TSMC's move to cut off Chinese chip firms weighs on annual Beijing semiconductor forum

Chinese chip industry experts and investors have congregated in Beijing for one of the largest annual chip forums to discuss the impact of Taiwan Semiconductor Manufacturing Company (TSMC) cutting advanced foundry services for some mainland clients and the outlook for the country’s chip sector under a new Donald Trump administration in the US.

Despite US threats of more sanctions, China should be bullish about developments in advanced semiconductors and generative artificial intelligence (AI) because of the potential of its huge market, according to industry insiders attending the 21st China International Semiconductor Expo.

The conference, which kicked off on Monday, gathered more than 500 firms from China’s semiconductor supply chain spanning design, foundry services and packaging in Beijing. Leading Chinese semiconductor equipment tool firms Naura Technology Group, 3D NAND flash memory chipmaker Yangtze Memory Technologies Corporation, DRAM chipmaker ChangXin Memory Technologies, and chip designer Huawei Technologies all took part in the three-day event.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Geopolitics has been one of the key concerns for many at the expo, as China braces for the uncertainty surrounding US policies when Trump returns to the White House for a second presidential term in January. Trump has vowed to increase tariffs on China-made goods by 60 per cent.

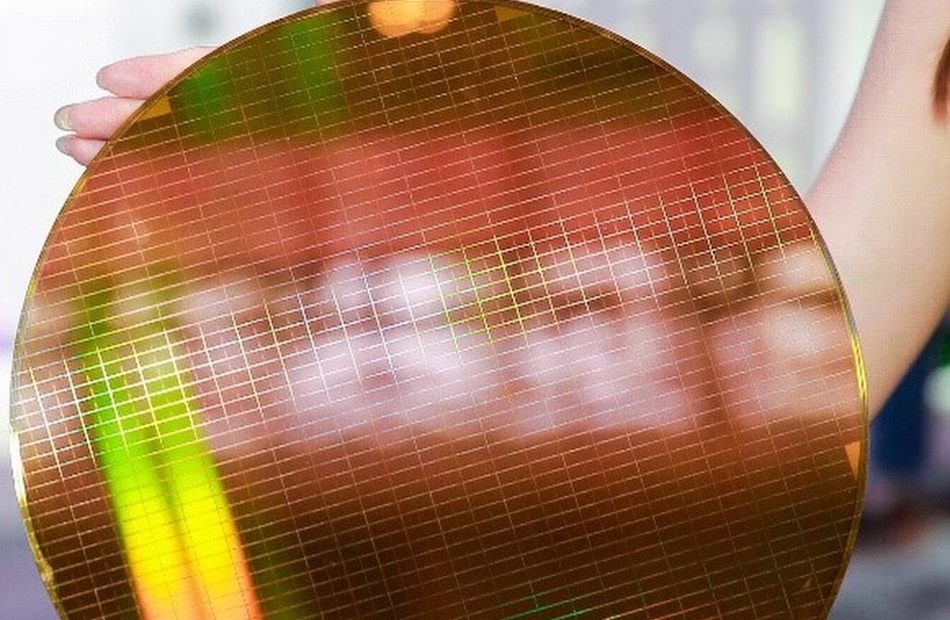

YMTC’s 64-layer 3D NAND flash memory wafer. Photo: YMTC alt=YMTC’s 64-layer 3D NAND flash memory wafer. Photo: YMTC>

He Weiwei, co-founder and general manager at BASiC Semiconductor, said during a panel at the Expo on Tuesday that the company has poured an extra 20 million yuan to 30 million yuan (US$2.8 million to US$4.1 million) into developing manufacturing facilities and materials in mainland China over fears that US sanctions could cut off supplies.

“This is a huge burden for a start-up like us,” He said. “We used to buy US materials and have the chips manufactured in Taiwan, and then ship them back to mainland China for packaging.”

When Trump started a trade war with China in 2018, BASiC feared it could be cut off from Taiwanese manufacturing, according to He. Technological decoupling in subsequent years also started to hurt expansion plans for Chinese companies.

“Some first-tier American carmakers made it very clear that they will not buy products made in China,” He said.

Leave a Reply