Decoding Robinhood Markets's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on Robinhood Markets HOOD.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with HOOD, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 17 options trades for Robinhood Markets.

This isn’t normal.

The overall sentiment of these big-money traders is split between 29% bullish and 64%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $29,800, and 16, calls, for a total amount of $1,056,398.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $30.0 and $40.0 for Robinhood Markets, spanning the last three months.

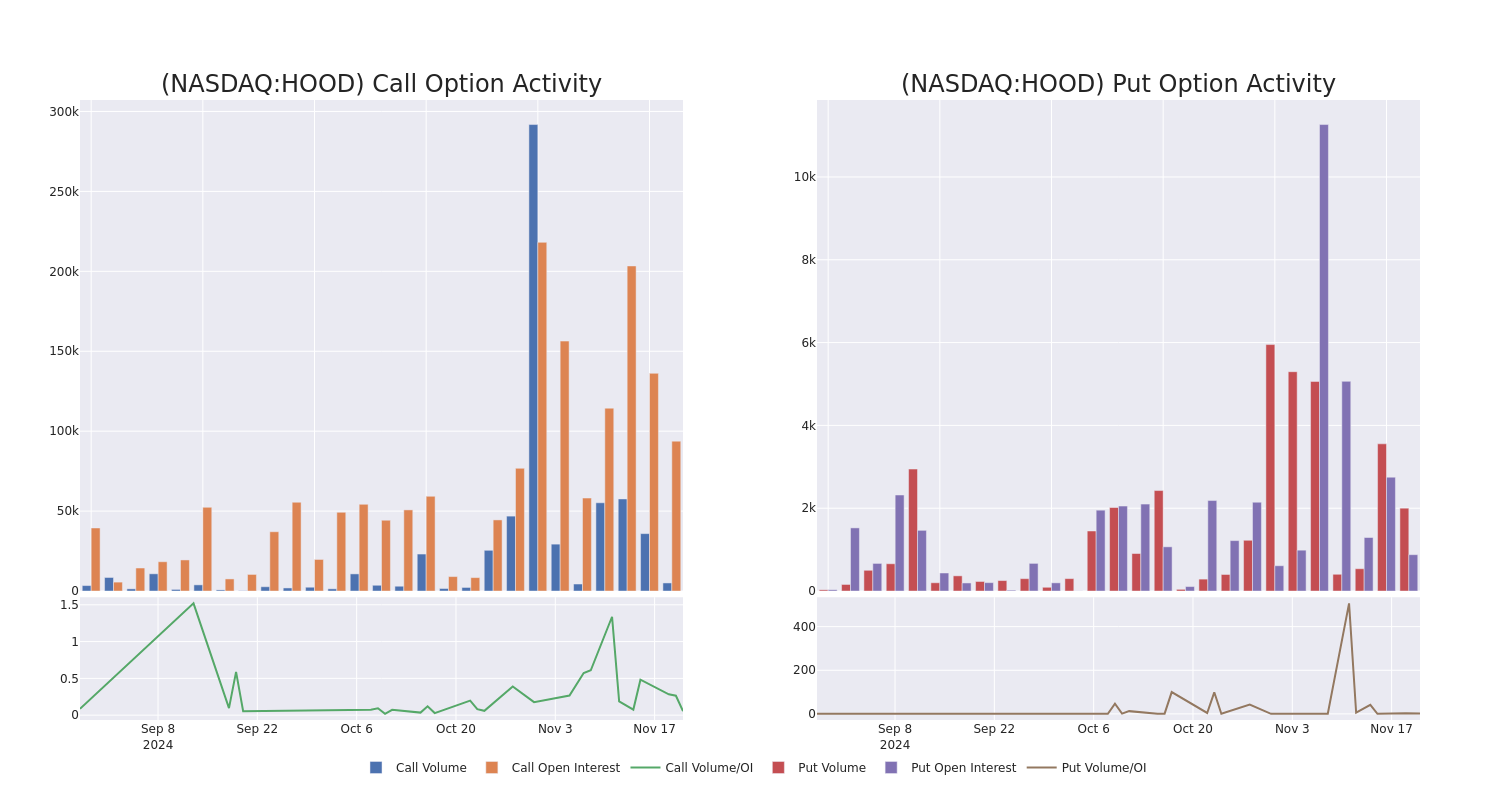

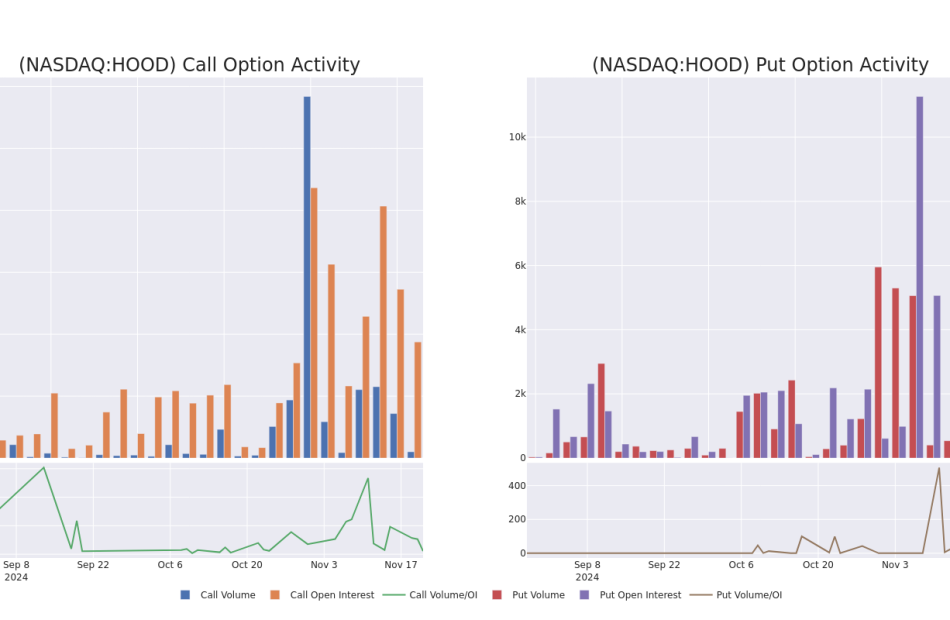

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Robinhood Markets’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Robinhood Markets’s whale activity within a strike price range from $30.0 to $40.0 in the last 30 days.

Robinhood Markets Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | SWEEP | BEARISH | 12/20/24 | $2.31 | $2.2 | $2.2 | $39.00 | $220.0K | 2.1K | 0 |

| HOOD | CALL | SWEEP | BULLISH | 01/17/25 | $3.65 | $3.55 | $3.65 | $37.00 | $146.0K | 22.6K | 928 |

| HOOD | CALL | SWEEP | BULLISH | 01/17/25 | $5.15 | $5.05 | $5.1 | $34.00 | $127.5K | 3.4K | 257 |

| HOOD | CALL | SWEEP | BEARISH | 12/20/24 | $1.91 | $1.9 | $1.9 | $40.00 | $84.7K | 17.7K | 957 |

| HOOD | CALL | TRADE | NEUTRAL | 01/17/25 | $7.95 | $7.5 | $7.75 | $30.00 | $77.5K | 14.8K | 105 |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

Having examined the options trading patterns of Robinhood Markets, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Robinhood Markets

- With a trading volume of 2,118,067, the price of HOOD is up by 2.25%, reaching $36.89.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 82 days from now.

Professional Analyst Ratings for Robinhood Markets

5 market experts have recently issued ratings for this stock, with a consensus target price of $31.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Robinhood Markets with a target price of $26.

* An analyst from Piper Sandler persists with their Overweight rating on Robinhood Markets, maintaining a target price of $36.

* Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Robinhood Markets, targeting a price of $32.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Robinhood Markets with a target price of $24.

* An analyst from Needham upgraded its action to Buy with a price target of $40.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Robinhood Markets, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply