MicroStrategy Tumbles After Citron Research Shorts the Stock

(Bloomberg) — MicroStrategy Inc shares tumbled after Andrew Left’s Citron Research said in a post on X that it’s betting against the software company, which has effectively transformed itself into a Bitcoin investment fund.

Most Read from Bloomberg

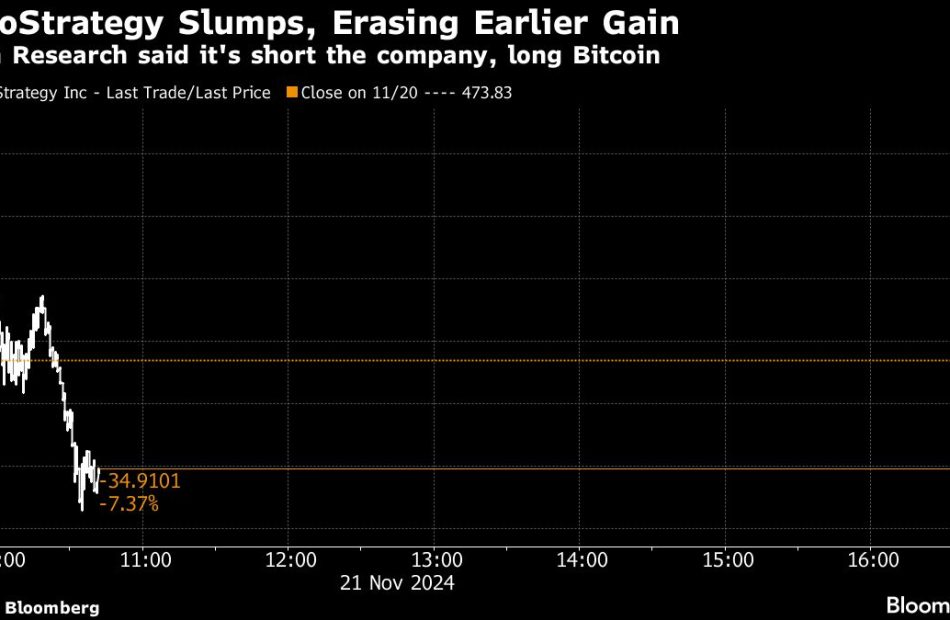

The stock fell as much as 10% in intraday trading Thursday, reversing a gain of nearly 15% from earlier in the session. By Wednesday’s close, Microstrategy had surged 650% this year.

Under Chair Michael Saylor, MicroStrategy has become nearly synonymous with Bitcoin after it snapped up billions of dollars of the cryptocurrency, sometimes selling debt to finance the purchases. But with the rolllout of Bitcoin ETFs, investors can buy such funds directly instead of using MicroStrategy’s stock as a publicly traded proxy.

Now that Bitcoin investing is “easier than ever,” MicroStrategy’s volume “has completely detached from BTC fundamentals,” Citron wrote in an X post, adding that “while Citron remains bullish on Bitcoin, we’ve hedged with a short $MSTR position.”

MicroStrategy did not immediately respond to a Bloomberg News request for comment.

The surge in Bitcoin — which pushed over $98,000 Thursday — has also lifted MicroStrategy shares. The company now has a market capitalization of more than $100 billion, making it as valuable as one of the top 100 stocks in the S&P 500.

Citron Research is not the first to suggest hedging a bullish Bitcoin position by shorting MicroStrategy. In March, Kerrisdale Capital Management LLC made a similar suggestion, saying that it was long Bitcoin but short shares of MicroStrategy.

MicroStrategy Falls as Kerrisdale Shorts, Says It’s Long Bitcoin

The post is one of few public positions that Citron has put out since founder Andrew Left was charged with securities fraud in July. In September, the firm posted about another previous bet on private prisons.

In October, Left asked a judge to dismiss the US Securities and Exchange Commission’s lawsuit against him.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Leave a Reply