Why Nvidia earnings could be a sink-or-swim moment for this bull market

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

Chip stocks are down 3% since the election. Meanwhile, the S&P 500 is up by about the same measure.

Once the pillar of this two-year bull market, semiconductors have been a net drag on US stocks over the last four months.

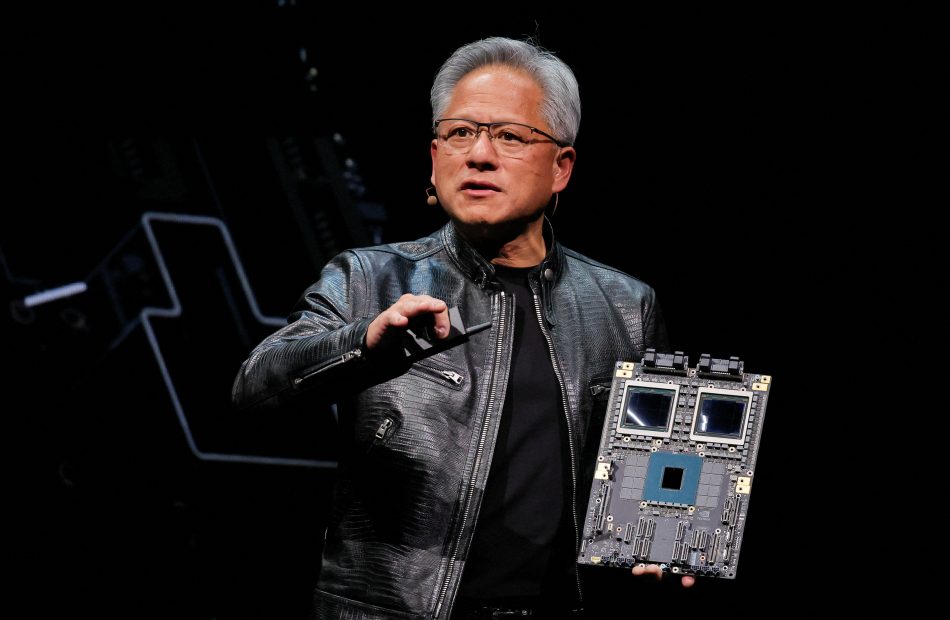

Nvidia (NVDA) earnings — coming after the bell Wednesday — will provide a reality check on just how important the AI poster child (and its cousins) are to this rally.

Tom Essaye, founder and president of the Sevens Report, recently joined Yahoo Finance and broke down the key elements traders are looking for in Nvidia earnings Wednesday.

“It’s all about the guidance. How enthusiastic and how aggressive [Nvidia is] on the guidance,” said Essaye. “It’s a growth story here. We all know it. It’s the future. It’s the next big thing. They’ve got to keep us excited about it via this earnings print.”

Nvidia has roared back strong since its July slump, rising 45% from the major August low. The chip stock — up nearly 200% this year and up over 1100% in the last two years — hit record highs following the election.

But many of Nvidia’s peers, especially smaller ones, have become a net drag on the industry and US stocks writ large since the start of the second half of the year.

The worst-off among this group of chip stocks, Super Micro Computer (SMCI), faces idiosyncratic problems as it struggles to avoid delisting on the Nasdaq exchange. Qorvo (QRVO) is down over 40%, as is Mobileye Global (MBLY) in the second half of the year so far.

Meanwhile, Intel (INTC), Micron (MU), KLA Corp (KLAC), Applied Materials (AMAT), and Microchip (MCHP) are all down more than 20%. Advanced Micro Devices (AMD) — seen as Nvidia’s biggest competitor — is down 14%.

The PHLX Semiconductor Index (^SOX), which tracks chip industry stocks, has fluctuated for several months. And a fresh two-month low on Monday this week made some technical traders nervous.

To be fair, the US rally has already broadened in the third and fourth quarters far beyond the influence of chip stocks, and that’s likely to continue next year, as Josh Schafer wrote Monday.

“Nvidia is not the full market driver that it was, say, earlier [in the rally],” said Essaye.

Since the second quarter, Tech (XLK) has been the second-worst-performing sector after Healthcare (XLV), barely in positive territory. Accordingly, investors might wonder if this bull market can continue if tech suddenly becomes an anchor on the S&P 500. And should Nvidia — “priced to perfection” according to many analysts — underdeliver and underwhelm, investors may face that reckoning.

Leave a Reply