Red Cat Hldgs's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bearish move on Red Cat Hldgs. Our analysis of options history for Red Cat Hldgs RCAT revealed 10 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $248,470, and 7 were calls, valued at $246,565.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $5.0 to $12.0 for Red Cat Hldgs over the recent three months.

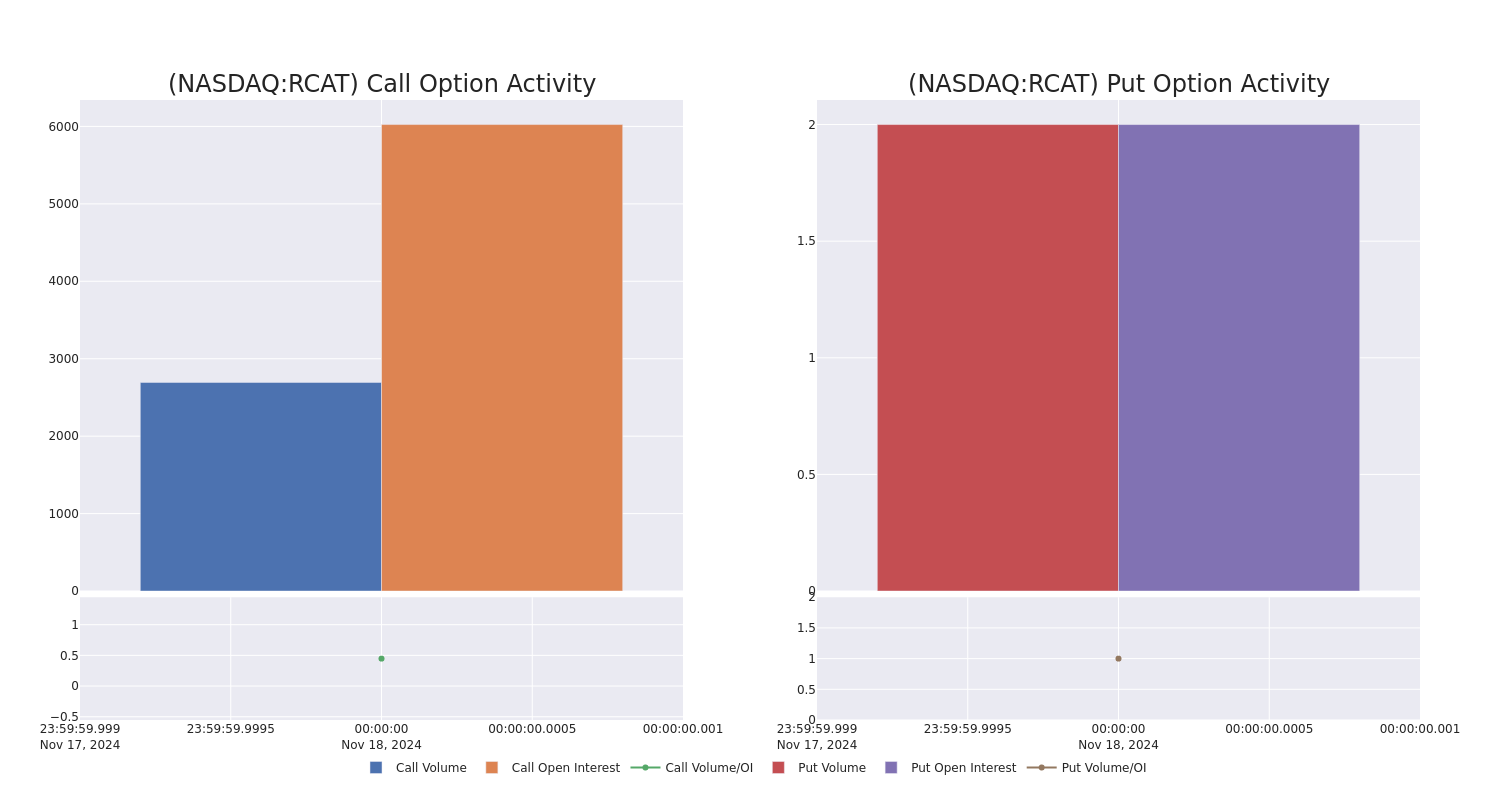

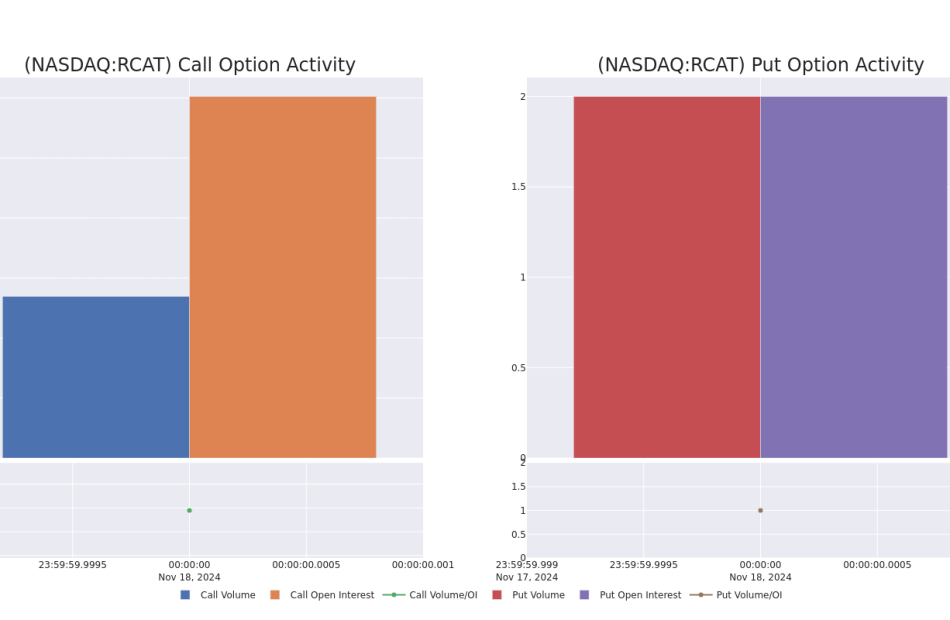

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of Red Cat Hldgs stands at 1970.57, with a total volume reaching 6,692.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Red Cat Hldgs, situated within the strike price corridor from $5.0 to $12.0, throughout the last 30 days.

Red Cat Hldgs Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RCAT | PUT | SWEEP | BEARISH | 12/20/24 | $5.1 | $4.8 | $5.06 | $12.00 | $101.9K | 0 | 720 |

| RCAT | PUT | TRADE | NEUTRAL | 12/20/24 | $4.9 | $4.5 | $4.7 | $12.00 | $93.5K | 0 | 920 |

| RCAT | PUT | SWEEP | BULLISH | 12/20/24 | $5.4 | $5.3 | $5.3 | $12.00 | $53.0K | 0 | 110 |

| RCAT | CALL | SWEEP | BEARISH | 12/20/24 | $1.4 | $1.25 | $1.27 | $8.00 | $50.9K | 2.6K | 2.0K |

| RCAT | CALL | TRADE | BEARISH | 12/20/24 | $3.1 | $2.95 | $2.95 | $5.00 | $44.2K | 2.8K | 338 |

About Red Cat Hldgs

Red Cat Holdings Inc is a military technology company that integrates robotic hardware and software to provide critical situational awareness and actionable intelligence to on-the-ground warfighters and battlefield commanders. Its mission is to enhance the effectiveness and safety of military operations domestically and globally. Red Cat’s suite of solutions includes Teal Drones, developer of the Golden Eagle, a small unmanned system with the highest resolution imaging for night-time operations, and Skypersonic, a provider of unmanned aircraft for interior spaces and other dangerous environments.

Having examined the options trading patterns of Red Cat Hldgs, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Red Cat Hldgs

- With a volume of 10,495,244, the price of RCAT is up 21.98% at $7.77.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 22 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Red Cat Hldgs, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply