What's Next: Gap's Earnings Preview

Gap GAP is set to give its latest quarterly earnings report on Thursday, 2024-11-21. Here’s what investors need to know before the announcement.

Analysts estimate that Gap will report an earnings per share (EPS) of $0.58.

Gap bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

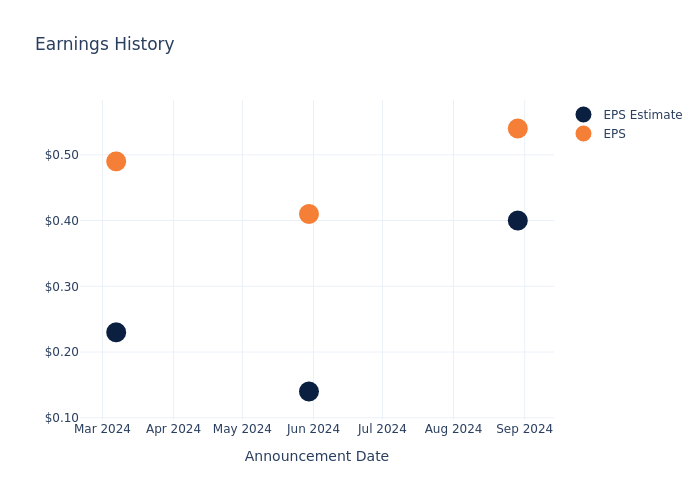

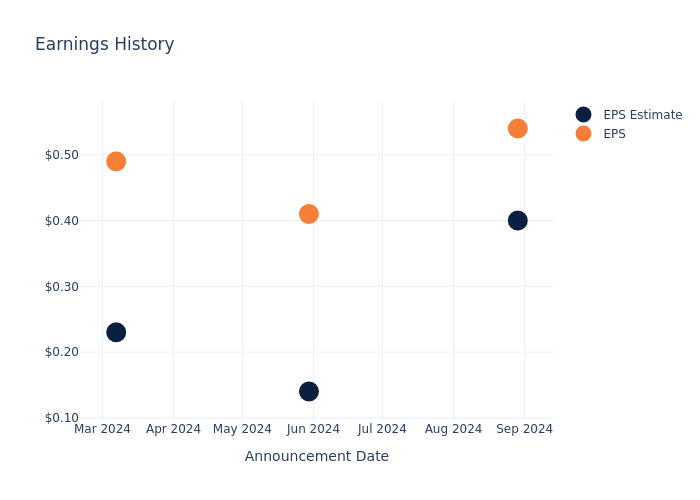

Performance in Previous Earnings

During the last quarter, the company reported an EPS beat by $0.14, leading to a 1.62% drop in the share price on the subsequent day.

Here’s a look at Gap’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.40 | 0.14 | 0.23 | 0.18 |

| EPS Actual | 0.54 | 0.41 | 0.49 | 0.59 |

| Price Change % | -2.0% | 28.999999999999996% | 8.0% | 31.0% |

Stock Performance

Shares of Gap were trading at $21.0 as of November 19. Over the last 52-week period, shares are up 8.72%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on Gap

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Gap.

The consensus rating for Gap is Neutral, based on 6 analyst ratings. With an average one-year price target of $27.17, there’s a potential 29.38% upside.

Understanding Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Abercrombie & Fitch, Boot Barn Holdings and Urban Outfitters, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The consensus among analysts is an Neutral trajectory for Abercrombie & Fitch, with an average 1-year price target of $185.62, indicating a potential 783.9% upside.

- The consensus among analysts is an Buy trajectory for Boot Barn Holdings, with an average 1-year price target of $171.56, indicating a potential 716.95% upside.

- Urban Outfitters received a Neutral consensus from analysts, with an average 1-year price target of $41.0, implying a potential 95.24% upside.

Peers Comparative Analysis Summary

The peer analysis summary presents essential metrics for Abercrombie & Fitch, Boot Barn Holdings and Urban Outfitters, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Gap | Neutral | 4.85% | $1.58B | 7.35% |

| Abercrombie & Fitch | Neutral | 21.24% | $736.26M | 11.65% |

| Boot Barn Holdings | Buy | 13.71% | $152.86M | 2.94% |

| Urban Outfitters | Neutral | 6.27% | $493.29M | 5.34% |

Key Takeaway:

Gap is positioned in the middle among its peers for revenue growth. It ranks at the bottom for gross profit. In terms of return on equity, Gap is also placed in the middle.

Delving into Gap’s Background

Gap retails apparel, accessories, and personal-care products under the Gap, Old Navy, Banana Republic, and Athleta brands. Old Navy generates more than half of Gap’s sales. The firm also operates e-commerce sites, outlet stores, and specialty stores under various Gap names. Gap operates approximately 2,500 stores in North America, Europe, and Asia and franchises about 1,000 more in Asia, Europe, Latin America, and other regions. Gap was founded in 1969 and is based in San Francisco.

A Deep Dive into Gap’s Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Gap showcased positive performance, achieving a revenue growth rate of 4.85% as of 31 July, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Gap’s net margin excels beyond industry benchmarks, reaching 5.54%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Gap’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 7.35% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.84%, the company showcases effective utilization of assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.88, caution is advised due to increased financial risk.

To track all earnings releases for Gap visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply