Behind the Scenes of Walt Disney's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards Walt Disney DIS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DIS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 15 extraordinary options activities for Walt Disney. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 60% leaning bullish and 20% bearish. Among these notable options, 6 are puts, totaling $240,736, and 9 are calls, amounting to $439,043.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $125.0 for Walt Disney during the past quarter.

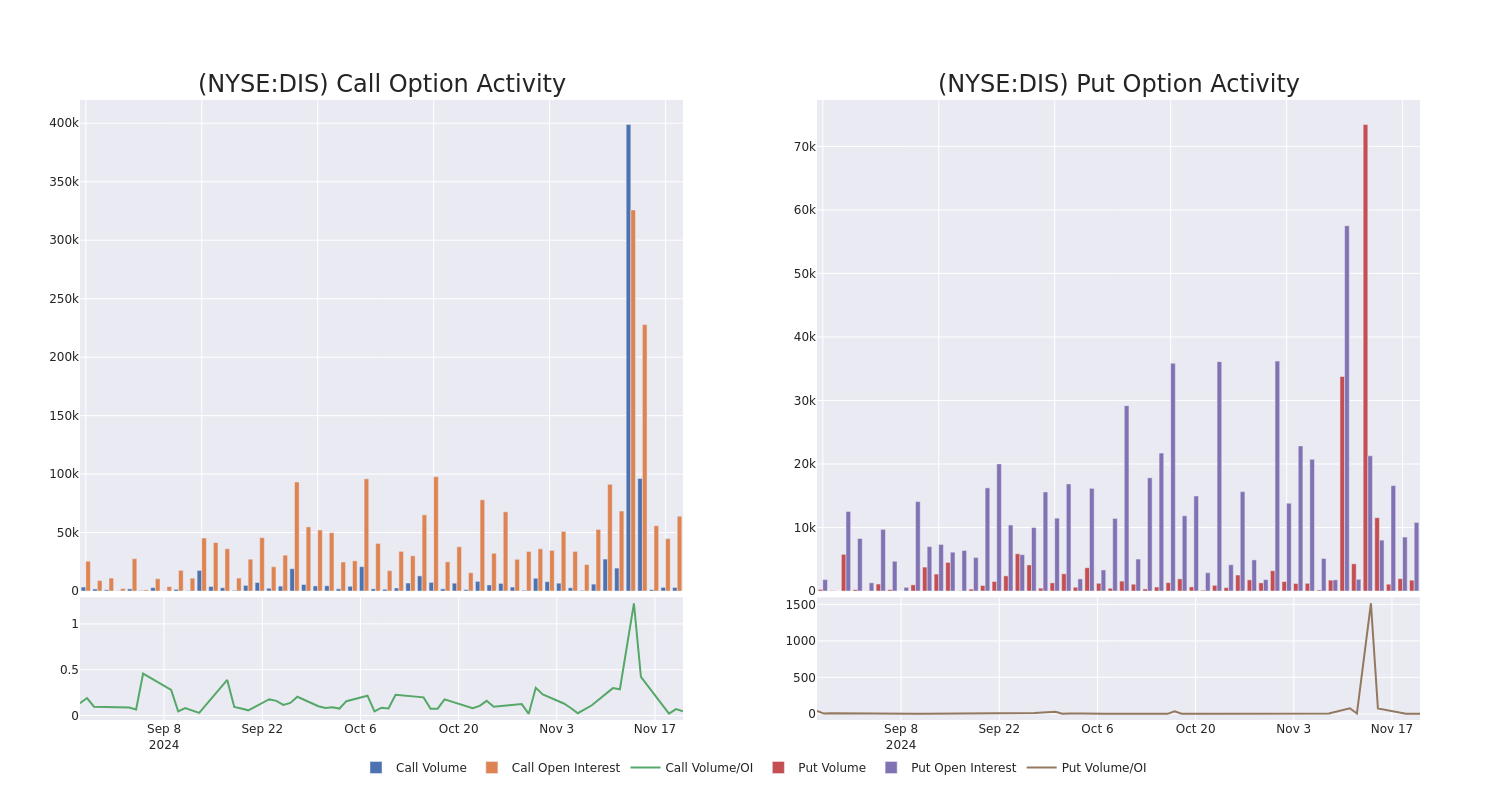

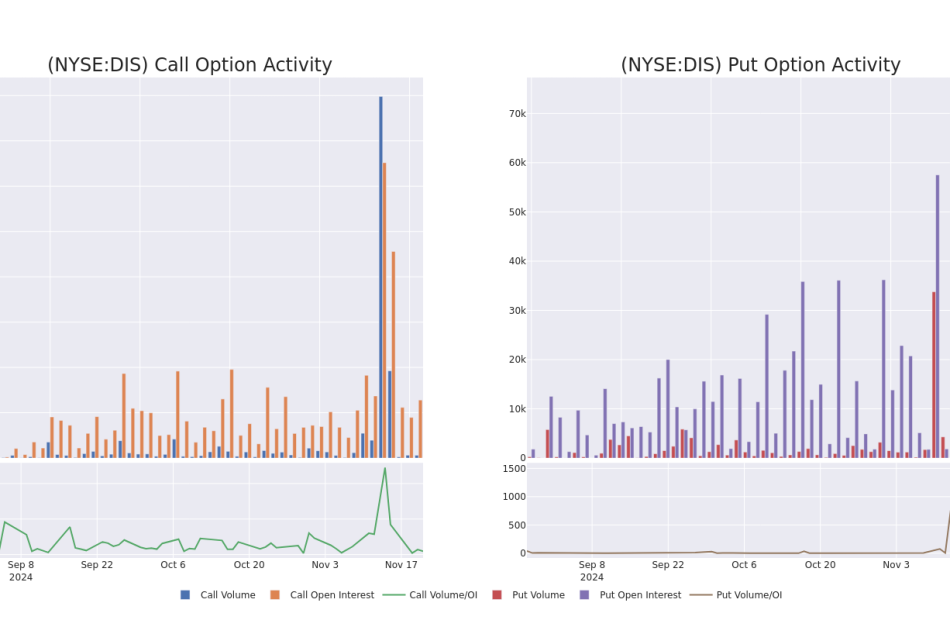

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Walt Disney’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Walt Disney’s substantial trades, within a strike price spectrum from $95.0 to $125.0 over the preceding 30 days.

Walt Disney Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | BEARISH | 01/17/25 | $6.75 | $6.7 | $6.7 | $110.00 | $76.3K | 26.8K | 440 |

| DIS | CALL | TRADE | BULLISH | 12/06/24 | $1.6 | $1.6 | $1.6 | $115.00 | $64.0K | 2.8K | 426 |

| DIS | CALL | TRADE | NEUTRAL | 01/17/25 | $15.45 | $15.05 | $15.22 | $100.00 | $60.8K | 17.0K | 40 |

| DIS | CALL | SWEEP | BULLISH | 03/21/25 | $7.55 | $7.4 | $7.52 | $115.00 | $59.4K | 3.2K | 442 |

| DIS | CALL | SWEEP | BEARISH | 01/17/25 | $6.75 | $6.7 | $6.7 | $110.00 | $47.5K | 26.8K | 518 |

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from the firm’s ownership of iconic franchises and characters. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney’s own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney’s theme parks and vacation destinations, and also benefits from merchandise licensing.

Current Position of Walt Disney

- With a volume of 6,075,759, the price of DIS is up 0.99% at $115.39.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 76 days.

What Analysts Are Saying About Walt Disney

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $129.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Deutsche Bank persists with their Buy rating on Walt Disney, maintaining a target price of $131.

* An analyst from B of A Securities has decided to maintain their Buy rating on Walt Disney, which currently sits at a price target of $140.

* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Walt Disney, which currently sits at a price target of $134.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $130.

* An analyst from Needham downgraded its action to Buy with a price target of $110.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Walt Disney, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply