0 to $200.0 for GE Aero over the recent three months.

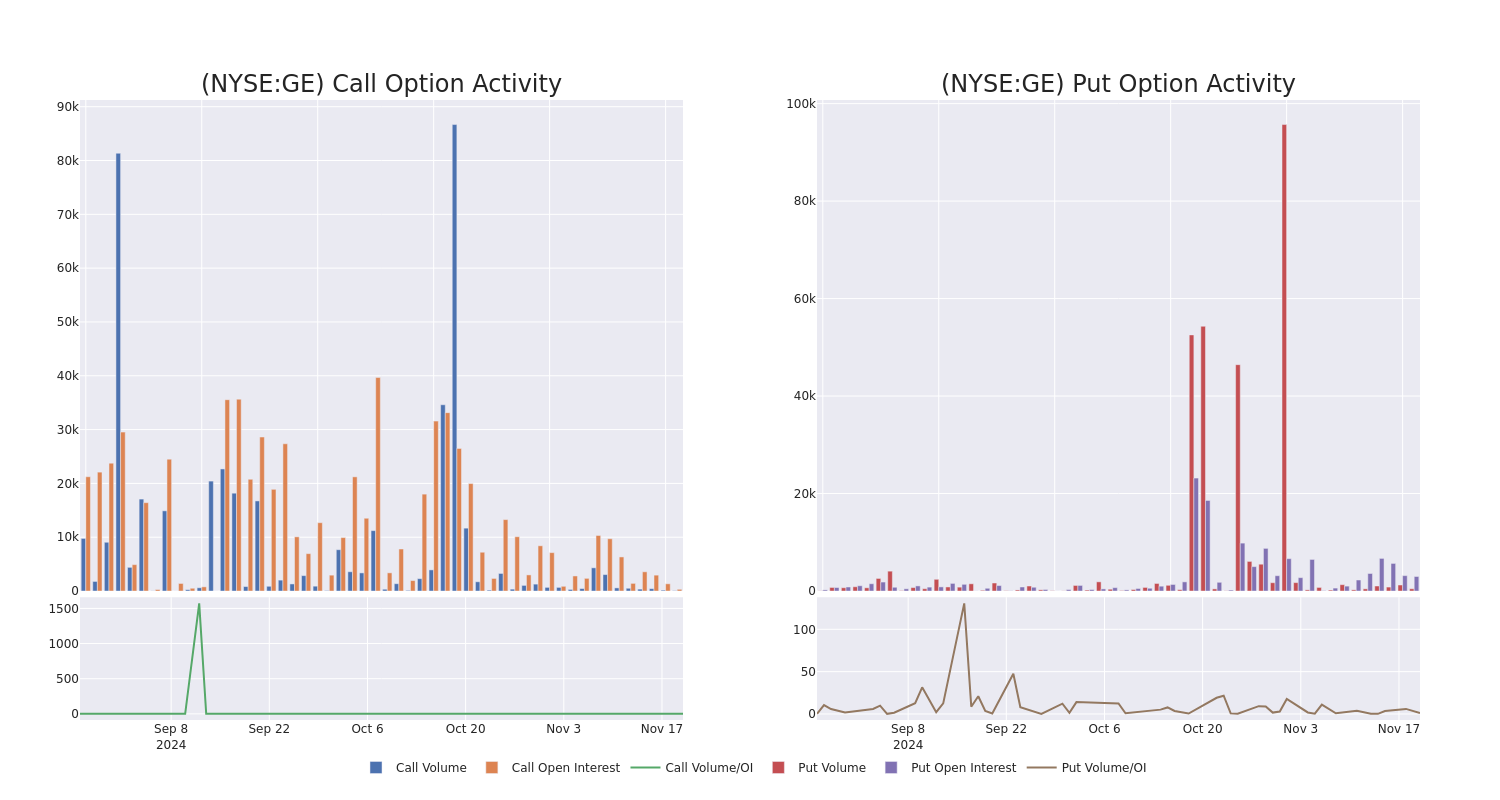

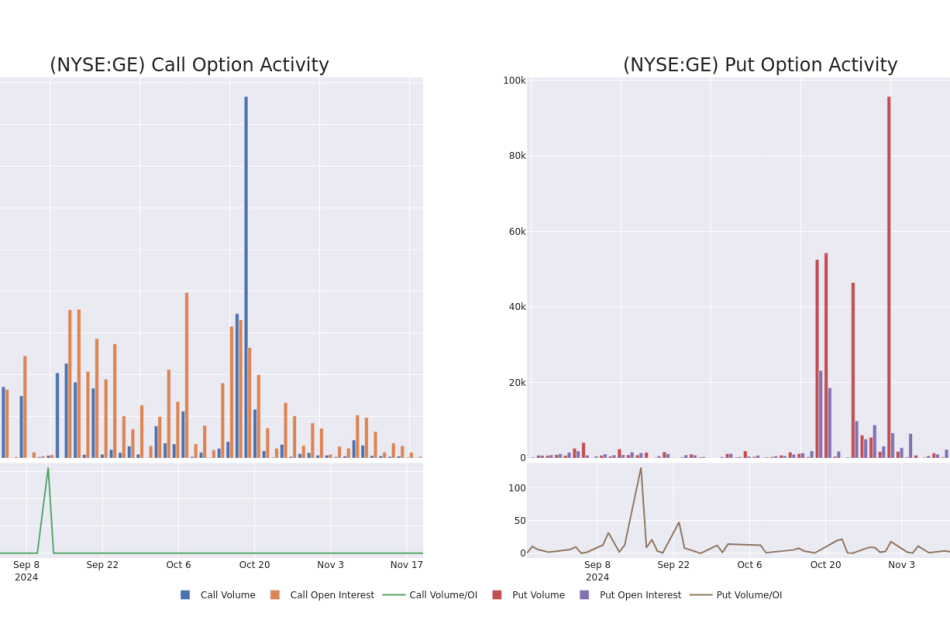

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for GE Aero’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across GE Aero’s significant trades, within a strike price range of $175.0 to $200.0, over the past month.

GE Aero Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GE | PUT | SWEEP | NEUTRAL | 02/21/25 | $11.55 | $11.5 | $11.55 | $180.00 | $51.9K | 172 | 48 |

| GE | PUT | SWEEP | BULLISH | 01/17/25 | $24.25 | $23.25 | $23.34 | $200.00 | $51.3K | 1.3K | 44 |

| GE | PUT | TRADE | BULLISH | 01/17/25 | $9.55 | $9.4 | $9.44 | $180.00 | $50.0K | 972 | 66 |

| GE | PUT | SWEEP | BULLISH | 01/17/25 | $9.45 | $9.25 | $9.26 | $180.00 | $49.0K | 972 | 197 |

| GE | PUT | SWEEP | BULLISH | 02/21/25 | $18.25 | $17.75 | $17.91 | $190.00 | $48.3K | 79 | 27 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

GE Aero’s Current Market Status

- With a trading volume of 1,683,143, the price of GE is down by -0.11%, reaching $177.37.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 62 days from now.

What Analysts Are Saying About GE Aero

4 market experts have recently issued ratings for this stock, with a consensus target price of $210.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on GE Aero, which currently sits at a price target of $210.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for GE Aero, targeting a price of $200.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on GE Aero with a target price of $230.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for GE Aero, targeting a price of $200.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for GE Aero with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply