A Closer Look at Twilio's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on Twilio TWLO.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with TWLO, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 8 options trades for Twilio.

This isn’t normal.

The overall sentiment of these big-money traders is split between 37% bullish and 25%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $28,604, and 7, calls, for a total amount of $311,820.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $140.0 for Twilio during the past quarter.

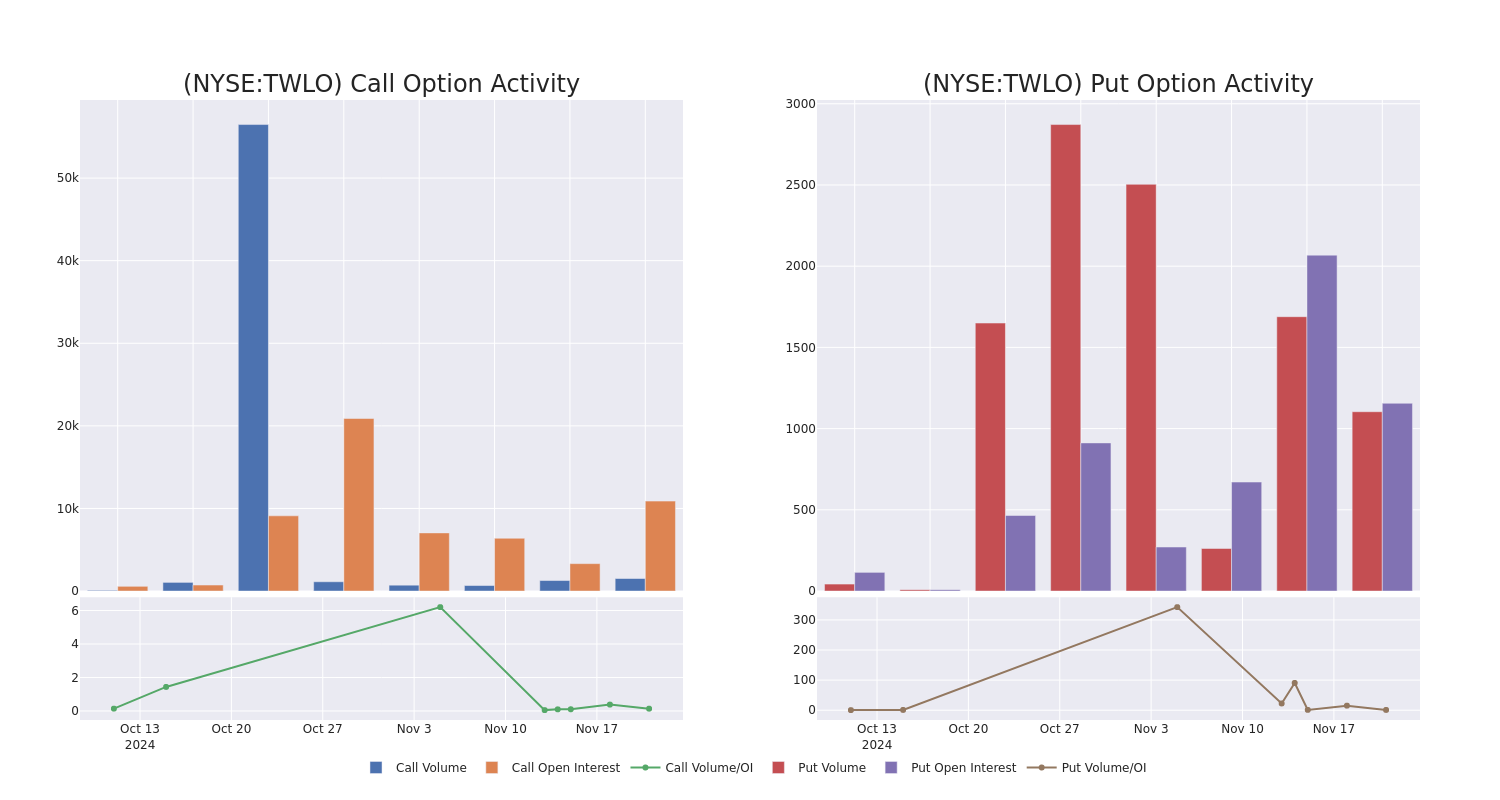

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Twilio’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Twilio’s whale activity within a strike price range from $75.0 to $140.0 in the last 30 days.

Twilio Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TWLO | CALL | TRADE | NEUTRAL | 09/19/25 | $5.9 | $5.7 | $5.8 | $140.00 | $87.0K | 0 | 150 |

| TWLO | CALL | SWEEP | BULLISH | 02/21/25 | $6.95 | $5.75 | $7.0 | $110.00 | $70.0K | 1.5K | 12 |

| TWLO | CALL | TRADE | BULLISH | 01/17/25 | $2.02 | $2.01 | $2.02 | $115.00 | $40.4K | 3.1K | 414 |

| TWLO | CALL | TRADE | BEARISH | 01/15/27 | $39.75 | $39.15 | $39.15 | $75.00 | $31.3K | 20 | 8 |

| TWLO | PUT | SWEEP | NEUTRAL | 01/17/25 | $7.3 | $7.15 | $7.15 | $105.00 | $28.6K | 1.1K | 1.1K |

About Twilio

Twilio is a cloud-based communications platform-as-a-service company offering communication building blocks that allow for a fully customized customer engagement experience spanning voice, video, chat, and SMS messaging. It does this through various application programming interfaces and prebuilt solution applications aimed at improving customer engagement. The company leverages its Super Network, a global network of carrier relationships, to facilitate high-speed, cost-effective communication.

In light of the recent options history for Twilio, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Twilio Standing Right Now?

- Trading volume stands at 2,724,508, with TWLO’s price up by 0.68%, positioned at $99.11.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 83 days.

Expert Opinions on Twilio

In the last month, 5 experts released ratings on this stock with an average target price of $95.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Twilio, targeting a price of $94.

* Consistent in their evaluation, an analyst from Baird keeps a Neutral rating on Twilio with a target price of $80.

* An analyst from Wells Fargo persists with their Equal-Weight rating on Twilio, maintaining a target price of $80.

* An analyst from Oppenheimer has decided to maintain their Outperform rating on Twilio, which currently sits at a price target of $90.

* In a positive move, an analyst from Monness, Crespi, Hardt has upgraded their rating to Buy and adjusted the price target to $135.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Twilio options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply