What the Options Market Tells Us About Warner Bros. Discovery

Whales with a lot of money to spend have taken a noticeably bullish stance on Warner Bros. Discovery.

Looking at options history for Warner Bros. Discovery WBD we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 66% of the investors opened trades with bullish expectations and 11% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $233,408 and 6, calls, for a total amount of $333,960.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $17.0 for Warner Bros. Discovery during the past quarter.

Insights into Volume & Open Interest

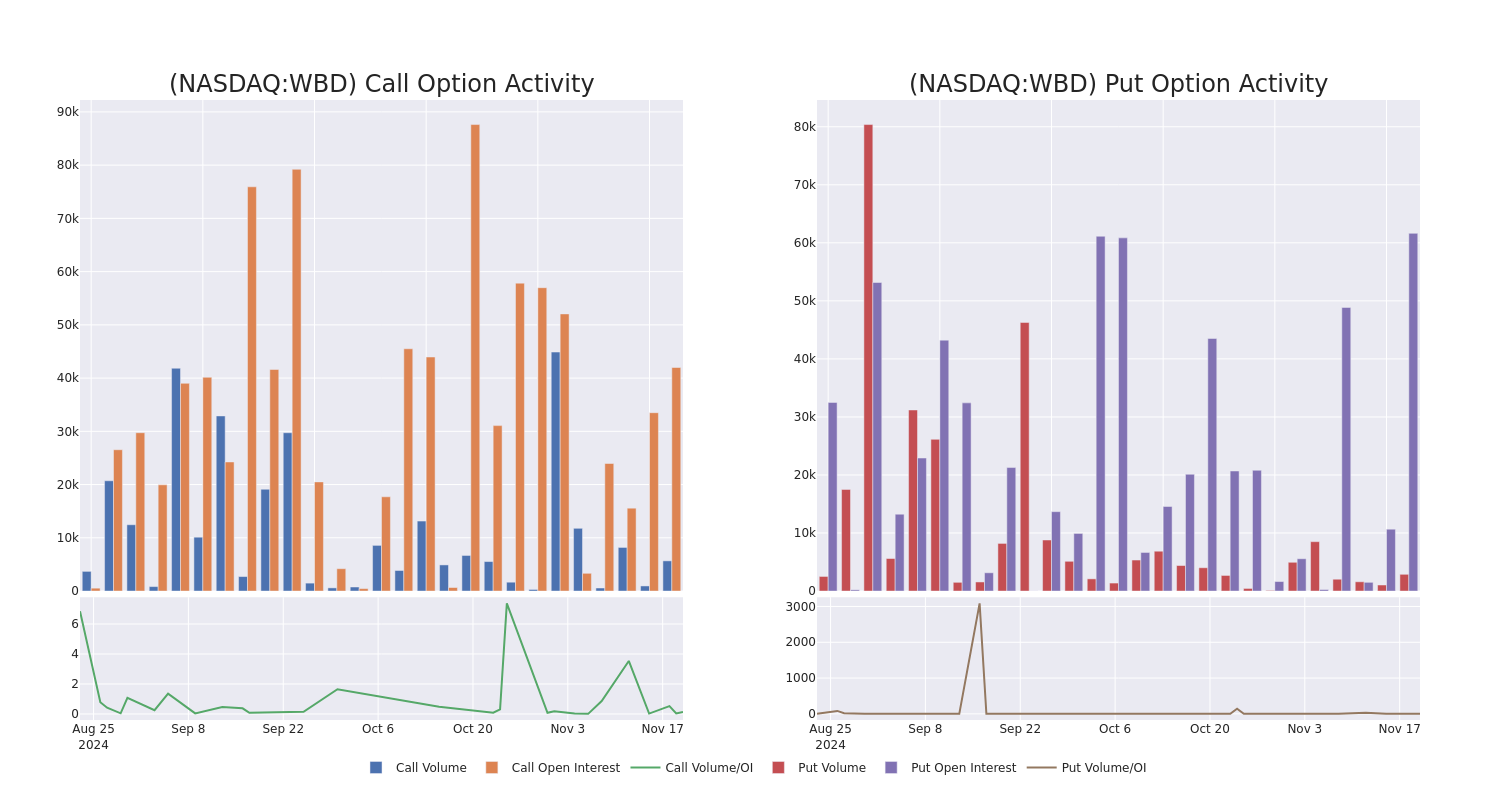

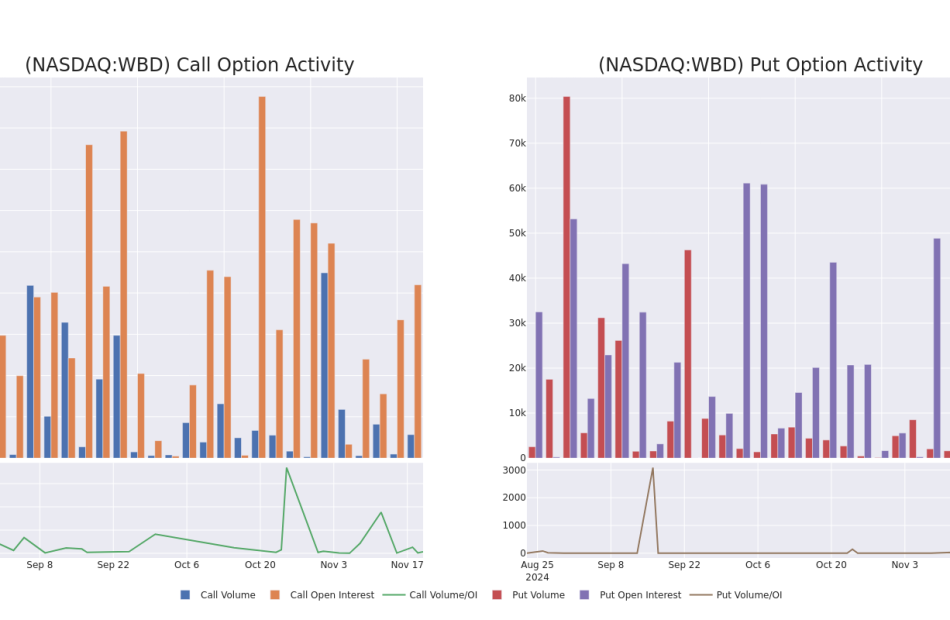

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Warner Bros. Discovery’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Warner Bros. Discovery’s whale trades within a strike price range from $7.5 to $17.0 in the last 30 days.

Warner Bros. Discovery Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WBD | PUT | TRADE | BULLISH | 02/21/25 | $1.54 | $1.49 | $1.51 | $11.00 | $151.0K | 545 | 1.0K |

| WBD | CALL | SWEEP | BULLISH | 01/17/25 | $0.27 | $0.25 | $0.26 | $11.00 | $89.0K | 2.5K | 3.4K |

| WBD | CALL | TRADE | BULLISH | 12/20/24 | $2.1 | $2.08 | $2.1 | $8.00 | $79.8K | 13.1K | 398 |

| WBD | CALL | SWEEP | BULLISH | 11/29/24 | $0.73 | $0.59 | $0.6 | $9.50 | $60.0K | 2.4K | 1.3K |

| WBD | PUT | SWEEP | BEARISH | 06/20/25 | $0.4 | $0.39 | $0.4 | $7.50 | $51.4K | 60.7K | 1.7K |

About Warner Bros. Discovery

Warner Bros. Discovery was formed in 2022 through the combination of WarnerMedia and Discovery Communications. It operates in three global business segments: studios, networks, and direct-to-consumer. Warner Bros. Pictures is the crown jewel of the studios business, producing, distributing, and licensing movies and television shows. The networks business consists of basic cable networks, such as CNN, TNT, TBS, Discovery, HGTV, and the Food Network. Direct-to-consumer includes HBO and the firm’s streaming platforms, which have now been consolidated to Max and Discovery+. Much of the DTC content is created within the firm’s other two business segments. Each segment operates with a global reach, with Max available in over 60 countries.

In light of the recent options history for Warner Bros. Discovery, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Warner Bros. Discovery

- With a trading volume of 30,484,682, the price of WBD is up by 3.21%, reaching $9.8.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 93 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Warner Bros. Discovery with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply